Protect Your Premiums: insurance fraud car scams & tips

Car insurance fraud is not some distant corporate problem. It is a deceptive act committed to squeeze money out of an insurance policy and it is costing the UK over £1 billion every single year . This is not just a number on a page; it is a widespread issue that directly inflates the premiums for every honest driver, acting like a hidden tax that makes essential cover more expensive for all of us.

The True Cost of Car Insurance Fraud for UK Drivers

It is easy to think of insurance fraud as a victimless crime, a case of one person getting a little extra from a massive, faceless company but that could not be further from the truth. The reality is that every single fraudulent claim, big or small, adds to a colossal collective bill that is ultimately passed down to consumers like you and me.

When an insurer pays out a dishonest claim, that money does not just vanish from a corporate vault. Instead, the loss is spread across the entire pool of policyholders. How? In the form of higher premiums. This means your annual insurance cost is directly hit by the actions of those who decide to cheat the system and the provability of any claim is central to protecting honest drivers.

A Hidden Tax on Every Driver

Think of car insurance fraud as a stealth tax you are forced to pay. From someone slightly exaggerating the damage on a legitimate claim to highly organised 'crash for cash' gangs, each act of deception piles onto the overall cost. This is not just a minor inconvenience; it is a significant financial drain on households right across the country.

The scale of this problem is staggering. Recent data shows that the cost of motor insurance fraud is a huge financial burden for the UK. In 2024, insurers sniffed out over 98,400 fraudulent claims with a total value of £1.16 billion —that is a 12% jump in the number of cases from the previous year. Motor insurance is by far the most targeted sector, making up 53% of all detected fraudulent claims , with these scams costing a jaw-dropping £576 million.

