A Practical Guide to Your Car Accident Claim Insurance

Filing a car insurance claim in the UK has become a much more intense process than it used to be. With financial pressures mounting on both drivers and insurers, every single detail gets put under the microscope. Now more than ever, having a provable, completely honest claim is absolutely critical.

The Rising Stakes of UK Car Accident Claims

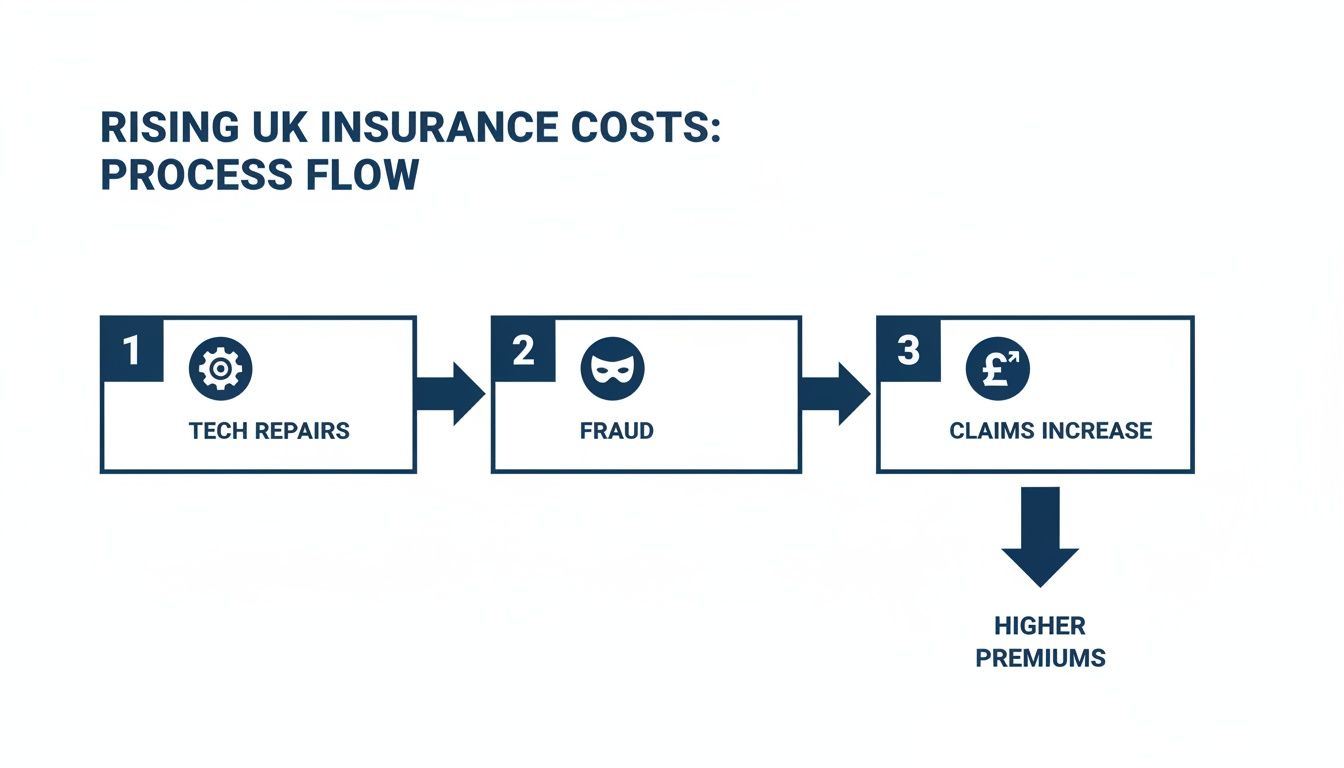

Let's be blunt: navigating a car accident claim isn't as straightforward as it once was. The entire landscape has shifted. Soaring costs have created a tense, challenging environment for everyone involved. For drivers it means the premiums just keep climbing. For insurers it means a laser-focus on claim validity to keep a lid on those spiralling expenses.

Two big factors are driving this change: the sheer complexity of modern vehicle repairs and a worrying jump in insurance fraud. Today's cars are essentially computers on wheels, packed with sensors, cameras, and advanced driver-assistance systems. While these features are great for safety, they make even a minor bump incredibly expensive to fix, sending the cost of accidental damage claims through the roof.

The Financial Squeeze on Insurers

The financial hit is staggering. Recent figures show that UK motor insurance claims costs exploded by 34% between 2019 and 2023, jumping from £6.8 billion to a massive £9.1 billion. This surge, which blew past general inflation, was fuelled by a 52% spike in accidental damage costs alone. You can dig deeper into these findings in the FCA's analysis. That kind of financial pressure forces insurers to investigate every claim with forensic-level detail.

