A Guide to Insurance Fraud Prevention

Think "insurance fraud" and what comes to mind? For many, it is a blurry, victimless crime—someone padding a claim here, bending the truth there. A small fib against a massive, faceless corporation. What is the harm?

This could not be further from the truth. In reality, insurance fraud is a massive problem that hits every single honest policyholder in the UK right where it hurts: their wallet. The provability of claims is central to tackling this issue and protecting consumers from the rising costs driven by fraudulent activity.

The Real Price Tag of a "Victimless" Crime

When an insurer pays out a fraudulent claim, that money does not just disappear into thin air. The losses are spread across the board, pushing up the premiums for everyone. It is a hidden tax we all pay. Insurance fraud costs the industry and its customers dearly, making robust prevention strategies more critical than ever.

The Association of British Insurers (ABI) caught £1.1 billion in detected fraud in 2023 alone. And that is just the tip of the iceberg—the scams they actually uncovered. The real figure is almost certainly much, much higher, representing a significant financial drain on the UK economy.

It Is Everyone’s Problem

This is not just a number on a balance sheet. It directly translates into higher annual costs for your car, home and business insurance. For an average family, this can mean paying a significant chunk more each year to cover the costs of other people's dishonesty, putting a real strain on household budgets. This is the direct cost of insurance fraud to all of us.

To get a sense of the sheer scale of this issue, it is worth digging into the £308 billion problem and what insurance fraud really costs the industry.

And we are not just talking about opportunistic individuals trying their luck. Insurance fraud has become the playground for sophisticated, organised criminal gangs. These groups run elaborate schemes that are anything but victimless:

- Staged Accidents: Deliberately causing road collisions, often with innocent drivers, just to file bogus injury and vehicle damage claims.

- Ghost Broking: Selling fake insurance policies to unsuspecting people, leaving them completely uninsured and on the wrong side of the law.

- Fabricated Claims: Inventing entire events—like a warehouse fire or a home burglary—to claim for losses that never happened.

The money made from these schemes often gets funnelled into other serious crimes, linking insurance fraud directly to wider societal harm. Understanding how criminals operate across different sectors is key and exploring comprehensive loss prevention services shows just how deep these protective strategies need to go.

Why Prevention is Non-Negotiable

Given the staggering costs and the criminal element involved, robust insurance fraud prevention has moved from a "nice-to-have" to an absolute necessity. It is the only way to protect the integrity of the insurance system, keep customers' trust and stop premiums from spiralling out of control for honest people. The focus must be on the provability of any claim to ensure only genuine losses are paid.

If insurers fail to invest in effective prevention, they do not just absorb financial losses. They end up passing the cost of crime directly onto the very customers they are supposed to be protecting.

This guide is designed to give you a clear roadmap for building a modern, effective defence against fraud. We will break down the different types of fraudulent activity—from small-time claim padding to complex criminal conspiracies—and walk through the technologies and processes needed to stop fraudsters in their tracks. The goal is simple: to give insurers the tools they need to fight back, protecting their business and their customers from this incredibly costly crime.

Decoding the Types of Insurance Fraud

To build a solid defence against insurance fraud, you first have to get to grips with the different shapes it takes. It is not just one type of crime; fraud covers a huge spectrum, from small exaggerations all the way to complex, organised criminal operations. Getting these distinctions right is the first step toward effective insurance fraud prevention .

Fraud is usually split into two main camps: soft fraud and hard fraud . Think of them as two completely different levels of deception.

Opportunistic Versus Premeditated Fraud

Soft fraud is what you might call opportunistic. It happens when someone makes a legitimate insurance claim but decides to stretch the truth to get a bigger payout. For instance, after a minor car accident, a claimant might add some pre-existing damage to the repair list or overstate the severity of a whiplash injury. It might feel like a white lie but it is still a crime and these "small" fibs collectively cost the industry billions.

