A Guide to the Insurance Fraud Prevention Act

The Insurance Fraud Prevention Act is a landmark piece of UK law that gives insurers the legal footing they need to share data on suspected fraudulent claims. Its goal is simple but powerful: to create a unified, industry-wide defence against fraud. It allows companies to spot and track fraudsters who try their luck by hopping from one insurer to another, which ultimately protects honest policyholders from paying higher premiums.

What the Fraud Prevention Act Means for Insurers

For any UK insurer, the Insurance Fraud Prevention Act is much more than just another regulation to tick off a list; it’s a foundational tool for collaborative defence.

Think of it as an industry-wide neighbourhood watch scheme. But instead of spotting burglars, everyone is working together to identify suspicious claims. The Act’s core purpose is to break down the information silos that fraudsters have always exploited, letting insurers legally and securely share intelligence on dishonest activity.

This isn’t about creating an adversarial relationship with customers. Quite the opposite. The Act is fundamentally designed to protect the vast majority of honest policyholders. When fraudulent claims slip through the net, they bloat the overall claims pool, which inevitably pushes up premiums for everyone. By working together under the Act's framework, insurers can isolate and challenge bad actors far more effectively, keeping costs down and ensuring genuine claims get processed without unnecessary suspicion.

The FCA and a Culture of Compliance

Of course, the Act doesn't operate in a vacuum. It sits alongside broader expectations from regulators like the Financial Conduct Authority (FCA). The FCA’s claims handling rules are very clear: customers must be treated fairly, and claims must be processed in a timely manner. While the legislation provides the mechanism to investigate potential fraud, this power must always be balanced with the FCA’s core principles.

This creates a clear directive for insurers. You need robust systems in place that can both identify potential fraud and validate genuine claims swiftly. A vague hunch isn’t enough to put a payout on hold indefinitely.

This is where compliance becomes a real strategic advantage. Having a clear, evidence-based process for fraud detection not only satisfies your legal duties under the Insurance Fraud Prevention Act but also proves your commitment to fair customer outcomes, just as the FCA demands.

The government's official legislation portal provides the full text and structure of the Act for reference.

This screenshot shows the main parts of the legislation, outlining the offences and the legal powers it grants for disclosing information. You can learn more about how different bodies collaborate by reading our guide on the UK Insurance Fraud Prevention Authority explained.

Ultimately, the Act formalises the idea that fighting fraud is a collective responsibility. It provides the legal "safe harbour" for sharing data, but it’s up to each insurer to build the internal processes and adopt the technologies needed to turn that raw data into actionable intelligence. This proactive stance is no longer just good practice; it’s essential for survival and success.

The True Cost of Insurance Fraud

To really get your head around why the Insurance Fraud Prevention Act is so important, you first have to understand the sheer scale of the problem it was designed to fix. Insurance fraud isn't some victimless, technical offence; it’s a direct hit on your profitability, your operational efficiency, and the trust you’ve built with your customers. The financial bleed alone is a massive commercial headache.

The numbers in the UK are frankly staggering. The Association of British Insurers (ABI) revealed that in 2022, insurers uncovered 72,600 dishonest claims valued at £1.1 billion. That averages out to nearly 200 fraudulent claims detected every single day. This isn't a small leak; it's a flood of bad-faith claims washing away your bottom line.

These figures prove the Act isn’t just another piece of dry legislation. It's an absolutely essential tool in the ongoing war against a highly organised and costly threat.

