Unlocking Certainty in Diamond Rings Insurance

Getting diamond rings insurance should be about peace of mind but for both insurers and policyholders, the process is often riddled with risk. The heart of the problem is a deep-seated lack of certainty. Policies are frequently written based on paper valuations alone, creating a dangerous gap between what is written on the policy and what actually exists.

This uncertainty is more than just a minor issue; it is an open invitation for fraud and a direct cause of inflated costs for everyone.

The Hidden Risks of Unverified Jewellery Insurance

Insuring a high-value asset like a diamond ring without seeing it first is like insuring a car based purely on a photograph from five years ago. You are putting all your trust in a document that could be out of date or, in the worst-case scenario, completely fabricated. This fundamental weakness creates major headaches for the entire insurance industry and ultimately affects the provability of any subsequent claim.

The two most immediate dangers are fraudulent claims and the reliance on outdated valuations. When an insurer cannot definitively prove an item’s existence or its condition when the policy starts, they become vulnerable. It is this ambiguity that fraudsters know how to exploit.

The Cost of Uncertainty

This lack of provable fact has a direct financial fallout. It forces insurers to sink more time and resources into investigating claims, which drives up their operational costs. In the end, these expenses get passed on to honest customers through higher premiums. In essence, every policyholder ends up paying for the fraud committed by a handful of criminals.

The core issues that spring from unverified insurance are clear:

- Increased Fraud: Without solid proof from day one, it is far too easy to claim for an item that never existed, was already damaged or has been deliberately overvalued. The lack of verifiable evidence makes such claims difficult to refute.

- Inflated Premiums: The financial hole left by fraudulent payouts and long-winded investigations gets filled by the entire customer base, making cover more expensive for everyone. The cost of fraud is a cost to all of us.

- Slower Claims Processing: Genuine claims get stuck in the slow lane. Insurers have to conduct painstaking, often manual, investigations to rule out deception, creating a deeply frustrating experience for the policyholder.

The traditional model of insuring jewellery based on a paper valuation alone has created a system built on trust, not truth. This gap is where risk thrives, leading to financial losses and chipping away at customer confidence when legitimate claims are delayed.

It is clear that a modern solution is desperately needed to bring certainty and provability back into the process. For a detailed breakdown of the steps involved, our practical guide on insuring an engagement ring in the UK offers some valuable insights for ring owners.

Shifting Towards Verifiable Proof

The future of insuring diamond rings depends on one thing: establishing verifiable, digital proof right from the start. By capturing time-stamped evidence of a ring's existence and condition the moment a policy begins, insurers can finally close the loopholes that enable fraud.

This simple shift creates a transparent and efficient system that works better for everyone. Insurers slash their losses and genuine claims can be settled with the speed and confidence that customers deserve.

How Jewellery Insurance Fraud Inflates Every Premium

It is easy to think of insurance fraud as a victimless crime, a small fib told to a massive, faceless corporation. The truth is, its financial sting is felt by everyone. It creates a ripple effect that ultimately drives up the cost of diamond rings insurance for honest policyholders like you.

When an insurer pays out a fraudulent claim, that money does not just vanish into thin air. To stay in business, they have to recover those losses. The cost gets absorbed into their operational overheads and is then spread across their entire customer base through higher annual premiums.

In short, the honest majority ends up footing the bill for the actions of a dishonest few. This is not a minor rounding error, either. The cumulative impact of thousands of seemingly small fraudulent claims adds up to a massive financial drain on the industry.

The Problem of After-The-Event Fraud

One of the most common and damaging tactics is something we call 'after-the-event' fraud . Picture this: someone loses, damages or has their diamond ring stolen. Only then do they take out an insurance policy for it. To make the claim look legitimate, they might wait a few weeks before reporting the 'loss'.

This sneaky move exploits a weakness in the traditional insurance model, which often relies on paper valuations without demanding upfront, physical proof that the item even exists or is in good condition when the policy starts. Without a verifiable starting point, it is incredibly difficult for an insurer to challenge a claim that, on the surface, seems perfectly plausible.

