Uncovering Car Insurance Fraud and How to Stop It

Car insurance fraud is not a victimless crime. It is a calculated act that costs the UK insurance industry billions every year and that deception directly inflates the premiums for every honest driver on the road. The heart of the problem has always been the sheer difficulty of proving what really happened after an incident.

The Hidden Cost of Car Insurance Fraud

Think of car insurance fraud as a hidden tax that everyone with a policy has to pay. When a fraudster gets away with an exaggerated or fabricated claim insurers have to absorb those losses. But those costs do not just disappear; they get passed straight on to honest policyholders in the form of higher annual premiums. It creates a frustrating cycle where responsible drivers end up paying for the criminal actions of a dishonest few.

The financial damage is staggering. Detected fraudulent claims in the UK consistently top £1 billion each year with motor insurance being the biggest contributor by far. And that figure does not even touch the undetected fraud that slips through the net which means the true cost is almost certainly much higher. You can get a clearer picture of what insurance fraud really costs the industry and see exactly how those figures break down.

More Than Just Money

Beyond the direct financial hit car insurance fraud puts a huge operational strain on insurers. Investigating a suspicious claim is a complex and resource-heavy process. It demands:

- Dedicated counter-fraud teams to sift through evidence and spot suspicious patterns.

- Costly expert opinions from engineers and medical professionals to verify damage and injuries.

- Lengthy, expensive legal battles to dispute fraudulent claims in court.

All of this burns through time and money that could be invested in improving customer service, lowering premiums or developing more competitive products for everyone.

The core challenge for insurers is establishing a single source of truth. Without irrefutable evidence of a vehicle's condition before an incident, proving a claim has been exaggerated or fabricated becomes an uphill battle fought with assumptions and arguments, not hard facts.

The Problem of Provability

This very issue of provability is where most fraudulent schemes thrive. A criminal can stage a collision or deliberately exaggerate the damage to their vehicle knowing that the insurer has no baseline record to compare it against. They are exploiting the information gap that exists between the moment a policy is issued and the moment a claim is filed.

This guide will dive into the sophisticated world of modern vehicle fraud, from staged 'crash for cash' accidents to complex digital deception. We'll show you how these schemes are designed to challenge an insurer's ability to verify claims and more importantly how technology is finally shifting the balance.

Instead of just reacting to fraud after the loss has occurred, leading insurers are now using proactive verification to establish undeniable proof right from the start. This approach does not just stop criminals in their tracks; it creates a fairer, more transparent system for everyone.

How Common Fraud Schemes Actually Work

To really get to grips with car insurance fraud you have to look past the abstract terms and see how these schemes play out on the ground. These are not just little white lies; they are often calculated plans designed to exploit the single biggest weakness in claims handling: verifying what happened after the event.

Think about it from a claims handler's perspective. Trying to piece together the truth with no reliable starting point is like solving a puzzle with half the pieces missing.

This lack of verifiable, pre-incident evidence is exactly what fraudsters bank on. They know that without a clear, independent record of a vehicle's condition before an incident it becomes their word against the insurer's analysis. This ambiguity is where deception thrives leaving claims teams in the difficult position of separating legitimate cases from outright fabrications.

Let's break down some of the most prevalent schemes that insurers face every day.

Anatomy of Common Car Insurance Fraud Schemes

To understand the operational challenges it helps to see how different fraud types work. The table below outlines the mechanism behind each scheme and pinpoints the core difficulty they create for claims handlers.

| Fraud Type | How It Works | Key Challenge for Insurers |

|---|---|---|

| Crash-for-Cash | Organised criminals deliberately cause an accident with an innocent driver, often by braking suddenly, to manufacture a "fault" claim for fake injuries and damage. | Proving the collision was intentional is incredibly difficult as the innocent driver appears clearly at fault based on the circumstances. |

| Damage Exaggeration | A driver involved in a minor, genuine accident submits a claim that includes pre-existing scuffs, scratches or even unrelated mechanical faults to get a larger payout. | Without a baseline record of the vehicle's condition at the policy's start it is nearly impossible to dispute which damage is new and which was already there. |

| Ghost Broking | Fraudsters posing as brokers sell fake or invalid insurance policies, often targeting vulnerable drivers with unrealistically cheap deals via social media. | Invalid policies are only discovered after an accident occurs leaving the driver uninsured and creating a complex, costly investigation for the insurer. |

Each of these schemes exploits a different vulnerability in the traditional insurance process but they all hinge on the difficulty of verifying facts after the event.

