Certificates of Insurance: Verify Coverage & Protect Your Business

A Certificate of Insurance is far more than just a piece of paper in UK business. Think of it as a crucial snapshot, providing verifiable proof of insurance coverage at a specific moment in time. This document is often your first and most important line of defence against serious financial and legal risks when you engage contractors, partners or new clients.

Why Certificates of Insurance Are So Important

In any commercial relationship trust is the foundation but verification is essential. A Certificate of Insurance acts as a formal summary of an insurance policy, giving you a quick, standardised way to confirm that a business or individual holds the right cover. It establishes a baseline of financial responsibility before any work even begins.

Without this proof, your business could find itself liable for accidents, property damage or professional errors caused by an uninsured third party. Imagine hiring a contractor who accidentally causes thousands of pounds in damages. If it turns out their insurance has lapsed or never existed, that financial burden could fall squarely on your shoulders.

The Problem of Provability and Fraud

The real value of a certificate lies in its provability . A genuine document confirms that if something goes wrong, there’s an active policy ready to respond. Unfortunately this system is increasingly under threat from insurance fraud, where documents are altered or completely fabricated just to win contracts.

This deception creates a dangerous illusion of security. A fraudulent certificate means a claim cannot be proven against a valid policy, leaving your business exposed to crippling liability. And this is not an isolated issue; it is a widespread problem that ultimately affects everyone.

When fraudulent claims succeed or uninsured incidents occur, the costs are absorbed by the entire insurance industry. Those losses are then passed on to all policyholders through higher premiums, meaning every honest business ends up paying the price for deception.

Navigating a Complex Insurance Environment

The scale of this challenge is significant. The UK's insurance industry is the 4th largest in the world and manages investments totalling about £1.91 trillion . In such a vast and complex environment, COIs play an indispensable role in managing risk. You can explore more data on the UK insurance industry to get a sense of its scale.

Ultimately, understanding and properly verifying these documents is no longer optional—it is a fundamental part of sound business management. It safeguards your finances, protects your reputation and contributes to a more trustworthy commercial landscape for everyone. That is why modern verification methods are now so crucial for protecting your business from these hidden liabilities.

How to Read a Certificate of Insurance Correctly

Before you can spot a fake certificate, you need to get comfortable with a real one. At first glance, a Certificate of Insurance can look like a wall of dense legal jargon and random numbers. But once you know what you are looking for, it is actually quite straightforward.

Think of a certificate as an ID card for an insurance policy. It is not the policy itself but a snapshot that gives you all the vital details in a standardised format. This means you can quickly check the crucial information without having to wade through a massive, multi-page document.

Getting to grips with these key fields is the first step in protecting your business. It allows you to spot inconsistencies and decide whether the cover shown is actually good enough for your project. This is not just a paper-pushing exercise; it is about shielding your business from the serious financial fallout of relying on dodgy or inadequate insurance.

Demystifying the Key Fields

Every certificate, no matter the insurer, contains a few essential pieces of information that give you a complete picture of the policy. The layout might change slightly from one provider to another but the core components are always there. Learning where to find them and what they mean is what verification is all about.

Let’s start with the basics.

To get started, you will need to identify the key players and the unique policy identifier. These are the absolute fundamentals of the certificate, confirming who is covered, who is providing the cover and which specific policy it all relates to.

- The Insured: This is the legal name of the person or company holding the policy. It is vital that this name exactly matches the contractor or partner you are working with. Even a small typo or variation could be a red flag.

- The Insurer: This tells you which insurance company is actually backing the policy and will be liable for paying any valid claims. Seeing a familiar, reputable insurer adds a layer of confidence. An unknown name warrants a bit more digging.

- The Policy Number: This is the unique code assigned to the policy. Think of it like a tracking number. It is the most important detail for verification because you can use it to confirm the policy’s existence and status directly with the insurer.

Understanding Coverage and Limits

Once you have confirmed who is covered and by whom , the next step is to figure out what they are covered for and for how much. This is where you get to the financial heart of the certificate, which outlines the different types of protection and their monetary caps.

These details are what determine if the policy is actually fit for purpose. It is no good having a certificate if the cover limits are too low for the risks involved in the job. In fact, mismatched or inadequate limits are a common reason for rejecting a certificate—and for good reason. They can leave you dangerously exposed.

