Property Inventory Software: A Strategic Tool for Insurers & Brokers

In commercial terms, property inventory software is a digital solution for creating a detailed, evidence-backed catalogue of a property's contents and condition. For insurers, brokers, and landlords, it is the strategic tool that replaces unreliable memory and inefficient spreadsheets with a structured, verifiable record designed to slash claims disputes, prevent fraud, and cut operational costs.

Why Traditional Inventories Create Commercial Risk

Ask any policyholder to list every item in their lounge, and they will tell you it's simple. Ask them after a burglary or fire, and you will spend the next six weeks in dispute. This is the fundamental weakness of traditional inventories, a flaw that creates enormous commercial risk for insurers, brokers, and landlords alike.

When a crisis hits, human memory is the least reliable asset. Policyholders forget items, cannot recall serial numbers, and have no way to prove an item's pre-loss condition. This ambiguity is the breeding ground for protracted disputes, inflated claims cycles, and profound customer dissatisfaction. For landlords, the same problem arises at tenancy check-outs, where a lack of clear, agreed-upon evidence turns minor disagreements over wear and tear into costly deposit disputes.

The Commercial Cost of Ambiguity

The reliance on manual methods—whether handwritten notes, basic spreadsheets, or a policyholder's recollection—injects serious financial leakage into claims and tenancy management. These outdated processes are not just inefficient; they are a direct hit to the bottom line.

- Prolonged Claims Cycles: Without clear proof, loss adjusters spend significantly more time verifying ownership and condition, which delays settlements and inflates claims handling costs.

- Increased Fraud Risk: A lack of pre-loss evidence is an open invitation for 'after-the-event' fraud, where claims are padded with items that were never owned or were already damaged.

- Tenancy Deposit Disputes: Vague check-in reports without verifiable photographic evidence make it almost impossible for landlords to successfully claim for damages, leading to direct financial losses.

For homeowners hit by a fire or flood, a staggering 30% of insurance claims fail because of insufficient proof of ownership, turning the claims process into a months-long battle. Insurers feel the strain, too; UK claims processing costs average £500 per case, but using verified inventories can slash this figure by 40% , getting payouts sorted much faster.

To quantify the scale of the problem, one need only compare manual methods against modern, software-based solutions.

Manual vs Software-Based Inventory: A Commercial Comparison

The table below offers a stark comparison, highlighting the business risks of retaining outdated methods versus the strategic advantages of adopting a modern software solution.

| Aspect | Traditional Method (Memory, Spreadsheets) | Property Inventory Software |

|---|---|---|

| Data Accuracy | Highly prone to human error, omissions, and emotional bias. | Objective and verifiable, with timestamped and geolocated evidence. |

| Fraud Vulnerability | Wide open to opportunistic and premeditated fraud ('after-the-event' claims). | Dramatically reduces fraud risk by creating a pre-loss baseline of truth. |

| Dispute Resolution | Leads to prolonged, costly disputes based on subjective "he said, she said" arguments. | Minimises disputes with irrefutable, agreed-upon evidence. |

| Operational Efficiency | Slow, manual, and admin-heavy. Increases claims handling time and costs. | Streamlines the process, enabling faster settlements and lower operational overheads. |

| Customer Experience | Stressful, confrontational, and frustrating for honest policyholders. | Provides a smooth, fair, and transparent experience, building trust and loyalty. |

| Risk Management | Reactive. Evidence is gathered after a loss, creating uncertainty and risk. | Proactive. Risk is managed from day one by establishing an evidence-based record. |

The conclusion is unavoidable: manual inventories are a liability, whereas software-based inventories are a strategic asset that delivers tangible commercial benefits.

From Disputed Claims to Verifiable Facts

Property inventory software tackles these commercial pain points head-on by shifting the entire foundation of a claim from subjective memory to objective evidence. By creating a timestamped, photographic, and detailed catalogue before a loss event occurs, the dynamic changes. The conversation moves from, "What do you think you owned?" to, "Here is the verified record of what you owned."

This shift is not just about efficiency; it is about robust risk management. For claims directors, it means cutting claims leakage and preventing fraud. For brokers, it provides a powerful tool for client support and retention. To fully grasp the impact, it is worth exploring how real-time evidence changes everything in the claims journey. Ultimately, the software transforms a chaotic, dispute-prone process into a structured, evidence-based system that protects insurer and client alike.