Organised Crash-for-Cash Incidents

One of the most damaging and sophisticated forms of fraud involves ‘crash-for-cash’ schemes . These are not accidents at all—they are premeditated collisions orchestrated by criminal gangs. A common tactic involves a fraudster slamming on their brakes at a roundabout or junction, forcing an unsuspecting driver to crash into the back of them.

The entire event is staged to create a clear-cut "fault" accident. The fraudsters then flood the insurer with claims for exaggerated vehicle damage, phantom passenger injuries and even long periods off work. Because the innocent motorist technically appears to be at fault insurers face a huge uphill battle to prove the collision was deliberate. You can learn more about the tactics these groups use in our guide on the persistent threat of crash-for-cash schemes.

The scale of this problem is staggering. Aviva for instance reported that its counter-fraud team stopped over 6,000 fraudulent claims in the first half of a recent year alone. That single action saved honest policyholders more than £60 million —which works out to a mind-boggling £334,000 per day .

Deliberately Exaggerated Damage Claims

A far more common and opportunistic fraud involves inflating the damage after a genuine, minor incident. A driver might pick up a small dent in a supermarket car park but then submit a claim that conveniently includes every pre-existing scratch, scuff and even an unrelated mechanical issue they'd been meaning to fix.

The core problem for insurers is the lack of a baseline. Without a timestamped, photographic record of the vehicle's condition when the policy was taken out, it is nearly impossible to prove which damage is new and which was already there.

This forces claims handlers into a tough spot. They might strongly suspect fraud but lack the hard evidence needed to reject the embellished parts of the claim. More often than not it leads to a higher settlement than is fair with the cost ultimately passed on to every other policyholder.

The Rise of Ghost Brokers

A particularly cruel and growing scheme involves ‘ghost brokers’ . These criminals pose as legitimate insurance brokers, typically on social media, dangling the promise of unbelievably cheap car insurance. They prey on younger or more vulnerable drivers who are desperate for a way to reduce their high premiums.

The scam plays out in one of two ways:

- Totally Fake Policies: The ghost broker takes the victim's money and provides them with worthless, forged insurance documents. The driver is left completely uninsured and personally liable for any accidents.

- Fraudulent Applications: The broker uses the victim's real details but lies about key information—like their age, address or no-claims history—to get a cheaper quote from a genuine insurer. The policy exists but it is built on false pretences and will be voided the second a claim is made.

In either case the driver is left unprotected and out of pocket. For insurers this fraud creates a tangled web of invalid policies that only surface after an accident, triggering complex and expensive investigations.

How Fraud Inflates Your Insurance Premiums

It is easy to think of insurance fraud as a victimless crime, a case of one person pulling a fast one on a massive, faceless corporation. But that is a dangerous misconception. The reality is that every single fraudulent claim acts like a hidden tax with the cost spread across every honest driver's policy.

When an insurer pays out for a bogus claim that money does not just vanish into thin air. It has to be recovered and it is done by nudging up premiums for everyone. This creates a direct, painful link between a criminal’s actions and your annual insurance bill. The losses are not absorbed by the industry; they are passed straight on to you. Essentially honest policyholders are forced to subsidise the criminal actions of a dishonest few.

The Billion-Pound Bill We All Pay

The sheer scale of car insurance fraud in the UK is staggering, creating a financial black hole that affects the entire market. When you add up all the exaggerated claims, staged accidents and outright fabrications the total cost is immense. This is not just an operational headache for insurers; it is a real, tangible expense for every household with a car.

Recent data paints a pretty stark picture. In a single year UK insurers uncovered a shocking 98,400 fraudulent claims, a 12% jump from the 88,100 caught the year before. The value of these dodgy claims? A whopping £1.16 billion . Motor insurance was hit the hardest, accounting for 51,700 of those scams worth £576 million – that is 53% of all detected fraud. For a deeper dive into these numbers you can explore more insights from the Association of British Insurers.

