Marine Insurance Cargo Explained for UK Businesses

Marine cargo insurance is a specific type of cover designed to protect goods while they’re being moved from one place to another. It doesn't matter if the journey is by sea, air, or land; this protection is your financial safeguard against loss from damage, theft, or other mishaps during transit.

Understanding the Need for Marine Cargo Insurance

Ask a friend to list everything in their lounge without looking. They'll probably say it's easy, but when they try, they'll forget half of it. Now, ask them to recall serial numbers and purchase dates for those items. Impossible, right? This simple exercise highlights a massive problem that businesses face every single day, but on a much larger and more costly scale.

Imagine a shipping container full of your valuable products is lost at sea, damaged in a storm, or stolen from a port. Just like trying to remember everything in your lounge, could you prove precisely what was inside that container, its exact condition before it was shipped, and its total value? Without a detailed, verified record, you're relying on memory and fragmented paperwork. This is where marine cargo insurance becomes absolutely essential. It's the financial safety net for your goods on their journey.

Why Standard Policies Are Not Enough

Many businesses mistakenly assume their standard property insurance or the carrier's liability will cover them if something goes wrong. This is a dangerous assumption. Carrier liability is often severely limited by international conventions and may only cover a tiny fraction of your cargo's true value. Standard property policies typically only cover assets at your fixed business premises, not while they are in transit across the world.

This gap in cover creates significant financial risk. At the end of the day, a successful claim hinges on one simple thing: proof . Without it, you’re looking at:

- Claim Delays: Insurers have to spend extra time investigating the validity and value of your loss, slowing down the entire process.

- Reduced Payouts: If you can't prove the value of every single item, insurers may have no choice but to reduce the settlement amount.

- Outright Rejection: In the worst-case scenario, a lack of credible evidence can lead to your claim being rejected entirely.

The Realities of Global Trade

The journey from manufacturer to customer is full of potential pitfalls. Understanding common logistics issues, such as a shipment exception , clearly illustrates the types of unforeseen events that marine cargo insurance is designed to cover. From handling errors at a depot to customs delays and severe weather, your goods are exposed to risks at every stage.

Marine cargo insurance isn't just about protecting against a total loss, like a ship sinking. It's about managing the countless smaller risks that can erode your profits and damage your business's reputation—from water damage due to a leaky container to breakage from improper handling.

Effective marine insurance cover, backed up by solid documentation, transforms this uncertainty into manageable risk. It ensures that if the worst happens, you have the evidence to make the claims process smooth and efficient, protecting your cash flow and allowing your business to keep moving.

Navigating the Key Types of Cargo Policies

Picking the right marine insurance cargo policy can feel like a maze, but it really boils down to one question: how much risk are you comfortable taking on? These policies aren't a one-size-fits-all solution; they’re designed to match the unique nature of your goods and the specific perils they might face on their journey.

Think of it like choosing car insurance. Do you want the peace of mind that comes with fully comprehensive cover, protecting you from almost anything? Or are you happy with a more basic policy that only kicks in for specific events like a fire or theft? Marine cargo policies work on a similar principle, offering everything from broad, sweeping protection to much more limited cover.

All Risks vs Named Perils

At the heart of it all are two fundamental approaches: 'All Risks' and 'Named Perils' . Getting your head around this distinction is the first step to securing the right protection for your cargo.

An All Risks policy provides the widest possible safety net. It covers any and all physical loss or damage from any external cause, unless it's something specifically excluded in the policy wording. This is the go-to choice for high-value or fragile goods—think electronics or pharmaceuticals—where even minor damage can lead to a major financial hit.

A Named Perils policy, as the name suggests, is far more restrictive. It only covers losses that are directly caused by the specific risks listed—or 'named'—in the policy. Common examples include fire, explosion, sinking, or collision. If your cargo is damaged by something that isn't on that list, you’re out of luck. This type of policy is often a good fit for bulk commodities like coal or scrap metal, where the potential risks are fewer and more predictable.

