UK No Fault Claim Guide: Simplify Your Car Insurance Process

A ‘no fault claim’ sounds simple enough but it is one of the most misunderstood terms in car insurance. It means you are claiming on your own insurance policy for an accident that was absolutely not your fault.

So, why would you do that? It usually happens when the at-fault driver is either uninsured or has vanished without a trace, leaving your insurer to pick up the bill. It is a critical concept for any UK driver to get their head around.

What a No Fault Claim Really Means

Let's clear something up straight away. The phrase ‘no fault claim’ does not mean nobody was to blame. It simply means the person who was to blame cannot be held financially accountable through their own insurance. This is what shifts the responsibility for the claim onto your policy.

Think about it this way: you come back to your car in a supermarket car park and find a huge dent in the door. No note, no witness, nothing. You are clearly not at fault but with no third party to chase, you have two choices: pay for the repairs out of your own pocket or make a claim on your insurance. If you choose the second option, you have just started a no fault claim .

The Burden of Proof and Its Consequences

In a straightforward claim where the other driver admits fault, their insurer pays up. Simple. But in a no fault scenario, the tables are turned. The burden of proof falls squarely on your shoulders.

You have to provide solid, convincing evidence that you had nothing to do with the damage. Without that proof, your insurer has no way of knowing what really happened. This is where things can get tricky and it is why insurers are so thorough. They have a duty to protect themselves—and all their other honest policyholders—from fraud. Staged accidents and inflated damage claims are massive problems that cost the industry and all of us billions every year.

Every fraudulent claim that gets paid out adds to a pool of losses that insurers have to recover. That financial pressure is a big reason why your premiums might go up, even after an incident that was not your fault.

Why It Matters to Everyone

These claims have a ripple effect that goes far beyond a single dented door. The combined cost of paying out for accidents caused by untraceable or uninsured drivers is enormous.

When insurers cannot recover their money from an at-fault party, those costs do not just disappear. They get absorbed into the system. Ultimately, this leads to higher insurance premiums for all drivers, not just the ones who have made a claim. Understanding this helps explain why proving your claim is so important—it is not just about your case but about keeping the entire insurance system fair and affordable for everyone.

No Fault Claim vs At-Fault Claim At a Glance

To make the distinction clearer, it helps to see the two types of claims side-by-side. From a policyholder's perspective, the process and outcomes can feel worlds apart.

| Aspect | No Fault Claim (Claiming on Your Policy) | At-Fault Claim (Third Party's Insurer Pays) |

|---|---|---|

| Who Pays for Repairs? | Your insurer pays initially. They may try to recover costs later if the at-fault party is found. | The other driver's insurance company pays from the start. |

| Impact on No Claims Discount | Protected if you have NCD protection but might be lost temporarily or permanently if not. | Your No Claims Discount is unaffected as you are not the one claiming. |

| Paying the Excess | You will likely have to pay your policy excess upfront. It might be refunded if your insurer recovers its costs. | You do not pay any excess on your policy. |

| Burden of Proof | It is on you to prove you were not at fault. Without evidence, it can be difficult. | Liability is established and the other party's insurer handles the process. |

| Claim Process | Can be more complex and require more evidence from you, such as dashcam footage or witness statements. | Generally more straightforward as liability is not in dispute. |

Ultimately, while both scenarios are frustrating, a no fault claim puts more of the initial financial and administrative burden on you, the innocent driver. This is why having comprehensive cover and protecting your No Claims Discount is so valuable.

The Hidden Costs of No Fault Incidents

When you make a no fault claim , it is easy to think the financial buck stops with your insurer. After all, you were not to blame. The reality, however, is that these incidents create significant financial ripples that spread across the entire insurance industry, eventually reaching every policyholder in the UK.

Each claim gets added to a massive pool of losses that insurers have to absorb. If the at-fault driver is uninsured or simply cannot be traced, there is no third-party insurer to recover the costs from. This leaves your provider footing the bill for everything—from repairs and courtesy cars to any potential injury compensation.

The problem is getting worse, thanks to soaring costs across the board. The price of vehicle parts, the specialist labour needed for modern cars and even paint has shot up. A minor repair from a few years ago might now be enough to write a vehicle off completely, sending the value of the claim sky-high.

