An Insurer's Guide to Annual Boiler Service and Claims Prevention

An annual boiler service is a routine inspection by a Gas Safe registered engineer. For a policyholder, it's a maintenance task. For an insurer, it's a critical risk mitigation event that, when unverified, represents a significant source of claims leakage and fraud. The failure to confirm this simple check at policy inception is a direct contributor to some of the most frequent and costly domestic claims: escape of water, fire, and catastrophic carbon monoxide incidents.

The Unquantified Risk in UK Home Insurance Portfolios

For every home insurance policy written, there is a hidden, undocumented liability ticking away in millions of UK properties: the unserviced boiler. From a claims director's perspective, this is not a minor homeowner oversight; it is a significant and unquantified risk. Each neglected unit is a potential trigger for a high-cost claim that standard underwriting and self-declaration fail to capture.

This oversight creates a dangerous blind spot. A faulty boiler is a primary catalyst for some of the most expensive domestic claims, including escape of water and fire. The Association of British Insurers (ABI) reports that escape of water claims alone cost the industry £1.8 million per day. A significant portion of these claims originates from boiler and central heating system failures—failures that regular servicing is designed to prevent.

From Household Chore to Critical Underwriting Data

Framing the annual boiler service as just a homeowner's responsibility is a commercial error. An unverified service history should be as alarming as an undocumented property extension or undeclared high-risk contents. Both represent a fundamental misunderstanding of the actual risk being insured. A service is not just maintenance; it is a critical risk mitigation event.

An annual boiler service transforms an unknown variable into a verified data point. It confirms that a key source of potential property damage and liability has been professionally inspected and deemed safe, directly reducing the likelihood of a high-cost claim.

This perspective shifts the whole conversation from post-claim investigation to pre-inception prevention. By treating the boiler service record as a key underwriting document, insurers can move from reacting to costly incidents to proactively managing a core peril. The cost of inaction is not just the potential claim payout; it is the entire ecosystem of dispute management, loss adjuster visits, and customer churn that follows a preventable disaster.

The Commercial Cost of Boiler Neglect for Insurers

It is easy to view an unserviced boiler as a policyholder's problem, but for a claims director, it is a ticking financial time bomb. The commercial impact becomes clear when the minor cost of prevention is weighed against the massive, spiralling cost of a claim. It is in this gap that preventable claims leakage quietly erodes profitability. A policyholder’s decision to skip an annual boiler service is a direct line to a major liability on an insurer's balance sheet.

What is shocking is how little it costs to mitigate this risk. A gas boiler service typically runs between £80 and £120 . This small, predictable expense stands in stark contrast to the unpredictable and often devastating claims that arise from boiler failures.

The Financial Fallout of a Failed Boiler

When a neglected boiler fails, the results are rarely minor. They are often catastrophic events that cause extensive property damage, racking up costs far beyond a simple replacement.

- Escape of Water Claims: A corroded pipe or a faulty pressure valve is all it takes. This can lead to claims costing thousands of pounds for drying, restoration, and alternative accommodation.

- Fire and Explosion Damage: These are low-probability, high-severity events. A gas leak or wiring fault can lead to a fire resulting in a total loss claim, costing tens or even hundreds of thousands of pounds.

- Carbon Monoxide Liability: A CO poisoning incident can lead to immense personal injury and liability claims, not to mention the severe reputational damage that follows.

This is the same problem as the "lounge exercise." Ask a policyholder to list their contents after a burglary, and a six-week dispute over undocumented valuables ensues. Discovering a boiler has not been serviced for five years after it has flooded a home is simply too late. The damage is done, and the insurer is left to foot the bill for a preventable failure.

Shifting from Reactive Payouts to Proactive Prevention

The fundamental problem is that the small cost of an annual boiler service falls on the policyholder, but the five-figure cost of its failure lands squarely on the insurer. This financial misalignment creates a steady, predictable stream of avoidable claims. Verifying regular boiler maintenance is not about enforcing policy conditions for the sake of it; it is a direct, effective strategy to slash claims leakage.

