The Cost of Inaction: De-Risking Block of Flats Insurance Portfolios

On the surface, block of flats insurance seems like a straightforward commercial property policy. But for claims directors and underwriters, it's a portfolio riddled with hidden risks and escalating costs. These policies are tangled with complex shared liabilities and huge valuation discrepancies that traditional underwriting processes often miss, creating a high-stakes environment where bad data at inception guarantees a major financial loss at the claim stage.

Unlike standard property cover, a single incident can trigger a cascade of claims, making accurate initial risk assessment essential for profitability. The current model, however, relies on guesswork, leaving insurers exposed and claims teams fighting fires they could have prevented.

The Hidden Financial Risks in Block of Flats Portfolios

For claims directors and underwriters, a block of flats isn’t one property; it’s a web of interconnected liabilities. A single escape of water can set off a chain reaction of claims through multiple flats and communal areas. This inherent complexity makes accurate risk assessment at policy inception critical for portfolio profitability.

The primary source of claims leakage is systemic underinsurance. According to industry data, a staggering 76% of UK properties are underinsured against their full rebuild cost. Another study found that 88% of buildings were underinsured, with more than a third covered for less than half their actual value.

This gaping valuation gap is the starting point for significant commercial headaches for insurers, leading directly to contentious claims and spiralling operational costs.

The Problem of Inaccurate Valuations

The legacy underwriting process often leans on outdated desktop valuations or figures provided by property managers who are not specialist surveyors. This approach fails to capture the true condition of the building, the state of its communal areas, or the reality of critical assets like lifts and fire safety systems.

The core issue is a fundamental lack of visibility. Without an accurate, verified picture of the asset at risk from day one, underwriters are pricing policies based on guesswork, and claims teams are left to untangle the costly consequences.

Mastering these risks requires an understanding of the finer points of effective leasehold management.

The Commercial Consequences of Inaction

When a major claim hits an underinsured property, the fallout is severe. Invoking the average clause is almost guaranteed to ignite a contentious dispute, resulting in longer claims handling times, costly loss adjuster involvement, and significant reputational damage.

The table below summarises the main financial drains insurers face with blocks of flats policies.

Key Financial Risks in Block of Flats Portfolios

| Risk Factor | Primary Impact for Insurers | Common Scenario |

|---|---|---|

| Claims Leakage | Payouts complicated by disputes over the correct sum insured, leading to preventable financial losses. | A fire causes significant damage, but the policy only covers 60% of the rebuild cost, triggering the average clause and a lengthy, costly dispute. |

| Increased Operational Costs | Protracted disputes demand more time from senior claims handlers and expensive site visits from loss adjusters. | An escape of water affects three floors. The lack of initial data requires multiple expert visits to assess damage that should have been clear from the start. |

| Policyholder Dissatisfaction | Arguments over underinsurance create an adversarial relationship, damaging broker client retention and eroding trust in the insurer. | A leaseholder discovers they are personally liable for a shortfall after a major claim, leading to official complaints and reputational harm. |

Ultimately, these hidden risks transform what should be a standard commercial policy into an unpredictable source of financial strain. The legacy approach of discovering the true risk after a loss has occurred is no longer commercially viable.

How Underinsurance Creates the Average Clause Catastrophe

Underinsurance is the single most corrosive problem in any block of flats portfolio. For insurers, it is the direct trigger for applying the average clause—a necessary but commercially damaging tool that guarantees a contentious claim. Once invoked, it transforms a standard claims process into a protracted, expensive, and reputation-shredding dispute.

The root of this issue isn’t malicious intent. It’s a fundamental flaw in how properties are valued at inception. Expecting a freeholder or property manager to accurately calculate a complex building's rebuild cost is like asking a policyholder to catalogue their lounge contents six weeks after a burglary—it’s a recipe for inaccuracy, leaving insurers to carry the commercial risk of that guesswork.

This chronic undervaluing is deeply embedded in the block of flats sector. Outdated valuations, often years old, fail to account for soaring material and labour costs. Worse, the complex sums required for shared structures and communal areas are frequently beyond the expertise of those managing the property, leading to huge shortfalls in the declared value.

The Declared Value Deception

The declared value is the bedrock of any block of flats insurance policy, representing the cost to rebuild the property at the start of the insurance period. When this figure is wrong, the entire policy is built on a faulty foundation.

Consider this common scenario from a claims director's perspective:

- A block of flats has a true rebuild cost of £5 million .

- The property manager, using an old survey, provides a declared value of £3.5 million .

- The property is therefore insured for only 70% of its true value.

