Underinsurance: The Hidden Cost of Poor Small Business Inventory Management

Poor inventory management is more than an operational headache; for a small business, it's a direct threat to financial stability and a significant source of commercial risk. At its core, inventory management is the practice of ordering, storing, and selling products efficiently. But viewed through a commercial lens, it's a critical component of risk mitigation that directly impacts cash flow, profitability, and, crucially, insurance claim outcomes.

Why Poor Inventory Management Creates Commercial Risk

For any small enterprise, inventory isn't just stock on a shelf; it's capital tied up in physical form. Every item represents cash that could be servicing debt, funding growth, or providing a buffer against economic shocks. When this capital is poorly documented and managed, it creates two distinct but related problems: operational inefficiency and significant insurance risk.

The link between stock levels and cash flow is direct. Holding too much inventory— overstocking —locks up vital working capital and incurs costs that erode profitability, such as storage fees and insurance premiums. On the flip side, holding too little stock— understocking —leads to lost sales and reputational damage.

The Problem: Inaccurate Valuation Leads to Underinsurance

This financial fragility is a stark reality. UK small businesses operate on thin margins, with a sobering 12.1% of micro-firms holding no cash reserves at all. Only 25.1% believe their reserves would last longer than six months. An inaccurate understanding of stock value often leads business owners to under-declare their total assets, resulting in inadequate insurance cover. This oversight becomes catastrophic after an insurable event like a fire or flood. More details on the financial state of UK small businesses can be found in this 2023 Enterprise Research Centre report.

A business's stock is one of its most valuable assets. Managing it well is fundamental to operational stability, but documenting it properly is essential for financial protection and preventing costly claims disputes.

The Cost of Inaction: Disputed Claims and Financial Ruin

Effective inventory management for small business goes far beyond tracking sales and reordering products. It is a cornerstone of a company's financial resilience. Every piece of equipment, every box of stock, and every office computer is an asset that must be accounted for—not just for tax purposes, but for insurers.

Without a precise, verified, and time-stamped record of assets, a business is dangerously exposed. In the event of a major loss, the owner will struggle to prove the value of their losses to an insurer, inevitably leading to delayed, disputed, or reduced claim payouts. This is a common trigger for the application of the 'average clause', where the insurer reduces the payout in proportion to the level of underinsurance. Treating inventory as a critical, documentable asset is a vital part of any business risk management framework. This isn't just an administrative chore; it’s a foundational step in securing a business’s future against unforeseen events.

Choosing the Right Inventory Management System to Mitigate Risk

The ubiquitous tangled spreadsheet is a significant liability for a growing business. While manual methods feel cost-effective initially, they are rife with human error and lack real-time data, creating a distorted picture of a business's true asset value. A single typo can lead to ordering errors that strain cash flow or, more dangerously, contribute to an inaccurate valuation for insurance purposes.

Choosing the right inventory management system isn't just an operational upgrade. It's a strategic decision that directly impacts efficiency, profitability, and insurability. The right system provides accurate data for growth; the wrong one perpetuates risk.

To understand the options available, let's compare the common methods SMEs use.

Comparing Inventory Management Methods for SMEs

This table breaks down the main options, highlighting their suitability for different stages of business growth. The key is balancing cost, complexity, and the ability to generate accurate, verifiable data.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Pen and Paper | Very small, local businesses with a handful of products. | Extremely low cost; no technical skill required. | Highly prone to error, impossible to scale, provides no verifiable data for insurers. |

| Spreadsheets | Start-ups and businesses with a small, slow-moving inventory. | Low cost (using Excel or Google Sheets); more organised than paper. | Prone to human error, not real-time, easily corrupted, poor evidence in a claim. |

| Inventory Software | Growing SMEs, e-commerce stores, and multi-channel retailers. | Real-time tracking, automates tasks, integrates with other systems. | Higher initial cost, requires setup and training. |

| ERP Systems | Larger businesses with complex operations across multiple departments. | Fully integrated system for all business functions (inventory, finance, HR). | Very expensive, complex implementation, can be overkill for SMEs. |

For most growing businesses, the choice is between persisting with a spreadsheet or investing in dedicated software. While spreadsheets serve a purpose at inception, they are a temporary and high-risk solution. True control, efficiency, and risk mitigation come from a purpose-built system.

