12 Essential Apps for Business Management in the UK (2025)

In today's competitive landscape, effective business management is not just an advantage; it is a necessity. UK businesses are increasingly turning to specialised applications to streamline operations, enhance productivity and secure their assets. However, choosing the right tools can be a formidable task, particularly with the vast array of options available.

This guide cuts through the noise, offering a curated selection of the best apps for business management available in 2025. We will delve into platforms that not only manage projects and finances but also tackle complex challenges like asset verification and insurance fraud. This is a pervasive issue that costs the industry billions annually and affects everyone. By adopting robust digital solutions, companies can establish provable records of assets, deter fraudulent claims and ultimately contribute to a more stable and cost-effective insurance market.

Our analysis provides a comprehensive overview to help you find the right fit for your specific needs. Each recommendation includes detailed feature analysis, screenshots and direct links to get you started. For a broader understanding of how modern software drives efficiency, it is helpful to explore how Cloud Based Business Applications can enhance growth. Let's explore the applications that empower your business to operate with greater efficiency, transparency and security.

1. Proova

Proova stands out as a sophisticated and highly specialised platform among apps for business management, specifically engineered to tackle the complex challenges within the insurance sector. It provides a robust framework for insurers, brokers and claims managers to streamline critical operations, from underwriting to claims processing, by focusing on the core issues of verification and fraud prevention. Its unique approach centres on creating an authenticated database of insured items, which serves as a single source of truth throughout the policy lifecycle.

This digital-first strategy fundamentally transforms how insurance professionals manage risk and validate claims. By enabling on-site verification of items during the underwriting phase, Proova significantly reduces the reliance on costly physical surveys and loss adjuster visits. The platform’s ability to prevent 'after the event' fraud, where claims are made for items damaged or added after a policy's inception, directly addresses a major financial drain on the industry. The impact of such fraud is significant, driving up premiums for all consumers and costing the industry billions annually.

Key Strengths and Use Cases

Proova's strength lies in its dual-purpose functionality, serving both as a powerful underwriting tool and a highly efficient claims management system. For businesses looking to enhance their operational integrity, Proova offers a comprehensive solution.

- Fraud Mitigation: At its core, Proova is a powerful deterrent against fraudulent activity. By requiring verified proof of ownership and item condition before a loss event, it closes common loopholes exploited by fraudsters. This proactive stance is invaluable for fraud prevention specialists seeking to reduce losses.

- Accelerated Claims Processing: Claims managers can leverage the platform’s verified data to process legitimate claims at an unprecedented speed. The system drastically cuts down the time spent on identity checks and ownership verification, improving customer satisfaction and operational efficiency.

- Accurate Underwriting: For commercial and home insurers , the platform allows for real-time item evaluation, ensuring policies are priced accurately based on verified assets. This eliminates guesswork and protects against underinsurance. For a deeper insight into how Proova can benefit your operations, you can learn more about its business solutions on proova.com.

Practical Considerations

While immensely powerful, the platform’s effectiveness is contingent on the thoroughness of the initial data capture by the policyholder. Users must proactively document their items in detail for the system to function optimally. Subscription plans are highly accessible, starting from just £5 per month, making this advanced technology available to a wide range of insurance stakeholders.

- Pros: Dramatically speeds up claims processing, significantly reduces fraudulent claims, supports accurate underwriting and is affordably priced for wide adoption.

- Cons: Requires diligent initial documentation from the end-user and its full potential relies on the accuracy of this user-provided data.

Website: https://www.proova.com

2. Microsoft AppSource

For organisations already embedded within the Microsoft ecosystem, AppSource is less a marketplace and more an essential extension of their existing technology stack. It serves as the official, secure repository for thousands of third-party apps for business management, all designed for deep integration with services like Microsoft 365, Dynamics 365 and Power Platform. This unified approach streamlines deployment and centralises administration directly through the Microsoft 365 admin centre, which simplifies procurement and enhances security.

Unlike general app stores, AppSource’s primary advantage is its rigorous vetting process and seamless integration. For claims managers and fraud prevention specialists, this means finding and deploying industry-specific tools that are already compliant and guaranteed to work with their core systems. This tight integration is critical for maintaining data integrity and improving the provability of claims. For further insights, you can learn more about the importance of robust systems on proova.com.

