Car Insurance Fronting: A Definitive Guide to Fraud and Risk

Car insurance fronting sounds technical but it’s a simple concept. It’s when a lower-risk driver, usually a parent, insures a car in their own name, claiming they’re the main driver. In reality, the car is mostly driven by someone with a much higher risk profile, like their newly-qualified child.

It might feel like a harmless white lie to get a cheaper premium but it’s not. It is illegal and brings serious consequences for everyone involved.

The Real Scale of Car Insurance Fronting

Many people see fronting as a little fib to help a young driver get on the road. This view masks a huge, costly problem for the insurance industry. It’s not a victimless act; it’s a deliberate misrepresentation that strikes at the heart of risk-based pricing.

When a policy is fronted, the insurer is unknowingly covering a high-risk driver for a low-risk price. This creates an unquantified liability in their portfolio and completely distorts the risk pool. In the end, the premiums paid by honest customers have to stretch to cover losses from those who have lied about their risk, pushing up the cost of insurance for everyone.

A Tempting but Dangerous Shortcut

The motive is almost always money. Motor premiums for young drivers are stubbornly high, making it incredibly tempting for parents to find a shortcut. The problem is, this shortcut often leads straight to a dead end with voided policies and refused claims.

Recent UK data shows just how common this temptation is. A 2024/2025 national survey found that a staggering 69% of parents with children aged 17–25 would either consider fronting or have already done it. Even more telling, 11% admitted they were actively fronting a policy at that moment. Another 2024 study revealed that 17% of young drivers believed they were already named on a fronted policy. You can dig deeper into the findings from this Go.Compare survey.

Fronting is legally defined as 'fraud by false representation' under the Fraud Act 2006. Industry bodies like the Association of British Insurers warn this can result in policy cancellation, unlimited fines and complete refusal of claims, leaving individuals personally liable for huge costs.

The Cost to the Industry and Consumers

The impact of fronting ripples across the entire insurance market. When insurers have to pay out claims for risks they never agreed to underwrite, it puts them under unexpected financial strain. These losses inevitably contribute to the rising cost of insurance for everyone as companies are forced to adjust their pricing to cover this hidden risk.

The true cost of insurance fraud is a massive industry-wide headache, hitting both premiums and operational efficiency. Learn more about what insurance fraud really costs the industry in our detailed guide.

In response, insurers are stepping up their game. They are increasingly using more robust underwriting checks, like address verification and data analysis, to spot and deter this costly fraud before a policy is even issued.

So, What's the Real Cost of Fronting?

That initial feeling of relief from a lower premium can be tempting but it evaporates the moment a fronted policy is discovered. This isn't some harmless white lie or a clever loophole; it's a type of insurance fraud and it comes with a steep price for everyone involved. The money saved upfront is a mere drop in the ocean compared to the financial tsunami that hits when a claim is inevitably refused.

When a claim comes in, you can bet the insurer's investigators will be poring over the details. If they suss out that the named main driver isn't the one who’s actually behind the wheel most of the time, the fallout is swift and severe. The most common outcome? The insurer will declare the policy void, treating it as though it never existed.

The Personal Price of Deception

For the policyholder, having a policy voided is nothing short of catastrophic. It means you’re suddenly standing uninsured in the middle of an accident that has already happened. The insurer is under no obligation to pay out for any damages, leaving both the driver and the policyholder on the hook for every single penny.

This could mean covering:

- Repair costs for your own car and anyone else's vehicle involved in the crash.

- Liability for injuries , which can spiral into tens or even hundreds of thousands of pounds without warning.

- Legal fees from the accident and the fraud investigation that’s sure to follow.

Make no mistake: being caught fronting is the same as driving with no insurance at all. Not only will the insurer refuse to pay out but you could also face prosecution under the Fraud Act 2006. That can lead to a criminal record, unlimited fines and even a driving ban.

And the financial pain doesn't stop there. Having a policy cancelled for fraud or non-disclosure puts a black mark on your insurance history. Getting cover in the future becomes incredibly difficult and eye-wateringly expensive, with premiums shooting far higher than they ever would have been with an honest declaration.

The Ripple Effect on the Industry and Honest Customers

Fronting is far from a victimless crime. Its effects spread outwards, ultimately hitting every honest policyholder in the pocket. When insurers have to cover risks they haven't been able to price correctly, it leads to unexpected losses. Those losses don't just vanish—they get absorbed into the system and are passed on to all customers through higher premiums across the board.