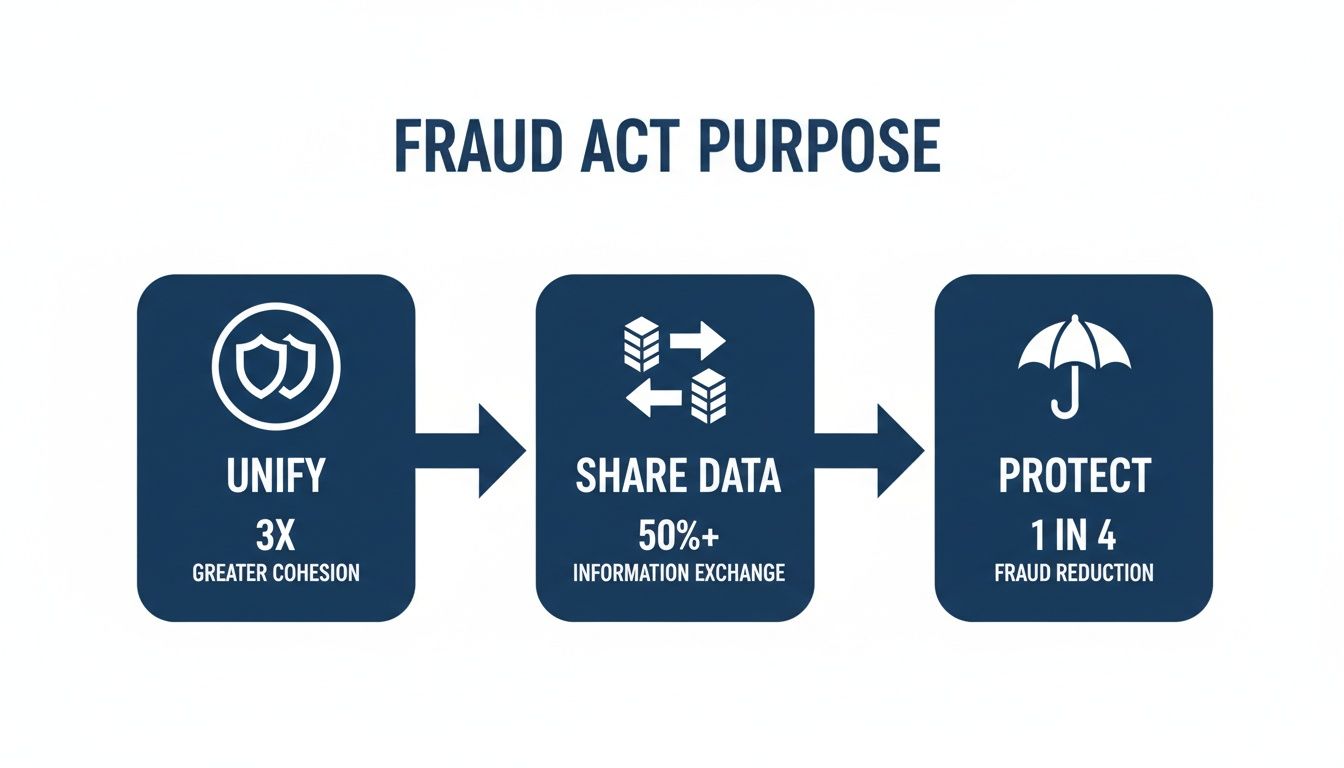

The infographic below breaks down the Act's core purpose, which is all about unifying the industry, sharing data, and protecting everyone involved.

As you can see, a unified, data-driven strategy is the only way to build an effective, industry-wide defence against this kind of activity.

Common Fraud Tactics and Their Impact

Fraudsters are creative, and their methods come in all shapes and sizes. Each one poses a unique challenge for claims and underwriting teams, but getting to know their playbook is the first step in building a solid defence.

- Opportunistic Exaggeration: This is the bread and butter of insurance fraud. A policyholder has a genuine leak that ruins their laminate flooring, but they decide to claim for top-of-the-range solid oak instead. Without clear, pre-loss evidence of what was actually there, challenging these inflated claims turns into a long, expensive negotiation.

- Fabricated Claims: This is where things get more brazen. It involves submitting a claim for something that never even happened—a faked burglary, for instance, or a "stolen" piece of jewellery that the claimant never owned.

- After-the-Event Fraud: This one is particularly tricky to catch. Someone damages an item they don't have cover for, then quickly takes out a policy and waits a few weeks before filing a claim. They’re betting on the fact that you have no record of the item’s condition when the policy started.

This last point is a perfect commercial example of our "lounge exercise." If you ask a policyholder to list everything they own, they’ll struggle. Now, try asking an insurer to prove an item was already damaged before a policy began, without any pre-inception record. It's a nearly impossible task.

