How a Home Inventory App Cuts Claims Costs for Insurers

A home inventory app is, at its core, a digital tool designed to help policyholders prove what they own. For insurers, it is the key to creating a secure, verifiable record of assets at policy inception, preventing fraud, eliminating disputes, and driving down claims costs. By cataloguing belongings with time-stamped photos, receipts, and serial numbers, this technology replaces post-loss guesswork with pre-inception fact.

The Hidden Costs of Unverified Home Contents

Ask any policyholder to list the contents of their lounge from memory. Most will tell you it’s easy. Now, ask them to do it again after a burglary, under extreme stress, and to include purchase dates and values for every single item. You will spend the next six weeks in dispute. The list they produce will be a product of guesswork and anxiety. This isn't just a customer service headache; it's a quantifiable financial drain for insurers.

The traditional claims model, built on post-loss declaration, is commercially broken. It relies on perfect memory and honesty at the most stressful time in a policyholder's life. This creates fertile ground for claims leakage and fraud. The Insurance Fraud Bureau (IFB) reports that undetected general insurance fraud costs the industry £1.1 billion annually, a significant portion of which stems from exaggerated or fabricated contents claims.

The Direct Costs of Post-Loss Verification

When a claim is filed without a pre-existing inventory, a costly and inefficient process grinds into gear. Insurers are forced to deploy expensive resources to validate a reality that no longer exists, incurring significant operational expenses.

- Loss Adjuster Fees: For any substantial or ambiguous claim, a loss adjuster’s visit is standard. These visits are expensive, involving travel, on-site time, and detailed reporting, with costs running into hundreds of pounds per claim.

- Administrative Overhead: The internal burden is immense. Claims handlers spend weeks in a frustrating back-and-forth with distressed policyholders, chasing vague details and non-existent proof of purchase to piece together an accurate picture of the loss.

- Dispute Resolution: Ambiguity is the enemy of efficiency. When the ownership, value, or existence of an item cannot be verified, disputes are inevitable. These conflicts drag out claim lifecycles, increase staff workloads, and escalate into costly formal dispute resolution.

Relying on a policyholder's memory isn't just inefficient; it's a direct invitation for opportunistic fraud. Every unverified item represents a potential point of leakage.

"Relying on a customer's memory after a traumatic event is commercially unsound. The gap between what was actually owned and what is claimed is where millions in claims leakage occurs. Verification at inception is the only way to close that gap."

Inflated Claims and Financial Leakage

Without a baseline of verified assets, it becomes almost impossible to challenge a policyholder's submitted list. This systemic weakness allows for both conscious and unconscious inflation of claims. A standard television model is recalled as the premium version, or a forgotten item is suddenly remembered.

This problem is compounded by widespread underinsurance, which creates disputes around the UK average house contents value . Each inflated item, no matter how small, adds to a cumulative financial leakage that erodes the profitability of the entire home insurance portfolio. The current model forces insurers to pay out on faith rather than fact.

This reactive, trust-based system is unsustainable. The financial bleeding from unverified contents—through adjuster fees, administrative drag, and inflated payouts—demands a fundamental shift. The solution is to move validation from the point of claim to the point of policy inception, creating an undisputed record before a loss ever occurs. This proactive approach is the only viable way to stem the flow of these hidden costs.

Why Current Fraud Detection Methods Fail Insurers

The traditional approach to fraud in home insurance is fundamentally reactive. It’s an expensive, after-the-fact scramble to validate a loss, often long after the financial damage is done. This puts claims teams on the back foot, forcing them to disprove a claim rather than work from a solid foundation of verified facts. It’s a system designed for disputes and financial leakage.

The process typically starts with a self-declaration form, a document hinging entirely on a policyholder’s memory and honesty. Commercially, this is a huge liability. It becomes nearly impossible to challenge the existence, condition, or ownership of an item after it’s been destroyed or stolen. The insurer is left trying to verify a ghost inventory—a process that is both adversarial and incredibly costly.

