Waiver of Subrogation: A Practical UK Insurance Guide

A waiver of subrogation is a complex legal term but the idea behind it is straightforward. It is a contractual agreement where you essentially tell your insurance company they cannot go after a specific third party to recover their money after paying your claim.

In short you agree upfront that your insurer cannot sue a particular person or business even if that party caused the loss. This kind of clause is a cornerstone of UK commercial contracts and it is all about preventing messy expensive legal fights between business partners.

What a Waiver of Subrogation Means for You

Let's make this real. Imagine you are a landlord and your tenant accidentally starts a fire that damages your building. Normally your insurance company would step in, pay for the repairs and then turn around and sue the tenant to recover those costs. That legal process is called subrogation.

But if there is a waiver of subrogation in the lease it stops that lawsuit dead in its tracks.

By signing that waiver you are instructing your insurer to give up their right to sue the tenant. This is not just a minor detail in the paperwork; it is a fundamental shift in how risk is handled between everyone involved. The financial buck stops with your insurance policy. This is exactly why these waivers are so common in situations where different parties are working closely together. Think about:

- Construction Projects: A main contractor will nearly always ask subcontractors for a waiver. It prevents a circus of insurers suing each other after an accident on site which could bring the whole project to a grinding halt.

- Commercial Leases: Landlords and tenants use them to keep the peace. A simple property damage claim should not have to blow up into a massive legal dispute that sours the relationship.

- Vendor Agreements: Businesses often include them in contracts with key suppliers to protect collaborative partnerships from the friction of insurance-related lawsuits.

