A UK Driver's Guide to Motor Insurance Excess

In simple terms, your motor insurance excess is the slice of the bill you agree to pay yourself when you make a claim. It is a fixed amount that comes out of your pocket before your insurer covers the rest, ensuring you both have a bit of skin in the game.

Understanding the Role of Motor Insurance Excess

Think of it like the deposit you put down on a rental. It is an upfront commitment showing you will take good care of things. When it comes to your car, the excess is your contribution towards repair or replacement costs. You pay your pre-agreed share and the insurer handles the remainder up to your policy limit. This partnership is at the heart of how UK insurance works.

Why Does Excess Exist?

So, why have an excess at all? It is mainly there to discourage small, frequent claims. Imagine if insurers had to process every minor car park scratch or tiny dent—the administrative costs would be astronomical. Those costs would inevitably be passed on to everyone, driving up premiums for all drivers.

The excess makes you pause and think. Is it worth claiming for a £150 scuff if your excess is £250? Probably not. This keeps the claims system focused on more serious, costly incidents and acts as a surprisingly effective line of defence against insurance fraud.

By making the claimant financially invested in the process, the excess system discourages fabricated or inflated claims. This is vital for the industry's stability as insurance fraud is a serious issue that drives up costs for every honest driver on the road.

This initial contribution is a key component of policies like comprehensive car insurance in the UK , helping to strike a balance between risk and affordability. Ultimately, a provable, honest claims process benefits everyone—from individual drivers to the insurers that protect them. Getting your head around motor insurance excess is the first step to managing your policy well and avoiding any nasty financial surprises down the line.

Compulsory vs. Voluntary Excess: The Two Parts of Your Total Payment

When you see the word "excess" on your insurance policy, you are not looking at a single, random figure. It is actually made up of two distinct parts that work together and understanding how they combine is key to managing your policy effectively. This total amount is what you will pay out of your own pocket if you need to make a claim.

First up is the compulsory excess . This part is non-negotiable; your insurer sets it for you. They calculate this figure by assessing the risk you represent, considering everything from your age and driving history to the type of car you drive and even your postcode. Think of it as the baseline contribution they require from you in any claim scenario.

The second piece of the puzzle is the voluntary excess . This is the part you control. It is the amount you choose to pay on top of the compulsory figure and it is your main tool for influencing the price of your annual premium. By agreeing to a higher voluntary excess, you are telling the insurer you are willing to shoulder more of the financial risk yourself, which often earns you a tidy discount on your premium.

How Compulsory and Voluntary Excess Combine

Getting to your total excess is simple arithmetic: Compulsory Excess + Voluntary Excess = Total Excess . This final number is what you are on the hook for if you make an at-fault claim.

For instance, if your insurer sets a compulsory excess of £200 and you opt for a voluntary excess of £300 , you would need to pay the first £500 of any claim yourself.

This calculation is especially important for certain groups of drivers, who often find themselves facing much higher compulsory figures right from the start.

For newly qualified or younger drivers, the compulsory excess can be particularly steep. Insurers view this demographic as a higher statistical risk and that is reflected directly in the non-negotiable part of their excess.

The Real-World Impact for UK Drivers

This risk-based approach has a very real financial impact on younger motorists. Recent analysis shows that young UK drivers are dealing with some of the highest insurance excesses in the market. It is not uncommon for insurers to set compulsory levels at £300 or more for drivers with less than two years of experience, even if they have a perfectly clean record.

When this is combined with an average voluntary excess of around £300 , the total contribution for a claim can easily top £550 . This trend is driven by nearly a quarter of all drivers choosing a voluntary excess of £500 just to secure much-needed reductions on their premiums. You can dig deeper into the data and see how different driver groups are affected in Zego's 2025 car insurance report.

Getting your head around how these two parts stack together is essential. It empowers you to make an informed decision about your voluntary amount, letting you strike the right balance between saving on your premium and what you could realistically afford to pay if you had an accident.

Ever wondered why your motor insurance excess and premiums seem to be creeping up year after year? It is not just you. The answer lies in the enormous financial pressures facing the entire insurance industry. At its heart, the excess on your policy is not just a random figure on a page; it is a critical tool for managing those pressures.

The whole system is designed to strike a fair balance. Your excess ensures you have a financial stake in any claim you make, which acts as a powerful filter. It discourages the small, low-value claims that would otherwise clog up the system and drive up administrative costs for everyone. It is also a surprisingly effective deterrent against insurance fraud—a problem that costs the industry billions and pushes up premiums for all policyholders.