Deceptive claims like these put insurers on the back foot. They are forced to launch lengthy, expensive investigations to try and piece together the truth, eating up time, money and administrative resources.

"Insurance fraud is a drain on resources and a breach of trust. It forces insurers to treat every claim with an initial layer of suspicion, which inevitably slows down the process for legitimate policyholders who genuinely need support."

This culture of suspicion is a direct result of fraud. It means that even genuine claims for lost or damaged diamond rings face tougher scrutiny, leading to delays and frustration for customers who have done absolutely nothing wrong. The entire claims process becomes slower and more difficult for everyone.

The True Cost to the Industry and You

The financial fallout from fraud goes way beyond just the money paid out for bogus claims. You also have to factor in the huge costs of investigation, legal challenges and all the administrative work involved. These rising operational expenses make it harder for insurers to keep their business financially stable.

For policyholders, the consequences are painfully clear:

- Higher Premiums: To make up for fraud-related losses, insurers have no choice but to adjust their pricing. That means increased premiums for all customers.

- Stricter Claim Processes: To defend themselves, insurers roll out more complex and demanding claims procedures, making it harder for honest clients to get their money quickly.

- Reduced Trust: A system strained by widespread fraud erodes the fundamental trust between an insurer and the people they protect, tarnishing the industry's reputation.

When you connect the dots, you can draw a straight line from unverified items at the start of a policy to the inflated premiums every customer has to pay. To really tackle this problem and protect everyone’s premiums, insurers are turning to advanced solutions like proactive AI fraud detection.

Having a solid, upfront verification of an item's existence and condition is no longer just a 'nice-to-have'. It is absolutely essential for the financial health of the entire insurance ecosystem. It is the single most effective way to stop 'after-the-event' fraud in its tracks, creating a fairer and more affordable system for us all. Understanding this is key, especially when you see the scale of the issue. To get a sense of the staggering figures involved, you can explore our deep dive into what insurance fraud really costs the industry.

Moving Past Paper: Modernising Valuations and Underwriting

The old ways of valuing and underwriting high-value jewellery are becoming dangerously outdated. For decades, the insurance industry has built its policies on a foundation of paper documents but this process is riddled with flaws, exposing both insurers and honest policyholders to risks that are entirely avoidable.

Relying solely on a paper valuation creates two huge problems: underinsurance and over-insurance. An outdated valuation can leave a client severely underinsured, meaning they could never replace their treasured diamond ring for its true current worth. On the other hand, an inflated valuation creates a moral hazard, where the insured value is much higher than the market value, opening a door to potential fraud.

This dependence on paper puts underwriters in a tough spot. They are forced to be reactive, trusting documents without any real-world proof. It is a system that assumes honesty but does not have the tools to verify it, creating vulnerabilities that get exploited time and time again.

The Problem with Inconsistent Standards

One of the most glaring issues is the wild inconsistency in valuation standards. There is no single, agreed-upon rule for how old a valuation can be before it is considered invalid for a diamond rings insurance policy. This lack of a clear standard creates a chaotic and unpredictable risk landscape.

Some insurers might be happy with a valuation that is five years old, while others demand one completed just days before the policy starts. This is not just a minor detail; it has massive consequences. An older valuation simply does not account for market swings in gold, platinum and diamond prices. This can easily leave a client paying for cover that does not actually match their ring's replacement cost.

In the UK, insuring a diamond ring is a big step. Many high street insurers cap their single-item cover at around £10,000 , so owners of more expensive pieces have to find specialist providers. Premiums can be reasonable but the valuation rules are often the biggest hurdle. NFU Mutual tries to solve this by offering a buffer, covering up to 150% of the insured amount if the item was valued within the last three years, which is a good step towards tackling underinsurance. You can learn more about the different approaches to engagement ring insurance in the UK.

This inconsistency forces underwriters to make decisions with incomplete or stale information, which only increases the chance of disputes and financial loss when a claim is finally made.

Shifting to an Evidence-Based Approach

The solution is to move away from this paper-based trust system and towards a proactive, evidence-based model. Technology gives us the tools to completely transform this outdated process. Instead of just relying on a document that could be inaccurate or even fake, underwriters can now demand real-time, verifiable proof.