Understanding the Institute Cargo Clauses

To bring some order to the global market, insurers around the world rely on a standardised framework known as the Institute Cargo Clauses (ICC) . Developed in London, these clauses create a clear and consistent baseline for what is and isn't covered. There are three main sets you’ll encounter: A, B, and C.

-

Institute Cargo Clauses (A): This is the top tier of cover, effectively an 'All Risks' policy. It protects against all risks of loss or damage, aside from a handful of specific exclusions like wilful misconduct by the insured or ordinary wear and tear.

-

Institute Cargo Clauses (B): This is your middle-of-the-road option, offering cover against a specific list of named perils. It includes major incidents like fire, explosion, vessel sinking, and collision, but it also extends to things like earthquakes, volcanic eruptions, and water damage caused by sea, lake, or river water entering the vessel or container.

-

Institute Cargo Clauses (C): This is the most basic level of cover you can get. It provides a safety net against a very limited list of major catastrophic events, such as fire, explosion, vessel sinking, or collision, but not much else. It's the most restrictive and, therefore, the most affordable option.

The UK's influence in this space is huge. With a legacy stretching back centuries to the coffee houses of Lloyd's of London, the UK now commands 14.5% of the global marine cargo insurance market . This history is built on a simple principle: marine cargo works best with meticulously documented inventories, a practice that helps maintain the low loss ratios seen across Europe. You can discover more about the global marine cargo insurance market and its key trends.

Comparison of Institute Cargo Clauses A, B, and C

To make the differences clearer, let’s break down what each clause really offers. Choosing the right one means understanding exactly what you're protected against—and what you're not.

| Clause | Coverage Level | Key Risks Covered | Common Exclusions |

|---|---|---|---|

| ICC (A) | All Risks (Broadest) | All risks of physical loss or damage, except for those specifically excluded. | Wilful misconduct, ordinary leakage/wear & tear, inherent vice, insolvency of carrier. |

| ICC (B) | Named Perils (Intermediate) | Fire, explosion, stranding, sinking, collision, discharge at port of distress, general average, plus earthquake, volcanic eruption, lightning, washing overboard, entry of sea/lake/river water. | All risks not explicitly named, plus the exclusions listed for Clause A. |

| ICC (C) | Named Perils (Most Basic) | Fire, explosion, stranding, sinking, collision, discharge at port of distress, general average. | All risks not explicitly named, including most forms of water damage and loss overboard. |

This table shows why matching the clause to your cargo is so vital. You wouldn't ship sensitive medical equipment with anything less than the comprehensive protection of ICC (A). On the other hand, a shipment of hardy raw materials might be perfectly fine with the more limited cover of ICC (C).

