Comprehensive Car Insurance Meaning UK Guide

Comprehensive car insurance is the top tier of cover you can get in the UK, designed to protect you against the widest possible range of everyday risks. It covers damage to your own car in an accident—even if it is your fault—along with nasty surprises like fire, theft and any damage you might cause to other people or their property.

But here’s something to keep in mind: ‘comprehensive’ does not mean ‘all-inclusive’ . Every policy has its limits and specific things it will not cover.

What Does Comprehensive Car Insurance Mean?

Instead of thinking of comprehensive cover as some kind of magical shield for your car, it’s better to see it as the ultimate safety net. While a basic Third-Party policy only pays for damage you cause to others, a comprehensive policy wraps that protection around your own vehicle too. That is the crucial difference and it is what gives you real peace of mind when you’re out on the road.

This guide will unpack what comprehensive car insurance really means, going beyond the simple dictionary definition. We will explore the balancing act insurers perform between the premium you pay and the soaring costs of claims and we will touch on the hidden impact of insurance fraud—a problem that quietly adds a little extra to every honest driver's bill. Getting your head around these factors is key to understanding what you are actually paying for.

The True Cost of Cover

When you pay your insurance premium you are not just buying a policy; you are contributing to a massive pool of funds that insurers use to pay out everyone's claims. The trouble is, the cost of those claims is climbing steeply and for a few key reasons:

- Complex Vehicle Repairs: Modern cars are packed to the brim with sensors, cameras and advanced electronics. This means that even a minor bump can lead to an eye-wateringly expensive repair bill.

- Rising Vehicle Theft: Thieves are getting smarter, using sophisticated methods that lead to more cars being stolen and written off completely.

- Insurance Fraud: From slightly exaggerated claims to professionally staged 'crash for cash' incidents, fraud is not a victimless crime. It costs the insurance industry billions every year and that cost inevitably gets passed on to all of us through higher premiums.

The whole insurance system hinges on the provability of claims. Insurers have to verify every detail to protect that shared pool of money from being drained by fraudulent activity. This helps keep premiums as fair as possible for everyone.

This constant financial pressure means that while your policy gives you fantastic protection, it has to have clear boundaries. If you have got more questions about how it all works, you can find detailed answers in our frequently asked questions.

To give you a clearer picture, the table below gives a quick overview of what a typical comprehensive policy does and does not cover. It is a great starting point but always remember to read your specific policy documents carefully!

Comprehensive Cover At a Glance

| What Is Typically Included | What Is Typically Excluded |

|---|---|

| Damage to your own vehicle in an at-fault accident | General wear and tear (e.g., tyres, brakes) |

| Damage from fire, theft, or vandalism | Mechanical or electrical breakdowns |

| Injuries to other people or damage to their property | Using your car for business without the correct cover |

| Windscreen damage (often with a separate excess) | Damage from track days or racing |

| Personal belongings stolen from the car (up to a limit) | Deliberate damage caused by the policyholder |

Ultimately, a comprehensive policy is there to catch you when something unexpected happens but it is not designed to cover predictable maintenance or high-risk activities. Knowing the difference is what makes you a savvy policyholder.

The Full Scope of Your Comprehensive Cover

So, what does 'comprehensive' actually mean in the real world, away from all the insurance jargon? Think of it as your financial backstop for those everyday mishaps. It is for when you accidentally reverse into a bollard at the shops or come back to find another driver has scraped your car in the supermarket car park.

It is also designed to shield you from the financial shock of bigger events, like your car being stolen or damaged by fire or vandals.

Essentially, if something happens to your car that is not a clear-cut collision with another driver, comprehensive cover is what you will be relying on. It covers the unpredictable stuff that can catch out even the most careful of us.

Core Protections for Your Vehicle

The real heart of comprehensive insurance is the cover it provides for damage to your own vehicle. This is the critical difference that sets it apart from more basic policies. It does not matter if you are deemed 'at-fault' or not; your insurer steps in to handle the repair or replacement costs, minus your excess.

