A Practical Guide to Insure My Car in the UK

Right, let's get you insured. Before you even think about comparing quotes you will need to get some paperwork in order. Insurers need to know who you are, what you are driving and how you drive. It is that simple.

Getting all this information ready upfront makes the whole process faster and more importantly ensures the quotes you get are actually accurate.

Everything You Need to Get Your Car Insured

Think of it as building your driver profile. Every detail helps the insurer calculate the risk and ultimately your premium. If you leave something out or get a detail wrong it can cause major headaches later. An insurer could hike up your premium, refuse to pay out on a claim or even cancel your policy altogether if they find a discrepancy. Honesty is definitely the best policy here because inaccurate information undermines the entire system.

The Foundation: Your Personal and Vehicle Details

First things first, let's cover the basics about you and your car. Insurers will need your:

- Full name and date of birth

- Address and occupation (your postcode and job title can surprisingly swing your premium)

- Vehicle's registration number, make and model

- Car's age and your estimated annual mileage

Do not forget to declare any modifications, no matter how small. From new alloy wheels to a cheeky engine remap, it all needs to be on the table.

Insurers rely on the absolute accuracy of the information you provide. A small, undeclared modification or a slightly incorrect address might seem trivial but it can be viewed as misrepresentation, which is a form of insurance fraud. The provability of your information is paramount for a valid policy.

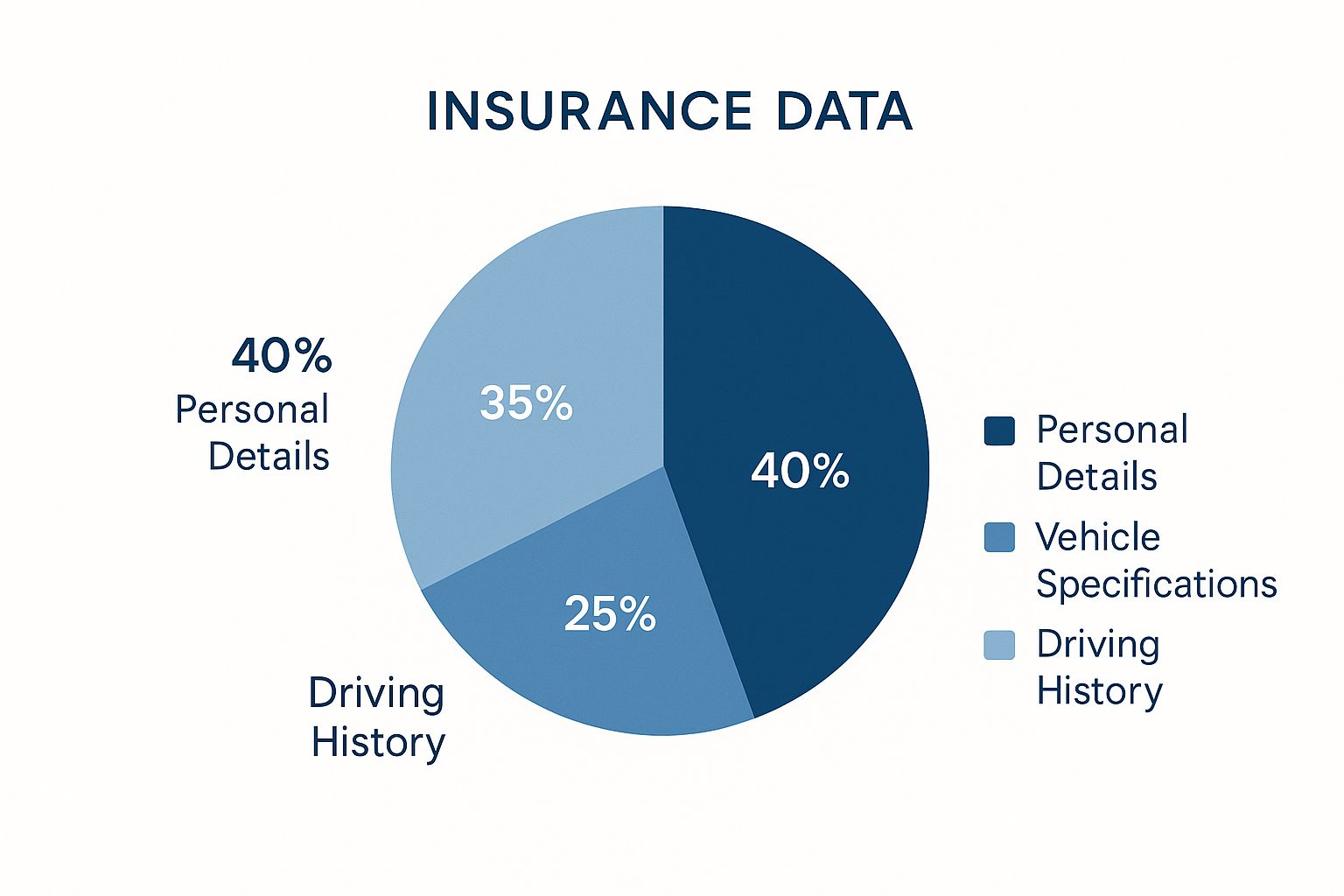

This infographic gives you a good idea of what insurers are looking at and how much weight each piece of information typically carries.

