The UK Insurance Cooling Off Period: A Commercial Risk Guide

For a policyholder, the insurance cooling off period is a simple safety net—a statutory window to reconsider a purchase. For insurers and brokers, however, this same period represents a phase of heightened commercial risk, administrative cost, and potential fraud. Understanding and managing this window is not a matter of consumer rights compliance, but of commercial risk management.

Understanding The Cooling Off Period as a Business Risk

From the outside, the cooling-off period appears as a straightforward consumer right. Internally, it is a complex operational challenge that erodes profitability and efficiency. This statutory window is not merely a compliance checkbox; it is a period where the business is commercially vulnerable, exposing insurers to costs and risks before a policy becomes profitable.

The standard 14-day window creates a trio of commercial problems that directly impact the bottom line:

- Wasted Customer Acquisition Costs (CAC): Early cancellations mean that all upfront expenditure on marketing, broker commissions, and underwriting is immediately lost, resulting in a negative return on investment.

- Increased Administrative Burden: Every cancellation requires processing, system updates, and refund calculations, consuming valuable team resources and driving up operational overheads.

- Opportunistic Fraud Exposure: The period can be exploited by individuals who insure an already-damaged item, wait for the policy to be active, and then submit a claim—a classic form of 'after-the-event' fraud.

The Regulatory Foundation and Its Commercial Impact

The legal framework for this period is defined by the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013, which mandate a 14-day cooling-off period for most consumer insurance contracts. This period commences from the policy start date or the date the policyholder receives their documents, whichever is later.

While designed to protect consumers, this regulation has direct, tangible consequences for insurers. It establishes a period where the policy is legally active, but the premium income is not yet secure. This uncertainty complicates underwriting projections and demands a robust, efficient process for handling cancellations without incurring regulatory penalties from bodies like the FCA.

From an insurer's perspective, the cooling off period isn't a customer service feature—it's a critical phase in the policy lifecycle that must be managed as part of a wider business risk management framework. Every cancellation is a leak in the revenue pipeline.

Effectively navigating this period requires more than processing refunds. It involves analysing cancellation drivers, identifying patterns of high-risk behaviour, and—most critically—ensuring the policy was correctly underwritten from day one. By reframing this period from a regulatory hurdle to a strategic risk checkpoint, insurers can mitigate losses and build more resilient portfolios.

Calculating The Real Cost of Policy Cancellations

The insurance cooling-off period often dominates discussions about early policy terminations, but it represents only the tip of the iceberg. A narrow focus on this initial 14-day window risks obscuring the much larger, more systemic issue of customer churn. The real financial drain comes from the persistent flow of cancellations throughout the policy year—a significant and predictable source of claims leakage.

While cancellations within the cooling-off period are an administrative nuisance, UK insurance data reveals they are a small fraction of the total problem. They account for just 15% of all policy terminations. A far larger proportion, 37% , occurs between 16 and 100 days post-inception. A staggering 48% take place from day 101 up to the policy's renewal date. This data clearly indicates that the drivers of churn extend far beyond initial "buyer's remorse."

Every cancellation carries a direct administrative cost. For a deeper look into the data behind these figures, you can learn more about predicting insurance cancellations. The processing of system updates and refunds for each terminated policy typically costs an insurer between £25 and £75 .

For an insurer managing 100,000 policies with a modest 5% annual churn rate, this translates into a direct operational loss of £125,000 to £375,000 each year. This figure, however, only scratches the surface of the true financial damage.

The Hidden Financial Impact of Churn

Beyond direct processing fees, the true cost of cancellations is magnified by several less obvious but equally damaging factors. These hidden costs quietly erode underwriting margins and undermine long-term portfolio stability.

The most significant of these is the squandered Customer Acquisition Cost (CAC) . Every pound spent on marketing, broker commissions, and underwriting to onboard a new policyholder is lost the moment they cancel. For a customer who leaves after only a few months, the insurer rarely recoups this initial investment.

A policy that cancels is more than a lost premium; it's a negative return on investment. The entire acquisition effort results in a net loss, impacting everything from marketing budgets to profitability forecasts.