The limits of liability represent the maximum amount of money the insurer will pay out for a covered claim. If a claim exceeds this limit, the policyholder—and potentially you—could be responsible for the difference.

The most common types of cover you’ll see are Public Liability, Employers’ Liability and Professional Indemnity, each with its own specified limit. Your job is to check that these limits meet or exceed the minimum requirements you’ve set out in your contract. If they do not, the certificate has failed its primary purpose. This is where the proof becomes practical; the document does not just show a policy exists but that it is the right policy for the job.

The Real Cost of Insurance Certificate Fraud

While a correctly issued Certificate of Insurance brings peace of mind, a fraudulent one creates a dangerous illusion of security. This is not just about a simple admin error; it is a deliberate act of deception with severe financial consequences that ripple through the entire economy. Make no mistake, insurance fraud is not a victimless crime and its impact is felt by every honest business.

The core issue always comes back to provability . A genuine certificate is your proof that a valid insurance policy exists to cover potential liabilities. When that certificate is fake, the proof evaporates—and the financial safety net you thought you had disappears right along with it. This leaves your business directly exposed to crippling legal costs and compensation claims.

Insurance certificate fraud can range from the deceptively simple to the outright elaborate. A contractor might be tempted to change an expiry date just to win a job or a business might inflate their liability limits on paper to meet contractual demands. In more extreme cases, the entire certificate is a forgery, created from scratch with no underlying policy in sight.

The Domino Effect of a Single Fake Certificate

Imagine you hire an electrical contractor for a major office renovation. You do your due diligence and request a Certificate of Insurance, which shows they have £5 million in Public Liability cover . The document looks professional, so you file it away, confident that you are protected.

A few weeks into the project, faulty wiring sparks a fire overnight. It causes hundreds of thousands of pounds in damage to your building and destroys valuable equipment. When you try to claim against the contractor’s insurance, the ugly truth emerges. The certificate was a fake; their actual policy had lapsed months ago.

This single oversight sets off a devastating chain reaction:

- Immediate Financial Loss: Your own insurance will have to cover the damage but you can be sure your premiums will skyrocket at renewal. You will also be liable for the policy excess.

- Legal Battles: You will likely have to pursue the contractor through the courts to recover your losses. This process is expensive, time-consuming and offers no guarantee of success, especially if the contractor declares bankruptcy.

- Operational Disruption: Your business operations are severely disrupted, leading to lost revenue and potential damage to your client relationships and professional reputation.

- Regulatory Scrutiny: Depending on your industry, you may also face an investigation for failing to ensure your contractors were adequately insured, which can result in hefty fines and other penalties.

This scenario highlights the critical importance of verification. A fraudulent certificate is not just a misleading piece of paper; it is a direct threat to your financial stability. The absence of provable cover means the liability falls back onto your business.

How Fraud Drives Up Costs for Everyone

The consequences of certificate fraud extend far beyond the individual business that gets caught out. When uninsured losses occur, the costs are ultimately absorbed by the insurance industry as a whole. Insurers have to pay out for claims that should have been covered by a third party's policy and these mounting losses are eventually passed on to all policyholders.

This means that every fraudulent act contributes to higher premiums for honest businesses across the board. The collective cost of insurance fraud is staggering and a significant portion of it is attributable to this type of document-based deception. To get a better sense of the scale of the issue, you can learn more about what insurance fraud really costs the industry and see how these figures impact everyone.

Ultimately, robustly verifying certificates of insurance is not just about protecting your own company. It is a collective responsibility that helps maintain the integrity of the insurance system, ensuring that cover remains affordable and accessible for all the businesses that play by the rules. It is a crucial step in preventing your business from becoming another cautionary tale.

Your Guide to Verifying Insurance Certificates

Knowing how to read a certificate is one thing but turning that knowledge into decisive action is what truly protects your business. A proactive, multi-layered verification strategy is your best defence against the risks that come with fraudulent or simply inadequate insurance. It is about shifting from passively accepting a document to actively confirming it is legitimate and fit for purpose.

This process does not have to be some monumental task. It starts with a simple request and moves through a series of checks, ensuring the certificate you are holding is worth more than the paper it's printed on. The goal is to build a systematic approach that reduces human error and gives you real certainty.