Unfortunately, this tough environment has also become a breeding ground for fraud. Organised "crash for cash" schemes and wildly exaggerated claims aren't victimless crimes. They pump billions in illegitimate costs into the system and that money has to come from somewhere – namely, the pockets of honest policyholders through higher premiums for everyone.

The hard reality is that every single fraudulent claim adds to the cost of your annual insurance premium. It's a collective problem that hits every driver on the road, costing us all dearly.

Because of all these pressures, the provability of your claim is everything. Insurers have to be able to clearly separate a genuine, unfortunate accident from a deceptive or inflated claim. They aren't just looking for excuses to deny claims; they are legally and financially required to verify them. This means your evidence has to be clear, consistent, and verifiable. Understanding this context is the first step to building a solid claim that gets you a fair and timely settlement.

What to Do Immediately After a Car Accident

The minutes after a car accident are a blur of adrenaline and stress but what you do at the scene lays the groundwork for your entire insurance claim. Your immediate actions can be the difference between a smooth settlement and a long, drawn-out dispute.

Honestly, the best thing you can do is try to stay calm and methodical. It's your greatest asset in a chaotic situation.

First things first: safety. Check on yourself and your passengers. Is anyone hurt? If so, or if the cars are blocking the road and creating a hazard, call 999 right away. Ask for both police and an ambulance.

If it’s a minor bump with no injuries, try to move the vehicles to a safe place like the hard shoulder. This simple step can prevent a second, more serious collision.

Once you know everyone is safe, you need to exchange details with the other driver. It’s absolutely vital that you resist the urge to apologise or say things like "that was my fault," even if you think it was. Just stick to the facts.

Gathering Critical Information

This is where you start building your case. Don’t ever rely on memory – the shock of the moment can make details fuzzy later on. You need to get specific information from the other driver involved.

- Full Name and Address: Get their complete name and home address.

- Phone Number: A direct contact number is essential.

- Insurance Details: Ask for their insurer's name and their policy number.

- Vehicle Information: Note the car's make, model, and colour. Most importantly, get the registration number .

It's a criminal offence for a driver to refuse to provide these details after an accident. If they won't cooperate, or you have a gut feeling they’ve given you fake info, call the police. The same goes if you suspect they're under the influence of drink or drugs.

The infographic below shows why gathering solid evidence is so crucial. Factors like sophisticated tech repairs and rising fraud are pushing up the cost of claims for everyone.

This really brings home how the soaring expense of modern vehicle repairs and the constant battle against fraud feed directly into higher claim costs, which in turn hits every driver's premium.

Documenting the Scene with Your Phone

Your smartphone is your most powerful tool right now. Photos and videos are impartial, time-stamped proof that’s incredibly hard to argue with later. They create a factual record that backs up your side of the story.

Take photos from every angle you can think of. Capture the big picture and the tiny details. You should aim to document:

- The Overall Scene: Get wide shots showing where the cars ended up, especially in relation to road markings, junctions, and any traffic signs.

- Vehicle Damage: Take close-ups of the damage to your car and the other vehicle(s). Get every dent, scratch, and broken part.

- The Surrounding Area: Photograph skid marks on the road, debris from the crash, and even the weather conditions (like a wet road or poor visibility).

- Proof of Location: Getting a street sign or a nearby landmark in your photos is a great way to prove exactly where the accident happened. For undeniable proof, accurate geolocation data can strengthen insurance claims by confirming the precise time and place of the incident.

Don’t just take a few quick snaps. Be thorough. Think like an investigator and capture anything that might be relevant later on. A slow video walk-around of the whole scene can be especially powerful.

Finally, have a look around for any independent witnesses. A statement from a neutral third party can be invaluable. If anyone stopped and saw what happened, politely ask for their name and phone number. Their account can add serious weight to your claim, especially if the other driver's story suddenly changes down the line.

How to Build an Undeniable Insurance Claim

Once the initial shock of a crash wears off, your focus has to pivot to one critical goal: making your insurance claim as airtight as possible. A successful claim isn't built on your version of events but on a foundation of solid, verifiable evidence that tells an undeniable story.

Insurers are under immense pressure to validate every payout so your job is to make their decision easy. This means going beyond the photos you snapped at the scene and assembling a formal case file that leaves zero room for doubt or suspicion.

From Scene Photos to Official Documents

The evidence you gathered right after the accident is your starting point but now it’s time to add official weight. The single most powerful document you can have is the official police report. It’s a neutral, third-party account of the incident and insurers value that impartiality.