Hard fraud , on the other hand, is premeditated and deliberately criminal. This is where someone invents a loss out of thin air. We are talking about staging a car crash, faking a burglary or claiming a valuable item was stolen when it was really just sold. These are not exaggerations; they are outright fabrications designed purely to rip off an insurer.

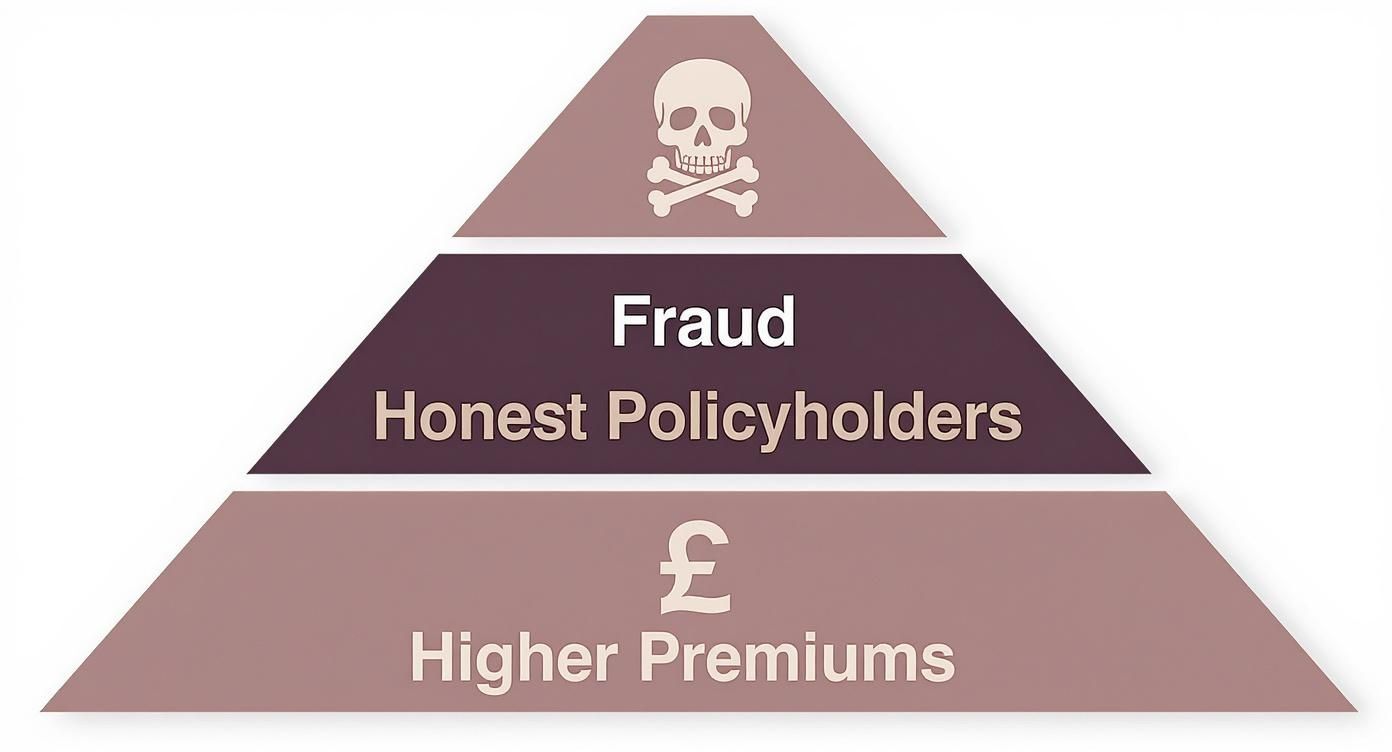

Insurance fraud is never a victimless crime. Every bogus claim, whether it is a little white lie or a calculated con, adds to a pool of losses. Insurers have to cover those losses and they do it by raising the premiums that honest policyholders pay.

