Your Essential Guide to a Commercial Property Insurance Quote

Getting a commercial property insurance quote is your first move in protecting your business assets but it is much more than just a price tag. Think of it as the blueprint for a potential contract, one built on a principle called utmost good faith. In simple terms, this means the accuracy of the information you provide directly shapes the validity of your future cover.

Getting the details wrong, even by accident, can have some seriously painful consequences down the line.

Why Honesty Is Your Best Policy

Securing a commercial property insurance quote is really an exercise in transparency. Insurers base their offer on the information you give them, trusting it is a complete and honest picture of the risks they are agreeing to take on. This is not just a bit of formal paperwork; it is the legal bedrock of your entire policy.

Any discrepancy, whether it is an intentional falsehood or a simple oversight, can lead to your policy being voided right when you need it most. Imagine a fire, flood or major theft. A rejected claim means you are left covering the full cost out of pocket—a nightmare scenario that could easily sink an otherwise healthy business.

The Real Cost of Getting It Wrong

The fallout from flawed information goes beyond just one denied claim. The entire insurance industry is built on a model of pooled risk. When fraudulent or inflated claims get paid out, those losses are absorbed and then spread across all policyholders in the form of higher premiums for everyone next year. Insurance fraud is not a victimless crime; it costs the industry billions and that cost is passed on to all of us.

So, being accurate is not just about protecting yourself. It helps keep the insurance market fair and sustainable for every business out there. This is especially critical when you look at how widespread the issue of inaccurate property valuations has become.

Recent analysis of over 43,000 UK property assessments revealed a staggering statistic: 71% of commercial properties were underinsured . On average, these businesses were only covered for 67% of their actual rebuild cost, leaving a massive, often invisible, gap in their financial protection.

This systemic underinsurance points to a major disconnect. Many business owners are unintentionally leaving themselves wide open to huge financial risks by undervaluing their assets. For instance, a small factory owner might insure their building for what it is worth on the market, completely forgetting that the cost to rebuild it from the ground up after a fire would be significantly higher.

If a total loss occurs, their insurance payout would fall disastrously short, making it practically impossible to get back on their feet. You can learn more about these findings on underinsurance to really grasp the scale of the problem.

What Your Quote Actually Covers

A standard commercial property insurance quote is designed to address several core areas of risk. Getting your head around these components is key to providing the right information and making sure you get the right level of protection.

Here’s what is typically included:

- Buildings Cover: This protects the physical structure of your property—the walls, roof and permanent fixtures and fittings—against damage from events like fire, storms or vandalism.

- Contents Cover: This insures all the movable assets inside your business, such as your stock, machinery, essential equipment and even the office furniture.

- Business Interruption: This is a vital piece of the puzzle. If your business cannot operate because of damage to your property, this cover helps replace lost income and pays for ongoing costs (like salaries and rent) to keep you afloat.

Ultimately, a precise and truthful declaration is your best strategy. It ensures the commercial property insurance quote you receive is not just a number but a reliable promise of protection when you need it most.

Gathering Verifiable Information for an Accurate Quote

Getting a commercial property insurance quote that is both fair and genuinely reliable hinges on one thing: accurate, verifiable information. Insurers are not just ticking boxes; they are meticulously assessing the risk your business represents. Every single detail you provide helps them build a clearer picture, which in turn directly shapes your premium and, crucially, the validity of your policy down the line.

Think of this process as building a foundation of trust. The provability of the information you submit can be the difference between a smooth, quick process and a painfully difficult one. When underwriters are met with incomplete or questionable details, they naturally default to a more cautious position. For you, that often translates into higher premiums or much stricter terms.

The Problem of Inaccurate Valuations

A common and costly pitfall for business owners is accidentally underinsuring their property. This happens when the value you declare is less than the true cost to rebuild or replace everything after a total loss. While it might seem like an easy way to trim your premium, it is an incredibly risky gamble that rarely pays off.

