The Real Cost of Inaccurate Underwriting in Insurance

In the world of insurance, underwriting is the commercial engine room. It's the critical process of assessing a potential risk—be it a commercial property portfolio or a high-net-worth home—and deciding whether to offer cover, and at what price. Get it right, and the premiums collected are more than enough to cover future claims, building a profitable book. Get it wrong, and you're on a fast track to claims leakage and financial instability.

For insurers and brokers, effective underwriting is the primary defence against financial loss. It's where the decisions are made that determine whether the business sinks or swims.

The Commercial Core of Insurance Underwriting

From a commercial perspective, underwriting is far more than a procedural step. It is the single most important tool for building a profitable, balanced book of risks and the first line of defence against adverse selection—the classic insurer’s nightmare of disproportionately covering high-risk clients who are far more likely to claim.

An underwriter acts as a gatekeeper. Their role is to meticulously evaluate information to forecast the probability and potential cost of a future claim. This isn't theory; it has direct commercial consequences. Take the UK property market, where soaring claims costs have put underwriting under immense pressure. In 2023, the average home insurance premium for properties built between 1925 and 1940 shot up by a staggering 39.3% , a direct reaction from underwriters to escalating risk. You can dig into the numbers in the full home insurance statistics report from Confused.com.

For both insurers and brokers, sharp underwriting directly shapes several key commercial outcomes:

- Profitability: Pricing risk with precision is the absolute bedrock of a healthy loss ratio.

- Market Competitiveness: Price too high, and you lose good business to competitors. Price too low, and you're heading for unsustainable losses. It's a constant tightrope walk.

- Fraud Prevention: Rigorous analysis at policy inception is the best opportunity to spot and deter fraudulent applications, particularly "after-the-event" fraud where cover is sought for already damaged items.

- Customer Retention: Fair, accurate, and transparent underwriting builds trust. This is vital for long-term client relationships, particularly for brokers who build their reputation on providing top-tier service.

The table below breaks down these core responsibilities and their commercial objectives for any UK insurer.

Core Functions of Modern Insurance Underwriting

| Function | Objective For The Insurer | Key Commercial Challenge |

|---|---|---|

| Risk Assessment | To accurately evaluate the likelihood and potential cost of a claim from a specific applicant. | Balancing data-driven analysis with the need for human expertise, especially on complex or unusual risks. |

| Pricing Strategy | To set a premium that is profitable for the insurer but remains competitive in the market. | Avoiding the "race to the bottom" on price while still attracting and retaining quality customers. |

| Portfolio Management | To build and maintain a balanced and diversified book of business, avoiding over-exposure to any single risk type. | Responding to shifting market conditions and emerging risks (like climate change or cyber threats) without destabilising the portfolio. |

| Fraud Detection | To identify and reject applications that show signs of misrepresentation or outright fraudulent intent at inception. | Spotting sophisticated fraud schemes that exploit gaps in data and verification processes. |

Each of these functions is interlinked, and a weakness in one area inevitably puts pressure on the others.

In essence, underwriting is a balancing act. It requires the skill to accept enough risk to generate revenue while avoiding exposures that could jeopardise the entire book of business. Getting this balance right is the difference between profit and loss. Getting it wrong leads directly to claims leakage, customer disputes, and regulatory scrutiny.

The Underwriting Journey: From Application to Policy

The underwriting process is a structured journey that begins the moment an application is received and ends with a firm decision on cover. For insurers and brokers, understanding this workflow is crucial—it's where friction points drive up operational costs and leave valuable clients waiting.

Think of it as a methodical investigation. Each stage builds on the last, designed to ensure that by the end, the insurer has a clear, defensible position on the risk they’re being asked to take on.

Stage 1: Data Gathering and Initial Assessment

The journey begins with the proposal form. Whether for a commercial property, a landlord’s portfolio, or a high-net-worth individual’s art collection, this self-declared information is the foundation for everything that follows.

The underwriter's first task is to assess the submission for completeness and ensure it doesn't immediately fall outside the insurer's risk appetite. This is also where the real investigation starts, as they pull in data from external sources to build a complete picture. This often involves checking:

- Claims History Databases: Pulling reports to verify the applicant's claims record against what has been declared.

- Credit and Fraud Checks: A review of the applicant's financial stability and a search for red flags that might signal a moral hazard.