Think about it: when someone has to contribute their own money, they are far less likely to inflate repair costs or invent damages. This shared responsibility helps keep the system honest.

The Rising Tide of Industry Costs

In recent years, insurers have been hit by a perfect storm of rising expenses. Today’s cars are packed with complex tech like sensors, cameras and advanced driver-assistance systems. While these features make our roads safer, they also make even minor repairs incredibly expensive. A simple bumper replacement can now involve recalibrating multiple electronic systems, easily costing thousands.

At the same time, sophisticated vehicle theft is on the rise. Criminals are using advanced techniques to bypass modern security, making recovery rare and pushing theft-related payouts to new heights. The sheer difficulty and expense of proving what was lost or damaged adds another layer of complexity and cost to every claim. This reality has led to a major increase in claim values across the board, which eventually impacts every policyholder. For instance, a catastrophic event like a vehicle fire can lead to a challenging total loss claim where proving ownership and condition is vital.

The motor insurance excess is a fundamental mechanism that helps insurers manage the financial impact of escalating repair costs and pervasive fraud, ensuring the system remains sustainable for honest customers.

How This Affects Your Excess

These massive industry-wide costs are not just absorbed by insurers; they are reflected in the premiums and excesses paid by every driver on the road. The numbers paint a pretty stark picture.

Across the UK motor insurance market, the average theft excess has surged to £267 —a staggering 47% increase since 2020. This spike is a direct response to insurers paying out a record £11.7 billion in 2024 alone. These figures highlight the severe financial strain the industry is under. You can discover more insights about motor excess in 2025 and the data behind these rising costs.

Ultimately, your motor excess is a key part of a delicate balancing act between risk and affordability. It helps to offset the spiralling costs of repairs, technology and crime, making sure the insurance pool remains viable for everyone. Without it, premiums would be significantly higher for every single driver.

How Your Excess Is Applied During a Claim

When you need to make a claim, knowing what to expect can make a stressful situation a lot more manageable. The way your excess is handled is actually quite straightforward but it does change depending on who was at fault for the incident. It is a fundamental part of how the insurance system works to keep costs under control for everyone.

From the moment an incident is reported to the final payout, your insurer is working to figure out the costs and, crucially, verify that everything is legitimate. This is not just about bureaucracy; it is a vital step in controlling expenses, from genuine repairs to sniffing out fraud, which ultimately helps keep everyone's premiums down.