This is the hard reality: fraudulent activities place a direct financial burden on everyone else, demonstrating the true cost of insurance fraud to all of us.

The pyramid shows it perfectly. Fraud sits at the top and its weight presses down on the honest customers at the bottom, who end up footing the bill through higher costs.

Key Categories of Fraudulent Activity

Beyond the soft versus hard distinction, you can also categorise fraud by where it pops up in the insurance lifecycle. Pinpointing these specific types helps insurers identify exactly where they are most vulnerable.

To help break it down, here is a look at the most common categories of fraud you are likely to encounter.

| Common Types of Insurance Fraud | ||

|---|---|---|

| Fraud Category | Description | Common Example |

| Claims Fraud | Deception that happens during the claims process. It covers everything from inflating a genuine claim (soft fraud) to faking an incident entirely (hard fraud). | Claiming for a brand-new laptop after your five-year-old one was stolen. |

| Application Fraud | Providing false information when applying for a policy to get a lower premium or cover that would not otherwise be offered. | Lying about where a vehicle is kept overnight, your driving history or the security measures installed at your property. |

| Internal Fraud | Fraud committed by an insurer's own staff, agents or brokers. This is an inside job. | An employee creating fake policies to earn commission, colluding with a claimant to inflate a payout or stealing customer data. |

Each of these categories presents its own unique challenges, requiring different detection methods and controls.

The threat of application fraud , in particular, is growing at an alarming rate, especially schemes involving identity theft. The Insurance Fraud Bureau (IFB) has warned that identity theft cases linked to organised insurance fraud have surged, rising to more than seven times the levels seen in 2021. This is not just a minor uptick; Cifas also reported a 25% increase in fraud linked to identity theft and false applications, highlighting a critical weak point for insurers.

You can read more about the UK's top policy fraud hotspots to see where these risks are most concentrated.

Identifying the Key Fraud Battlegrounds

Effective insurance fraud prevention is not about casting a wide, hopeful net. It is about being strategic, focusing your resources on the exact moments in the insurance lifecycle where deception is most likely to creep in. These predictable points are the key battlegrounds where a proactive defence can make the biggest difference.

By mapping out these fronts, insurers can shift from a reactive, wait-and-see stance to a state of readiness. It is about anticipating criminal tactics before they cause serious financial damage. The three primary battlegrounds are underwriting, claims processing and the post-claim investigation period.

Each stage presents unique vulnerabilities but also unique opportunities to intervene. Understanding these distinct environments is the key to building a layered defence that is far more effective than any one-size-fits-all approach.

The First Line of Defence: Underwriting

The fight against fraud begins long before a claim is ever filed. The underwriting stage—where a policy is first assessed and issued—is the first and arguably most crucial battleground. Get this right and you can stop a fraudulent relationship from ever forming.

This is your frontline against application fraud, where individuals or organised groups deliberately falsify information to get cheaper premiums or cover they would not otherwise qualify for. One of the most damaging schemes here is ghost broking , where criminals sell fake or invalid insurance policies to unsuspecting victims, leaving them uninsured and on the hook for any losses.

Spotting these attempts requires robust verification processes. Insurers have to scrutinise application data for the kind of inconsistencies and red flags that signal deception.

Key areas for vigilance during underwriting include:

- Address Verification: Cross-referencing addresses against databases to confirm they are genuine and not linked to known fraud hotspots.

- Claims History Checks: Analysing an applicant's past claims for patterns of frequent or suspicious losses.

- Identity Validation: Making sure the applicant is who they say they are, preventing the use of stolen or synthetic identities to get cover.

Failing to secure this first front is like leaving the gate wide open. You are letting fraudsters in, making every subsequent stage far more difficult and costly to manage.

The Critical Moment: Claims Processing

The claims stage is the most traditional and high-stakes battleground for insurance fraud. When a First Notification of Loss (FNOL) comes in, the clock starts ticking. Early detection at this point can stop a fraudulent payment dead in its tracks. The provability of the claim is paramount here.