Furthermore, a high churn rate creates a portfolio of transient, higher-risk customers. Policyholders who frequently switch providers can be an indicator of higher claims frequency or fraudulent intent, injecting instability into the underwriting pool. This constant flux makes it incredibly difficult to build a predictable and profitable book of business.

Why Mismatched Cover Drives Cancellations

Many of these cancellations, both early and late, are not random. They are often symptoms of a fundamental flaw in the onboarding process: a mismatch between the policy cover and the policyholder’s actual assets and needs. This disconnect is a primary driver of dissatisfaction and, ultimately, cancellation.

Consider these common commercial pain points:

- Underinsurance Discovery: A policyholder realises their sum insured is inadequate, prompting them to seek a more accurate policy elsewhere to avoid the risk of an average clause application.

- Average Clause Anxiety: Upon understanding the potential financial penalties of the average clause, a customer with high-value items cancels to find a policy that offers greater certainty.

- Post-Purchase Doubt: The initial confidence in the policy fades as the policyholder questions whether their unique assets, such as specialist equipment or collections, are properly covered.

These issues all stem from a lack of asset verification and clarity at policy inception. By proactively addressing this mismatch—ensuring the policy is accurate from day one—insurers can significantly reduce the costly cycle of customer churn.

Nailing Down Cancellation Rules and Refund Procedures

For claims and policy administration teams, a cancellation request during the insurance cooling-off period is a process laden with regulatory tripwires and the potential for customer disputes. A clear, consistent procedure is essential to protect the business while honouring consumer rights and minimising operational friction.

When a policyholder cancels within the 14-day window, the insurer is legally permitted to make deductions for the cover provided, a concept known as 'time on risk' . This pro-rata charge ensures the customer pays for the protection they received, even if only for a few days.

Additionally, a reasonable administration fee can be deducted to cover the cost of setting up and subsequently cancelling the policy. This is permissible only if the fee was explicitly stated in the policy documentation before the contract was concluded. Any ambiguity here creates a significant risk of a complaint to the Financial Ombudsman Service (FOS).

Calculating Refunds and What You Can Deduct

A standardised approach to calculating refunds is non-negotiable for maintaining consistency and compliance. The formula must be simple, transparent, and easily justifiable to both customers and regulators.

A typical refund calculation follows these steps:

- Start with the Total Premium Paid: This forms the baseline figure.

- Calculate the 'Time on Risk' Charge: Divide the annual premium by 365 to obtain a daily rate. Multiply this rate by the number of days the policy was active.

- Apply the Administration Fee: If applicable and clearly disclosed in the policy terms, this fee is added to the deduction.

- Determine the Final Refund: Subtract the 'time on risk' cost and the administration fee from the total premium paid.

For a £500 annual home insurance premium cancelled after 10 days, the 'time on risk' charge would be approximately £13.70 (£500 / 365 * 10). If the policy terms included a £25 administration fee, the total deduction would be £38.70. The customer would receive a refund of £461.30.

This methodical process ensures every cancellation is handled fairly and consistently, significantly reducing the likelihood of a dispute. To handle the broader complexities of these situations, it's useful to know how to cancel a contract the right way.

Navigating Claims and Renewals

Two scenarios frequently cause procedural confusion: claims made during the cooling-off period and the application of rules to renewals.

If a policyholder makes a claim and then cancels within the 14 days , the insurer is not obligated to provide a refund. The policy has been utilised to cover a loss, and the insurer is typically entitled to the full annual premium. This must be explicitly stated in the policy wording.

Regarding renewals, the 14-day cooling-off period generally does not reset for policies that auto-renew without significant changes. This is standard industry practice designed to ensure continuity of cover. It is vital that renewal notices clearly communicate this, explaining that the right to cancel without penalty applies only at the inception of the first contract.

Turning The Cooling Off Period Into A Fraud Prevention Tool

For many insurers, the insurance cooling off period is perceived as a liability—a 14-day window of uncertainty and administrative cost. This perspective, however, overlooks a significant strategic opportunity. This period can be repurposed from a passive risk window into one of the most effective tools for proactive fraud prevention.

