Your Guide to a Certificate of Insurance

A certificate of insurance is far more than just another bit of administrative paperwork; it is your business's tangible proof of protection.

Think of it like an MOT certificate for a car. It does not tell you the whole history but it confirms that on a specific date, the vehicle was roadworthy. In the same way, a certificate of insurance is a crucial snapshot, confirming that an active insurance policy is in place. This simple document is absolutely essential for managing risk in any commercial relationship.

Why a Certificate of Insurance Is Non-Negotiable

In the world of business—especially in high-stakes sectors like construction and events—trust is vital but verification is everything. A certificate of insurance offers immediate, concrete assurance that your partners are covered. It is your first line of defence against a major financial loss if something goes wrong.

Without this document, a client has no real way of knowing if a contractor they have hired has the right public liability cover. If an accident happens on site, that client could suddenly find themselves liable for damages, legal fees and massive compensation claims. The certificate is designed to close that gap, offering provable evidence of cover.

The True Cost of Skipping Verification

Here is the problem: simply accepting a certificate at face value without proper checks can be catastrophic. Insurance fraud is a huge issue and these documents are prime targets for being doctored or completely fabricated. An altered expiry date on an old certificate or a totally fake document can create a devastating illusion of security.

If an incident occurs and the certificate turns out to be fraudulent, any claim made against that policy will be worthless. This leaves you exposed to the full financial fallout. This is not just a problem for individual businesses; it is a criminal activity that impacts the entire industry, driving up premiums for every honest policyholder.

The core issue is that a certificate only proves cover existed on the day it was issued. It is no guarantee that the policy is still active or that the premiums have been paid. Verification is the only way to confirm you are protected right now.

The Foundation of Business Trust

Ultimately, the proper use and verification of insurance certificates is fundamental to building trust in the insurance industry . It provides a clear, standardised way for businesses to demonstrate responsibility and manage their risk effectively.

The UK insurance market is enormous—it manages investments of around £1.91 trillion and stands as the fourth largest in the world. Within this vast system, certificates are the everyday tools that confirm contractors, suppliers and partners have the necessary cover to operate safely and professionally.

Understanding this document is not just about ticking a compliance box; it is about actively safeguarding your financial future. It ensures that when you enter a partnership, the safety net you believe is there is real, active and ready to protect you from the unexpected.

So, you have been handed a Certificate of Insurance. At first glance, it can look like a wall of jargon, codes and dates. It is easy to feel overwhelmed.

But think of it like a business passport. Each stamp and detail tells a story, verifying that a company has the credentials it needs to operate safely. Learning to read it turns a confusing piece of paper into a powerful risk management tool, allowing you to quickly see if a contractor or partner meets your standards.

The Core Components of the Certificate

Every certificate, no matter who issued it, follows a standard layout. These details work together to give you a complete snapshot of the insurance policy. If any of this information is missing or does not match what you have been told, it should be an immediate red flag.

The first things you will always see are:

- The Policyholder: This is simply the name and address of the business or person holding the insurance policy. You will want to make sure this matches the details of the company you are about to work with.

- The Insurer: This tells you which insurance company is actually providing the cover and backing the policy financially.

- The Broker or Agent: Often, a certificate is issued by an insurance broker. Their details are included here, giving you a direct point of contact if you need to verify anything.

- Policy Numbers: Each type of cover listed will have its own unique policy number – the specific ID for that insurance contract.

These details establish the ‘who’ and ‘what’ of the arrangement. From there, the certificate gets into the really important stuff: the cover itself.

Understanding the Coverage Details

This is the heart of the document. It is where you will find out what protection is actually in place, how long it is active for and crucially, how much the policy will pay out if something goes wrong.

The key coverage information includes:

- Policy Effective and Expiry Dates: This shows the window of time the policy is active. A certificate is only valid proof of cover between these two dates.

- Types of Insurance: This section lists the specific policies held, like Public Liability, Employers’ Liability or Professional Indemnity. You need to check that the cover required for your project is actually listed here.

- Limit of Indemnity: This is one of the most critical figures on the certificate. It states the maximum amount the insurer will pay for a single claim or over the policy period. If your contract demands a £5 million limit but the certificate only shows £2 million, that is a major problem.

Verifying these details is not just a box-ticking exercise. It is a fundamental part of your due diligence. A small error or discrepancy in the coverage section could leave your business completely exposed to third-party claims, legal fees and serious reputational damage.

Now, let us break down exactly what that information means for you in a bit more detail.

