Digital Transformation in Insurance to Fight Fraud

At its heart, digital transformation in insurance is about moving away from slow, paper-based operations towards smarter, technology-driven processes. It is about using tools like AI and automation to sharpen everything from underwriting and risk assessment to how claims are paid out.

This is not just a simple tech upgrade. It is a complete rethink of how the insurance industry operates to become more efficient, secure and genuinely focused on the customer.

Why Digital Transformation in Insurance Is No Longer Optional

The insurance industry has reached a crossroads. Sticking with outdated, manual processes is no longer a viable option. Relying on paper-based systems in today's world is like trying to secure a modern vault with a rusty old padlock; it just will not hold up against sophisticated threats. This weakness is most glaring when it comes to fighting insurance fraud.

Manual claims verification is painfully slow and riddled with human error, creating wide-open opportunities for fraudsters to exploit cracks in the system. And these are not just minor hiccups—they represent a massive financial drain. Insurance fraud is estimated to cost the UK economy over £3 billion every single year . That is a heavy burden that ultimately gets passed on to honest policyholders through higher premiums. Without strong digital defences, insurers are left vulnerable and their customers are the ones who pay the price.

Modernising to Survive and Thrive

Digital transformation is not just a buzzword; it is the only realistic strategy for bringing every part of the insurance model into the 21st century. By weaving technology into their core operations, insurers can build a much more resilient and efficient business. This goes far beyond just getting rid of filing cabinets.