- Third-Party Property Data: Using external databases to verify critical details like a building's age, construction type, or its specific risk of flooding or subsidence.

Stage 2: Risk Analysis and Application of Guidelines

With a richer set of data, the underwriter moves to the core analysis. Here, they apply the insurer’s internal underwriting guidelines—a detailed rulebook that dictates which risks are acceptable, how they should be priced, and what terms should apply.

This is where an underwriter’s experience is critical. They must weigh the specific details of the application against established rules, identifying both red flags and mitigating factors. A history of multiple small claims, for instance, might suggest poor risk management, potentially leading to a higher premium or an endorsement excluding certain types of cover.

At this stage, it’s all about matching the applicant's risk profile to the insurer's commercial strategy. An underwriter isn't just looking at a single property in isolation; they’re deciding if this particular risk fits profitably within the wider portfolio.

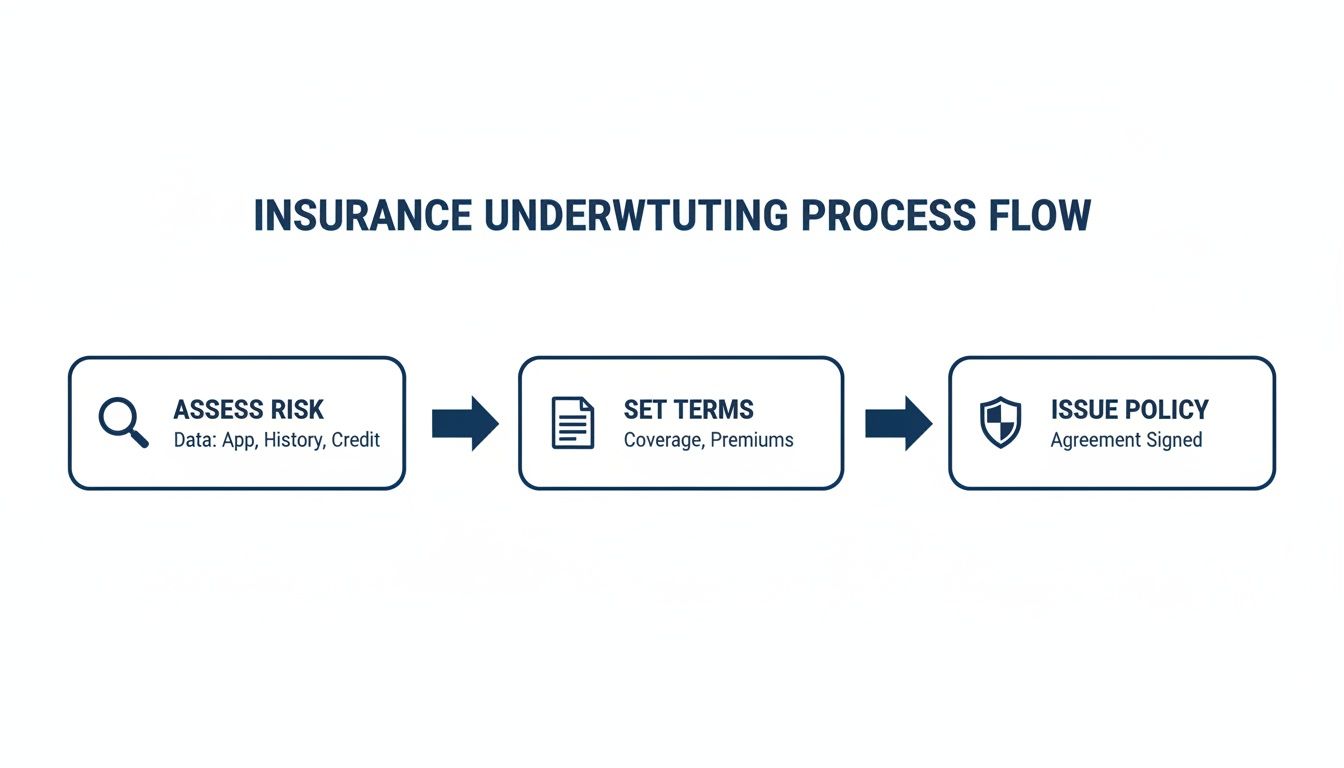

This visual flow shows the core sequence: assess the risk, set the terms, and finally, issue the cover.