How Software Stamps Out Underinsurance and Fraud

From an insurer's perspective, the primary power of property inventory software is its ability to proactively address two of the industry's most significant cost centres: underinsurance and fraud. By creating an objective, evidence-based record at policy inception, this technology fundamentally changes the dynamic for underwriters and claims teams.

It shifts the entire process from reactive fire-fighting after a loss to proactive risk prevention before a policy even goes live. This directly plugs the financial leaks caused by inadequate cover and closes the door on fraudulent claims before they are submitted. For any claims director or fraud investigator, this represents a significant step towards a more secure and efficient operation.

Neutralising the Threat of Underinsurance

Widespread underinsurance is a chronic problem in the UK property market, with an estimated 76-80% of properties incorrectly insured. When a sum insured does not reflect the true replacement value of contents, a major claim almost always triggers the average clause. This results in reduced payouts, dissatisfied customers, and long, drawn-out disputes that damage brand reputations.

Property inventory software tackles this threat head-on. It guides the policyholder in creating a detailed, itemised, and valued catalogue of their possessions from day one. The insurer then has a clear and accurate picture of the total sum that requires cover.

This is a much bigger deal than it sounds. ABI statistics show that a shocking 28% of contents claims are rejected due to a lack of proof. This can delay rebuilds by an average of six months and cost families over £10,000 in lost value. By providing a verified, pre-loss snapshot, insurers can cut fraud by 35% and get their underwriting right from the start.

This process delivers several key commercial advantages:

- Accurate Sums Insured: The software facilitates a proper valuation, ensuring premiums are aligned with the real risk.

- Prevention of Average Clause Disputes: With an agreed-upon inventory, ambiguity is removed, leading to faster, smoother settlements.

- Enhanced Underwriting Data: Underwriters receive granular data on the specific items being covered, allowing for more precise risk assessment.

For insurers, pairing this software with other specialised tools is a game-changer. For example, a good inventory platform can integrate with tools like Xactimate software to streamline cost estimation, making the entire claims assessment process more accurate.

Proactive Fraud Prevention at Inception

The traditional claims process is vulnerable to "after-the-event" fraud. A claimant might inflate the value of a lost television, claim for a laptop that was already broken, or invent items that never existed. Investigating these claims is a significant drain on fraud teams, and it is often impossible to prove malfeasance without a pre-loss baseline.

Property inventory software provides that baseline with absolute certainty. By capturing timestamped and geolocated photographic evidence of an item's existence and condition before the policy begins, it creates an irrefutable record.

This proactive approach makes many common types of fraud impossible. A claimant cannot credibly report the theft of a high-value television if there is no record of it in their initial, verified inventory. Likewise, they cannot claim for a pristine laptop if the pre-inception photos clearly show a cracked screen. You can learn more about this approach in our article on fighting fraud before it happens with verified evidence.

This evidence-first model is a powerful defence, transforming the role of fraud teams from reactive investigators to proactive risk managers. The focus shifts from costly investigations to simply checking the claim against the existing, verified record. It saves time, reduces claims leakage, and protects the business from unnecessary losses.

Boosting Operational Efficiency for Insurers and Landlords

Beyond preventing fraud and underinsurance, property inventory software delivers a direct and significant boost to day-to-day operations. For claims handlers, brokers, and landlords, this technology is the key to replacing slow, friction-filled processes with speed and clarity. It collapses timelines, reduces the administrative burden, and professionalises every key interaction.

The core benefit is simple: a pre-verified digital inventory eliminates ambiguity. When a claim is filed or a tenancy ends, the need for lengthy investigations, endless email chains, and contentious disputes diminishes. The evidence is already organised, timestamped, and agreed upon, enabling decisive action.

Accelerating the Claims Lifecycle

For insurers, the traditional claims process is burdened with multiple touchpoints that extend timelines and inflate costs. Each step—from the first notice of loss to loss adjuster visits and evidence gathering—adds days or weeks to a settlement. A verified inventory, created at policy inception, transforms this dynamic.

