Annual Boiler Service: A Critical Control Point for Claims Cost Reduction

For an insurer, an annual boiler service isn't a trivial homeowner task; it's a critical risk management event. A verifiably maintained boiler is a predictable asset. A neglected one is a primary driver of escape of water claims, which cost UK insurers an estimated £987 million per year. This lack of documented upkeep is what fuels fraudulent claims for pre-existing damage and sends settlement costs soaring.

The Quantified Cost of Boiler Neglect for Insurers

Every winter, UK insurers face a surge in claims driven by boiler failures. The problem isn't the breakdown itself, but the black hole of information surrounding the appliance's maintenance history. Without verifiable records, claims handlers must distinguish genuine, sudden failures from catastrophic breakdowns caused by years of neglect. This reactive approach is a significant source of claims leakage.

The financial gap between prevention and reaction is vast. A policyholder who skips their annual service transfers a significant financial risk directly to their insurer. This gamble often leads to complex, disputed claims that are far more expensive than a simple component failure.

The Financial Risk of Inaction

The £100 average cost of an annual boiler service is insignificant compared to the claims costs it prevents. Compare that to an emergency call-out for a neglected system, which can easily reach £120 to £450 —before factoring in the subsequent escape of water damage. This same logic applies directly to insurers, but on a much larger scale. A single claim from a neglected boiler could force an insurer to cover:

- Water Damage Restoration: Costs can spiral into thousands for professional drying, mould remediation, and structural repairs.

- Alternative Accommodation: A major leak can render a home uninhabitable, leading to weeks or months of hotel bills.

- Contents Replacement: Soaked furniture, electronics, and personal belongings add another costly layer to the claim.

- Loss Adjuster Fees: Investigating a complex claim where liability is unclear requires professional assessment, adding another operational cost.

Why Current Approaches Fail: Proactive Prevention vs Costly Reaction

The value of verified upkeep becomes clear when contrasted with a reactive approach. A policyholder with a consistent, verifiable service history presents a lower risk. Their claim is more likely to be legitimate and straightforward to process. Conversely, a claim rooted in years of neglect is an invitation for disputes, fraud, and spiralling costs. By understanding this distinction, insurers can see how a simple, verified check-up prevents the very claims that erode profitability. You can learn more about the distinction between preventive versus reactive maintenance .

What a Gas Safe Boiler Service Actually Prevents for Insurers

For claims handlers and underwriters, an "annual boiler service" is often a vague, tick-box item. In reality, it’s a series of precise checks by a Gas Safe engineer, each designed to dismantle a specific insurance risk. Understanding what happens during a service provides the technical insight to assess liability and challenge claims rooted in poor maintenance.

A professional service is not a quick visual check; it's a deep dive into the boiler's health, involving inspections and tests that catch minor issues before they become catastrophic failures. A properly executed service directly prevents the incidents—from carbon monoxide leaks to major water damage—that drive high-cost claims.