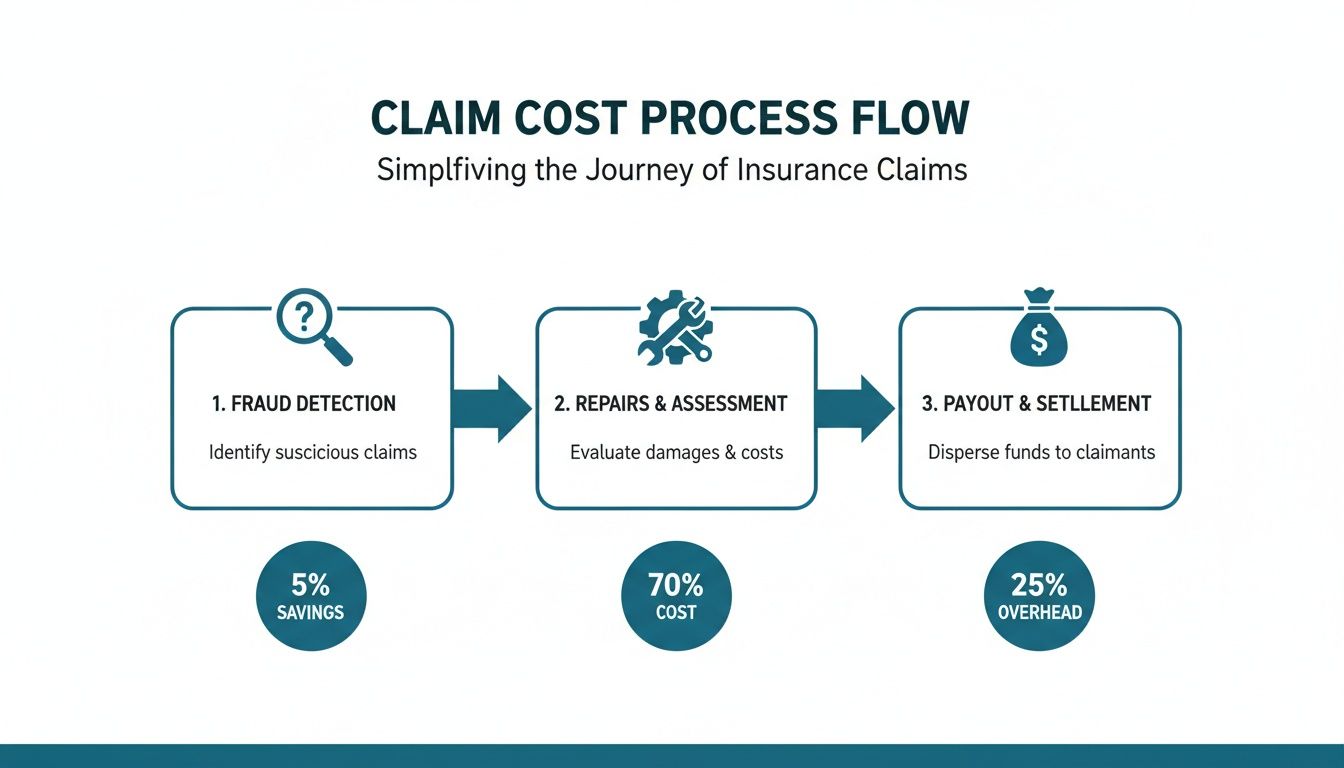

The infographic below gives a clear breakdown of where the money goes in a typical claim, from fraud detection all the way to the final payout.

As you can see, while repairs are the biggest chunk of the cost, a significant effort goes into making sure every claim is genuine.

At-Fault vs Non-Fault Claims

How and when you pay your excess really comes down to one thing: liability. Were you responsible for the accident or was the other driver?

-

If you are at fault: It is simple – you will always have to pay your total excess. Say your car needs £2,000 worth of repairs and your total excess is £500 . You will pay the first £500 and your insurer will cover the remaining £1,500 .

-

If you are not at fault: The process is a bit different. You might still need to pay your excess upfront to get your car back on the road quickly. However, once the other driver’s insurer accepts full responsibility, your insurer gets all its costs back from them. That includes your excess, which they will then refund to you in full.

The critical factor here is provability . For a non-fault claim to run smoothly, it needs to be crystal clear that the other party was entirely to blame and, just as importantly, that they are insured.

How Is the Excess Actually Paid?

You will not usually be asked to write a cheque to your insurance company. Instead, the payment is handled practically as part of the claims settlement.

It typically happens in one of two ways:

- Paid directly to the garage: If your car is being repaired, you will usually pay the excess amount straight to the garage after they have finished the work.

- Deducted from the settlement: If your car is a write-off, your insurer will simply deduct your total excess from the final payout they send you.

In cases of theft or a total loss, the excess is taken from the market value payment your insurer provides. This ensures your contribution is made before the final settlement is finalised, upholding the risk-sharing agreement of your policy.

This whole process ensures your contribution is made without creating extra paperwork or hassle. It keeps the system running efficiently while ensuring every claimant has a financial stake in the outcome—a key measure in discouraging inflated or fraudulent claims that drive up costs for all policyholders.

Choosing Your Voluntary Excess: A Financial Balancing Act

Deciding on your voluntary excess is more than just ticking a box to get a lower premium. It is a genuine financial strategy and it pays to get it right. While the idea is simple—agree to pay more yourself and your insurer charges you less—setting that figure too high can leave you in a real bind when you actually need to claim.

The goal is to find that sweet spot. You are looking for an amount that makes a noticeable dent in your premium but is still a sum you could comfortably find at short notice. Go too low and you are leaving money on the table. But push it too high and you might not be able to afford the repair bill, which completely defeats the point of having insurance in the first place.

A Quick Personal Finance Health Check

Before you commit to a number, you need to ask yourself one crucial question: could I pay this amount tomorrow, no questions asked? A great place to start is your emergency fund. Your voluntary excess should never, ever be more than the cash you have set aside for unexpected costs.

Think about your driving habits, too. If you have got years of clean driving under your belt, you might feel more comfortable nudging that excess up. Your track record suggests you are less likely to make a claim, which gives you a bit more breathing room. If you want to dive deeper, our guide on how no claims bonuses work for UK drivers breaks this down further.

Finding the Point of Diminishing Returns

It is tempting to keep increasing your voluntary excess to watch your premium fall but be careful. You will eventually hit a point of diminishing returns. After a certain threshold, adding another £100 to your excess might only shave a few quid off your annual premium. It is always worth getting a few quotes with different excess levels to see where the real value stops.

Choosing a voluntary excess is a personal calculation. It has to reflect your financial reality, not just the temptation of a cheaper quote. An unaffordable excess is a false economy, one that can cause huge financial stress when you are already dealing with an accident.

