UK Average House Contents Value Explained

Ever wondered what all your stuff is actually worth? If you had to guess the value of everything inside your home, what figure would you land on?

Most people are surprised to learn that the average house contents value in the UK is around £43,040 . It is a number that feels high until you start mentally adding up the cost of your furniture, electronics, clothes and kitchen gadgets. It all accumulates surprisingly quickly.

Uncovering the True Value of Your Possessions

The truth is, most of us are prone to significantly underestimating what our belongings are worth. It is easy to forget just how much it would cost to replace absolutely everything after a fire, flood or burglary. This common miscalculation creates a dangerous gap between what your contents are worth and what you have insured them for, a gap that can be financially devastating if you ever need to make a claim.

This guide will walk you through why getting that valuation right is so important. We will look at the real risks of being underinsured and why an accurate and provable figure is a responsibility that helps keep the entire insurance market fair for everyone.

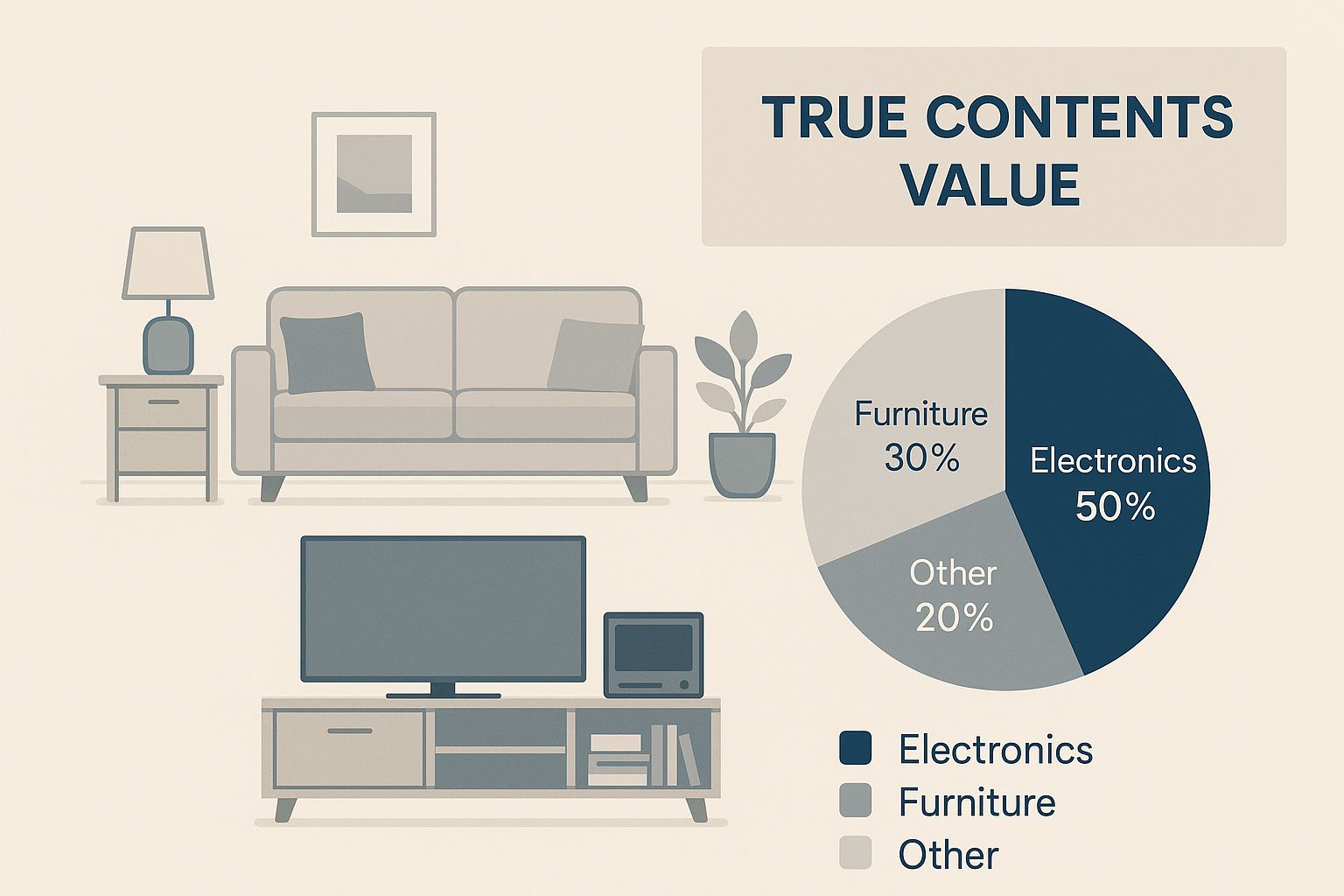

This image of a modern living room gives you a sense of just how many items contribute to that final number.

Think about it: from the sofa and TV to the smaller decorative pieces, books and lamps, the collective replacement cost can easily soar into the tens of thousands.

Why Accurate and Provable Valuations Matter

Understanding your home's contents value is not just an admin task to tick off a list; it is a crucial pillar of your financial security. A vital first step is getting to grips with the critical distinction between Actual Cash Value (ACV) and Replacement Cost Value (RCV) , as this determines how an insurer will compensate you after a loss. Nailing down an accurate total ensures you are paying the right premium for your cover and, more importantly, that you will get a fair payout when you need it most.

Underestimating your contents’ worth is a gamble not worth taking. It not only risks your financial stability but also contributes to market instability, affecting premiums for everyone. Proving your ownership and the value of your possessions becomes crucial.

Regional Differences in Contents Value

It is also worth remembering that where you live plays a big part. The average value of home contents can vary significantly across the UK. Below is a quick look at how different regions stack up, highlighting the disparities that homeowners should be aware of when considering their insurance needs.