This table provides a quick reference for the essential components you will find on a standard ACORD form or similar certificate, explaining what each part signifies for your business's protection.

| Key Information on a Certificate of Insurance |

| :--- | :--- | :--- |

| Component

| What It Tells You

| Why It Is Important

|

| Policyholder Name & Address | Who is covered by the insurance policy. | Ensures you are verifying the correct entity. A mismatch could mean you are looking at the wrong company’s insurance. |

| Insurer(s) Affording Coverage | The name of the insurance company providing the financial backing. | Confirms the policy is underwritten by a reputable insurer. You need to know who is ultimately responsible for paying a claim. |

| Policy Number | The unique identifier for each specific insurance policy listed. | This is the reference number needed to verify the policy directly with the insurer or broker. |

| Policy Effective/Expiry Dates | The period during which the insurance is active. | Cover is only valid within this date range. An expired policy offers no protection. |

| Types of Insurance & Limits | The kinds of cover held (e.g., Public Liability) and the maximum payout for each. | This is the most crucial section. It confirms the policyholder has the right type

and amount

of cover your contract requires. |

| Certificate Holder | The name and address of the party who requested the certificate. | Identifies who the proof of insurance was issued to. Note:

This does not grant you any rights under the policy itself. |

| Additional Insured Status | An explicit note or endorsement box showing you are also covered by the policy. | This is a vital upgrade. It extends the policy’s protection to you, giving you a right to defence if a claim arises from their work. |

Understanding these fields is the first step towards transforming the certificate from a simple document into a clear, actionable tool for managing your business risk.

Certificate Holder vs. Additional Insured

This is where many businesses get caught out. At the bottom of the certificate, you will see a box for the ‘certificate holder’ – that is you, the party who requested proof of insurance.

Being named here simply means you have been given a copy of the certificate. It grants you no rights under the policy. This is a common point of confusion that can create a dangerous false sense of security.

For real protection, you need to request to be named as an ‘additional insured’ . This is a formal endorsement that extends the policy's protection directly to your business. If a claim arises from the policyholder's work that also involves you, their insurance policy will defend you. This status must be shown explicitly on the certificate as it fundamentally changes your level of protection from a spectator to a participant.

The Hidden Costs of Insurance Fraud

A certificate of insurance is meant to provide peace of mind but accepting one without a second thought can create a catastrophic false sense of security. While the document itself is just a snapshot in time, a far more sinister threat lurks beneath the surface: deliberate insurance fraud.

When a business knowingly hands over a doctored or entirely fake certificate, they are not just bending the rules—they are committing a crime.

This deception leaves your business dangerously exposed. Imagine a contractor you have hired causes significant property damage or injures someone on your site. You reach for their certificate of insurance, confident you are protected, only to discover the document was a clever forgery. The consequences can be devastating.

Common Tactics of Certificate Fraud

Fraudsters have a few go-to tricks to create the illusion of legitimate cover. These deceptive methods are often tough to spot with a quick visual check, which is why proper due diligence is so critical. A hurried glance is simply not enough to protect your business from these calculated risks.

Some of the most common fraudulent tactics include:

- Altering Dates: An expired certificate can be easily manipulated by changing the policy expiry date, making old, invalid cover appear current.

- Inflating Liability Limits: The fraudster might alter the limit of indemnity on the certificate, changing a £1 million limit to the £5 million your contract requires.

- Complete Fabrication: Using simple software, a dishonest party can create a professional-looking but entirely fake certificate from scratch, inventing policy numbers and insurer details.

These doctored documents undermine the very foundation of trust that allows businesses to work together safely. The provider of a fraudulent certificate is banking on you not bothering to verify the details.

The Financial Fallout of a Fake Certificate

The single most severe consequence of accepting a fraudulent certificate is that it renders any potential claim invalid. Insurance is a contract of utmost good faith and a fake document shatters that contract entirely. If an incident occurs, the insurer has absolutely no obligation to pay out.

This means your business could be left solely responsible for all the associated costs, which could include:

- Hefty legal defence fees.

- Compensation payouts for injuries or damages.

- The full cost of repairing damaged property.

- Significant, lasting reputational harm.

A fraudulent certificate of insurance is not just a piece of misleading paperwork; it is a ticking financial time bomb. It transfers the entirety of the risk from the negligent party directly onto your business, potentially leading to bankruptcy.

A Problem That Costs Everyone

Insurance fraud is far from a victimless crime. It is a pervasive issue that erodes trust and creates systemic costs that are ultimately passed on to every honest policyholder. When insurers are forced to spend more resources investigating and fighting fraudulent activity, their operational costs rise.

These increased costs are inevitably reflected in higher premiums for everyone. In essence, every business that pays its insurance premiums is subsidising the losses created by those who cheat the system. This creates an environment where trust is diminished and the cost of legitimate cover rises for all. For a deeper look into the scale of this issue, you can explore more about what insurance fraud really costs the industry and its far-reaching consequences.