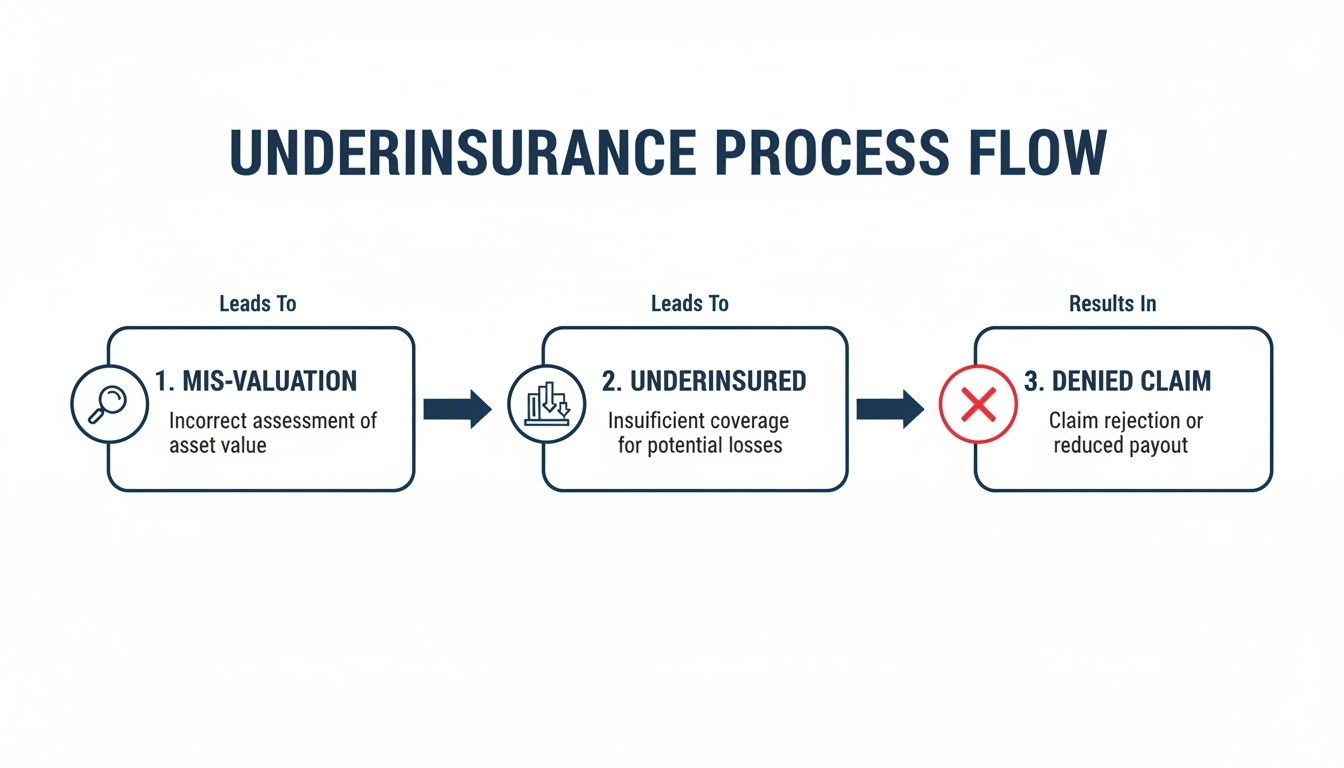

This flowchart shows the dangerous path from a simple mis-valuation to a potentially devastating financial outcome.

As you can see, an incorrect valuation is a direct line to being underinsured. That puts you at a massive risk of having a claim denied or significantly slashed right when you need the support most.

Creating an Indisputable Record

So, how do you avoid these problems? By creating a detailed and provable inventory of your assets. I am not talking about a simple spreadsheet. You need a digital, evidence-based record of your building, its contents and any high-value equipment.

Modern tools that let you capture time-stamped photos and videos of your assets are a game-changer here. This creates an indisputable record of what you own and its exact condition the moment your policy begins. For an insurer, this kind of hard evidence is gold.

An underwriter's job is to price risk based on facts. A verifiable, time-stamped inventory of your property and assets removes ambiguity and demonstrates that you are a diligent, low-risk client. This can lead to a more favourable quote and a much faster claims process.

This record does not just make the quoting process smoother; it becomes your most powerful tool if you ever need to make a claim. It removes the guesswork and potential for disputes, paving the way for a faster, fairer payout. It also helps combat insurance fraud, where claims are sometimes embellished after an incident. A clear, provable record from day one protects both you and the insurer, contributing to a healthier insurance market for everyone.