As you can see, the car you drive and your personal details are the building blocks of your initial risk profile.

Proving Your Driving Experience

The final part of the puzzle is your history behind the wheel. This is where your experience (good or bad) really comes into play. You will need to have details on hand for:

- Your driving licence number and what type of licence you hold.

- How many years of No Claims Discount (NCD) you have built up.

- Any claims or accidents in the last five years , even if it was not your fault.

- Any driving convictions or penalty points on your licence.

There is no room for guesswork here. Insurers have access to shared industry databases so they can easily verify your claims history and any convictions. Being upfront is non-negotiable. With fraudulent claims costing everyone more, the ability to prove your history accurately is vital.

New technology is also making it easier for people to provide verifiable information. Platforms are emerging that help you prove your driving history and possessions, which helps create a fairer system for everyone. You can learn more about how technology assists with the provability of claims for consumers and why it is a win-win for both honest customers and the industry.

Choosing the Right Level of Insurance Cover

Picking the right level of insurance is more than just ticking a box to stay legal—it is a major financial decision. When you insure your car you are deciding how much risk you are comfortable shouldering yourself and how much you want the insurer to handle. Getting that balance right is absolutely crucial for your peace of mind and financial security.

The UK insurance market is built around three core levels of cover. Each one offers a different degree of protection and it is vital to understand what you are actually paying for. Trust me, the cheapest quote that pops up on a comparison site is not always the best value for your real-world needs.

The Three Tiers of Car Insurance

First things first, you need to get your head around the fundamental differences between the policies. While the names give you a clue the small print is where the real distinctions lie. Let’s break down what each level actually means when you’re out on the road.

-

Third Party Only (TPO): This is the bare-bones legal minimum you need to drive in the UK. It covers any injury or damage you cause to other people , their cars or their property. The key thing to remember? It provides zero cover for damage to your own car or for your own injuries if you are to blame for the accident.

-

Third Party, Fire and Theft (TPFT): This policy includes everything from TPO but adds a layer of protection if your car is stolen or damaged by fire. It is a step up but it still will not pay out for repairs to your own car if you cause a smash.

-

Comprehensive: As the name suggests, this is the highest level of cover you can get. It includes all the protection from TPFT but crucially it also covers damage to your own vehicle, no matter who was at fault. It often bundles in extras like windscreen cover as standard too.

It is a classic myth that Comprehensive cover is automatically the priciest. Insurers noticed that higher-risk drivers often flocked to the cheapest Third Party policies, which has ironically pushed up the average premium for that level of cover. My advice? Always get quotes for all three. You might be pleasantly surprised.

UK Car Insurance Levels at a Glance

To make it even clearer, let's compare the three main types of car insurance side-by-side. This table shows you exactly what you can expect to be covered for under each policy type.

| Coverage Feature | Third Party Only | Third Party, Fire & Theft | Comprehensive |

|---|---|---|---|

| Damage to other people's property | ✔️ | ✔️ | ✔️ |

| Injury to others | ✔️ | ✔️ | ✔️ |

| Your car stolen | ❌ | ✔️ | ✔️ |

| Your car damaged by fire | ❌ | ✔️ | ✔️ |

| Damage to your own car in an accident | ❌ | ❌ | ✔️ |

| Personal injury to you | ❌ | ❌ | ✔️ |

| Windscreen damage | ❌ | ❌ | Often included |

Seeing it laid out like this really highlights the gaps in the lower levels of cover. While a cheaper policy might save you money upfront it could leave you with a massive bill if the unexpected happens.

Thinking About Optional Extras

Beyond the core levels of cover, insurers offer a menu of add-ons to bolster your policy. These can be brilliant for peace of mind but you need to weigh up whether you genuinely need them, as each one will nudge up the cost to insure your car.

Some of the most common add-ons include:

- Breakdown Cover: For roadside assistance if your car gives up on you.

- Legal Expenses Cover: Helps you recover uninsured losses, like your excess or personal injury compensation, after an accident that was not your fault.

- Courtesy Car: Gives you a temporary replacement vehicle while yours is in the garage for repairs after a claim.