Instead of a drawn-out investigation, the process becomes a simple cross-reference. The claims handler compares the submitted claim against the existing, verified catalogue. This immediate access to objective evidence can slash claims handling time from weeks to days.

This acceleration has a massive commercial impact:

- Reduced Loss Adjuster Costs: Fewer site visits are needed when high-quality, timestamped photographic evidence is already on file.

- Lower Administrative Overhead: Claims teams can stop chasing policyholders for information and focus on settling claims.

- Improved Customer Satisfaction: Policyholders receive their payouts faster, turning a potentially negative experience into a positive one.

The impact of inefficient systems is staggering. Outdated manual lists contribute to 1 in 4 home insurance payouts being rejected or undervalued, often due to a simple lack of photos or serial numbers. For brokers looking to stand out, introducing clients to property inventory software can help cut the loss adjuster fees that contribute to the £3 billion annual cost burden on UK insurers.

By compressing the claims lifecycle, insurers do not just save money; they build a reputation for fairness and speed—a powerful differentiator in a competitive market.

Professionalising Tenancy Management

For landlords and property managers, the check-in and check-out process is a constant source of friction. Without an indisputable record of a property's condition and contents, disagreements over damage can spiral into formal tenancy deposit disputes. These are not only time-consuming but can result in financial loss if the landlord's evidence is deemed insufficient.

Property inventory software professionalises this workflow. It creates a comprehensive, impartial report at the start of the tenancy, complete with timestamped photos and detailed descriptions. This document becomes the single source of truth for both landlord and tenant.

When the tenancy ends, the check-out inspection is no longer a subjective argument but a straightforward comparison against the original report. This clarity delivers immediate benefits, whether for a single property or an entire portfolio. As you can see, the right tools help brokers speed up claim resolutions significantly.

This software replaces friction with facts, ambiguity with evidence, and ultimately, cost with efficiency. It is a foundational tool for any modern insurance or property management operation focused on measurable results.

What to Look for in Property Inventory Software

Choosing the right property inventory software is a commercial decision, not merely an IT one. The objective is to find a platform that directly solves your most significant operational challenges, whether plugging claims leakage, preventing fraud, or winning tenancy deposit disputes. A good solution should deliver a tangible return by replacing ambiguity with hard evidence.

To make an informed decision, you must look past superficial features and ask how each function drives a specific commercial outcome. The right tool does not just catalogue items; it builds a robust, evidence-based defence for your business from day one.