The Solution: Moving from Manual Methods to Verifiable Data

A well-organised spreadsheet can suffice for a business with a handful of products. It's a low-cost entry point to grasp the basic principles of stock tracking.

However, as a business grows, so does its risk profile. This is where dedicated inventory management software becomes essential. These systems automate tasks, reduce errors, and, crucially, provide a single, reliable source of truth for stock levels. This data is the foundation for accurate insurance valuation.

The UK inventory management software market is set to double, from USD 146.6 million in 2024 to an estimated USD 276.8 million by 2033 . This growth is driven by the need to fix widespread inaccuracy; a staggering 62% of UK retail brands report inventory accuracy below 80% , a gap that directly translates to underinsurance risk.

Essential Features for a Risk-Ready System

When investing in software, the focus should be on core functions that provide accurate and defensible data.

- Real-Time Tracking: The system must update stock levels instantly across all sales channels. This is fundamental to maintaining an accurate asset valuation at any given moment.

- Barcode Scanning: This feature drastically reduces manual data entry errors, ensuring the data feeding into your system is correct from the point of goods-in.

- Key Integrations: The system must integrate with e-commerce platforms (like Shopify) and accounting software (such as Xero) to create a cohesive and accurate financial picture.

- Reporting and Analytics: The software must provide clear dashboards showing stock valuation, turnover rates, and profit margins, enabling smarter purchasing and more accurate sum insured calculations.

Choosing a system is about finding the right fit for your current needs and future ambitions. A system that cannot scale will become a bottleneck to growth and a source of inaccurate data.

It is vital to consider the intuitive software behind smart inventory to ensure team adoption. A complex system that is poorly used is no better than an error-filled spreadsheet.

Ultimately, the goal is to implement a tool that brings order, clarity, and accuracy to operations. To see how this fits into the broader technology stack, refer to our guide on the 12 essential apps for business management in the UK. The right system provides the accurate data needed to run the business and, critically, to prove its value when it matters most.

Laying the Groundwork for Organised Stock

Before inventory can be managed, it must be accurately identified and located. A disorganised stockroom is the root cause of picking errors, slow fulfilment, and inaccurate counts that undermine the entire business operation and its insurance cover. The goal is to create a logical system that provides a clear, auditable trail for every item.

It starts with giving every item a unique identity through Stock Keeping Units (SKUs). A SKU is a descriptive identifier that communicates key product information at a glance, forming the language of your inventory system.

A poorly designed SKU system causes as much confusion as having none. Random numbers are unhelpful, and inconsistent formats make data analysis impossible. A clear, logical architecture is essential from the outset.

Designing a Smart SKU Architecture

SKUs should be constructed from meaningful components that describe the item, making them human-readable and useful for sorting and reporting.

For a boutique selling t-shirts, a smart SKU structure might be:

- Category: TS (for T-Shirt)

- Style: PL (for Plain) or GR (for Graphic)

- Colour: BLU (for Blue) or BLK (for Black)

- Size: S (for Small), M (for Medium), L (for Large)

A plain blue t-shirt in a medium size becomes TS-PL-BLU-M . This systematic approach is a core principle of effective inventory management for small business and the first step towards accurate valuation.

When creating SKUs:

- Start Broad, Get Specific: Begin with the main category and narrow down to specific attributes.

- Keep It Simple: Use letters and numbers. Avoid easily confused characters like 'O' and '0'.

- Be Consistent: Adhere strictly to the chosen format for all new products.

Organising Your Physical Stockroom

With products logically identified, the next step is organising the physical space. A chaotic stockroom is where time and money are lost. Stock should be arranged so the most valuable items are most accessible and easily audited.

ABC analysis is a powerful method for categorising stock based on its value to the business.

- A-Items: Bestsellers, representing around 20% of stock items but 80% of revenue. They must be stored in the most accessible locations for fast picking and frequent cycle counting.