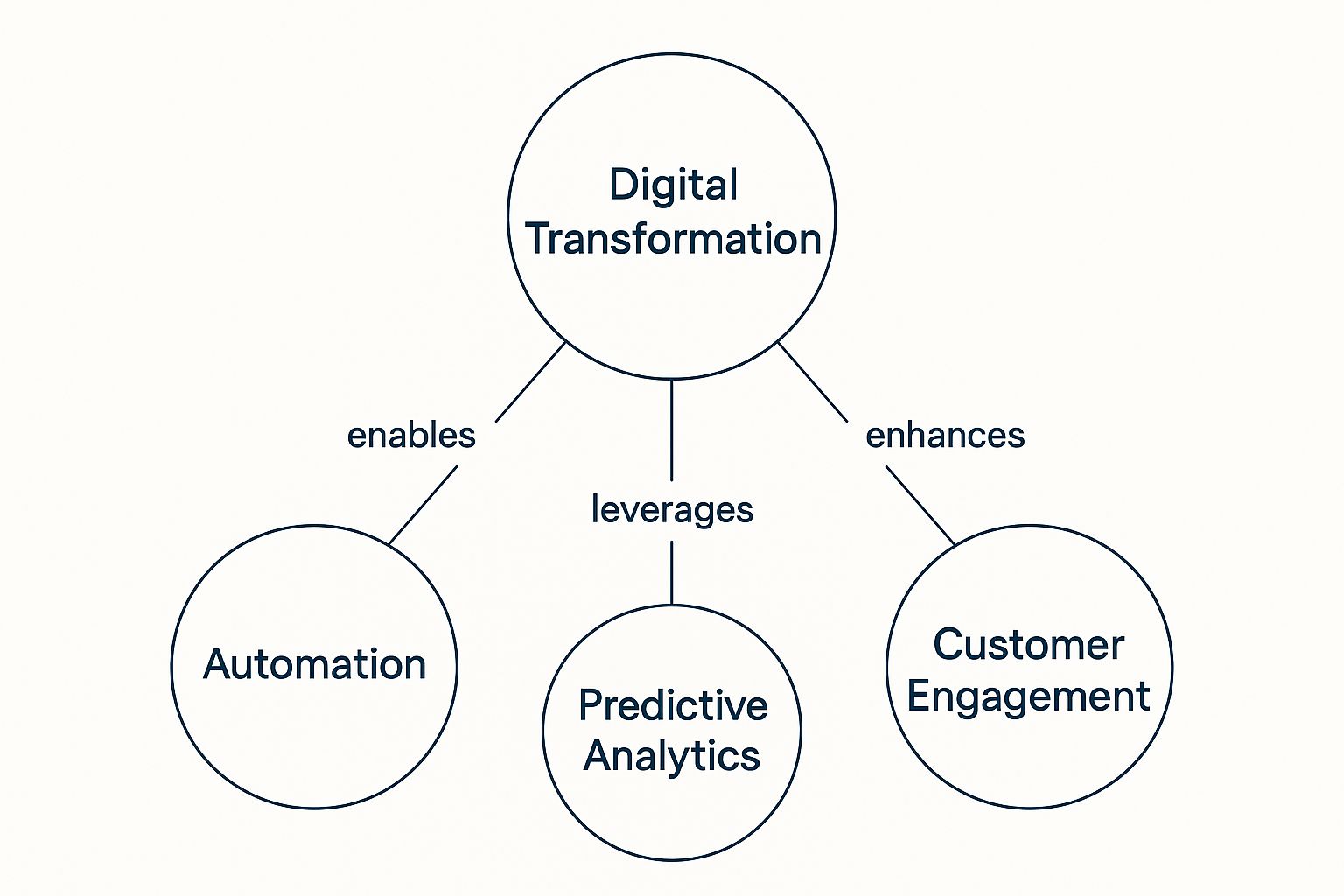

This infographic shows how core concepts like Automation, Predictive Analytics and Customer Engagement are central pillars of this change.

As you can see, a successful shift is not about plugging in one new piece of software. It is about creating a connected ecosystem where multiple advancements work together to build a stronger, more intelligent operation.

The benefits here are twofold. First, it massively strengthens an insurer's defences against fraudulent claims by introducing powerful, automated verification tools. Second, it smashes through the operational bottlenecks that slow down processes and leave customers frustrated.

The real urgency behind digital adoption lies in its ability to solve the fundamental challenges of provability and trust. By creating a transparent and verifiable claims process, technology not only fights fraud but also reinforces the core promise of insurance.

Let's look at how this shift changes things on the ground. The table below breaks down the key differences between the old way of doing things and a modern, digital approach.

Legacy vs Modern Insurance Operations

| Process Area | Traditional Approach | Digital Approach |

|---|---|---|

| Claims Submission | Manual forms, physical paperwork and email attachments. | Instant submission via a mobile app with real-time data capture. |

| Verification | Slow, manual checks by adjusters, prone to human error and bias. | Automated, AI-driven verification of evidence like photos and documents. |

| Fraud Detection | Relies on adjuster experience and manual flagging of suspicious claims. | Predictive analytics and AI algorithms identify fraud patterns in real time. |

| Customer Updates | Infrequent communication via phone calls or letters, causing anxiety. | Proactive, automated updates via SMS, app notifications and portals. |

| Payouts | Lengthy approval chains and cheque-based payments taking weeks. | Instant digital payments upon claim approval, often within minutes. |

| Data Security | Physical files and siloed systems create significant security risks. | Centralised, encrypted cloud storage with strict access controls. |

The contrast is stark. A digital-first approach means insurers can offer faster settlements, more accurate underwriting and ultimately, a fairer pricing model for their customers.

As we explored in our analysis of the global fraud epidemic and how Proova is fighting back, technology provides the tools needed to verify claims with an accuracy that was impossible just a few years ago. This evolution is absolutely essential for building a more secure and sustainable insurance ecosystem for everyone.

The Core Technologies Powering Modern Insurance

The big shift in insurance is not down to one single invention. Instead, it is a collection of powerful technologies working together, forming the engine of the modern industry. These tools are replacing slow, manual processes with intelligent, automated systems, building a more responsive and secure world for both insurers and their customers.

Leading the charge are Artificial Intelligence (AI) and its partner, machine learning. Think of AI in claims processing like a top-tier detective who can sift through thousands of pieces of evidence in seconds. It spots inconsistencies, flags suspicious patterns and verifies information with a speed and accuracy that is simply beyond human reach. This is a game-changer for strengthening claims provability and fighting fraud.