The Commercial Pain Points of Fraud

The money paid out on fraudulent claims is just the tip of the iceberg. The real cost of fraud ripples through your entire organisation, causing serious operational and reputational damage.

For an insurer, every fraudulent claim that slips through represents more than just a financial loss. It inflates loss ratios, increases operational costs for investigation, and ultimately forces honest customers to pay higher premiums, damaging long-term trust and loyalty.

The knock-on effects are profound and incredibly costly:

- Inflated Loss Ratios: Dodgy payouts hit your loss ratio directly, one of the most critical health indicators for any insurer’s profitability.

- Soaring Operational Costs: Your fraud and claims teams spend huge amounts of time and energy investigating suspicious claims. This often means expensive loss adjuster visits, endless back-and-forth correspondence, and potential legal fees—all resources that should be used to help genuine customers.

- Reputational Damage: Paying out fraudulent claims can, unfortunately, encourage more of them. On the flip side, aggressively fighting suspected cases without rock-solid proof can lead to complaints and bad press. It's a constant tightrope walk that puts your reputation at risk.

Fraud isn't just a claims problem; it's a business problem. To get a better sense of its far-reaching consequences, you can read our deep dive into what insurance fraud really costs the industry. Once you understand these costs, the case for a robust prevention strategy—backed by legislation like the Insurance Fraud Prevention Act —becomes clearer than ever.

Meeting Your Key Obligations Under the Act

Understanding the theory behind the Insurance Fraud Prevention Act is one thing, but putting it into practice in your daily work is where it really counts. For fraud and claims teams, compliance isn't about legal jargon; it's about taking concrete steps to protect the industry. The Act gives you the power to fight fraud, but it also assigns specific duties that are the bedrock of our collective defence.

At its core, your primary responsibility is to share and report information on suspected fraudulent activity. This isn’t just a ‘nice to have’—it’s the central pillar that makes the whole system work. When you add your findings to shared industry databases, you help paint a much bigger picture of fraudulent behaviour, stopping criminals before they can move on to their next target.

The Duty to Report and Share Data

The Act creates a legal "safe harbour" for sharing data on suspected fraud. This is crucial because it protects you from civil liability, as long as you act in good faith. This protection encourages the open exchange of intelligence needed to spot criminal patterns. For example, specific obligations fall upon various stakeholders, including insurers , to comply with the act.

A key part of this duty involves contributing to centralised databases like the Claims and Underwriting Exchange (CUE) . When you come across a claim with the classic red flags of fraud—whether it’s a blatant exaggeration, a fabricated story, or non-disclosure—you have a duty to record it.

This data sharing isn't just for claims, either. It’s a powerful underwriting tool. Information from CUE helps you assess risk more accurately right from the application stage, flagging individuals with a history of dodgy claims before a policy is even issued. It's prevention at its most effective.

To make these duties clearer, here’s a breakdown of what the Act expects from insurers.

Insurer Obligations Under the Fraud Act

A summary of the primary duties and responsibilities for insurers to ensure compliance with fraud prevention regulations.

| Obligation | Description | Practical Application Example |

|---|---|---|

| Data Sharing | The duty to contribute information about suspected fraudulent claims and applications to recognised industry databases. | A claims handler flags a motor theft claim due to inconsistencies and uploads the claimant's details and the reason for suspicion to the CUE database. |

| Accurate Reporting | Ensuring that all shared information is factual, relevant, and supported by evidence, not just speculation. | Before reporting, the team documents specific evidence, such as altered invoices or conflicting witness statements, to justify their suspicion. |

| Meticulous Record-Keeping | Maintaining a clear internal audit trail for every decision made to flag or investigate a claim for potential fraud. | An internal file is created for a suspicious household claim, detailing every investigative step, communication, and the final rationale for flagging it. |

| Acting in Good Faith | The legal requirement to share information without malice or reckless disregard for its accuracy. | A manager reviews a junior investigator's fraud report to ensure the conclusions are objective and based on evidence, preventing a malicious or careless entry. |

These obligations work together to create a robust, legally sound framework for tackling fraud head-on.

What Information Should You Share?