- B-Items: Mid-range items, making up about 30% of stock and 15% of revenue.

- C-Items: Slow-movers, representing the bulk of stock items (about 50% ) but only contributing around 5% of revenue. These can be stored in less prime locations.

By organising a storeroom based on ABC analysis, you ensure your team's time is focused on the products that drive revenue, and your stock-taking efforts are concentrated on your most valuable assets.

Finally, a clear location system is non-negotiable. Assigning specific location codes (bin locations) to every shelf, rack, or bin (e.g., A-03-02-B) is crucial.

This location code should be logged in your inventory system alongside the SKU. This eliminates guesswork, reduces picking times, and simplifies training. It transforms the stockroom from a source of chaos into a streamlined, auditable asset.

Mastering Stock Replenishment and Control

With an organised stockroom and a clear SKU system, the next challenge is balancing supply and demand to maintain profitability without tying up capital. This involves moving from passive tracking to active control of stock levels.

This requires answering two critical questions: when to reorder, and how much to reorder? Getting this right prevents both costly stockouts and the cash-draining effects of overstocking. This is achieved by setting intelligent reorder points and calculating a prudent safety stock level.

Setting Your Reorder Point

A reorder point (ROP) is the stock level that triggers a new order. It removes guesswork from replenishment, preventing the lost sales that result from waiting until a shelf looks empty.

The formula is:

Reorder Point = (Average Daily Sales x Lead Time in Days) + Safety Stock

For a coffee shop selling an average of 10 bags of its house blend per day, with a supplier lead time of 5 days , the initial reorder point would be: (10 bags/day x 5 days) = 50 bags .

This means an order is placed the moment stock drops to 50 bags. In theory, the new order arrives just as the last bag is sold.

Calculating Your Safety Stock

However, business is rarely predictable. A sudden sales spike or supplier delay can lead to a stockout. Safety stock is a deliberate buffer of extra inventory to protect against this volatility.

A simple formula for small businesses is:

Safety Stock = (Maximum Daily Sales x Maximum Lead Time) – (Average Daily Sales x Average Lead Time)

Using the coffee shop example:

- Maximum daily sales: 15 bags .

- Maximum lead time: 7 days .

The calculation is: (15 bags x 7 days) – (10 bags x 5 days) = 105 – 50 = 55 bags .

The true reorder point is therefore: (10 bags/day x 5 days) + 55 bags = 105 bags . This buffer allows the business to handle unexpected demand or supply disruptions without losing sales.

Fortunately, UK supply chains are stabilising. As of August 2023, 72% of trading businesses reported no disruption in sourcing goods domestically, making lead time calculations more reliable.

Of course, a key part of this process is learning how to avoid over-stocking , as excess inventory ties up essential capital. Safety stock is a calculated risk buffer, not an excuse for hoarding.

Choosing Your Stock-Taking Method

For reorder points and safety stock levels to be effective, they must be based on accurate physical stock counts. There are two primary methods:

- The Full Physical Count: The traditional annual method where the business closes to count every item. It provides a single snapshot but is highly disruptive and means errors go undetected for months.

- Cycle Counting: A far superior method involving counting a small portion of inventory on a continuous basis. High-value 'A-Items' might be counted monthly, 'B-Items' quarterly, and 'C-Items' semi-annually. This is less disruptive and allows for the rapid identification and correction of discrepancies.

For most small businesses, cycle counting is the optimal approach. It integrates stock-taking into routine operations, ensuring data remains accurate year-round.

