A UK Guide to Dog Insurance Lifetime Cover

When it comes to insuring your dog in the UK lifetime cover is the gold standard. It's designed to provide financial support for vet fees throughout your dog's entire life covering both illnesses and injuries so long as you renew the policy each year. The real game-changer here is its approach to ongoing or chronic conditions which get continuous cover up to a set annual limit.

What Exactly Is Lifetime Dog Insurance?

Think of lifetime cover as a long-term healthcare promise for your four-legged friend. This isn't just about patching them up after a one-off accident or a short-term bug but about committing to their health for the long haul. This type of policy offers the highest level of protection available giving you invaluable peace of mind as vet costs continue to climb.

The core idea is simple but incredibly powerful. Every year you renew your policy the pot of money available for vet fees resets to its full amount. This is a lifeline for dogs that develop long-term conditions like arthritis, diabetes or stubborn skin allergies that need treatment year after year.

How Continuous Cover Works

Let's say your dog is diagnosed with a condition that will need managing for the rest of its life. With other more basic types of insurance the cover for that specific illness might stop after 12 months or once you hit a fixed financial cap. After that you're on your own paying for all future treatment out of pocket.

A dog insurance lifetime cover policy works completely differently. As long as you keep renewing it the insurer will continue to help with the costs for that condition year in year out.

The real value of lifetime cover lies in its renewal promise. The annual vet fee limit refreshes every single year ensuring that your dog can receive consistent, uninterrupted care for recurring or chronic health problems throughout its life.

This continuous protection is what truly sets it apart and makes it the top choice for so many UK dog owners. It means you can always make decisions based on what your vet recommends not on whether your insurance is about to run out.

To give you a clearer picture here’s a quick breakdown of what you can typically expect from a lifetime policy.

Lifetime Cover at a Glance

| Feature | How It Works |

|---|---|

| Annual Limit Reset | The maximum amount you can claim for vet fees resets every year when you renew your policy. |

| Chronic Condition Cover | Lifelong illnesses like diabetes or allergies are covered year after year up to the annual limit. |

| New Conditions | Any new injuries or illnesses your dog develops are covered provided they're not pre-existing. |

| Comprehensive Protection | This is the highest level of cover you can get offering the most security against unexpected bills. |

| Renewal Guarantee | As long as you keep up with your premiums the insurer will continue to offer cover for existing conditions. |

While the premiums might be higher than for more basic plans the security it provides against potentially massive vet bills is priceless. It acts as a robust financial safety net protecting both your dog’s health and your wallet and helps you avoid being underinsured just when you need that support the most.

Choosing the Right Cover for Your Dog

Trying to navigate the world of dog insurance can feel a bit overwhelming. You're faced with a handful of policy types all promising to protect your best mate but the truth is not all cover is created equal—especially when you think about their long-term health. Choosing the right plan means looking past the monthly premium and really thinking about how that policy will perform if your dog develops a chronic ongoing condition.

In the UK your main options boil down to three categories: Lifetime , Maximum Benefit and Time-Limited . They might sound similar at first glance but each one offers a completely different level of protection and ultimately peace of mind.

Understanding the Policy Types

The cheapest option you’ll come across is usually a Time-Limited policy. This type of cover protects your dog for a specific condition for a set period which is typically 12 months from the first treatment. Once that time is up or you hit the financial limit (whichever comes first) that condition is permanently excluded from future claims. You’re then left to foot the bill for any ongoing care yourself.

A Maximum Benefit policy is a bit of a step up. It gives you a fixed pot of money to treat a specific condition and there’s no time limit on when you can use it. The catch? Once you’ve used up that financial cap for an illness or injury the insurer won’t pay for any more treatment for that specific problem ever again.