This systemic weakness is a wide-open invitation for 'after-the-event' fraud. This occurs when an individual intentionally damages an uninsured item, then buys a policy with the sole purpose of claiming for it. Without a time-stamped, geolocated record of assets at policy inception, this type of fraud is incredibly difficult to stop.

The Problem with Post-Loss Validation

Attempting to validate a claim after the event creates a cascade of operational and financial problems. The entire process is built on unreliable data and guesswork, leading to poor commercial outcomes.

- Unreliable Self-Declaration: A policyholder’s memory is notoriously unreliable under stress. Lists are often incomplete, inaccurate, or unintentionally inflated, leading to endless back-and-forth that drains resources.

- Impossibility of Disproving Claims: How can an insurer definitively prove a high-end television wasn't in the living room before a fire? Without pre-inception evidence, challenging a claim turns into a costly "he said, she said" scenario that often ends in a payout simply to close the case.

- Erosion of Customer Trust: Contentious interviews and requests for years-old receipts create friction when a customer is most vulnerable. This damages the relationship, turning a claim into a conflict and driving customers to competitors.

The fundamental problem is timing—detecting fraud at the point of claim is too late. The financial damage is already done.

"The industry's reliance on post-loss validation is a hangover from a pre-digital era. We're asking claims handlers to perform forensic accounting with no ledgers. It’s inefficient, expensive, and fails to address the root cause—the lack of verified data at inception."

The Rise of Proactive Verification

The consumer landscape is shifting. In the United Kingdom, home inventory apps have seen a remarkable surge in adoption, with 4.2 million active users . For the 28 million UK households , many of whom have experienced a rejected claim due to a lack of proof, this digital shift is a welcome change. This presents a massive opportunity for insurers to fix the claims process. Learn more about the findings on the home inventory app market.

The failure of the current model is not a people problem; it’s a process problem. It creates a negative cycle of high costs, disputes, and customer churn. Breaking this cycle requires moving away from reactive investigation towards proactive prevention, a core principle of effective digital transformation in insurance. The solution is to verify assets before cover begins, stamping out ambiguity and fraud at the source.

Using a Home Inventory App to Stop Inception Fraud

For too long, the insurance industry has been stuck in a reactive loop on fraud. This flawed strategy forces claims teams into costly, adversarial investigations after a loss, trying to validate assets that no longer exist. This model is a major source of financial leakage. It’s time for a fundamental shift—from expensive detection to proactive prevention.

A modern home inventory app is the key to this shift. By requiring a policyholder to create a verified, time-stamped, and geolocated inventory at policy inception, an insurer changes the entire dynamic of fraud prevention. This single step creates a powerful barrier against opportunistic claims fraud.

Creating an Immutable Record of Ownership

The power of this approach lies in its simplicity and the solid proof it creates. The process is straightforward for the policyholder but delivers immense value to the insurer.

- Documenting Assets: The policyholder uses the app to photograph and log their valuable items.

- Capturing Key Data: They add purchase receipts, serial numbers, and notes on an item's condition.

- Verifying Existence: The app captures metadata—time, date, and geographical location—for every entry.

This builds a verifiable digital dossier of the policyholder's assets before cover begins. It is no longer a matter of memory or trust; it is a matter of record. This immutable evidence neutralises the most common types of inception fraud before they can start.

