Compulsory Excess and Voluntary Excess Explained Clearly

Getting to grips with your insurance excess is the first step in making a smarter choice about your policy. Put simply, your total excess is the amount you have to pay towards any claim before your insurer steps in to cover the rest. This figure is a combination of two parts: compulsory excess and voluntary excess.

Decoding Your Insurance Excess

Insurance policies can feel as if they are written in another language, with terms like 'compulsory' and 'voluntary' excess often causing the most confusion but understanding how these work is key to managing your car or home insurance policy effectively.

The idea is actually quite straightforward. The compulsory excess is the baseline amount your insurer insists you pay on any claim. They calculate this figure based on their assessment of your risk profile—think of your age, driving history or where you live.

The voluntary excess , on the other hand, is a tool you can use to your advantage. By agreeing to pay a bit more out of your own pocket in the event of a claim, you are signalling to the insurer that you are a lower risk. In return, they will usually offer you a cheaper annual premium.

The Role of Excess in the Insurance Industry

Excess payments are not just about splitting the bill for a claim; they serve a much bigger purpose for the insurance industry. By making the policyholder contribute, insurers discourage small, trivial claims that are often expensive to process. This simple mechanism helps to keep everyone's administrative costs down.

More importantly, a meaningful excess acts as a real deterrent against insurance fraud. Exaggerated or completely fabricated claims are a significant problem, adding an estimated £50 to the average household's annual insurance bill . When someone has to find a portion of the claim themselves, it immediately reduces the financial incentive for opportunistic fraud. This has a profound effect on the cost of insurance for us all and for the industry as a whole.

This system helps protect the integrity of genuine claims while filtering out fraudulent ones. A claims process underpinned by provable facts ensures that honest customers are not left carrying the can for the costs generated by criminal activity.

The table below breaks down the core differences at a glance.

| Attribute | Compulsory Excess | Voluntary Excess |

|---|---|---|

| Who Sets It? | The insurer, based on your risk profile. | You—the policyholder—choose this amount. |

| Is it Negotiable? | No, this amount is fixed and non-negotiable. | Yes, you can adjust it to influence your premium. |

| Primary Purpose | To cover the insurer's minimum risk on your policy. | To reduce your annual premium by taking on more personal risk. |

Compulsory Versus Voluntary Excess Compared

Getting to grips with the difference between compulsory excess and voluntary excess is essential as they each serve a very different purpose in your insurance policy. The main distinction boils down to one simple thing: control. Your insurer sets the compulsory amount but the voluntary figure is entirely up to you.

The compulsory excess is not just a random number. Insurers calculate it using a risk-based approach, looking at factors like your age, claims history and even the type of asset you are insuring. Think of a high-performance car or a home in a flood-prone area – these naturally carry more risk, leading to a higher compulsory excess. It’s the baseline amount the insurer needs you to cover before they step in.

On the other hand, the voluntary excess is a strategic lever you can pull to manage your premium. By agreeing to pay a larger chunk of any claim yourself, you’re signalling to your insurer that you are less likely to bother with small, minor claims. This commitment to share more of the financial risk is rewarded with a lower annual premium because it reduces the insurer's potential payout and the likelihood of a fraudulent claim being pursued.

The Trade-Off Between Cost and Risk

Deciding on your voluntary excess is a classic balancing act. A higher amount can unlock some serious savings on your premium but it also means you will have to dig deeper into your own pockets if you ever need to make a claim. This is exactly why the level of excess is such a hot topic in conversations about insurance affordability and fraud.

A hefty total excess (the sum of both compulsory and voluntary amounts) is a powerful deterrent against opportunistic claims. If a minor repair costs less than your total excess, you simply will not make a claim, which helps filter out low-value incidents. This behaviour tells insurers you’re a lower-risk customer and helps fight the costs of fraudulent claims that ultimately push up premiums for everyone. Provability is therefore key to ensuring a fair outcome for all parties.