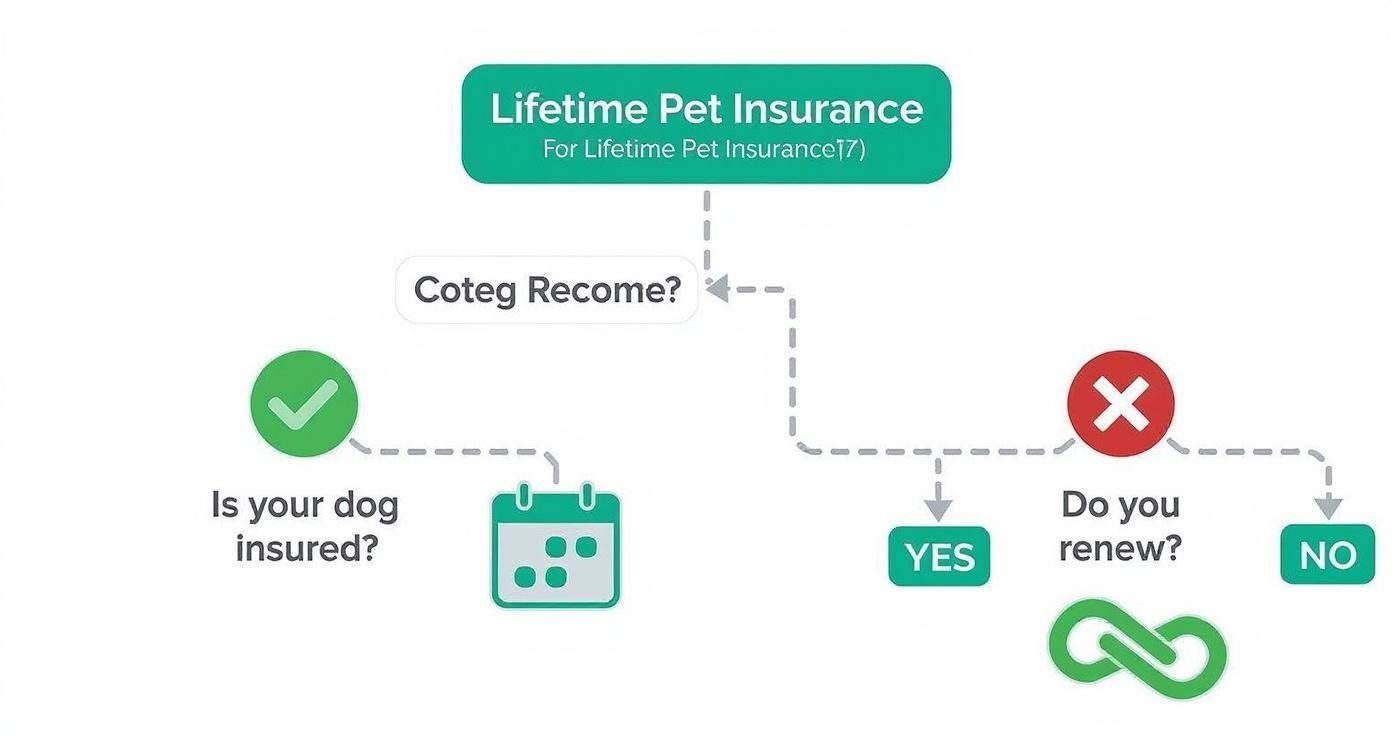

This decision tree helps to visualise how lifetime cover hinges on the simple act of renewing your policy each year to guarantee that continuous care.

As the graphic shows the real power of dog insurance lifetime cover is unlocked when you stick with it renewing your policy annually without fail.

A Clear Comparison

In stark contrast Lifetime Cover is designed for the long haul. Think of it as a safety net that rebuilds itself every single year. As long as you renew your policy the financial limit for vet fees resets giving you a fresh pot of money to use. This makes it the only type of policy that provides true ongoing support for chronic conditions like arthritis, allergies or diabetes that require years of management.

To make the differences crystal clear let's put them side-by-side.