Protecting your business starts with recognising that a certificate of insurance is a claim that must be proven. By implementing a robust verification process, you not only safeguard your own financial stability but also contribute to a more honest and transparent industry. The small effort required to verify a certificate is nothing compared to the immense cost of discovering it was fake when you need it most.

How to Properly Verify a Certificate of Insurance

Given the high stakes and the very real threat of fraud, a simple glance over a certificate of insurance just will not cut it. It is a dangerously insufficient check. Accepting a document at face value is practically an open invitation for risk because a certificate is merely a snapshot in time; it proves cover existed on the day it was issued but tells you nothing about its current status. Proper due diligence is the only way to confirm the protection you are relying on is genuine, active and sufficient for the job at hand.

This process is not about distrust; it is about professional rigour. The most reliable method is to go straight to the source: the insurance provider or the broker who arranged the policy. Taking this proactive step transforms a piece of paper from a potential liability into verified proof of protection, safeguarding your business from the costly fallout of deception.

Your Step-by-Step Verification Guide

Verification is a straightforward process but it demands attention to detail. The golden rule is to never use the contact information printed on the certificate itself . Think about it: if the document is fraudulent, the contact details will almost certainly lead you back to the fraudster or an accomplice, not the legitimate insurer.

Instead, follow these steps to make your verification foolproof:

- Independently Source Contact Details: Use a search engine or an official directory like the Financial Conduct Authority (FCA) register to find the genuine telephone number or email for the insurance broker or insurer named on the certificate.

- Prepare Key Information: Before you get in touch, have the certificate in front of you. You will need to provide the policyholder's name, the policy number and the effective and expiry dates listed on the document.

- Make Direct Contact: Call or email the insurer or broker using the details you found. Clearly state that you are a third party wishing to verify the details of a certificate of insurance you have received.

- Confirm the Specifics: Ask them to confirm that the policy is still active and that the premiums are fully paid. Crucially, verify that the limits of indemnity and the specific types of cover match what is shown on your copy.