Average House Contents Value by UK Region

| Region | Average Contents Value |

|---|---|

| South East | £46,023 |

| UK Average | £43,040 |

| Northern Ireland | £37,521 |

As you can see, while the national average sits at £43,040 , households in the South East of England reported the highest average at £46,023 . In contrast, Northern Ireland came in with the lowest at £37,521. That is an 18% regional difference, which clearly shows just how much location can influence your insurance requirements.

How to Calculate Your Contents Value Accurately

Figuring out the true value of your home’s contents is more than just a quick guess; it is the single most important step you can take to get the right insurance cover. Get it wrong and you risk a serious financial hit. But with a methodical approach, you can make sure you are properly protected.

The best place to start? A detailed, room-by-room inventory.

This process forces you to actually see and account for everything you own, from the big-ticket furniture down to the smaller stuff like books and kitchenware. The goal is to build a comprehensive, provable list that leaves no doubt about what you need to protect.

New for Old vs Indemnity Cover

Before you land on a final number, you need to get your head around how insurers value your items. The two main approaches are fundamentally different and they will dramatically change the amount of cover you need.

-

New for Old (Replacement Cost): This is the one you probably want. It covers the cost of replacing a lost or damaged item with a brand-new equivalent. If your five-year-old TV is stolen, the policy pays out enough to buy a similar new model today. It is the most common type of cover because it offers the greatest peace of mind.

-

Indemnity Cover (Actual Cash Value): This cover is less generous. It only pays out the current value of your item, factoring in all the wear, tear and age. Using the same TV example, the payout would be much lower because it reflects five years of depreciation.

For most people, a ‘new for old’ policy is the clear winner. It ensures you can fully replace what you have lost without having to dip into your own savings. Because of this, you should calculate your contents value based on the full replacement cost of every single item.

A detailed, provable inventory is your best defence against underinsurance and a slow claims process. In cases of theft, fire or flood, the burden of proof rests on you to demonstrate ownership and value. A simple list is good but having verifiable evidence is far better.