Before you start adding these to your basket check if you are already covered elsewhere. Many packaged bank accounts for example include breakdown cover as a perk. There is no point paying twice for the same service.

Understanding What Drives Your Insurance Premium

When you get a car insurance quote the final price can often feel like a number plucked from thin air. The reality is it is the result of a detailed risk calculation that weighs up your personal circumstances against much bigger industry trends. Insurers are essentially trying to predict how likely you are to make a claim and crucially how much that claim might cost them.

This calculation starts with you. Factors like your age, where you live, your driving history and even your job all paint a picture of your individual risk. It makes sense that a young driver in an area with high car theft will face a higher premium than a middle-aged motorist with a spotless record living in a quiet village. But that is only half the story.

The price you pay is also heavily swayed by external factors that affect the entire insurance market. So even if nothing about your life has changed since last year your renewal quote could look very different because of pressures impacting every single driver on the road.

The Rising Cost of Keeping Cars on the Road

Today's cars are packed with sophisticated technology. Features like adaptive cruise control, lane-assist sensors and complex infotainment systems make driving safer and more comfortable but they also make repairs incredibly expensive.

What used to be a simple bumper scrape is no longer a cheap fix. Now it could involve recalibrating sensitive electronics, a job that can run into hundreds or even thousands of pounds.

This complexity creates a knock-on effect. There is a shortage of mechanics with the specialist skills needed to repair these high-tech vehicles, which drives up labour costs even further. When insurers have to pay more for every single repair claim that cost is inevitably passed on to all policyholders in their premiums.

Think of it this way: your insurance premium is a contribution to a collective pot of money used to pay for everyone's claims. When the average cost of a claim goes up due to pricier repairs the collective pot needs to be bigger. That means everyone's contribution must rise to keep the system working.

Broader Market Trends and Your Premium

Beyond just repair costs, other industry-wide issues also play a big part in your quote. Rising vehicle theft rates, particularly for keyless entry cars, add significant pressure on insurers. Likewise the sheer volume and total cost of claims paid out have a direct impact on pricing.

Interestingly despite these soaring costs for insurers fierce competition in the market can sometimes push prices down for consumers. According to the Association of British Insurers (ABI), the average premium for motor insurance between April and June 2025 was £562 . This was actually a drop of about 10% from the same period in 2024 yet insurers still paid out a staggering £3.1 billion in claims during that quarter alone.

This shows the complex balancing act insurers have to perform. On top of traditional factors, emerging trends like Generative AI Use Cases in Insurance are starting to influence how premiums are calculated and how the industry operates, adding yet another layer to the equation. Ultimately the price you pay is a blend of your personal risk profile and these powerful, market-wide forces.

The Real Cost of Insurance Fraud for Every Driver

When you take out car insurance it is easy to see it as a simple deal between you and your insurer. But the reality is that every single policyholder is part of a much bigger pool and the dishonest actions of a few have a real, tangible impact on everyone else.

Insurance fraud is not a victimless crime against some faceless corporation. It is a costly problem that directly inflates the premiums for every honest driver on the road. The provability of a claim is the bedrock of a fair insurance system and fraud undermines it completely.

This dishonesty can be anything from small exaggerations to large-scale criminal rings. It could be something that seems minor, like adding a few hundred pounds to a claim for a laptop that was damaged in the car or telling the insurer a more expensive phone was stolen than the one you actually owned. Each unproven or false claim adds to the collective cost.

At the other end of the scale you have organised ‘crash for cash’ schemes. In these scams criminals deliberately cause accidents with innocent motorists purely to make fraudulent personal injury claims. These are not only dangerous but also incredibly expensive for the industry to investigate and process, costs which are passed on to all of us.

How Dishonesty Hits Your Wallet

Every fraudulent payout creates a massive financial hole that insurers have to fill. To stay in business they have little choice but to spread that cost across their entire customer base. The result is simple: your annual premium is higher than it should be because a slice of it goes towards covering losses from fraud.

The Insurance Fraud Bureau (IFB) estimates that undetected general insurance fraud costs the industry over £1 billion every single year. That is a staggering sum that ultimately comes out of the pockets of law-abiding customers like you, pushing up the cost to insure my car and everyone else's.

When an insurer pays out on a dodgy claim it is not their own money they are losing—it is the collective pot of funds from all their policyholders. In essence every honest driver is subsidising the criminals. This makes the provability of genuine claims even more critical.

The Consequences of Getting Caught

Insurers do not just take claims at face value. They have dedicated fraud teams and sophisticated data analytics tools designed to spot suspicious patterns and inconsistencies.

They cross-reference claim details against industry-wide databases, check for previous claims and investigate any red flags that pop up. If you get caught the consequences are severe and can follow you for years.