This constant financial drain means insurers have no choice but to build a ‘fraud tax’ into their pricing. It is estimated that fraud adds a significant chunk to the average motor insurance premium—a cost honest drivers are forced to pay.

The Ripple Effect of Operational Costs

Beyond the direct payouts for fraudulent claims there is a secondary, equally damaging cost. Insurers have to pour huge amounts of money into fighting fraud and these operational expenses are substantial. It is money that could otherwise be used to make insurance better and cheaper for genuine customers.

This investment includes:

- Specialist Investigation Teams: Insurers fund entire departments of highly trained investigators whose only job is to sift through suspicious claims, piece together evidence and spot fraudulent patterns.

- Legal and Court Fees: Challenging a fraudulent claim often ends in a lengthy and expensive legal fight. The costs from solicitors’ fees to court expenses quickly spiral.

- Expert Witness Costs: Proving a claim is fake often requires testimony from outside experts like accident reconstruction specialists or medical professionals, all of whom come with a hefty price tag.

Every pound spent fighting fraud is a pound that cannot be used to lower premiums, improve customer service or develop better technology for genuine policyholders. It represents a massive misallocation of resources, driven entirely by criminal activity.

Ultimately tackling car insurance fraud is about more than just catching criminals. It is about creating a fairer, more affordable and more efficient insurance market for every driver on the road. By stopping fraudulent claims before they get paid insurers can slash these unnecessary costs and pass those savings directly back to their honest customers, building a more equitable system for everyone.

Identifying Fraud Hotspots and Red Flags

To get a real handle on car insurance fraud you have to stop playing defence and start playing offence. It is about shifting from reacting to claims to proactively spotting trouble before it hits your bottom line. This means fraud specialists and underwriters need to think more like detectives, using intelligence to pick up on high-risk signals long before they turn into a financial loss.

That proactive mindset starts with a simple question: where is fraud most likely to come from? Because it is not random. Fraud often pops up in clusters in specific areas where organised crime networks have set up shop. These groups are experts at exploiting local communities, staging accidents and filing bogus claims on an industrial scale.

Pinpointing Geographic Hotspots

Data is your map for finding these high-risk zones. In the UK the motor insurance landscape is unfortunately dotted with several well-known hotspots for policy fraud. After digging into 2.4 million policies the Insurance Fraud Bureau (IFB) pointed to West Yorkshire, Greater Manchester and the West Midlands as the biggest problem areas in England. Other hotspots include Glasgow, the Isle of Anglesey and County Fermanagh.

These findings often go hand-in-hand with a shocking seven-fold increase in identity theft linked to organised fraud rings which is the fuel for scams like 'ghost broking' and 'crash-for-cash' schemes. You can explore the IFB’s deep dive into the UK’s top policy fraud hotspots to see the full geographical breakdown.

Knowing where these hotspots are allows underwriters to apply an extra layer of scrutiny to applications from those postcodes. It is not about penalising honest people who happen to live there; it is about recognising the heightened risk and doing the necessary due diligence to throw a spanner in criminal operations.

Behavioural Red Flags at the Application Stage

While geography gives you valuable context the real detective work is in spotting suspicious behaviour. Right from the initial application several red flags should set off alarm bells and trigger a much closer look.

These early warning signs include things like:

- Frequent Policy Changes: An applicant constantly switching insurers or cancelling policies mid-term could be trying to bury a bad claims history or just stay one step ahead of being found out.

- Unusual Vehicle and Driver Combinations: Think a high-performance sports car registered to a young driver working a low-income job. It just does not add up.

- Vague or Inconsistent Information: If the address they provide does not match other records or they cannot give you clear details it could be a sign they are hiding something.

Spotting these indicators early is your first line of defence. A policy that is fraudulent from day one is almost guaranteed to lead to a fraudulent claim down the road. That makes robust initial checks absolutely critical.

Warning Signs During a Claim

Even with the best underwriting some bad apples will slip through. The next chance to catch car insurance fraud is when a claim is filed. Fraudulent claims often have a certain 'feel' to them with claimants acting in ways that just are not normal.