A fire then causes £1 million worth of damage. The insurer must apply the average clause, meaning they are only liable for 70% of the loss. The payout is capped at £700,000 , leaving a £300,000 shortfall that ignites a fierce dispute between the freeholder, leaseholders, and the insurer.

The average clause isn't a penalty; it's a mechanism to correct a flawed premium calculation. But from a commercial standpoint, its application signals a failure at the underwriting stage—a failure that costs time, money, and client relationships at the claims stage.

This situation isn't an anomaly; it's standard operating procedure for a huge portion of block of flats portfolios across the UK. The commercial consequences of this systemic inaccuracy directly impact an insurer's bottom line.

Quantifying the Commercial Damage

The impact of invoking the average clause goes far beyond the initial claim shortfall. It creates a cascade of operational costs and reputational damage that quietly eats away at profitability. Each dispute stemming from underinsurance introduces serious friction into the claims lifecycle.

The direct costs are painful and predictable:

- Inflated Claims Handling Times: What should be a straightforward claim becomes a complex negotiation, consuming weeks or even months of a senior claims handler's time. This can increase claims handling costs by over 50%.

- Costly Loss Adjuster Involvement: Disputes demand multiple site visits and detailed investigations by expensive loss adjusters to validate the extent of the underinsurance and damage.

- Reputational Harm: Policyholder dissatisfaction leads to formal complaints, negative reviews, and damaged broker relationships, making both client retention and new business acquisition harder.

Ultimately, every time the average clause is applied, it underscores a critical intelligence gap at policy inception. The insurer is left managing a costly, adversarial process that could have been entirely prevented with accurate, verified data from day one.

Managing the Domino Effect of Claims and Fraud

Beyond underinsurance, insurers are navigating a perfect storm of soaring claim costs and opportunistic fraud within block of flats portfolios. These interconnected properties mean small incidents rarely stay isolated. Instead, a domino effect sends claim severity and operational costs through the roof, putting immense pressure on claims teams.

The financial strain is significant. The ABI reports that UK insurers paid out a record £1.6 billion in property claims in a single quarter, a 7% increase. With inflation pushing the cost of an average home claim up by 33% , total property payouts have exceeded £4.1 billion . Blocks of flats carry a heavy slice of this burden, particularly as threats like subsidence have a greater impact on multi-tenanted buildings.

This challenging claims environment is worsened by the persistent threat of fraud.

The Multiplier Effect in Complex Claims

In a block of flats, a single event triggers a chain reaction of claims far more expensive than a similar incident in a detached house. A burst pipe on the top floor cascades through units below, seeps into communal hallways, and shorts out electrical systems, leading to a web of interdependent claims under one policy.

This creates significant challenges for claims handlers:

- A Tangle of Causation: Establishing the exact cause and liability can be a nightmare, often involving multiple leaseholders, the freeholder, and various contractors.

- Protracted Negotiations: Juggling repairs and settlements means dealing with numerous parties, slowing the claims process and increasing handling times.

- Spiralling Loss Adjuster Costs: The complexity of these claims necessitates loss adjuster involvement to assess damage across private and shared spaces, adding a significant layer of expense.

After-the-Event Fraud: A Fertile Ground for Loss

The reactive nature of traditional claims handling creates the perfect environment for opportunistic fraud. Without a definitive, time-stamped record of the property's condition at policy inception, fraud teams investigate claims with patchy or non-existent evidence. This is especially true for "after-the-event" fraud.

The core problem is that the 'detect at claim' model is fundamentally broken. It relies on evidence gathered after the loss, which is often unreliable or easily manipulated. This just piles more work and cost onto already stretched fraud and claims teams.

This reactive stance allows specific types of fraud to thrive in multi-occupancy buildings:

- Claiming for Pre-Existing Damage: A policyholder might claim for damaged kitchen units that were scuffed long before the policy began, knowing the insurer has no baseline record to challenge it.

- Padding Communal Contents Claims: After a genuine leak, a claim might be inflated with items that were never in the communal area, or were of a much lower quality.

- Exaggerating Repair Costs: With no clear record of the original condition, it’s easier to claim for a "like-for-like" replacement that is a far higher specification than the original item.

Every fraudulent claim is a direct financial leak. Crucially, the resources spent investigating suspicious claims—even those ultimately rejected—add to operational drag. A proactive approach is needed, shifting the focus from costly detection to efficient, evidence-based prevention. Learn more in our guide on insurance fraud prevention.

Why Traditional Underwriting and Claims Processes Fail

The systemic problems plaguing block of flats insurance are symptoms of a broken model. For underwriters, the process is built on unreliable data, forcing them to price massive risks without full visibility. This legacy approach is no longer commercially sustainable.