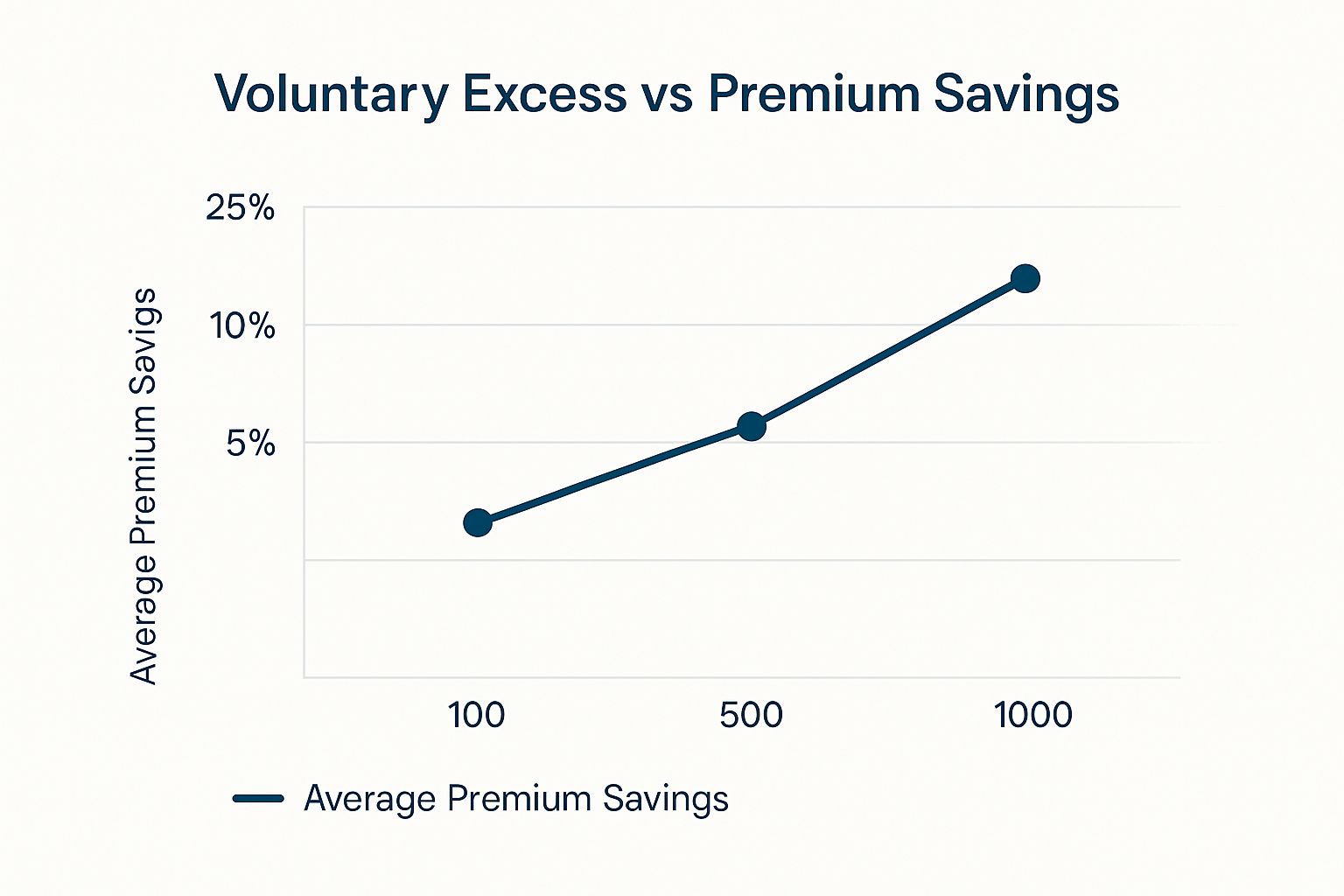

This chart shows the direct relationship between how much voluntary excess you choose and the potential savings you can make on your premium.

As you can see, bumping your voluntary contribution from £100 up to £1,000 could cut your premium by up to 25% . It’s a clear illustration of how taking on more personal risk can lead to lower upfront costs.

Compulsory Excess vs Voluntary Excess Key Differences

To put it simply, while both types of excess affect what you pay out of pocket during a claim, they are fundamentally different in purpose and control. The table below breaks down these key distinctions.

| Attribute | Compulsory Excess | Voluntary Excess |

|---|---|---|

| Control | Set by the insurer and is non-negotiable. | Chosen by you, the policyholder. |

| Purpose | To cover the insurer’s baseline risk for your profile. | To lower your annual insurance premium. |

| Impact on Premium | A higher compulsory excess reflects a higher risk profile. | Increasing it reduces your premium; decreasing it raises it. |

| Flexibility | Fixed for the policy term based on risk factors. | Can be adjusted at renewal to suit your financial situation. |

Ultimately, compulsory excess is a reflection of the risk you present, whereas voluntary excess is a tool you can use to manage your insurance costs based on the risk you are willing to accept yourself.