Here are a few classic red flags for claims handlers to watch for:

- Pressure for a Quick Settlement: Fraudsters want their money and they want it now. They'll often try to rush a settlement hoping you'll pay out to close the case without looking too closely. They might get unusually pushy or aggressive.

- Inconsistent or Evolving Stories: The claimant's story of the accident changes every time they tell it. Or it flat-out contradicts the physical evidence and what witnesses are saying. This is a huge warning sign.

- Connections to Known Fraudsters: Modern data analytics are fantastic for uncovering hidden links. You can now spot connections between the claimant, witnesses or other parties and people already flagged for fraud.

- Claim Submitted Long After the Incident: A big delay in reporting an accident without a good reason is suspicious. It often suggests the claimant needed time to cook up a story or stage the damage.

By combining geographic data with a sharp eye for these behavioural tells insurance pros can shift from just processing claims to actively shutting down fraud. It is a proactive approach that not only protects the company’s finances but also helps create a fairer market for every honest customer out there.

Shifting from Reaction to Proactive Prevention

For decades the insurance industry has been stuck playing defence against car insurance fraud. A claim comes in, a few red flags pop up and a costly, time-consuming investigation kicks off. This traditional model forces insurers onto the back foot, trying to prove a negative—that the damage was already there or the crash was staged—long after the event. The whole system is built on post-claim suspicion, not pre-policy clarity.

But what if we could flip that model on its head? What if you could establish the truth before a claim is even a possibility? That is the core idea behind proactive prevention. It is all about creating a single, indisputable source of truth right from the very start of the relationship with a policyholder.

This shift empowers insurers to base their decisions on hard facts, not assumptions, effectively neutralising many common fraud tactics before they even get off the ground.

Creating a Digital Logbook

The best way to stop fraud is to remove the ambiguity that fraudsters thrive on. This is where proactive verification comes in, creating what is essentially a digital vehicle logbook. The concept is simple but incredibly powerful.

At the very start of a policy the new policyholder uses a straightforward app to capture a complete, photo-verified record of their vehicle. This is not just a couple of random snaps; it is a structured process that documents the car’s condition from every angle, inside and out. Each image is automatically timestamped and geotagged, creating a verifiable baseline that cannot be disputed later.

This one simple step gives underwriters and claims handlers concrete evidence of the vehicle’s exact condition on the day the policy began. It becomes the definitive reference point for any future claim.

Neutralising Common Fraud Tactics

Once you have this baseline of truth many of the most common types of car insurance fraud become almost impossible to pull off. The power dynamic shifts entirely. It is no longer the fraudster's word against the insurer’s suspicion; it is a simple comparison against verifiable facts.

Here’s how this approach directly counters specific schemes:

- Exaggerated Damage Claims: When a driver tries to add old scratches, dents or scuffs to a new claim the timestamped photos from day one instantly prove the damage was already there. The argument is over before it begins.

- After-the-Event Fraud: This is the classic tactic where someone damages their vehicle, quickly takes out a new policy and then files a claim a few weeks later. A verified photographic record taken at inception makes this scam impossible to sustain.

- Staged Accidents: While proactive verification cannot stop a staged collision from happening it provides invaluable context. It confirms the condition of the vehicles just before the incident, helping investigators easily spot inconsistencies in the claimed damage.

This evidence-based model transforms the claims process from an adversarial negotiation into a straightforward validation. If the claimed damage is new and consistent with the incident the claim is legitimate. If not the evidence to refute it is already on file.

This fundamental change allows insurers to stop just reacting to fraud and finally start preventing it. You can learn more about how this works by fighting fraud before it happens with the power of verified evidence .

By securing irrefutable proof at the very beginning of a policy insurers can build a much stronger, more resilient defence against car insurance fraud . This does not just protect the business from financial losses; it creates a fairer system for honest policyholders who ultimately bear the costs of these crimes. It moves the industry from a place of inherent distrust to one of shared transparency which benefits everyone—except the fraudsters.

The Business Case for Evidence-Based Claims

Switching to a proactive, evidence-based approach for handling claims is not just about catching fraudsters; it is a strategic move that delivers a powerful return on investment. Insurers who make this shift see real, tangible benefits across their entire operation, transforming a major cost centre into an opportunity for growth and stronger customer relationships.