The Scale of the Financial Burden

We are not talking about a minor issue here; this is a multi-billion-pound problem. The collective weight of these claims puts immense pressure on insurers. To stay in business, they have to balance their books and one of the main ways to do that is by adjusting premiums for everyone.

A no fault claim is never truly cost-free. While you may not be directly liable for the incident, the payout from your insurer adds to industry-wide losses that are eventually passed back to all drivers through higher annual premiums.

This financial reality is precisely why insurers investigate every no fault claim so meticulously. They have a duty to all their policyholders to ensure only legitimate, accurately valued claims are paid out. It is a process of verifying every single detail and guarding against insurance fraud, like exaggerated damage or even staged accidents.

A Closer Look at the Numbers

Industry data paints a stark picture. A review of UK motor insurance between 2019 and 2023 showed that bodily injury claims alone hit a staggering £2.9 billion in 2023. Over the same period, the costs for property and accidental damage claims jumped by 44% and 52% respectively, reflecting just how much more complex and severe incidents have become. This escalation helps explain why the Association of British Insurers (ABI) reported a record £11.7 billion paid out on motor claims in 2024, a figure you can explore in the full FCA multi-firm review findings.

Ultimately, the integrity of the claims system hinges on the provability of each case. Insurers are not just protecting their own bottom line; they are safeguarding the affordability of insurance for millions of honest drivers. Every fraudulent or inflated claim that slips through the net pushes up the cost of cover for everyone, making the fight against fraud a collective responsibility.

Proving Your Claim: The Burden of Evidence

Getting a no-fault claim approved comes down to one thing: the quality of your evidence. Because the other driver is either unknown or uninsured, the responsibility falls squarely on your shoulders to build an undeniable case for your insurer. Without solid proof, your claim is just your word against… well, nothing. That makes it incredibly difficult for an insurer to sign off on it.

This is exactly why insurers are so thorough. They are the gatekeepers protecting the system from insurance fraud, which ends up costing every honest policyholder a fortune in higher premiums. Every fake or inflated claim adds to the industry’s losses and robust evidence is the best defence against it.

What to Do at the Scene of the Accident

The actions you take in the first few moments after an incident can genuinely make or break your claim. Your main priority is to create a detailed, objective record of what happened. This is not the time for emotion; it is about collecting cold, hard facts that paint a crystal-clear picture for the claims handler.

Think of it as creating an evidence-gathering toolkit on the spot:

- Photos and Videos: Snap everything from every angle. Get wide shots to show the whole scene but also get close-ups of the damage to your car, any relevant road markings and even debris on the road.

- Detailed Notes: As soon as you can, jot down the precise time, date and location. Do not forget to note the weather and road conditions—these small details add crucial context.

- Dashcam Footage: This is often your most powerful ally. Unbiased video evidence can instantly show what happened, leaving no room for argument or doubt.

When it comes to proving your case, precise data is invaluable. For example, a car tracker's detailed route history provides an objective digital footprint that can back up your account of exactly where your vehicle was and when.

The Power of Independent Verification

While the evidence you gather is vital, anything from an independent source adds a massive layer of credibility. Insurers give significant weight to information from impartial third parties because it helps validate your version of events.

An independent witness or a clear police report can transform a questionable claim into an open-and-shut case. Their testimony is seen as objective, which is essential when the other party is not available to give their side of the story.

If anyone saw what happened, be sure to ask for their name and contact details. A short statement from an unbiased observer can be the final piece of the puzzle that gets your claim approved without a hitch. These elements form the foundation of a verifiable claim, which is key for the power of verified evidence in preventing fraud.