Machine learning algorithms do not just stop there; they constantly learn from new data, getting smarter at predicting risks and identifying fraudulent behaviour over time. This means an insurer's defences are not static—they adapt as fraudsters invent new tactics.

Artificial Intelligence and Automation in Action

AI and automation are the true workhorses of operational efficiency. By handling repetitive, time-consuming tasks, they free up human agents to focus on the complex, customer-facing work that really matters. It is like giving your claims team a set of tireless digital assistants.

These technologies are reshaping core insurance functions in several key ways:

- Automated Underwriting: Algorithms analyse vast datasets to generate accurate quotes and assess risk profiles almost instantly. This helps remove bias and speeds up the entire process of getting a policy.

- Intelligent Claims Processing: AI can automatically review submitted documents, photos and other evidence for authenticity. It can even estimate damages, drastically cutting the time from the first notice of loss to the final payout.

- Proactive Customer Communication: Chatbots and automated messaging provide customers with 24/7 support and real-time updates on their claims, reducing anxiety and improving the experience.

By automating these processes, insurers can slash claim processing costs—in some cases by as much as 30% —while simultaneously improving accuracy. You can dive deeper into how AI is transforming claims for home, travel and gadget insurance .

The Rise of Advanced Data Analytics

Data is the fuel for this entire transformation. Modern insurance now relies on predictive analytics to turn raw information into genuine insights. Instead of just reacting to events, insurers can now anticipate them. This means spotting potential risks before they lead to claims or identifying emerging fraud trends before they cause serious financial damage.

Predictive analytics allows insurers to move from a reactive stance to a proactive one. By analysing historical data and real-time information, they can optimise pricing, manage risk far more effectively and prevent losses before they happen.

The UK insurance sector is a great example of this shift, with a huge focus on Insurtech innovation. Progress in AI and Large Language Models (LLMs) is central to boosting efficiency and customer experiences, especially when it comes to modernising compliance and overhauling core insurance systems.

Blockchain and Building Trust

Another important piece of the puzzle is blockchain. While most people associate it with cryptocurrency, its real value in insurance lies in transparency and security. Blockchain creates a decentralised and unchangeable digital ledger for recording transactions.

Imagine it as a shared, tamper-proof notebook that everyone involved in a policy can see but no one can alter. This has massive implications for claims provability and fraud prevention. When a claim is filed and verified on a blockchain, it creates a permanent, auditable record that cannot be disputed. This cuts through ambiguity and builds a solid foundation of trust between insurer and policyholder, making the entire process transparent and fair.

Strengthening Claims Provability to Combat Fraud

Insurance fraud is not just a minor business expense; it is a deep-rooted problem that quietly inflates costs for everyone. The Association of British Insurers (ABI) uncovered a staggering £1.1 billion in dishonest insurance claims in 2022 alone. That figure is not just a statistic—it is a clear signal that the industry needs a much stronger defence.

At its core, a traditional insurance claim has always relied heavily on trust. An insurer has to trust that the policyholder's story is accurate and the evidence they provide is genuine. This very reliance creates a weak spot, one that fraudsters are all too happy to exploit. Digital transformation tackles this vulnerability head-on by shifting the foundation of a claim from simple trust to concrete provability.

Instead of taking a claimant's word for it, modern insurance uses technology to build a verifiable and objective record. It is about replacing ambiguity with certainty and creating a process where a claim's legitimacy can be demonstrated, not just asserted.

The Power of Immutable Digital Evidence

The first line of defence in this new era is an immutable evidence trail. Think of it as a digital fortress for claims data. When a policyholder uses a dedicated app to document their assets before anything goes wrong, they are creating a time-stamped, verifiable inventory.

This proactive approach completely changes the game. It shuts down common fraudulent tactics, like claiming for items that were never owned in the first place or inflating the value of goods that were lost.

- Verifiable Timestamps: Digital tools prove when an item was documented. This stops "after-the-event" fraud where someone damages an item, quickly takes out a policy and then files a claim a few weeks later.

- Geotagging and Metadata: The data attached to a digital photo—its location, the device used and the exact time—adds layers of verification that a simple printed picture could never offer.