Translating a Service Checklist into a Risk Assessment

To a claims director or an underwriter, a Gas Safe engineer's service checklist is more than a record of maintenance. It is a powerful, point-in-time risk assessment document. Each item on that list systematically neutralises a specific, insurable peril, turning technical jargon into a direct statement on the property's risk profile.

Reframing the engineer's tasks reveals their immediate impact on preventing high-cost claims. Every check is confirmation that a potential liability has been identified and mitigated.

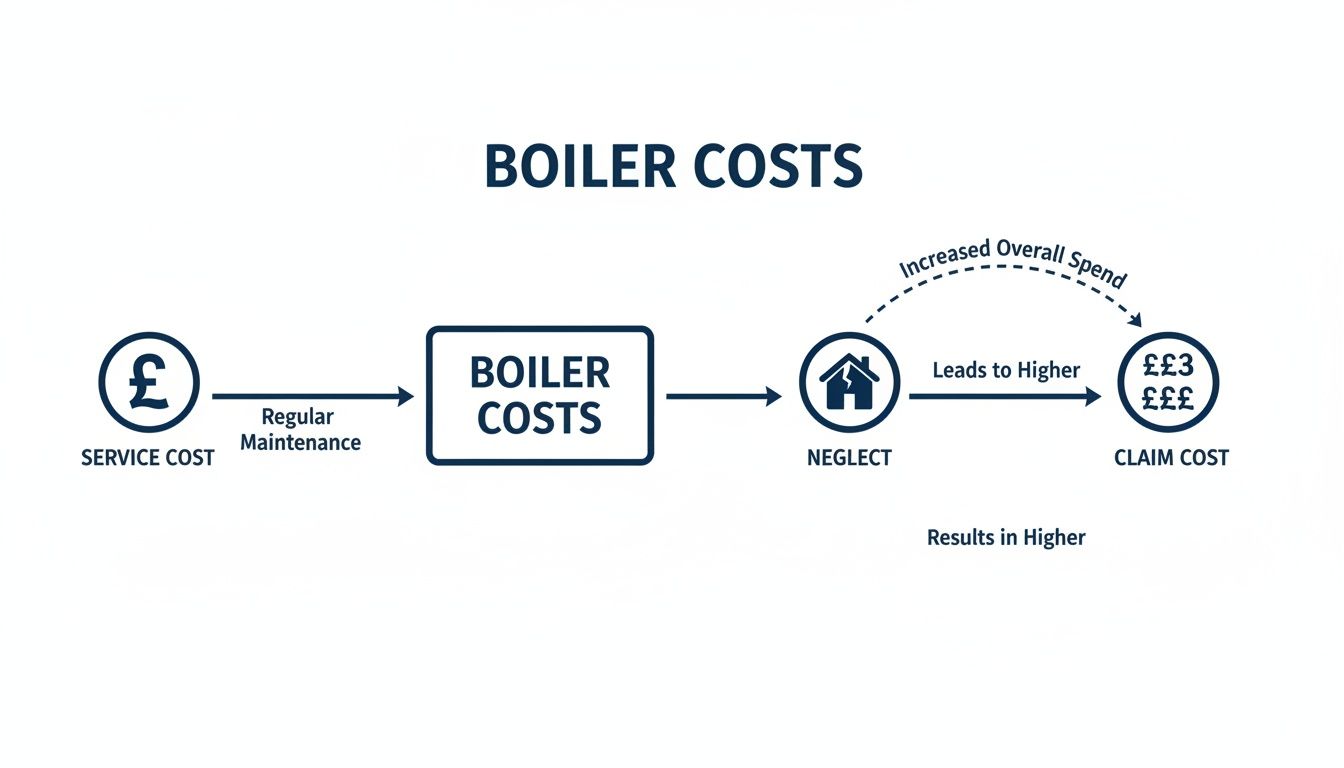

This infographic cuts to the chase, illustrating the simple financial equation for insurers: a small, upfront cost for a service prevents exponentially larger claim costs down the line.

It makes it clear that investing in verified maintenance is not just good practice; it is a direct strategy for reducing the financial fallout from boiler-related claims.

