UK Guide to Total Vehicle Loss Claims

Hearing words like 'total loss' or 'write-off' after a car accident is never easy. It is stressful, confusing and often feels personal. But in the world of insurance, it is a purely financial decision. A total vehicle loss simply means that your insurer has calculated that repairing your vehicle would cost more than it was actually worth just before the incident.

This is not a subjective judgement on the state of your car; it is a straightforward calculation based on repair estimates, the price of parts and your vehicle's market value.

Demystifying the Total Vehicle Loss Decision

When an insurer declares your vehicle a total loss, it can feel abrupt, even unfair. What you see as a repairable dent, they might see as an economic write-off. This decision comes down to a simple economic principle, not an emotional assessment of your car’s condition.

The magic number here is the repair-to-value ratio . This is a threshold set by the insurer where the cost of repairs becomes uneconomical compared to the car’s pre-accident value.

Let's say your car was worth £5,000 just before the accident. If your insurer’s threshold is 70% and the repair estimate comes in at £4,000, your car is getting written off. Why? Because £4,000 is 80% of the car’s value, which sails past that 70% line. This is not just about the visible damage; it accounts for hidden structural issues, pricey modern sensors and the ever-increasing cost of skilled labour.

Insurers use a range of factors to arrive at this decision. It is a blend of the vehicle's condition, the severity of the damage and market realities.

Key Factors That Determine a Total Loss

The table below breaks down the primary elements that insurers assess when deciding if a vehicle is a write-off.

| Factor | How It Is Assessed | Impact on the Decision |

|---|---|---|

| Pre-Accident Value (PAV) | Market research, vehicle history reports and comparisons with similar models. | A higher PAV means the car can sustain more expensive repairs before being written off. |

| Estimated Repair Costs | Detailed quotes from approved garages covering parts, labour and paintwork. | High repair costs, especially for labour or specialist parts, push the vehicle closer to the total loss threshold. |

| Salvage Value | The estimated amount the insurer can recover by selling the damaged vehicle for parts or scrap. | A higher salvage value can sometimes make writing the vehicle off a more attractive financial option for the insurer. |

| Age and Condition | The vehicle's age, mileage and overall condition before the accident. | Older vehicles or those in poor condition typically have a lower PAV, making them easier to write off. |

| Type of Damage | Assessment of whether the damage is cosmetic, mechanical or structural. | Structural or frame damage is often incredibly expensive to fix correctly, significantly increasing the likelihood of a total loss. |

Ultimately, these factors all feed into that core repair-to-value calculation, painting a complete financial picture for the insurer.

The Growing Trend of Vehicle Write-Offs in the UK

If it feels like more cars are being written off these days, you are not wrong. This is not just happening to a few unlucky drivers; it is a clear trend across the UK.

Recent data shows that the proportion of vehicles written off after accidents has climbed from 58% in 2019 to 66% —an 8 percentage point jump. During that same period, the average repair bill shot up from £4,162 to £5,191, a massive 24.7% increase. You can dig into more detailed data on UK repair costs and total losses to see just how much the figures are rising.

This shift highlights a critical reality for UK drivers: even seemingly moderate damage can now push a vehicle over the economic edge into total loss territory, making the provability of a claim more important than ever.

So, what is driving these rising costs? It is a combination of factors hitting the repair industry from all sides:

- Advanced Technology: Modern cars are packed with complex electronics—cameras, sensors and driver-assistance systems. Damaging these sensitive components means costly replacements and specialist calibration.

- Supply Chain Issues: Global disruptions have made essential parts more expensive and harder to get, leading to longer and pricier repairs.

- Skilled Labour Shortages: There is a real lack of qualified technicians in the UK repair industry, which drives up labour costs—a huge part of any repair bill.

What This Means for You as a Policyholder

Getting your head around this financial logic is the first step to navigating the claims process. It helps you manage your expectations and understand the 'why' behind your insurer's decision.

Knowing that a total loss is a calculated outcome, not a personal one, empowers you to focus on what is next: getting a fair valuation and moving towards a settlement with confidence. For any driver facing this situation, that foundation is crucial.