This protection covers a whole host of common scenarios:

- Theft and Vandalism: If your car gets stolen and is not recovered, or is deliberately damaged, your policy is there to cover the loss.

- Fire Damage: This is not just for external fires. It also includes accidental fires, like one caused by an electrical fault in the car itself.

- Accidental Damage: This is a broad category covering everything from a minor scrape against a wall to more significant damage where you are the only one involved.

Of course, for an insurer to pay out, the claim has to be provable. They have to validate every incident to protect the shared pot of money that all claims are paid from. It is what keeps the system fair and affordable for everyone.

Valuable Extras and Their Limitations

Beyond just protecting the car itself, most comprehensive policies throw in some valuable extra benefits. These often include things like windscreen repair, cover for personal belongings stolen from the car and a courtesy car to keep you on the road while yours is being fixed.

These 'extras' are where policies can differ dramatically. The limit for personal belongings might range from £100 to over £500 and a courtesy car may only be provided if your car is repaired at an approved garage—not if it is a total write-off.

Getting to grips with these details is vital. It is easy to assume you are covered for every possibility but the small print really defines the true scope of your protection. The terms for these add-ons can vary wildly between insurers, so always take the time to check your policy documents.

Insurers are in a constant balancing act, trying to offer attractive benefits while managing ever-rising costs. In the UK, the average cost for comprehensive car insurance was around £562 a year in mid-2025, a noticeable drop from the previous year.

But even with falling premiums, insurers paid out a staggering £3.1 billion in claims in just one quarter, with repair costs alone hitting £2.1 billion —largely driven by the complexity of modern cars. You can discover more about these motor insurance trends and what they mean for your premium. It just goes to show the immense financial pressure the industry is under.

Understanding Your Policy's Exclusions

Knowing what your comprehensive policy covers is only half the story; understanding what it excludes is just as important. The word ‘comprehensive’ can suggest total protection but this is a common misconception that often leads to confusion and rejected claims. Every policy has firm boundaries to keep it affordable and prevent misuse.

These boundaries are not arbitrary. They exist to ensure the system remains viable for everyone. Insurers must carefully manage the pool of money funded by premiums, paying out only for legitimate, insurable events. This is why certain predictable or non-accidental costs are always excluded.