This means capturing time-stamped visual evidence of an item at the very moment the policy begins. By doing this, an insurer creates a concrete, undeniable record of three critical facts:

- Existence: The item definitely exists when the policy starts.

- Condition: The item's precise condition, including any existing wear and tear or flaws, is documented.

- Unique Identifiers: Distinguishing features, like laser inscriptions on a diamond's girdle, are captured on camera.

This simple but powerful step shifts underwriting from a reactive, trust-based guess to a proactive and precise risk assessment. It builds certainty right from the start.

With verifiable digital evidence, underwriting is no longer about interpreting a piece of paper. It is about confirming reality. This fundamentally changes the risk profile of every policy and protects everyone involved.

This modern approach does not just help the insurer. For the honest policyholder, it sets the stage for a much faster, smoother claims process. When the existence and condition of their diamond ring have been proven from day one, there is far less room for doubt or delay if they ever need to make a claim. It establishes a foundation of transparency that benefits everyone.

A Clearer Path for Underwriters

Let us break down how this shift changes the game for underwriters. Moving from a document-centric process to an evidence-led one brings clarity, efficiency and a huge reduction in risk.

| Aspect | Traditional Underwriting | Modern Underwriting (with Proova) |

|---|---|---|

| Proof of Ownership | Relies on paper receipts or valuations, which can be easily forged or outdated. | Uses time-stamped, geo-located digital records linking the item directly to the policyholder. |

| Condition Assessment | Based on written descriptions in a valuation, often lacking detail on wear and tear. | Captures high-resolution images and videos, creating an undeniable visual record of the item's exact condition at inception. |

| Valuation Accuracy | Accepts valuations that could be years old, ignoring market price fluctuations. | Verifies the item's existence in real-time, complementing the valuation with current proof. |

| Fraud Detection | Reactive. Fraud is often only discovered during a claim investigation, after the loss has occurred. | Proactive. Flags inconsistencies upfront and makes it nearly impossible to insure a non-existent or misrepresented item. |

| Process Speed | Slow and manual, involving paper handling, scanning and subjective reviews. | Fast and digital. Evidence is captured and verified in minutes via a secure platform, speeding up policy issuance. |

| Claim Certainty | High potential for disputes over pre-existing damage or the item's actual value at the time of loss. | Drastically reduces disputes. A clear "before" picture simplifies the "after" assessment, leading to faster, fairer settlements. |

Ultimately, the traditional method forces underwriters to make educated guesses based on potentially unreliable paper trails. A modern, evidence-based approach like the one enabled by Proova empowers them to make decisions based on concrete, verifiable reality. This is not just an upgrade; it is a fundamental change in how risk is understood and managed.

Smoothing Out the Claims Process with Verifiable Proof

The moment a policyholder makes a claim is the real test for any insurer. It is often the most stressful and contentious part of the whole insurance journey. The old way of handling claims for diamond rings can be a long, drawn-out ordeal, choked with paperwork, uncertainty and potential disputes that leave everyone feeling drained.

This friction comes from a familiar problem: a lack of solid, verifiable proof from day one. When a claim for a lost or stolen diamond ring comes in without that concrete starting point, the insurer has to kick off a slow, manual investigation. They are left trying to piece together evidence, question the details and rule out fraud before they can even think about a payout.

For an honest policyholder, this feels like an interrogation. For the insurer, it is a costly but necessary step to protect their business. This adversarial dynamic does not help anyone and erodes the trust that should be the foundation of the relationship.

Changing the Game with Digital Evidence

Now, imagine a different scenario. A claim is filed but this time, the insurer has instant access to a verifiable, time-stamped digital record of the ring. This record, created right when the policy started, shows exactly what the ring looked like, its condition and its unique identifying marks.

This single piece of evidence completely changes the claims process.

The ambiguity that fuels disputes and invites fraud is gone. The focus shifts from investigation to resolution. Instead of asking, "Did this ring even exist in this condition?", the insurer can confidently say, "We have proof of the ring and its condition, so let us get this claim sorted."