The Rising Cost of Write-Offs and Insurance Fraud

When an insurer declares a total vehicle loss , the consequences ripple outwards, touching far more than just the individual policyholder. The increasing frequency of write-offs in the UK is putting significant financial strain on the entire insurance ecosystem. This pressure does not just stay with the insurers; it is a cost that eventually finds its way to every driver in the form of higher premiums.

Each written-off vehicle represents a substantial payout. As these incidents become more common, the collective financial burden grows, forcing insurers to rethink risk and adjust their pricing. In the end, the cost of cover rises for everyone, regardless of their driving record.

But the steady rise in legitimate write-offs is only one part of the story. A far more damaging issue lurks just beneath the surface, adding immense pressure on the industry and its customers: insurance fraud.

The Hidden Tax of Insurance Fraud

Insurance fraud is not a victimless crime. It works like a hidden tax, levied on every honest policyholder in the country. From organised 'crash for cash' schemes to individuals simply exaggerating damage after a genuine bump, these deceptive practices inject billions of pounds of illegitimate costs into the system. These fraudulent activities cost honest policyholders an estimated £50 per year in additional premiums.

These fraudulent activities directly inflate the number of total loss claims. A criminal might deliberately stage an accident or inflate a repair quote just enough to push a vehicle over the write-off threshold, all to secure a cash payout.

The Association of British Insurers (ABI) regularly highlights the relentless threat from fraudsters, with detected scams hitting staggering numbers every year. We are not talking about little white lies; these are calculated attempts to exploit the system for profit.

Every fraudulent claim that gets paid out is a loss that has to be recouped. That money comes directly from the premiums paid by honest drivers, creating a vicious cycle where dishonesty makes essential cover more expensive for all.

Insurers have to invest heavily in fraud detection, from special investigation units to advanced data analytics. The cost of running these departments, combined with the fraudulent payouts that inevitably slip through, is factored directly into the price of your annual policy.

The Challenge of Provability

A core problem that fuels both inflated claims and outright fraud is the difficulty of proving the exact circumstances of an incident. What was the vehicle's pre-accident condition? What really happened in the moments leading up to the collision? Without concrete, verifiable evidence, insurers are often caught in a difficult position.

This lack of provability creates a grey area that fraudsters are experts at exploiting. They can dispute the condition of their vehicle, invent non-existent personal items that were 'lost' or argue about the severity of the impact because there is no tamper-proof record to contradict them.

Just think about these common tactics:

- Staged Accidents: Criminal gangs intentionally cause collisions with innocent motorists to make bogus personal injury and vehicle damage claims.

- Exaggerated Damage: After a real but minor incident, a claimant might deliberately inflict more damage on their car to ensure it is declared a total loss.

- Phantom Passengers: Claiming for injuries to people who were not even in the vehicle at the time of the accident.

Each of these scenarios thrives on ambiguity. Insurers are forced to spend time and resources investigating suspicious claims, which slows down the process for everyone and adds yet more cost. For a deeper look at the sheer scale of this problem, you can explore what insurance fraud really costs the industry and see the staggering financial impact.

Ultimately, the fight against fraud and the rising tide of write-offs are two sides of the same coin. Both place immense financial pressure on the insurance industry and both make driving more expensive for every single person in the UK. Tackling these issues demands a much greater focus on provability and transparency to build a system that is fair, efficient and affordable for honest customers.

How Insurers Work Out Your Car's Payout Value

When your car is written off, the valuation stage can quickly become the most frustrating part of the whole claim. So, how does an insurer land on that final figure? It is vital to understand that the payout is not based on what you paid for the car but on its Actual Cash Value (ACV) at the very moment before the accident happened.

Think of the ACV as your car's fair market value. It is the price a willing buyer would have paid a willing seller for your vehicle in its pre-accident condition. This number is the cornerstone of your settlement offer and insurers do not just pluck it out of thin air.

They use a mix of established industry resources, like Glass’s Guide and real-world market data to establish a baseline value for your car’s make, model and year.

The Valuation Process Unpacked

To get to a precise ACV, the insurer's assessor starts with that baseline figure and then makes adjustments based on your car’s unique story. These tweaks are crucial, as they can push the final payout up or down significantly.