To make sure you are providing your insurer with the best possible data, conducting a comprehensive asset audit is an invaluable first step.

This proactive approach extends beyond your own four walls, too. It is also wise to ensure your key partners and suppliers have adequate cover. You can learn more about how to verify insurance coverage to protect your business in our detailed guide. This reinforces your commitment to mitigating risk across your entire operation.

Essential Information for Your Insurance Quote

Pulling together the right documents and details from the start is crucial. It prevents endless back-and-forth with brokers and ensures the quotes you receive are based on fact, not fiction. Here is a breakdown of what you will typically need.

| Information Category | Specific Details Required | Why It's Important |

|---|---|---|

| Business & Property Details | Business name, company registration number, address, year business was established, building age and construction materials (e.g., brick, wood frame). | Establishes the identity of the insured entity and the fundamental risk characteristics of the physical structure. |

| Operational Information | Description of business activities, number of employees, annual turnover, history of any previous insurance claims ( last 5 years ). | Helps the insurer understand the nature and scale of your operations, which directly influences liability and risk exposure. |

| Building & Contents Valuation | Sum insured for the building (rebuild cost), sum insured for contents (replacement cost), detailed inventory of high-value items. | This is the most critical part for avoiding underinsurance. Accurate values ensure you have enough cover to recover from a total loss. |

| Security & Safety Measures | Details of alarm systems (monitored, local), fire protection (sprinklers, extinguishers, smoke detectors), security cameras and physical security (locks, safes). | Demonstrates proactive risk management, which can lead to lower premiums as it reduces the likelihood of theft, fire and other perils. |

| Supporting Documentation | Previous insurance policy documents, professional property valuations, detailed asset registers or inventories (especially digital, time-stamped records). | Provides verifiable evidence to support your application, speeding up the underwriting process and increasing the accuracy of the quote. |

Having this information ready to go shows insurers you are organised and serious about managing your risk. It sets a positive tone for the entire process and puts you in a much stronger position to negotiate a fair premium.

What Really Determines Your Insurance Premium

Ever wonder why two seemingly identical businesses get wildly different insurance quotes? The answer is not just about the size of your building; it lies in the detailed world of risk assessment, where insurers analyse a whole range of factors to land on your final premium.

Your property’s location is a huge piece of the puzzle. A business in a high-crime area or a flood zone will naturally face a higher premium. It is simple risk and reward. Likewise, the very bones of your building matter. A modern, brick-built structure is seen as a much lower fire risk than an older, timber-framed property and your quote will reflect that.

Rebuild Cost Versus Market Value

Here is one of the most common—and costly—mistakes I see business owners make: confusing market value with rebuild cost . Getting this wrong can cause major headaches with your commercial property insurance quote.

- Market Value is what your property would sell for on the open market, land and all.

- Rebuild Cost is what it would actually cost to reconstruct the building from the ground up after a total loss. Think materials, labour and clearing the debris.

Insurers only care about the rebuild cost. Why? Because even if the building is a pile of rubble, the land underneath it still has value. Insuring your property based on its market value often means you are either paying for cover you do not need or, far worse, you are dangerously underinsured. Knowing how to value commercial property correctly is fundamental to getting an accurate quote.

The Ripple Effect of Insurance Fraud

Beyond the factors specific to your business, there is a wider industry problem that hits every single policyholder in the pocket: insurance fraud. When a business makes a bogus or dishonestly inflated claim, those costs do not just vanish. Insurers have to absorb them and they do so by passing them on to all their customers through higher premiums the next year.

That means every honest business owner is indirectly footing the bill for the dishonesty of a few. The Association of British Insurers reported that detected insurance fraud in the UK was valued at a staggering £1.1 billion in 2022. This number shows exactly why insurers are so rigorous and why providing solid, verifiable evidence of your assets is non-negotiable. It protects you and helps create a fairer system for everyone. Properly documenting your assets should be a core part of your business risk management framework .

