Voluntary compulsory excess: How to cut premiums without risking your claim

Think of your insurance excess as the portion of a claim you agree to pay out of your own pocket before your insurer steps in to cover the rest. It's a fundamental part of most policies in the UK, but it's not a single figure. It's actually split into two distinct parts: a compulsory excess and a voluntary excess .

The compulsory part is set by your insurer and is non-negotiable. The voluntary part, however, is an extra amount you can choose to pay on top of that. Opting for a higher voluntary excess is a common way to bring down your yearly premium, which sounds great upfront. But it can be a nasty shock if you suddenly need to find hundreds of pounds after a burglary or fire.

Understanding Your Total Insurance Excess

Your total excess is simply the compulsory and voluntary amounts added together. This is the magic number you need to be aware of because it’s the full sum you are responsible for when you make a claim.

So, if you file a claim for £1,000 of damage caused by a burst pipe, and your total excess is £300 , you have to pay that first £300 yourself. Your insurer then steps in and pays the remaining £700 of the approved claim. It’s that simple, but getting the balance right is crucial.

The Two Parts of Your Excess

Getting your head around the difference between the two parts is key to managing your finances and making smart policy choices. The compulsory part is fixed, but the voluntary element is a lever you can pull to adjust your policy.

- Compulsory Excess: This is the baseline amount your insurer requires you to pay on any claim. It’s not a random number; it's calculated based on their assessment of your risk profile, taking into account things like where your home is and your previous claims history.

- Voluntary Excess: This is the extra amount you agree to contribute if you need to make a claim. By increasing it, you’re signalling to your insurer that you're willing to share more of the risk, and they’ll often reward you with a lower annual premium.

Striking the right balance here is a personal financial decision. For some homeowners, a higher voluntary excess makes perfect sense. For others, the upfront saving isn't worth the potential pain of a large payout down the line. It's all about balancing a lower premium today against what you can realistically afford if you need to claim.

For a deeper dive into the core concepts behind insurance, it can be helpful to review broader resources on understanding insurance policies.

Voluntary vs Compulsory Excess at a Glance

To make it even clearer, here’s a straightforward table that breaks down the fundamental differences between the two types of excess.

| Feature | Compulsory Excess | Voluntary Excess |

|---|---|---|

| Who sets it? | Your insurer sets this amount. | You choose this amount. |

| Is it optional? | No, it is a mandatory part of your policy. | Yes, you can often set it to £0 . |

| Primary purpose | To deter small claims and cover initial risk. | To reduce your annual insurance premium. |

| Financial Impact | A fixed, unavoidable cost on every claim. | A flexible cost that influences your premium. |

This quick comparison should help you see exactly where you have control and what's fixed. Knowing this puts you in a much better position to tailor your insurance cover to your own circumstances.

How Insurers Determine Your Compulsory Excess

The compulsory excess on your policy isn't a figure just plucked from thin air. It’s a carefully calculated reflection of the risk your insurer believes they are taking on by covering your home. Think of it as their way of establishing the baseline financial stake you both share if something goes wrong.

This figure is the result of a detailed analysis of several key factors specific to you and your property. Insurers use sophisticated modelling to predict the likelihood and potential cost of a claim, and the compulsory excess is set accordingly. In many ways, it’s their first line of defence against small, frequent claims that are often disproportionately expensive to administer.

Key Factors in the Calculation

Several elements directly influence the amount an insurer will set for your compulsory excess. It’s quite simple: the higher they perceive the risk, the higher this non-negotiable figure is likely to be.

Key risk factors include:

- Property Location: An insurer will look at postcode-level data for things like burglary rates and environmental risks such as flooding or subsidence. A home in an area with a higher crime rate will almost certainly attract a higher compulsory excess.

- Property Type and Age: The construction and age of your home matter a great deal. For example, a Grade II listed cottage in the Cotswolds with a thatched roof presents entirely different risks compared to a modern new-build flat in Birmingham, which will be reflected in the excess.

- Your Claims History: If you have a history of making claims on previous home insurance policies, you’ll naturally be seen as a higher risk. A no-claims history, on the other hand, works in your favour and can lead to a lower compulsory excess.

Essentially, the compulsory excess acts as a filter. It ensures policyholders have a direct financial interest in preventing minor losses, which helps keep the overall cost of insurance down for everyone.

This same risk-based logic applies across different types of insurance. The principles for calculating home insurance excess are similar to those used in motor insurance, where a driver's age and experience play a major role. To see how these factors are applied in another context, you can explore a UK driver's guide to motor insurance excess . Understanding this helps you see that your excess is a personalised calculation, not a one-size-fits-all fee.