Dog Insurance Policy Types Compared

Looking at the core features of each policy type really highlights how different the levels of protection are particularly when it comes to long-term health issues.

| Policy Type | Cover for Chronic Conditions | Financial Limit | Best For |

|---|---|---|---|

| Lifetime | Covered year after year as long as the policy is renewed. | A set annual limit that resets at renewal. | Owners seeking comprehensive long-term protection for total peace of mind. |

| Maximum Benefit | Covered until the financial limit for that condition is reached. | A fixed limit per condition with no time restriction. | Owners of dogs with a lower risk of chronic illness who want a mid-level cover. |

| Time-Limited | Covered for a set period (e.g. 12 months ) or until the limit is hit. | A fixed limit per condition that is also restricted by time. | Owners on a strict budget who need cover for short-term illnesses or accidents. |

While Time-Limited and Maximum Benefit policies can look like a tempting cost-effective choice at first their limitations become painfully obvious when you're faced with a recurring or lifelong health issue. For owners who want to ensure they can always afford the best possible care for their dog no matter what lifetime cover offers a far more robust and reliable solution. It’s about aligning your financial security with your dog’s potential long-term veterinary needs.

The True Cost of a Lifetime Policy

It’s easy to focus on the monthly premium but the real cost of dog insurance lifetime cover is a much bigger conversation. It’s about striking a balance between that upfront payment and the massive often unpredictable costs of modern vet care. You also have to understand how your own situation shapes the price you’ll pay.

There’s no getting around it: lifetime cover usually comes with a higher premium than other policies. That’s because it offers the most comprehensive long-term protection acting as a financial safety net for the worst-case scenarios. But insurers don't just pluck these numbers from thin air; your premium is carefully calculated based on a few key factors.

What Determines Your Premium?

The price you're quoted is a direct reflection of risk. When an insurer works out how likely you are to make a claim several pieces of the puzzle come into play.

- Your Dog's Breed: Some pedigree dogs are simply more susceptible to hereditary conditions. A French Bulldog for example carries a higher risk of breathing issues than a sturdy crossbreed and the premium will reflect that.

- Your Dog's Age: It's no surprise that younger dogs are cheaper to insure. As your dog gets older and the likelihood of needing veterinary care increases so will the premiums.

- Your Postcode: Vet fees vary wildly across the UK. If you live in London or the South East where treatment costs are higher you can expect a higher premium than someone living in other parts of the country.

These factors help an insurer build a clear picture of the potential costs. But there's another piece to this puzzle that affects everyone's premiums: the integrity and provability of the claims process itself.

The Hidden Costs We All Share

For the insurance model to work claims must be provable. This is a crucial step to prevent fraud which is a significant problem for the industry. Dishonest claims whether it’s exaggerating a condition or submitting completely fake invoices create huge operational costs for insurers who have to invest time and money into fraud detection and verification. The entire system relies on genuine claims backed by evidence.

Insurance fraud isn't a victimless crime. The cost of investigating and managing fraudulent activity is ultimately passed on to all honest policyholders in the form of higher premiums for everyone.

This shared responsibility is why transparent provable claims are so vital. The cost of a lifetime policy isn't just your monthly payment; it’s also influenced by the collective honesty of all pet owners. Keeping the system fair helps keep premiums as affordable as possible. By choosing the right cover and only making legitimate provable claims you’re doing your part to build a more sustainable insurance market for every dog owner in the UK.

Underinsurance and the Hidden Cost of Fraud

Choosing a dog insurance lifetime cover policy is a big step. But trying to save a few pounds by picking a cheaper less comprehensive plan can backfire sometimes with devastating consequences. The risk of underinsurance is a very real and growing problem for dog owners across the UK. It usually starts with an innocent decision: picking a policy that looks good on paper but just doesn't have the muscle to handle a serious diagnosis.

When a vet bill lands that's far higher than your policy's payout limit you're left in an awful position both financially and emotionally. Suddenly you might be scrambling to find thousands of pounds to cover the gap or even worse facing heartbreaking choices about your dog's care. This kind of situation defeats the entire purpose of having insurance in the first place—to be a safety net when you need it most.

It's tempting to go for a lower annual limit to keep the monthly premium down and that's understandable. But with vet fees for complex treatments easily hitting four or five figures a policy with a low cap can be wiped out by a single illness or accident. That leaves you completely exposed for the rest of the year.

The Problem of Dishonest Claims

Beyond the personal risk of being underinsured the pet insurance world is grappling with a challenge that affects every single honest policyholder: fraud. This isn't some victimless issue; it has a real tangible impact on the price of cover for everyone. Insurance fraud erodes trust and inflates costs across the board impacting the entire industry.