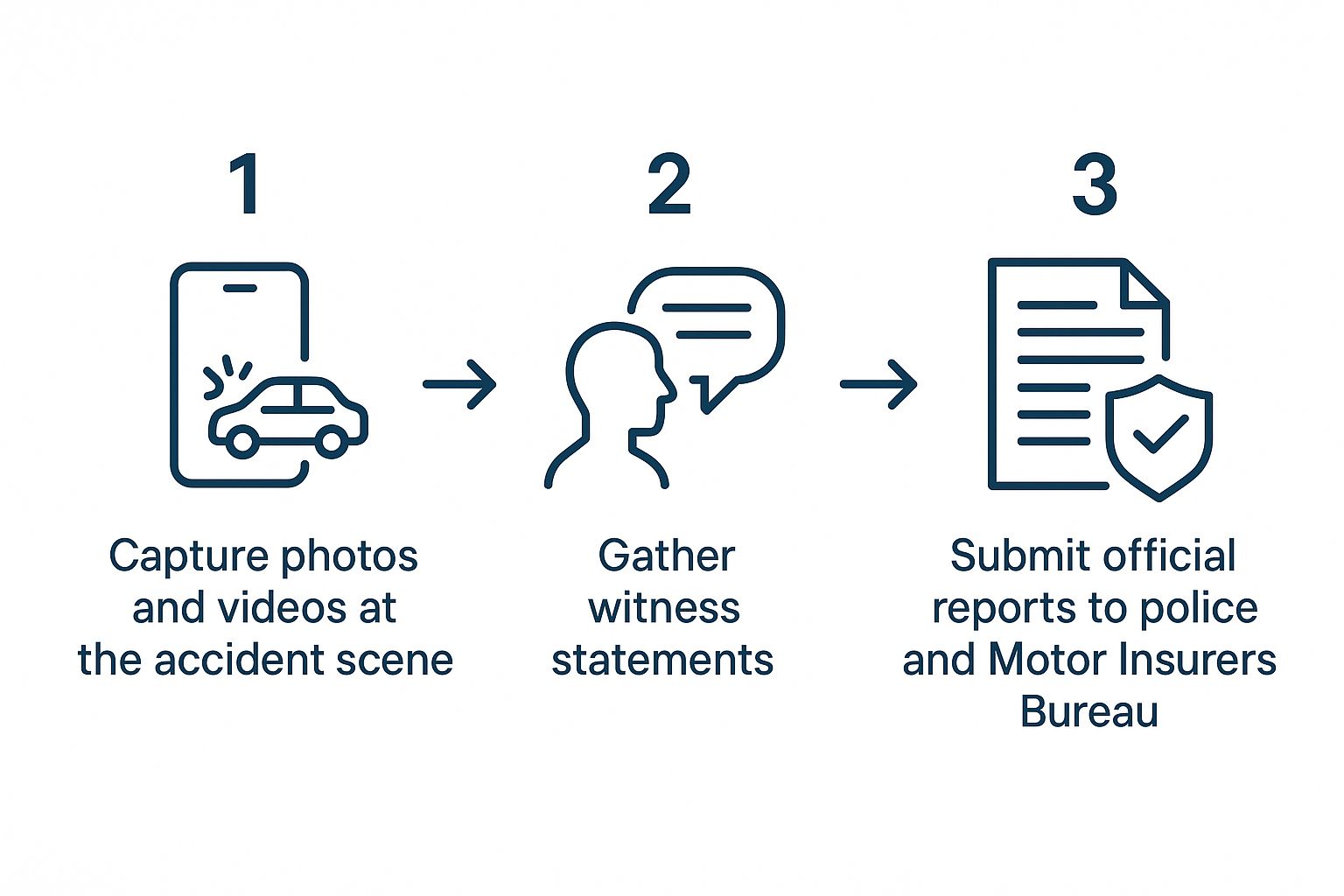

This infographic breaks down the core steps for gathering strong evidence.

Moving from capturing immediate evidence at the scene to securing official reports is how you build a comprehensive and trustworthy case file for your insurer.

If the other driver is uninsured or drives off, you have to take two extra steps. First, report the incident to the police within 24 hours to get a crime reference number. Second, you or your insurer must contact the Motor Insurers' Bureau (MIB), which is the organisation that compensates victims of uninsured and hit-and-run drivers. In these situations, a strong evidence portfolio is not just helpful—it is your only path to a successful outcome.

Navigating the Claims Process Step by Step

Starting a no-fault claim is pretty straightforward: it all begins the moment you ring your insurer. That first call really sets the tone for everything that follows, so being prepared is your best bet for a smooth start. Before you even dial, get your policy number handy, grab the crime reference number from the police (if there is one) and have all the evidence you gathered at the scene ready to go.