Key Considerations:

- Best for: Businesses heavily invested in Microsoft’s software suite.

- Pros: Strong security vetting, tight product integration and streamlined procurement.

- Cons: Limited value outside the Microsoft ecosystem; some pricing is not transparent.

3. Salesforce AppExchange

For organisations whose operations revolve around the Salesforce CRM, the AppExchange is the definitive marketplace for extending platform capabilities. It functions as a comprehensive enterprise cloud marketplace, offering thousands of pre-built apps for business management and certified consulting partners. This ecosystem is designed to enhance every aspect of the Salesforce experience, from sales and service to marketing and analytics, ensuring businesses can tailor the platform to their precise operational needs.

The primary strength of the AppExchange lies in its mature, highly integrated ecosystem. For claims managers and insurance professionals, this means access to specialised tools that embed directly into their claims management workflows. The platform’s robust security review process ensures that these third-party integrations maintain data integrity, which is essential for bolstering the provability of claims and identifying patterns that may indicate insurance fraud. Its vast selection and strong administrative controls make it a powerful resource, though it requires administrative permissions to install new applications.

Key Considerations:

- Best for: Businesses deeply integrated with the Salesforce CRM platform.

- Pros: Mature ecosystem with extensive app options and strong security controls.

- Cons: Pricing often requires direct vendor contact; higher costs can be a barrier.

4. Atlassian Marketplace

For teams built around Atlassian’s suite of products like Jira, Confluence and Trello, the Atlassian Marketplace is the definitive source for extending functionality. It provides over 8,000 specialised add-ons and apps for business management, allowing organisations to customise their project management, ITSM and collaboration workflows. This ecosystem is particularly powerful for creating highly specific, integrated systems that enhance operational control and process documentation.

The marketplace’s unique value lies in its deep, native integration with core Atlassian platforms. For claims managers and fraud investigators, this means tools that seamlessly plug into Jira Service Management can provide structured, auditable trails for every claim. This level of integration is essential for improving the provability of claims and maintaining a robust, evidence-based workflow. Centralised billing aligned to Atlassian user tiers simplifies procurement while ensuring every tool contributes to a single, cohesive operational view.

Key Considerations:

- Best for: Organisations that use Atlassian products as their central operational hub.

- Pros: Deep integration into Atlassian tools, transparent user-tier pricing and unified billing cycles.

- Cons: Costs scale with the number of users; admins are typically required to install apps.

5. Apple App Store + Apple Business Manager

For organisations operating within the Apple ecosystem, the App Store combined with Apple Business Manager provides a powerful framework for deploying and managing business applications. Apple Business Manager (ABM) allows UK-based organisations to purchase apps for business management in volume, assign licences to employees or devices and securely distribute them through a Mobile Device Management (MDM) solution. This centralised approach streamlines app deployment without requiring individual employees to use their personal Apple IDs, enhancing both security and administrative control.

The key advantage of this system is its robust, secure distribution channel, especially for custom or private B2B apps. For claims managers and fraud investigators, this means the organisation can deploy proprietary evidence-gathering or case management tools directly to company-issued iPhones and iPads. This ensures that sensitive claims data is handled within a controlled environment, strengthening data integrity and improving the provability of evidence collected in the field. This controlled deployment is vital for preventing data breaches and combating insurance fraud effectively.

Key Considerations:

- Best for: Businesses that rely on Apple hardware (iPhones, iPads, Macs) for their operations.

- Pros: Strong enterprise controls, volume purchasing options and the ability to manage custom B2B apps privately.

- Cons: Apple Business Essentials is US-only, so UK organisations must integrate ABM with a third-party MDM solution.

6. Google Play (Managed Google Play for Enterprise)

For organisations managing an Android device fleet, Managed Google Play is the cornerstone of a secure and controlled application ecosystem. It transforms the public Google Play Store into a private, curated enterprise platform. This allows IT administrators to discover, approve and securely distribute specific apps for business management to company-owned devices or personal devices with work profiles. Its core function is to centralise app deployment through an Enterprise Mobility Management (EMM) solution, ensuring only whitelisted applications are accessible.