Documenting High-Value Possessions

While you should be listing everything, pay special attention to your high-value items. Most standard policies have a ‘single item limit’, which is often around £1,500 . Any single possession worth more than this needs to be specified separately on your policy.

To build a rock-solid inventory, just follow these steps:

- Photograph Everything: Take clear photos or videos of your valuable items. Make sure to capture any identifying marks or serial numbers.

- Keep Receipts: Store digital or physical copies of receipts for your expensive purchases. This is undeniable proof of what you paid and when you bought it.

- Use Valuation Tools: For things like jewellery, antiques or art, get a professional valuation and keep the certificate somewhere safe.

Creating this record does not just give you an accurate total for your insurance; it makes any potential claim infinitely smoother and faster. It is crucial for insurance brokers to have this kind of digital proof to verify claims efficiently , as it cuts down delays and helps prevent fraudulent activity.

Key Factors That Influence Your Contents Value

Ever wondered why two seemingly similar homes can have wildly different contents valuations? The truth is, a mix of personal and environmental factors come together to shape the real replacement cost of everything you own. Getting to grips with these influences is the first step toward landing on an accurate figure for your insurance.

Your personal situation means a generic online calculator or a national average probably will not cut it. The contents of a minimalist city flat, for instance, are a world away from a large family home packed with furniture, toys and gadgets gathered over many years.

The Growing Impact of Technology

One of the biggest drivers pushing up contents value today is our ever-growing collection of modern tech. Just think about the electronics in your home right now – from smartphones and laptops to smart TVs and voice assistants. Every single device adds hundreds, if not thousands, of pounds to your total.

This is not just a feeling; the data backs it up. Recently, the estimated value of UK household possessions saw a huge jump from £42,180 to £58,210 – that is an increase of about 38% . This surge is largely down to our love for gadgets, with the average value of devices like laptops and tablets leaping by 48% . You can dive into the specifics by reading the full findings on household possession values.

With new, high-value electronics constantly entering our homes, your contents value is a moving target that needs a regular check-up.

Property Size and Lifestyle Choices

It almost goes without saying but the size and type of your property play a massive role. A larger home naturally has more space to fill with furniture, art and other belongings. The difference in contents between a one-bedroom flat and a four-bedroom house is stark; the larger property will almost certainly have a much higher overall contents value.

Your lifestyle choices are just as important in shaping your insurance needs.

- Hobbies and Collections: Are you a collector of art, vinyl records or expensive sporting gear? These specialist items can seriously bump up your valuation.

- Family Structure: A growing family means more stuff. Over time, you will accumulate more clothes, more toys and definitely more electronics.

- Fashion and Jewellery: If you have a substantial wardrobe of designer clothing, high-end watches or valuable jewellery, these will need careful attention and possibly even separate cover.

Your home is a unique reflection of your life and your valuation needs to be just as personal. Failing to account for these specific factors is a direct path to being underinsured and risking a major financial hit.

An accurate, provable inventory is your best defence against this risk. When every single item is documented with a clear value, it removes the guesswork for both you and your insurer. This clarity is not only vital for a fair and fast claims process but it also helps combat insurance fraud by creating a verifiable record of what you own. Fraudulent claims based on exaggerated or non-existent items drive up costs for everyone, pushing premiums higher for honest policyholders. A provable valuation, therefore, is not just for your own protection—it is a contribution to a fairer market for all.

The Hidden Dangers of Underinsurance

Getting your contents value wrong can have some pretty serious financial consequences. It is the kind of mistake that can turn a stressful event like a burglary or a house fire into a complete catastrophe. Many homeowners only find out about this the hard way, when they stumble across a term in their policy called the ‘average clause’ .

This clause can slash your payout and it is a real shock if you are not expecting it.

Insurers put it in there to stop people from knowingly underinsuring their stuff just to get a cheaper premium. While that makes sense on paper, it also ends up penalising people who have just made an honest mistake when estimating their average house contents value .