Fraudulent activity isn't always as dramatic as inventing a phantom pet. More often it's the small deliberate deceptions that quietly add up to a massive problem for insurers.

- Exaggerating Conditions: A pet owner might inflate the severity of a genuine illness to try and claim for more expensive treatments they didn't actually receive.

- Fabricating Treatments: In some cases people submit claims for vet visits or procedures that never even happened.

- Hiding Pre-existing Issues: Not disclosing a condition your dog had before the policy started is a common type of fraud and it can invalidate your cover entirely.

These dishonest claims force insurers to spend a fortune on sophisticated fraud detection systems and investigation teams. The cost of rooting out the false claims is significant and unfortunately those expenses get passed on to all customers in the form of higher premiums.

The hard truth is that every fraudulent claim paid out adds to a pool of losses that insurers have to recover. Inevitably this is reflected in higher premiums for the entire community of responsible dog owners.

A Shared Responsibility for Fair Premiums

This creates a frustrating cycle where a dishonest minority makes essential cover more expensive for the honest majority. Keeping dog insurance lifetime cover affordable is therefore a responsibility we all share. By giving accurate information and only making honest provable claims you help keep the system fair and sustainable for everyone. The fight against insurance fraud costs the industry billions annually and you can learn more about what insurance fraud really costs us all.

Ultimately choosing a policy with the right level of cover and being honest in your dealings doesn't just protect your own dog. It helps protect the whole community of pet owners who rely on insurance to give their companions the best care possible. It ensures the system works as it should providing reliable support without being undermined by deception.

Understanding Policy Limits and Exclusions

Let's be clear: no insurance policy is a blank cheque and a dog insurance lifetime cover plan is no different. Getting to grips with what is and isn't covered is vital to avoid nasty surprises when you need support the most.

Taking the time to read the small print before you commit is one of the most important things you can do as a responsible owner. The policy documents can look a bit daunting but they contain crucial information about exclusions annual limits and the excess you’ll have to pay. Nailing these concepts down now means you’ll have a realistic idea of what your cover can actually do for you.

Common Policy Exclusions

Every lifetime policy will come with a list of exclusions. These are simply specific situations or treatments that the insurer won’t pay for. While the exact details vary between providers some exclusions are pretty standard right across the industry.

It's really important to check these before signing on the dotted line so you’re fully in the picture about what falls outside your cover.

You'll almost certainly come across exclusions for things like:

- Pre-existing Conditions: This is a big one. Any illness or injury your dog showed signs of before the policy started won't be covered.

- Routine and Preventative Care: Standard treatments like vaccinations flea and worming treatments grooming and dental check-ups are considered your responsibility.

- Elective Procedures: Things that aren't medically essential such as neutering or spaying are typically excluded from cover.

- Pregnancy and Birth: Any costs linked to breeding pregnancy or giving birth are not usually covered.

Vet Fee Limits and Your Excess

Two of the most important numbers in your policy are the annual vet fee limit and the excess . The vet fee limit is the absolute maximum your insurer will pay out for all your claims put together in a single policy year. The beauty of a lifetime policy is that this limit resets to its full amount every time you renew.

The excess is the amount you have to chip in towards a claim before the insurer pays the rest. It's a fixed amount you agree to when you take out the policy and you’ll pay it for each new condition you claim for. Some policies have a compulsory excess set by the insurer while others let you choose a voluntary amount on top. You can learn more about how compulsory and voluntary excess is explained clearly in our detailed guide.

Reading your policy documents isn't just a formality; it's a vital step in responsible pet ownership. Knowing your limits exclusions and excess empowers you to use your dog insurance lifetime cover effectively and avoid the stress of a rejected claim.

By getting familiar with these key elements you can be confident that your policy will provide the financial help you expect. It turns your insurance from a piece of paper into a reliable safety net for your dog’s health.

Why Lifetime Cover is the UK's Top Choice for Dog Owners

It's no accident that lifetime cover has become the go-to choice for so many dog owners across the UK. Look at the numbers and you'll see it’s the most popular policy by a country mile. The reasons are simple: it offers a powerful combination of financial security and genuine peace of mind which is more important than ever as vet fees continue to climb.