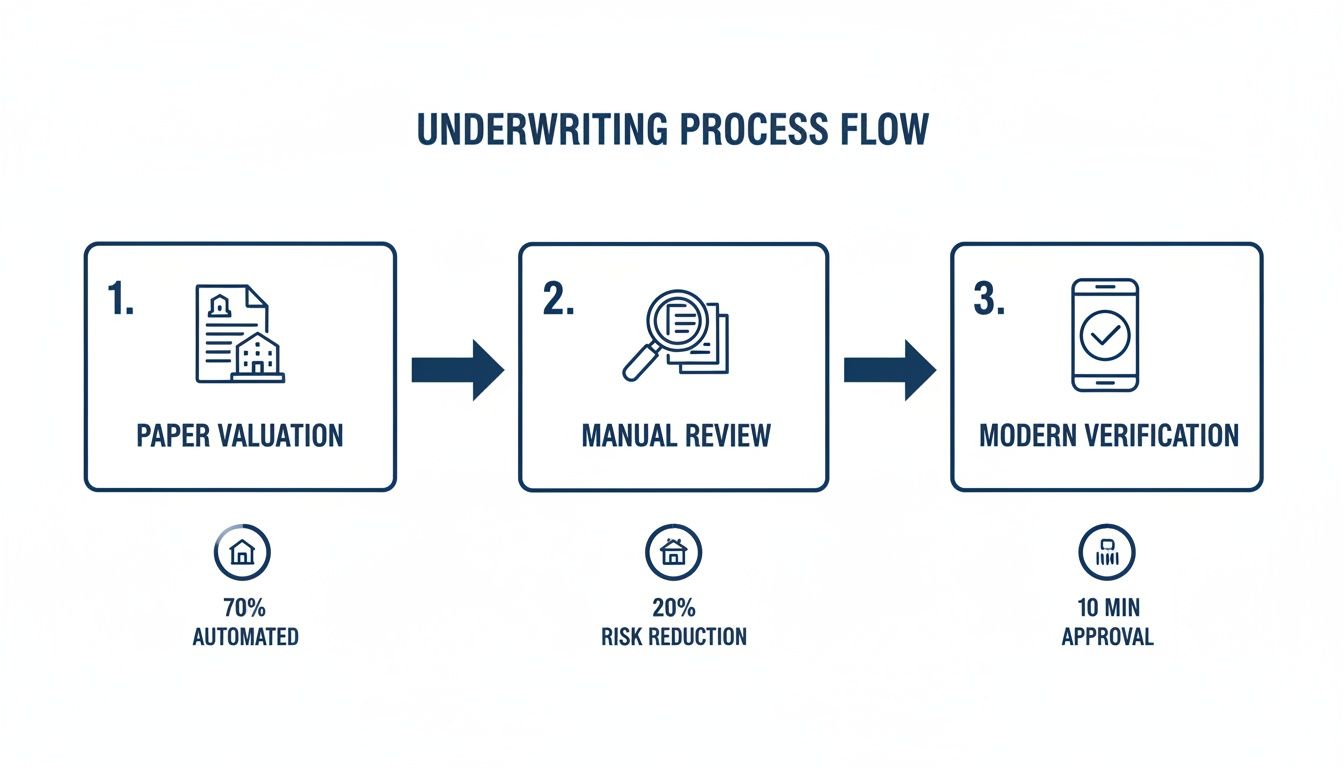

The diagram below shows the evolution from a clunky, paper-based system to a modern, evidence-led approach.

As you can see, modern verification replaces slow manual reviews with instant certainty, which has a direct and hugely positive impact on the claims experience.

From Weeks of Waiting to a Decision in Minutes

The efficiency gains are massive. With verifiable proof on file, the claims handler's job becomes remarkably simple. They can immediately compare the established record with the details of the claim, getting rid of the need for endless back-and-forth or painstaking evidence gathering.

This brings several powerful benefits for the insurer:

- Drastically Reduced Handling Time: Claims that once took weeks or even months to investigate can now be validated and approved in minutes.