If the police attended, make sure you get the incident number before they leave. You’ll need it to request a copy of the report. This document locks in key details like the time, location, and parties involved, making it much harder for stories to change later on.

Next up, get professional repair estimates. Don't just settle for one; get quotes from at least two reputable garages. These estimates need to be itemised, breaking down the cost of both parts and labour. This not only establishes the financial scale of the damage but also shows you’re being diligent and reasonable.

A strong claim is an organised one. Keep every email, letter, and receipt in a dedicated file. Log every phone call with your insurer—note the date, time, who you spoke to, and a summary. This meticulous record-keeping can be your best defence if a dispute arises.

The Power of Provability and Technology

The strength of your claim rests on its provability . Every piece of evidence needs to support the others, creating a cohesive narrative. Your photos must match the damage described in the repair estimates and both should align with the details in the police report.

It’s this consistency that separates a genuine claim from a fraudulent one. Inconsistencies are immediate red flags for investigators. For example, if your dashcam footage shows a low-speed bump but your repair bill includes extensive mechanical work, that discrepancy will be scrutinised.

This is where modern tech becomes your best ally.

- Dashcam Footage: Video evidence is king. It captures the event exactly as it happened, often settling liability disputes on the spot. Save the relevant clip immediately so it isn’t overwritten.

- Telematics Data: If your car has a "black box," the data it records on speed, braking, and impact force can provide an objective, unemotional account of the collision.

- Verification Tools: Modern platforms can authenticate the time and location of your photos and videos, shutting down any suggestion that the evidence was manipulated after the event.

To really build a robust claim, it helps to understand what’s happening on the other side. Learning about automated claims processing gives you a glimpse into the systems your evidence will be fed into, helping you prepare your documentation in a way that’s easier for them to digest.

Key Evidence for a Provable Car Accident Claim

Gathering the right evidence is everything. Here’s a checklist of what you need and, more importantly, why it’s so critical for building a claim that stands up to scrutiny and helps prevent fraud.

| Evidence Type | What to Collect | Why It's Critical for Provability |

|---|---|---|

| Photographs & Videos | Multiple angles of vehicle damage, the wider scene, road conditions, and any injuries. | Creates an immediate, undeniable visual record of the incident's aftermath. |

| Police Report | The official report number and a copy of the final document. | Provides a neutral, third-party account that validates the core facts of the accident. |

| Witness Information | Names, phone numbers, and a brief statement if they are willing to provide one. | Corroborates your version of events and adds credibility from an independent source. |

| Repair Estimates | Detailed, itemised quotes from at least two reputable garages. | Quantifies the financial damage and demonstrates a fair and diligent approach to repairs. |

| Digital Data | Dashcam footage, telematics data, and location-verified photos. | Offers objective, tamper-proof evidence that can instantly clarify liability and impact. |

| Personal Notes | A detailed account of the incident written down as soon as possible after the event. | Helps you recall specific details accurately and consistently when speaking to insurers. |

This table isn’t just a list; it’s your strategic blueprint. Each item you collect adds another layer of validation, making it progressively harder for your claim to be disputed.

Navigating Rising Costs and Write-Offs

The financial stakes have never been higher and that directly impacts how your claim is assessed. An analysis of nearly 32,000 non-fault accident claims revealed a staggering 24.7% jump in average repair costs between 2019 and 2025, climbing from £4,162 to £5,191. On top of that, the proportion of vehicles being written off has also risen from 58% to 66% , a clear reflection of how expensive modern cars are to fix.

This economic reality means your insurer will look very closely at whether your car is even worth repairing. If your claim is for a total loss, you’ll need proof of ownership (your V5C logbook) and any service history to help establish the vehicle’s pre-accident value. Having this documentation ready from the start will significantly speed up the settlement process.

Understanding the True Cost of Insurance Fraud

When you think about a car insurance payout, it's easy to picture it as a simple transaction between a driver and a massive, faceless corporation. But insurance fraud throws a spanner in the works and it's far from the victimless crime some people imagine. It’s a costly problem that effectively adds a hidden tax to every honest driver's premium.

The financial pressure on insurers is immense. In the second quarter of 2025 alone, UK car insurers paid out an eye-watering £3.1 billion in claims. That figure is being pushed ever higher by soaring repair costs and a spike in vehicle theft. This high-stakes environment means fraudulent activity isn't just a minor annoyance; it's a major financial drain. That’s why insurers scrutinise claims so carefully—they’re protecting the pot of money that all policyholders pay into.