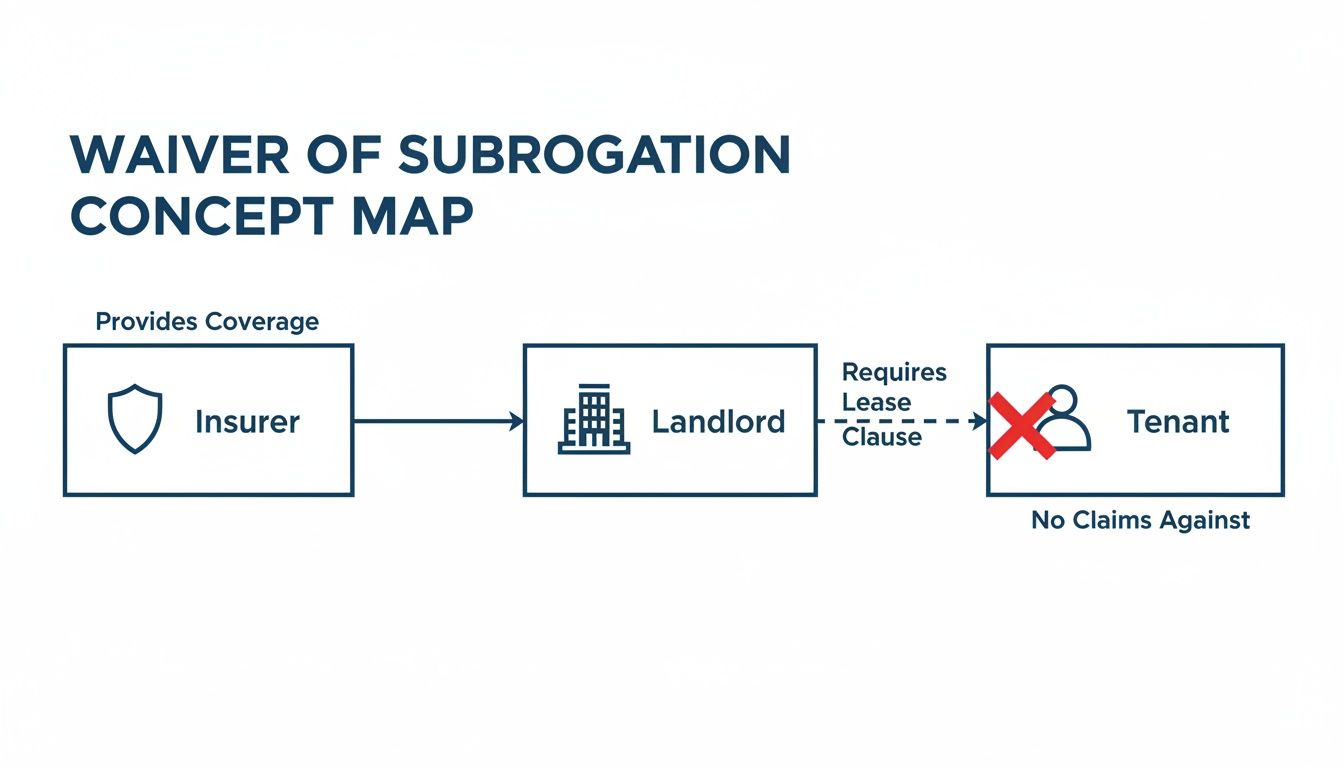

This diagram perfectly shows how the waiver acts as a shield breaking the chain of recovery that would normally lead back to the tenant.

As you can see the insurer pays the landlord for the loss but the usual path to get that money back from the tenant is completely blocked by the waiver.

The Hidden Costs and Risks

While these waivers are great for keeping business relationships smooth they do not come without a catch. When an insurer gives up its right to recover its losses it absorbs the full financial hit of the claim. Naturally that increased risk often gets passed back to you the policyholder in the form of higher premiums. For the industry as a whole it is one of the factors that can contribute to rising insurance costs over time for all of us.

Even more concerning is how a waiver of subrogation can unintentionally open the door to fraud. If a third party knows they are protected from being sued they might become careless—or worse intentionally cause or exaggerate a loss. This puts a much heavier burden on you to prove your claim is legitimate. To really get your head around this it helps to understand the fundamentals of liability insurance as this is the bedrock of who pays for what when things go wrong.

The Legal Framework for Subrogation in English Law

Under English law subrogation is not just some dusty clause tucked away in an insurance policy. It is a principle rooted in fairness designed to stop an insured party from getting paid twice for the same loss—once from their insurer and then again from whoever caused the damage in the first place. This long-standing doctrine gives an insurer the right to step into their policyholder's shoes after paying a claim allowing them to chase the responsible third party for the costs.

This right is the default position. A waiver of subrogation however contractually sets this right aside. It is a deliberate pre-agreed decision between parties to manage risk differently. The idea is to ensure any financial loss stops with the insurer preventing a messy cycle of blame and litigation between business partners. But whether this waiver actually holds up in court often comes down to the precise wording and context something UK courts have spent a lot of time examining.

Explicit vs Implied Waivers

Ideally a waiver of subrogation is spelled out clearly as an explicit term in a contract. This leaves no room for doubt and gives you a solid defence if an insurer later tries to pursue a recovery action. Relying on an implied waiver—one that is not written down but is assumed to exist from the context of the agreement—is a much riskier game to play.

For a court to recognise an implied waiver they need to be completely convinced that both parties fully intended for insurance to be the one and only source of compensation for a particular loss. This often spirals into costly and unpredictable legal battles with each side arguing over what was really meant when the contract was signed. The legal fees alone can run into the millions completely defeating the purpose of having the waiver in the first place.

Without precise drafting an insurer’s default right to pursue recovery can ignite damaging legal conflicts between contractually linked businesses underscoring the high cost of legal uncertainty.

A classic example of how courts interpret implied waivers is the landmark UK Court of Appeal decision in the Ocean Victory case. The court ruled that where parties are co-insured under a single policy a waiver of subrogation is generally implied because it is seen as an "insurance-funded solution" agreed upon by everyone. After this ruling the use of waivers in marine insurance shot up by 45% . On a wider scale the Association of British Insurers (ABI) noted in 2023 that waivers saved an estimated £2.1 billion in legal pursuits. That is a saving that could translate to a 10% premium reduction for policyholders. You can learn more about the far-reaching impact of subrogation decisions on the industry.

The Burden of Proof and Contractual Certainty

The legal system places a huge emphasis on clear contractual language. If a waiver is poorly drafted or its scope is vague it can be challenged and ultimately thrown out by a court. This is exactly why businesses must ensure any waiver of subrogation is meticulously defined within their agreements.

This need for contractual certainty is also vital when you are making a claim. Policyholders have to be able to show that their insurance arrangements are solid and that all parties understand their respective roles and responsibilities. Keeping clear records is non-negotiable and knowing how to properly present evidence of cover is a critical skill. For a deeper dive check out our complete guide to a certificate of insurance which explains exactly how this document proves your coverage is in place.

The bottom line is simple: while English law provides the framework it is up to the parties involved to build the contractual certainty needed to make a waiver stick and avoid a costly dispute down the line.

