insurance for learner drivers aviva - Aviva Learner Guide

Getting behind the wheel for the first time is a massive step but sorting out the right insurance can feel like a complete minefield. Aviva learner driver insurance is a specific, temporary policy built just for provisional licence holders. Think of it as a standalone cover that runs alongside the main car owner's policy, giving everyone peace of mind while you get your practice hours in.

Understanding Aviva Learner Driver Insurance

Learning to drive in a friend's or family member's car throws up a tricky insurance problem. Just adding a learner to an existing policy can send the price soaring and often puts the car owner's No Claims Discount on the line. If you had a prang, it could push up their premiums for years – a major worry for anyone kind enough to lend you their motor.

This is where a dedicated policy like Aviva's comes in. It's a clever alternative that acts as a separate, top-up cover, completely independent of the main insurance. This means if something unfortunate happens while you are driving, any claim is made against your learner policy.

The real beauty of this setup is that the car owner's No Claims Discount stays completely untouched. It removes a huge financial risk for the person lending you their car, making the whole learning process a lot less stressful for everyone.

Protecting Against Risk And Unnecessary Costs

This kind of insurance is built for flexibility because everyone's learning journey is different. You might need cover for a day, a week, or a few months. The cost usually depends on how long you need it for. Of course, before you even think about insurance, you need your provisional licence. For those across the pond, the process for getting a Florida learners permit is the first crucial step.

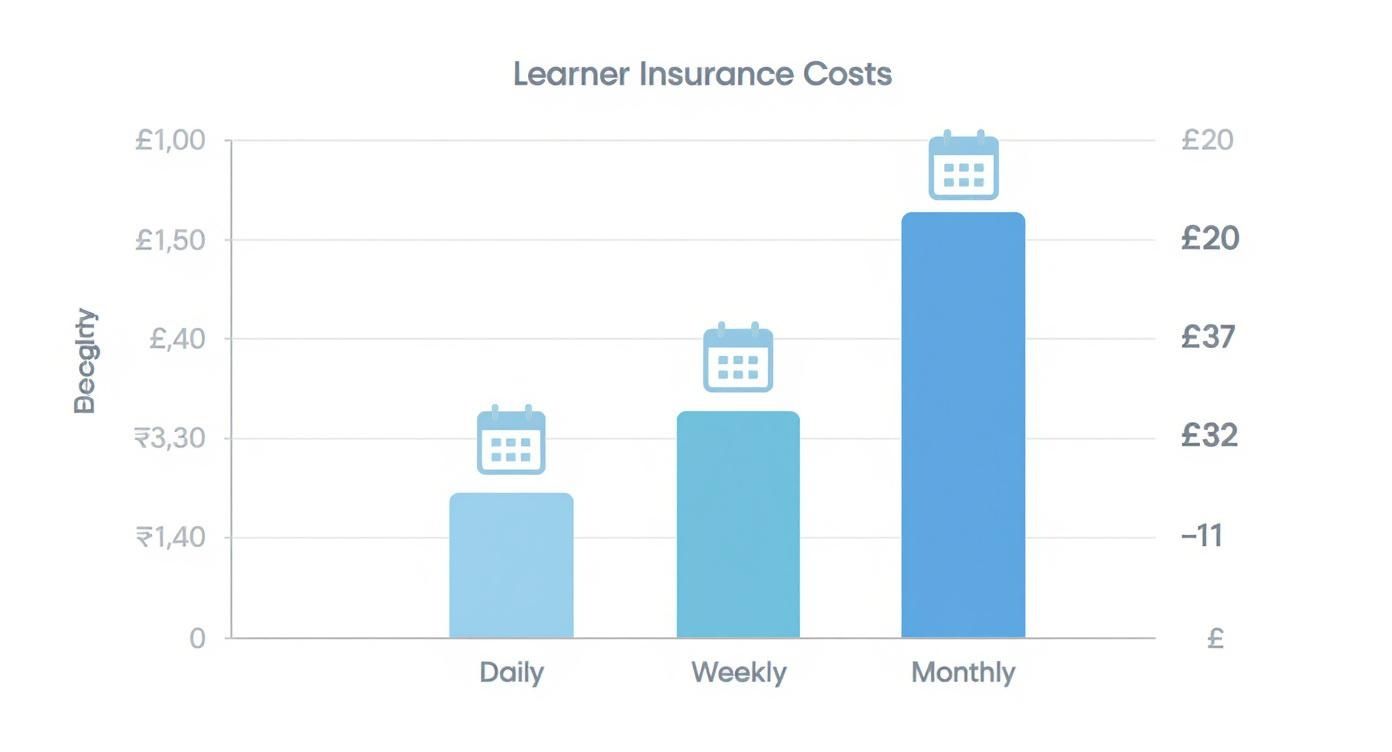

The chart below gives you an idea of typical costs for these flexible learner policies.