Just look at the volatility of young driver premiums. Average motor premiums have already jumped from around £415 in early 2022 to peaks over £635 by early 2024, making the temptation to front a policy stronger than ever. In response, insurers have had to ramp up their anti-fraud measures, adding to their operational costs. This cycle of fraud and reaction just fuels more premium instability, penalising the law-abiding customers who end up footing the bill. The problem is made worse by a major awareness gap; research shows less than four in ten people even understand what fronting is. You can read more about how parents are tempted by this illegal practice on which.co.uk.

At the end of the day, car insurance fronting completely undermines the core principle of insurance: pricing risk fairly. It forces insurers to work with bad data, creating a less stable and more expensive market for everyone. That small saving at the start is a false economy, one that's paid for many times over by those who get caught and by the honest majority.

Spotting Fronting Before a Policy Even Starts

The best way to deal with car insurance fronting isn’t investigating it after a claim comes in—it’s stopping it from getting on your books in the first place. Catching it at the underwriting stage is the strongest defence an insurer has against this sneaky type of fraud. It means moving beyond simple box-ticking and adopting a more analytical mindset to spot applications that just don’t add up.

Underwriting teams are your first line of defence. By developing a sharp eye for the classic red flags and using modern data tools, they can challenge suspicious applications before a policy is ever issued. This doesn't just shield the insurer from unpriced risk; it builds a culture of honesty right from the start of the customer relationship.

Common Red Flags in Policy Applications

Fronted policies often share a few tell-tale signs. While a single indicator on its own might be nothing, a combination of them should definitely trigger a closer look. Underwriters should be especially cautious when an application ticks several of these boxes.

- Age and Vehicle Mismatch: A 50-year-old with a perfect driving record suddenly insuring a modified hatchback or a small, sporty car loved by younger drivers? That's a classic warning sign. The car should make sense for the proposed main driver's lifestyle and history.

- Geographical Inconsistencies: The application lists a parent's address in a sleepy rural village but the car will clearly be used by a student in a city centre hundreds of miles away. That’s highly suspect. The declared address and the likely location of use need to be scrutinised.

- Occupation vs. Use: If the main driver is retired but the policy includes business use or daily commuting in rush hour, it’s a good bet someone else is the real primary user. The declared use must be plausible for the policyholder.

- Unusual Named Drivers: Seeing a young, newly qualified driver on a policy for a high-performance car is a major red flag, especially if their relationship to the main driver seems distant or unclear.

Moving Beyond Basic Checks

Spotting these basic inconsistencies is a great start but modern underwriting needs to go deeper. Insurers can't just rely on the information an applicant provides anymore. Bringing in external data and analytical tools gives you a much clearer, more accurate picture of the real risk involved.

The goal is to build a verifiable profile of the applicant and all the proposed drivers. This changes the underwriting process from an exercise in trust to one of verification, making it significantly harder for fraudulent applications to slip through the net.

This verification-first approach is the key to fighting fraud before it happens as it locks in a baseline of truth from day one. By proactively confirming the details, insurers not only deter fronting but also create a more robust and accurately priced portfolio.

A Practical Toolkit for Underwriters

Giving your team the right tools and processes is essential if you want to consistently catch car insurance fronting. The best results come from a multi-layered approach that combines human expertise with smart technology.

Key Verification Techniques:

- Advanced Address Validation: Go beyond a simple postcode check. Use tools that can cross-reference data to confirm residency, spot properties linked to multiple high-risk policies and flag addresses known to be student accommodation.

- Data Enrichment Services: Enhance the application with third-party data. This could include vehicle history reports, previous claims data and public records that help you verify the applicant's story and build a more complete risk profile.

- Behavioural Analytics: Look at how the applicant fills out the online form. Are the answers rushed? Are details about the drivers amended multiple times? Hesitation on key questions can sometimes be a sign of deception.

- Social Media and Open-Source Intelligence: This requires a careful and ethical approach to privacy but a quick check of public social media profiles can sometimes reveal glaring discrepancies. Think of a young driver proudly posting pictures of "their new car" which you know is insured by a parent.

By embedding these checks into the standard underwriting workflow, insurers can build a formidable barrier against fronting. It sends a clear message that misrepresentation will be challenged, protecting the business and ensuring honest customers aren't left subsidising fraud.

Investigating Fronting When a Claim Is Made

The moment a claim comes in is often the first real chance an insurer gets to see if the information provided at the start of the policy was the whole truth. For claims handlers and fraud investigators, this is a crucial point. It’s where the carefully constructed story of a fronted policy can start to come apart at the seams.