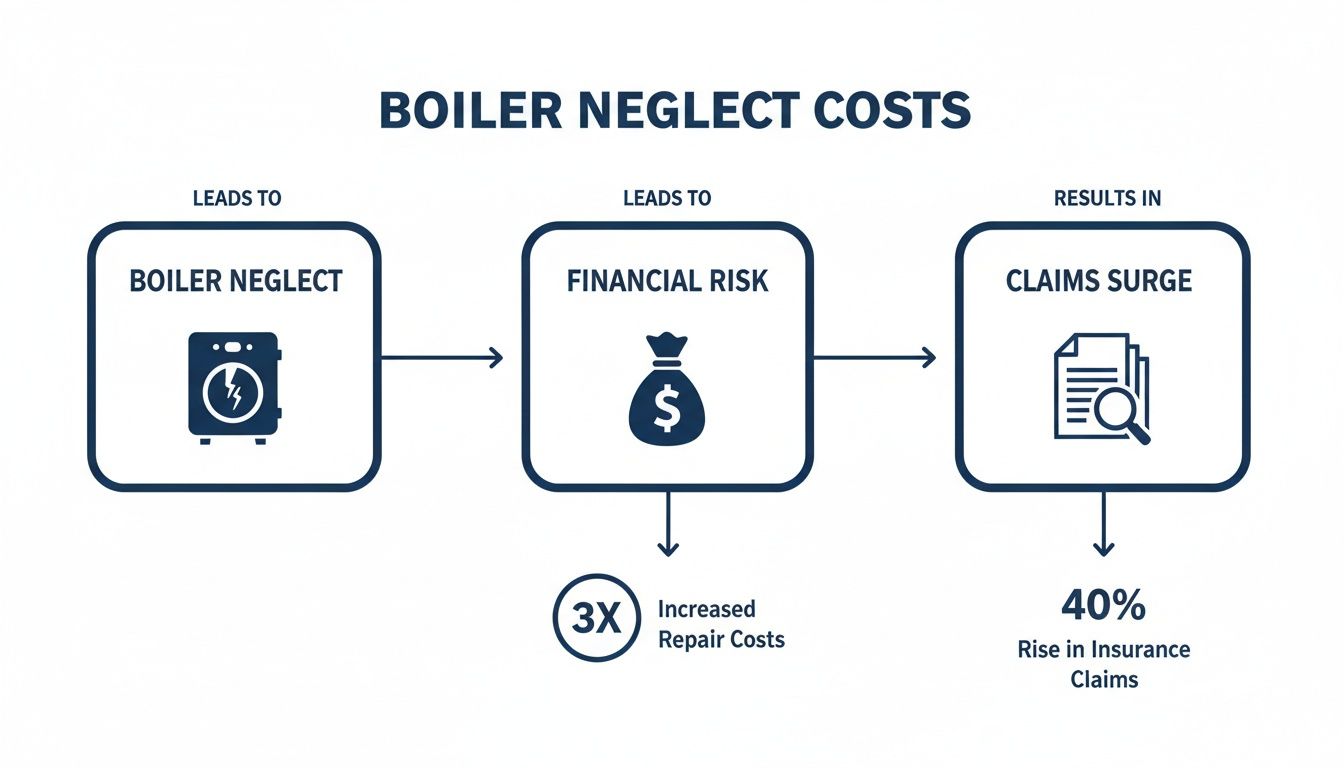

This flowchart shows how simple neglect can spiral into significant financial risk, fuelling a surge in preventable claims.

The direct line from unaddressed wear-and-tear to expensive insurance payouts highlights the commercial value of proactive, verified maintenance.

Key Checks That Mitigate Insurance Risk

During a service, an engineer actively hunts for the early warning signs of future failures. This preventative mindset is what saves insurers from paying for avoidable claims.

Here’s a look at some key checks and the specific risks they neutralise.

Annual Boiler Service Checklist: An Insurer's Perspective

The table below breaks down crucial engineering steps and, more importantly, the insurance risks each one directly mitigates.

| Engineer Check | Purpose | Insurance Risk Mitigated |

|---|---|---|

| Flue & Combustion Analysis | Checks the boiler is burning fuel correctly and safely venting harmful gases like carbon monoxide. | Prevents catastrophic claims for CO poisoning, which carry immense liability and reputational damage. |

| Cleaning the Heat Exchanger | Removes soot and debris buildup that forces the boiler to work harder, causing strain and inefficiency. | Mitigates claims for premature component failure presented as sudden, unforeseen events. |

| Pressure & Flow Checks | Verifies the boiler’s gas pressure and water flow rates are within the manufacturer's safe limits. | Stops slow, undetected internal leaks from worsening over time and culminating in major escape of water claims. |

| Inspecting Seals & Gaskets | Examines all seals for signs of perishing or wear, which can lead to slow, hidden water or gas leaks. | Catches minor integrity issues before they become a source of significant water damage or a potential gas explosion. |

| Testing Safety Devices | Ensures all cut-out mechanisms and safety devices are functioning correctly to shut the boiler down if a fault occurs. | Prevents small faults from escalating into total system failure, boiler fires, or other major incidents. |

Each check is a link in a chain of risk prevention, designed to stop small issues from becoming an insurer’s expensive problem.

From Minor Faults to Major Claims

A dirty burner might seem trivial, but left unchecked, it can lead to incomplete combustion and a system shutdown in winter. A tiny leak in a seal may go unnoticed by a homeowner, but to an underwriter, it represents a ticking clock for a major water damage claim.

Every action an engineer takes is a deliberate step to stop this domino effect. To get a better feel for the full scope of this preventative work, exploring these essential boiler maintenance steps can provide a deeper insight. Each task is designed to catch a small problem before it morphs into a large, expensive claim.

Why Post-Claim Proof of Maintenance Is Too Late

The traditional process for verifying boiler maintenance is fundamentally flawed. Waiting until after a catastrophic escape of water claim to request a paper certificate is a reactive, inefficient process that directly fuels claims leakage. The approach is built on unreliable self-declaration, creating a system ripe for disputes, delays, and fraud.