As you can see, longer-term policies tend to offer much better value, making them a smarter choice if you are planning on getting plenty of practice in. These flexible policies are a cornerstone of the UK insurance market, offering comprehensive protection that even covers you during your driving test. If you want to dive deeper into the nuts and bolts of car insurance, our practical guide on insuring a car in the UK is a great place to start. Ultimately, this approach makes sure learners are properly protected without financially penalising the car owners helping them out.

Right, before you jump in and get a quote for Aviva's learner driver insurance, there are a few boxes you and the car need to tick. Think of it as a pre-flight check – getting these details sorted first makes the whole process a lot smoother, so you can get on the road with proper cover.

Insurers need to be pretty thorough here. It’s not just red tape; it’s about preventing fraud, which is something that ends up pushing up prices for everyone if it goes unchecked.

Checking You're Eligible

First things first, let's look at the driver. You will need to have a valid UK provisional driving licence , and of course, meet Aviva's age requirements. It goes without saying but being upfront and honest here is absolutely essential. Fudging the details isn't just bending the rules – it's a type of insurance fraud, which carries serious legal and financial consequences.

Once you are cleared, it’s the car’s turn. Not every motor is a good fit for a learner policy so it is really important to check the specifics before you go any further.

Key Car Requirements

The car you'll be practising in has to meet certain criteria. These rules are all about managing risk and making sure the vehicle is suitable for someone who is still getting the hang of driving.

Typically, you will need to check for things like:

- Car Value: The car cannot be worth too much. Insurers usually set a limit, often under £30,000 , to cap their potential payout if the car is written off.

- Insurance Group: Cars are categorised into insurance groups from 1 to 50 , based on things like performance and repair costs. For learners, insurers will almost always stick to cars in the lower, cheaper-to-insure groups.

- Age and Condition: There is often an age limit on the car, for example, it might need to be less than 20 years old . It must also be fully roadworthy and have a valid MOT if it needs one.

Taking a moment to confirm these points is a huge deal. If you try to insure a car that does not meet the criteria, you could find your policy is completely invalid. That would leave you uninsured and on the hook for all the costs if an accident happens, making the claim unprovable for you and potentially marking you as a fraud risk for future insurance.

What Your Learner Policy Actually Covers

It’s easy to get bogged down in the small print so let's cut to the chase. Understanding what your insurance for learner drivers Aviva policy actually protects you for is vital. The good news is that most learner policies, including Aviva’s, are designed to be comprehensive. This gives you a solid level of protection while you are legally getting those all-important practice hours in.

So, what does that mean in the real world? It means you’re generally covered for damage to the car you’re driving, even if an accident is your fault. It also typically includes protection against fire and theft. But—and this is a big but—this cover is only valid as long as you are playing by the rules of your provisional licence, like always having a qualified driver supervising you.

Staying Within Your Policy Limits

Knowing what isn’t covered is just as important. Straying outside the rules can invalidate your insurance in a flash, leaving you completely exposed. For example, if you decide to drive solo, use the car to commute to a part-time job, or just give a mate a quick lift, you will not be insured. If you have an accident in those circumstances, the consequences are the same as driving without any insurance at all.

This has serious knock-on effects, not just for you but for everyone. When claims are invalidated or fraud occurs, insurers have to spend a lot of time and money investigating. Those costs ultimately get passed on to all drivers through higher premiums. Sticking to the rules does not just protect you; it helps keep costs down for the entire driving community.

The second you pass your driving test, your learner policy is void. It’s illegal to drive away from the test centre without sorting out a full licence policy first. Don't get caught out—it’s a form of insurance fraud that carries significant penalties.

Understanding Your Aviva Learner Policy Coverage

To make things crystal clear, think of your cover in terms of simple 'dos' and 'don'ts'. The table below breaks down some common scenarios to show you exactly what is covered and what is not under a typical Aviva learner policy.

| Scenario Covered | Scenario Not Covered |

|---|---|

| Accidents during a supervised practice drive | Driving solo without a qualified supervisor |

| Damage from fire or attempted theft | Using the car after passing your driving test |

| Liability for injury to other people (third parties) | Driving for business or commuting purposes |

| Driving to and from your official driving test | Damage from an accident on a motorway (check your specific policy details) |

Always double-check the specifics of your own policy document but this gives you a great starting point for understanding where the boundaries lie. Staying inside them is key to a stress-free learning experience.

The Real Cost of Insurance Fraud and Ghost Broking

For many young drivers, a super-cheap insurance deal can feel like a massive win. But if it seems too good to be true, it almost certainly is. This is especially the case in the world of learner driver insurance, where the threat of ‘ghost broking’ has become a serious and growing problem.

These criminals often use social media to hook in learners with offers of unbelievably low prices, only to sell them completely fake or invalid policies. This fraudulent activity not only harms the individual but also imposes significant costs on the insurance industry, which are then passed on to all policyholders.

The fallout from getting caught up in a scam like this is severe. It’s not just about losing the money you paid. If you are stopped and found to be driving without valid insurance, the police can seize your car, hit you with heavy fines, and slap penalty points on your licence before you’ve even passed your test. On top of that, this type of fraud pushes up the cost of legitimate insurance for everyone, as the industry has to absorb the losses from these illicit schemes.