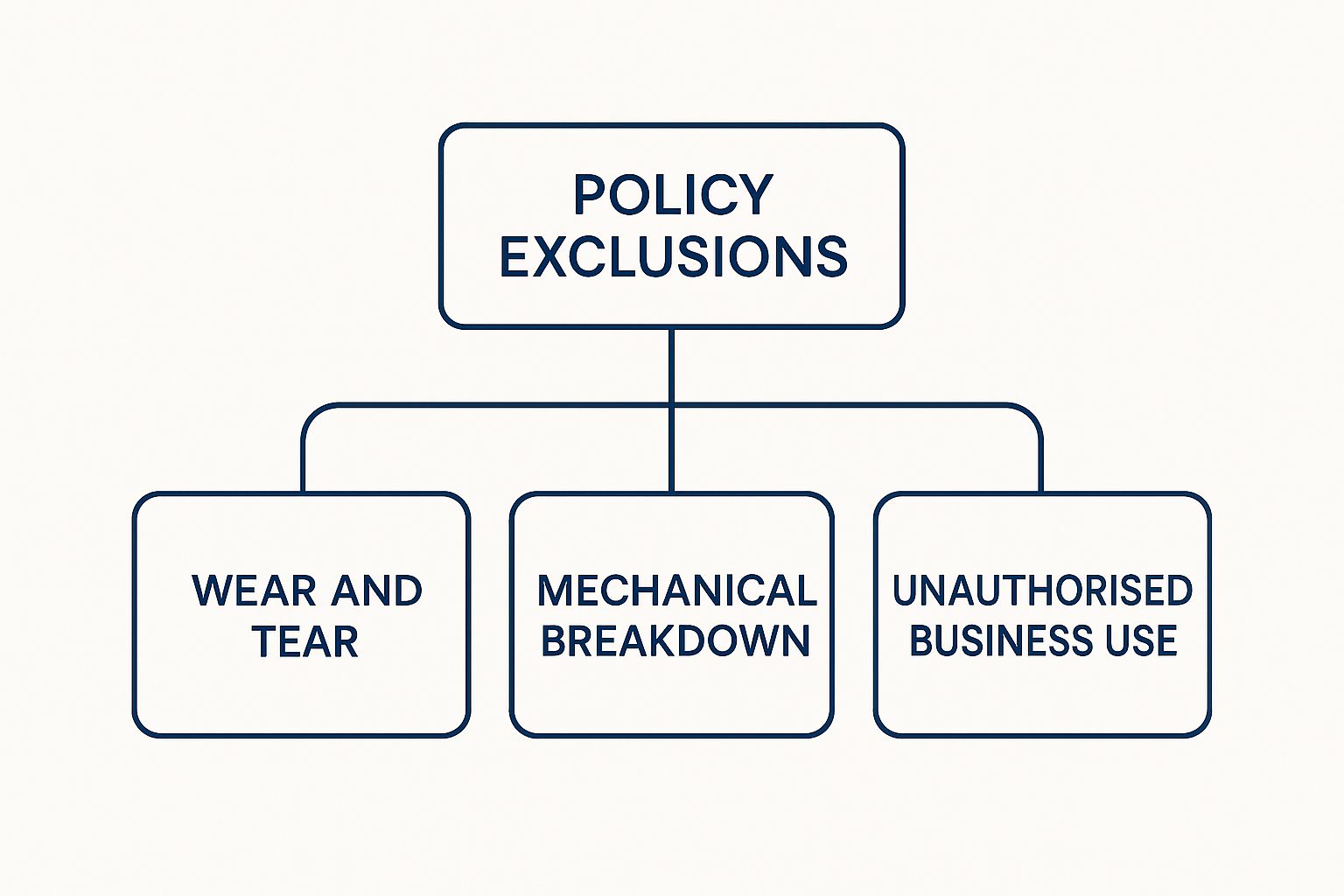

This infographic breaks down some of the most common policy exclusions you will encounter.

As you can see, exclusions fall into distinct categories. They are designed to separate genuine insurable risks from routine running costs or deliberate misuse of your vehicle.

Common Exclusions That Catch Drivers Out

One of the most significant exclusions is general wear and tear . Your insurance policy is designed to cover sudden and unforeseen events, not the gradual deterioration of your car. You cannot claim for ageing brakes, a worn-out clutch or balding tyres, as these are considered your responsibility as part of routine maintenance.

Similarly, mechanical or electrical breakdowns are almost always excluded. If your engine seizes or the gearbox fails without being part of an accident, your comprehensive policy will not cover the repair costs. This type of risk is typically handled by separate breakdown cover or warranty products.

Insurers must be able to prove that a claim is valid and falls within the policy terms. Exclusions for wear and tear or breakdown prevent the system from being used as a general maintenance fund, which would drive up premiums for every honest policyholder.

Another critical exclusion relates to how you use your vehicle. If you use your personal car for courier or delivery work without the correct business insurance, your standard policy could be completely invalidated. In the event of an accident, your insurer would be well within their rights to refuse the claim entirely. You can learn more about why your insurance company might refuse a claim and what steps you can take.

Reading the Small Print

Your policy documents are a legal contract and it is your responsibility to understand the terms. To fully grasp the legal intricacies of your comprehensive policy, especially concerning exclusions and specific terms, an AI Legal Contract Analyzer can sometimes offer clarity. Reading your policy with a critical eye empowers you to manage your expectations and ensures you uphold your side of the agreement, keeping your valuable cover valid.