This reliance on guesswork begins at quotation. Underwriters often work with desktop valuations that are years out of date, failing to account for current material and labour costs. The alternative—a full, in-person survey—is typically too expensive to be commercially viable for most residential blocks, creating a critical information vacuum.

Without boots on the ground or reliable digital evidence, underwriters have virtually zero visibility into the true state of the building. They cannot accurately assess the condition of high-risk communal areas or verify the maintenance of critical assets like lifts, roofing, or fire safety systems.

The Guesswork of Underwriting

In this environment, underwriting becomes less of a science and more of an educated guess. The declared value provided by a freeholder or property manager is often taken at face value, despite the high probability of inaccuracy. This forces insurers to accept a level of risk that is poorly defined and dangerously underestimated.

This failure to verify at inception has direct, painful commercial consequences:

- Inaccurate Premiums: Policies are priced using flawed data, leading to premiums that do not reflect the true exposure.

- Hidden Liabilities: Major risks, like poorly maintained electrical systems or creeping structural issues, remain hidden until a claim occurs.

- Adverse Selection: Insurers inadvertently attract higher-risk properties because their underwriting process cannot differentiate between a well-managed block and a poorly maintained one.

This flawed start virtually guarantees a chaotic and adversarial claims process down the line.

A Reactive and Adversarial Claims Model

When a claim is submitted, the process is immediately reactive and confrontational. The lack of clear, pre-loss evidence means there is no single source of truth. Instead of a straightforward validation, the claim descends into a drawn-out negotiation, often pitting leaseholders, freeholders, and the insurer against one another.

This administrative gridlock is where operational costs spiral. Simple claims become bogged down in arguments over the pre-loss condition of items, the required scope of repairs, and ultimate liability. Every email chain and delay adds to the claim's lifecycle and its cost.

The core failure is the absence of a baseline. Without an irrefutable, time-stamped record of the property's condition at inception, every claim is vulnerable to dispute, exaggeration, and outright fraud. The process becomes adversarial by default.

This reliance on post-event investigation creates an over-dependence on expensive third parties. Loss adjusters are called in not just for major disasters but for routine claims, simply to establish basic facts that should have been on record from day one. These visits add significant expense and drag out settlement times, directly impacting customer satisfaction and driving up operational overheads.

Ultimately, this operational friction translates into tangible business costs. Increased claims leakage, spiralling administrative expenses, and reputational damage all prove that the traditional model is broken. It's a commercially unsustainable cycle.

Implementing Pre-Inception Verification to De-Risk Portfolios

The reactive model for underwriting and claims—waiting for a loss and then picking up the pieces—is commercially unsustainable. It is a recipe for disputes, fraud, and spiralling costs. The solution is a fundamental shift towards pre-inception verification .

This approach establishes a single, verifiable source of truth about a property before the policy goes live, changing the entire dynamic.

Instead of working from guesswork and outdated documents, insurers and brokers can empower property managers to create a complete digital inventory of the building. This is more than a list of assets; it’s a geocoded and time-stamped record, providing an irrefutable baseline of the property’s condition and its contents from day one.

This proactive process systematically dismantles the core problems that plague these portfolios, moving the industry from costly uncertainty to data-driven confidence.