This strategic shift begins with addressing a specific vulnerability: 'after-the-event' fraud . This occurs when a policyholder intentionally insures an asset that is already damaged, lost, or stolen. They purchase the policy, wait for the 14-day cooling-off period to pass, and then file a claim, exploiting the lack of pre-inception evidence to their advantage. This is the modern equivalent of insuring a burning building.

It capitalises on the information asymmetry that exists at the start of most policies, forcing claims teams to rely on the policyholder's word without objective, verifiable proof.

Using The 14-Day Window Proactively

The solution is to transform the cooling-off period from a passive waiting game into an active verification window. By requiring new policyholders to create a verified digital inventory of their assets during these first 14 days , insurers establish an indisputable, time-stamped record of what is being insured—and its condition—from day one.

This proactive step fundamentally alters the dynamic. It creates a baseline of truth that renders after-the-event claims virtually impossible to sustain.

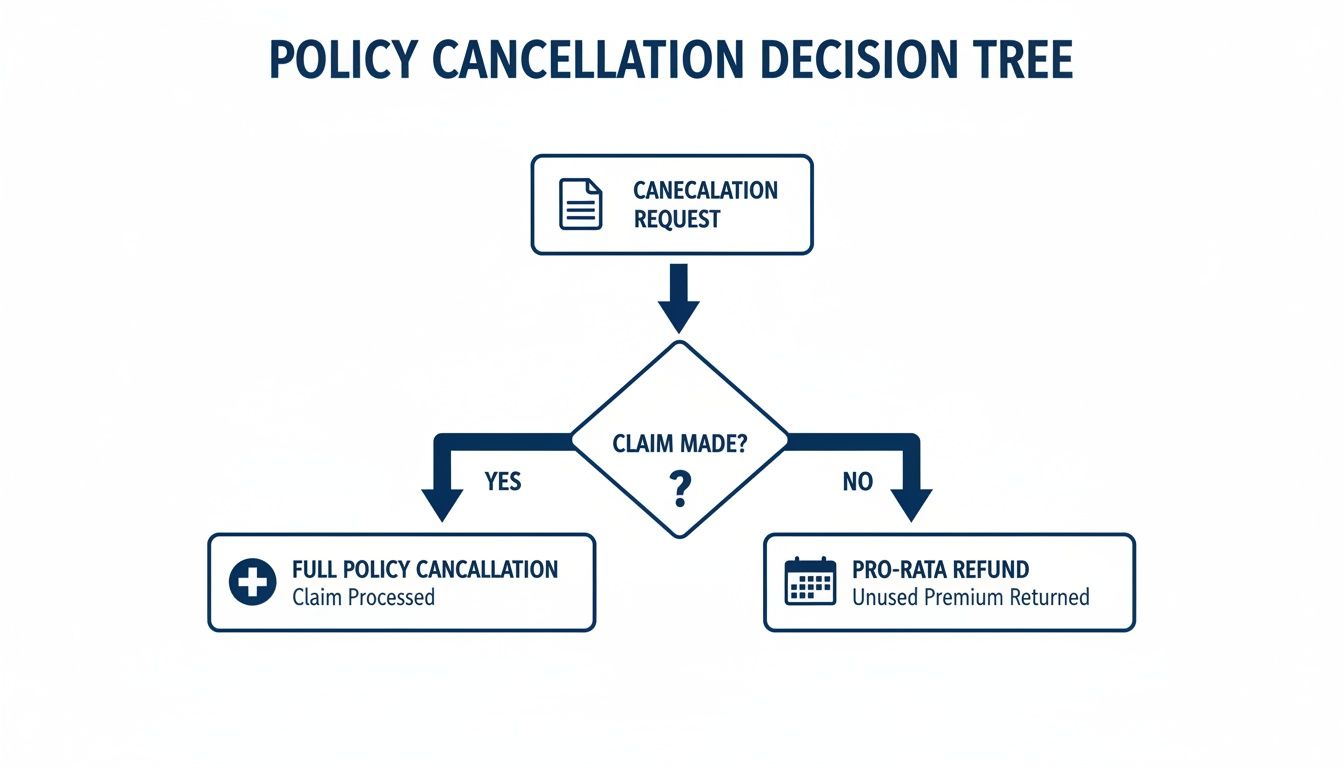

This infographic shows a typical decision flow for policy cancellations, highlighting the different paths taken depending on whether a claim has been made. The key takeaway is that the presence of a claim fundamentally alters the cancellation process, shifting it from a straightforward refund to a more complex resolution.