For any claims director, this scenario is painfully familiar. It's the classic ‘lounge exercise’ but for a central heating system; asking for proof after the damage is done is too late. The certificate, if it exists, might be lost, damaged in the incident, or fabricated after the event. This immediately initiates a costly, high-friction claims journey.

The High Cost of Reactive Verification

When proof is only demanded post-claim, insurers are immediately on the back foot. This inaction forces a series of expensive operational steps that could have been avoided.

The administrative burden and financial drain manifest in several ways:

- Prolonged Dispute Cycles: Without immediate proof, determining liability becomes a lengthy investigation, tying up claims handlers' time.

- Mandatory Loss Adjuster Visits: An adjuster must often be dispatched to hunt for evidence of long-term neglect, adding a significant and often unnecessary operational cost.

- Paying for Preventable Claims: Insurers frequently pay substantial sums for damage a simple annual boiler service would have prevented, because the lack of prior maintenance could not be definitively proven.

This reactive scramble for evidence is a primary driver of claims leakage. It transforms what should be a straightforward claim into a complex, expensive investigation, eroding profitability.

Shifting from Detection to Prevention

The core problem is that verification occurs at the worst possible time—after the loss. This model guarantees inefficiency and leaves the door open for opportunistic fraud. The only effective solution is to move verification from the claim stage back to policy inception.

By doing so, insurers can learn how pre-authentication can reduce claims costs by up to 30 percent , turning a reactive problem into a proactive solution. This fundamental shift is essential for any insurer seeking to cut operational waste and protect their bottom line.

The Critical Link: Service History, Warranties, and Your Bottom Line

A powerful lever many insurers overlook lies in the contractual connection between a boiler’s annual service history, its manufacturer’s warranty, and the home insurance policy. Most policyholders are unaware that skipping this check can void both, shifting a huge and avoidable financial burden directly onto their insurer.

This is not a contractual grey area. Most boiler manufacturers insist on an annual service by a Gas Safe registered engineer to keep their 5 to 10-year warranties valid. The moment that condition is broken, the warranty is worthless.

When the Warranty Fails, the Insurer Pays

The financial fallout from a voided warranty is immediate. A major breakdown that should have been the manufacturer's responsibility suddenly lands on the insurer as part of the claim. It is a classic and entirely preventable source of claims leakage.

Every claims handler has seen this scenario: a relatively new boiler fails, causing thousands in water damage. The claim arrives, but a quick check reveals a two-year gap in the service history. The manufacturer’s warranty is void, and the insurer is left footing a bill that a simple £100 service would have avoided.

For claims directors, this situation is a critical vulnerability. An unserviced boiler isn't just another risk; it's a direct transfer of liability from the manufacturer to the insurer, driven purely by the policyholder’s inaction.

Using Your Own Policy as a Defence

The problem is compounded by the fact that neglecting a boiler service is frequently a breach of the insurance policy itself. Almost every home insurance policy contains a clause requiring the policyholder to keep their property in a "good state of repair." A boiler without a valid service record is a clear failure to meet that condition.

This gives insurers a solid contractual footing to scrutinise, and in some cases, repudiate claims where clear neglect is the root cause. Checking the service history is not just good practice; it's about enforcing the terms of your own policy to stop paying for preventable losses.

With 90% of UK households relying on boilers, the scale of this issue is immense. Poor maintenance contributes to a huge number of claims, with average repair costs running between £120-£450 , a burden that often shifts to insurers when warranties are voided. You can discover more insights about these boiler statistics on greenmatch.co.uk. Proactively validating service history is a key strategy for shutting down this costly claims loophole.

How Pre-Inception Verification Solves This Problem

The traditional method of handling boiler claims—detection at claim—is inefficient and costly. Waiting until a claim is filed to request proof of an annual service is a reactive strategy that invites fraud and unnecessary claims leakage. The solution is to move from costly detection to proactive prevention.

Verification at inception allows insurers to confirm a boiler’s maintenance status from day one. Instead of discovering years of neglect during a stressful claims process, digital verification puts insurers back in control of the risk they underwrite.

This simple shift stops fraudulent claims for pre-existing damage dead in their tracks—claims that attempt to attribute long-term wear and tear to a sudden, insurable event.

Creating an Indisputable Digital Record at Inception

When a policyholder has their annual boiler service completed, they can use a simple app like Proova's to create a digital record of the Gas Safe certificate. This is not just a photo; it is time-stamped and geolocated evidence, proving exactly when and where the service was certified.

This verified record is then attached directly to their home insurance policy, creating immutable evidence available from day one of cover. For insurers, this transforms the claims validation process.