Unlike a standard app store experience, Managed Google Play’s strength lies in its granular control and security integration. Claims managers can deploy bespoke internal apps or approved third-party tools directly to field adjusters, ensuring data from site inspections is handled within a secure, managed environment. This controlled distribution is vital for maintaining the integrity of evidence and enhancing the provability of claims by preventing data leakage or the use of unvetted software. This controlled approach helps to combat insurance fraud by securing the entire data collection process.

Key Considerations:

- Best for: Businesses managing Android devices through an EMM/MDM solution.

- Pros: Fine-grained control over app visibility and installation and strong enterprise distribution for BYOD and corporate devices.

- Cons: Requires administrator setup with an EMM for full control; bulk purchasing of paid app licences via the platform has been discontinued.

7. AWS Marketplace

For organisations building their operations on Amazon Web Services, the AWS Marketplace is an indispensable digital catalogue. It allows businesses to find, purchase and immediately deploy thousands of third-party software solutions, data products and professional services directly within their AWS environment. This integration simplifies the procurement process for complex apps for business management, consolidating billing into a single AWS account and streamlining software governance and cost control across the enterprise.

The primary benefit for claims managers and fraud investigators is the ability to rapidly deploy powerful, specialised tools without complex procurement cycles. For instance, teams can access advanced analytics and machine learning applications to analyse claim patterns, identify fraudulent activities and enhance the provability of legitimate claims. Flexible pricing models, including free trials and pay-as-you-go, allow for cost-effective experimentation with new technologies. This agility is crucial for adapting to emerging fraud tactics and managing the operational costs associated with claims processing.

Key Considerations:

- Best for: Businesses already utilising or planning to migrate to AWS cloud infrastructure.

- Pros: Streamlined procurement and one-click deployment for AWS users; wide selection of enterprise-grade applications.

- Cons: Primarily benefits organisations within the AWS ecosystem; costs can escalate without proper governance.

8. Xero App Store (UK)

For small to medium-sized businesses operating within the Xero ecosystem, its dedicated UK App Store is an essential resource for extending the platform's core accounting capabilities. It provides hundreds of vetted third-party apps for business management, covering everything from payment processing and payroll to specialised reporting and e-commerce. The direct-install functionality ensures that these tools connect seamlessly with a company’s financial data, creating a single, integrated source of truth.

Unlike generic marketplaces, the Xero App Store is curated specifically for finance-related automation, which is critical for maintaining accurate records and improving the provability of financial claims. For claims managers, having integrated systems for transaction tracking or inventory management provides a clear audit trail, significantly reducing ambiguity and the potential for fraudulent activities. This ecosystem approach strengthens data integrity across all business operations. If you're exploring options for cloud-based accounting, you can find more details on Xero , a popular platform with a dedicated app store.

Key Considerations:

- Best for: UK-based small and medium-sized businesses already using Xero for accounting.

- Pros: Specialised focus on finance automation and e-commerce connectors, with accessible trials.

- Cons: Primarily useful for existing Xero users; some payment apps have mixed user reviews.

9. Sage Business Cloud Marketplace (UK)

For UK businesses using Sage for accounting or payroll, its Business Cloud Marketplace is a crucial resource for extending their software’s capabilities. It provides a curated library of third-party apps for business management specifically designed to integrate with Sage solutions like Accounting, Intacct and Payroll. This focus ensures that any add-on, whether for advanced reporting, compliance or HR, is tailored to meet specific UK tax, payroll and regulatory standards, which simplifies operations.

Unlike generic marketplaces, the platform’s value lies in its regional specialisation. For sectors like insurance, finding tools that seamlessly connect financial data with claims management systems is vital for maintaining data accuracy and enhancing the provability of claims. The direct integration offered by these vetted apps ensures that financial records and claim information are synchronised, reducing manual errors and bolstering defences against fraudulent activities which drive up costs for everyone.

Key Considerations:

- Best for: UK-based small to mid-market businesses already using Sage products.

- Pros: Strong fit for UK-specific tax and payroll requirements, extensive partner network for deployment support.

- Cons: Value depends heavily on which Sage product is used; some apps route users to third-party sites for pricing details.