When you report suspected fraud, the data you provide needs to be accurate, relevant, and proportionate. You’re not just flagging a person; you’re creating a record that your peers across the industry will depend on. The typical information includes:

- Personal Details: Name, address, and date of birth.

- Policy Information: The type of policy and its effective dates.

- Incident Details: A summary of the loss, including date, time, and circumstances.

- Reason for Suspicion: A clear, factual summary explaining why the claim is being flagged.

It's absolutely critical that this is based on solid evidence, not just a gut feeling. A clear, objective rationale for your suspicions is essential for meeting your obligations under both the Act and data protection laws like GDPR.

The core principle is collaboration through information. By contributing accurate and timely data to shared databases, you transform an isolated suspicion into a piece of a larger puzzle, helping the entire industry see the bigger picture of organised and opportunistic fraud.

Record-Keeping and Legal Protections

Alongside reporting comes the mandate for meticulous record-keeping. Every decision to flag a claim must be fully documented internally, detailing the evidence found and the steps taken. This internal audit trail is your first line of defence if a decision is ever questioned.

While the Act provides significant legal protection, it's not a free pass. Your protection hinges on acting in good faith and without malice. If data is shared carelessly or with a reckless disregard for the truth, those protections can disappear. That's why having solid internal processes to verify and document information before it goes anywhere is completely non-negotiable.

This structured approach makes sure your fraud prevention work is both effective and compliant, strengthening your position while helping create a safer insurance market for everyone.

The Commercial Risks of Non-Compliance

Ignoring the obligations laid out in the Insurance Fraud Prevention Act and related FCA regulations isn't just a compliance slip-up; it's a high-stakes commercial gamble. For claims directors and senior leaders, treating compliance as just another box-ticking exercise is a critical mistake. The consequences of inaction ripple far beyond a simple slap on the wrist, creating serious financial and reputational threats that can damage a business from the inside out.

Failing to comply isn't about bending the rules—it's about breaking them, and that exposes your entire organisation to severe commercial fallout. This isn't some theoretical problem. The Financial Conduct Authority (FCA) has shown time and again that it won't hesitate to levy substantial fines against firms that fall short of their duties. These penalties can easily run into the millions, turning a simple compliance oversight into a major financial event that directly craters profitability.

But the financial sting of a fine is often just the opening act. The reputational damage that follows an enforcement action can be far more costly and much, much harder to repair.

Beyond the Fines: The Lasting Stain of Reputational Damage

In the insurance world, trust is the single most valuable currency you hold. When a regulator publicly sanctions your company for compliance failures, that trust evaporates almost overnight. Customers, brokers, and partners all take notice. A reputation for lax controls or unfair practices can trigger a loss of business that dwarfs the initial penalty.

This kind of damage creates a vicious cycle. A tarnished reputation can quickly lead to:

- Customer Churn: Policyholders will jump ship to competitors they see as more trustworthy and reliable.

- Broker Hesitancy: Intermediaries might think twice about placing business with an insurer that's flagged as a regulatory risk.

- Increased Scrutiny: Once you're on the FCA’s radar, you can bet you'll face more intense and frequent oversight.

Make no mistake: inaction is the most expensive strategy an insurer can possibly adopt. Proactive compliance isn't an expense; it's a fundamental investment in the long-term health and stability of the business.

The Clear Business Case for Proactive Prevention

Looking at fraud prevention through a purely defensive lens means you're missing the bigger picture. A robust strategy, built on the principles of the Insurance Fraud Prevention Act , actually delivers tangible commercial benefits. It strengthens the business case for investing in modern systems and processes that actively protect your bottom line.

Neglecting compliance is like leaving the vault door wide open and just hoping for the best. The real cost isn't just what's stolen, but the long-term damage to your credibility and the trust your customers have placed in you.

By embracing your obligations, you build a more resilient and efficient operation. You empower your claims teams to challenge fraudulent activity with confidence, knowing their actions are backed by a clear, evidence-based framework. This not only protects honest policyholders and improves loss ratios but also reinforces your reputation as a fair and diligent insurer.

Ultimately, robust compliance is a cornerstone of sustainable commercial success.