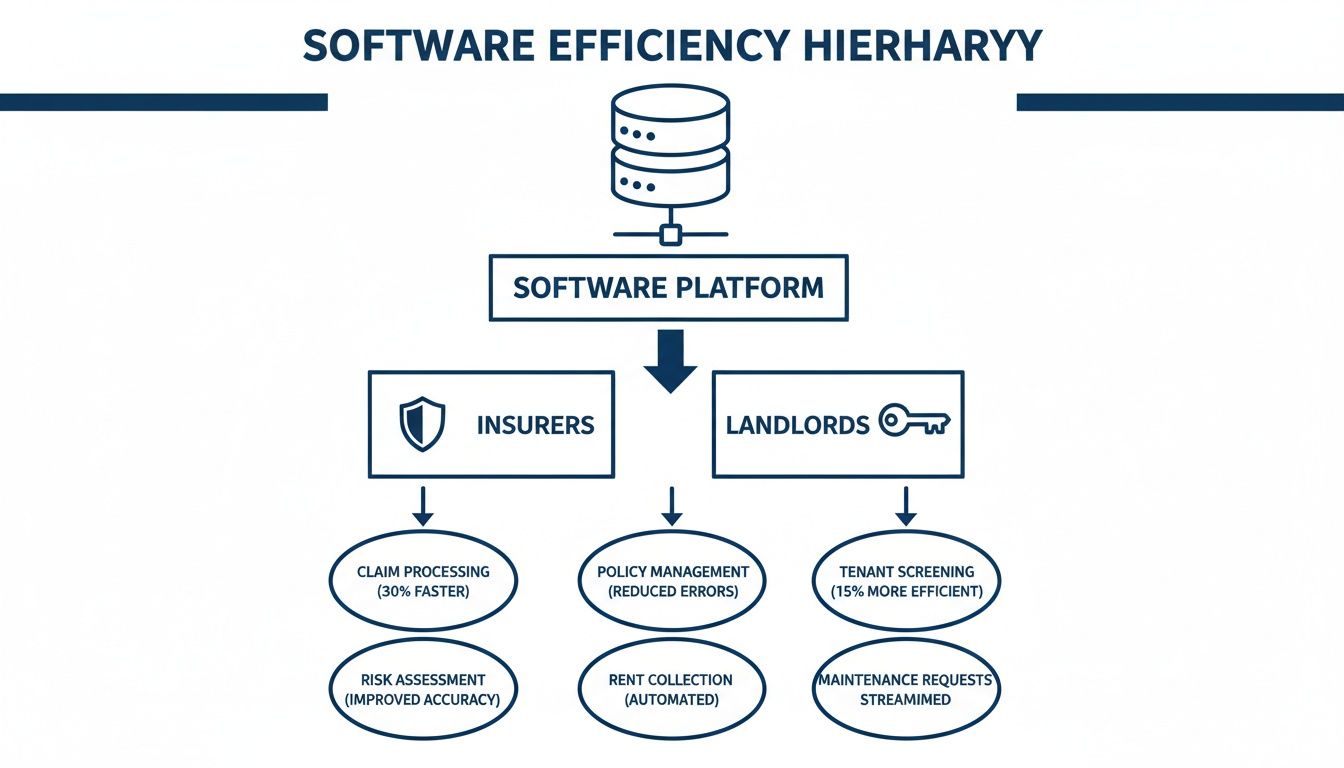

This diagram illustrates how the best software acts as a central hub, improving efficiency for both insurers and landlords.

As shown, a single, well-designed platform can connect different parts of the business, creating a unified and more efficient workflow.

The Non-Negotiable Features

Certain features are not optional; they are the foundation of any serious property inventory software. These are the core tools that deliver the security, evidence, and usability required to impact your bottom line. Ensure any platform you consider has these essentials.

- Mobile and Offline Functionality: Inventories are conducted on-site. The ability to use a smartphone or tablet is essential. A robust offline mode is critical, allowing data capture in basements or rural properties with no signal, then automatically synchronising when a connection is restored.

- Secure, UK-Based Cloud Storage: You are handling sensitive client data, so security is paramount. Look for solutions offering end-to-end encryption and GDPR-compliant data hosting in the UK. This is a regulatory necessity that ensures data sovereignty.

- Timestamping and Geocoding: This is the bedrock of fraud prevention. Every photo and entry must be automatically stamped with the precise time, date, and geographic location. This creates irrefutable proof of an item's existence and condition at a specific moment, neutralising 'after-the-event' fraudulent claims.

The table below connects these must-have features directly to the commercial benefits they deliver for insurers and landlords.

Must-Have Features and Their Commercial Benefits

| Feature | Description | Primary Commercial Benefit |

|---|---|---|

| Mobile & Offline Mode | Allows on-site data capture via smartphone or tablet, even without an internet connection, syncing later. | Operational Efficiency: Drastically cuts admin time by eliminating the need to return to an office to upload data. |

| Secure UK Cloud Storage | Data is encrypted and stored on GDPR-compliant servers located within the United Kingdom. | Regulatory Compliance: Avoids hefty fines and reputational damage by meeting strict UK data protection laws. |

| Timestamping & Geocoding | Automatically embeds time, date, and location data into every photo and record. | Fraud Reduction: Provides undeniable, tamper-proof evidence that stops fraudulent claims in their tracks. |

| Itemised & Professional Reporting | Generates detailed, customisable PDF reports with photos and descriptions for easy sharing. | Dispute Resolution: Speeds up tenancy deposit and insurance claim settlements by providing clear, professional evidence. |

| API Integration | Allows the software to connect and share data with existing claims or property management systems. | Process Automation: Eliminates manual data entry, reducing human error and freeing up staff for higher-value tasks. |

By ensuring these core capabilities are in place, you build a foundation of trust and efficiency that yields returns across your operations.