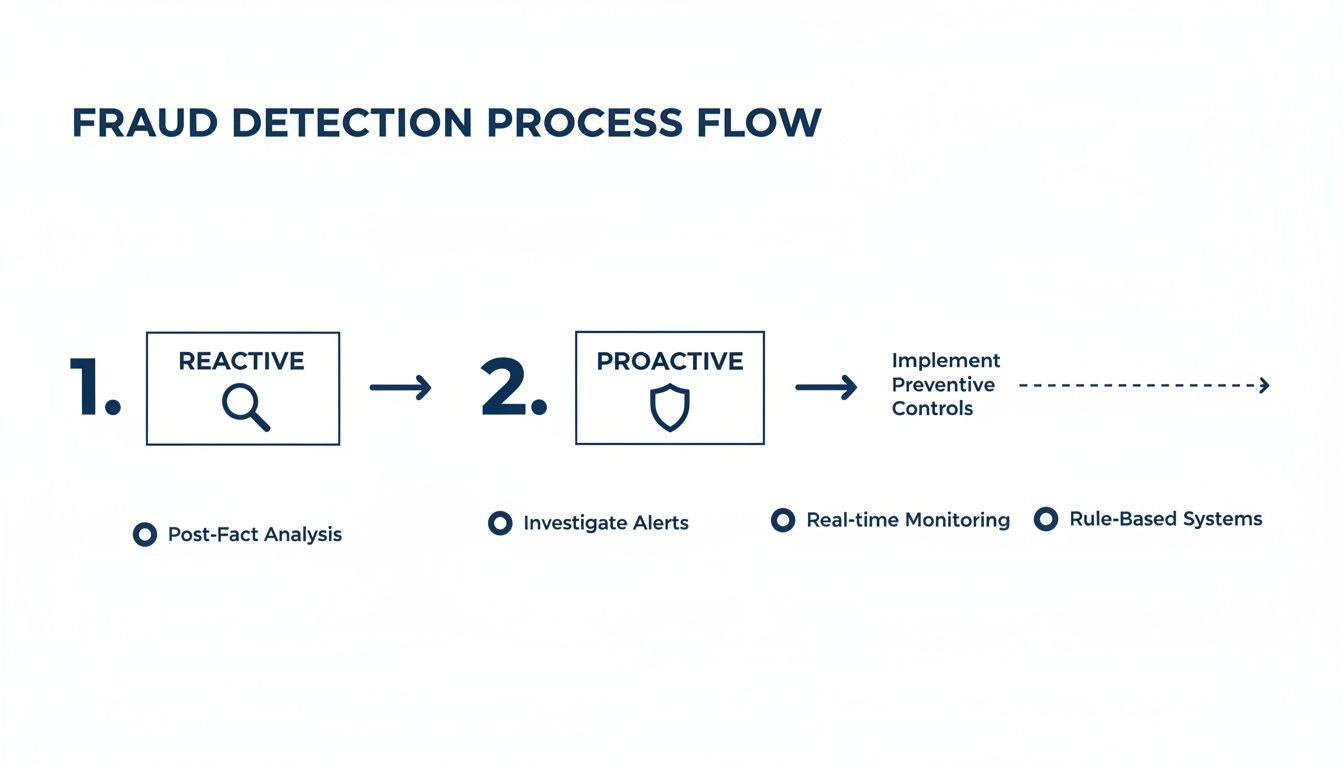

The following graphic illustrates the move from a reactive, high-cost detection model to a proactive, low-cost prevention model.

This process highlights how verifying assets at the start intercepts fraud before it becomes a costly claim, unlike reactive methods that only start investigating after the fact.

Neutralising After-the-Event Fraud

A major drain on profitability is "after-the-event" fraud, where someone buys a policy specifically to cover an item that's already damaged or stolen. Without a baseline inventory, proving this is nearly impossible, demanding expensive investigations that rarely deliver a clear outcome.

A verified, pre-inception inventory makes this type of fraud obsolete. If an item isn't in the initial, time-stamped catalogue, it can't be claimed for. The argument is over before it begins, saving countless hours and directly slashing claims costs.

It works just as well for shutting down claims for non-existent "ghost" items or assets with pre-existing damage. The photographic evidence and condition notes captured by a home inventory app provide a clear, undisputed record, closing common avenues for claim inflation. You can learn more about this approach by fighting fraud before it happens with the power of verified evidence.

The commercial outcome is immediate and measurable. A huge source of opportunistic fraud is cut off at the source. This leads to a direct reduction in claims payouts, dispute resolution costs, and wasted administrative time. By embedding a home inventory app into the onboarding process, insurers finally move from a position of costly suspicion to one of verified confidence.