One of the most direct ways to get a handle on your yearly home insurance cost is to tweak your voluntary excess. It's a bit like a seesaw: the more you agree to pay towards a potential claim, the lower your annual premium tends to be. Insurers like this because it shows you're willing to share more of the financial risk.

When you opt for a higher voluntary excess, you're sending a clear signal that you won’t be bothering with small, low-value claims. That cuts down their admin costs and potential payouts, and in return, they pass some of those savings back to you as a cheaper policy. It’s a straightforward trade-off—you take on more personal risk in a claim scenario for an immediate saving on your premium.

The Financial Balancing Act

The trick is finding a balance that actually works for your bank account. The appeal of a lower premium is strong, but you have to be honest with yourself about what you could realistically afford to pay out of pocket during an emergency. Saving £60 a year feels great until you're suddenly trying to find £650 to cover your share after a break-in.

Here’s a quick breakdown of how the total excess is calculated:

- Compulsory Excess (set by your insurer): £250

- Your Chosen Voluntary Excess: £400

- Your Total Excess: £650

In this situation, if you had a loss valued at £2,000 , you would have to pay the first £650 . Your insurer would then cover the remaining £1,350 . The big question you need to ask yourself is whether finding that £650 would put you under serious financial pressure.

How Much Can You Really Save?

The savings can be pretty significant, especially when every pound counts. In the UK, pushing up your voluntary excess can often slice 5-15% off your premium because it directly shrinks the insurer's potential exposure. For example, if your compulsory excess is £200 and you add a £400 voluntary amount (for a £600 total), you could see a real difference, particularly on policies in higher-risk areas where premiums can top £2,000 . You can learn more about how these figures are calculated by reviewing UK insurance statistics.

The danger with a high excess isn't just the upfront cost. It's that your financial hit gets worse if your final claim payout is reduced because you can't prove what you owned. A £650 excess feels much bigger when your insurer only agrees to pay out half of what you thought your claim was worth.

This is exactly why that 'lounge exercise' is so important. If you can’t recall every valuable item off the top of your head, what makes you think your insurance settlement will cover the full loss, minus your hefty excess? Having proper, verifiable documentation is your only real defence against taking that double financial hit.

Comparing How Your Excess Impacts a Real Claim

Theory is one thing, but seeing how your choice of excess plays out in a real-world claim makes the financial impact hit home. Let's walk through two scenarios following a burglary to see exactly how a low versus a high voluntary excess changes the final payout a homeowner receives.

For both examples, we'll assume the homeowner has a standard UK home insurance policy with a compulsory excess of £250 . The total value of the items stolen comes to £3,000 . Crucially, in both cases, the homeowner used Proova to create a verified digital inventory, meaning the insurer agrees on the full value of the loss without any dispute.

Scenario A: Low Voluntary Excess

In this first scenario, the homeowner chose a low voluntary excess of £100 . Their priority was keeping any out-of-pocket expense small if they had to make a claim, and they accepted a slightly higher annual premium for that peace of mind.

Here’s how their claims process would look:

- Total Loss Agreed: The insurer verifies the £3,000 loss against the homeowner's Proova inventory. There are no arguments over what was stolen or its value.

- Total Excess Calculated: The compulsory excess ( £250 ) is added to the voluntary excess ( £100 ), bringing the total excess to £350 .

- Final Payout: The insurer deducts the £350 total excess from the agreed loss of £3,000 .

The final payment received by the homeowner is £2,650 . While they paid a bit more for their policy over the year, their immediate financial hit during a stressful time was kept manageable.

Understanding the typical steps involved can demystify the experience. For a complete overview, see our detailed breakdown of the insurance claims process in the UK .

Scenario B: High Voluntary Excess

Now, let's look at a homeowner who opted for a much higher voluntary excess of £500 to bring their annual premium down significantly. They were comfortable taking on more of the initial risk to save money upfront.

For the same £3,000 loss, their claim would be handled like this:

- Total Loss Agreed: Just like before, the insurer quickly confirms the £3,000 loss using the Proova digital record.

- Total Excess Calculated: The compulsory excess ( £250 ) is combined with their high voluntary excess ( £500 ), creating a much larger total excess of £750 .

- Final Payout: The insurer subtracts this £750 excess from the £3,000 loss.

The final payment this homeowner receives is £2,250 . They saved money on their premium but had to cover a much larger chunk of the loss themselves.

The table below puts these two outcomes side-by-side, making the financial trade-off perfectly clear.

Claim Payout Comparison With Low vs High Voluntary Excess

| Claim Detail | Scenario A: Low Voluntary Excess | Scenario B: High Voluntary Excess |

|---|---|---|

| Agreed Loss Value | £3,000 | £3,000 |

| Compulsory Excess | £250 | £250 |

| Voluntary Excess | £100 | £500 |

| Total Excess Due | £350 | £750 |

| Final Payout | £2,650 | £2,250 |

As you can see, the decision made when taking out the policy directly dictates how much cash you'll have to find when disaster strikes.