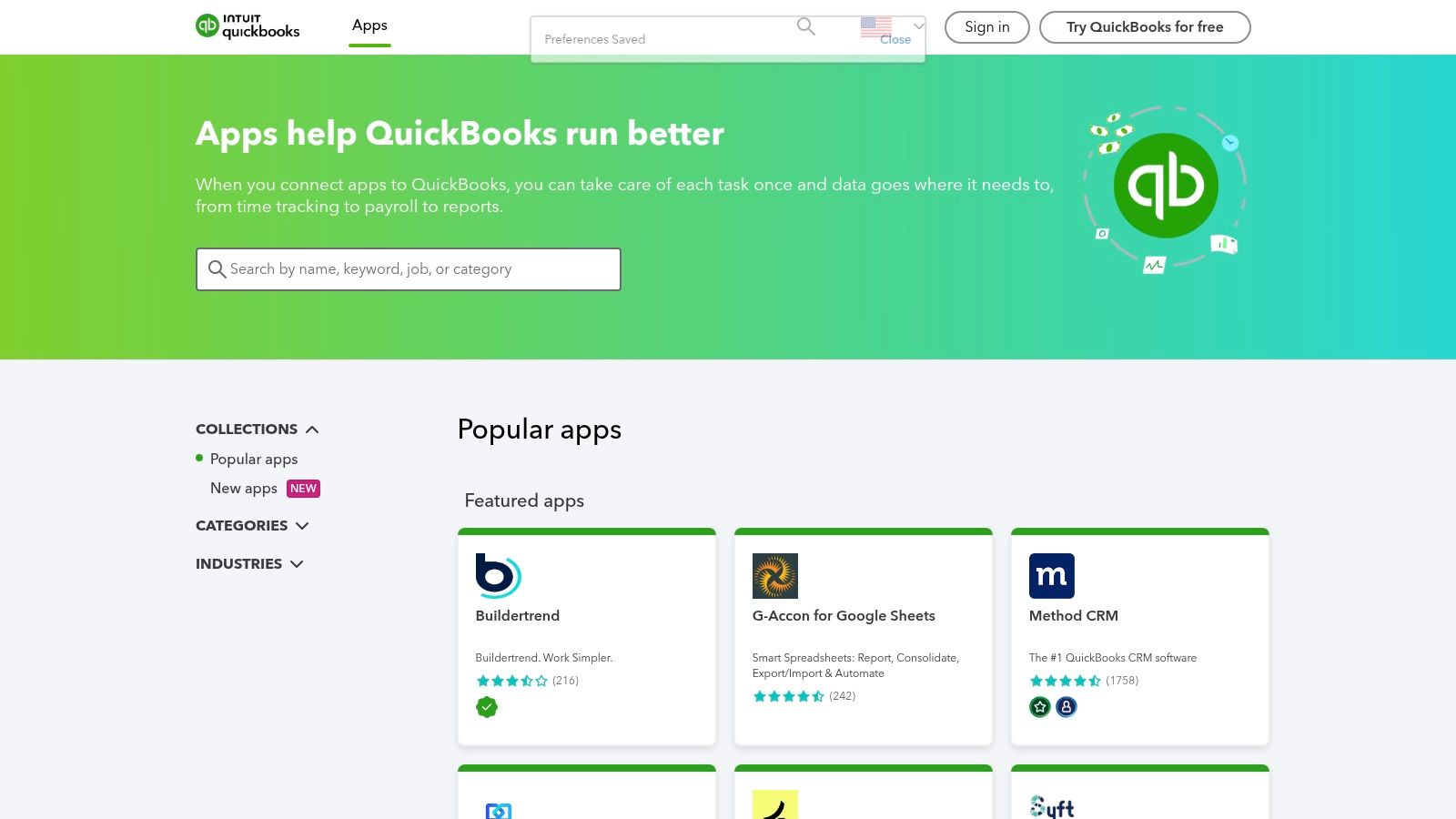

10. QuickBooks App Store (UK)

For small to medium-sized businesses whose financial operations are built around QuickBooks, its official App Store is an indispensable resource. It functions as a curated marketplace for third-party apps for business management, with each application designed to integrate directly with QuickBooks Online. This ecosystem is particularly robust for UK-based businesses, offering localised solutions for payments, e-commerce, payroll and enhanced financial reporting, all aimed at automating workflows and centralising data.