Here are the main factors they dig into:

- Mileage: A car with lower-than-average mileage for its age will almost always be valued higher. On the flip side, high mileage will bring the ACV down.

- Condition: The assessor looks at the overall state of the vehicle before the accident. This covers everything from the bodywork and interior to its mechanical health. Proof of regular care and maintenance can really help your case.

- Service History: A complete, stamped service book from reputable garages is solid proof that the vehicle was well looked after, which adds to its value.

- Modifications and Upgrades: Recently fitted new tyres or a professionally installed sound system can bump up the value but only if you have the receipts to prove it.

All these adjustments are meant to build a detailed and fair picture of what your specific car was worth. For a deeper dive into the different estimation methods that can influence these valuations, you might find some useful insights on sites like microestimates.com.

An insurer's first offer is exactly that—an offer. It is not the final word. You have every right to see their valuation report and question how they got to their numbers if you think it is unfair.

How to Challenge a Low Valuation

If the insurer’s offer feels way off the mark, you are not stuck. The secret to a successful negotiation is backing up your claim with hard evidence. Just saying you think the car was worth more will not cut it; you need to prove it.

First, ask for a copy of the insurer’s valuation report. This document should list the comparable vehicles they used to calculate the ACV. Go through these examples with a fine-tooth comb. Are they really like-for-like? Check their mileage, condition and spec against your own car.

Next, it is time to build your own case with evidence. Taking this proactive step shows the insurer you have done your homework and are serious about getting a fair settlement.

Your evidence file should contain:

- Comparable Adverts: Find cars of the same make, model, year and similar mileage for sale in your local area. Screenshot adverts from sites like Auto Trader or local dealership websites to show the going market rate.

- Receipts for Recent Work: Did you just fork out for new tyres, replace the exhaust or get a major service done? Pull out the invoices to prove you were investing in the car right before the crash.

- Proof of Condition: If you have photos of your car from before the accident showing it was in great nick, they can be incredibly persuasive.

- Full Service History: Present your complete service book as clear evidence of diligent maintenance over the years.

When you present a well-organised case backed by solid proof, you turn the negotiation from a simple disagreement into a discussion based on facts. This puts you in a much stronger position to challenge that initial offer and work towards a settlement that truly reflects what you have lost.

Navigating the Total Loss Claims Process Step by Step

Finding out your car is a total vehicle loss can be incredibly stressful but knowing what comes next can make a world of difference. The claims process is not random; it is a structured sequence of events. Understanding each stage, from that first phone call to the final payout, puts you back in control.

The journey starts the moment the incident occurs. Your first, most important job is to report the accident to your insurer as soon as it is safe. This one action kicks off the entire process, getting you a claim number and an adjuster who will be your main contact. Just be ready to give them the facts, clearly and simply.