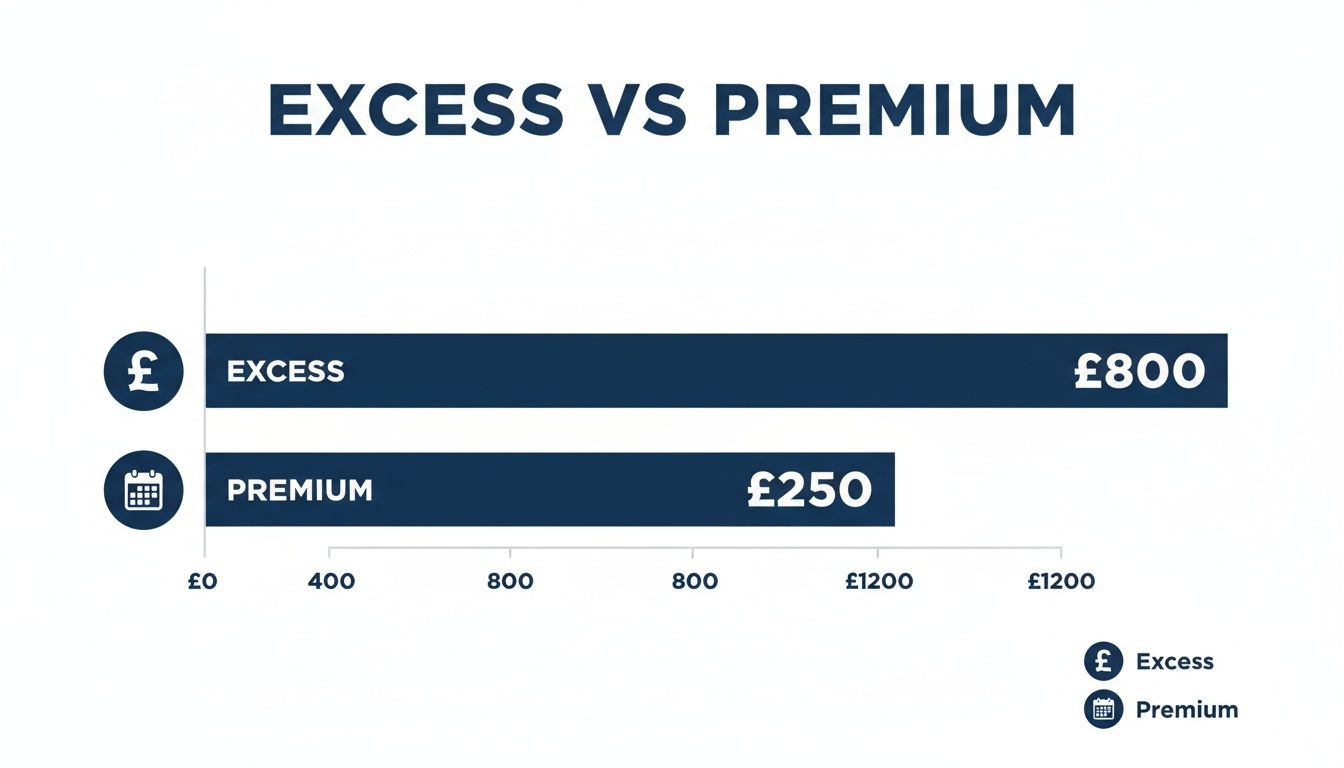

The following chart illustrates the direct relationship between the excess you choose and the premium you pay.

This visualisation drives home a simple point: as the excess (your potential out-of-pocket cost) goes up, the premium (your guaranteed annual cost) almost always comes down.

These scenarios highlight something crucial: your excess is a fixed deduction, but the value of your claim is not. Without solid proof, insurers can dispute the value of your stolen items, reducing your payout even further. Having a verified inventory ensures you get the full amount you're owed, making your chosen excess the only deduction you have to worry about.

Choosing the Right Voluntary Excess for Your Situation

Deciding on a voluntary excess is a serious financial choice, not just another box to tick on an insurance form. It forces you to take an honest look at your finances and your real-world appetite for risk.

Pick a number that’s too low, and you could be needlessly overpaying on your premium year after year. But set it too high, and a stressful claim could quickly escalate into a genuine financial crisis. The goal is to find that sweet spot: a meaningful premium reduction without taking on a level of risk you can’t comfortably handle.

This decision isn’t a one-and-done guess, either. It’s something you should revisit regularly, especially when your financial circumstances shift. What seemed affordable last year might be totally out of step with your reality today, particularly after a big life event.