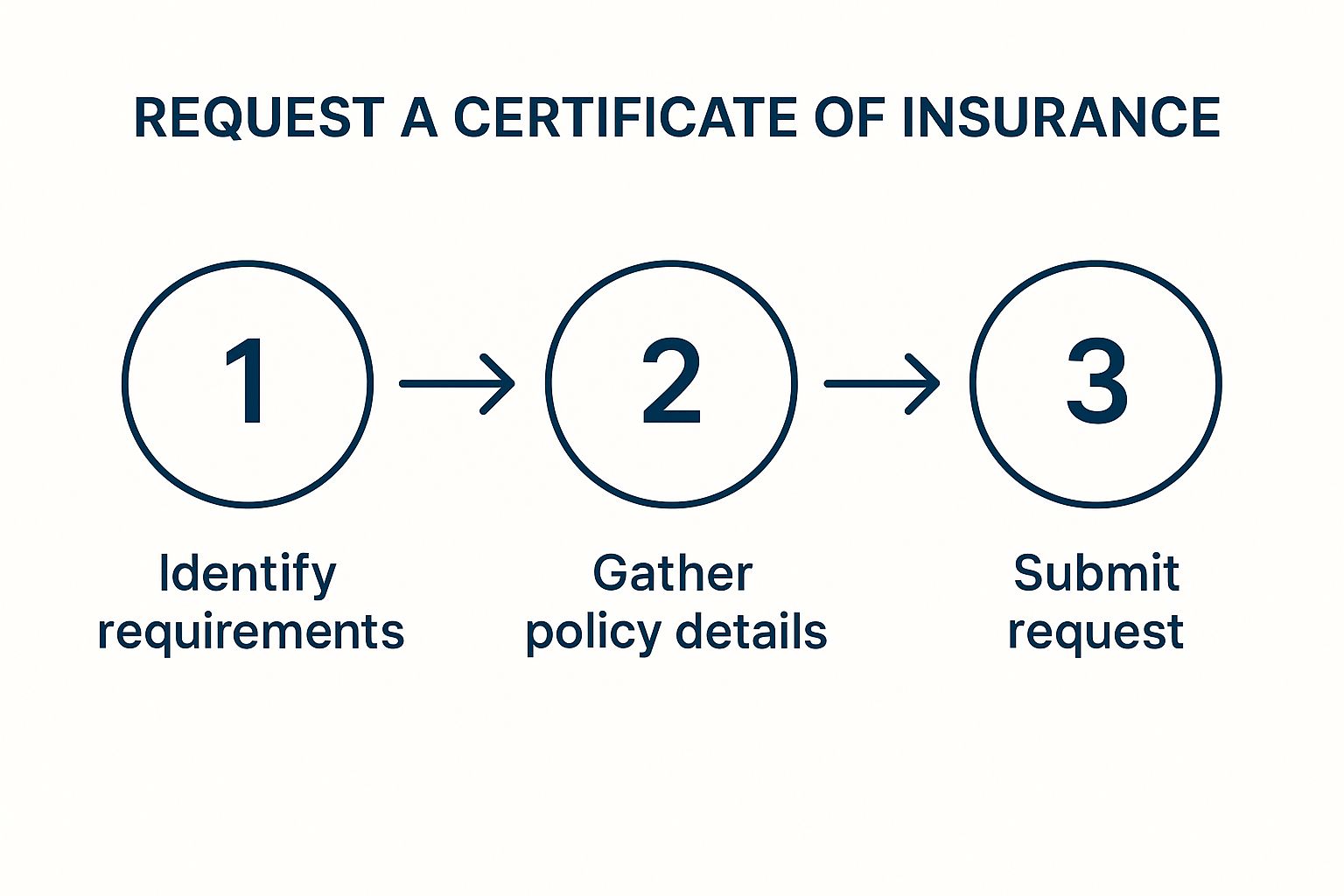

This infographic outlines the simple process for requesting a certificate, which is the first step before you get to the vital verification stage.

This just goes to show that obtaining the document is only the beginning. The real security comes from confirming its authenticity and current validity.

What to Do if You Suspect Fraud

If the insurer has no record of the policy, or if the details they give you do not match your certificate, you are likely dealing with insurance fraud. At this point, you should immediately cease all engagement with the party who provided the document. It is also wise to consider reporting the incident to Action Fraud, the UK’s national reporting centre for fraud and cybercrime. Taking proactive steps is essential in fighting fraud before it happens by using the power of verified evidence .

Verification is not an accusation; it is a standard business practice. By making it a non-negotiable part of your onboarding process for any new contractor or partner, you create a culture of accountability and protect your business from significant financial and reputational harm.

In a competitive market, insurers are often willing to provide more detailed assurances. The competition among insurers has remained strong, contributing to rate reductions between 10% and 20% across many lines of business. In this climate, you are in a strong position to request enhanced certificates of insurance that confirm not only the existence of cover but also specific terms, like limits of indemnity, policy extensions and endorsements. This makes your verification process even more powerful as you can confirm these granular details directly with the source.

When You Will Need a Certificate of Insurance

It is one thing to understand the theory behind a certificate of insurance but seeing it in the real world is where its importance really clicks. This is not just abstract paperwork; it is a practical tool used every single day across the UK to manage risk in business relationships. From muddy construction sites to polished corporate offices, asking for a certificate is a standard, essential step in building a secure partnership.

The need for a COI pops up whenever one party’s actions could create a financial headache for another. Think of it as a formal way of making sure that risk stays where it belongs—with the person or company responsible. It proves they have an insurer ready to step in and cover the costs if something goes wrong. This simple document underpins countless transactions, making it a cornerstone of modern business and due diligence.

Construction Projects and Subcontractors

Nowhere is the demand for a COI more obvious than in the construction industry.

Imagine a large building firm running a major project. They hire a specialist electrical subcontractor to handle the wiring. The main contractor is ultimately responsible for everything that happens on that site, from the safety of the public walking by to the other tradespeople working there.

Before that subcontractor sets foot on site, the main contractor will demand a certificate of insurance. This is completely non-negotiable. They will be looking for proof of a few key covers:

- Public Liability Insurance: This is the big one. It covers the costs if the subcontractor’s work injures a member of the public or damages someone else’s property. The contractor will check that the limit is high enough, often insisting on £5 million or more.

- Employers’ Liability Insurance: A legal requirement for any subcontractor with staff. It protects their own workers if they get hurt on the job.

By getting and checking this certificate, the main contractor makes sure that any accident caused by the electrician is covered by the electrician's policy, not their own. It is a simple step that protects them from enormous financial and legal fallout.

Commercial Property Leases

When a business decides to lease a commercial property—whether it is an office, a shop or a warehouse—the landlord will almost certainly ask for a certificate of insurance before handing over the keys. You will find this clause in nearly every commercial lease agreement in the UK.

The landlord needs to know the tenant has the right insurance to cover any damage they might cause to the building. What if a fire starts because of the tenant's faulty equipment? The landlord’s own insurance might pay for the repairs initially but you can bet their insurer will then try to recover those costs from the tenant.