How Comprehensive Compares to Other Policies

To really get to grips with what comprehensive car insurance means and why it is so popular, it helps to see how it stacks up against the other options out there. In the UK, you are mainly looking at two alternatives: Third Party Only and Third Party, Fire & Theft.

Think of them as levels in a video game. Each one gives you a bit more power and protection, with comprehensive sitting right at the top.

The most basic level, Third Party Only , is the absolute legal minimum you need to drive on UK roads. It is designed to cover the other person if you are in an accident – their injuries, their car, their property. The crucial thing to remember is that it provides zero cover for your own vehicle .

Step up a level and you have Third Party, Fire & Theft . This includes everything from the basic policy but throws in protection for your own car if it is stolen or damaged by fire. It is a definite improvement but if you cause an accident, you are still on your own to cover the repair bills for your car.

A Clear Comparison of Cover Levels

Seeing the differences side-by-side makes it much easier to decide what is right for you. This table breaks down what is typically covered at each level of UK car insurance.

| Coverage Scenario | Third Party Only | Third Party, Fire & Theft | Comprehensive |

|---|---|---|---|

| Damage you cause to others | ✅ Covered | ✅ Covered | ✅ Covered |

| Your car is stolen or damaged by fire | ❌ Not Covered | ✅ Covered | ✅ Covered |

| Damage to your own car (at-fault accident) | ❌ Not Covered | ❌ Not Covered | ✅ Covered |

| Windscreen damage | ❌ Not Covered | ❌ Not Covered | ✅ Often Included |

Looking at this, you would be forgiven for thinking comprehensive cover is always the most expensive. It is a logical assumption but in the slightly weird world of insurance, it is a myth that could end up costing you.

The Pricing Myth: Comprehensive vs Cheaper Policies

Here is a strange but true quirk of insurance pricing: a comprehensive policy can sometimes be cheaper than a third-party one. It sounds backwards, I know. But it all comes down to how insurers calculate risk.

Insurers crunch enormous amounts of data on past claims and they have spotted a pattern. They found a link between drivers who opt for the bare minimum legal cover and a higher chance of making a claim. Statistically, these drivers are seen as a bigger risk.

An insurer might figure that a driver choosing basic third-party cover is less risk-averse or maybe has an older car they are not as fussed about protecting. This statistical profile can actually push the price for lower-level cover up, sometimes making it more expensive than a comprehensive policy.

This is exactly why you should always get quotes for all three levels of cover . Do not just assume third party will be the cheapest. You might find you can get far better protection for a similar price – or maybe even less. It is a simple check that could save you a decent chunk of cash while giving you the best safety net possible.

The Real Cost of Claims and Insurance Fraud

Ever wondered what really goes into your insurance premium? It is not some arbitrary figure pulled from thin air. Instead, it is a careful calculation based on the immense financial pressures that insurers face every single day. Those costs have to be covered and they ultimately translate directly into the price you and I pay for our cover.

Two massive factors are pushing up the cost of claims that insurance companies pay out. Getting your head around these helps explain the logic behind your policy's price tag and why proving a genuine claim is so incredibly important.

The Rising Price of Repairs and Theft

First up is the sheer expense of fixing modern cars. It is a completely different ball game now. A minor bump that might have once meant a quick panel repair can now involve recalibrating a whole suite of delicate sensors and cameras embedded in bumpers and windscreens.

This growing complexity means repairs take longer, demand specialist technicians and use eye-wateringly expensive parts. All of this sends the cost of a claim soaring.

On top of that, a rising tide of sophisticated vehicle theft adds another layer of financial strain. Organised gangs using advanced tech are stealing more cars that are never recovered, forcing insurers to pay out for a total loss.

Historically, the price of comprehensive car insurance has always reflected these pressures. Premiums in the UK shot up from 2022, hitting an average of £635 by early 2024. This jump of nearly 40% was fuelled by parts inflation, post-pandemic driving habits and a surge in theft claims, making cover more expensive for everyone.