How the Average Clause Works in Practice

The idea behind it is actually quite simple. If your contents are underinsured by a certain percentage, your insurer will only pay out that same percentage of your claim. This means a small miscalculation on your part can lead to a massive financial headache right when you need the support most.

Let's walk through an example.

Imagine the true replacement value of everything in your home is £40,000 but you only insured it for £30,000 . That means you are underinsured by 25% .

Now, say a pipe bursts and causes £10,000 worth of damage to your carpets, sofa and TV. You would probably assume your insurer will pay the full £10,000, since it is well within your £30,000 cover limit.

Unfortunately, that is where the average clause kicks in.

Because you were 25% underinsured, your insurer is only required to pay 75% of your claim. So instead of the £10,000 you need to replace everything, you would only get £7,500 . You are left to find the other £2,500 out of your own pocket.

This is a perfect illustration of why trying to save a few quid on your premium by lowering your cover is a false economy.

To see just how much this can sting, take a look at the table below. It shows how the same £10,000 claim gets chipped away by underinsurance.

Impact of Underinsurance on a £10,000 Claim

This table shows how an insurer applies the 'average clause', reducing the payout in proportion to how much the policyholder was underinsured.

| True Contents Value | Insured Value | Percentage Underinsured | Claim Payout |

|---|---|---|---|

| £40,000 | £40,000 | 0% | £10,000 |

| £40,000 | £30,000 | 25% | £7,500 |

| £40,000 | £20,000 | 50% | £5,000 |

As you can see, the connection between an accurate valuation and a fair payout could not be clearer.

Getting your sums insured right from day one is the only way to be sure you are properly protected. If you would like to understand more, you can learn why your insurance company might refuse to pay a claim and the steps you can take to prevent it. By making sure your home inventory is accurate and provable, you take the risk of the average clause completely off the table.

It is easy to blur the line between an honest mistake and outright deception but when it comes to home insurance, the distinction is critical. While underinsuring your home can happen accidentally, deliberately inflating the value of your possessions or inventing ‘phantom’ items on a claim is a different game entirely. It is insurance fraud and it is a serious criminal offence.

The consequences for getting caught are not trivial. A conviction can land you with a criminal record, hefty fines or even time behind bars. On top of the legal fallout, it makes getting any kind of future insurance—from car to travel cover—incredibly difficult and expensive, if not impossible.

The True Cost of a "Victimless" Crime

Many people write off insurance fraud as a victimless crime, assuming it only hurts massive, faceless corporations. That could not be further from the truth. The reality is that every single fraudulent claim creates a financial ripple effect that eventually washes up on the shores of honest policyholders.

When insurers are forced to pay out on bogus claims, they have to claw those losses back from somewhere. How do they do it? By raising premiums for everyone. In short, your annual insurance bill is higher because it has to cover the costs of a dishonest minority.

Insurance fraud is not a clever way to beat the system. It is a costly crime that forces insurers to hike up premiums, meaning honest customers are the ones who ultimately foot the bill.

Why Provable Valuations Are a Collective Responsibility

This is where having an accurate, provable valuation becomes more than just a smart move for your own protection. When you create a detailed, verifiable inventory of your home's contents, you are not just safeguarding your own potential claim; you are helping to build a fairer and more transparent insurance market for everyone. Claims backed by solid evidence make it much harder for fraudulent activity to slip through the cracks.

For a deeper dive into just how big this problem is, you can explore the real impact of the £308 billion problem of insurance fraud on the industry and see why tackling it benefits us all. Ultimately, fighting fraud helps keep premiums stable and ensures that insurance remains affordable for the honest majority. Accurate valuations are our first and best line of defence.

Why Property Value Influences Contents Cover

You might think that buildings and contents insurance are entirely separate worlds but in an insurer’s eyes, they are two sides of the same coin. There is a surprisingly strong link between what your house is worth and the likely replacement value of everything you keep inside it. This connection is not just a passing thought for insurers; it is a core part of how they assess risk and decide what your premium should be.