- Lower Admin Costs: Less time spent on investigations means significantly lower operational costs. Resources once tied up in manual reviews can be put to better use serving customers.

- Airtight Fraud Prevention: Dodgy claims are stopped dead in their tracks. A claim for a non-existent, pre-damaged or misrepresented item simply cannot get through when there is an immutable record to disprove it. If you want to dive deeper, you can learn more about fighting fraud before it happens with the power of verified evidence.

This modern approach ensures fraudulent claims are weeded out early, preventing them from draining industry resources and driving up premiums for everyone else.

The goal of a modern claims process is to pay genuine claims as quickly as possible and robustly defend against the fraudulent ones. Verifiable proof is the tool that makes this possible, creating a system that is both fair and efficient.

For the honest policyholder, the experience is transformed. The stress and anxiety of a long wait are replaced with the relief of a quick, fair settlement. This builds immense goodwill and loyalty, turning a moment of crisis into a positive reflection of the insurer's brand. It proves their diamond rings insurance was a worthwhile investment, delivering on its promise of protection when they needed it most.

Right, let us move from theory to action. For insurers and brokers ready to modernise how they handle diamond ring insurance, the way forward is to adopt new processes and tech that build certainty from the very start. This checklist is your practical roadmap.

It is designed for insurance professionals who know it is time to leave outdated, paper-reliant systems behind for a more secure and efficient model. Every step here is directly linked to cutting fraud, boosting operational efficiency and earning greater customer trust.

1. Modernise Your Policy Wording

First things first: you need to embed the requirement for digital proof directly into your policy language. Traditional wording often leaves far too much room for interpretation and ambiguity. By updating your terms, you are setting a new, crystal-clear standard for what is needed to secure cover.

This means spelling out that a time-stamped, verifiable digital record of the item is a condition of the insurance. It is a simple change but it makes it obvious to the policyholder that their cooperation is required. More importantly, it establishes a solid legal foundation for a modern, evidence-based relationship.

Your policy wording should specify:

- The requirement for high-resolution images or video of the ring.

- That this evidence must be captured when the policy begins.

- That unique identifiers, like laser inscriptions, must be clearly visible wherever possible.

2. Implement Digital Verification at Inception

This is the most critical change you can make. You need to integrate a digital verification process right at the point of sale or when the policy is bound. Instead of just relying on a paper valuation, you will require the applicant to create a digital record of their diamond ring using a secure, third-party application like Proova.

This proactive step provides undeniable proof of the item's existence and condition before you take on any risk. It effectively slams the door on ‘after-the-event’ fraud and gives underwriters the concrete data they need to assess risk with genuine accuracy. You are no longer guessing; you are making proactive, evidence-based decisions.

3. Train Your Teams on the New Tech and Processes

New tools are only effective if your teams understand how and, crucially, why to use them. Rolling out comprehensive training for your underwriters, claims handlers and customer service staff is absolutely essential for a smooth transition.

Focus the training on the benefits for their specific roles, not just the business as a whole. For underwriters, it means making better, faster decisions. For claims handlers, it means they can resolve genuine claims in minutes, not weeks and have irrefutable evidence to challenge suspicious ones.

"A well-trained team that understands the 'why' behind a new process is your greatest asset. They become advocates for a system that makes their jobs easier and better protects the company and its honest customers."

This ensures everyone applies the new standards consistently. It also helps your staff explain the benefits of the new process to customers, turning a procedural change into a mark of trustworthiness and efficiency.

4. Re-evaluate Your Claims Workflow

Once you have verifiable proof from day one, your entire claims workflow can be re-engineered for speed and accuracy. The traditional, investigation-heavy process becomes obsolete for policies with digital verification.

Your new workflow should start with a simple question: "Does the claim align with the inception evidence?". The claims handler can immediately pull up the time-stamped record. If it all matches up, the claim can proceed straight to settlement. If there are discrepancies, the investigation is targeted and efficient. This shift dramatically cuts down claims handling time and associated costs, freeing up your team to focus on what they do best: providing excellent service to genuine claimants.