The key takeaway is that the presence of a claim fundamentally alters the cancellation process, shifting it from a straightforward refund to a more complex resolution.

By validating assets before this point, insurers can prevent fraudulent claims from ever entering the workflow.

The Commercial Benefits Of Inception Verification

Leveraging the insurance cooling off period for verification delivers tangible commercial benefits that extend far beyond fraud prevention. It addresses several core operational challenges that directly impact profitability.

The primary benefits include:

- Deterring Opportunistic Fraud: When policyholders are required to provide evidence of an item's existence and condition at inception, the incentive for after-the-event fraud is eliminated.

- Eliminating Sum Insured Ambiguity: A verified inventory provides a clear, agreed-upon valuation of assets, drastically reducing the risk of underinsurance and the subsequent average clause disputes that drive up claims handling costs.

- Reducing Claims Leakage: By preventing fraudulent and inflated claims at the source, insurers can significantly reduce claims leakage—a major drain on financial resources.

- Accelerating Legitimate Claims: For honest policyholders, a pre-verified inventory enables claims to be processed and paid faster, significantly improving customer satisfaction and retention.

This approach transforms the policy inception process from a transactional formality into a foundational risk management activity. It establishes a verifiable, data-led relationship with the policyholder, building a solid defence against future disputes and fraud.

Beyond using the cooling-off period, it is crucial to implement robust fraud prevention strategies. A comprehensive look at this can be found in a guide to fraud risk assessment , which offers a broader perspective. By combining pre-inception verification with a solid risk assessment framework, insurers can create a powerful, multi-layered defence. You can learn more about how this fits into a wider strategy in our guide to insurance fraud prevention schemes.

How Brokers Can Add Value During The Cooling-Off Period

For most insurance brokers, the cooling-off period is often treated as a passive, administrative interval—a 14-day period in which they hope the client does not cancel. This perspective misses a crucial opportunity to demonstrate value, build client trust, and improve retention.

By transforming this statutory window into an active engagement phase, brokers can elevate their role from policy arrangers to indispensable risk advisors. This is particularly vital for brokers serving high-net-worth individuals, commercial property owners, or landlord portfolios, where the risks of underinsurance and coverage gaps are most acute.

From Passive Wait to Proactive Validation

An effective strategy is to reframe the cooling-off period as a "policy validation window." Instead of allowing the client to file away their new documents, the broker should proactively guide them to confirm that the cover purchased accurately reflects the assets they own.

This involves encouraging the client to use these two weeks to compile a detailed, verified inventory of their insured items. This structured activity addresses a primary driver of cancellations: the uncertainty that the policy will perform as expected at the point of claim. By leading this validation process, the broker shifts the conversation from price to protection.

This approach is a game-changer. It turns a compliance requirement into a strategic client retention tool. By confirming the sum insured is accurate from day one, you prevent future disputes and showcase your commitment to the client's financial resilience.

This hands-on guidance is a powerful differentiator in a competitive market. You can explore more on how this strengthens your position by understanding why insurance brokers need digital proof to stay competitive.

Demonstrating Expertise and Preventing Future Pain Points

Guiding a client through asset verification during the cooling-off period is a masterclass in proactive risk management. It allows the broker to pre-empt critical issues before they escalate into contentious claims disputes.

The value delivered through this process includes:

- Preventing Underinsurance: You actively help clients avoid the underinsurance trap, a problem affecting an estimated 76-80% of UK properties. This protects them from the severe financial consequences of the average clause.

- Clarifying Policy Exclusions: While reviewing assets, you can highlight specific policy limits or exclusions relevant to high-value items, such as fine art or jewellery, ensuring there are no surprises at the point of claim.

- Building a Stronger Claim Defence: A verified inventory, created at policy inception, serves as immutable evidence. This simplifies and accelerates the claims process, reinforcing your value when it matters most.