The Initial Request and Visual Inspection

First things first: ask your partner, vendor or contractor for a current Certificate of Insurance. It is best to be crystal clear about your minimum coverage requirements right from the start. Once the document lands in your inbox, your verification process kicks off with a careful visual inspection.

Think of this initial review like a quick quality control check. You are looking for common red flags that might suggest tampering or just a lack of professionalism. Often, the small details tell the biggest story.

- Typos and Grammatical Errors: A professional insurance document should be flawless. Silly mistakes in names, addresses or policy details are immediate warning signs.

- Unusual Formatting: Keep an eye out for inconsistent fonts, awkward spacing or text that just does not line up. These can be tell-tale signs that the document has been edited with basic software.

- Blurry Text or Logos: A poor-quality or pixelated document could be a doctored photocopy or a completely fabricated certificate.

This first pass helps you weed out the most obvious fakes. But remember, a visually perfect document can still be fraudulent, which is why the next step is absolutely non-negotiable.

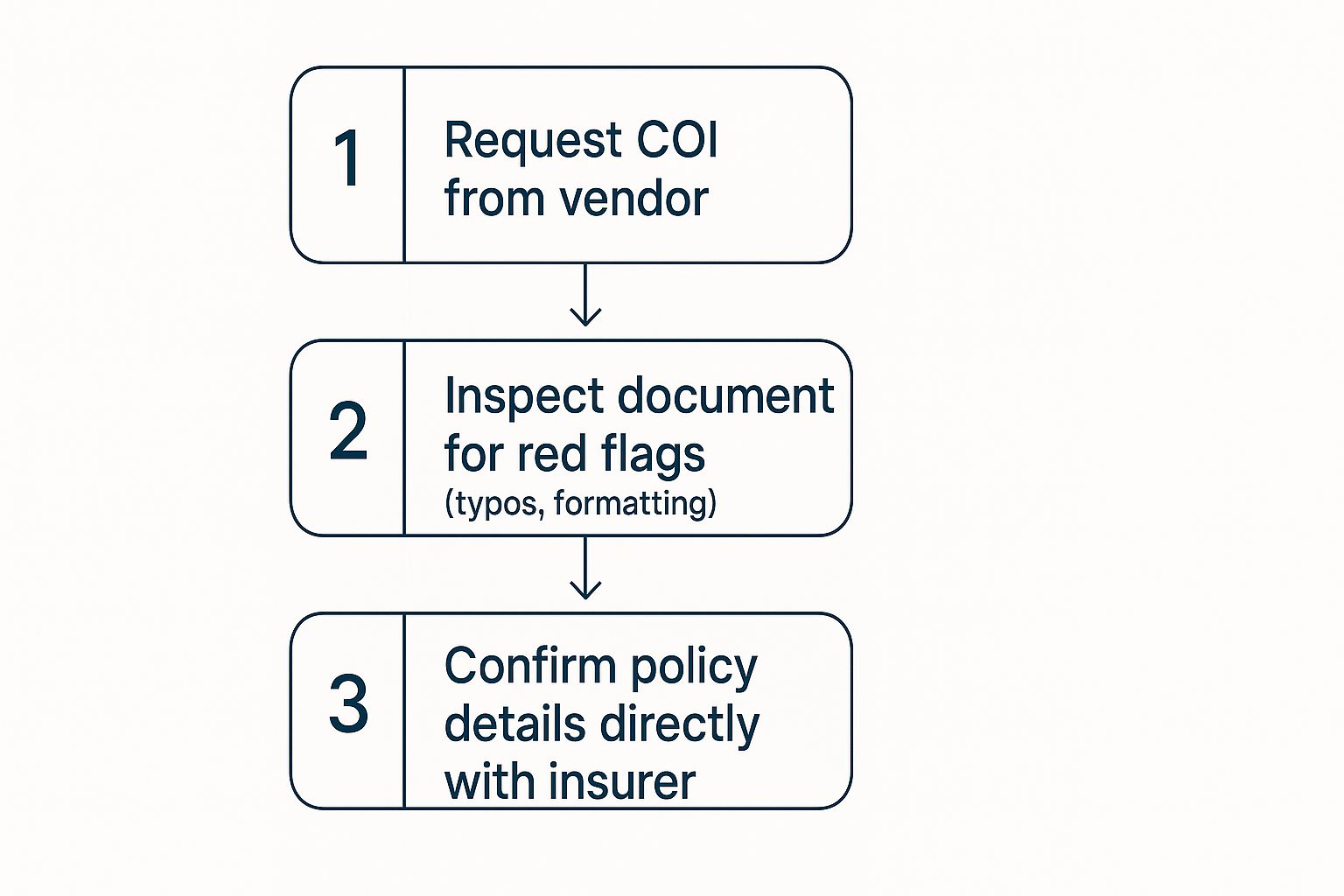

The following infographic breaks down the essential steps for a solid verification process, from that initial request all the way to final confirmation.

This visual guide distils the process into three critical stages, reinforcing that a simple visual check is only the beginning of true due diligence.

The Crucial Step: Direct Confirmation

The only way to be 100% certain a certificate is genuine is to go straight to the source. This means getting in touch with the insurer or the broker listed on the document to confirm the policy details. A visual inspection might spot a clumsy forgery but it cannot tell you if a policy has been cancelled or changed since the certificate was issued.

A Certificate of Insurance is only a snapshot in time. The policy it represents could be altered or cancelled the very next day, making direct confirmation with the insurer the only way to verify current, active coverage.

When you contact the insurer or broker, have the certificate handy. You will need to provide the insured's name and the policy number so they can pull up the correct details. Politely ask them to confirm that the policy is active and that the coverage types and liability limits match what is stated on your copy. That simple phone call or email is the most powerful tool you have to prevent fraud.

Managing and Automating the Process

For businesses juggling dozens or even hundreds of certificates of insurance , manual verification can quickly become a huge administrative headache. A key part of effective verification is maintaining robust document management practices to keep track of renewals and ensure everyone stays compliant.

This is where modern digital solutions can make a world of difference. Automated platforms can handle the entire verification workflow, from requesting certificates to flagging expired policies and even initiating direct confirmation with insurers. By taking manual input out of the equation, these systems minimise human error and give you a much higher degree of confidence in your compliance efforts.