Solving Underinsurance and Average Clause Disputes

Beyond opportunistic fraud, one of the most stubborn and costly issues in home insurance is underinsurance. This is not a niche problem; it is systemic. According to the Association of British Insurers (ABI), a staggering 76-80% of UK properties are underinsured.

This isn't a minor rounding error. It's a ticking time bomb that only detonates at the point of a claim, creating enormous financial and reputational risk. When a policyholder underestimates their contents' total value, it almost always leads to the application of the 'average clause'—a tool that, while designed to protect insurers, inevitably sparks contentious disputes and leaves customers feeling betrayed.

The True Cost of Guesswork

The root of the problem is guesswork. Most policyholders have no accurate grasp of what their belongings are collectively worth. They forget expensive tech, underestimate replacement costs of furniture, or fail to account for specialist items like art or jewellery.

This unintentional mistake puts the insurer in an impossible position. During a claim, when the true value at risk is found to be far higher than the sum insured, the average clause must be applied, proportionally reducing the payout.

This triggers a cascade of damaging commercial outcomes:

- Drawn-Out Disputes: Claims handlers are forced into difficult, time-consuming conversations, explaining complex insurance principles to distressed policyholders.

- Increased Churn: A lower-than-expected payout is a major driver of customer dissatisfaction. It erodes trust and sends policyholders to competitors at renewal.

- Brand Damage: Negative sentiment from poor claims experiences tarnishes an insurer's brand and makes it harder to attract new business.

The entire issue stems from a single point of failure: the lack of verified data at policy inception.

Shutting Down the Average Clause at Its Source

A home inventory app provides the definitive fix. By making a visual, itemised, and valued inventory a standard part of the process before cover starts, insurers shift from a reactive, dispute-driven model to a proactive, preventative one.

The policyholder uses the app to create a comprehensive catalogue of their belongings. As they add items, the app can help provide accurate valuations, giving them a clear, evidence-based picture of the total sum insured they need.

By establishing an accurate and agreed-upon valuation from day one, the entire basis for applying the average clause is eliminated. The policyholder is correctly covered, and the insurer has a precise understanding of the risk being underwritten.

This proactive approach delivers immediate commercial benefits. It stops underinsurance from becoming a claims-stage problem, drastically cutting the number of disputes and associated administrative costs. It also ensures the policyholder pays the correct premium for the risk, protecting the insurer’s book.

Ultimately, a verified inventory transforms the insurer-customer relationship from one based on tense, post-loss negotiation to one founded on pre-agreed facts. This doesn't just cut claims leakage; it builds the trust and satisfaction that ensures customers are properly protected when it matters most.

Driving Claims Efficiency and Reducing Leakage

Beyond fraud prevention, a pre-verified digital inventory re-engineers the entire claims operation. The traditional claims process is a manual, inefficient slog, bogged down by checks, investigations, and expensive site visits—all of which drive up operational costs and lead to significant claims leakage. An agreed-upon, digital record of assets, locked in from day one, changes this dynamic entirely.

This verified inventory, created at policy inception, becomes the single source of truth. The moment a claim is filed, the handler has instant access to a time-stamped, geolocated, and photographed catalogue of the insured items. The ambiguity that fuels disputes and delays is removed from the equation.

Eliminating Unnecessary Operational Costs

In a typical contents claim, sending a loss adjuster is standard practice and a major cost centre. These visits are required to validate the claim, assess damage, and check for fraud. With a pre-verified inventory, the need for many of these visits is dramatically reduced, and in some cases, eliminated completely.

The app's data provides the necessary evidence remotely:

- Proof of Ownership: Time-stamped photos confirm the item existed long before the loss occurred.

- Condition Assessment: The visual record establishes the pre-loss condition, preventing disputes over existing wear and tear.

- Accurate Valuation: Stored receipts and model numbers allow for precise and swift valuation.

By removing the need for a physical site visit for many claims, insurers realise immediate and substantial cost savings. It frees up experienced loss adjusters to focus only on the most complex, high-value cases where their expertise is genuinely required.