- Reducing Client Churn: When a client is confident their broker has ensured their policy is robust and accurate, the incentive to switch providers diminishes significantly. They recognise tangible value beyond the initial transaction.

By taking these steps, you transform the insurance cooling-off period from a potential cancellation risk into a powerful foundation for a long-term, trust-based relationship. It is a proactive strategy that proves your expertise, secures your client's financial position, and protects your business from unnecessary churn.

Your Questions Answered: An Insurance Pro’s Guide

For insurers, brokers, and claims teams, the insurance cooling off period raises numerous practical questions regarding operations, compliance, and risk. This section provides direct answers to common queries from a commercial perspective.

Does the Cooling Off Period Apply to All UK Insurance Policies?

No. While the 14-day insurance cooling off period is a standard consumer right for most general insurance policies in the UK (e.g., home, motor, pet), it is not a universal rule. Key exceptions exist that professionals must understand to manage client expectations and maintain compliance.

The most common exception is for policies with a duration of less than one month, such as single-trip travel insurance. The transient nature of the cover makes a cooling-off period impractical.

For commercial policies, the situation is different. Cancellation rights are governed by the specific terms and conditions of the contract, not by consumer protection regulations. It is essential that brokers and underwriters ensure all policy documents clearly define the cancellation rules to prevent disputes, particularly with SMEs who may mistakenly assume they have the same rights as they do with personal lines products.

What Are Our Obligations If a Claim Is Made During the Cooling Off Period?

This scenario requires precise handling. If a policyholder submits a valid claim within the 14-day cooling off period and subsequently requests to cancel, the primary obligation is to adhere to the policy terms, which should clearly outline this eventuality.

Once a claim is made, the policy has been used to cover a loss. Consequently, a standard cancellation and refund no longer apply. The insurer is entitled to charge for the service provided.

Two common approaches, both of which must be detailed in the policy wording to be compliant, are:

- Deducting the Full Premium: The valid claim is paid, but the full annual premium is deducted from the final settlement amount.

- Charging for Service Rendered: The cancellation is processed, but a charge is made for the time on risk, plus any reasonable administration costs associated with setting up the policy and handling the claim.

Clarity in policy wording is paramount. Any ambiguity creates a risk of an adverse ruling from the Financial Ombudsman Service.

How Can Pre-Inception Verification Reduce Early Cancellations?

A significant number of cancellations during the insurance cooling off period are not driven by price, but by "buyer's remorse"—anxiety that the purchased cover may be inadequate. This doubt often arises from uncertainty about the accuracy of the sum insured or whether high-value items are properly protected.

Pre-inception asset verification is a powerful tool to mitigate this. By requiring or encouraging policyholders to create a verified digital record of their assets at the start of the policy, insurers build confidence and accuracy from day one.

When a policyholder has a clear, immutable record of their assets, the sum insured is no longer a guess. It's a fact. This alignment of policy cover to reality dramatically reduces post-purchase doubt and the subsequent urge to cancel.

This proactive step transforms policy inception from a simple transaction into a collaborative validation process. It fosters a more stable, long-term relationship based on transparency and accuracy, leading to fewer early-stage cancellations and a more resilient portfolio.

Are We Required to Give a Full Refund If a Policy Is Cancelled on Day 13?

No, a full refund is not typically required. If a policy is cancelled within the 14-day insurance cooling off period and no claims have been made, the insurer must provide a refund but is permitted to make deductions.

UK regulations allow insurers to charge a pro-rata amount for the days the policy was active—known as "time on risk." This ensures the policyholder pays for the cover they have received. For example, on a £365 annual premium, a charge of £13 for 13 days of cover is a standard and justifiable deduction.

In addition, insurers can charge a reasonable administration fee to cover the costs of policy setup and cancellation, provided this fee was clearly disclosed in the policy terms before the contract was agreed. A partial refund reflecting these deductions is standard and compliant industry practice.

Verifying assets at policy inception isn't just about preventing fraud; it's about building better, more accurate policies that reduce churn and eliminate disputes. Proova provides the tools to embed this verification into your workflow, turning the cooling off period from a risk into a retention opportunity. Discover how our platform can reduce your claims handling costs and prevent underinsurance disputes by visiting https://www.proova.com.