A Practical Framework for Your Decision

Making a smart choice here involves more than just seeing how much your premium drops. It’s about creating a safety net that actually works for you when you need it most. Before you commit to a figure, it pays to walk through these practical steps.

Key considerations for UK homeowners:

- Evaluate Your Emergency Savings: This is the most critical step. Look at your savings account and figure out what amount you could genuinely pay out tomorrow without causing serious financial strain. Your voluntary excess should never be more than your emergency fund can comfortably cover.

- Consider the Total Value of Your Belongings: A higher excess might seem acceptable if you're only picturing a single stolen item. But what if you suffer a total loss from something like a fire? The excess gets deducted from the total claim value, so understanding the full potential loss gives you crucial context.

- Review Your Excess Annually: Don't just let your policy auto-renew without a second thought. A salary increase, a new baby, or a home renovation can all change your financial picture. An annual check-in ensures your excess level still makes sense for your current situation.

Before setting your excess, do you know the true value of your belongings? The lounge exercise proves most of us don't. A high excess is a huge gamble if you can't even be sure what you'd be claiming for.

This is where preparation becomes paramount. Using an app like Proova to create a detailed digital inventory doesn’t just help you after a disaster; it empowers you to make smarter financial decisions from the start.

Once you have a clear, verified picture of what you own and what it’s worth, you can choose a level of cover and a voluntary compulsory excess that truly make sense for your circumstances.

Why Proof of Ownership Is Key to a Successful Claim

It’s a common misconception that your excess is the only cost you’ll ever face during a claim. The reality is that your voluntary compulsory excess is only taken off the final figure after your insurer agrees on the value of your loss. This is where things can, and often do, go wrong.

Without concrete proof of ownership, you’re walking into a claim with one hand tied behind your back. It’s one thing to say a top-of-the-range television was stolen; it’s another to prove you actually owned it with receipts, photos, or serial numbers. This is where that simple ‘lounge exercise’ becomes a harsh financial lesson for thousands of UK policyholders every single year.

The Documentation Gap

When you can’t provide solid evidence, insurers are forced to make assumptions. They might undervalue your items or, in some cases, dispute their existence entirely. This shortfall in your payout is a cost that comes right out of your pocket, on top of the excess you already have to pay. It’s a painful double hit right when you’re at your most vulnerable.

This documentation gap is a major reason claims get reduced or refused. You can get a deeper understanding of the common pitfalls in our guide on why your insurance company might refuse to pay a claim and what you can do about it .

The core problem is simple: your insurer’s valuation is based on the evidence you provide. If that evidence is weak or non-existent, their settlement offer will reflect that, leaving you to cover the difference.

This is precisely the headache Proova was designed to solve. By using our app, you can create a timestamped, verified digital record of your belongings before anything happens, completely removing any doubt from the equation. You’re giving your insurer undeniable proof of what you owned and its condition.

For homeowners, this means faster, fairer payouts and a lot less stress. It ensures your voluntary compulsory excess is the only deduction from a claim that has been valued correctly from the start. Ultimately, it makes the entire system work as it should for honest customers. For more tips on protecting your belongings, particularly during a move, check out these Essential Insurance Tips for a Stress-Free Move .

Common Questions About Insurance Excess

We get it, insurance excess can feel a bit like navigating a maze. To help clear the air, here are some straight answers to the questions we hear most often from UK homeowners about their voluntary and compulsory excess .

Can I Change My Voluntary Excess Mid-Policy?

In most cases, you can only set your voluntary excess when you first take out or renew your policy. Insurers use your chosen excess as a key factor when they calculate your premium, locking it in for the term.

If you’re determined to change it midway, you’ll need to speak directly with your insurer. Be prepared, though—it might mean cancelling and restarting your policy, which often comes with admin fees.

Do I Have to Pay the Excess If I’m Not at Fault?

Yes, you usually have to pay your excess upfront, even if the incident wasn't your fault. Your insurer will then work to get their costs—and your excess—back from the responsible person or their insurance company.

If they successfully recover the full amount, your excess will be refunded to you. Just remember, this process isn't always quick, and a full recovery is never guaranteed.

What Happens If a Claim Is Less Than My Total Excess?

If the value of your claim is less than your combined compulsory and voluntary excess, it simply doesn't make sense to file a claim.

For instance, if your total excess is £500 and a stolen bike is only worth £400 , your policy won’t pay out a penny. In that scenario, you’d have to cover the entire replacement cost yourself.

Navigating the details of insurance is stressful enough without the added worry of proving what you own. With Proova , you can create a simple, verified digital inventory of your belongings, ensuring any claim you make is settled quickly and fairly. Get started for free today and protect what matters most. Find out more at https://www.proova.com.