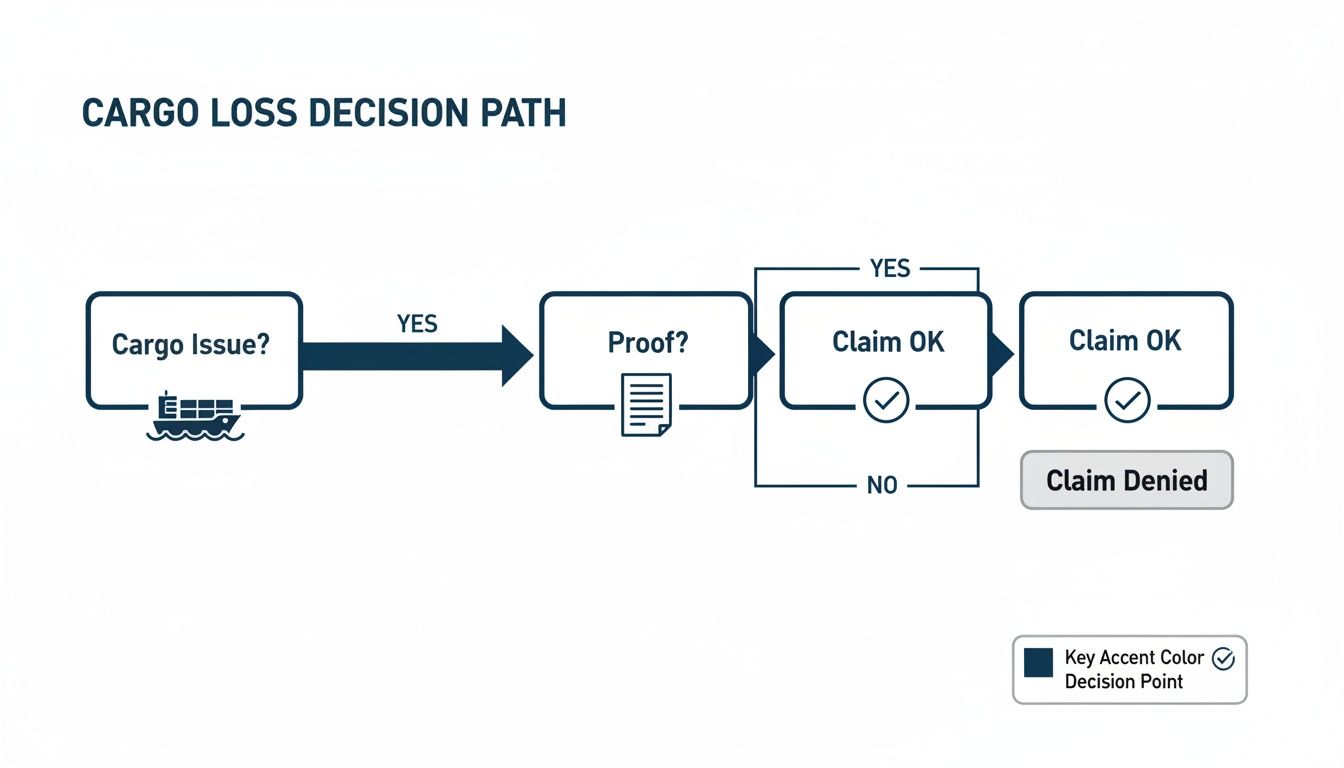

The chart below shows the simple decision path when something goes wrong with a shipment. It highlights a critical point: without solid proof, a claim hits a dead end.

As you can see, the pivotal moment in any claim is the ability to provide proof. Without it, the path to a successful resolution is effectively blocked.

Making the right choice from the start ensures you aren't overpaying for unnecessary cover while still being properly protected against the risks that actually matter to your business.

The Critical Role of Valuation and Documentation

Choosing the right policy is just the starting line. When a shipment gets damaged or goes missing at sea, the success of your marine insurance cargo claim will hinge on two things: getting the valuation right and keeping your paperwork straight. Without these, even the most comprehensive policy is little more than an expensive piece of paper.

This is where that 'lounge exercise' we talked about becomes a harsh reality for businesses. You can't remember every single item in your living room after a fire, and a logistics manager can't perfectly recall the contents of a specific container that was lost months ago. Relying on memory is a recipe for disaster, leading to frustrating delays, reduced payouts, or even a flat-out claim denial.

Getting the Cargo Value Right

Accurately valuing your cargo is non-negotiable. If you get it wrong, you'll either overpay for cover you don't need or, far worse, find yourself seriously underinsured when it's time to make a claim. The value you provide to your insurer, known as the declared value , sets the foundation for both your premium and any potential settlement.

And it’s not just about the cost of the goods. A proper valuation needs to be comprehensive and typically includes:

- The Commercial Invoice Value: The price the buyer is paying for the goods.

- Freight Costs: The money spent to get the goods from A to B.

- Insurance Premium: The cost of the insurance policy itself.

- An Additional Percentage: It's standard practice to add 10-20% on top to cover unexpected costs like customs duties, extra expenses, and potential loss of profit.

Getting this wrong has real consequences. Insurers will only ever pay out up to the declared amount, leaving your business to swallow the shortfall if the goods were undervalued.

The Paper Trail That Proves Everything

When something goes wrong, insurers need proof, not just your word for it. A solid paper trail is your best friend and the key to getting a claim settled quickly and fairly. While specific requirements can vary, a handful of core documents are always needed.