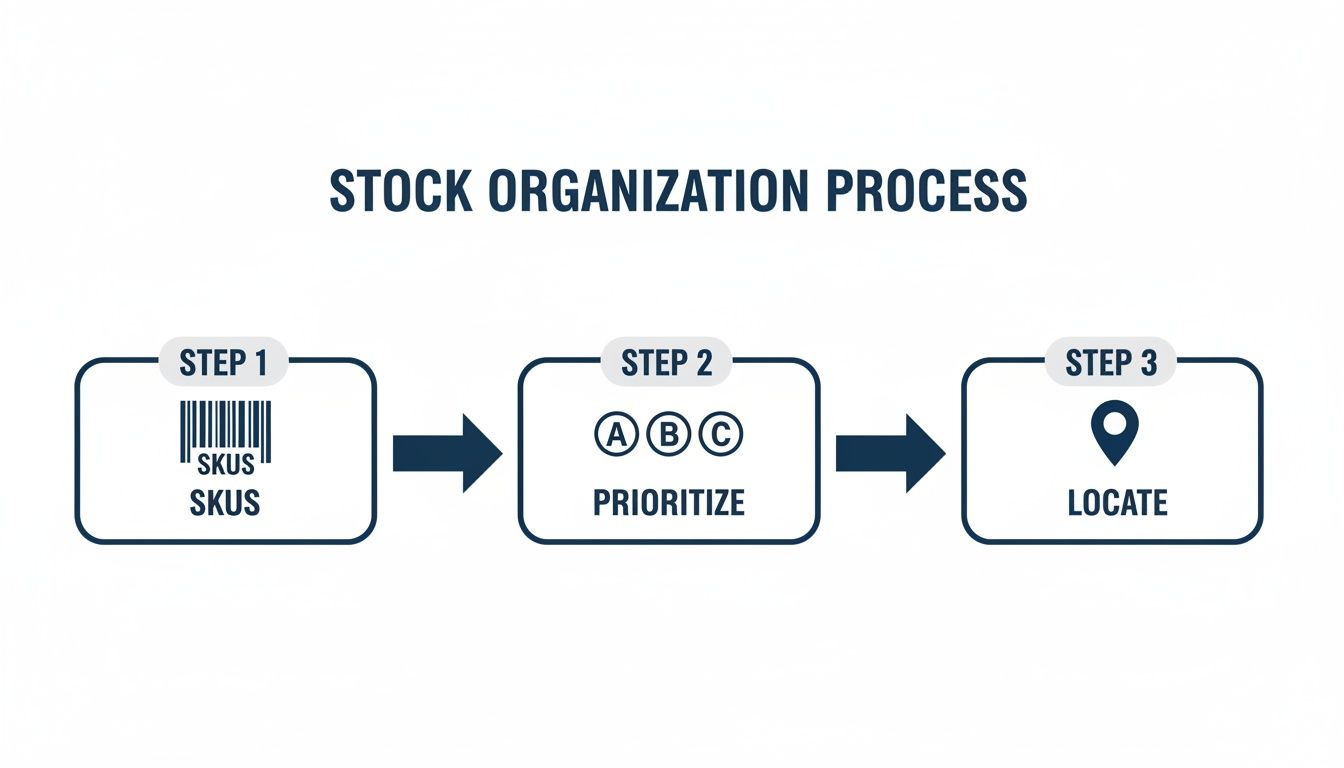

The infographic below summarises the foundational process for organising stock—a prerequisite for any effective replenishment strategy.

This simple flow—assigning a unique SKU, prioritising valuable stock, and knowing its precise location—is the bedrock upon which successful replenishment and accurate asset valuation are built.

Protecting Your Business Assets for Insurance

Good inventory management does more than optimise operations; it forms a critical part of a business's financial defence. Your stock, equipment, and other fixed assets are all valuable. If a disaster like a fire, flood, or theft occurs, simply knowing you owned them is insufficient for an insurance claim.

Without robust, verifiable proof of ownership and value, a business owner enters a costly and frustrating dispute with their insurer. This is where inventory management pivots from an operational task to a strategic tool for business survival.

The danger of underinsurance is a significant threat to UK businesses. An inability to accurately prove the total value of lost assets will almost certainly lead to a reduced claim payout, forcing the business to cover a substantial shortfall out of pocket.

The High Cost of Poor Documentation

In the aftermath of an incident, an insurer will require a detailed schedule of every lost or damaged item. A vague list created from memory or outdated spreadsheets is a direct route to delays and disputes.