From Technical Checks to Commercial Insights

Instead of a dry list of tasks, consider the commercial outcome of each action. The moment its technical language is translated into the language of risk management, that service certificate becomes an invaluable underwriting tool.

- Flue & Combustion Analysis: An engineer’s check on the flue is a direct intervention to prevent catastrophic carbon monoxide liability claims —the kind that carry immense financial and reputational costs.

- Gas Pressure & Rate Checks: When a technician tests the gas pressure, they are actively mitigating the risk of fire and explosion perils , preventing a potential total-loss event.

- Inspection of Seals & Gaskets: A visual check for degrading seals is a proactive measure against escape of water claims , catching wear and tear that leads to slow leaks or sudden bursts.

Validating Safety Device Functionality

A critical part of any boiler service is testing the mechanisms designed to prevent a disaster. For an insurer, this is the most important part of the report.

When an engineer confirms that a boiler's pressure relief valve and temperature controls are functioning correctly, they are providing documented proof that the primary defences against catastrophic failure are operational. This transforms the service record from a simple receipt into a definitive statement on the property's risk profile.

Looking at the annual boiler service through this lens, the certificate is no longer just proof of maintenance. It is an essential underwriting document. It confirms that key risks have been professionally assessed and neutralised. The challenge, however, has always been verifying this document exists before cover is granted.

Why Relying on the 'Reasonable Care' Clause Fails

The traditional industry response to a claim involving a neglected boiler is to invoke the 'reasonable care' clause. The argument is simple: the policyholder failed their duty to maintain the property, so the claim can be repudiated.

On paper, the commercial logic feels solid. Argue negligence, repudiate the claim, save money. But this approach is a classic case of winning the battle and losing the war. It ignores the significant hidden costs that arise the moment a claim is denied on grounds of non-compliance.

The True Cost of Reactive Denials

Relying on a post-claim denial is a strategy that unleashes a torrent of negative commercial consequences, often costing far more than the original claim.

- Prolonged Disputes: A repudiated claim is the start of a long, drawn-out dispute that consumes adjuster and handler time.

- Costly FOS Complaints: Unhappy customers often take their case to the Financial Ombudsman Service (FOS), racking up significant legal and administrative costs, win or lose.

- Customer Churn: Denying a claim, even if justified, shatters customer trust and generates negative word-of-mouth that harms retention.

The real issue is that finding out about non-compliance at the point of claim is already too late. The insurer is backed into a corner, forced into a confrontational stance that destroys trust and piles on dispute-related expenses. It turns a preventable problem into a major cost centre.

When you consider that around 90% of UK homes depend on boiler systems, the scale of this potential conflict is massive. Verifying maintenance before a policy starts completely sidesteps this costly cycle. For landlords, understanding compliance is especially critical, as detailed in this guide on the Landlord Gas Safety Certificate and Boiler Service. It is always cheaper to prevent the dispute than to win it.

Stopping Pre-Existing Damage Fraud at Inception

Beyond simple neglect, insurers face a more deliberate and costly problem with boilers: after-the-event fraud. A policyholder with a boiler they know is failing buys a new home insurance or emergency cover policy, only to file a hefty claim for a breakdown a few weeks later.

This problem is baked into the traditional insurance model. The pre-existing damage only comes to light at the point of claim, forcing the insurer into a difficult position. This kicks off expensive investigations, requires loss adjuster visits to determine the fault's timeline, and often ends in costly disputes. The entire process is reactive, inefficient, and drains claims team resources.

The Failure of the Current Model

The current approach fails because it relies on self-declaration, which is notoriously unreliable for catching deliberate fraud. The insurer is effectively flying blind, underwriting a risk without verifying the condition of one of the most claim-prone assets in the home.

The cost of inaction is severe. Insurers absorb the financial hit from fraudulent claims, spend heavily on dispute resolution, and risk reputational damage. This is not just leakage; it is a systemic vulnerability that opportunistic policyholders can easily exploit.

This is a classic case of detection at the claim stage being too late. By then, the financial and operational damage is done. You can read more about fighting fraud before it happens with the power of verified evidence .