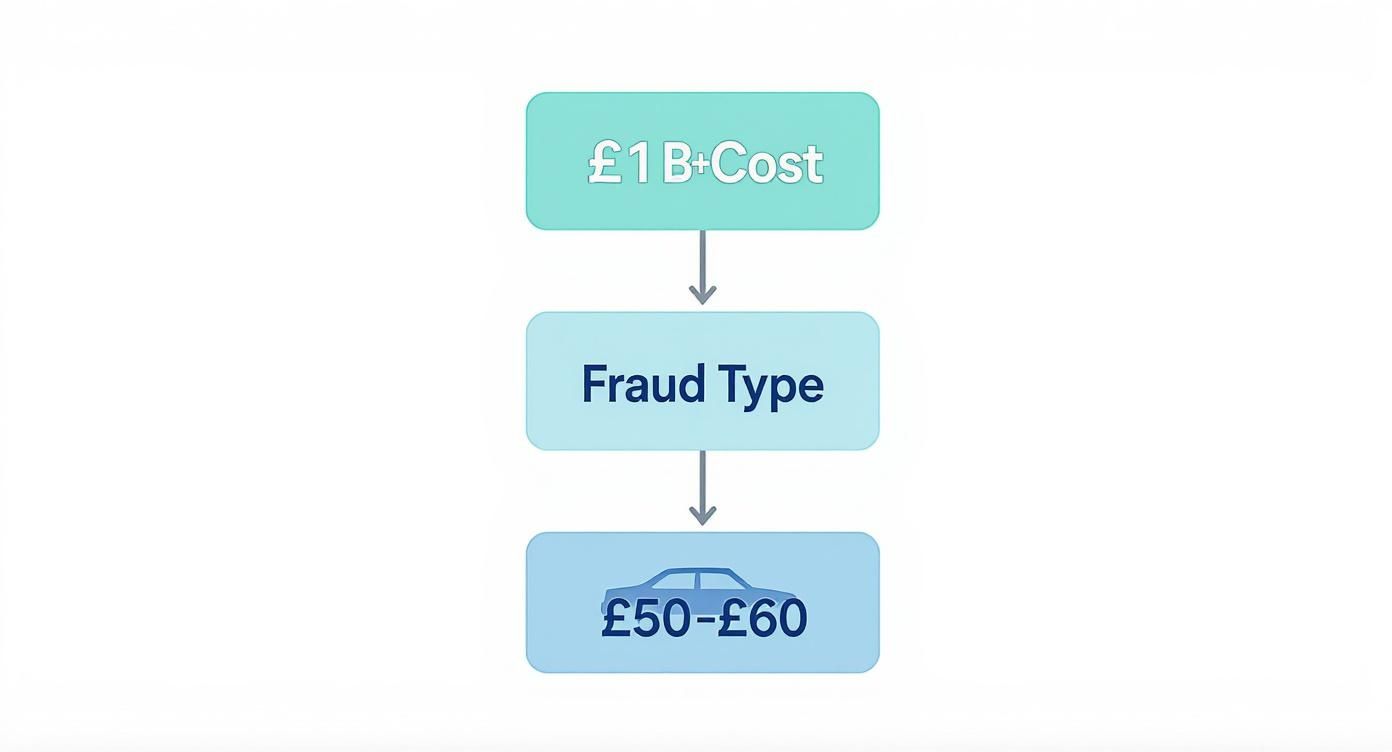

The direct consequence? Honest UK drivers are paying an estimated £50-£60 extra each year on their premiums just to cover these fraudulent activities.

This is not just about statistics; it is about real money coming out of your pocket. Every fabricated injury or exaggerated repair bill is a cost that you and millions of other honest drivers have to bear.

The Ripple Effect of Fraud

The fallout from fraud goes well beyond just the financial side of things. Organised criminal operations, like staged accidents, actively endanger the public and put innocent drivers at risk of real injury. These schemes also clog up our emergency services and police resources, pulling them away from genuine incidents where they are desperately needed.

Understanding the far-reaching economic impact of insurance fraud is the first step toward realising why tackling this problem is so vital. It is not just about protecting the insurance industry's bottom line; it is about safeguarding the financial wellbeing of every single person who buys a car insurance policy. By getting to grips with the true cost, we can all appreciate the need for robust verification and prevention methods.

Deconstructing Common Car Insurance Scams

Car insurance fraud is not a single, straightforward crime. It exists on a spectrum, running from subtle dishonesty by otherwise law-abiding people to highly coordinated criminal operations that put the public in real danger. Getting to grips with these different schemes is the first step towards spotting and stopping them.

At its heart, car insurance fraud falls into two main camps: opportunistic fraud (often called 'soft fraud') and organised fraud (known as 'hard fraud'). The real difference boils down to intent and complexity.

The Two Faces of Deception

Opportunistic fraud is the kind many people wrongly see as a minor fudge. It happens when someone in a genuine accident decides to bend the truth a bit for a bigger payout. This could mean claiming for a scratch that was already there, exaggerating a whiplash injury or inflating the value of items stolen from their car.

While each individual act might seem small, the sheer volume of these little white lies is what makes them so damaging. They add up, creating a massive financial black hole for the industry.

On the other end of the scale is organised fraud , which is deliberate and premeditated. These are crimes planned from the get-go, with the sole aim of tricking an insurer out of money. There is no real accident; the entire event is manufactured for profit. This is where you find some of the most dangerous and costly scams on UK roads.

The flowchart below shows exactly how the billion-pound cost of fraud filters down to every driver in the UK.

It is a direct line from a huge industry problem to a tangible hit on your wallet, making it a personal issue for every single motorist.

This table breaks down the key differences between the two main types of fraud.

Opportunistic vs Organised Car Insurance Fraud

| Characteristic | Opportunistic Fraud (Soft Fraud) | Organised Fraud (Hard Fraud) |

|---|---|---|

| Intent | Spontaneous, unplanned exaggeration of a genuine claim. | Premeditated and deliberately planned to defraud. |

| Complexity | Simple, usually involves a single individual. | Complex, often involves multiple people and staged events. |

| Trigger | A legitimate accident or loss. | No legitimate incident; the event is entirely fabricated. |

| Examples | - Inflating repair costs - Claiming for pre-existing damage - Exaggerating injury severity |

- Staged 'crash for cash' collisions - Faking vehicle thefts - Inventing 'ghost' accidents |

| Financial Impact | Low per claim, but high collective cost due to volume. | High per claim, involving multiple fraudulent claims. |

| Risk to Public | Generally low, as the initial incident is genuine. | High, as it involves deliberately causing accidents. |

While both forms of deception are illegal and costly, organised fraud presents a much more direct and dangerous threat to public safety.