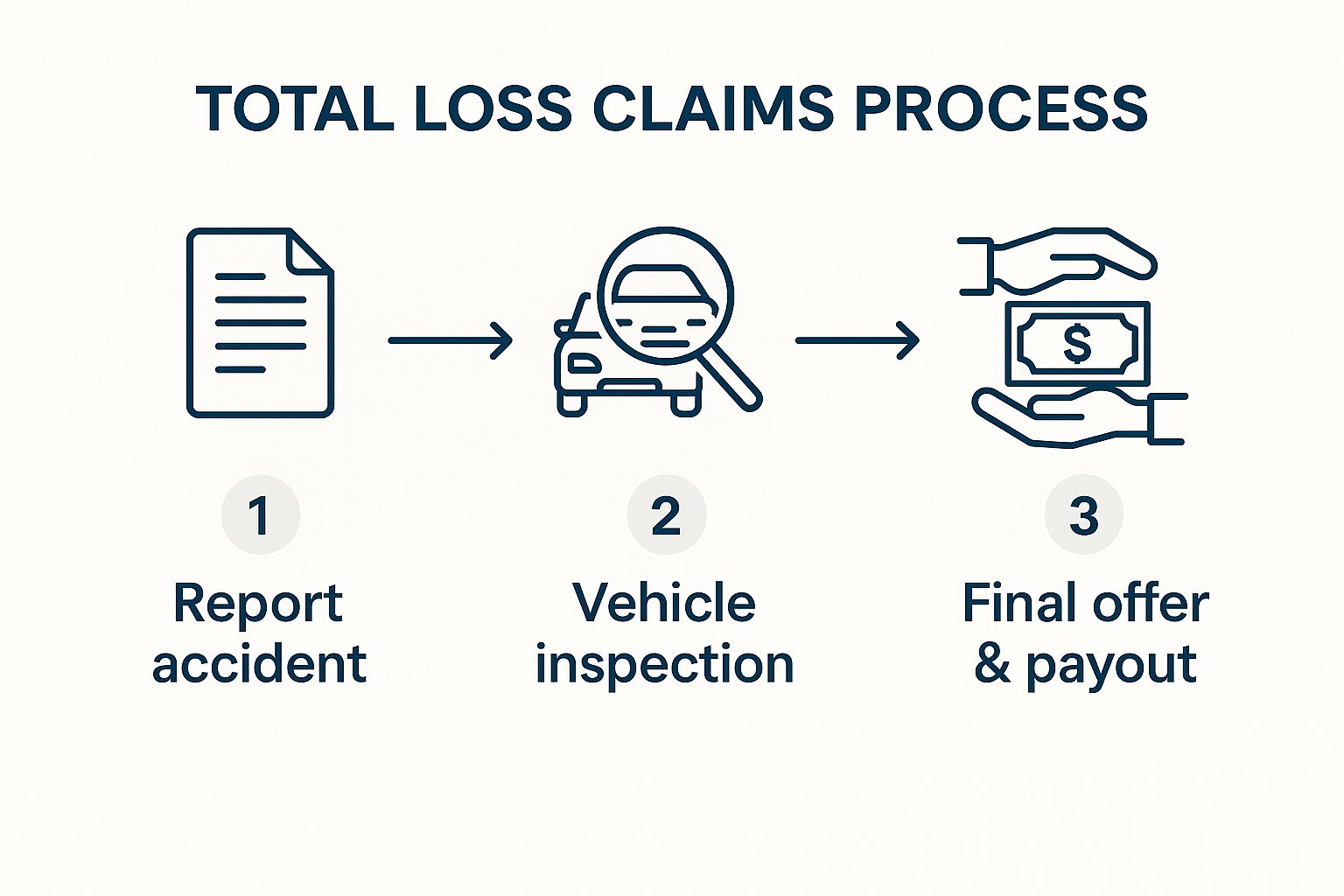

This infographic lays out the main stages of the total loss journey in a straightforward way.

As you can see, it is a logical flow from reporting the incident right through to getting paid. The vehicle inspection is the crucial middle step where the big decisions are really made.

The Inspection and Engineer's Report

Once you have logged the claim, the insurer will get an independent engineer or assessor to inspect your vehicle. They will go over the damage with a fine-tooth comb to work out how much repairs would cost. This is not just a quick glance—it is a detailed assessment that forms the foundation of the total loss decision.

The engineer then pulls all their findings into a detailed report for the insurer. This document will list every damaged part, estimate the repair bill and give a professional opinion on whether fixing the car makes financial sense. You are well within your rights to ask for a copy of this report and you absolutely should, so you can see exactly how they came to their conclusion.

The engineer's report is the single most important piece of evidence in your claim. It is what determines if your car is a write-off and provides the baseline data used to calculate its pre-accident value.

It is here we see the ripple effect of a total loss extend beyond just personal drivers. For British businesses, having a vehicle off the road is a genuine financial threat. In fact, research shows that for 35% of UK businesses , vehicle downtime has become a critical crisis. This delay, often caused by a total loss, can cost a small or medium-sized company over £50,000 in lost earnings and disruption. You can discover more insights about the business vehicle downtime crisis from WeCovr to grasp the wider economic fallout.