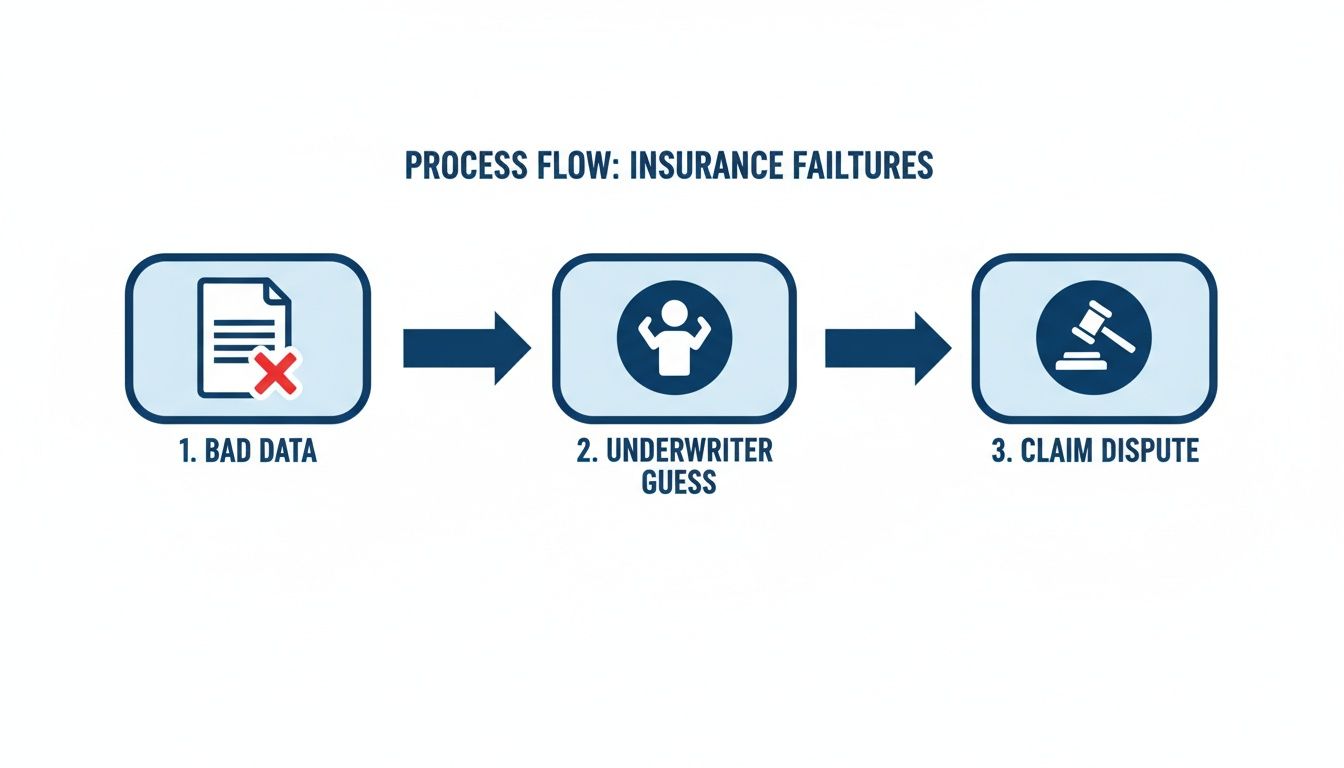

The infographic below illustrates the broken process that pre-inception verification is designed to prevent.

As you can see, poor initial data inevitably leads to underwriting guesswork, which in turn fuels expensive and damaging claims disputes.

Guaranteeing Accurate Sum Insured Calculations

The most immediate commercial benefit of pre-inception verification is the elimination of underinsurance and overinsurance. By creating a detailed, itemised record of the property and its communal areas, the sum insured is calculated based on tangible evidence, not estimates.

This solves a problem that cuts both ways. While underinsurance leads to disputes over the average clause, overinsurance is also a growing issue. Recent industry data shows that a staggering 23% of UK blocks of flats are now overinsured , a sharp rise from just 14% two years ago.

An analysis of over 43,000 assessments revealed that a mere 7% of properties were insured for the correct amount. By photographing and cataloguing everything upfront, insurers gain the precision needed to avoid both pitfalls.

A verified inventory acts as a preventative measure. It ensures the premium accurately reflects the true risk, protecting both the insurer from claims leakage and the policyholder from paying for cover they don't need.

To effectively de-risk portfolios, insurers and brokers can explore integrating data from the best property management apps to streamline this verification process.

Shutting Down Opportunistic and After-the-Event Fraud

A time-stamped, geolocated photographic record is a fraud team's most powerful weapon. It provides an unchallengeable evidence base that neutralises the most common types of opportunistic fraud in residential blocks before a claim is even filed.

Consider these classic scenarios:

- Pre-existing damage: A claim for a damaged communal carpet is instantly cross-referenced with the inception inventory, which clearly shows the damage was pre-existing. Claim stopped.

- Inflated contents: A freeholder claims for high-value furniture allegedly destroyed in a flood. The inventory proves the communal area only contained basic, low-cost items. Claim adjusted.

- Exaggerated repairs: A claim for a full kitchen replacement is countered by evidence showing only a single countertop was damaged. Claim reduced.

This evidence-first approach flips the burden of proof, making fraudulent claims incredibly difficult to sustain while slashing the investigative workload for claims teams.

Accelerating Claims and Reducing Operational Costs

With a single source of truth agreed upon by all parties at inception, the entire claims process becomes dramatically more efficient. The moment a claim is submitted, handlers have instant access to verified, pre-loss data. The need for protracted, back-and-forth information gathering vanishes.

This has a direct and measurable impact on operational expenditure. Disputes over what was owned, its condition, and its value are eliminated, cutting claims handling times from weeks to days. The need for expensive loss adjuster visits for routine claims is significantly reduced, as the core facts are already established.