When an incident is first reported, it’s a goldmine of potential clues. A thorough but sensitive investigation at this stage isn’t about blocking a legitimate claim; it’s about doing your due diligence to catch potential fraud. The real skill lies in separating genuine claims from fraudulent car insurance fronting schemes, making sure honest customers get paid quickly while pushing back firmly against deception.

First Notice of Loss Red Flags

The very first phone call after an accident can tell you a lot. Claims handlers need to listen closely to who is reporting the claim and how they describe what happened. Any inconsistencies this early on can point to bigger problems with how the policy was set up.

Think about these key questions:

- Who is reporting the claim? If the young, named driver is the one making the call and handling all the communication, it suggests they have a much greater sense of ownership than an "occasional" driver normally would.

- How familiar is the policyholder with the incident? If the main policyholder sounds vague about the details—like the exact time, location or what happened—it could be because they weren't the one using the car or weren’t even there.

- Is there hesitation or inconsistency in their story? A classic red flag is when the policyholder and the named driver give conflicting accounts of why they were even on that journey in the first place.

Scrutinising the Incident Details

Once you've logged the initial report, it's time to dig into the details and compare them to what’s on file. This is where you test whether the declared use of the car matches reality. Having a solid process for understanding claims processing is absolutely vital for spotting these suspicious patterns.

For example, imagine an accident happens at 8 AM on a weekday during term time, right next to a university campus. If the car is insured for social use by a parent living 100 miles away, the story just doesn't add up.

This is where technology can be a game-changer. Telematics data, if you have it, can provide undeniable proof of who was driving, where the car is usually kept overnight and typical journey patterns, often completely contradicting what was declared. This kind of digital evidence is invaluable; you can learn more about how real-time evidence changes everything in our detailed guide.

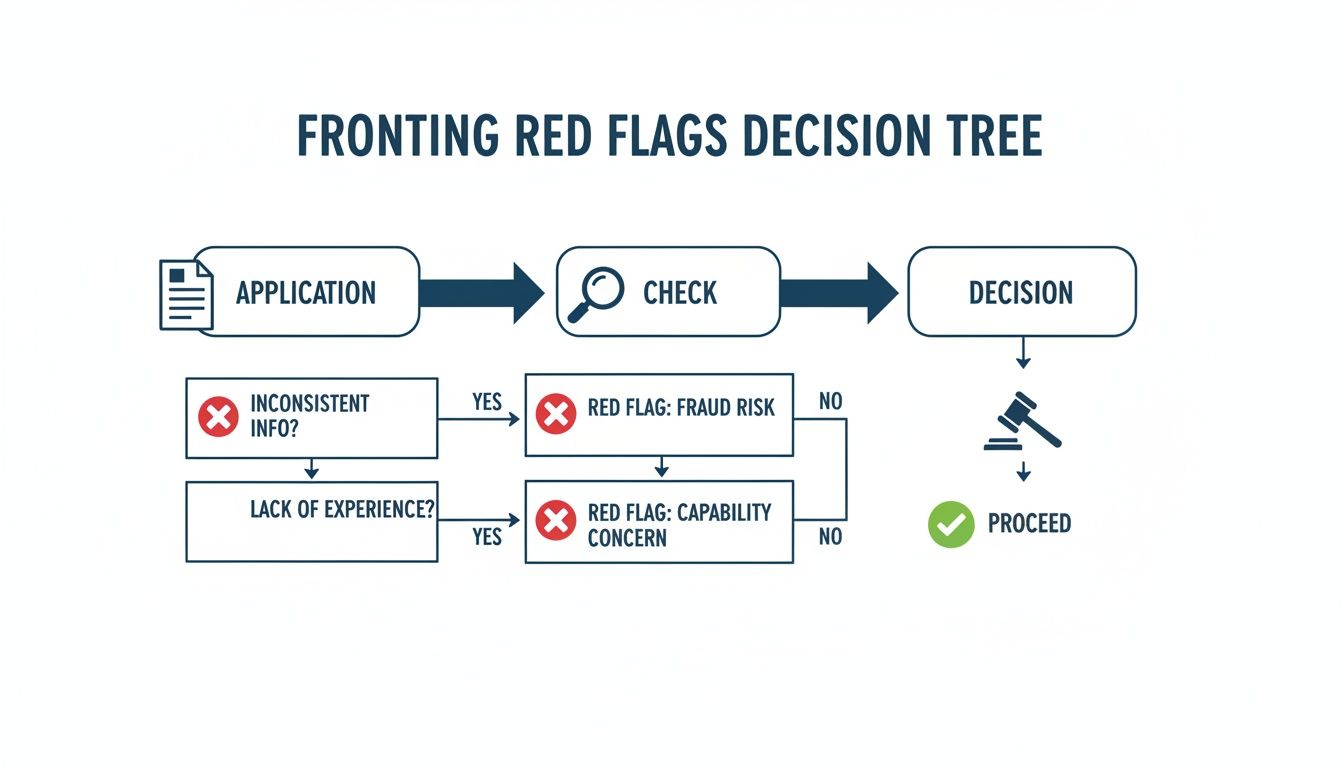

This decision tree gives you a simple workflow for spotting potential fronting red flags during an investigation.