The Future of Jewellery Insurance Is Built on Certainty

The biggest headaches in diamond ring insurance all stem from the same root problem: a fundamental lack of certainty. Inflated premiums driven by fraud, the operational drag of lengthy claims investigations—these issues thrive in ambiguity. For too long, the industry has run on a mixture of paper and trust but that model is showing its age.

The solution is not a minor tweak. It is a complete shift in thinking. We need to move away from a system based on assumption to one grounded in undeniable, verifiable proof. Technology now gives us the power to establish the existence, condition and ownership of a high-value item right from the start of a policy.

This is about more than just adopting a new tool. It is about moving to a smarter, more resilient way of managing risk. When an insurer has a time-stamped digital record of a diamond ring at policy inception, the entire dynamic changes. The loopholes that enable fraud get sealed shut and the frustrating delays that plague genuine claims become a thing of the past.

A New Standard of Trust

This evidence-first approach builds a stronger, more transparent relationship between the insurer and the policyholder. For the customer, it brings peace of mind, knowing that a genuine claim will be handled quickly and fairly. For the insurer, it provides the confidence needed to underwrite and settle claims efficiently, protecting the business from unnecessary losses.

The future of insurance is not about eliminating trust but about reinforcing it with truth. By embracing technology that provides verifiable evidence, we build a foundation of certainty that benefits everyone in the chain.

This evidence-based model creates a more sustainable and trustworthy market. It reduces the financial burden of fraud that currently gets passed on to all policyholders, which in turn helps to stabilise premiums. Better yet, it allows insurers to focus their resources on providing excellent service to honest customers instead of chasing down deceptive claims.

The Call to Action for a More Certain Future

The path forward is clear. Insurance professionals have a real opportunity to lead this change and build a more robust industry. Adopting modern verification solutions is a critical step towards protecting your business, serving your customers better and fostering a market built on a bedrock of certainty.

This is the moment to move beyond outdated, paper-based processes. It is time to embrace a future where every policy is backed by irrefutable proof. By doing so, we create a fairer, faster and more secure environment for insuring the items people treasure most.

Answering Your Questions

When brokers and insurers look at modernising how they handle diamond ring insurance, a few practical questions always come up. Adopting new verification technology is a big step and understanding how it will actually affect day-to-day work is essential. Here are some of the most common queries we hear from professionals in the field.

At its core, this kind of technology is designed to replace ambiguity with certainty. In doing so, it directly tackles some of the most persistent challenges in the industry.

How Does Digital Verification Prevent Fraud?

Think of digital verification as creating an unshakeable starting point. It produces a time-stamped, geo-located record of an item’s existence and condition the moment the policy kicks in.

This simple step makes it practically impossible for someone to insure a ring that was already damaged, lost or never even existed in the first place. If there is no initial record of the item in its insured condition, any later claim for that item falls flat. It is a clean, verifiable way to close the loopholes that enable this type of fraud.

Will Requiring Photographic Proof Create Customer Friction?

While it does add a new step to the process, it is designed to be quick and painless for the policyholder. Using a simple mobile app, the whole thing takes just a few minutes.

The real sell for genuine customers is what happens later: a much faster, smoother claims process if they ever need it.

By framing it as a way to guarantee swift payouts and protect them from the rising costs of fraud, most customers actually appreciate the measure. It builds transparency and trust right from the start.

Can This Verification Process Integrate With Existing Systems?

Absolutely. Modern verification platforms are built with integration in mind. They typically offer API access, which allows an insurer’s core systems to seamlessly request, receive and store the verification data.

This means underwriters and claims handlers can see all the evidence directly within the platforms they already use every day. It is all about minimising disruption and maximising efficiency, not adding another complicated tool to the stack.

For those looking to fully protect their investment, gaining a clear understanding of engagement ring insurance costs is also an essential step. Ultimately, combining robust verification with fair pricing creates a system that benefits both the insurer and the honest customer.

Secure your assets and simplify your claims process with Proova . Our platform provides the verifiable proof you need to reduce fraud and build customer trust. Visit us at https://www.proova.com to see how we can help.