Features That Drive Real-World Results

Beyond the basics, several advanced features distinguish a standard tool from a genuine strategic asset. These are the capabilities designed to save significant time, improve the quality of your evidence, and make your entire process more rigorous and defensible.

For instance, side-by-side reporting is a game-changer for landlords. It allows an effortless comparison of check-in and check-out reports, making any damage that occurred during a tenancy instantly obvious. Such a visual comparison is far more compelling in a dispute than written notes.

“360-degree images are useful in showing the adjudicator the general layout and presentation of a room. They supplement the written word well and allow an adjudicator to look at the size of a room and the detail within.” - Steve Harriott, Chief Executive of the TDS .

This quote highlights the value that tenancy deposit adjudicators place on clear, comprehensive visual evidence—a key strength of modern software.

Connecting Your Systems

Even the best software is ineffective if it does not integrate with your other systems. A powerful solution must work seamlessly with your existing workflow and produce clear, professional reports. Without this, your valuable data remains trapped in a silo, limiting its impact.

Look for these key integration and reporting features:

- Customisable Reporting: The software must generate detailed, well-organised PDF reports that can be easily shared with policyholders, tenants, or adjudicators. The ability to add your branding and tailor templates is a significant advantage.

- API Integration: The capacity to connect the inventory platform with your core claims management or property management system via an API is crucial for efficiency. This allows verified data to flow directly where it is needed, eliminating manual data entry and minimising the risk of human error.

Rolling Out a Solution for Your Business

Implementing new technology can seem like a major undertaking, but deploying property inventory software is a structured process that delivers a clear, measurable return. For claims directors and portfolio managers, the goal is to find a solution that resolves immediate problems without disrupting existing workflows. This involves selecting the right deployment model, understanding costs, and ensuring interoperability with your current systems.

When rolling out new technology, knowing how to create an inventory system properly is key to securing buy-in from your teams. The right approach ensures a smooth transition for everyone, from claims handlers to underwriters.

Choosing Your Deployment Model

For modern insurance and property management operations, the choice of deployment model is straightforward. While on-premise software installation is an option, the overheads for maintenance, security, and access are considerable.

Cloud-based Software-as-a-Service (SaaS) is the superior model.

- Access Anywhere: Your teams can access inventory data from any location—the office, home, or on-site during a loss assessment. This is critical for efficient claims handling.

- Robust Security: Reputable SaaS providers handle all security patches, server maintenance, and data backups. Your sensitive policyholder data is protected by specialists.

- Scalability: A cloud solution scales with your business. You can add users or increase storage without purchasing physical hardware.

- Always Up-to-Date: The software is constantly updated by the provider, giving you the latest features and security fixes automatically.

This model removes the IT burden, allowing your teams to focus on their core responsibilities.

Understanding Integration and Data Security

A tool that does not connect to your other systems creates data silos and forces your team into tedious manual work. The real value is realised when your systems communicate with each other.

Look for a property inventory software solution with a robust Application Programming Interface (API) . An API acts as a secure bridge, allowing the inventory platform to feed verified data directly into your core systems. For example, a completed inventory can automatically update a policyholder's file in your claims management system. This eliminates manual data entry, reduces the risk of human error, and transforms the software from a simple documentation tool into the core of your risk and claims workflow.

Data security is non-negotiable. Any software that handles policyholder information must be fully GDPR compliant . Furthermore, for UK-based operations, you must ensure the provider respects UK data sovereignty by storing all data within the country. This is a critical due diligence step.

A Step-by-Step Pilot Programme Plan

Attempting to roll out a new system across an entire organisation at once is a recipe for failure. A structured pilot programme is a smarter approach to prove value, gather feedback, and ensure smooth, company-wide adoption.

- Select a Pilot Team: Start small. Choose a focused group, such as a high-net-worth claims team or a landlord insurance portfolio team.

- Set Clear, Measurable Goals: For example, "Reduce the average claims handling time for the pilot group by 25% " or "Eliminate 90% of initial queries for evidence."

- Provide Training: Ensure the pilot team is confident using the software. The best platforms are intuitive and require minimal training.

- Run the Pilot (4-6 Weeks): Use the software on a set number of new policies or claims and monitor progress closely.