How Waivers Affect Different UK Insurance Policies

A waiver of subrogation is not just some dusty legal term; it is a practical tool used every single day across the UK insurance market. Its real-world impact changes dramatically depending on the industry and the policy in question fundamentally altering how risk is shared between business partners.

In some sectors these waivers are so common they are simply part of doing business. They are essential for keeping commercial relationships on track and stopping projects from getting bogged down in expensive time-consuming legal fights.

Construction Projects and JCT Contracts

The UK construction industry is probably the best place to see waivers of subrogation in action. Think about a large building site—it is a complex web of project owners main contractors and dozens of subcontractors all working side-by-side. The potential for one person's mistake to cause a massive loss for everyone else is incredibly high.

To head off a domino effect of lawsuits after an incident Joint Contracts Tribunal (JCT) contracts —the gold standard in UK construction—almost always include waiver of subrogation clauses. In practice this means if a subcontractor accidentally starts a fire that damages the whole site the project owner's insurer pays for the loss and then stops. They cannot turn around and sue the subcontractor to get their money back.

This simple clause keeps vital working relationships intact and allows the project to continue. It ensures insurance is the final stop for the financial loss not the first step towards a courtroom battle. Without it the constant threat of being sued would create a toxic uncooperative environment on site.

Commercial Property and Leases

In the world of commercial property the relationship between a landlord and tenant is another prime example of where these waivers are critical. A standard commercial lease will typically require both the landlord and the tenant to have their own insurance policies.

A waiver of subrogation clause in that lease makes sure that if a tenant’s negligence causes say water damage to the building the landlord’s insurer cannot chase the tenant for the repair costs after paying the claim. This is a huge protection for the tenant against a lawsuit that could bankrupt them and it helps maintain a stable predictable relationship for the landlord.

To really grasp how these waivers change the game it is worth understanding the basics of navigating home insurance claims as the core principles of proving a loss are similar no matter the policy type.

Professional Indemnity Insurance

When we move into financial lines insurance especially professional indemnity (PI) waivers become crucial for managing risk inside a company. A PI policy is there to protect a firm from claims that its professional advice or services were negligent.

Imagine a firm has to pay out a large negligence claim. Normally the insurer might look at the situation and try to subrogate—or recover its losses—from the individual employee who made the mistake. A waiver of subrogation built into the PI policy blocks this completely. It shields employees from being personally sued by their own company's insurer which is absolutely vital for morale and retaining top talent in professions like law accountancy and architecture.

This area is getting a lot of attention from regulators. For instance planned SRA updates in 2025 will lift indemnity limits from £1.5 million to £2 million partly driven by court cases where subrogation was insurers' only path to recovery after dishonest acts. Looking back PI claims totalled £4.5 billion between 2018-2023 and subrogation was successful in 25% of cases involving condoned dishonesty. While UK insurers estimate that waivers cut their administrative costs by £500 million a year they also create a risk if a major loss blows past the policy limits.

A waiver of subrogation clause is a commercial decision to prioritise business relationships over an insurer's right to recovery placing the financial burden squarely on the insurance policy itself.

By understanding how these waivers work in different real-world scenarios business owners and risk managers can make much smarter decisions. Whether it is on a building site in a leased office or within a professional firm the goal is always the same: use insurance to absorb a financial hit without destroying valuable commercial partnerships in the process.

The Hidden Costs of Ambiguity and Insurance Fraud

While a waiver of subrogation is a powerful tool for keeping commercial relationships running smoothly any ambiguity in the wording can create a costly legal minefield. A poorly drafted clause does not just cause confusion; it can ignite disputes that spiral into millions in litigation completely defeating the waiver's core purpose of preventing conflict.

When the scope of a waiver is not crystal clear it is practically an invitation for a legal challenge. Parties can get bogged down in a protracted court battle arguing over who was meant to carry the financial loss. This uncertainty not only poisons business relationships but also racks up enormous legal fees that can easily dwarf the original claim amount. This ultimately pushes up insurance costs for everyone.

The High Price of Imprecise Language

The financial stakes of a poorly drafted waiver of subrogation are immense. When contractual language is vague the default legal principles of recovery come roaring back. This forces courts to try and interpret the original intentions of the contract often years after it was signed.