The financial upside really comes down to three core areas. Each one tackles a major headache in the traditional claims model and helps build a more profitable, resilient business.

Direct Reduction in Fraudulent Payouts

The most immediate win is a sharp drop in fraudulent payouts. When you have an indisputable, timestamped photographic record of a vehicle's condition right from the policy's start it becomes nearly impossible for embellished or outright fictitious claims to hold up.

Fraudsters thrive on ambiguity. An evidence-based system strips that away completely. A claim for pre-existing damage is instantly debunked by the initial photos. An attempt at 'after-the-event' fraud where damage occurs before the policy even starts is stopped dead in its tracks. This hard evidence gives claims teams the confidence to reject dodgy claims, directly protecting the bottom line. Building a strong business case for this approach often leans on sophisticated methods for detecting errors in insurance claims , which can bring fraudulent patterns to light.

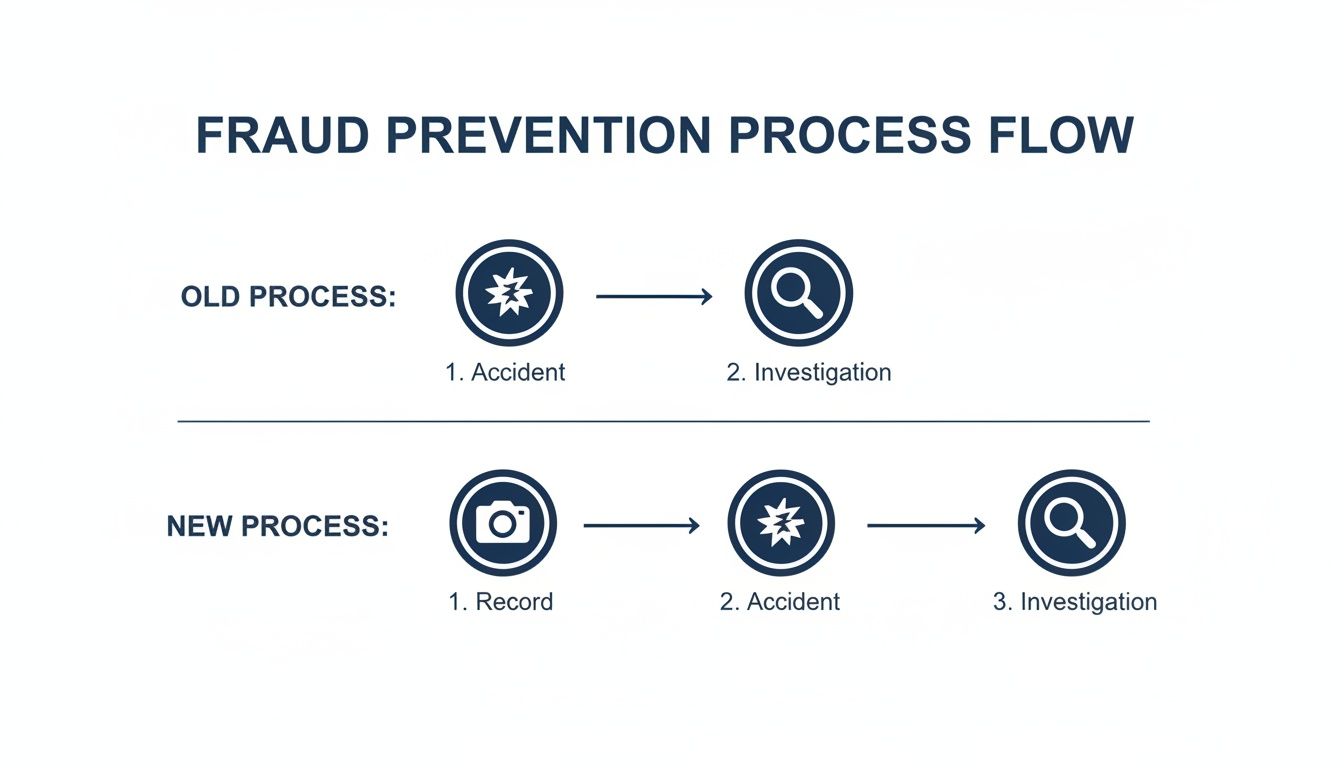

This flowchart shows the shift from a reactive, old-school investigation model to a proactive, evidence-first one.