Once you have made that call, your insurer will assign a claims handler to your case. Think of this person as your main point of contact; they are there to guide you through the investigation, sort out repairs and handle the settlement. Their job is to review your evidence, arrange for your vehicle to be assessed and keep you in the loop.

Staying organised is your secret weapon here. Keep a dedicated file for everything – emails, notes from phone calls with dates and times, the lot. This simple step helps you keep track of what is happening and gives you a complete record if any disagreements pop up later on.

Facing Common Delays and Challenges

While everyone hopes for a quick resolution, the reality can be a bit more complicated. It is not uncommon for claimants to face frustrating delays that are completely out of their hands. Things like the availability of approved repairers, a shortage of specific parts or even just a backlog at the garage can really slow things down.

These are not isolated incidents; they are a widespread issue across the UK motor insurance market. While official figures show that around 97% of private motor insurance claims are accepted, complaints about the process itself have shot up. In the first three months of 2023/24, there were over 3,800 new car insurance complaints, a massive 50% jump from the previous year. A huge chunk of these were about delays, which shows just how much pressure the system is under.

Another common sticking point is the vehicle's valuation. If your car is written off, your insurer will offer a settlement based on its market value right before the incident. This figure can sometimes feel a bit lower than you were expecting, which can lead to some tough negotiations.

Managing Expectations for a Realistic Outcome

Understanding these potential bumps in the road is the key to keeping your expectations in check. A no-fault claim is not a quick fix. It is a methodical process designed to check every detail and make sure the outcome is fair and based on solid evidence.

Patience and persistence are vital. While your insurer works through the necessary steps, your role is to remain proactive, responsive and organised. This collaborative approach is the most effective way to navigate the process.

If your vehicle has lost value after an accident that was not your fault, knowing how to recover this is a crucial part of the process. This guide on How to File a Diminished Value Claim is a really helpful resource. It is also wise to understand why an insurance company might refuse a claim if you run into serious problems. By preparing for potential frustrations, you can approach the whole journey with a clearer head and focus on getting the right result.

How Insurance Fraud Hits Every Driver in the Pocket

While most people play by the rules, a dishonest minority ends up costing everyone. Insurance fraud is not some harmless white lie; it is a serious crime that ranges from slightly exaggerating a genuine claim to staging dangerous accidents on purpose. These are not victimless acts—they create a ripple effect that ultimately lands at the feet of every single driver in the UK.

Think of dishonest claims as a hidden tax on your insurance. When an insurer pays out on a fraudulent claim, that money has to come from somewhere. Those losses are pooled together and recouped, which inevitably pushes up premiums for all policyholders, no matter how clean their driving record is.

The True Cost of Dishonesty

Insurance fraud is far more than just a few fibs about a scraped bumper. It includes sophisticated criminal operations that seriously undermine the whole system.

- Opportunistic Fraud: This is the most common kind. It happens when a claimant decides to exaggerate the extent of vehicle damage or cleverly adds pre-existing scuffs to an otherwise legitimate claim.

- Fabricated Claims: This is making things up entirely. A classic example is reporting a vehicle as stolen when it has actually been sold or squirrelled away somewhere safe.

- ‘Crash for Cash’ Schemes: These are incredibly dangerous, premeditated collisions. Criminals deliberately cause an accident with an innocent driver, all so they can make bogus injury and damage claims.

Every fraudulent payout adds to the industry's overall losses. This financial pressure is a key reason why premiums rise for honest drivers, as the collective cost of fraud is passed on to the entire customer base.

How Insurers Fight Back

Insurers are not just sitting back and letting this happen. They invest a huge amount of money and resources into teams and technology dedicated to sniffing out and stopping fraud. Sophisticated data analysis tools are constantly running, flagging suspicious patterns like multiple claims coming from the same person or address.

Claims handlers are trained to spot the red flags and for the really complex cases, specialist investigators are brought in. They comb through evidence, interview witnesses and analyse accident data to separate the genuine claims from the fake ones. For organised crime like ‘crash for cash’ scams, you can learn more about how insurers and authorities are tackling the persistent threat of these schemes.

The consequences for getting caught are severe. Insurance fraud is a criminal offence that can lead to hefty fines, community service or even a prison sentence. A conviction also leaves a permanent mark on your record, making it nearly impossible to get affordable insurance ever again. By weeding out fraud, insurers protect the integrity of the system and work to keep premiums fair for the honest customers who rely on it.