This is where you will encounter both opportunistic soft fraud, like someone exaggerating a genuine claim, and premeditated hard fraud, such as claiming for a staged accident. The initial information a claimant provides is a goldmine of potential indicators of deception.

A fraudulent claim is rarely a perfect story. The pressure to fabricate details often leaves behind a trail of inconsistencies, behavioural clues and data anomalies that a well-trained system—and team—can detect.

Effective prevention at the claims stage relies on a blend of automated analysis and human expertise. Automated systems can flag high-risk claims for immediate review, looking for tell-tale signs like multiple claims in a short period or connections to known fraudsters. This frees up your experienced claims handlers to focus their investigative skills where they are most needed, separating legitimate customers from the criminals.

The Final Front: Post-Claim Investigation

The last battleground emerges after a claim has already been accepted, during the settlement and investigation phase. This is where fraudsters try to inflate costs or introduce new deceptions once the initial claim has been deemed legitimate.

This type of fraud is often more subtle and can involve collusion with third parties. Think of repair shops billing for work that was never done or medical providers submitting invoices for fabricated treatments. It is a slow bleed of funds that can add up to substantial losses over time.

This battle is won through meticulous oversight and strong partnerships with trusted vendors. Insurers must audit invoices, scrutinise medical reports and verify the legitimacy of all third-party costs tied to a claim. Building a network of verified and vetted repairers and medical experts is a powerful weapon in preventing post-claim cost inflation and ensuring settlements are fair and accurate.

Building Your Modern Fraud Detection Arsenal

Manual checks and human intuition just do not cut it anymore. The scale and cleverness of modern insurance fraud mean we need a much bigger toolkit. To build a robust defence, insurers must assemble an arsenal of advanced technologies designed to spot suspicious patterns that are completely invisible to the human eye. This is where data analytics, machine learning and AI become your most valuable players in insurance fraud prevention .

These systems go way beyond simple, rigid rules. Instead, they learn from vast amounts of data, identifying subtle connections, oddities and hidden networks that give away potential deception. This allows for a much smarter, more proactive approach, stopping fraudsters faster and more accurately than ever before.

Harnessing the Power of Data Analytics

The bedrock of any modern fraud detection system is data. By pulling together your own internal data with information from external sources, you can create a powerful, multi-dimensional view of every single application and claim. This unified data environment is the fuel for everything else in your arsenal.

The core components of this data-first approach include:

- Predictive Modelling: This uses historical claims data to build models that calculate a risk score for every new claim the moment it arrives. Any claim that trips a certain risk threshold gets automatically flagged for review, letting your investigators focus their precious time where it is needed most.

- Anomaly Detection: Machine learning algorithms can establish a baseline of what 'normal' looks like for a specific policy, region or customer group. When a new claim deviates wildly from this baseline—like a suspiciously high repair cost for a minor bump—it is instantly flagged as an outlier worth a closer look.

- Social Network Analysis: Sophisticated fraud is rarely a one-person job. These tools map out the relationships between claimants, suppliers, medical providers and even addresses to uncover hidden fraud rings that would otherwise go completely unnoticed.

Fraudsters thrive in the shadows, exploiting disconnected data systems and manual processes. A modern detection arsenal shines a light on these dark corners, connecting the dots to reveal the full picture of fraudulent activity.

The reality is that criminals are already using advanced tech against us. A recent report found that over half ( 53% ) of insurers believe fraudsters' use of AI has made attacks harder to prevent. The same study revealed a huge vulnerability, with 52% still leaning heavily on manual claims processing.

Real-World Applications in Fraud Detection

So, how does this look in practice? These technologies have tangible uses across the entire insurance lifecycle. Natural Language Processing (NLP), for example, can analyse the text in claim notes, emails and call transcripts to pick up on linguistic patterns often associated with deception. In the same way, image analytics can spot tell-tale signs of digital manipulation in photos submitted as evidence.