As the diagram shows, checking the initial application data against the claim details is what brings you to that critical decision point on whether to launch a full fraud investigation.

At its heart, a fronting investigation is all about finding the truth of who really uses the vehicle and where it's kept. Witness statements, police reports and even feedback from the repair garage can all help build a complete picture that either validates the claim or confirms it’s a case of fraud.

Fronting vs Legitimate Named Driver Comparison

To help claims handlers spot the difference, here’s a quick comparison of the common signs you’ll see in a legitimate named driver policy versus a potential fronting setup.

| Indicator | Legitimate Named Driver | Potential Fronting Arrangement |

|---|---|---|

| Primary User | The policyholder uses the vehicle most often. The named driver is genuinely an occasional user. | The named driver uses the car daily (e.g., for commuting to work or university). |

| Vehicle Location | The car is primarily kept at the policyholder's address as declared on the policy. | The vehicle is usually kept at the named driver's address, which is often different. |

| Claim Reporting | The policyholder is knowledgeable about the incident and usually reports the claim. | The named driver reports the claim and handles all communications. The policyholder is vague on details. |

| Journey Purpose | The incident occurs during a journey consistent with the policyholder's usage patterns. | The accident happens during a commute or journey that aligns with the named driver's routine. |

| Modifications | The car is standard or modified to the policyholder's taste. | Modifications are present that are typically associated with younger drivers. |

This table isn't a definitive checklist but it provides a solid framework for asking the right questions and identifying patterns that warrant a closer look.

By following a structured approach, claims teams can confidently tell the difference between a legitimate claim involving a named driver and a clear-cut case of car insurance fronting . This protects the business from fraud losses and maintains the integrity of the risk pool, which helps keep premiums fair for your honest customers. The goal isn't to delay payment—it's to verify the truth, a principle that sits at the very heart of fair and effective claims handling.

Using Technology to Verify Risk and Prevent Fraud

Fighting car insurance fronting has often felt like playing defence. Insurers are left sifting through claims or application data long after a mispriced, high-risk policy is already on their books. It's a reactive game of cat and mouse but modern technology is flipping the script.

It allows us to move from a reactive investigation to a proactive verification process. Instead of asking, "Did this person lie?", technology gives us the power to ask, "Can you prove this is true?" right from the start. This simple but powerful shift is our best defence against fronting.

Shifting from Trust to Verification

The fundamental problem with fronting is that it's built on a policyholder's self-declaration. Technology shatters that foundation by introducing a layer of undeniable, evidence-based truth right at the point of sale. Platforms like Proova give insurers the tools to confirm crucial details before a policy is issued, making it incredibly difficult to bend the facts.

This isn't about adding hassle for the customer. Quite the opposite. It involves simple, user-friendly steps that build a relationship based on honesty from day one.

For example, an underwriter can ask an applicant to submit a short, geolocated and time-stamped video of their vehicle. This one piece of evidence can confirm multiple data points at once:

- Primary Location: The video’s metadata can prove the vehicle is parked at its declared overnight address, not at a student hall of residence miles away.

- Vehicle Condition: The visual evidence confirms the car's state, preventing future arguments about pre-existing damage.

- Proof of Existence: It verifies that the vehicle actually exists and is in the policyholder's possession.

This approach gives underwriters a crystal-clear, evidence-based view of the risk they're about to take on. It replaces guesswork with provable facts.

Here’s a glimpse of how an app can capture proof of a vehicle's location, making it effortless for genuine applicants to verify their details.

By embedding a simple verification step like this into the application process, insurers make it almost impossible for someone to successfully front a policy.

The Power of Data Analytics

Beyond just visual proof, technology supercharges an insurer's ability to spot the subtle red flags hidden in application data. In the fight against fronting, advanced insurance data analytics is crucial for identifying suspicious patterns and validating risk profiles far more accurately.