Using Technology to Fight Insurance Fraud

Manually checking a certificate of insurance is a decent starting point but in a world of sophisticated fraud, it is just not enough anymore. Relying on the human eye to catch subtle forgeries leaves your business wide open to risk. It is time to move past that. Technology provides a far more secure, efficient and dependable alternative, turning insurance verification from a reactive chore into a proactive defence.

Modern verification platforms are much more than just digital filing cabinets. They are intelligent systems built specifically to stamp out document tampering and human error. Instead of just storing a static PDF, these tools create a direct, live link to the source of truth: the insurer.

The advantages of this approach are immediate and powerful. You can get contractors and partners up and running faster, slash the admin burden on your compliance team and gain near-total confidence in the insurance coverage you are depending on.

Real-Time Data Verification

The real game-changer here is the ability to verify data in real time. Think of it like a bank checking your account balance before letting you take cash out. They do not look at a printed statement from last week; they check the live account at that exact moment.

That is essentially how modern verification platforms operate. They plug directly into an insurer’s database to confirm that a policy is not just valid on paper but is active right now and that its details perfectly match what is on the certificate.

This creates multiple layers of protection:

- It shuts down tampering: A digitally altered expiry date or an inflated liability limit is instantly flagged when checked against the insurer’s live records.

- It confirms active status: The system verifies the policy has not been cancelled or lapsed since the certificate was issued, closing a massive, often overlooked, window of risk.

- It guarantees accuracy: Any mismatches in names, policy numbers or coverage details are automatically caught, removing the potential for human oversight.

By shifting verification from a visual scan of a static document to a live data check, technology makes fraud almost impossible to hide. It replaces guesswork with provable, real-time facts.

This direct connection offers a level of certainty that manual checks could never hope to achieve. The future of insurance hinges on the authentication of claims and policies and this technology is a huge step in that direction. To really tighten your defences, look into adopting intelligent document processing solutions that can analyse certificates automatically.

Strengthening Your Compliance Framework

Technology does more than stop one-off instances of fraud. It reinforces your entire risk management and compliance strategy. An automated system creates a clear, auditable trail of every single verification check, giving you a solid record of due diligence if a dispute ever comes up.