- Policy Cancellation: Your insurer will cancel your policy on the spot, leaving you without cover.

- A Black Mark: You will be added to the Insurance Fraud Register. This makes it extremely difficult and expensive to get insurance for anything—not just your car—in the future.

- Criminal Record: Insurance fraud is a criminal offence. If prosecuted it can lead to hefty fines or even a prison sentence, leaving you with a permanent criminal record.

Being completely truthful on your application and any claims is the only way to protect yourself while helping keep costs down for everyone. For a deeper dive into the sheer scale of this problem you can read more about what insurance fraud really costs the industry and its far-reaching effects.

How to Find the Best Policy and Secure Your Cover

Price comparison websites are often the first port of call and for good reason. They give you a broad view of the market in minutes. But treat them as a starting point, not the final word. The policy with the lowest headline price might hide a punishingly high excess or skimp on features you consider essential.

Scrutinising the Details of Your Quote

As you sift through the quotes your eyes should go straight to the compulsory and voluntary excess . This is your contribution towards any claim. A low monthly premium looks great on paper but it is no help if the excess is so high that making a small claim becomes completely unaffordable.

Next look at what is included as standard. Does the policy cover your windscreen without impacting your No Claims Discount? Is a courtesy car guaranteed or is it merely “subject to availability”? These small details can make a massive difference to your experience after an accident.

Never assume all policies are created equal. Two comprehensive policies from different insurers can have wildly different terms. Taking ten minutes to read the policy summary document can save you from a nasty surprise later.

Beyond Comparison Sites

While comparison sites are brilliant for casting a wide net they do not have everyone on board. Some of the UK’s biggest insurers only sell directly to customers. It is always worth spending a little extra time getting a few quotes directly from their websites—you might find they offer competitive deals or multi-car discounts you will not see anywhere else.

The UK motor insurance market is fiercely competitive right now. Recent analysis shows just how tight things are, with the industry's net combined ratio—a key measure of profitability—expected to hit 100% in 2025 and 107% in 2026 . In simple terms insurers are projected to break even this year and make a loss next year. This intense pressure often means better prices for consumers but it also puts immense strain on providers.

This financial reality is exactly why every single detail on your application matters. With margins this thin insurers have no room for error in assessing risk. After you have weighed up your options the next step is to obtain an insurance quote and be as accurate as possible. Providing honest and provable information does not just get you covered; it helps keep the market fair and sustainable for every driver on the road.

Your Car Insurance Questions Answered

Let's be honest, navigating the world of car insurance can feel like a minefield of jargon and what-ifs. From policy details to renewal tactics getting clear answers is the only way to feel confident you have made the right choice.

We will tackle some of the most common questions that crop up for drivers.

Key Policy and Ownership Questions

One of the first hurdles people often face is whether they can insure a car they do not legally own. The simple answer is yes but only if you have an 'insurable interest'. This just means you would be out of pocket if the car were damaged or stolen. It is a common scenario if you are the main driver of a vehicle owned by your partner or a family member.

So what happens if you make an innocent mistake on your application? It happens. The best thing to do is contact your insurer immediately to get it corrected. However deliberately misrepresenting facts is fraud. That is a fast track to getting your policy cancelled and finding it incredibly difficult—and expensive—to get insured in the future.

Claims and Renewals Explained

When it comes to claims a big worry is whether a small chip in the windscreen will torpedo your No Claims Discount (NCD). In most cases if you have comprehensive cover a windscreen claim will not affect your NCD. Still it is always worth double-checking the small print of your specific policy document just to be sure.

Come renewal time many drivers wonder if sticking with their current provider is the cheapest move. Spoiler: it rarely is. Insurers often save their best deals to attract new customers so taking a few minutes to shop around on comparison sites almost always pays off.

It is a fiercely competitive market out there for insurers and that competition often means better prices for drivers who are willing to look. Do not let misplaced loyalty cost you—a quick search could uncover some serious savings.

For more detailed answers it is always a good idea to check out a comprehensive list of frequently asked questions to cover all your bases.

Understanding Premium Fluctuations

It might feel like premiums only ever move in one direction—up—but the market can be surprisingly volatile. In fact comprehensive car insurance premiums in the UK have seen a pretty significant drop recently.

After peaking at an all-time high of £995 in December 2023 the average premium fell by a whopping 24% to £757 by May 2025, its lowest point in two years. This was largely driven by intense competition among insurers even as they battled rising costs for repairs and theft. You can dig deeper into this dramatic fall in car insurance premiums and see what it could mean for you.

At Proova , we believe in making the entire insurance process clearer and more secure. Our platform helps you prove ownership and document the condition of your assets, which can speed up claims and help tackle fraud head-on. Get started with Proova today.