A Guide to the Pet Protect Claim Form and Proving Your Claim

When you need to make a claim for your pet's treatment, your starting point is the Pet Protect claim form . Think of this document as more than just paperwork; it is the formal request you send to the insurer, laying out everything from the illness or accident to the veterinary care and the costs involved. It is the very foundation of your claim and its provability is paramount.

Understanding the Pet Protect Claim Form

Let's be honest, submitting a pet insurance claim usually happens when you are already stressed and worried about your furry family member. The last thing you want is complicated paperwork. But understanding why the form is so detailed is the key to getting through the process smoothly. It is designed to gather all the facts upfront to prevent delays and make sure your claim is assessed fairly.

This isn't just about red tape. The UK's pet insurance industry is bigger than ever, with insurers processing around 4,900 claims every single day . With that kind of volume, clarity and provable evidence are absolutely essential for the system to function and to combat insurance fraud, which costs the industry and its honest customers millions each year.

Why Every Detail Matters

Insurers need specific information to check your claim against your policy terms. This isn't meant to be difficult but it's a crucial step in tackling insurance fraud. Unfortunately, exaggerated or entirely false claims are a serious problem and they have a direct impact on the industry, eventually pushing up premiums for all of us responsible pet owners.

By providing clear, accurate and verifiable information right from the start, you don't just speed up your own claim—you also help create a fairer insurance system for everyone and fight the fraud that costs us all money.

This is exactly why the form asks for things like detailed vet reports, a full medical history and itemised invoices. They aren't optional extras. Each piece of information helps the insurer build a complete picture, allowing them to confirm that the treatment you're claiming for is definitely covered under your plan. This rigorous process is a key defence against fraudulent activity.

If you're ever unsure about what your policy includes, it's worth getting familiar with the different types available. Understanding concepts like lifetime cover, for example, can make a huge difference in what you can claim for. If you need a refresher, our UK guide to dog insurance lifetime cover offers a helpful overview.

The Rising Cost of Care

Another reason for this level of detail is the soaring cost of veterinary medicine. Vet treatment costs have shot up by around 60% over the last eight years , so the financial stakes are much higher for everyone.

To put it in perspective, managing a common condition like elbow dysplasia in a dog can easily cost over £50,000 during its lifetime. These staggering figures highlight why insurers have to be so meticulous when they verify every claim. Keeping this context in mind when you fill out your Pet Protect claim form helps you see why being thorough and accurate is so important for proving your case.

A Step-by-Step Guide to Completing the Form Accurately

Nailing your Pet Protect claim form is the single most important thing you can do to get a swift and fair payout. Think of it this way: your goal is to paint a crystal-clear picture of your pet’s situation and the costs involved. You want to leave absolutely no room for questions that could slow things down.

Precision isn't just about ticking boxes. It's about building a solid, undeniable and provable case for why your claim should be paid.

Every single part of that form is there for a reason, designed to gather the specific proof the insurer needs to validate everything. You'd be surprised how small errors, like getting a date wrong or giving a vague description of the illness, can grind the whole process to a halt. Insurers aren’t trying to be difficult; they are legally required to verify every last detail to uphold their policies and stamp out fraud.