As you can see, capturing verified evidence upfront eliminates the need for those lengthy, costly investigations after an incident, fundamentally changing how claims are handled from day one.

Major Gains in Operational Efficiency

The second massive benefit is a huge boost in operational efficiency. While fraudulent claims are a serious problem the vast majority of policyholders are honest. An evidence-based system actually accelerates the validation of these legitimate claims, dramatically cutting down the workload for handlers and slashing investigation costs.

With verifiable proof already on file the need for endless back-and-forth emails, expensive loss adjuster visits and long-winded reviews is massively reduced. Claims handlers can approve genuine claims faster and with far more certainty.

This efficiency gain is critical. It frees up your most experienced staff to focus on the complex cases that genuinely need their expertise, rather than wasting time arguing over minor damage that could have been verified from the start.

Enhanced Customer Experience and Brand Loyalty

Finally this approach completely transforms the experience for your honest customers. Let us face it, nobody wants to feel like a suspect when they make a claim. A faster, smoother settlement process during what is already a stressful time is one of the most powerful ways to build customer loyalty.

When genuine claims are settled in days instead of weeks it reinforces the insurer's core promise to be there when needed. This positive experience does not just improve retention; it strengthens the insurer's brand reputation, turning satisfied customers into vocal advocates. It proves that fighting car insurance fraud and delivering exceptional customer service can and absolutely should go hand in hand.

Digging into Fraud Prevention: Your Questions Answered

If you are in the insurance business you are always on the lookout for solid, practical ways to get a handle on car insurance fraud. But bringing in new strategies naturally raises a few questions. How does it work on the ground? What will customers think? And does it actually stop organised crime?

Let us tackle some of the most common queries. The answers show how moving from a reactive stance to a proactive one builds a much stronger, more efficient system for everyone—insurers and honest customers alike.

How Can We Challenge an Exaggerated Claim Without Proof From Day One?

Let us be honest, challenging a padded claim is a real headache. It usually kicks off a long, expensive investigation involving loss adjusters and expert reports, often fizzling out into a negotiated settlement instead of a clean, fact-based decision. Fraudsters know this and they bank on that ambiguity.

This is where a proactive approach completely changes the game. By creating an undeniable, time-stamped record of a vehicle's condition before the policy even starts any post-incident exaggeration sticks out like a sore thumb. Claims handlers are no longer arguing opinions; they are armed with cold, hard facts allowing them to shut down inflated claims quickly and confidently. It saves a ton of time and of course money.

What's the Biggest Hurdle in Fighting Organised 'Crash-for-Cash' Schemes?

The real challenge with 'crash-for-cash' rings is their sheer sophistication. They are experts at coordinating incidents that look completely unrelated, making it tough to connect the dots. While things like telematics can spot suspicious driving the true foundation of these schemes is their ability to get fraudulent policies in the first place, often using stolen identities.

The most effective way to dismantle these networks is to pull the rug out from under them. If you make it incredibly difficult for criminals to get the cover they need to run their scams, you strike at the very heart of their business model. Proactive identity and vehicle checks at the policy's start are the best way to do just that.

Does New Verification Tech Create Hassle for Honest Customers?

It is actually the complete opposite. It smooths out the friction for genuine customers right when they need support the most. That initial step of documenting a vehicle's condition takes just a few minutes but it saves an immense amount of stress and delay when they eventually need to make a claim.

When a genuine incident happens the claim can be verified and paid out far more quickly because the proof of the car's prior condition is already on file. This takes the stress out of the most critical part of the insurance journey which is a direct path to happier, more loyal customers. By front-loading the verification the claims process becomes a better experience for everyone.

Take control of your claims process and stop fraud in its tracks. Proova gives you the tools to build an evidence-based system that protects your bottom line and rewards honest policyholders. Find out how our verification technology can reshape your operations at https://www.proova.com.