How Your Excess Level Affects Premiums and Claims

The relationship between your insurance excess and your annual premium is a classic trade-off. By agreeing to a higher voluntary excess , you are telling your insurer that you are willing to take on a bigger slice of the financial risk if you need to make a claim. In return, they reward you with a lower premium because their potential payout—and the admin that comes with it—is reduced.

This balancing act has become more important than ever as UK drivers grapple with soaring insurance costs. To claw back some control over their expenses, many are now deliberately choosing a higher voluntary excess, a decision that fundamentally changes their approach to the claims process.

Finding the Tipping Point for a Claim

A higher total excess creates a very clear financial 'tipping point' for policyholders. If the repair bill is less than your combined compulsory and voluntary excess , there’s simply no financial sense in filing a claim. You would just pay for it yourself.

This behaviour signals to insurers that you are a lower-risk customer who is not likely to file small, frequent claims for every minor knock. That reduction in their perceived risk is what directly translates into a more affordable premium for you.

By shouldering a greater share of the initial cost, you actively filter out minor claims. This not only saves you from potential premium hikes at renewal but also helps insurers combat the rising tide of opportunistic insurance fraud that costs honest policyholders so much.

A Powerful Deterrent to Fraud

A significant excess is one of the most effective tools against insurance fraud. When a policyholder has to put a chunky sum of their own money on the table, the temptation to submit an exaggerated or completely fabricated claim shrinks dramatically. This is crucial as fraudulent claims are a major reason why premiums go up for everyone, damaging the industry's ability to offer affordable cover.

As drivers adapt to rising costs, we are seeing a clear trend of people accepting more personal risk. Recent figures show the number of UK drivers opting for a £500 voluntary excess shot up to 23% in August 2023 , a notable increase from 20% just a year earlier. For more on this, The Independent offers some interesting insights into car insurance premium trends.

This dynamic also highlights why a verifiable claims process, with provable evidence, is so critical. When insurers and policyholders can lean on modern tools to prove ownership and condition, it fosters a much more transparent system. Understanding the role of technology in reducing insurance claims costs is the key to building a fairer market for all.

Putting Excess Into Practice: Car and Home Scenarios

The real-world impact of compulsory and voluntary excess truly hits home when you see it in action. These are not just abstract terms; your choices have tangible consequences that shape your financial risk, especially when it comes to car and home insurance.

For home insurance, some risks come with a surprisingly high compulsory excess set by the insurer. Imagine a home in an area prone to subsidence. The insurer, knowing the heightened local risk, might impose a £1,000 compulsory excess just for that specific peril. It is their way of managing a concentrated threat.

Even a small voluntary excess can make a difference. Data from Confused.com shows that choosing a £150 voluntary excess correlates with the lowest median home insurance cost of £218 a year. That’s about 5% less than a policy with no voluntary excess at all but a word of caution: simply hiking it higher does not always guarantee bigger savings.

How Different Driver Profiles Are Affected

The contrast becomes even sharper with car insurance. Let’s look at two very different drivers to see how their excess structure and financial exposure stack up.

-

The Young Driver (Aged 20): A new driver with little road experience is a high-risk bet for insurers. Their provider might impose a steep £500 compulsory excess . To get the premium down to a manageable level, the driver might then add a £250 voluntary excess , bringing their total excess to a hefty £750. While this makes their annual cost more affordable, any claim will mean finding a significant sum of money upfront.

-

The Experienced Driver (Aged 50): With decades of driving and a solid no-claims history, this driver is a much safer risk. Their insurer sets a minimal compulsory excess of £150 . Feeling confident, they might add a modest £100 voluntary excess , making their total just £250. Their premium is already low and their financial hit in the event of a claim is far more manageable.

These scenarios make it clear: your decisions around excess have to align with your personal risk profile and what you can comfortably afford to pay out of pocket. It’s also a reminder that having robust, provable evidence of ownership is crucial to streamline any claim you do have to make. To see how this works in practice, you might be interested in our guide on how real-time evidence changes everything from theft to payout.