This proactive approach does not just prevent financial losses; it strengthens your business relationships. When partners and contractors know you have a rigorous verification process, it fosters a culture of trust and transparency right from the start. You can learn more about how authentication is the missing piece in the future of insurance claims and see how this strengthens the whole ecosystem.

At the end of the day, when you embrace this kind of technology, you are not just catching fraudsters. You are building a more resilient, efficient and trustworthy business from the ground up.

Building Trust in Your Business Relationships

We have established throughout this guide that a Certificate of Insurance is much more than a piece of paper. It is the very foundation of commercial trust. In today's business world, verifying its authenticity is not just good practice—it is a non-negotiable part of managing your risk.

Accepting a certificate at face value is a massive gamble and one you simply cannot afford to take.

The fallout from insurance fraud is severe. It does not just impact individual businesses left with crippling liabilities; it damages the entire industry. The cost of that deception eventually trickles down to every honest policyholder in the form of higher premiums. Diligence, then, is not just about protecting yourself—it is a collective responsibility that shores up the integrity of the market for everyone.

The Future of Risk Management

Managing commercial risk effectively means embracing this diligence and adopting better tools to do the job. We strongly encourage you to take a hard look at your current verification processes. Ask yourself honestly: is a quick visual check really enough to protect your operations from the immense financial damage a fake document can cause?

By ensuring the certificates of insurance you accept are genuine, you do more than just shield your own business from harm. You strengthen your partnerships and contribute to a more trustworthy commercial environment. This level of care is crucial for anyone committed to building trust in the insurance industry and securing a stable future.

Ultimately, every verified certificate reinforces the entire system. It is a small act of diligence that, when multiplied across thousands of transactions, creates a more resilient and transparent economy for all.

Frequently Asked Questions

Getting your head around certificates of insurance can bring up a lot of practical questions. Let's break down some of the most common ones to help you protect your business and manage your risks effectively.

Can a Certificate Holder Make a Claim on the Policy?

No, simply holding a certificate does not give you the right to make a claim. Think of the certificate holder as just the recipient of the document—it is proof that the insured party has cover but that is it. The certificate itself does not change the policy or grant you any new rights.

If you need the ability to make a claim, you have to be named as an additional insured on the policy. This is a specific endorsement that extends coverage to you under certain conditions, a critical difference when it comes to managing risk. Without that status, the certificate is purely for your information.

Why Do Certificates Get Rejected?

Certificates often get rejected for small but critical mistakes that make them useless for compliance. A simple typo, a wrong policy number or formatting that does not match a client's strict rules can lead to an instant rejection and cause frustrating project delays.

Other common reasons for a thumbs-down include:

- Incorrect Liability Limits: The cover amounts shown do not meet the minimums required in your contract.

- Missing Endorsements: Key clauses like "additional insured" status or a "waiver of subrogation" have not been included.

- Expired Policies: The certificate shows a policy that is no longer active—an easy mistake to make with manual tracking.

Are Insurance Requirements the Same for All Clients?

Absolutely not. Insurance requirements can change dramatically from one client to the next. One client might be happy with £2 million in Public Liability cover, while another in a riskier industry could demand £10 million plus extra policies like Professional Indemnity or Cyber Liability.

This is exactly why you have to check every certificate against the specific contract. Never assume that a certificate that was fine for one job will work for another. A mismatch could leave you non-compliant and exposed to serious financial risk.

Why Is Verification So Important Now?

The pressure to rigorously verify insurance certificates is higher than ever, largely due to growing economic strains on the industry. For example, inflation has pushed the average cost of building insurance up by a staggering 84.7% between 2021 and 2024. At the same time, with cybercrime hitting 60% of large UK firms, the need for verified cyber liability cover has shot up. You can discover more insights about these UK insurance trends and risks. These pressures create a bigger temptation for fraud, making it vital to confirm that the cover you're relying on is real and sufficient.

A certificate is only a snapshot in time. The policy behind it could be cancelled or changed the very next day. This makes direct, real-time verification the only way to be sure your business is truly protected against liability.

Stop chasing paper and get rid of the uncertainty. Proova provides real-time, digital verification of insurance by connecting directly with insurers to confirm that cover is active and accurate. Protect your business from fraud and speed up compliance by visiting https://www.proova.com to see how it works.