Insurers are in the business of playing the odds. Their starting assumption is often that a higher-value property, especially one in an affluent postcode, is far more likely to be filled with expensive belongings. A multi-million-pound home in London is presumed to hold more valuable art, electronics and furniture than a modest flat somewhere else. It is this assumption that begins to shape your risk profile.

The Economic Context

This link between your property and your possessions makes a lot more sense when you look at the bigger economic picture. Regional house prices give us a great clue as to why the average house contents value swings so dramatically from one part of the country to another. If you are a homeowner in a pricey property market, insurers do not just see the high cost of your bricks and mortar; they also expect you will need a much higher level of contents cover.

Right now, the average UK house price is sitting at around £269,735, which is a 2.8% jump from last year. This resilient market means the assumed value of what is inside these homes is also on the rise. If you are curious, you can dig into the UK house price trends from the Land Registry and see the data for yourself.

An insurer's perspective is built on risk assessment. They view an expensive property as a greater potential liability, not just for the structure itself but for the high-value possessions it is likely to house.

This has a direct knock-on effect on your insurance. It means that before you have even started listing your belongings, your address has already given your insurer a starting point for your contents premium.

This is precisely why having a provable, itemised inventory of your possessions is so critical. An insurer's assumption is just that—an assumption. A solid, verifiable inventory swaps their guesswork for hard facts, making sure you are covered for what you actually own, not just what your postcode suggests you might own. This accuracy is a powerful defence against being underinsured and also helps combat fraudulent claims, which are what ultimately push up costs for all of us.

Common Questions About House Contents Value

Working out the finer details of your home insurance often brings up a few practical questions. They might seem small but getting them right has a massive impact on your cover. Clear, straightforward answers help you make confident decisions, ensuring you are not left underinsured or, just as bad, paying for more than you need.

Let's walk through some of the most common questions people ask when calculating the value of what is inside their home.

An accurate valuation is the bedrock of a solid policy. It helps you avoid the financial shock of the 'average clause' if you need to make a claim and plays a part in tackling insurance fraud—a crime that ends up pushing up premiums for everyone.

What Should I Actually Include in My Contents Value?

This is a big point of confusion for many. What really counts as ‘contents’? The easiest way to think about it is to imagine you are moving house. Everything you would pack up and take with you is part of your contents.

That list typically covers:

- Furniture and Furnishings: Think sofas, beds, tables but also things like carpets and curtains.

- Electronics: This is all your gadgets, from the big-screen TV and laptops right down to smaller kitchen appliances.

- Personal Belongings: All your clothes, shoes, books and jewellery fall into this category.

What about things like a fitted kitchen or a bathroom suite? Those are considered fixtures and fittings, so they are generally covered by your buildings insurance , not your contents policy.

How Often Should I Update My Valuation?

It is a smart move to review your contents value at least once a year. A good time to do this is just before your policy is up for renewal. It is a simple check-in to make sure the figure has not become outdated.

You should also take another look after making any significant new purchases. A brand-new sofa, an expensive laptop or a valuable piece of jewellery can easily nudge your total upwards. It is crucial to adjust your cover accordingly to stay fully protected.

A single item limit is the most an insurer will pay out for any one item unless you have declared it separately. This is often around £1,500 . If you own anything worth more than that, like a piece of art or an engagement ring, you must list it specifically to ensure it is fully covered.

For answers to a wider range of general insurance FAQs , exploring other expert resources can be incredibly helpful. At the end of the day, an accurate, provable valuation is your best tool for a fair and efficient claims process.

A verifiable digital inventory is the best way to secure your assets and ensure a fast, fair claims process. With Proova , you can create a detailed, provable record of your possessions, removing the guesswork and protecting yourself from underinsurance and fraud. Take control of your cover today by visiting https://www.proova.com.