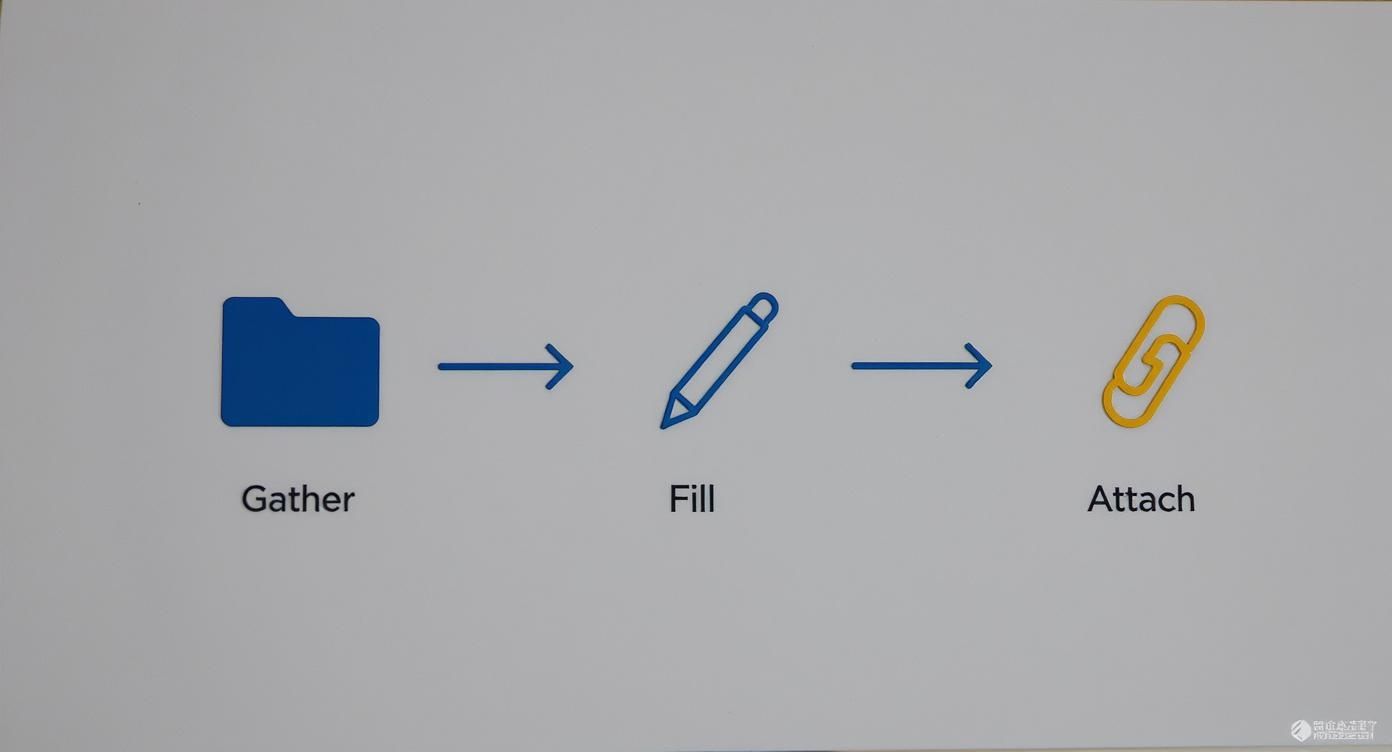

To make it simpler, you can break the whole process down into three key stages.

This little flow chart drives home a crucial point: get all your documents together before you even start filling out the form. It is the secret to a smooth, complete submission.

Describing the Condition or Injury

How you word this part is absolutely critical. Your description needs to be factual and, most importantly, match your vet's diagnosis perfectly. Insurers scan this section to confirm the condition is actually covered by your policy and isn’t a pre-existing issue if you're a newer customer.

Let's look at a couple of real-world examples:

- For an accident: Imagine your dog slips and fractures a leg. Don't just write "hurt leg." Instead, be specific: " On 15th May 2024, my dog slipped on wet pavement and sustained a fracture to his right foreleg, as diagnosed by the vet. " This gives them a clear, datable event they can work with.

- For an ongoing condition: With something like arthritis, the story is different. You would phrase it more like this: " Diagnosed with osteoarthritis in both hips on 10th January 2024. This claim is for ongoing pain management medication and hydrotherapy treatment administered from 1st June to 30th June 2024. "

See the difference? An accident is a one-off event. An ongoing illness needs you to clearly state the specific treatment period you’re claiming for.

Documenting Dates and Costs

Getting the dates and costs right is non-negotiable. Mismatched information between your form and the vet's invoices is one of the most common red flags and it will trigger a query and a delay.

Top Tips for Accuracy:

- Match Treatment Dates: Double-check that the treatment dates you write on the form are identical to the dates printed on the vet invoices.

- Itemise, Don't Bundle: List each cost separately, exactly as it appears on the itemised invoice. Don't just lump sums together. This means consultation fees, medication and X-rays should all get their own line.

- Check the Vet's Bit: Your vet has their own section to fill out. Before you send anything off, give their part a quick once-over to make sure the clinical details and dates line up with the information and invoices you’re providing.

Remember, the person reviewing your claim has never met you or your pet. The paperwork you send is the only thing they have to go on. Your Pet Protect claim form and its supporting documents must tell a complete, consistent story with no gaps or contradictions. This focus on provability is everything.

Assembling Your Evidence: The Key to a Provable Claim

A Pet Protect claim form is only as good as the evidence you send with it. Without solid, verifiable proof, you're essentially just asking the insurer to take your word for it. In an industry where fraud is a constant worry, that is rarely going to be enough. Building an undeniable case means giving the insurer every bit of verified information they need to approve your claim quickly and without any questions.

This focus on provability isn't about mistrust; it is about keeping the system fair for everyone and combating fraud. When claims come in with patchy or questionable evidence, it just creates delays. Worse, it contributes to an environment where insurance fraud can take root, which ultimately pushes up premiums for all the honest pet owners out there. Think of your evidence as the foundation of your claim—the stronger it is, the smoother the whole process will be.