Will a No-Fault Claim Affect My No Claims Bonus?

This is the big question every driver asks after an accident that was not their fault. You would think the answer would be a simple ‘no’ but unfortunately, the reality is a lot more complicated. Making a no-fault claim can, and often does, affect both your No Claims Bonus (NCB) and your future premiums.

Here is the thing: even if your insurer gets every single penny back from the person who was at fault, the claim itself still gets logged against your policy. Insurers work on risk and their data suggests that a driver who has been involved in one accident—regardless of who was to blame—is statistically more likely to be in another one. This shift in your risk profile can lead to a higher premium when it is time to renew.

Protected vs. Unprotected NCB

This is where having a "protected" NCB really comes into play. If your bonus is not protected, you are almost guaranteed to lose some, if not all, of it if you make a claim and your insurer cannot recover its costs.

A protected No Claims Bonus is designed to be a safety net. It usually lets you make one or two claims over a few years without losing the discount you have built up. But there is a common misunderstanding about what "protection" actually means.

A protected NCB does not freeze your premium; it only protects the percentage discount you receive. Your insurer can still increase the underlying cost of your insurance because they now see you as a bigger risk.

A Real-World Example

Let's break it down. Say your premium is £500 and your 50% protected NCB brings the cost down to £250.

After you make a no-fault claim , your insurer might re-evaluate your risk and decide your base premium for next year should be £600. Your 50% protected discount is still applied but it is now applied to that higher £600 figure. Your new premium becomes £300. So, while you kept your discount, your bill still went up by £50.

Recent figures show just how much financial pressure insurers are under, which helps explain these decisions. Between 2019 and 2025, the average repair cost for non-fault claims in the UK shot up by nearly 25% to over £5,191 . On top of that, the number of vehicles written off in these incidents has climbed to 66% . This puts a massive strain on insurers and inevitably contributes to premium adjustments for everyone.

To get a clearer picture of the market forces at play, you can dive into the full insights on rising repair costs and total losses. Understanding these trends can help you see why your premium might change, even when you were not to blame for an accident.

Got Questions About No-Fault Claims? We've Got Answers

Let's clear up some of the most common questions people have when navigating a no-fault claim in the UK. Getting to grips with the practical steps can make the whole experience feel far less daunting.

What If the Other Driver Has No Insurance?

This is a scenario no one wants but there is a clear path forward. If you discover the at-fault driver is uninsured, you can still make a no-fault claim through your own comprehensive policy. The first, most crucial step is to report the incident to the police immediately to get a crime reference number.

Your insurer will manage your claim as normal. Behind the scenes, they will likely seek to recover their expenses from the Motor Insurers' Bureau (MIB). The MIB is a UK-wide body set up specifically to compensate victims of accidents caused by uninsured or untraceable drivers, ensuring you are not left out of pocket.

How Long Does a No-Fault Claim Usually Take?

Honestly, the timeline can vary wildly. A very straightforward case, where you have undeniable proof like crystal-clear dashcam footage showing exactly what happened, could be wrapped up in just a few weeks.

However, things can get complicated. If the claim involves a personal injury, there are disputes over who was really to blame or the financial losses are significant, it could take many months to reach a final settlement. Throughout this period, patience and clear communication with your insurer are your best friends.

The two biggest factors that dictate the speed of your claim are its complexity and the quality of your evidence. Solid, verifiable proof nearly always leads to a faster resolution.

Do I Need to Hire a Solicitor?

For a simple claim involving only vehicle damage, you generally will not need to bring in a solicitor. You can handle the entire process directly with your insurance company without any trouble.

But if your claim is more serious, getting professional legal advice is a very smart move. You should definitely consider hiring a solicitor if your situation involves:

- Any kind of personal injury

- Complex arguments over who is to blame

- A substantial financial loss that goes beyond just the car repairs

A specialist solicitor knows how to navigate the legal maze and will fight to make sure you get fair compensation for everything you have lost.

Simplify your insurance and protect your assets with Proova . Our platform helps you create a verified digital record of your possessions, making any future claims process faster and more secure. Stop worrying about proving ownership after a loss. Learn more and get started with Proova today.