Each step is completely dependent on the quality of information from the one before it. A data gap early on can compromise the entire decision.

Stage 3: The Final Decision

The journey concludes with one of three outcomes. Based on the analysis, the underwriter will:

- Accept the Risk: The application meets all criteria, and a policy is offered on standard terms.

- Offer a Counter-Proposal: The risk is acceptable, but with modifications. This could mean proposing a higher premium, a larger excess, or adding endorsements to limit specific types of cover.

- Decline the Risk: The application falls completely outside the insurer's risk appetite and is rejected.

This final decision is carefully documented, and the policy is either issued or the outcome is communicated back to the broker or applicant, completing the underwriting cycle.

How Underwriters Evaluate and Price Risk

Once an application passes initial checks, the underwriter’s real work begins: digging into the specific risk factors to set a premium that is both competitive and profitable.

For property insurance, this process involves a deep dive into the asset, the applicant’s history, and, most critically, the declared sum insured. An underwriter does not simply take an application at face value; they interrogate the data to build a complete picture of the potential risk.

Key Factors in Property Risk Pricing

Underwriters weigh several core elements to calculate the right premium for a property policy. Each factor feeds into the final pricing model, and a weakness in one area can throw the whole calculation off.

-

Property Characteristics: This covers the building's age, construction materials, and location (including flood and subsidence risk). It also includes security measures and the property's use. A commercial building with a sophisticated fire suppression system presents a very different risk profile to one without.

-

Applicant's Claims History: A track record of frequent claims can signal a higher moral hazard or poor property maintenance. This data is always cross-referenced with industry databases to ensure accuracy.

-

The Declared Sum Insured: This is arguably the most critical and vulnerable part of the process. The underwriter has to trust that the value of the property and its contents, as declared by the applicant, is accurate.

This total reliance on unverified, self-declared information for the sum insured is a significant commercial vulnerability. It’s the point where the underwriting process often breaks down, leading directly to future disputes and financial loss.

Consider the 'lounge exercise'. Ask any policyholder to list what's in their lounge and they'll say it's easy. Ask them after a burglary or fire and you'll spend weeks in dispute over forgotten items, inaccurate values, and questionable ownership. Relying on memory-based valuations at policy inception is a recipe for disaster.

This guesswork is a primary driver of underinsurance. With 76% of UK properties potentially underinsured, underwriters face immense pressure. They're trying to avoid the massive payouts seen recently, like the £1.6 billion paid in property claims in a single quarter. As a result, many are now demanding more robust proof of assets before they’ll even offer cover. You can find more detail on these trends in this UK home insurance statistical report.

When unverified data is used to set a premium, the policy is built on a foundation of sand. It directly leads to the costly application of the average clause, damaging both the insurer’s bottom line and the client relationship. This is a core component of a wider insurer strategy, which you can explore in our guide to building a business risk management framework.

Put simply, accurate data at the start prevents disputes at the end.

The Real Cost of Inefficient Underwriting

Outdated underwriting isn't just a procedural headache. It’s a quiet but significant drain on an insurer’s profitability, turning what should be a robust risk assessment into a source of commercial instability. The damage isn't theoretical—it shows up as direct, painful hits to the bottom line.

This inefficiency bleeds cash in several ways. Every underinsured property that ends up as a claim creates claims leakage, where the premium collected was never enough to cover the actual risk. Likewise, when you rely on unverified data at the start, you're forced into costly interventions later, like sending out loss adjusters for routine claims that clear, upfront proof could have settled in minutes.

The Financial Drain of the Status Quo

The financial bleeding doesn’t stop with a few leaky claims. It poisons the entire book of business, creating systemic problems that drag everything down.

-

Increased Claims Handling Costs: When an underwriter lacks verified asset data, the problem lands squarely with the claims team. They are left to investigate ownership, condition, and value after a loss, which means longer claim lifecycles and ballooning operational costs.

-

Erosion of Profit Margins: In UK general insurance, profitability depends on accurately balancing losses against premiums. This challenge is stark in the motor industry, where some sectors consistently post underwriting losses despite hiking premiums. Home insurance is no different; soaring premiums fail to keep pace as weather events and inflation bloat claims costs, leaving underwriters in a constant state of catch-up. You can explore the data for yourself in the general insurance value measures published by the FCA.