When building your modern fraud detection arsenal, it is worth exploring solutions like Bluenotary's biometric approach to reducing fraud risk. Biometric verification adds another powerful layer of security, making it significantly harder for criminals to get away with using stolen or fake identities.

Integrating these technologies allows you to create a dynamic and adaptive defence. For instance, linking your internal claims history with external industry databases can instantly flag an applicant who has a history of dodgy claims with other providers—a critical step in stopping known fraudsters from ever getting onto your books. If you want to dig deeper, you can learn more about the key insights from insurance fraud prevention claims databases in our article.

By combining data, analytics and AI, insurers create a defence that not only detects today's fraud schemes but also learns and adapts to counter the threats of tomorrow.

Combining Technology with Human Expertise

Advanced analytics and AI are powerful weapons in the fight against fraud but they are not a silver bullet. The most successful insurance fraud prevention strategies understand that technology is an enabler, not a replacement for human insight. A truly solid defence is one that seamlessly blends automated detection with the irreplaceable expertise of skilled investigators.

This combination creates a powerful feedback loop. Technology flags suspicious activity with incredible speed and accuracy, letting human experts focus their efforts on complex cases that need nuanced judgement. In turn, the findings from these human-led investigations can be fed back into the system, making the algorithms smarter and more effective over time.

Think of it as a top-tier detective duo. The technology is the partner that can sift through millions of pieces of evidence in seconds, highlighting leads a human might miss. But it is the experienced investigator who interviews witnesses, weighs up motives and pieces the final puzzle together to prove fraudulent intent.

Creating a Powerful Anti-Fraud Culture

For this partnership to truly work, you need more than just good software. You need a strong operational framework and a company-wide culture that champions fraud prevention. This culture has to run through every department, from underwriting to claims, creating a unified front against deception.

It all starts with clear protocols and empowered teams. When an automated system flags a claim, what happens next? A well-defined process ensures suspicious cases are escalated efficiently to the right people, without causing frustrating delays for genuine customers.

Fostering close collaboration between underwriters, claims handlers and investigators is also crucial. These teams often hold different pieces of the same puzzle. Encouraging open communication allows them to share insights and connect dots that might otherwise stay isolated. When everyone gets their role in fraud prevention, the entire organisation becomes a much tougher nut to crack.

The Role of the Special Investigation Unit

At the heart of this human-centred approach is the Special Investigation Unit (SIU). This dedicated team of specialists is trained to handle the most complex and high-value fraud cases that automated systems first identify. They are the seasoned experts who take data-driven leads and turn them into provable outcomes.

Training is absolutely paramount. An effective SIU needs to be skilled in a whole range of areas:

- Interview Techniques: Knowing how to conduct interviews that uncover inconsistencies and deception is a core skill.

- Evidence Gathering: Properly collecting and preserving evidence is essential for building a case that will stand up to scrutiny.

- Legal and Regulatory Knowledge: Understanding the legal framework is vital for ensuring all investigations are compliant and prosecutions can be pursued where appropriate.

By investing in a dedicated SIU, insurers show they are serious about tackling fraud. This not only boosts detection rates but also acts as a powerful deterrent. It sends a clear message to potential fraudsters: you will be caught and held accountable. For a deeper look at proactive measures, check out our guide on fighting fraud before it happens with the power of verified evidence.

Measuring Success and Proving Value

To justify the investment and keep improving, it is essential to measure how effective your fraud prevention efforts are. Setting meaningful Key Performance Indicators (KPIs) lets you track progress, prove the value of your strategy and meet your regulatory obligations.

An investment in fraud prevention is not a cost centre; it is a direct investment in protecting honest policyholders and preserving the financial health of the business. Proving its value is key to securing ongoing support.