The Settlement Offer and Finalising the Payout

After the insurer has gone through the engineer’s report and officially declared the vehicle a total loss, they will come back to you with a settlement offer. This figure is based on their calculation of the vehicle’s Actual Cash Value (ACV) right before the accident, minus any excess you need to pay on your policy.

Take your time and review this offer carefully. If you think the valuation is too low, do not be afraid to challenge it. You can and should provide your own evidence to support your case, like adverts for similar vehicles or receipts for any recent, valuable work you have had done. A faster claims process helps everyone and you can learn about how brokers speed up claim resolutions by 70% when they adopt better workflows.

Once you have agreed on a settlement figure, the final steps are pretty simple:

- Paperwork: You'll sign an acceptance form and post your V5C log book to the insurer.

- Payment: The insurer will process the payment, which is usually a direct bank transfer.

- Ownership Transfer: At this stage, legal ownership of the damaged vehicle passes to the insurer.

As soon as the money lands in your account, the claim is officially closed. You can finally move forward and start the search for a new vehicle.

Why Claim Provability Matters for Everyone

In a world of rising insurance fraud and tangled claims, provability has become the bedrock of a fair and efficient system. When you are dealing with a total vehicle loss , the last thing you need is a long, drawn-out dispute. Provability is what separates a quick, smooth settlement from a frustrating battle and it impacts every single policyholder in the UK.

At its heart, provability is simple: it means having a clear, undeniable record of the facts. What was the vehicle's exact condition before the incident? What really happened at the scene? Without this solid proof, claims fall into a grey area where ambiguity breeds disputes, delays and worse, fraud.

This is exactly where dishonest individuals thrive. They exploit the lack of verifiable evidence to exaggerate damage, invent phantom injuries or even stage accidents entirely. Every fraudulent claim that slips through the net is a cost the entire industry has to absorb—and that financial burden is ultimately passed on to honest customers through higher premiums for everyone.

The Power of a Verifiable Digital Record

To fight back, the insurance industry is turning to solutions that build trust through technology. Modern platforms can create a secure, tamper-proof digital record of an incident and a vehicle's condition, stripping away the ambiguity that fraudsters rely on. This verifiable evidence is a genuine game-changer for everyone involved.

For insurers, it provides the solid proof needed to process legitimate claims much faster. When the facts are clear and indisputable, there is no need for lengthy investigations. It means they can confidently reject fraudulent claims while fast-tracking payments for genuine ones.

By establishing a trusted, verifiable baseline of a vehicle's condition and the circumstances of a loss, technology helps to weed out dishonesty. This not only protects insurers but also fosters a fairer system that rewards honesty and transparency.

For honest policyholders, this focus on provability means a far less stressful experience. Instead of feeling like you have to fight to prove your case, a verifiable record does the heavy lifting for you, ensuring your genuine claim is handled with the speed and fairness it deserves.

How Provability Impacts Your Total Loss Claim

Imagine your vehicle is written off. With a verifiable digital record of its pre-accident condition, the valuation process becomes far more objective. There is no room for argument over its state of repair, mileage or unique features because the evidence is already locked in. A thorough auto condition report , detailing the vehicle's state before any incident, is indispensable for proving the merits of your claim.

This whole principle is about creating a single source of truth that benefits everyone:

- For the Policyholder: Your claim gets processed faster, the valuation is fairer and the entire experience is less of a battle.

- For the Insurer: The risk of paying out on fraudulent claims is drastically cut, saving both money and resources.

- For the Industry: Overall costs come down, which helps to stabilise premiums for all UK drivers.

This transparent approach is paving the way for a more efficient future for UK insurance claims. Solutions like Proova are at the forefront of this shift, helping policyholders create a secure digital locker for their assets. This makes it simple to create a tamper-proof record that proves ownership and condition, making any future claim straightforward and clear.

By embracing technologies that prioritise provability, we are not just speeding up a single claim; we are building a more resilient and trustworthy insurance ecosystem. If you want to dive deeper into this proactive approach, understanding the importance of fighting fraud before it happens with the power of verified evidence shows just how crucial this shift is. This focus on provable facts is essential for keeping insurance fair, affordable and effective for the honest majority.