Instead of looking at isolated red flags, analytical tools connect the dots between different data points to build a complete picture. An algorithm, for instance, might flag an application where a 60-year-old policyholder with a perfect no-claims bonus is insuring a second, high-performance car with a young named driver living at an address flagged as student accommodation. On its own, each piece of information might seem fine but together, they tell a very different story.

This data-driven approach moves underwriting from an art to a science. It allows insurers to make smarter, evidence-backed decisions, reducing their exposure to the unpriced risk that car insurance fronting introduces.

By combining solid visual evidence with powerful data analysis, insurers can build a formidable defence. This strategy not only deters fraud but also speeds up the onboarding process for honest customers, cutting down the need for slow and expensive manual checks. The result is a more efficient, accurate and fair system for everyone.

Building a Fairer Future for Car Insurance

Dealing with car insurance fronting isn't just about plugging a financial leak; it's about preserving the fairness and integrity of the whole industry. This isn't a victimless crime. When it happens, honest customers end up paying more to cover the unpriced risk and it eats directly into an insurer's profitability. Moving forward needs a joined-up strategy.

This means we need to get much better at educating the public about just how serious the consequences are. It also means smarter, data-led underwriting and, of course, thorough claims investigations. But crucially, it demands that we start using verification technology to lock down the facts right from the very beginning.

Creating a More Honest Ecosystem

By embedding simple, evidence-based tools into the application process, insurers can change the game from one of blind trust to one of clear verification. Just asking an applicant to provide real-time proof of where a vehicle is kept or its current condition sets a baseline of truth that's incredibly difficult to argue with later.

This shift towards provable facts creates a much more transparent ecosystem. It allows for pricing that reflects genuine risk, cuts fraud-related losses and ultimately builds a fairer, more sustainable market for every single policyholder.

When insurers can be confident in the data they’re seeing, they can price risk accurately and handle claims far more efficiently. This proactive stance not only weeds out deception but also rewards honesty, reinforcing the very principles insurance was built on.

Unpacking Car Insurance Fronting: Your Questions Answered

To get a real grip on car insurance fronting, it's helpful to break down the most common questions. Getting these points clear is the first step to managing this kind of risk properly.

What’s the Difference Between a Named Driver and Fronting?

Adding a named driver to your policy is a completely normal and legal thing to do. Think of a university student who only uses their parent's car on weekends or during holidays. They're a genuine occasional user, not the person driving it every day.

Fronting is when this reality gets deliberately twisted. It's when someone declares the occasional, higher-risk driver as the main user to chase a cheaper premium. The entire difference boils down to one provable fact: who is the 'main user' ? Getting this wrong—whether you meant to or not—is misrepresentation and can give an insurer grounds to void the policy.

Can an Insurer Really Void a Policy if They Discover Fronting?

Yes, absolutely. If an insurer finds clear evidence of a deliberate or reckless misrepresentation like fronting, they have the right to treat the policy as if it never existed. This is known as avoiding the policy ab initio , or 'from the beginning'.

Under the Consumer Insurance (Disclosure and Representations) Act 2012, this action is legally supported. The upshot? Any claims made would be rejected and the insurer is only required to return the premiums paid. This leaves the policyholder to foot the bill for all accident costs themselves.

How Can Technology Help Prove Where a Vehicle Is Kept?

Modern verification tech gives insurers the power to ask an applicant to confirm information in real-time, right there on the spot. For instance, you could request a time-stamped, geo-located video of the car parked outside a specific address, whether that's a student hall of residence or a workplace car park.

This kind of digital proof provides undeniable evidence of where the car is actually kept overnight. It helps either confirm or challenge the declared main driver's address and usage pattern. This makes underwriting decisions significantly stronger and fraud much, much harder to get away with.

What Are the Wider Costs of Widespread Fronting?

The financial fallout from fronting goes way beyond a single policy; it ends up costing all of us. It completely corrupts the risk pool, forcing insurers to cover high-risk drivers at low-risk prices, which naturally leads to unexpected and unpriced claims losses.

To make up for these losses, insurers have no choice but to raise premium rates for everyone. It means that honest customers end up paying more to subsidise the cost of fraud. On top of that, it inflates the operational costs for fraud detection and investigation teams. Ultimately, it erodes the data integrity and trust that the entire insurance model is built on.

At Proova , we provide the tools to establish verifiable proof right from the start. Our platform helps insurers confirm critical details like vehicle location and condition with real-time evidence, reducing fraud and speeding up genuine claims. Learn how Proova can protect your portfolio and promote fairer insurance for everyone.