Think of it this way: your documentation is the evidence that validates your claim. Without it, your insurer is flying blind, and the whole process grinds to a halt. The stronger your evidence, the faster you get paid.

These documents work together to tell the complete story of the shipment: what was in it, where it was going, and exactly how much it was worth.

Essential Documents for a Cargo Claim

Here are the three non-negotiable documents every business needs to have organised and ready to go:

-

Commercial Invoice: This is the bill from the seller to the buyer. It’s the primary piece of evidence used to establish the cargo's value. Without a clear invoice, proving your financial loss is almost impossible.

-

Bill of Lading (B/L): This is the master document in shipping. It acts as a contract between the shipper and the carrier, a receipt for the goods, and a document of title. It proves the carrier took possession of the cargo and contains vital details about the shipment, vessel, and destination. A quick look at a Bill of Lading example shows just how critical its structure and details are.

-

Packing List: This document gives a granular breakdown of the shipment's contents. It details what’s inside each package, including weights, measurements, and item counts, working alongside the commercial invoice to give a complete picture.

The Power of Pre-Shipment Evidence

The documents above are the bare minimum. The real game-changer? Verifiable, pre-shipment evidence. Imagine being able to show an insurer a time-stamped, geolocated photo of your cargo, pristine and perfectly packed, just as it was being loaded onto the ship. That simple action can instantly shut down any debate about when or where the damage occurred.

This proactive approach is exactly what modern technology makes possible. The same principles that allow a homeowner to create an indisputable digital record of their assets with Proova can be applied to goods in transit. Creating this irrefutable proof before the journey begins is the single best way to ensure your marine insurance cargo policy does its job when you need it most. It’s also crucial to understand how these records fit into the bigger picture of compliance, which is why we explain how to verify certificates of insurance to protect your business on all fronts.

Tackling Fraud in Marine Cargo Insurance

Fraud is a major headache for insurers. It drives up costs, creates operational drag, and ultimately means everyone pays more. While the colossal scale of global shipping might seem worlds away from a domestic burglary claim, the fraudulent behaviours are strikingly similar. The same dishonest tactics that plague home and business contents insurance are rampant in the marine insurance cargo sector—just with more complex supply chains and far higher values at stake.

The problem, as it so often does, comes down to proof. Think about it. A homeowner would struggle to list every single item in their lounge after a fire. Now imagine a business trying to prove the exact contents and condition of a shipping container that’s now sitting at the bottom of the ocean. This ambiguity is precisely what fraudsters thrive on, leaving insurers to pick up the bill.

Common Fraud Schemes in the Cargo Sector

Opportunistic and organised fraud in the cargo world often mirrors the patterns we see elsewhere. The lack of verifiable, independent evidence at the point of loading creates the perfect environment for dishonest claims to flourish. Insurers are constantly battling a range of deceptive tactics.

Three common schemes are responsible for huge financial losses:

- Phantom Shipments: This is the most audacious of the lot. A claim is filed for a shipment that never even existed. With cleverly forged documents, a non-existent cargo of high-value electronics can look completely legitimate, making it incredibly difficult for an insurer to disprove the loss without solid pre-shipment verification.

- Exaggerated Claims: Far more common is the practice of simply inflating the value of a genuine claim. A pallet of goods with minor water damage might be claimed as a total write-off. Or the value of lost items is significantly overstated.

- 'After-the-Event' Fraud: This is a particularly cynical scheme where someone insures cargo that's already damaged. A business might discover a container has been compromised at the port, quickly take out a new policy, and then file a claim a few weeks later, pretending the damage happened during the insured transit.

These aren't just theoretical problems; they have a real-world impact. The UK logistics insurance market is substantial, with cargo insurance leading the way in 2023 by securing a 36.78% revenue share . Yet, with claims rejection rates hovering between 15-20% due to inadequate proof, the parallels to a frustrated homeowner are obvious. Tackling this requires a robust approach, which you can read about in our guide to fraud prevention for UK businesses.