A recent UK Court of Appeal case Royal & Sun Alliance v Textainer illustrates this danger perfectly. The dispute centred on how to allocate a staggering USD 101 million loss a conflict born entirely from imprecise clauses. The court's ruling clarified that while subrogation aims to prevent double recovery a waiver must be completely explicit to override an insurer's default rights. This case is a stark reminder of how ambiguous wording directly leads to millions in disputed funds and reinforces the absolute need for clear unequivocal terms.

How Waivers Can Open the Door to Fraud

Beyond contractual disputes a waiver of subrogation can create a more sinister problem: insurance fraud . By shielding a third party from being sued by an insurer a waiver can inadvertently create a moral hazard . This is a situation where a party knowing they are protected from financial fallout has less incentive to prevent a loss—or may even be tempted to cause one.

For example a contractor protected by a waiver might be tempted to use substandard materials or cut corners on safety. They know that if something goes wrong the project owner's insurance will have to pay up without coming after them. In a more extreme scenario a protected party might deliberately cause or exaggerate the extent of damage confident that they are immune from a recovery action.

This moral hazard dramatically raises the stakes for the policyholder. They now face a much greater burden to prove that their claim is entirely legitimate as the insurer will scrutinise it with increased suspicion.

This environment of heightened risk ultimately affects everyone. Insurers must factor the increased potential for fraud into their pricing models which leads to higher premiums for all policyholders. The cost of this fraud is not just absorbed by the insurance industry; it is a financial burden passed on to every business and consumer. To grasp the sheer scale of the problem it is helpful to understand what insurance fraud really costs the industry.

Ultimately a waiver of subrogation shifts risk in a profound way. It places a heavy emphasis on the provability of a claim and demands absolute clarity in the contract. Without these safeguards what starts as a tool for commercial harmony can quickly become a catalyst for costly litigation and a gateway for fraudulent activity that we all end up paying for.

Managing Your Risk with Clear Contracts and Technology

So we have seen the potential problems. Let's move on to the practical solutions. Proactive risk management is your strongest defence against the pitfalls of a waiver of subrogation and it all starts with your contracts.

The most crucial element is ensuring your contracts contain clear unambiguous language. Think of ambiguity as the enemy of certainty—it is an open invitation for costly legal disputes down the line.

When a waiver is poorly worded it creates a grey area that can be exploited. This could render the entire clause useless exposing you to the very litigation it was meant to prevent. This places a huge burden on everyone especially the policyholder who now has to prove their claim's legitimacy under a microscope. The financial fallout can be crippling completely undermining the business harmony the waiver was supposed to protect.

Strengthening Your Contractual Defences

The main goal of any waiver of subrogation clause should be to eliminate doubt. Vague terms like "reasonable efforts" or undefined scopes of work are common contractual traps. They have to be avoided at all costs.

An effective waiver clause is specific and direct. It needs to clearly identify:

- The Parties Involved: Name the exact individuals or entities the waiver applies to.

- The Scope of the Waiver: Detail the specific types of claims and losses being covered.

- The Duration: Define exactly when the waiver begins and ends tying it directly to the contract's lifecycle.

A meticulously written waiver acts as a contractual firewall. It heads off legal challenges by leaving no room for interpretation ensuring that the agreement to shift risk to the insurer is legally solid and enforceable. This clarity is not just good practice; it is a fundamental risk management strategy.

This precision is vital. A court will scrutinise every word and any weakness can be used to tear down the waiver. That re-opens the door for subrogation claims and the associated costs that ultimately impact us all through higher premiums.

The Role of Technology in Proving Claims

While strong contracts are your first line of defence modern technology offers a powerful second layer of protection. This is particularly true when a waiver of subrogation shifts the burden of proof onto the policyholder and frankly creates opportunities for insurance fraud. The age-old challenge has always been proving what you owned and its condition before a loss.

Digital platforms offering asset verification and authentication provide the answer. By creating an indisputable time-stamped digital record of an asset's existence condition and serial number before anything goes wrong you build a powerful evidence locker. This makes it significantly harder for fraudulent claims to succeed and much much easier for honest policyholders to validate their losses swiftly.

This technological proof is invaluable in a scenario where an insurer’s right to recover costs from a negligent third party has been signed away. It gives the insurer the confidence needed to process the claim without dragging their feet or sparking unnecessary disputes.