Crash for Cash: The Most Notorious Scam

The most infamous example of organised fraud has to be the ' crash for cash ' scheme. These are not accidents at all—they are staged collisions deliberately caused by criminals to submit bogus claims for vehicle damage, recovery fees, personal injury and a whole host of other costs.

These schemes usually follow a few classic scripts:

- The Slam-On: A fraudster pulls in front of their target and slams on the brakes for no reason, giving the innocent driver behind no chance to stop. They often do this at roundabouts or busy junctions to make the collision seem more believable.

- The Induced Accident: A criminal driver at a junction will flash their headlights to let another driver pull out, only to accelerate and crash into them on purpose. They then deny ever giving the signal, pinning the blame on the victim.

- The Ghost Accident: In this scenario, there is no collision at all. Fraudsters simply invent a crash out of thin air, using fake details to submit a claim for an accident that never happened.

The scale of the problem is staggering. Fresh analysis shows that more than one in every five car insurance claims is impacted by fraud . That means over 20% of all submissions involve some form of deception.

This activity adds an estimated £400 million to our collective insurance bill every year, which works out to an extra £50-£60 on every honest motorist's policy. While a lot of this is low-level dishonesty, organised gangs staging dozens of accidents are a serious threat to public safety.

Phantom Passengers and Fake Injuries

Another common tactic, often bolted onto 'crash for cash' schemes, is the use of 'phantom passengers'. After staging a collision, the fraudster claims their car was full of people, all of whom are now suffering from injuries like whiplash.

These non-existent passengers then flood the insurer with personal injury claims, dramatically inflating the value of the fraud. Without solid evidence to the contrary, proving these people were never there can be incredibly difficult, making it a very profitable move for criminals.

How Criminals Turn Stolen Identities into Fraudulent Claims

In the world of insurance fraud, a car can be a tool, a target or a smokescreen but there is a far more powerful weapon in the fraudster’s arsenal and it is something much more personal: your identity. Organised criminal networks are increasingly hijacking stolen personal data to orchestrate large-scale scams that are not only profitable but incredibly difficult to trace back to them.

This is not just about small-time opportunism. We are talking about the calculated theft of names, addresses and dates of birth, often harvested from major data breaches or clever phishing scams. Once they have this information, it becomes the raw material for building entirely fabricated scenarios, leaving a trail of financial and personal ruin for both insurers and the innocent people whose names have been used.

The Rise of Ghost Broking

One of the most damaging forms of identity-driven fraud is 'ghost broking' . This scam preys on drivers desperate for cheaper insurance—especially younger or higher-risk individuals who are facing sky-high premiums. A ghost broker is basically an unlicensed con artist who sells forged or invalid insurance policies to unsuspecting drivers.

So, how does the scam actually work?

- Completely Fake Policies: The fraudster might simply forge the insurance documents from scratch, creating a policy that looks real but offers zero actual cover.

- Real Policies with Fake Details: A slightly more sophisticated method involves the ghost broker buying a legitimate policy from a real insurer. The catch? They use a stolen identity or false details (like a different address or a much older age) to get a heavily discounted price. They then sell this doctored policy on to the victim, pocketing the difference.

The victims often only find out they have been scammed when they need to make a claim or get pulled over by the police. The consequences are serious, ranging from fines and penalty points to being held personally liable for all the costs of an accident.

Stolen Identities: The Engine Behind 'Crash for Cash' Schemes

Beyond selling fake cover, stolen identities are a crucial component of many organised 'crash for cash' incidents. Criminal gangs use them to build layers of deception, making their fraudulent claims seem much more believable and harder for investigators to pick apart. This tactic turns a simple staged collision into a complex web of lies.