The key advantage of the QuickBooks App Store is its focus on creating a seamless, interconnected financial management system. For claims managers, this means the ability to connect expense tracking or inventory management apps directly to their accounting software, ensuring all financial data related to a claim is accurate, auditable and easily accessible. This level of data integrity is vital for increasing the provability of claims and reducing the administrative overhead associated with verifying financial records, ultimately strengthening fraud prevention efforts.

Key Considerations:

- Best for: Small businesses and organisations already using QuickBooks for their accounting.

- Pros: Highly suited for small businesses, many plug-and-play connectors for marketplaces and payment solutions.

- Cons: App availability and features can vary by country and plan; some support content is US-centric.

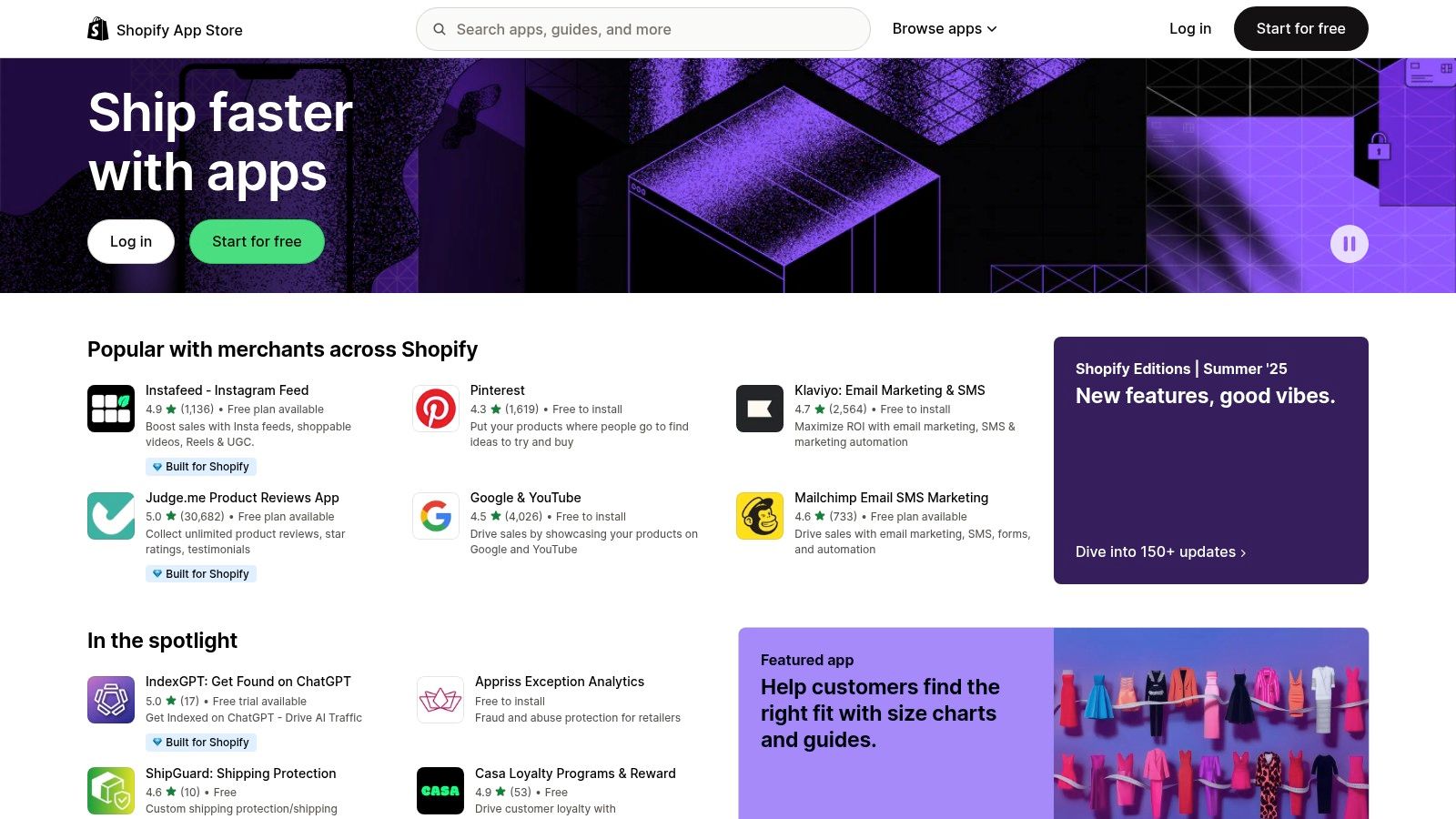

11. Shopify App Store

For e-commerce businesses, the Shopify App Store is an indispensable resource for building a tailored operational infrastructure. It acts as a dedicated marketplace offering over 8,000 vetted apps for business management, covering everything from inventory control and order fulfilment to marketing automation and customer service. This allows merchants to construct a sophisticated, end-to-end technology stack directly within their e-commerce platform, ensuring seamless integration and data flow across all business functions.

What distinguishes the Shopify App Store is its rigorous 100-checkpoint review process and the ‘Built for Shopify’ badge, which guarantees quality and performance. For businesses managing high-volume transactions, this curated environment is crucial for maintaining operational integrity and reducing risk. Integrating robust reporting or customer verification apps can strengthen the provability of transactions and help mitigate fraudulent claims, which is essential for protecting revenue and ensuring operational transparency. Many apps also offer free plans or trial periods, allowing for low-risk evaluation.

Key Considerations:

- Best for: E-commerce businesses seeking to customise and expand their online store's capabilities.

- Pros: Quick assembly of end-to-end e-commerce stacks and robust reviews for informed app choices.

- Cons: Potential for app sprawl to increase overall costs and policy changes may affect future pricing.

12. Capterra UK – Business Management Software Category