Using Technology for Smarter Fraud Prevention

While the Insurance Fraud Prevention Act provides the legal framework for a collective defence, just relying on reactive data sharing is like trying to fix a leak with a bucket. Modern insurtech offers a far more powerful, proactive approach—one that stops fraud before it even happens and delivers some serious commercial advantages along the way. The key is to shift the focus from after-the-fact investigation to pre-inception verification.

Imagine having a complete, timestamped, and geolocated digital inventory of a customer’s property before their policy even kicks in. This simple step fundamentally pulls the rug out from under some of the most common and costly fraud tactics, especially 'after-the-event' schemes where opportunists try to insure items that are already damaged. With a clear digital record, the argument is over before it starts.

This kind of digital proof doesn't just block dodgy claims; it completely transforms the entire claims journey for genuine customers. It speeds up settlement times, often removes the need for expensive loss adjuster visits, and gives your fraud teams the concrete evidence they need to act decisively. You end up improving both your loss ratio and your customer satisfaction scores.

Disrupting Fraud at the Point of Underwriting

The traditional underwriting process often operates on a foundation of trust, which, unfortunately, can be an open invitation for fraudsters. Without a baseline record of what’s being insured and its condition, insurers are left vulnerable. This is where pre-inception documentation becomes a genuine game-changer.

By weaving a simple digital inventory process into your onboarding, you create an indisputable source of truth from day one. It’s a proactive step that acts as a powerful deterrent.

Creating a verified, pre-inception record of assets is the single most effective way to eliminate 'after-the-event' fraud. It shifts the burden of proof from a post-loss debate to a pre-cover fact, saving time, money, and conflict.

The commercial benefits of this approach stretch far beyond just fraud prevention. It gives underwriters a much richer understanding of the risk they're taking on, allowing for more accurate pricing and risk assessment without the need for costly physical surveys.

The scale of the problem is immense. Aviva, the UK's largest insurer, detected £122 million in fraudulent claims in 2021. That’s fraud worth over £334,000 every single day . Technology that provides an undeniable inventory at policy inception is critical to tackling this issue head-on.

The Operational Benefits of a Verified Inventory

A verified digital inventory does more than just stop criminals; it streamlines your operations and enhances the customer experience for the honest majority. This dual benefit makes it a powerful investment for any forward-thinking insurer.

- Accelerated Claims Processing: When a customer can provide a pre-existing, verified list of their belongings, the claims process becomes dramatically faster. Your team gets immediate access to proof of ownership, condition, and value, cutting down on the endless back-and-forth that frustrates customers and inflates handling costs.

- Reduced Loss Adjuster Costs: With clear photographic and video evidence on file, the need for an on-site visit from a loss adjuster is significantly reduced, if not eliminated, for many claims. This delivers direct and immediate cost savings.

- Enhanced Customer Satisfaction: A faster, smoother claims process is one of the most powerful drivers of customer loyalty. By removing the stress and uncertainty of proving a loss, you build stronger relationships and improve your Net Promoter Score (NPS).

This proactive approach fundamentally changes the dynamic of a claim. It moves from a position of potential dispute to one of simple validation, which benefits everyone. For a deeper look into this shift, you can explore our article on digital transformation in insurance to fight fraud.

Integrating Technology into Your Fraud Strategy

Adopting this kind of technology isn't about replacing your existing fraud teams; it's about arming them with better tools. It lets them focus their expertise on complex, organised fraud rings rather than wasting time on low-level opportunistic claims.

Implementing a digital inventory solution like Proova gives your team the hard evidence they need to comply confidently with the Insurance Fraud Prevention Act . It ensures that any data you share is based on verifiable facts, not just suspicion. This strengthens your legal standing and reinforces your commitment to fair and accurate claims handling. To see how a real insurance company leverages technology for security, check out the All Clear Insurance case study.

By embracing these tools, you build a more resilient, efficient, and customer-centric organisation that's truly fit for the future.

Common Questions About the Insurance Fraud Prevention Act

When it comes to putting the Insurance Fraud Prevention Act into practice, it’s natural for questions to pop up. Insurers, brokers, and compliance teams often grapple with how this legislation fits into their day-to-day operations. Let's break down some of the most common queries with clear, straightforward answers.