The Different Faces of Car Insurance Fraud

Insurance fraud isn't always as dramatic as a Hollywood film. It runs the gamut from highly organised criminal schemes to small exaggerations by otherwise honest people but every instance contributes to the same problem. Knowing what to look for helps you spot the red flags and protect yourself.

One of the most notorious scams is the ‘crash for cash’ scheme . This is where fraudsters deliberately cause an accident, often by slamming on their brakes in front of an innocent driver, just to make a bogus claim for vehicle damage and personal injury. They often prey on lone drivers or people who seem less likely to stand their ground at the scene.

Then there’s opportunistic fraud, which can include:

- Exaggerating Injuries: Claiming whiplash is far worse than it is, or inventing injuries entirely.

- Inflating Damage: Adding old, pre-existing scratches or dents to a claim for new damage.

- Phantom Passengers: Lying about other people being in the car who were also injured in the collision.

It might seem like a small fib to add an old scratch to a repair bill but when you add them all up, these "minor" exaggerations cost the industry millions each year, driving up premiums for absolutely everyone.

How Insurers Detect Deception

Insurers have become incredibly skilled at spotting the tell-tale signs of a dodgy car accident claim. They use a mix of savvy data analysis, seasoned investigators, and smart technology to pinpoint claims that just don't add up.

A massive red flag is inconsistency. If the damage to the vehicles doesn't match the description of the accident, alarm bells start ringing. A low-speed bump shouldn't cause major structural damage, for example. In the same way, if a claimant’s story keeps changing or directly contradicts what witnesses say, it’s going to trigger a much deeper investigation. You can get more detailed insights on this in our guide to spotting scams and proving false claims.

Insurers also hunt for patterns, like multiple claims coming from the same person or address in a short space of time. They cross-reference details against industry-wide databases to catch known fraudsters and organised gangs. For insurers, it all comes down to provability. A genuine claim is backed by solid, verifiable evidence, whereas a fraudulent one often has holes that investigators are trained to find. These principles of verifying details and hunting for inconsistencies are common across other sectors, as outlined in a practical guide to preventing credit card fraud.

By understanding how fraud works, you're not just protecting yourself from being the next target of a ‘crash for cash’ scam. You're also learning how to present your own legitimate claim in a way that is clear, consistent, and completely above suspicion. In the end, fighting fraud is a team effort that helps keep insurance fair and affordable for all honest drivers.

Navigating the Claims Process and Common Disputes

Once you’ve submitted your evidence and officially reported the incident, your claim is now in the hands of the insurer. This part can feel like a bit of a waiting game but knowing what’s happening behind the scenes helps manage expectations and keeps you in the loop. Your claim is officially under review and what happens next really depends on how clear-cut and complex it is.

First, you should get an acknowledgement from your insurer, usually within a few working days. They’ll assign a claims handler or an adjuster to your case. This person is now your main point of contact. It’s their job to go through the evidence, figure out who’s liable, and work out the settlement value.

The Role of the Claims Adjuster

The claims adjuster—sometimes called a loss adjuster—has one primary function: to investigate the claim for the insurance company. They aren't your adversary but their role is to verify every single detail to make sure the claim is legitimate and accurately priced. Think of them as the gatekeepers, protecting the insurer from the huge financial pressures of fraud and spiralling repair costs.

An adjuster will dig into all the information you’ve provided, from your statement and photos to witness details and police reports. They’ll cross-reference your version of events with the other driver's account to piece together a full picture. On more complicated claims, they might even bring in an independent investigator to visit the scene or speak to witnesses directly.

Common Disputes and How to Handle Them

Even if you’ve built a rock-solid claim, disagreements can and do happen. Being prepared for these potential roadblocks is crucial for getting a fair outcome. Most arguments boil down to three things: liability, repair costs, and vehicle valuation.

Here are a few classic disputes you might run into:

- Disputes Over Fault: The other driver might suddenly change their story, or their insurer could contest who’s to blame. This is precisely where your initial evidence—especially dashcam footage and independent witness statements—becomes absolutely priceless.

- Disagreements on Repair Costs: Your insurer’s approved garage might quote a lower price than the one you trust. If that happens, you’ll need to get detailed, itemised quotes from your preferred garage to justify why the higher cost is necessary.

- Low Settlement Offers for Write-Offs: If your car is declared a total loss, the insurer will offer its pre-accident market value. If you believe the offer is too low, you have to challenge it. Gather evidence of what similar cars are selling for from online marketplaces and dealerships.

When a dispute kicks off, keep all your communications calm and professional. Log every phone call and save every email. The goal is to build a logical, evidence-based argument, not to get dragged into an emotional slanging match.

If the incident was clearly the other party’s fault, things should be more straightforward. You can find detailed steps in our UK no-fault claim guide to help make the process smoother.