With premiums on the rise, it is no surprise that many UK drivers are opting for higher excesses to keep costs manageable. By 2025, it is projected that 23% of drivers will select a £500 voluntary excess, pushing the average amount up by 10% since 2023. The savings can be significant; one analysis showed a whopping 27% premium reduction just by increasing an excess from £250 to £500. This trend highlights a clear strategy but it also reinforces just how important it is to make sure that figure is genuinely affordable for you.

Voluntary Excess vs Potential Premium Saving

To see how this plays out in the real world, here are a few illustrative examples. Remember, these figures are just for guidance but they show the powerful relationship between what you agree to pay and what you save.

| Voluntary Excess | Example Annual Premium | Potential Annual Saving |

|---|---|---|

| £150 | £600 | £0 |

| £300 | £525 | £75 |

| £500 | £450 | £150 |

| £750 | £420 | £180 |

As you can see, the biggest jump in savings often comes from the initial increases. After a certain point, like going from £500 to £750, the extra saving becomes much smaller, showing that point of diminishing returns in action.

Mitigating Your Risk with Excess Protection Insurance

Choosing a higher voluntary excess is a classic strategy to get your car insurance premiums down but it is not without its catch. You save money upfront but you are also accepting the risk of a hefty out-of-pocket expense if you ever need to make a claim.

If that potential financial hit worries you, there is another layer of protection worth considering.

Enter excess protection insurance . It is a separate, standalone policy designed to be your financial safety net. Its job is simple: to reimburse you for the total excess you have to pay after a successful claim on your main car insurance.

This makes it an especially smart buy for certain drivers. If your insurer has slapped on a high compulsory excess or if you have deliberately opted for a high voluntary amount to keep your premiums manageable, this cover can step in to bridge the gap.

How Does Excess Protection Work?

The process is refreshingly simple. Let's say you make a claim on your car insurance for an accident, fire or theft. You start by paying your motor insurance excess as usual—either as a deduction from the final settlement or as a direct payment to the garage doing the repairs.

Once your main claim is all settled, you then make a claim on your excess protection policy. You will just need to provide the proof, like confirmation of the settled claim and evidence you have paid your excess. After that, the insurer pays you back the full amount.

It is a clever way to benefit from the premium savings of a higher excess without having to shoulder all the risk that comes with it.

Essentially, excess protection insurance lets you have your cake and eat it. You get a lower annual premium by agreeing to a higher excess but you do it with the peace of mind that a backup policy is ready to cover that cost if the worst should happen.

Beyond specific insurance products, remember that other forms of risk mitigation can also play a huge role. For example, installing a reliable car alarm can significantly lower the chances of an incident that would lead to a claim in the first place, helping to protect both your no-claims bonus and your excess.

By combining a smart excess strategy with practical security measures, you can build a really robust plan to manage your motoring costs effectively.

Common Questions About Motor Insurance Excess

Digging into the details of motor insurance excess can bring up a few tricky questions. Let's walk through some of the most common queries to give you clear, straightforward advice.

Do I Have to Pay Excess if an Accident Wasn’t My Fault?

Yes, in almost all cases, you will have to pay your excess upfront to get the repair process started. Think of it as your initial contribution to the claim.

However, once the other driver’s insurer accepts full responsibility for the accident, your insurance company will recover all their costs from them. This includes your excess, which will then be refunded to you in full. It is worth remembering that this can sometimes take a few months to sort out, so clear proof that the other driver was entirely at fault is absolutely key to getting your money back.

What Happens if My Excess Is More Than the Repair Cost?

This is a scenario where it makes no financial sense to claim on your insurance. If your total excess adds up to more than the repair bill, you are much better off paying for the damages yourself.

Why? Because making a claim would mean your insurer pays nothing towards the repair but you would still likely lose your No Claims Discount. On top of that, you would have to declare the incident at renewal, which could push up your future premiums—all for no benefit.

Choosing not to claim when the repair cost is below your motor insurance excess is a sensible financial decision. It protects your claims history and prevents future premium increases for a minor incident.

Can I Change My Voluntary Excess Mid-Policy?

Most insurers will let you adjust your voluntary excess during your policy term but they will usually charge an administration fee for the change.

If you decide to increase your excess, you might get a partial refund on your premium. If you decrease it, you will need to pay a bit more for the rest of the policy term to cover the higher risk for the insurer.

Verifying your assets before a claim is the simplest way to get paid quickly and fairly. Proova gives you a clear, dated record of your possessions, making the claims process faster and reducing the potential for disputes. Find out more at https://www.proova.com.