What Is the Primary Purpose of the Act?

At its heart, the Act provides a legal framework for UK insurers to share data about dodgy claims. It’s all about collaboration.

Think of it as creating an industry-wide neighbourhood watch. Instead of fraudsters hitting one insurer and then moving on to the next undetected, the Act allows companies to connect the dots. By breaking down the information silos that criminals love to exploit, the industry can mount a united defence, protecting honest customers from the higher premiums that fraud inevitably causes.

How Does the Act Interact with FCA Claims Handling Rules?

The Act and FCA regulations aren't in conflict; they work together. You can think of them as two sides of the same coin. The Act gives you the legal tools to fight fraud, while the FCA makes sure you use those tools fairly and responsibly.

An insurer can’t just put a claim on hold indefinitely because of a vague hunch. There have to be reasonable grounds for an investigation, and it must be handled efficiently. The FCA's rules on treating customers fairly are non-negotiable and remain paramount throughout any investigation.

The Insurance Fraud Prevention Act gives you the right to investigate, but the FCA dictates the responsibility to do so fairly and promptly. They are balancing forces designed to protect both insurers and honest policyholders.

This is where technology that provides clear, pre-incident evidence really shines. It helps you meet both obligations perfectly. You can validate genuine claims at speed, ensuring fair and prompt handling for honest customers. At the same time, it gives you a rock-solid, evidence-based case to robustly challenge fraudulent ones.

Can Sharing Data Under the Act Breach GDPR?

This is a huge concern for any compliance officer, but the Act was specifically built to work within GDPR guidelines. The legal basis for sharing personal data here is 'legitimate interest' in preventing crime—in this case, insurance fraud.

That doesn't mean it’s a free-for-all, though. Any data shared must be necessary, proportionate, and—most importantly—accurate. Having robust data security protocols and being completely transparent with policyholders about how their data might be used are absolutely essential. The Act opens the legal door for data sharing, but all the core principles of GDPR must still be rigorously followed.

What Is After-the-Event Fraud and How Can Technology Stop It?

'After-the-event' fraud is one of the oldest tricks in the book and notoriously difficult to prove. It happens when someone damages an item they don't have insurance for, quickly buys a policy, and then claims for the pre-existing damage a short time later.

Without a baseline record of the item's condition, proving the damage was there before the policy started becomes a classic "he said, she said" argument—a scenario that's incredibly tough for an insurer to win.

This is exactly where pre-inception documentation technology is a complete game-changer. By requiring a new policyholder to create a timestamped, geolocated photographic inventory of their assets before cover begins, you create an undeniable, objective record.

This digital proof makes this type of fraud practically impossible to pull off. It swaps ambiguity for factual, verifiable evidence, protecting insurers from what can be very significant losses.

How Does the Act Affect Insurance Brokers?

While the Act’s main obligations are on insurers, it has big implications for brokers, too. Brokers have a duty of care to their clients, which includes helping them have a smooth claims experience.

By encouraging clients to properly document their assets from day one, brokers can add real value. This proactive step helps ensure that if a genuine claim ever happens, it can be processed without the delays and intense scrutiny that a lack of evidence often brings. Plus, a good understanding of the Act allows brokers to better advise their commercial clients on risk management, solidifying their role as a trusted advisor.

Is Compliance with the Act Just a Defensive Measure?

Not at all. While compliance obviously protects your business from regulatory fines, seeing it as just a defensive move is a missed opportunity. A strong fraud prevention strategy, built on the foundations of the Act, delivers real commercial advantages.

It empowers your teams to act with confidence, improves your loss ratios, and makes your operations more efficient. More importantly, by weeding out fraudulent claims, you help create a fairer market for everyone. That’s a powerful way to build brand trust and long-term customer loyalty. Proactive compliance isn't just a cost; it's an investment in a healthier, more profitable business.

By creating an undeniable record of ownership and condition before a policy begins, Proova provides the hard evidence needed to meet your obligations under the Insurance Fraud Prevention Act with confidence. Learn how our technology can help you reduce fraud, accelerate genuine claims, and lower operational costs at https://www.proova.com.