Escalating Your Claim If You Are Unhappy

If you hit a brick wall and feel your insurer just isn’t treating you fairly, there’s a formal route you can take. The first move is to make an official complaint directly to the insurance company. They are legally required to investigate it and give you a final response, which usually takes up to eight weeks .

Still not happy with their final decision? You can then take your case to the Financial Ombudsman Service . This is a free, independent body that resolves disputes between consumers and financial firms. Their decision is binding on the insurer if you decide to accept it.

Taking this step means you’ll need to present your entire case file, including every shred of correspondence and evidence. It just goes to show why keeping meticulous records from the very beginning is so important. A well-documented claim doesn't just strengthen your initial position; it gives you a solid foundation for an appeal if you need it.

Common Questions After a Car Accident

Dealing with the aftermath of a car accident is stressful enough without the confusing jargon and processes that follow. Let's tackle some of the most common questions drivers have, cutting through the noise with practical advice grounded in how the insurance industry actually works.

What if the Other Driver Admits Fault but Later Changes Their Story?

It’s an incredibly common scenario and one of the most frustrating things a driver can experience. This is precisely why objective, independent evidence isn't just a 'nice-to-have'—it's absolutely essential.

Whatever evidence you managed to gather at the scene instantly becomes your strongest asset. This means your notes, photos showing where the vehicles ended up, and crucially, the contact details of anyone who witnessed what happened. An independent witness account is gold dust; get their details to your insurer immediately. Their unbiased view can completely dismantle the other driver’s change of heart.

In these situations, dashcam footage is the ultimate trump card. It provides an indisputable, time-stamped record of events that's almost impossible to argue with.

Even if you don't have that silver bullet, you must report the change in story to your insurer. Give them every piece of circumstantial evidence you have. Insurers have investigation teams that will analyse the impact points and damage on both cars. Often, the physical evidence tells a story that directly contradicts a false denial of fault.

How Does an Insurer Decide if My Car Is a Write-Off?

Insurers declare a car a 'total loss' or 'write-off' when the cost to repair it properly and safely becomes uneconomical. This tipping point is usually when the repair bill is expected to climb above 50-60% of the car's market value before the accident.

To figure out that value, they don't just pluck a number out of thin air. They use industry-standard guides and look at real-world market data for cars of the same make, model, age, and condition.

If you think their settlement offer is too low, you have every right to challenge it. But you can't just say you think it's unfair; you need to prove it. It's time to do some homework:

- Find examples of similar cars for sale on reputable sites like Auto Trader or Motors.co.uk.

- Check local dealership listings for comparable vehicles.

- Gather this evidence and present it clearly to the insurer’s engineer.

Don't feel pressured into taking the first offer if you have solid evidence that it's unjust. A polite, well-reasoned negotiation backed by proof can often lead to a much fairer settlement.

Will a No-Fault Claim Affect My No Claims Discount?

Ideally, a 'no-fault' claim—where your insurer successfully recovers 100% of its outlay from the at-fault driver's insurer—should leave your No Claims Discount (NCD) untouched. The reality, however, can be a bit more complicated.

If your insurer can't get all their costs back, you might lose some or all of your NCD. This is common in hit-and-run incidents or if the other driver was uninsured. This is where having a protected NCD really shows its value, as it typically allows you to make one or two claims within a set period without your discount being affected.

But here’s the catch: even with a clear no-fault claim and a protected NCD, your premium might still go up at renewal. Insurers calculate premiums based on perceived risk. Simply being involved in any accident, regardless of blame, can statistically place you in a higher risk category from their point of view. Always check your specific policy wording to understand exactly how your NCD is treated.

What Is an Insurance Excess and When Do I Pay It?

The excess is simply the amount you agree to contribute towards the cost of a claim. It’s usually made up of two parts: a compulsory excess set by the insurer, and a voluntary excess , which you chose to add in exchange for a lower premium.

You’ll typically need to pay this excess when you claim for damage to your own vehicle. For example, if the repair bill comes to £1,500 and your total excess is £250, you pay the first £250 and your insurer handles the remaining £1,250.

If the accident wasn't your fault, your insurer will work to recover all their costs, including your excess, from the third party's insurer. Once they get that money back, they'll refund your £250. Be prepared for a bit of a wait, though—this recovery process can sometimes take several months to complete.

A provable claim is a successful claim. With Proova , you can document your assets with timestamped and geolocated photos before an incident ever happens, creating an undeniable record of ownership and condition. This simple step eliminates disputes, prevents after-the-event fraud and ensures your claims are paid faster. Secure your assets and simplify your insurance experience by visiting https://www.proova.com today.