The Hidden Cost of Insurance Fraud

The second and perhaps more damaging pressure is insurance fraud. This is far from a victimless crime; it is a multi-billion-pound problem that effectively puts a tax on every honest policyholder through higher premiums.

Fraud comes in all shapes and sizes, from organised criminal rings to opportunistic individuals.

- 'Crash for Cash' Scams: These are premeditated collisions where fraudsters deliberately cause an accident with an innocent driver, all to make bogus claims for personal injury and vehicle damage.

- Exaggerated Claims: This happens when someone with a genuine claim dishonestly inflates the value of their loss, maybe by adding items that were not actually damaged or stolen.

- Application Fraud: This is all about providing false information when taking out a policy—like lying about your address or driving history—just to get a cheaper quote.

Insurance fraud is a serious issue that imposes a hidden tax on every honest driver. When insurers pay out on bogus claims, that money has to be recouped from the overall pool of premiums, pushing up the price for everyone.

This is exactly why the provability of claims is so fundamental to the entire insurance system. Insurers have to rigorously verify every single claim to protect the shared pot of money from being drained by fraud.

This strict process is what keeps the system fair and sustainable. It stops the actions of a dishonest few from unfairly penalising the vast majority of motorists. Tackling the huge problem of insurance fraud is absolutely crucial to keeping our premiums as affordable as possible.

Your Comprehensive Insurance Questions Answered

Navigating the world of car insurance can feel like a maze but understanding the nuts and bolts of your comprehensive policy gives you real confidence on the road. Let's tackle some of the most common questions UK drivers have, breaking down the jargon into clear, straightforward answers.

These are the kind of practical, real-world scenarios where the true meaning of "comprehensive" really clicks into place.

Is Comprehensive Insurance Always the Most Expensive Option?

It sounds backwards but the answer is often no. While comprehensive cover gives you the highest level of protection, it can sometimes work out cheaper than a third-party policy. This strange quirk is all down to how insurers play the odds using huge amounts of data.

Their computer models have shown that some drivers who go for the bare-minimum legal cover are, statistically speaking, more likely to be involved in a smash and make a claim. This perception of higher risk can actually push the price up for lower-level policies. Because of this, it is always worth getting quotes for all three levels of cover before you decide. You might just get better protection for less money.

How Does a Claim Affect My No Claims Bonus?

Making a claim will almost certainly hit your No Claims Bonus (NCB) if you are considered 'at fault' for what happened. That discount you have worked hard to build up will likely shrink at your next renewal, which means your premium goes up.

However, if the claim is a 'non-fault' one—meaning your insurer gets all its money back from the other driver's insurance company—your NCB should come out unscathed. Lots of drivers also choose to buy NCB protection to soften the blow.

No Claims Bonus protection lets you make a certain number of at-fault claims within a year or two without losing your discount level. But here is the crucial bit: it does not stop your overall premium from rising after an accident. Your risk profile has changed in the insurer's eyes and that will still be reflected in the price.

Can I Drive Other Cars on My Policy?

This is a massive point of confusion and getting it wrong can land you in serious trouble. The 'Driving Other Cars' (DOC) extension is no longer a standard feature on most comprehensive policies here in the UK. It used to be common but now it is becoming a rarity.

Even if your policy does include it, the cover is almost always third-party only. What does that mean? If you borrow a friend's car and have an accident, your insurance would pay for damage to others but it would provide zero cover for damage to the car you were driving .

Never, ever assume you have this cover. You must check your policy certificate and schedule carefully. Driving another vehicle without the right insurance, even if you do it by mistake, has severe legal consequences. The responsibility to check is all on you.

At Proova , we believe in making insurance clearer and more secure for everyone. Our platform helps validate claims quickly and accurately, fighting fraud and making sure honest policyholders are protected. Discover how we're building trust in insurance at https://www.proova.com.