- Centralised Digital Vault: Storing this evidence in a secure, central system ensures it cannot be altered or tampered with later, creating a single source of truth for both the insurer and the customer.

AI as the Modern Fraud Detective

Once a claim is filed, Artificial Intelligence steps in. It acts like a modern-day fraud detective, working at a speed and scale that would be impossible for any human team. AI algorithms are trained on vast datasets of both legitimate and fraudulent claims, teaching them to spot subtle anomalies that would otherwise fly under the radar.

AI does not just look at one piece of evidence in isolation. It analyses the entire context of a claim, cross-referencing information across multiple databases and identifying subtle patterns that indicate deceptive behaviour. This systemic approach is the key to uncovering organised and sophisticated fraud rings.

This analytical power is applied in real time. For instance, an AI system can instantly analyse the metadata of a submitted photograph. If the image was downloaded from the internet or edited with software, the system flags it for immediate review. It can also check a claimant's details against known fraud databases or see if multiple claims have been filed for the same incident with different insurers.

This capability turns fraud detection from a slow, reactive investigation into a proactive, preventative measure. You can learn more about how real-time evidence changes everything from theft to payout in our detailed guide.

Reducing the Cost to the Industry and Policyholders

Every fraudulent claim paid is a loss the industry has to absorb. These losses are not just written off; they are passed directly to honest customers through higher premiums. When fraud is rampant, everyone ends up paying the price.

Digital transformation in insurance directly addresses this financial drain. By strengthening claims provability, insurers can drastically reduce the number of fraudulent payouts. This creates a powerful ripple effect:

- Lower Operational Costs: Automated verification cuts down the time and manpower needed to investigate suspicious claims, freeing up valuable resources.

- More Accurate Risk Pricing: With a clearer picture of genuine risk, insurers can price their policies more fairly and accurately.

- Stabilised Premiums: Most importantly, by stopping the flow of fraudulent payouts, insurers can keep premiums more affordable for the honest majority.

Ultimately, the fight against insurance fraud is a collective one. By embracing digital tools that prioritise provability, the industry does not just protect its own bottom line—it upholds its promise to provide fair and affordable protection for all its customers. This digital evolution is essential for building a more secure and trustworthy insurance ecosystem.

The Real-World Benefits for Insurers and Customers

Digital transformation in insurance is not just about shiny new tech; it is about a cascade of real-world benefits that strengthen the entire industry. For insurers, this evolution drives powerful operational gains and a more resilient business model. For honest customers, it means faster, fairer and more secure service—often with lower costs to boot.

The most immediate win for insurers is a dramatic boost in operational efficiency . By automating repetitive, manual tasks like data entry and initial claims checks, technology frees up skilled professionals. Their time is better spent on the complex cases that genuinely need a human touch. This does not just speed things up; it drives down the costs tied to claims processing, a saving that goes straight to the bottom line.

Beyond efficiency, these digital tools give insurers a much clearer view of risk. Using advanced analytics, they can assess risk with far greater precision, ditching broad generalisations for a model built on specific, verifiable data. This allows for more accurate policy pricing and a significant drop in unexpected losses.

A Win-Win for Insurers and Policyholders

The benefits do not stop at the insurer's balance sheet. When the claims process is streamlined, policyholders get their settlements faster, which reduces the stress and uncertainty that always comes with making a claim. Transparency gets a huge boost, too, as customers can now track their claim's progress in real-time through digital portals and apps.

A crucial outcome of this digital shift is the huge drop in fraud-related losses. When fraud is stamped out, the entire insurance ecosystem becomes healthier. This financial stability lets insurers offer more competitive premiums, meaning the fight against fraud directly benefits the honest majority. It is a true win-win: the insurer’s profitability is improved by delivering a superior and more secure service to its customers.

The most powerful outcome of digital transformation is how it aligns the interests of the insurer and the customer. By cutting fraud and boosting efficiency, technology creates a system where lower costs for the insurer can lead directly to better value and faster service for the policyholder.