By adopting this model, insurers see a clear return on investment through lower operational costs and faster, more accurate settlements. Discover how pre-authentication can reduce claims costs by up to 30 percent.

A New Game Plan for Brokers and Insurers

The traditional model for insuring blocks of flats is broken. It forces insurers to accept high levels of risk based on unreliable data, while leaving brokers to manage the fallout from inevitable client disputes.

Pre-inception verification offers a clean break from this cycle of inefficiency. It transforms a high-risk, low-margin product into a more profitable and predictable asset for any portfolio. This evidence-based approach creates a clear value proposition that speaks directly to the commercial pressures felt by both insurers and brokers. It is time to shift from reactive damage control to proactive risk management.

For Insurers: A Clear Path to Profitability

For claims directors and underwriting managers, the benefits are direct and measurable. Implementing pre-inception verification is the single most effective strategy for de-risking a block of flats portfolio.

The commercial outcomes speak for themselves:

- Reduced Claims Costs: By eliminating underinsurance and providing indisputable evidence of an item’s condition, you remove the grounds for inflated payouts and disputes over the average clause.

- Lower Fraud Rates: Time-stamped, geolocated inventories create a robust defence against after-the-event fraud, giving fraud teams the evidence to reject illegitimate claims instantly.

- Superior Underwriting Accuracy: Underwriters can finally price risk based on an accurate picture of the asset, ensuring premiums precisely reflect the genuine exposure.

Ultimately, this technology delivers greater underwriting control and plugs leaks in the claims process. It directly improves the portfolio's loss ratio and overall profitability, turning uncertainty into predictable performance.

For Brokers: A Powerful Way to Stand Out

In a competitive market, brokers need more than keen pricing to win and retain high-value commercial clients. Pre-inception verification technology is a powerful service differentiator. It is a tangible demonstration of a commitment to protecting clients’ interests and guaranteeing a smooth claims experience.

For brokers, this translates into a stronger, more resilient business. By championing this technology, you can learn how Proova helps brokers speed up claim resolutions by 70%.

This approach empowers brokers to:

- Offer Best-in-Class Claims Support: Assure clients of a fast, fair, and frictionless claims process, backed by indisputable evidence.

- Strengthen Client Retention: Delivering a superior claims outcome is the most powerful retention tool available, building loyalty that price alone cannot secure.

- Deliver Tangible Value Beyond Price: Elevate your role from policy provider to strategic risk management partner for freeholders and property managers.

The time has come for claims directors, underwriting managers, and commercial brokers to move beyond the limitations of the past. By embracing verified inventories, you can de-risk your portfolios, reduce operational drag, and secure a measurable competitive advantage in the complex world of block of flats insurance.

Frequently Asked Questions

Understanding the finer points of a new verification process is a must for any insurer or broker. Here are a few common questions we hear about bringing this modern, evidence-based approach to your block of flats portfolio.

How Does This Process Work for a Large Property?

The process is far simpler than you might think. It is managed by the property manager or freeholder using a simple mobile app. They are guided step-by-step to catalogue the building’s communal areas and key assets, like fire safety equipment or entry systems.

This creates a time-stamped and geolocated digital record in just a few hours. The process is designed to be intuitive, requiring no specialist equipment or technical expertise. The result is a comprehensive, evidence-based view of the property that gives underwriters a clear, unambiguous picture before cover is finalised.

Is the Data Collected Secure?

Absolutely. Data security is paramount. All information, from photographs to specific property details, is encrypted both in transit and at rest.

Access is strictly controlled, ensuring that sensitive property information is available only to authorised personnel such as underwriters, claims handlers, and the policyholder. This secure framework provides a reliable single source of truth for every underwriting and claims decision.

This shift to a digital, evidence-led approach provides a secure, auditable trail that protects all parties. It moves the process from ambiguous paper trails to a transparent, verified digital record.

Will This Create More Work for Brokers and Clients?

While it involves an initial upfront task, the long-term benefits are substantial. Creating a digital inventory might take a few hours, but it saves weeks—or even months—of administrative challenges and disputes when a claim occurs.

For brokers, this is a powerful way to add value. By introducing a process that guarantees a smoother, faster claims experience, you differentiate your service and build stronger client loyalty. For clients, it offers peace of mind, knowing their property is correctly valued and that any claim will be handled efficiently, without the stress of being underinsured.

Proova transforms the underwriting and claims process for block of flats insurance. By establishing a verified, digital record at policy inception, we eliminate the guesswork that leads to underinsurance, fraud, and costly disputes. Secure your portfolio, improve profitability, and deliver a superior service to your clients by visiting https://www.proova.com today.