-

Costly Dispute Resolution: Ambiguity at policy inception is the number one cause of disputes at the point of claim. Every dispute burns cash, not just in staff time but in potential legal fees, regulatory fines, and the impossible-to-measure cost of a ruined customer relationship.

At its heart, the problem is singular: a critical lack of verified, objective asset data when the policy is written. This single failure point creates a domino effect, driving up costs and inefficiency across the entire insurance value chain. The status quo is not just inadequate; it is commercially unsustainable.

Moving from these outdated processes to a modern, verification-led approach isn’t just an upgrade—it's a fundamental shift in how you manage risk and protect profitability. The table below shows just how different the two worlds are.

Traditional vs Technology-Enhanced Underwriting

This comparison highlights the commercial benefits of ditching outdated, high-cost processes for a modern, verification-led approach. It’s a move from guesswork to certainty.

| Process Step | Traditional Method (High Cost) | Proova-Enhanced Method (Reduced Cost) |

|---|---|---|

| Sum Insured Validation | Relies on the applicant's best guess, creating a high risk of underinsurance. | Uses a verified, time-stamped digital inventory to lock in an accurate sum insured from day one. |

| Pre-Risk Surveys | Requires expensive physical visits by surveyors for high-value properties. | Allows for remote, digital pre-risk assessments using policyholder-submitted verified data. |

| Claims Validation | Involves lengthy investigations and potential loss adjuster visits to confirm ownership and value. | Presents a pre-agreed inventory, killing disputes before they start and speeding up settlement. |

| Fraud Prevention | Limited to checks at the claims stage, often long after "after-the-event" fraud has occurred. | Verifies asset existence and condition at inception, making post-loss fraudulent claims impossible. |

The difference is clear. One path is riddled with ambiguity, friction, and hidden costs. The other is built on a foundation of verified proof, creating a more efficient, profitable, and sustainable model for the future.

How Pre-Inception Verification Transforms Underwriting

Traditional underwriting often feels like trying to price risk with one hand tied behind your back. It relies on data that’s frequently incomplete, rarely verified, and sometimes dangerously subjective. This forces underwriters to base premiums on assumptions rather than solid facts, creating a commercial vulnerability right from the start.

The solution is a simple but powerful shift: move verification from the point of claim to the point of policy inception.

Imagine receiving a complete, time-stamped, and geolocated digital inventory of a client's assets before you issue the policy. This is the core of pre-inception verification . It replaces guesswork with objective proof, allowing underwriters to make decisions based on what they know, not what they hope is true. This fundamental change turns underwriting from a reactive, defensive function into a proactive, preventative one.

Preventing Underinsurance From Day One

The single biggest benefit is the prevention of underinsurance. When the sum insured is based on a verified digital catalogue of assets, the risk of it being wrong is virtually eliminated. This protects both the policyholder and the insurer from day one.

For the underwriter, it means the premium collected accurately reflects the true risk being covered. This directly prevents the financial leakage caused by the application of the average clause, where an insurer is forced to pay out on a property that was never adequately insured in the first place.

By establishing an accurate and agreed-upon sum insured at inception, underwriters can confidently price policies, knowing the foundation of the contract is solid. This kills the risk of costly average clause disputes before they ever have a chance to begin.

This shift doesn't just improve the numbers; it builds trust. Policyholders know they're correctly covered, and insurers can build a profitable, accurately priced book of business.

Shutting Down After-The-Event Fraud

A significant amount of claims fraud happens after a loss. An individual might try to include items they never owned or claim for damage that existed long before the policy was taken out. Pre-inception verification makes this type of fraud practically impossible.

With a time-stamped visual record of an asset's existence and condition at the start of the policy, any claim for pre-existing damage is dead on arrival. It’s a powerful tool for fraud teams and a massive deterrent for opportunistic fraudsters. To get a deeper insight into this preventative approach, you can learn more about fighting fraud before it happens with verified evidence .

Eliminating Costly Physical Surveys

For high-value properties or complex commercial risks, insurers often turn to expensive and time-consuming physical surveys to validate assets. Pre-inception verification offers a far more efficient and cost-effective alternative.