Identity theft is not just about the financial hit; it is about the erosion of trust and personal security. When a criminal uses your name to commit fraud, they drag your reputation through the mud, creating problems that can take years to sort out.

These networks might use a stolen identity to register a vehicle involved in a staged accident, creating a 'ghost driver' who is practically untraceable. They also invent ‘phantom passengers’, using stolen personal details to add fictional claimants to a crash report. Each made-up claimant represents another potential payout for personal injury, dramatically inflating the scam’s profitability.

Fuelling a Sophisticated Fraud Problem

The link between identity theft and car insurance fraud is undeniable and it is growing stronger. The UK has seen a massive spike in identity theft connected to organised insurance fraud, particularly in the motor sector.

In fact, figures from the Insurance Fraud Bureau (IFB) show that cases of identity theft linked to insurance fraud have jumped by more than sevenfold since 2021 . This alarming trend is fuelled by a surge in data phishing scams and the calculated efforts of organised crime groups. These criminals use stolen details not just for 'ghost broking' but also to enable complex 'crash for cash' scams by submitting claims for accidents that never even happened. You can learn more about the rise in identity theft and its impact on the UK's insurance industry.

Behind The Scenes Of A Fraud Investigation

When an insurance claim lands on a desk, it is more than just a damaged vehicle or an injury report. It is a story waiting to be verified. The vast majority of these stories are true accounts from honest customers needing support but woven amongst them are fabricated tales designed to exploit the system. Distinguishing fact from fiction is a complex process, blending old-school detective work with powerful modern technology to ensure only genuine claims get paid.

This is not about treating every claimant with suspicion. Far from it. It is about having a robust, fair process to protect the integrity of the insurance pool for everyone. The first step in any investigation is often digital, long before a human investigator ever sees the file.

The First Line of Defence: Data and AI

Today, insurers are armed with sophisticated data analytics and artificial intelligence systems that act as a digital sieve. These platforms scrutinise thousands of claims every hour, searching for anomalies and red flags that might point to an insurance fraud car claim. Modern fraud investigations are increasingly tech-driven and understanding the evolving role of AI in insurance claims really sheds light on how suspicious activities are flagged.

These automated systems do not make the final call but they are incredibly effective at prioritising which claims need a closer look. They analyse countless data points, spotting patterns a human might easily miss.

A system might flag a claim for several reasons, such as:

- Unusual Claim History: Does the claimant have a habit of making frequent or similar claims?

- Geographic Hotspots: Did the incident happen in an area known for 'crash for cash' schemes?

- Linked Parties: Are the people involved—drivers, passengers, witnesses, even the repair shop—connected to previous fraudulent claims?

- Inconsistent Timelines: Does the time of the reported incident clash with other known data points?

When the system flags a claim, it gets escalated to a human fraud investigator. This is where traditional detective work kicks in, guided by the initial insights from the data.

Connecting the Dots With Industry Databases

A crucial part of any investigation is cross-referencing information against shared industry databases. In the UK, one of the most important tools is the Claims and Underwriting Exchange (CUE) . This central database holds records of all incidents reported to insurance providers, whether a claim was made or not.

By checking CUE, an investigator can quickly see if a claimant has a history of similar incidents across different insurers or if they have conveniently forgotten to disclose previous accidents. This helps build a much clearer picture of an individual's claims history and identify potential patterns of behaviour consistent with fraud.

The goal of an investigation is not just to deny a fraudulent claim but to build a provable, evidence-based case. This protects honest policyholders from footing the bill and ensures criminals are held accountable for their actions.

Organisations like the Insurance Fraud Bureau (IFB) also play a vital role. They manage the Insurance Fraud Register (IFR) and work to uncover organised criminal networks. To get a better sense of what they do, check out our in-depth guide to the Insurance Fraud Bureau and see how they collaborate with insurers and police forces.

The Power of Physical Evidence and Telematics

While data provides the starting point, building a provable case often comes down to hard evidence. This is where forensic analysis and real-world data become indispensable.