How Verification at Inception Solves This

The solution is to move verification from the point of claim to the point of inception. By making the annual boiler service certificate a mandatory part of the onboarding process, insurers can block this fraud vector entirely. This is where pre-inception verification technology fundamentally changes the game.

By requiring an applicant to upload a dated, geolocated photo or video of their latest service certificate, the insurer gets definitive proof of the boiler's condition before cover is granted. This simple step stops fraudsters in their tracks, as they can no longer hide a pre-existing fault. The commercial outcome is clear: the elimination of a significant category of fraudulent claims and reduced dispute costs.

A Practical Framework for Verifying Boiler Servicing

Implementing a verification programme for an annual boiler service is a direct, common-sense way for insurers to cut claims costs and prevent fraud. It is a simple shift from reacting to claims to proactively preventing them.

The process is straightforward and integrates into the existing policy lifecycle. At new business or renewal, the insurer requests proof of a recent boiler service. Using a simple digital tool, the policyholder can capture a dated, geolocated photo or video of their Gas Safe engineer’s service certificate. This transforms a piece of paper into a solid, verifiable digital record tied to a specific property.

The Commercial Benefits of Verification

This simple check delivers measurable financial results that go straight to the bottom line. It is about removing future costs and arguments before they have a chance to start.

- Reduced Claims: Verified maintenance directly lowers the incidence of escape of water and fire claims originating from faulty boilers.

- Fraud Elimination: This approach blocks the path for ‘after-the-event’ fraud where a policyholder knowingly insures a failing appliance.

- Claims Efficiency: For genuine breakdown claims, having a verified service history on file from day one accelerates processing, as essential due diligence is already complete. You can learn more about how pre-authentication can reduce claims costs by up to 30 percent .

A Value-Added Service for Brokers

For brokers, this framework is more than a risk management tool; it is a powerful differentiator. By building this verification step into client onboarding, brokers demonstrate a proactive commitment to their clients’ safety and financial security. This reinforces the message that regular property maintenance is a crucial part of protecting their biggest asset.

By championing verified boiler servicing, brokers transform a compliance issue into a clear commercial advantage. They enhance client retention, reduce the likelihood of difficult claim disputes, and position their brokerage as a partner in proactive risk management, not just a seller of policies.

Frequently Asked Questions About Boiler Services and Insurance

From an insurer's perspective, the annual boiler service has significant implications for risk and cost. Here are the key questions.

Can an Insurer Reject a Claim for an Unserviced Boiler?

Yes. Most UK home insurance policies include a ‘reasonable care’ clause, requiring the homeowner to maintain their property. An insurer can argue that skipping an annual boiler service is a failure of this duty, providing grounds to reject a related claim. However, this strategy is often a commercial own-goal. It leads to disputes, FOS complaints, and customer churn, with the costs of fighting the claim often exceeding the original payout. A smarter, more cost-effective strategy is to verify the service has been done at inception, not argue about it after a claim.

What Documentation Proves a Boiler Service Took Place?

Traditionally, proof is a paper certificate or PDF invoice from a Gas Safe engineer. The problem is these are easily lost or forged. This lack of verifiable evidence complicates claim investigations.

A paper certificate is a static, unreliable piece of evidence. A digitally verified, geolocated, and dated record captured at policy inception is an immutable data point that provides absolute certainty, stopping disputes before they start.

How Does a Boiler Service Directly Reduce Claims Costs?

An annual boiler service is one of the most effective loss prevention measures available. It directly tackles the root causes of frequent and expensive claims, such as escape of water and fire. By ensuring critical components like seals, flues, and pressure valves are functioning correctly, the service systematically prevents failures. Verifying this check has occurred confirms this risk has been managed, strengthening the book of business and plugging a major source of claims leakage.

Transform your claims process from reactive and costly to proactive and efficient. With Proova , you can verify property conditions and asset maintenance at policy inception, eliminating fraud and preventing disputes before they ever happen. Visit https://www.proova.com to see how pre-inception verification can cut your claims costs.