An insurer's calculation is a delicate balance. They weigh your specific risks—from your postcode to your fire safety protocols—against broader industry-wide costs, including the pervasive impact of fraud. Understanding both sides of this equation empowers you to influence your final premium.

The link between your rebuild cost and your premium is direct. For instance, UK market data for 2025 shows a commercial property with a £200,000 rebuild cost might see an average annual premium of around £218 . For a property with a £1,000,000 rebuild cost, that average jumps to nearly £758 . These figures clearly show how premiums scale with value but always remember that your own unique factors, like your claims history and security measures, will cause that number to swing up or down.

How to Actively Reduce Your Insurance Costs

Getting a cheaper commercial property insurance quote is not about finding clever loopholes or stripping back essential cover. It is about proving to underwriters that your business is a better-than-average risk. The most powerful tools you have are the tangible, provable actions you take to reduce the chance of a claim.

This all starts with taking a hard look at your property's physical security and safety measures. Think of any upgrades not as operational costs but as direct investments in your insurability. Insurers genuinely favour businesses that get on the front foot and manage their own risk.

Demonstrating Lower Risk with Verifiable Actions

Imagine a business owner who invests in a new, monitored alarm system and installs modern, compliant fire extinguishers. These are sensible moves on their own, of course. But their real power in getting a better quote lies in provability . By documenting these upgrades with dated invoices and time-stamped photos, they give the underwriter solid evidence of reduced risk.

This simple step transforms a statement on an application form from a claim into a verifiable fact. Here are a few practical steps you could take:

- Upgrade Physical Security: Install or update CCTV systems, fit secure locks on all entry points and add security lighting. Keep every receipt and take photos.

- Enhance Fire Safety: Make sure you have modern, serviced fire extinguishers, clear escape routes and a regularly tested smoke alarm system. Log every maintenance check.

- Maintain Your Property: A well-kept building with a sound roof and clear guttering is far less likely to suffer water damage. Regular maintenance logs are excellent proof of this.

The core principle is simple: proof removes doubt. An underwriter who can clearly see and verify your risk management efforts is in a much better position to offer preferential terms than one who has to rely on assumptions.

This verifiable proof also serves another critical purpose. It creates an indisputable, time-stamped record of your property's condition right when the policy begins. If a dispute ever arises during a claim, this evidence becomes your strongest defence, heading off arguments over pre-existing conditions or the state of your assets.

Capitalising on Market Conditions

Your proactive risk management becomes even more important in a competitive insurance market. In 2025, for example, the UK property insurance market saw some rate decreases, with reports showing declines between 6% and 20% for certain types of cover. Yet even as insurers paid out massive sums like the £1.6 billion in property claims during Q2 2025, they also tightened their underwriting standards. To get the best rates, businesses had to provide top-quality risk information. You can find more insights on the UK insurance market outlook on aon.com.

Ultimately, by meticulously documenting your improvements, you are not just ticking boxes. You are building a compelling case that your business deserves a better commercial property insurance quote because you are, demonstrably, a better risk to insure.

Choosing the Right Policy, Not Just the Cheapest Price

Getting a stack of commercial property insurance quotes is just the start of the journey, not the finish line. It is human nature to immediately scan for the lowest number but picking the cheapest option is often a fast track to being dangerously underinsured.

That bargain premium can easily hide significant risks and gaping holes in your protection.

To make a truly informed decision, you have to look past the headline price. The real value of an insurance policy is buried in the details, so it is time to dig into the documents and see what is actually on offer. A slightly more expensive quote might provide vastly superior protection, making it a much smarter financial choice in the long run.

Beyond the Premium: What to Actually Compare

With several quotes in front of you, it is time to think like an underwriter. The premium is just one piece of a much larger puzzle. You need to pay close attention to the critical details that define how strong and reliable your cover really is.

Here are the key areas to scrutinise on every quote:

- The Policy Excess: This is what you will pay out of your own pocket for any claim. A cheap policy might look appealing until you realise it comes with a punishingly high excess that makes smaller claims completely pointless.

- Cover Limits: Check the maximum amount the insurer will pay out for different types of claims. You have to be sure these limits are high enough to cover a genuine worst-case scenario, like a total rebuild of your property from the ground up.