Avoiding Common and Costly Misunderstandings

There’s a massive knowledge gap around compulsory excess and voluntary excess among UK policyholders and it’s leading to some very expensive mistakes. This confusion often results in a nasty financial shock right when it’s time to make a claim.

So many people get caught out by the total excess they are liable for simply because they never fully grasped their policy terms. It’s a far more common problem than you might think.

The research paints a pretty clear picture. A study by Go.Compare revealed that only 39% of UK drivers fully understand what compulsory excess actually is, with the same figure for voluntary excess. This lack of understanding is especially stark among drivers aged 16 to 24, where a tiny 13% felt they had a full grip on both concepts.

This is not just about confusing jargon; it has real, costly consequences.

The Real Cost of Confusion

The biggest danger here is choosing a voluntary excess that’s completely unaffordable. Lured by the promise of a lower premium, many people commit to a figure they could not realistically pay on top of the compulsory amount if something went wrong.

The harsh reality is if you cannot pay your total excess, your insurer is unlikely to process your claim. That leaves you covering the entire loss yourself, despite having paid for a policy all along.

This misunderstanding can also fuel behaviour that drives up insurance fraud. A policyholder unable to afford their excess might be tempted to inflate a claim's value just to cover it. That, in turn, pushes up costs for everyone, forcing insurers to invest more heavily in fraud detection and provable claims to protect their honest customers.

Ultimately, being unable to pay an excess can leave you in a very difficult position. For more guidance, you can check out our guide on what to do if your insurance company refuses to pay a claim.

Choosing the right voluntary excess is not about finding a magic number—it's a balancing act. The goal is to land on a figure that gives you a decent reduction on your premium without leaving you high and dry if you actually need to make a claim. It all comes down to your personal finances and how much risk you are comfortable with.

Before you commit to a number, take an honest look at your savings. You should never agree to a voluntary excess that you could not comfortably pay tomorrow, on top of your compulsory excess. Think of this total amount as something you need to have tucked away in an emergency fund, ready to go.

Key Factors to Consider

Making a smart decision here goes beyond just the premium. You need to think about how you would handle a worst-case scenario.

- Your Emergency Savings: How much cash can you get your hands on right now without causing yourself a financial headache? Your total excess (compulsory + voluntary) should never be more than this.

- Your Claims History: If you have had a few claims in the past, a lower voluntary excess might be the wiser choice, even if it means a higher premium. On the other hand, if your record is squeaky clean, you might feel more confident taking a bigger risk for a better price.

- Asset Value: The logic changes for high-value items, like a luxury car or a large home, where potential repair costs are naturally higher. In these cases, a slightly larger excess could lead to significant premium savings that make the added risk worthwhile.

Ultimately, the ideal voluntary excess is high enough to make a real dent in your premium but low enough that paying it would not be a financial disaster. Getting this balance right is the key to responsible insurance management.

Frequently Asked Questions

Digging into the small print of an insurance policy can often feel like a chore. This section is here to clear up some of the most common questions about compulsory and voluntary excess , giving you straightforward answers.

Can You Have a Policy With No Excess At All?

In theory, yes, but in practice, it’s incredibly rare. Almost every standard insurance policy will have a compulsory excess baked in, which is the baseline amount the insurer insists on. Think of it as their way of filtering out very minor claims, which helps keep their own administrative costs down and deters fraud.

If you did find a policy with no excess whatsoever, you would almost certainly be looking at a much higher premium. Why? Because the insurer would be on the hook for 100% of the risk from the very first pound of any claim.

Does a Claim Affect My Future Compulsory Excess?

It definitely can. Making a claim flags you as a higher risk in the insurer's eyes and that often translates to a higher compulsory excess when it is time to renew. Insurers adjust this amount to shield themselves from potential future losses and to reflect what they now see as the updated risk of covering you.

This is exactly why so many people decide to just pay for small bumps and scrapes out of their own pocket, especially if the repair cost is hovering around their total excess. It avoids lodging a formal claim that could sting them with higher premiums and a bigger excess down the line.

Strengthen your claims and protect against fraud with Proova . Our platform provides indisputable proof of ownership and condition, creating a more transparent and trustworthy insurance process for everyone. Discover a smarter way to manage your assets at https://www.proova.com.