Non-Negotiable Documentation

Some documents are absolutely essential. If you miss any of these, your claim will almost certainly be sent back with a request for more information, adding frustrating delays right when you don't need them.

- The Full Vet Report: This is much more than just a diagnosis. Insurers need to see the clinical notes, the vet’s observations and their reasoning. It helps them understand the full context of the treatment and confirm it matches the condition you’re claiming for.

- Itemised Invoices: A simple credit card slip just won’t cut it. You must provide a fully itemised invoice that breaks down every single cost, from the consultation fee to individual medications and procedures. This transparency is crucial for the insurer to check that each expense is legitimate and covered by your policy.

Another critical piece of the puzzle is your pet's complete medical history. Insurers will request this directly from your vet to check for any pre-existing conditions that might not be covered. Being upfront about your pet's health from the very beginning is always the best policy.

Proving Accidents and Injuries

For claims involving accidents or sudden injuries, visual evidence can be incredibly persuasive. A time-stamped photo or a short video clip showing the immediate aftermath can back up your version of events in a way that words alone just can't.

It is also helpful to understand that insurers take digital evidence seriously. Knowing the key challenges in digital forensics helps you appreciate why they place so much value on verified, unaltered proof.

Ultimately, your goal is to create a complete and cohesive submission that leaves no room for doubt. This diligence not only helps your own claim but also supports the wider industry’s efforts in fighting fraud before it happens with verified evidence. A well-documented Pet Protect claim form shows you’re responsible and can turn the approval process into a simple box-ticking exercise for the insurer.

The Hidden Costs of Insurance Fraud and Why It Affects Us All

Submitting a Pet Protect claim form is more than just paperwork; it is about upholding your end of an honest agreement. While the overwhelming majority of pet owners are truthful, the small number of dishonest claims have a surprisingly big impact on the entire industry. Ultimately, that affects every single policyholder.

Insurance fraud isn’t always some grand, elaborate scheme. It often starts small, with what might seem like a harmless exaggeration. A pet owner might be tempted to add a few extra items to a genuine claim or slightly inflate the cost of a vet procedure. In other cases, it is more deliberate, like claiming for a condition that never existed or one that started long before the policy began.

Whatever the scale, the outcome is always the same. Each fraudulent claim is a financial loss for the insurer. To cover these losses and protect themselves from future risk, insurers have no choice but to adjust their prices. This is where it hits home for the rest of us. The cost of fraud is passed directly onto honest customers.

The Ripple Effect on Your Premiums

The money used to pay out dodgy claims has to come from somewhere and that 'somewhere' is the pool of premiums paid by all the honest customers. When fraud becomes more common, the costs for insurers shoot up and they pass that increase on to everyone in the form of higher annual premiums.

It's a simple but harsh reality. A dishonest claim made by one person contributes to higher insurance costs for the entire community of responsible pet owners. We all end up paying for the actions of a few.

This is exactly why insurers place so much importance on proof for every claim. That meticulous checking of invoices, vet reports and medical histories isn’t there to inconvenience you. It is a necessary defence against fraud that protects the affordability of pet insurance for everyone.

A Growing Market Under Pressure

The UK pet insurance market has grown massively, with over 4.6 million active policies and forecasts suggesting it could double by 2030. But this growth brings challenges, including a rise in fraudulent claims which threaten the stability and affordability of the market. The industry has no choice but to be more vigilant.

Despite this pressure, pet insurance is still the most trusted insurance sector, which just goes to show the vital role it plays in caring for our animals. You can find more insights into the state of UK pet insurance on crif.co.uk.

That's why keeping the system honest and transparent is so important. By making sure your Pet Protect claim form is accurate and backed up with solid, provable evidence, you're doing more than just getting your own payout. You are helping to maintain a sustainable insurance ecosystem that stays affordable and available for all pet lovers when they need it most.

How Technology is Sorting Out Claim Verification and Tackling Fraud

Let's be honest, the old way of submitting a Pet Protect claim form involves a lot of paperwork. All that manual checking is slow and, unfortunately, leaves the door open for fraud. It is a headache the industry has wrestled with for years: how to verify claims efficiently while weeding out the dishonest ones that push up premiums for everyone.

But things are changing. A new approach is shaking up how both pet owners and insurers handle the claims process.

This shift is being driven by platforms that let you submit tamper-proof evidence straight from your smartphone. Instead of just snapping a standard photo of a vet bill (which could be edited), this technology captures verifiable, time-stamped images and data. It creates a secure digital footprint that proves your documents and evidence are the real deal, right from the moment you capture them.