The Power of Verifiable Evidence

The most powerful weapon against these fraudulent activities isn't a complex investigation after the fact. It's simple, irrefutable proof from the very beginning.

The ability to verify the existence, condition, and identity of cargo before it even begins its journey changes the entire game. This is where modern verification technology provides a clear, decisive solution.

Robust, time-stamped, and geolocated documentation is the ultimate defence against cargo fraud. When you can prove exactly what was loaded, where it was, and what condition it was in, the opportunity for deception vanishes.

Imagine a logistics process where every high-value item is photographed and its serial number is recorded via a secure app as it's packed into the container. This creates an unchangeable digital inventory, complete with time-stamps and location data.

This simple, proactive step makes fraudulent claims nearly impossible to sustain. A fraudster can't claim for a phantom shipment if there's no digital record of it being loaded. They can't exaggerate damage if there's clear photographic evidence of its original condition. And 'after-the-event' fraud is dead on arrival.

By insisting on this level of pre-inception documentation, insurers can slash their loss ratios, cut investigative costs, and streamline the claims process for their honest clients. It creates better commercial outcomes for everyone involved.

Modernising Underwriting and Claims Processing

The marine insurance sector, long anchored in tradition, is finally starting to move away from its slow, paper-heavy legacy. For insurers and brokers, this isn't just about adopting new software. It’s a fundamental rethink that directly hits the bottom line, drives efficiency, and keeps clients happy.

At the heart of the old way of doing things is a persistent problem: a lack of verifiable information. This information gap creates friction at every single stage, both when a policy starts and when a claim is made.

Underwriters are often left trying to price risk with incomplete cargo manifests. Claims handlers can spend weeks, even months, trying to piece together what was lost after an incident. This painstaking process inflates operational costs and, understandably, frustrates clients who just want a resolution. The fix lies in creating a single source of truth right from day one.

Streamlining Underwriting with Pre-Inception Data

Imagine this: instead of assessing risk for a high-value shipment based on a paper list, you have a complete, time-stamped digital inventory before you even go on cover. This is rapidly becoming the new standard.

Pre-inception documentation gives underwriters a clear, verifiable picture of exactly what they are being asked to insure—its condition, its value, everything—before the policy is bound.

This level of detail changes the game for underwriting:

- Accurate Risk Pricing: With solid evidence of the cargo's condition and how well it’s packed, insurers can price risk with far greater confidence. It’s a move away from generalised, best-guess assumptions.

- Reduced Need for Surveys: Those costly and time-consuming physical surveys can be scaled back or even eliminated for many types of cargo. The digital record provides all the necessary oversight.

- Fraud Prevention: It becomes virtually impossible for a client to insure goods that are already damaged or simply don’t exist. This shuts down a common route for after-the-event fraud.

This approach transforms underwriting from a reactive, paper-shuffling exercise into a proactive, data-led discipline.

Accelerating Claims with a Verified Asset Register

The real commercial knockout comes when a claim is filed. When you have a verified asset register, created before the shipment even left the warehouse, it acts as the definitive record of what was there.

This completely flips the claims dynamic on its head.

Instead of a drawn-out investigation, the process becomes a straightforward verification exercise. The insurer already has proof of what was shipped and its condition. This makes straight-through processing for many claims a reality, which is a massive leap forward.

When a verified inventory exists from the outset, the claims process shifts from investigation to validation. This dramatically reduces claim cycle times, cuts loss adjuster costs, and provides the fast, fair service that modern clients expect.

The UK's marine sector is already feeling the benefits. In 2024, Lloyd's of London underwrote 9.7% of global cargo premiums , and UK cargo loss ratios have fallen for the sixth consecutive year. Still, exaggerated claims remain a headache, echoing issues in home insurance where ‘forgotten’ items mysteriously appear on a claim form. Technology that creates a verified inventory from day one is a powerful defence against this.

The impact on an insurer’s profitability is direct and measurable. Faster settlement times mean lower admin costs and happier customers who are more likely to renew. By implementing modern tools, insurers can significantly improve their operational workflows. You can learn more about how modern insurance claims management software helps to streamline processes and combat fraud. This principle of verification isn’t new; it’s already delivering huge commercial gains in property and contents insurance, proving its value and reliability.