- Measure and Report: At the end of the pilot, compare the results against your goals. Present the hard numbers—reduced handling times, lower dispute rates—to senior stakeholders.

This structured approach builds a solid commercial case for a wider rollout, backed by real-world data.

The Future: Where Asset Verification Gets Automated

The world of property inventory software is evolving rapidly, moving from simple cataloguing towards intelligent, automated asset verification. For insurers and portfolio managers, this next wave represents a significant leap forward in both efficiency and underwriting accuracy. The future is not about just listing items; it is about understanding their value and condition instantly, with minimal human intervention.

This shift is powered by artificial intelligence (AI) and machine learning. These technologies are set to automate the most tedious aspects of creating an inventory, transforming a manual task into a near-instantaneous process. This makes the software not just a tool for today, but a future-proof investment that will grow in value.

AI-Powered Item Recognition and Valuation

Imagine a policyholder takes a single picture of their television. Previously, they would have had to manually enter the make, model, and then search online for its current replacement value. The next generation of property inventory software makes this entire process obsolete.

Using advanced image recognition, the system can:

- Instantly identify the item: The software recognises the brand, model number, and even the year of manufacture.

- Automate valuation: It cross-references this data against live market information to pull an accurate, up-to-date replacement value.

- Catalogue key details: It can automatically detect and record serial numbers or other unique identifiers, with no typing required.

This level of automation drastically reduces the effort required from the policyholder, increasing the likelihood of them completing a full and accurate inventory. For insurers, this means receiving richer, more precise data at the start of a policy.

The real value here is the elimination of manual data entry. This not only improves inventory accuracy but also provides underwriters with deeper, more granular insights for sharper risk assessment and pricing.

The Impact on Underwriting and Claims

As this technology becomes standard, its commercial impact will be felt across the insurance lifecycle. Underwriters will no longer rely on vague estimates for contents cover. Instead, they will have a precise, valued, and verified list of assets before a policy goes live. This allows for far more accurate premium setting and dramatically reduces the risk of underinsurance.

For claims teams, the process becomes even faster. When a claim is submitted, the system already has a detailed, pre-verified, and valued record on file. The potential for disputes over an item’s value or existence is significantly reduced. This leads to faster settlements and an improved customer experience, cementing this technology as essential for any modern, data-driven insurance operation.

Your Questions Answered

We receive many questions from insurers, brokers, and landlords seeking to understand how this technology works in practice. Here are some direct answers to the most common queries.

Are Digital Inventories Admissible in a Dispute?

Yes, absolutely. A detailed digital inventory created with professional software is often the single most powerful piece of evidence in a tenancy deposit dispute. An adjudicator from a body like the Tenancy Deposit Scheme (TDS) will always favour clear, impartial proof over vague, handwritten notes.

Provided the report is comprehensive, timestamped, and agreed upon by both landlord and tenant at the start of the tenancy, it serves as the definitive record. The inclusion of dated photos and videos—a key strength of modern software—carries significant weight in resolving disputes fairly and quickly.

How Secure Is Our Policyholders' Data?

Data security is non-negotiable. The best property inventory software uses end-to-end encryption to protect data both in transit and at rest. For UK-based operations, it is critical to choose a provider that is fully GDPR compliant and stores all data in secure, UK-based data centres to ensure data sovereignty.

Before integrating any new software, conduct thorough due diligence on the vendor’s security protocols. This includes reviewing their access control policies, data breach response plans, and any third-party security certifications. It is the only way to ensure your clients' sensitive information is properly protected.

Is It Realistic to Expect Policyholders to Catalogue Everything?

Yes, because the motivation to do so is powerful. While it requires an initial time investment, that effort is minimal compared to the stress of recalling every possession after a traumatic event like a fire or burglary. Insurers report that up to 30% of claims are either rejected or significantly reduced simply because the policyholder lacks proof of ownership.

Using a simple app to walk through their property taking photos makes the task manageable. The real incentive for a policyholder is the peace of mind that comes from knowing their claim will be processed quickly, fairly, and for the correct amount. This reframes the task from a chore to a vital act of financial self-defence, making completion far more realistic.

Ready to eliminate claims disputes and prevent fraud before it happens? See how Proova provides the verified evidence you need from day one. Explore the solution at Proova.