Forensic engineers might be brought in to examine vehicle damage. They can determine if the impact patterns are consistent with the story being told. For instance, damage that looks like it was caused while a car was stationary completely contradicts a claim describing a high-speed collision.

Better yet, telematics data from black boxes or dashcams provides an impartial, second-by-second account of an incident. This technology can verify critical details with undeniable accuracy:

- Exact Location: Was the vehicle where the claimant said it was?

- Speed at Impact: Does the data match the described severity of the crash?

- Braking and Acceleration: Can the data confirm or refute claims of a sudden 'slam-on' manoeuvre?

This digital evidence is incredibly powerful for debunking staged accidents. When a fraudster’s story directly conflicts with the irrefutable data from their own vehicle, the case against them becomes rock-solid. This blend of digital intelligence and physical scrutiny shows just how committed the industry is to rooting out fraud and protecting every honest driver.

The Serious Consequences of Insurance Fraud

Thinking you can outsmart an insurer with a fraudulent claim might seem like a clever way to pocket some quick cash or dodge your policy excess. The reality? It is a brutally bad idea. The fallout is not just a few financial penalties; it is a cascade of life-altering events that can dismantle your future.

It is a dangerous mistake to see insurance fraud as a low-risk gamble. The short-term appeal of a few hundred, or even a few thousand, pounds is completely dwarfed by the devastating and long-lasting consequences. This is not just about a slapped wrist; it is a permanent black mark that follows you for years.

Immediate and Lasting Financial Penalties

The first thing an insurer will do once they prove an insurance fraud car claim is cancel the policy. That is not just a simple admin task—it is the start of a very long and difficult road. With the policy now void, the fraudster is often left personally on the hook for all the costs from the incident they tried to exploit. We are talking tens of thousands of pounds.

Beyond that immediate financial hit, the person’s details are added to the Insurance Fraud Register (IFR) . This is an industry-wide database, essentially a blacklist, that all UK insurers can see. Being on the IFR has serious implications:

- Difficulty Getting Future Cover: Most mainstream insurers will simply refuse to offer cover to anyone on the register.

- Extortionate Premiums: The few specialist insurers willing to provide a policy will charge incredibly high premiums, reflecting the massive risk the individual now poses.

- Broader Financial Impact: The blacklisting can spread beyond car insurance, making it harder and more expensive to get home, travel or even life insurance.

The Path to a Criminal Record

For more serious offences, like organised 'crash for cash' schemes or major financial deception, the consequences escalate well beyond civil penalties. Insurers work hand-in-hand with dedicated police units, such as the Insurance Fraud Enforcement Department (IFED), to build solid cases for criminal prosecution.

A conviction for fraud is not something that just disappears once a fine is paid. It leaves you with a criminal record that can fundamentally limit your life choices, hitting everything from job opportunities and travel plans to your ability to get a mortgage.

If the case goes to court and ends in a guilty verdict, the penalties can be severe. Under the Fraud Act 2006, prosecutors have a strong framework to work with, leading to outcomes like:

- Substantial Fines: Courts can impose unlimited fines, designed to strip away any and all financial gain from the crime.

- Community Service Orders: Offenders might find themselves doing unpaid work in the community.

- Prison Sentences: For the most serious and high-value frauds, a prison sentence is a very real possibility.

Ultimately, the gamble is never worth it. The slick promise of easy money from a dodgy claim quickly evaporates, replaced by a future of financial hardship, closed doors and the permanent stigma of a criminal conviction.

How to Protect Yourself and Fight Back Against Fraud

While insurers and authorities are getting smarter about tackling car insurance fraud, every single driver has a crucial part to play. Staying vigilant and informed is your best defence. Honestly, it is the most powerful tool we all have in the collective fight for a fairer system.

Your actions can directly help chip away at the costs that inflate premiums for everyone. Understanding the tricks criminals use is the first step. When you can recognise the warning signs of common scams, you are far less likely to get tangled up in a fraudulent scheme, whether it is a staged accident or a fake insurance policy.