To see how this works in practice you can learn more about how specialised insurance claims management software can streamline the process and combat fraud. By combining robust contracts with verifiable digital records businesses can effectively manage the risks tied to a waiver of subrogation protecting their relationships and their bottom line.

Key Takeaways for Managing Your Insurance Risk

A waiver of subrogation is a powerful tool for smoothing over business relationships but it is a double-edged sword that introduces serious risks if you are not careful. It is a calculated gamble—choosing to prioritise commercial harmony over your insurer’s right to chase a negligent third party for costs.

But make no mistake that decision has a ripple effect on the cost of insurance for everyone. When insurers are forced to absorb the full financial hit of a claim with no way to recover their losses that increased risk inevitably gets baked into higher premiums across the board. The cost does not just vanish; it gets redistributed.

On top of that these waivers can accidentally create a breeding ground for insurance fraud. By shielding a party from financial blowback a waiver strips away a major incentive to be careful and can tempt dishonest players to inflate or even invent claims. This places a much heavier burden on you the policyholder to prove your loss is completely legitimate.

Your Strategic Action Plan

Being proactive about risk management is not just a good idea; it is absolutely essential. You need a clear deliberate approach to navigate the minefield of these waivers. Here are the core actions you must take:

- Prioritise Legal Counsel: Never ever agree to a waiver of subrogation without getting professional legal advice first. The exact wording is everything. One misplaced comma or ambiguous phrase could render the clause useless and expose you to incredibly costly disputes down the line.

- Understand Industry Context: Realise that a waiver’s impact varies wildly from one sector to another. A clause tucked into a construction contract carries entirely different weight than one in a professional indemnity policy. You have to tailor your approach to the specific context.

- Embrace Technology for Provability: Use modern tools to create an ironclad indisputable record of your assets before a loss ever happens. Digital verification technology strengthens your hand makes it far harder for fraudulent claims to stick and simplifies the entire claims headache.

Ultimately managing the risks tied to a waiver of subrogation comes down to being empowered by knowledge. When you understand the costs the fraud risks and the challenges of proof you can handle your contractual duties proactively instead of just reacting to expensive problems after they have already happened.

Frequently Asked Questions

Getting your head around the details of a waiver of subrogation is the key to managing your contractual risks. Let's tackle some of the most common questions that crop up when dealing with this vital insurance concept.

Does a Waiver of Subrogation Increase My Insurance Premium?

Yes it often can. When you agree to a waiver of subrogation you are asking your insurer to give up a valuable right: the ability to recover money from a party that may have caused the loss. This naturally increases the insurer's potential payout on a claim.

To offset this increased risk the insurer will likely charge a higher premium for the policy or for an endorsement that adds the waiver. The cost increase varies depending on the insurer the industry and the level of risk involved in the contract. It is crucial to weigh the additional premium cost against the commercial benefit of preventing messy lawsuits between you and your business partners.

What Is the Difference Between a Waiver of Subrogation and 'Additional Insured' Status?

While both are used to protect third parties they work in completely different ways. Naming a party as an 'additional insured' grants them coverage under your policy for claims arising from your work or operations. In short they become an insured party themselves.

A 'waiver of subrogation' is much narrower. It does not give them any insurance coverage but simply stops your insurer from suing them to recover claim payments. It is very common for contracts to require both. For example a general contractor might require a subcontractor to name them as an additional insured and provide a waiver of subrogation making sure they are protected from all angles.

Think of it this way: an 'additional insured' status brings someone under your insurance umbrella. A waiver of subrogation simply agrees not to throw a legal stone at them from outside the umbrella. Both protect but in fundamentally different ways.

Can a Waiver of Subrogation Be Implied Under English Law?

Under English law a waiver can sometimes be implied but relying on this is incredibly risky. The landmark Ocean Victory case showed that courts may imply a waiver in a joint insurance situation where it is clear the parties intended for insurance to be the sole remedy for a loss.

However this often leads to expensive legal battles just to figure out what the parties originally intended. The best and standard business practice is to have an explicit clearly-worded waiver of subrogation clause written directly into the contract. This removes all ambiguity and ensures the agreement is enforceable preventing costly litigation down the line.

A clearly defined contract is your best defence but proving the details of a claim is where many policyholders fall short. Proova provides the technological certainty you need by creating an indisputable digital record of your assets before a loss occurs. Strengthen your claims protect against fraud and get paid faster. Discover how Proova can secure your assets today at https://www.proova.com.