In this scenario, the landlord is the one requesting proof. They need to see the tenant's Public Liability cover is active and adequate. The certificate proves the tenant can handle their legal liabilities, protecting the landlord’s valuable asset.

Event Organising and Vendor Contracts

Think about someone organising a large music festival. They are juggling contracts with dozens of vendors: food stalls, security teams, lighting technicians, you name it. Every single one of those vendors introduces a new layer of risk.

The event organiser has to manage all that risk. The way they do it is by requiring every vendor to provide a certificate of insurance showing they have their own Public Liability cover. After all, a food stall could cause a food poisoning outbreak or a temporary stage could collapse and cause serious injuries.

By collecting these certificates, the organiser confirms that each vendor is financially responsible for their own patch. If an incident happens, the claim goes to that specific vendor's insurer. This shields the main event organiser from being held responsible for the actions of their many contractors.

This approach has become so ingrained that businesses now place a huge emphasis on securing and validating these certificates. It is interesting to note that while a recent market analysis showed overall UK insurance rates fell by about 6% in early 2025, casualty insurance—the category covering these liability risks—actually ticked up by 1% . You can explore more about recent UK insurance rate trends and what they mean for businesses.

Common Questions About Certificates of Insurance

So, we have walked through the crucial role a certificate of insurance plays in modern business. It is a vital piece of the puzzle but it is also where a lot of confusion pops up. This final section is all about tackling those frequent questions head-on, giving you clear, straightforward answers.

Getting these details right will give you the confidence to handle insurance verification properly and shield your business from risks you might not have seen coming.

Is a Certificate of Insurance a Legal Contract?

This is probably the biggest mix-up we see. A certificate of insurance is not a legal contract . Think of it as an informational snapshot, a document that proves an insurance policy was active on the day it was issued. Nothing more.

The actual contract, with all its binding terms, conditions and exclusions, is the full insurance policy document itself.

Here is an analogy: a train ticket shows you have the right to travel on a certain service but it does not contain the entire rulebook for the railway network. The certificate summarises the cover but it cannot alter, amend or extend it in any way. All legal rights and obligations are set by the policy, not the certificate.

How Do I Get a Certificate of Insurance for My Business?

Getting a certificate is usually a simple process, as long as you have the right cover in place first. You will need an active business insurance policy, like Public Liability or Professional Indemnity. Once that is sorted, you just need to request a certificate from your insurance provider or broker.

Many insurers now have online customer portals where you can instantly download a standard certificate whenever you need one. But if your client needs specific wording or wants to be named on the certificate, you will likely have to contact your broker directly to get it sorted. Issuing a standard certificate of insurance is typically free of charge.

It is crucial to remember that providing a certificate is just a standard part of doing business professionally. If a contractor refuses or takes ages to provide one, it can be a major red flag. It often suggests there might be an issue with their insurance cover.

What Is the Difference Between a Certificate Holder and an Additional Insured?

Nailing this distinction is absolutely vital for managing your risk. Confusing these two roles can leave your business dangerously exposed.

- A Certificate Holder is simply the person or company who has been given the certificate as proof of insurance. Being named as the certificate holder gives you no rights under the policy. You are just a recipient of information.

- An Additional Insured is a party, other than the policyholder, who has been formally granted specific rights and protection under the policy. This is a significant upgrade in protection as it could allow you to make a claim directly against their policy if an incident is caused by their work.

This status has to be specifically requested and added to the policy, usually through something called an endorsement. If you need this level of protection, you must make sure it is clearly stated on the certificate of insurance you receive.

Can an Insurance Policy Be Cancelled After a Certificate Is Issued?

Yes, absolutely. This is the fundamental reason why you cannot just file the certificate away and forget about it. A policy can be cancelled for all sorts of reasons—most commonly for non-payment of premiums—even the day after a certificate has been issued.

The certificate is just a snapshot in time; it does not guarantee that the cover will stay in place for the whole policy period. While some older certificates might have included a 'notice of cancellation' clause promising to inform the certificate holder of any changes, these are rarely standard or enforceable today.

The only way to be certain that a policy is still active is to verify it directly with the insurer or broker. Relying on the certificate alone is a gamble that no responsible business should ever take. The potential cost of finding out the policy has lapsed when you need it most is simply too high.

At Proova , we understand that proving what you own is the foundation of a fair and fast insurance process. Our platform helps you securely document your assets, cutting through the uncertainty and delays that plague claims and underwriting. By creating a verified record of your property, you empower your insurer to settle claims quickly and underwrite risks accurately, preventing the fraud that drives up costs for everyone. Discover a smarter way to manage your insurance with Proova.