Frequently Asked Questions About Marine Cargo Insurance

Stepping into the world of marine insurance cargo can feel a bit daunting. Whether you're a business owner shipping your first container or a logistics veteran double-checking the fine print, questions always come up. Let's clear up some of the most common ones with the straightforward answers you need.

What Is the Difference Between Marine and Inland Marine Insurance?

This is a classic point of confusion, and it all comes down to the name. Think of Marine Insurance as the original: it covers goods travelling over water, whether that's an ocean-crossing voyage or a trip down a major river. It’s for the big, blue parts of the map.

Inland Marine Insurance is the historical sequel. As trade moved from seaports inland via canals, and later by rail and road, a new type of cover was needed. The name stuck, but today it has nothing to do with water. It protects goods in transit over land—think of a lorry moving stock between warehouses or a tradesperson's tools being taken to a job site.

Why Isn’t the Carrier’s Liability Insurance Enough to Cover My Goods?

This is a dangerous and costly assumption that catches too many businesses out. While your shipping line or road haulier will have liability insurance, it’s designed to protect them , not you, and its limits are incredibly low.

International conventions like the Hague-Visby Rules cap a carrier’s liability at a tiny amount per kilogramme. Imagine you're shipping £100,000 worth of lightweight electronics. If something goes wrong, the carrier’s maximum payout might only be a few hundred pounds. It's a token amount that bears no resemblance to your cargo's real value.

Relying solely on carrier liability is one of the biggest financial risks a business can take in logistics. A dedicated marine cargo policy is the only way to insure your goods for their full commercial value.

What Does General Average Mean and How Does It Affect Me?

General Average is an ancient maritime principle that can deliver a nasty shock to the unprepared. In simple terms, it means that if a voluntary sacrifice is made to save a ship and its cargo from a common danger (like a fire or running aground), all parties involved must share the financial loss equally.

Picture a fire breaking out on a container ship. The crew jettisons several containers to stop the fire from spreading and save the vessel. Under General Average, the owners of all the surviving cargo are now legally required to contribute to compensate the owners of the cargo that was sacrificed. Your goods could arrive at port in perfect condition, but you’ll still get hit with a hefty bill.

This is where a good marine insurance cargo policy is essential. A comprehensive plan, like one based on the Institute Cargo Clauses (A), will almost always cover your General Average contribution.

How Does Improper Packing Affect My Insurance Claim?

Insurers work on the principle that you’ve done everything reasonable to protect your cargo for its journey. If your goods are damaged and an investigation shows the cause was flimsy or inadequate packing, your claim is likely to be denied.

This isn’t seen as an accident or an insured peril. Instead, it’s considered an 'inherent vice'—a fundamental flaw in the goods or their preparation for transit.

- Your Responsibility: You need to pack your goods to withstand the normal rigours of the journey—being loaded, stacked, and rocked about at sea.

- Insurer’s View: They expect you to mitigate risk. Poor packing is a failure to do so, and they aren't on the hook for losses that were easily preventable.

Can I Insure Goods That Are Being Shipped via Air or Road?

Yes, absolutely. While the term "marine" points to its seafaring origins, modern marine insurance cargo policies are far more flexible. Most are structured as 'transit' or 'cargo' policies that cover goods across multiple modes of transport.

This is often called 'warehouse-to-warehouse' cover. It protects your goods from the moment they leave your facility until they safely reach their final destination, whether they travel by ship, plane, train, or lorry. A single, seamless policy ensures there are no dangerous gaps in cover as your cargo moves from one carrier to the next, which is vital for building a secure and resilient supply chain.

Just as accurate documentation is the bedrock of a successful cargo claim, a verified inventory is the key to a stress-free home or business contents claim. The problem is the same: without proof, you can't get what you're owed. Proova solves this by creating an undeniable, time-stamped digital record of your assets, making insurance work the way it should. Protect your business and your home by starting your digital inventory today.