The move to adopt these technologies is picking up speed. In the UK, there is a clear commitment to investing in AI and machine learning within the insurance world. A significant 63% of UK insurance executives are actively putting money into these technologies, a figure well above the 50% seen in the USA. This investment is laser-focused on improving both operational efficiency and customer service, with AI being put to work in digital underwriting and automated claims processing to streamline operations and stamp out manual errors.

Quantifying the Digital Advantage

To really grasp the impact, it helps to see how this technology moves the needle on key performance indicators. The table below shows the stark contrast between traditional benchmarks and the results possible through digital transformation. Another major benefit comes from optimising customer interactions, often through highly efficient and specialised call centres for insurance companies .

Impact of Digital Transformation on Key Insurance Metrics

| Metric | Impact of Digital Transformation | Example Technology |

|---|---|---|

| Claims Processing Time | Reduced from weeks to days or even hours, improving customer satisfaction. | Automated Claims Processing |

| Fraud Detection Rate | Significantly increased accuracy in identifying and preventing fraudulent claims. | AI Anomaly Detection |

| Operational Costs | Lowered through automation of manual tasks and more efficient workflows. | Robotic Process Automation (RPA) |

| Customer Retention | Improved due to faster service, greater transparency and personalised communication. | Customer Relationship Management (CRM) |

Ultimately, the real-world benefits are clear. For insurers, digital transformation is the path to greater profitability and sustainability. For customers, it is the key to a faster, more transparent and more affordable insurance experience, creating a stronger and more trustworthy industry for everyone involved.

Navigating the Challenges of Implementation

Starting a digital transformation journey is not as simple as installing new software. It is a fundamental shift in business culture, processes and strategy and it comes with its own set of significant hurdles. Acknowledging these obstacles head-on is the first step toward creating a plan that actually works.

For many established insurers, the first major barrier is their collection of deeply embedded legacy systems . These outdated platforms, often decades old, are the operational backbone of the company but are notoriously difficult to mesh with modern, agile technologies. They create data silos and operational bottlenecks, acting as a brake on real progress.

Moving forward requires a delicate balancing act. A complete 'rip and replace' approach is often far too costly and disruptive, so many insurers opt for gradual modernisation instead. This usually involves building new digital layers on top of existing systems and using APIs (Application Programming Interfaces) to help the old and new platforms talk to each other.

Overcoming Internal and Regulatory Hurdles

Beyond the tech, one of the most persistent challenges is simply resistance to change from within. Employees who are comfortable with long-standing processes might view new technology with scepticism or even fear. Without their buy-in, even the most advanced systems will fail to deliver their promised value.

This is where effective change management becomes crucial. It is all about clear communication from leadership, explaining the 'why' behind the transformation, not just the 'what'.

To ensure a smoother transition, insurers should focus on:

- Inclusive Training Programmes: Go beyond basic software tutorials. Provide comprehensive training that shows employees how the new tools will make their roles more effective and valuable.

- Creating Digital Champions: Identify enthusiastic team members who can act as advocates for the new systems, offering peer-to-peer support and encouragement.

- Demonstrating Early Wins: Highlight small, successful projects to build momentum and prove the tangible benefits of the new approach.

Another major hurdle is navigating the maze of complex regulations. The insurance industry is heavily governed, with strict rules around data privacy and security, like GDPR. As insurers collect more detailed customer data, they must ensure every new process is fully compliant. To streamline these processes, companies can leverage compliance automation platforms that help manage these requirements efficiently.

Managing Data and Security Risks

The shift to digital operations naturally introduces new security considerations. While technology offers powerful tools to fight fraud, it also creates potential vulnerabilities if not managed correctly. Insurers hold vast amounts of sensitive customer data, making them a prime target for cyber-attacks.

Protecting this information is paramount. This requires a multi-layered security strategy that goes far beyond a basic firewall.

A successful digital transformation must be built on a foundation of absolute trust. Insurers must demonstrate that their digital ecosystem is not only efficient and convenient but also completely secure, protecting customer data with the most robust measures available.