This is a great example of how modern verification platforms like Proova give instant, clear validation for your evidence. For you, the policyholder, it means a faster and more transparent experience. For the insurer, it is a rock-solid way to confirm a claim’s legitimacy with confidence, making fraud significantly harder to perpetrate.

A Win-Win for You and Your Insurer

This kind of tech builds a more efficient and trustworthy system for everyone. If you're an honest customer, it's a much simpler way to put together a provable claim that can get sorted out much faster.

Benefits for Pet Owners:

- It's Simple: You can capture and send evidence like vet reports and receipts in seconds, just using your phone.

- It's Fast: Verifiable data means insurers can approve legitimate claims far more quickly. No more waiting around.

- It's Trustworthy: You are building a strong, undeniable case for your claim, which cuts down on all that frustrating back-and-forth.

For insurers, the upsides are just as big. They get authenticated, tamper-proof data that slots right into their workflow. This doesn't just speed things up on their end; it also acts as a powerful deterrent against opportunistic fraud. When they can trust the data coming in, they can get on with what they're supposed to be doing: paying genuine claims promptly. The wider benefits of this digital transformation in insurance to fight fraud are massive, helping keep the whole system fair and affordable.

By embracing this technology, the insurance industry can finally move from a reactive, investigative model to a proactive, preventative one. This creates more transparency and efficiency, which ultimately benefits honest policyholders the most.

The Bigger Picture: Compliance and Costs

Adopting secure verification methods also ticks a lot of boxes for the industry's regulatory duties. Technology is crucial for improving the integrity of claims and learning about new ways of simplifying compliance and audit readiness offers a valuable perspective on how the whole process is being improved. When insurers can easily show they have a robust process for validating claims, it reinforces their commitment to fair practice.

Ultimately, it all comes down to this: by making it easier for honest people to prove their claims and harder for dishonest people to cheat the system, this technology helps control the costs tied to fraud. That's a vital step towards making sure pet insurance premiums stay as low as possible for the millions of responsible owners who rely on it.

After You Submit: What to Expect and How to Avoid Common Pitfalls

So, you have sent off your Pet Protect claim form. That is a big step but the journey isn’t quite over yet. What comes next is often a bit of a waiting game and knowing what to expect can save you a lot of stress and frustration.

Once your claim lands in the insurer's system, it joins a queue to be looked at by an assessor. You should get an acknowledgement pretty quickly, usually an email within a few business days. This email is important—it confirms they have your documents and gives you a claim reference number. Keep this number handy; you will need it for any future chats.

How Long Does It All Take?

Honestly, the time it takes to process a claim can vary quite a bit. If your claim is straightforward—say, a minor procedure with crystal-clear evidence—you might see the money in your account within a week or two.

However, more complex cases will naturally take longer. Think ongoing conditions that require a deep dive into your pet’s history or high-value treatments that need extra scrutiny. If the claims assessor needs more information, they will get in touch with you or your vet directly. Don't panic if this happens. It is a normal part of the process and just means they're being thorough before giving the green light.

Common Mistakes That Slow Things Down

A few simple slip-ups can easily derail your claim after you have submitted it. Being aware of them from the start will help keep everything moving along.

- Going silent. If Pet Protect asks for more information, get back to them as quickly and completely as you can. Any delay on your part directly translates into a delay in their decision.

- Not keeping your own copies. Always, and I mean always , keep a copy of every single thing you send them. From the claim form itself to every last receipt and vet report. If something gets lost in transit, you can re-send it in a flash.

- Assuming no news is good news. If a couple of weeks go by and you haven't heard a peep, it's perfectly fine to send a polite follow-up. Don’t let your claim just sit there and gather dust.

One of the best bits of advice I can give is to keep all your communication clear and polite. A short, courteous email quoting your claim reference number is usually the most effective way to get an update without ruffling any feathers.

Following Up the Right Way

Chasing an update requires a bit of tact. You want to stay informed without coming across as pushy, which can sometimes do more harm than good.

When you do make contact, have your policy number and claim reference number ready to go. Clearly state when you submitted the claim and that you're just checking on its progress. This organised approach shows you're on top of your game and makes it much easier for their team to help you out.

The goal here is to navigate this final stage with confidence, understanding what is happening until you see the reimbursement land in your account. By sidestepping these common errors and managing the follow-up process well, you stay in control and minimise the uncertainty.

To make sure your evidence is solid from the get-go and to help speed up the whole process, consider using a tool designed for trust. Proova offers a simple way to capture tamper-proof evidence, helping you build a stronger, more verifiable claim that insurers can process with confidence. Learn more at https://www.proova.com.