The Rising Threat to Young Drivers

It’s hard to overstate just how big this issue has become. Ghost broking schemes are designed to prey on young, inexperienced drivers who are often desperate to find cover they can afford. The latest figures paint a pretty worrying picture, showing a huge jump in this type of criminal activity.

New research from Aviva reveals that ghost broking has surged by 22% in just two years. The main targets are young drivers aged 17-25, who lose an average of £2,000 each when they fall for these scams. You can read the full research about ghost broking findings to get the full story.

Beyond the immediate financial hit and legal trouble, victims also face the risk of having their personal data stolen and sold online. This is why it’s so important to only buy your policy through a legitimate, regulated provider like Aviva and to be wary of any deal that seems unprovably cheap.

This is a different issue to other insurance mistakes like ‘fronting’, which is where a more experienced driver lies and says they are the main user of the car to get a lower price. To keep yourself fully protected, you should learn more about fronting in our detailed article and always make sure your details are declared correctly.

Ultimately, the only way to guarantee you are properly covered is to double-check that your insurer is the real deal.

How Technology Can Improve Your Driving Skills

Modern insurance is no longer just about cover when things go wrong; it’s about actively encouraging safer driving from day one. Aviva is leaning into this with technology like telematics, which uses a "black box" or a simple phone app to monitor your driving habits. Think of it as a helpful co-pilot, keeping an eye on your speed, acceleration, and braking.

This data is not about catching you out. Instead, it provides valuable, provable feedback that helps you become a safer, more confident driver and can be crucial evidence in the event of a claim.

While you are more likely to see telematics policies after you have passed your test, getting to grips with the tech now can pay off massively. The safe habits you build while learning can directly lead to cheaper premiums once you have got your full licence.

Embracing Smarter Driving

It turns out this approach is a big hit with younger drivers. UK survey data reveals that younger generations are 16.0 percentage points more likely to have black boxes fitted than older drivers. They’re also more open to using dashcams and tracking apps to keep an eye on their performance. It's a clear sign that tech-driven insurance is helping to tackle the high costs new drivers often face. You can discover more insights about Aviva's telematics for younger generations to get the full story.

For insurers, this data is gold. The geo-location information from telematics is incredibly useful for verifying claims, which helps to fight fraud and ultimately keeps premiums down for everyone. By providing irrefutable proof of exactly where and when an incident happened, it cuts through the confusion that can often muddy the claims process and weeds out fraudulent claims.

Looking ahead, things are getting even more interesting. Cutting-edge tech like augmented reality in automotive driving is set to completely change the game, offering new layers of safety and navigation. As these tools become more common, they’ll give drivers even more power to build and prove their safe habits.

To understand the nuts and bolts of how this works, you can dive into our guide on how geo-location data strengthens insurance claims.

Common Questions About Aviva Learner Insurance

Getting ready to sort out your Aviva learner driver insurance? It is completely normal to have a few questions buzzing around your head. Nailing down the answers now means you will not have any nasty surprises later, keeping you legal and properly covered every single time you’re behind the wheel.

It’s so important to get the rules right from the start. A simple mistake could be misinterpreted as trying to mislead your insurer and that can have serious consequences for everyone involved. Unintentional or not, insurance fraud ends up costing the industry a fortune, which is one of the reasons premiums go up for all of us.

Can I Get Insured on More Than One Car?

Your learner policy is tied to one specific car. When you take out cover, it is for you to practise in that particular vehicle and that vehicle only. Why? Because the insurer has calculated the risk based on that car's value, insurance group, and age.

If you want to practise in more than one car – say, your dad's some weekends and your mum's on others – you will almost always need a separate learner policy for the second vehicle. This keeps everything crystal clear and ensures each car is underwritten for the specific risk it represents.

Don't be tempted to use one policy for multiple cars. It is not allowed and would instantly invalidate your cover. This is a classic example of non-disclosure and could be flagged as insurance fraud, leaving you completely uninsured if you had an accident.

What Happens When I Pass My Test?

This is the big one and it catches so many newly qualified drivers out. The second you pass your driving test, your learner policy is null and void. It’s finished. You are no longer a learner so the insurance is no longer valid.

You must arrange a full licence insurance policy before you drive the car away from the test centre. Driving on your now-useless learner policy is illegal – it’s the same as driving with no insurance at all.

Who Can Supervise Me?

The law is very strict about who can sit next to you while you practise. They need to be experienced enough to offer safe guidance and step in if needed.

Your supervising driver must:

- Be over 21 years old .

- Have held a full, valid driving licence for the type of car you're in (e.g., manual or automatic) for at least three years .

- Be fit to drive – so definitely not under the influence of drink or drugs.

It is your responsibility to make sure the person supervising you meets all these legal requirements. It’s a fundamental condition of your insurance policy and getting it wrong could mean any claim you make is rejected.

At Proova , we believe in making insurance clearer and more secure for everyone. By providing a transparent way to verify what you own, we help speed up legitimate claims and fight the fraud that costs us all. Find out more at https://www.proova.com.