The reality is thanks to amazing advances in veterinary care our dogs are living longer. While that's fantastic news it also means a higher chance of them developing long-term age-related conditions like arthritis, diabetes or heart trouble. These aren't one-off problems; they need consistent and often expensive management. That’s where having continuous insurance cover really shows its worth.

The Clear Market Leader

Industry data paints a very clear picture. Lifetime policies now make up around 60% of the entire UK pet insurance market . That’s a huge slice of the pie and it signals a real shift in what owners are looking for: long-term dependable protection.

With the average cost per claim now hovering around £2,500 predictability is king. For over 70% of pet owners knowing their cover won't suddenly disappear is the number one reason they opt for a lifetime policy. You can get more insight into these shifts from the latest UK pet insurance market trends.

This isn't just about preparing for a single dramatic emergency. It's a smart response to the very real possibility of managing an ongoing health issue that could otherwise become a heavy financial weight.

Putting Your Dog's Health First, Always

When you boil it all down the popularity of lifetime cover comes from one fundamental benefit: it allows you to make decisions based on your vet's advice not your bank balance. If your dog is diagnosed with a condition that will need care for the rest of their life the last thing you want is the nagging worry that your insurance is about to run out.

A lifetime policy takes that agonising choice between your dog’s health and your finances off the table. It means that when your vet recommends a treatment plan your only focus needs to be on your dog's wellbeing not the bill.

That reassurance is priceless. It provides a solid financial safety net empowering you to give your dog the best possible care at every stage of their life from their chaotic puppy days right through to their gentle senior years. And that security plain and simple is why lifetime cover remains the undisputed top choice for UK dog owners.

Frequently Asked Questions

It’s completely normal to have a few questions when you’re digging into the details of dog insurance lifetime cover . Getting your head around these common queries is the best way to feel confident you're making the right choice for your dog's future.

Will My Premium Increase Every Year?

Yes it’s very likely you’ll see an increase when your policy renews each year. This isn't just a random price hike; it's a reflection of a few key things: your dog's age the rising cost of vet care right across the UK and any claims you might have made over the past year.

While no one likes seeing prices go up jumping ship to a new provider can be a really risky move. A new insurer will almost certainly view any conditions your dog has already developed as pre-existing which means they’ll be excluded from your new policy.

What Is Not Covered by a Lifetime Policy?

No insurance policy covers absolutely everything and lifetime plans are no different. Understanding what’s typically excluded helps set realistic expectations for what your insurance is there to do.

Common exclusions usually include:

- Pre-existing Conditions: Any illness or injury your dog showed signs of before your policy started.

- Routine Preventative Care: This covers things like vaccinations worming flea treatments and regular check-ups.

- Elective or Cosmetic Procedures: Treatments that aren't medically necessary such as neutering or spaying usually aren't covered.

Always take the time to read your policy documents carefully for a full list of what is and isn't included. If you have more general queries you might find our wider guide covering frequently asked questions useful.

Can I Get Lifetime Cover for an Older Dog?

This is where things can get tricky. Most insurers have an upper age limit for taking out a new policy which is often around eight or nine years old. Trying to insure an older dog for the very first time can be tougher and will definitely be more expensive.

But this is exactly where the real magic of a lifetime policy comes into play. Once your dog is insured the provider will typically continue to offer you cover for the rest of their life no matter how old they get or what health issues crop up. That continuity is precisely why it’s so important to get dog insurance lifetime cover in place while your dog is still young and healthy.

The growing reliance on these policies is clear from the industry figures. Back in 2021 UK insurers were paying out around £2.4 million every single day for pet claims with the total hitting £872 million for the year. This just goes to show the vital financial safety net that lifetime policies provide against ever-increasing vet costs. You can learn more about these UK pet insurance statistics on hepper.com.

Protecting your assets is crucial but proving ownership after a loss can be a major challenge. Proova simplifies this by creating an indisputable record of your belongings making insurance claims faster and more straightforward. Secure your peace of mind and ensure fair swift resolutions when you need them most. Visit https://www.proova.com to see how it works.