Understanding the Economic Pressures on UK Repair Costs

Ever wondered why a car that seems perfectly fixable ends up being declared a total vehicle loss ? The answer is not always in the crumpled metal or the shattered windscreen. Often, it is hidden in a web of economic forces that are pushing UK repair costs higher than ever before.

A total loss decision is fundamentally a financial calculation. These wider market pressures are tipping the scales, making it far more likely that the cost of repairs will outweigh the car's actual value. This is the simple reason why cars are now being written off for damage that, just a few years ago, would have been straightforward to repair.

The Forces Driving Up Costs

Several key factors are conspiring to make vehicle repairs so expensive. Together, they create a perfect storm, squeezing margins for insurers and making a write-off a more frequent outcome for everyone involved.

These interconnected issues include:

- Global Supply Chain Issues: Lingering disruptions mean sourcing parts is both difficult and expensive. A single delayed component can leave a car sitting in a garage for weeks, racking up storage fees and hire car costs.

- Skilled Labour Shortages: The UK’s automotive repair industry is facing a major shortage of qualified technicians. This drives up wages, which are a huge slice of any final repair bill.

- Advanced Vehicle Technology: Modern cars are packed with sensors, cameras and complex computer systems. Fixing even minor damage now often requires specialist recalibration, making the whole process far more costly than it used to be.

A total loss is frequently an economic decision, influenced by factors far beyond the immediate damage to your car. These background costs are what turn a repairable vehicle into a financial write-off.

The problem is made worse by challenges within the UK's own automotive production sector. In the first half of a recent year, UK vehicle manufacturing fell by nearly 12% , while commercial vehicle production collapsed by an alarming 45.4% .

Production drops like these constrain the supply of new vehicles and essential parts, which in turn pushes prices up and makes repairs even more uneconomical. You can read more about the UK automotive output decline on Boston Brand Media.

Ultimately, these economic pressures mean the threshold for declaring a total vehicle loss is lower than it has ever been. Understanding these forces gives you the crucial context for the current state of UK car insurance.

Your Questions About Total Vehicle Loss, Answered

When your car is written off, you are bound to have questions. It is a stressful situation and the claims process can feel confusing. Here are some clear, straightforward answers to the questions we hear most often from UK drivers.

Can I Disagree With the Insurer’s Valuation?

Yes, you absolutely can. Think of the insurer's first settlement offer as a starting point for a conversation, not the final word. If that number feels too low, you have every right to challenge it.

To do this properly, you need to build a case. Gather evidence that shows what your car was really worth right before the accident. Look for adverts for similar cars in your area—same make, model, age and mileage. Dig out receipts for any recent big jobs, like a new clutch or expensive tyres and find any documents that prove its excellent condition. A solid argument backed by real-world facts gives you the best chance of negotiating a fairer settlement.

What Happens If I Still Owe Money on My Car?

This is a really common worry. If you have an outstanding car loan, the insurance payout goes straight to your finance company first. Their job is to settle your remaining debt with that money.

If the payout is more than what you owe, you will get the rest. But what if it is less? This is known as being in 'negative equity' and you will still be responsible for paying the difference to the lender. This is exactly where Guaranteed Asset Protection (GAP) insurance is a lifesaver, as it is designed to cover that specific shortfall.

It is a common myth that the insurer just wipes your finance clean. The payout is based on your car's market value, while your loan is a completely separate contract you still need to honour.

Can I Keep My Car If It Is Written Off?

In many cases, yes, you can choose to keep the car. If you go down this route, the insurer will pay you the settlement amount but they will first subtract the car’s salvage value. That is the amount they would have got for selling the damaged car at auction.

Just be aware that the vehicle will be officially recorded as a write-off and given a salvage title. Before you can legally drive it again, it must be professionally repaired to meet road safety standards and then pass a specific inspection to get a rebuilt title. Getting insurance for a car that has been previously written off can also be trickier and more expensive.

At Proova , we believe in the power of provability. Our platform helps you create a tamper-proof digital record of your assets, ensuring that if you ever face a claim, the process is clear, fair and fast. Secure your assets and streamline future claims by visiting https://www.proova.com.