Capterra serves as a comprehensive discovery and comparison platform rather than a direct software provider. Its UK-specific portal is an invaluable starting point for businesses researching apps for business management, offering a vast directory that spans everything from enterprise resource planning (ERP) to niche claims management tools. The platform aggregates user reviews, provides filtering options by feature and business size and presents pricing information, which helps organisations create an initial shortlist before engaging with vendors directly.

The primary strength of Capterra is its breadth, allowing claims managers and fraud specialists to compare a wide array of solutions side-by-side. This is crucial for identifying software that not only meets operational needs but also enhances the provability of claims through robust data handling and reporting features. While it operates as a lead-generation site with sponsored listings, it remains a powerful tool for initial market research. If you need help selecting the right tools, you can always contact the experts at proova.com.

Key Considerations:

- Best for: Businesses in the discovery phase of sourcing new software.

- Pros: Extensive software categories, user-generated reviews and UK-specific focus.

- Cons: Sponsored placements can influence results; information requires final verification on vendor sites.

Visit Capterra UK – Business Management Software Category

Top 12 Business Management Apps Comparison

| Platform | Core Features / Capabilities | User Experience & Quality | Value Proposition | Target Audience | Price & Availability |

|---|---|---|---|---|---|

| Proova 🏆 | Streamlined claims, identity & ownership proof ✨ | ★★★★☆ App-based, fast, transparent | Affordable £5/mo 💰, reduces fraud, saves costs | 👥 Insurers, consumers, brokers, fraud specialists | Subscription from £5/month 💰, free app download |

| Microsoft AppSource | Thousands of vetted business apps, MS integration | ★★★★☆ Secure, seamless in MS ecosystem | Streamlined procurement for MS users | 👥 Enterprises using Microsoft stack | Pricing varies, some apps require contact |

| Salesforce AppExchange | Large app ecosystem for CRM extensions | ★★★★☆ Mature, secure, admin controls | Extensive app variety, but higher cost | 👥 Salesforce users & enterprises | Pricing mostly on vendor contact |

| Atlassian Marketplace | 8,000+ apps for project & IT management | ★★★★☆ Deep native integration | Transparent pricing tied to users | 👥 Jira, Confluence users | Pricing scales with users |

| Apple App Store + Business Manager | Volume app purchasing, MDM, private apps | ★★★★☆ Enterprise controls, privacy | Manage custom B2B apps privately | 👥 UK orgs with Apple device fleets | Requires ABM + third-party MDM |