Spotting a 'Crash for Cash' Scheme on the Road

'Crash for cash' incidents are cleverly designed to look like genuine accidents but if you know what to look for, certain behaviours should set off immediate alarm bells. Being aware of these signs can help you anticipate and, hopefully, avoid a deliberate collision.

Keep an eye out for these tell-tale signs from other drivers:

- Erratic Driving: A car that keeps speeding up and slowing down for no obvious reason might be trying to get into the perfect position right in front of you.

- Brake Light Tampering: Pay attention if a car’s brake lights do not seem to be working. It is a classic fraudster move to disable them, giving you zero warning before they slam on their brakes.

- Suspicious Passengers: If you notice passengers in another vehicle who are paying way too much attention to you or the cars around them, they could be scouting for a target.

- Pre-existing Damage: Be wary of cars that already look beaten up, especially at the back. It could be a sign that the vehicle gets used for this sort of thing regularly.

Avoiding 'Ghost Broker' Scams

'Ghost brokers' are con artists who prey on people searching for cheap cover. They often pop up on social media, advertising deals that seem too good to be true—because they are. Protecting yourself means being sceptical and doing your homework before you part with a single penny.

Always remember this: if an insurance deal seems impossibly cheap, it almost certainly is. A legitimate broker will never pressure you into making a snap decision or demand payment through weird methods like a bank transfer to a personal account.

Before you buy any policy, especially from a source you do not recognise, always check if the broker is registered with the Financial Conduct Authority (FCA) . It is a simple, free check you can do online and it confirms they are a legitimate, authorised seller.

Of course, a big part of protecting yourself from situations that can lead to fraud—like staged accidents or false claims after a vehicle is "lost"—is solid car security. Learning more about how to protect your car from theft in the UK can make your vehicle a much harder target and reduce your overall risk.

Reporting Suspected Fraud Safely

If you think you have witnessed or been the victim of an insurance fraud car scam, reporting it is absolutely vital. The information you provide helps investigators build a bigger picture and can stop others from being targeted.

You can report anything suspicious completely anonymously to the Insurance Fraud Bureau's Cheatline . This service is a safe way to pass on what you know, helping the authorities connect the dots and take action against organised criminals. By speaking up, you are doing your bit to make the roads safer and insurance more affordable for every honest driver out there.

Your Car Insurance Fraud Questions Answered

This section tackles some of the most common questions we hear about car insurance fraud, giving you clear, straightforward answers to help you stay informed and protected.

What Should I Do If I Suspect a Staged Accident?

If you get that gut feeling you have been caught in a 'crash for cash' scam, your first priority is always safety. Do not get into a confrontation with the other driver. Instead, call the police right away to report the collision and share your suspicions.

If it is safe, use your phone to snap photos of everything—the vehicle damage, the position of the cars and the wider scene. When you report the claim to your insurer, make it crystal clear that you believe the incident was deliberate. Your side of the story is crucial evidence for any insurance fraud car investigation.

Can a Minor Exaggeration on My Claim Really Cause Problems?

Yes, absolutely. What might seem like a tiny white lie to you is considered outright fraud by insurers. This includes tacking on a bit of pre-existing damage to a new claim or bumping up the value of a stolen item just a little.

If you are caught, your insurer has every right to void your entire claim, not just the part you exaggerated. They can also cancel your policy and add your name to the Insurance Fraud Register, making it incredibly difficult and expensive to get insured in the future.

How Can I Check If an Insurance Provider Is Legitimate?

All genuine UK insurers and brokers have to be authorised and regulated by the Financial Conduct Authority (FCA). Before you buy a policy, you can check their status for free by searching the online FCA Register.

Be extra wary of deals that look too good to be true, especially those popping up on social media or in messaging apps. These are prime hunting grounds for 'ghost brokers' selling worthless, fake policies. Always stick to official company websites and verified phone numbers to make sure you are dealing with the real deal.

At Proova , we offer a simple, powerful way to document your assets before a loss ever happens, making sure your claims get processed faster and with far less hassle. By creating an undeniable record of ownership and condition, our platform builds trust from the outset and speeds up the entire claims journey. Secure your assets and streamline your insurance experience at https://www.proova.com.