- Exclusions: This is arguably the most important section of any policy. Look for specific events or circumstances that are not covered. For example, a policy might exclude flood damage or certain types of theft, which could be disastrous depending on your location and business.

- Warranties and Conditions: These are strict obligations you must follow to keep your policy valid, like maintaining a specific type of alarm system. If you breach a warranty—even accidentally—an insurer could have grounds to reject your claim entirely.

To help you get organised, we have created a simple checklist. Use this table to lay out the key details from your top quotes side-by-side. It makes spotting the crucial differences much easier than flipping between pages of documents.

Quote Comparison Checklist

| Feature | Quote 1 Details | Quote 2 Details | Quote 3 Details |

|---|---|---|---|

| Annual Premium | |||

| Policy Excess (Standard) | |||

| Policy Excess (Specific, e.g., Flood) | |||

| Buildings Cover Limit | |||

| Contents Cover Limit | |||

| Key Exclusions Noted | |||

| Important Warranties | |||

| Public Liability Limit | |||

| Business Interruption Cover? |

Once you have filled this in, the best value option—not just the cheapest price—should become much clearer.

Broker Expertise vs. Going Direct

Another crucial decision is whether to use an experienced insurance broker or go directly to an insurer. While going direct might seem simpler, a good broker brings invaluable expertise to the table. They can translate confusing jargon, highlight hidden risks in the small print and even negotiate better terms on your behalf.

Remember, a broker works for you , not the insurance company. Their job is to find the most suitable cover for your specific needs, which often means striking the right balance between cost and comprehensive protection. For businesses with complex risks, their guidance can be indispensable.

Choosing insurance is about buying certainty. A cheap policy riddled with exclusions offers a false sense of security. True value lies in a robust policy that you can depend on when disaster strikes, ensuring your business can genuinely recover and rebuild.

Ultimately, your goal is to find a policy that represents genuine value. This means securing robust, reliable protection that fits your specific business risks at a fair price. It involves a bit of homework but this diligence ensures the quote you choose will actually deliver on its promise when you need it most.

After all, a cheap policy that fails is the most expensive one you can buy. You might also want to learn more about your broader obligations by reading our complete guide to public liability coverage in the UK .

Got Questions? We've Got Answers

Let's tackle some of the common questions that pop up when business owners are looking for commercial property insurance. Getting these details right can make a huge difference to your cover and your premium.

What is the Difference Between Rebuild Cost and Market Value?

This is a big one and it trips people up all the time. The market value is what you could sell your property for on the open market, which includes the land it sits on.

The rebuild cost , on the other hand, is the money it would take to reconstruct your building from the ground up after a total loss. Think materials, labour and clearing the site first. Insurers only care about the rebuild cost because, well, the land does not burn down. Basing your cover on market value is a classic mistake that can either leave you paying way too much or, far worse, leave you drastically underinsured.

How Does My Claims History Affect My New Quote?

Insurers see your claims history as a crystal ball. A track record with frequent or large claims signals to them that you are a higher risk and your premium will almost certainly reflect that when you are after a new quote.

On the flip side, a long, claim-free history paints you as a safe bet, often earning you some nice discounts. It is absolutely crucial to be upfront about your past claims. Insurers share data and if you are caught hiding something, they could void your policy entirely.

This all comes down to a principle called 'utmost good faith'. Not disclosing a past claim is a serious misrepresentation. It could get your cover cancelled, leaving you with nothing and a black mark against your name that follows you to other insurers.

Can I Get a Quote If My Building Is Unoccupied?

You can but you will need a specialist policy. An empty building is a magnet for trouble—vandalism, theft or a burst pipe that gushes for weeks before anyone notices. Because of this, standard commercial policies usually become invalid if a property is left empty for a long stretch, typically more than 30 consecutive days .

You have to tell your insurer or broker the moment your property becomes vacant. They will help you arrange the right unoccupied property insurance. Expect stricter conditions, like mandatory regular inspections and securing all windows and doors, plus a higher premium to match the higher risk.

Managing your insurance shouldn't be a headache. With Proova , you can create a verifiable, time-stamped digital record of all your business assets, making it easier to get an accurate quote and speeding up claims if the worst happens. Secure your business and prove your assets with confidence. Find out more at proova.com.