Insurers require three key elements: proof of ownership, proof of value, and proof that the item existed before the loss event. Without this, the claims process can extend for weeks or months.

This is not merely an administrative burden; it is a direct threat to business continuity. Every day spent debating the value of stolen equipment or damaged stock is a day of lost trade. Proper documentation transforms the claims process from a contentious negotiation into a straightforward verification.

The Proova platform provides an intuitive way to catalogue and verify business assets.

This screenshot shows how simple it is to build a verified digital record of assets, providing the exact proof insurers need to settle a claim quickly and fairly.

From Task to Strategy: Building a Verified Asset Catalogue

Creating a verified inventory is a crucial risk management strategy. This involves more than just listing items; it's about capturing irrefutable evidence. Modern tools enable the creation of a digital catalogue that is:

- Verified: Each entry is validated, confirming its existence and condition at a specific time.

- Time-stamped: The record proves ownership long before any claim event occurred.

- Geolocated: Location data confirms the asset was at the insured premises, pre-empting questions about its location.

This catalogue must extend beyond saleable stock to include all assets critical to the business:

- Equipment: Machinery, tools, and specialist gear.

- Technology: Computers, servers, printers, and point-of-sale systems.

- Furniture & Fittings: Desks, chairs, shelving, and custom installations.

Building this catalogue is not a one-off task. Just as cycle counting maintains stock accuracy, the asset register must be regularly updated. New purchases should be documented upon arrival, and disposed items removed.

This meticulous approach provides genuine peace of mind. It is not just about organising stock for daily operations; it is about building a robust financial defence for the business. For more on how this fits into a wider strategy, see our guide on verifying certificates of insurance to protect your business.

By taking control of asset documentation, a business owner ensures that if the worst happens, they can recover quickly and completely, armed with the proof needed to secure a fair and fast settlement.

Got Questions About Inventory Management? We’ve Got Answers.

Small business owners often encounter the same challenges when implementing stock control. Here are practical answers to common questions to help refine your approach.

How Often Should I Be Doing a Stock-Take?

This depends on your business, but the traditional annual physical count is an outdated and disruptive practice. The superior approach is cycle counting .

Cycle counting involves checking a small, manageable portion of your stock on a regular, rolling basis. It becomes part of your routine, not a disruptive annual event. A typical schedule would be:

- High-value A-Items: Count monthly. These are your bestsellers and represent the most value.

- Mid-range B-Items: Check quarterly.

- Slow-moving C-Items: Twice a year is usually sufficient.

This method allows you to identify and correct discrepancies quickly, ensuring your stock records—and therefore your asset valuation—remain accurate throughout the year.

What's the Difference Between Stock and Inventory?

The terms are often used interchangeably, but there is a key distinction, particularly for businesses that manufacture goods.

Stock refers specifically to the finished goods ready for sale to customers.

Inventory is a broader term encompassing all assets involved in the production and sale process. This includes:

- Raw materials.

- Work-in-progress (WIP) items that are partially assembled.

- The finished stock itself.

For a simple retailer, the terms are virtually synonymous. For a manufacturer, baker, or artisan, understanding this difference is crucial for accurately valuing the entire business operation for insurance purposes.

My Business Is Tiny. Is Software Really Necessary?

While a well-organised spreadsheet may suffice at the very beginning, it is a high-risk, temporary solution. Spreadsheets are highly susceptible to human error, do not provide real-time data, and become unmanageable as the business grows.

Investing in proper inventory management software is essential as soon as you are handling multiple product lines, selling across different channels, or have more than one person involved in order fulfilment. It is not a luxury; it's a foundational tool that prevents costly operational errors and provides the accurate, live data needed for sound commercial decisions and correct insurance valuation.

Think of it as a crucial investment in your operational efficiency and your business's long-term financial security.

A robust inventory system protects your cash flow, but what about protecting the value of those assets from a real disaster? Proova provides a simple, powerful way to create a time-stamped, geolocated, and verified catalogue of all your business assets—from stock and equipment to office furniture. Ensure your insurance claims are fast, fair, and undisputed. Visit https://www.proova.com to secure your business today.