This means investing in advanced cybersecurity defences, including data encryption, multi-factor authentication and regular vulnerability assessments. It also means fostering a security-conscious culture where every employee understands their role in protecting sensitive information. The goal is to build a digital infrastructure that is resilient by design, capable of defending against evolving threats while maintaining the trust of policyholders.

The Future of Digital Insurance in the UK

Looking ahead, the momentum is undeniable. A huge part of this push comes from the brokerage sector, which is increasingly using technology to redefine how it operates and the value it brings to clients. This is part of a much broader industry movement, which is projecting an 8% growth in technology spending as investments in AI and advanced digital platforms keep climbing. You can dive deeper into how digital adoption is reshaping brokerages in the full Insurance Times report.

This sustained investment is set to fuel several key trends that will shape the insurance landscape.

Hyper-Personalisation and On-Demand Products

The era of one-size-fits-all insurance policies is well and truly over. Using the power of big data and AI, insurers are moving towards hyper-personalisation , crafting policies that reflect an individual’s actual lifestyle and risk profile. This means premiums based on real behaviour, not just broad demographic stats.

This trend is giving rise to a new wave of products, including:

- Usage-Based Insurance (UBI): We have seen this in motor insurance for a while, but expect it to expand into other areas like home and contents, where smart devices can monitor how things are used and what condition they're in.

- On-Demand Insurance: Soon, consumers will be able to buy short-term cover for specific items or activities with just a few taps on their phone—think insuring a high-end camera for a weekend trip or a bicycle for a single race.

The Impact of the Internet of Things (IoT)

The Internet of Things (IoT) is set to become a central pillar of risk management. Connected devices in our homes, cars and even on our bodies will provide a constant stream of real-time data to insurers. A smart smoke detector could trigger an alert to stop a fire before it starts, or a sensor could detect a tiny water leak before it causes thousands of pounds in damage.

This shift moves insurance from a reactive model of compensation to a proactive one of prevention. By using IoT data to anticipate and mitigate risks, insurers can stop losses from ever happening, creating a genuinely safer world for their customers.

This is the definitive path forward for the industry. Digital transformation is more than just a strategy for efficiency; it is the fundamental way we will build a more secure, customer-focused and resilient insurance market. The future is not about simply digitising old processes—it is about reimagining what insurance can be.

Frequently Asked Questions

What Are the Primary Benefits of Digital Transformation?

It really comes down to two things. For insurers, the big win is a massive boost in operational efficiency—it helps lower claim processing costs and gives them a much sharper, more accurate way to assess risk.

For customers, it means a faster, more transparent claims process. And as fraud gets squeezed out of the system, it paves the way for more stable and affordable premiums for everyone.

How Does It Directly Impact Insurance Fraud?

Digital transformation fundamentally changes the game from a trust-based system to one built on provable evidence. Think of it this way: instead of just taking someone's word for it, technologies like AI and advanced analytics can spot suspicious patterns in real-time.

These systems can verify if a photo has been tampered with or cross-reference data to flag inconsistencies that a human might miss. This makes it incredibly difficult for fraudulent claims to slip through the net, protecting both the insurer and their honest policyholders from the costs.

Will This Technology Lower My Premiums?

While there is no direct guarantee, tackling fraud has a huge knock-on effect. Insurance fraud costs the UK economy billions every year and those losses inevitably get passed on to customers through higher premiums.

By using technology to drastically cut down on fraudulent payouts, insurers can keep their pricing more stable and competitive. In short, reducing fraud is one of the most significant factors in keeping everyone's premiums down.

What Is the First Step for a Smaller Firm to Begin Its Digital Journey?

For a smaller firm, the best way to start is to pinpoint the single biggest headache in your current operations. More often than not, it is the slow, manual process of verifying claims.

Instead of trying to overhaul everything at once, begin with a focused, scalable solution—like a platform for collecting digital evidence. This approach allows you to see a clear return on your investment and build momentum without the daunting cost and complexity of a complete system-wide change.

Take the first step towards a more secure and efficient claims process. With Proova , you can strengthen claims provability, reduce fraud and deliver a superior customer experience. Discover how our platform can support your digital transformation by visiting us at https://www.proova.com.