The verifiable data provided by a home inventory app is a critical component for enabling truly automated insurance claims processing , leading to significant efficiency gains and cost reductions.

Accelerating Settlement and Reducing Leakage

A faster claims process doesn't just cut administrative costs; it directly tackles claims leakage. Protracted claims cycles, full of back-and-forth communication and uncertainty, create an environment where small, unverified costs accumulate, often leading to overpayments.

Consider the contrast between a traditional claim and one supported by a verified inventory.

| Claims Metric | Traditional Process | Verified Inventory Process |

|---|---|---|

| Time to First Offer | 10-15 working days | 1-3 working days |

| Claim Handler Touchpoints | 8-12 interactions | 2-4 interactions |

| Loss Adjuster Requirement | High probability | Low probability |

| Dispute Potential | High | Minimal |

By compressing the timeline and reducing human touchpoints, the margin for error and potential for leakage shrinks dramatically. The speed of settlement also improves customer satisfaction, which boosts retention rates—a critical commercial outcome.

Integrating a home inventory app into the claims workflow is a fundamental operational upgrade. It strips out unnecessary costs, empowers claims handlers with definitive data, and builds a more resilient, profitable, and customer-focused claims function. It transforms the process from an expensive, adversarial investigation into a straightforward administrative task.

Straight Answers to the Questions Insurers Ask

Before adopting any new process, claims directors and underwriting managers need clear, commercial answers. Here are the straight responses to the most common questions.

How Does This Actually Speed Up Claims Handling?

It removes ambiguity. With a verified inventory from day one, your claims handlers are not spending weeks chasing policyholders for half-remembered lists of destroyed belongings or digging for non-existent proof of ownership.

- Instant Access to Evidence: The moment a claim is filed, your team has a time-stamped, photographed, and valued inventory at their fingertips.

- Fewer Touchpoints: This can slash the number of interactions needed to settle a claim from an average of 8-12 down to just 2-4 .

- Reduced Need for Loss Adjusters: For a significant number of contents claims, the digital evidence is sufficient. The cost and delay of a loss adjuster visit are eliminated.

This means a first offer can be made in days, not weeks, freeing up experienced staff to handle genuinely complex cases.

What’s the Real Impact on Fraud?

This model moves fraud management from reactive detection to proactive prevention. It directly shuts down the most common types of opportunistic fraud at the source.

First, it kills 'after-the-event' fraud . If an item was broken before the policy started, it won’t be in the time-stamped inception inventory. A fraudulent claim becomes impossible to sustain.

Second, it eliminates claims for non-existent or 'ghost' items . The simple requirement to photograph and document assets creates a powerful evidential barrier, deterring policyholders from inflating claims. The result is a direct reduction in fraudulent payouts.

Will Policyholders Actually Bother to Use It?

Adoption is driven by clear value. We frame the process not as a chore, but as a direct benefit—a guarantee of a faster, fairer claims experience should the worst happen.

By completing a digital inventory, the policyholder ensures their own peace of mind. They take a proactive step to protect their assets and remove the stress and guesswork from a future claim.

Furthermore, adoption can be encouraged through clear communication and simple incentives, such as small premium discounts. The user experience is designed for simplicity, requiring only a smartphone to snap photos and log items.

How Does This Change Our Relationship with Customers?

It improves it. The traditional claims process is inherently adversarial and often damages the customer relationship at its most critical moment. By verifying assets upfront, the dynamic changes.

Instead of a contentious negotiation, the claims process becomes an administrative task of checking items against a pre-agreed list. This transparency builds trust, leading to higher customer satisfaction and improved retention rates. The conversation shifts from arguing over an item's value to getting the policyholder back on their feet as quickly as possible.

A pre-verified inventory is the foundation for a more efficient, profitable, and customer-centric insurance model. By addressing fraud and underinsurance at inception, Proova provides the tools to cut claims costs and build stronger policyholder relationships. Discover how verification at inception can transform your claims operation.