| Google Play (Managed) | Private app approval, EMM integration | ★★★★☆ Fine control, BYOD support | Strong enterprise app distribution | 👥 Android enterprise & BYOD | Admin setup needed, free public apps |

| AWS Marketplace | Software for AWS, flexible pricing | ★★★★☆ Easy deployment in AWS | Large selection for AWS customers | 👥 AWS users & developers | Varies (hourly, monthly, BYOL) |

| Xero App Store (UK) | UK-focused finance & payments integrations | ★★★★☆ SMB-centric with trials | Specialized SMB finance connectors | 👥 Small & medium UK businesses | Varies by app, free trials common |

| Sage Business Cloud Marketplace | UK-centric tax, payroll apps | ★★★★☆ Strong partner support | Focused on UK compliance | 👥 SMBs using Sage | Pricing varies, often vendor-based |

| QuickBooks App Store (UK) | UK payment & ecommerce integrations | ★★★★☆ Frequent updates, user reviews | Best for QuickBooks users | 👥 Small businesses using QuickBooks | Varies, some US-centric content |

| Shopify App Store | 8,000+ vetted ecommerce apps | ★★★★☆ Large, active ecosystem | Quick ecommerce stack assembly | 👥 Shopify merchants | Many apps free trials; costs vary |

| Capterra UK – Business Software | Software comparison & reviews | ★★★☆☆ Helpful, UK-market focused | Discovery & side-by-side comparison | 👥 UK businesses researching software | Free, sponsored listings |

Making a Strategic Choice for Your Business's Future

Navigating the vast landscape of apps for business management can feel overwhelming but making an informed choice is one of the most impactful decisions you can make for your company's future. The platforms we have explored, from comprehensive enterprise ecosystems like Salesforce and Microsoft AppSource to specialised financial hubs such as Xero and Sage, all offer powerful pathways to streamline operations and foster growth. The key is not to find a single 'best' app but to build a cohesive digital toolkit that aligns perfectly with your unique operational model, industry demands and strategic objectives.

This process requires a shift in perspective. Instead of viewing these tools as mere software, consider them strategic assets. A project management tool from the Atlassian Marketplace is not just for tracking tasks; it is an engine for accelerating innovation. An accounting app from the QuickBooks App Store is not just for bookkeeping; it is a source of real-time financial intelligence that informs critical business decisions. This strategic mindset is crucial for leveraging technology to its fullest potential.

Key Considerations for Your Digital Strategy

When selecting your business management apps, moving beyond a simple feature comparison is essential. Your evaluation should be a holistic assessment of how a tool will integrate into your existing workflows and scale with your ambitions. Consider the following critical factors:

- Integration Capabilities: How well does the app connect with your current software stack? Seamless integration prevents data silos and ensures a single source of truth, which is vital for accurate reporting and efficient cross-departmental collaboration.

- Scalability and Future-Proofing: Will the platform grow with you? A solution that serves a five-person team might become a bottleneck for a fifty-person enterprise. Look for tiered plans, robust API access and a clear product roadmap that aligns with your growth projections.

- Security and Compliance: In an era of heightened data sensitivity, security is non-negotiable. Scrutinise the provider's security protocols, data encryption standards and compliance with UK regulations like GDPR. This is particularly crucial for financial and claims management systems.

- Total Cost of Ownership (TCO): Look beyond the monthly subscription fee. Factor in implementation costs, staff training time, customisation expenses and potential third-party integration fees to understand the true financial commitment.

A Final Thought on Proactive Management

Ultimately, the right combination of apps for business management empowers your organisation to be proactive rather than reactive. By automating routine tasks, you free up your team to focus on high-value strategic work. By gaining clear visibility into your operations and finances, you can anticipate challenges and seize opportunities before your competitors. In sectors like insurance and asset management, this proactive stance is a game-changer. Tools that enhance claim provability and deter fraud do more than just protect your bottom line; they build trust, improve client outcomes and contribute to the integrity of the entire industry. Choosing your tools wisely is not just an IT decision; it is a foundational step towards building a more resilient, efficient and future-ready business.

Ready to enhance your asset verification and claims management processes? Discover how Proova provides immutable, court-admissible proof to protect your business against fraud and streamline legitimate claims. Visit Proova to see how our specialised platform can become a cornerstone of your business management toolkit.