Policyholders can use technology to conduct their own detailed, verified inventories, giving underwriters all the rich data they need without the logistical headache of sending a surveyor. This approach delivers several key commercial benefits:

- Reduced Operational Costs: Drastically cuts the expense tied to physical site visits.

- Faster Policy Inception: Speeds up the entire underwriting process, allowing policies to be issued more quickly.

- Improved Data Quality: Provides a more detailed and easily accessible record than a traditional survey report.

Moving from physical to digital verification allows underwriting teams to scale their operations efficiently. It lets them focus their expertise on complex risk analysis rather than manual data collection, transforming the entire process into a more accurate, secure, and commercially sound operation.

The Future of Underwriting With Insurtech

The next frontier for underwriting is being carved out by technology. Artificial intelligence and advanced data analytics are constantly pitched as the solution for insurers looking to sharpen their risk assessment and increase efficiency. The promise is that these tools can process vast datasets, spot subtle patterns, and produce faster, more consistent decisions.

But there's a critical commercial reality often missed in the rush to adopt new systems: an advanced algorithm is only as good as the data it is fed. Without a foundation of accurate, verified, and objective information from the start, even the most powerful AI is simply automating guesswork.

Data Quality: The Non-Negotiable Ingredient

The real power of insurtech isn't unlocked by complex predictive models alone, but by applying them to high-quality, reliable data. Verified asset inventories provide the clean, structured information that AI needs to function effectively. This ground-truth data ensures that analytical models aren’t built on the same shaky assumptions that undermine traditional underwriting. As underwriting evolves, advanced data collection methods, including the role of AI and ESG data collection , are becoming crucial for building a complete picture of risk.

For a deeper dive into this, our guide on digital transformation in the insurance industry explores how this foundational data underpins any successful tech adoption.

A New Competitive Edge for Brokers

This shift also creates a significant opportunity for brokers. By using tools that facilitate pre-inception verification, brokers can offer a superior service that differentiates them in a crowded market. They can move from being simple intermediaries to becoming proactive risk management partners.

This approach delivers tangible benefits for brokers:

- Enhanced Client Service: Ensuring clients are correctly insured from day one prevents difficult conversations and financial headaches when a claim occurs.

- Stronger Insurer Relationships: Presenting underwriters with clean, verified risk data builds trust and can lead to more favourable terms for your clients.

- Improved Client Retention: A smooth, transparent process that demonstrably protects the client's interests is a powerful driver of loyalty.

Ultimately, the future of underwriting lies in a powerful partnership: human expertise, powered by intelligent technology, and fuelled by indisputable, verified data from day one.

Your Questions Answered

Understanding how modern, evidence-based tools fit into the daily grind of underwriting is crucial. Here are a few common questions we hear from insurers and brokers grappling with the shift from traditional methods to a more certain, verifiable approach.

How does pre-inception verification actually lower claims costs?

It eliminates the argument before it begins. By locking in a complete, agreed-upon inventory of what is being insured from day one, there is no room for lengthy, expensive debates over ownership or pre-existing condition when a claim occurs.

This transforms the claims handler's role. Instead of a protracted investigation, they have a clear baseline of truth. This slashes the time they—and any loss adjusters—spend on a case, directly reducing claims processing times and associated operational costs.

Is technology going to make skilled underwriters obsolete?

Absolutely not. It’s about enhancing expertise, not replacing it. This technology is a tool that frees up your best people to focus on what they do best: complex risk analysis and strategic decision-making.

By automating the tedious, manual grind of data collection and verification, it allows skilled underwriters to apply their judgement where it has the most commercial impact, improving the quality and profitability of the entire book of business.

What is the single biggest underwriting headache that asset verification solves?

Without a doubt, it’s the prevention of underinsurance and the costly average clause disputes that follow. This is a persistent problem that creates friction for everyone involved.

By establishing an accurate, verified sum insured at the start of a policy, you protect your customers from devastating claim shortfalls while protecting your business from taking on unprofitable risk. This single action helps sidestep regulatory scrutiny, boosts customer satisfaction, and strengthens the integrity of the policy from inception to claim.

Ready to transform your underwriting process from guesswork to certainty? Proova provides the tools to prevent fraud, eliminate underinsurance, and dramatically improve claims efficiency. Discover how Proova can strengthen your book of business today.