The commercial outcomes for claims handlers and underwriters are immediate:

- Eliminates After-the-Event Fraud: It becomes impossible for a policyholder to claim for damage caused by neglect while pretending a service was recently completed.

- Provides Instant, Verifiable Proof: Claims handlers have indisputable evidence at their fingertips, eliminating lengthy investigations and disputes over lost paperwork.

- Cuts Claims Processing Time: Validation becomes a simple check rather than a protracted investigation, slashing the claims lifecycle from weeks to days.

Slashing Leakage and Operational Costs

With proof of maintenance verified at inception, the operational costs of these claims plummet. The need for a loss adjuster to visit a property to determine the cause of failure is drastically reduced because the service history is already established. You can learn more about fighting fraud before it happens with the power of verified evidence in our detailed guide.

This pre-inception approach provides instant, indisputable evidence of an annual boiler service, cutting claims leakage from preventable incidents and stopping fraudulent claims before they can be submitted. It’s not about detecting fraud; it’s about making it impossible.

The Commercial Outcomes for Insurers and Brokers

Implementing verified annual boiler servicing delivers clear, measurable financial returns. For claims directors, the business case directly addresses the core drivers of claims costs and operational inefficiency. These are tangible improvements to the bottom line.

By mandating proof of maintenance at inception, you shift risk management from the chaotic aftermath of a claim to the controlled environment of underwriting.

For Insurers: Slashing Costs and Boosting Efficiency

The primary benefit for an insurer is a sharp reduction in the frequency and severity of escape of water claims. A verifiable maintenance history enables more accurate risk pricing and provides a firm, evidence-based reason to repudiate claims rooted in long-term neglect.

The financial upside includes:

- Lower Claims Leakage: Stop fraudulent claims for pre-existing neglect, shutting down a major source of financial loss.

- Reduced Operational Drag: Instant access to verified service records cuts claims processing time and reduces the need for costly loss adjuster visits.

- Improved Loss Ratios: Fewer high-cost water damage claims directly improve the profitability of your home insurance book.

While the UK's Boiler Upgrade Scheme encourages a shift to low-carbon heating, the reality is that 1.7 million new gas units are installed annually. Ensuring these are properly maintained is critical for managing risk. A routine £100 annual boiler service is all it takes to prevent the £120-£450 repair bills that often spiral into five-figure claims.

For Brokers: A Powerful Way to Stand Out

For brokers, offering clients a simple digital way to document their annual boiler service is a significant competitive advantage. It transforms your role from a transactional seller to a proactive risk advisor, strengthening client relationships and demonstrating value beyond premium price.

This positions you as a trusted partner, reducing post-claim friction that can damage relationships and boosting client retention. Providing tools for verification doesn't just help clients; it can directly speed up claim resolutions by 70% .

Your Questions, Answered

For claims directors, underwriters, and brokers, verifying a boiler service record may seem like additional administration. However, shifting that verification from post-claim to pre-inception transforms it into a powerful tool for cost and risk reduction.

How Does Pre-Verifying a Boiler Service Actually Cut Claims Costs?

Consider a typical escape of water claim. Without proof of regular maintenance, it is nearly impossible to distinguish a sudden, insurable failure from years of neglect. By confirming a valid annual boiler service at policy inception, you filter out a large number of these ambiguous, high-cost claims.

This prevents policyholders from passing off damage from long-term neglect as a sudden event. This single check leads to fewer loss adjuster visits, shorter liability disputes, and a direct reduction in claims leakage from preventable incidents.

Can We Really Refuse a Claim for Lack of Service?

Yes, in many cases. Most home insurance policies include a clause requiring the policyholder to keep their property in a "good state of repair." A boiler that has not been serviced by a qualified engineer for years is a clear breach of that condition.

Having proof of service—or lack thereof—from policy inception provides a firm, evidence-based reason to challenge or repudiate claims where neglect is the root cause. It protects your bottom line and reinforces the principle of policy conditions.

Won't This Just Create Hassle for Policyholders?

No. Modern digital verification makes this a seamless process. The policyholder can use a simple app to create a time-stamped, geolocated digital record of their Gas Safe certificate the moment it is issued.

This takes seconds and provides them with a secure digital record of important documents. It improves their experience while providing you with the critical risk data you need from day one.

By shifting verification to policy inception, you transform a high-friction, post-claim investigation into a simple, one-time administrative task that prevents fraud and validates risk from day one.

Verifying assets and their condition at policy inception is the only way to eliminate after-the-event fraud and reduce claims leakage. Proova provides the digital tools to make this a seamless part of your underwriting process. Discover how to cut claims costs and stop fraud before it happens at https://www.proova.com.