This is where you can really see the impact of blending tech with human expertise. For example, Aviva, one of the UK’s largest insurers, stopped over 6,000 fraudulent claims in the first half of one year, saving over £60 million . This success, averaging over £334,000 stopped every single day, was driven by combining advanced technology with expert investigation, leading to prison sentences for fraudsters totalling over 32 years. You can discover more about how Aviva is tackling fraudulent claims.

Key KPIs to keep an eye on include:

- Fraud Detection Rate: The percentage of fraudulent claims you successfully identify.

- Return on Investment (ROI): The financial return generated from your investment in technology and people.

- False Positive Rate: The percentage of legitimate claims incorrectly flagged as suspicious—a crucial metric for customer experience.

Answering Your Insurance Fraud Questions

Navigating the world of insurance fraud prevention often throws up questions about technology, strategy and emerging threats. Here, we tackle some of the most common queries, offering practical advice to help you build a more robust defence.

What Is the Most Effective Technology for Preventing Insurance Fraud?

There is no single magic bullet for stopping fraud. The most effective approach is a layered defence that weaves multiple tools together but right now, AI and machine learning are the most powerful technologies in the arsenal. These systems are brilliant at analysing vast datasets in real-time to spot the subtle patterns and hidden connections that signal fraudulent activity.

For example, AI can cross-reference a claimant's details against industry-wide databases, analyse the language in a claim submission for deceptive signals and even use image analysis to detect manipulated photos of damage. When you combine this with the expertise of human investigators who can verify its findings, fraud prevention shifts from a reactive chore into a predictive, intelligent strategy.

The real power of anti-fraud technology is not in a single tool but in the smart integration of several systems. A combination of predictive analytics, identity verification and data sharing creates a formidable barrier that is far more difficult for criminals to overcome.

This multi-faceted approach ensures different types of fraud are caught at different stages, from underwriting to claims settlement, proving that a unified defence is always stronger.

How Can a Smaller Insurer Start Building a Fraud Prevention Programme?

Smaller insurers do not need a massive budget to build a strong foundation. It all starts with focusing on the core principles. First, establish a clear anti-fraud policy and, just as importantly, promote an anti-fraud culture throughout the business. This ensures every employee understands their role in protecting the company and its honest customers.

Next, get your team trained up. Regular training for claims handlers and underwriters on spotting common red flags is crucial. This human element is fantastic at identifying suspicious behaviour that an automated system might otherwise miss. Third, make use of industry-wide resources like the Insurance Fraud Bureau (IFB) and the Insurance Fraud Register (IFR) to check applications and claims against known fraudsters.

Rather than building a complicated system from scratch, smaller firms can partner with specialist vendors offering fraud detection as a service. This gives them access to powerful analytics without a huge upfront investment and creates a solid base that can be scaled up over time.

What Is Ghost Broking and How Can It Be Prevented?

Ghost broking is a particularly nasty type of application fraud where a criminal poses as a legitimate insurance broker to sell fake or invalid policies. They typically forge policy documents or purchase a genuine policy using false information—like a different address to get a lower premium—then alter it before selling it on to an unsuspecting victim.

Prevention requires a two-pronged approach that targets both insurers and the public.

- For Insurers: Robust data verification at the underwriting stage is non-negotiable. Insurers must use technology to flag inconsistencies in applications, such as an address that does not match other records or a name linked to previous fraudulent activity.

- For the Public: Education is absolutely key. Consumers should be wary of deals that seem too good to be true, especially those advertised on social media. They must always verify a broker's legitimacy on the Financial Conduct Authority (FCA) register.

A final, crucial step for consumers is to check the Motor Insurance Database (MID) immediately after buying a policy. This simple check confirms their policy is valid and they are legally insured to drive, preventing significant financial loss and legal trouble down the line.

How Does Proving Ownership Affect a Claim?

The ability to prove a claim is central to fair and efficient settlements and it is a key battleground for insurance fraud prevention . When a policyholder makes a claim, the burden of proof is on them to demonstrate what they lost, its condition and its value. This process is often incredibly difficult, especially after a traumatic event like a fire or burglary.

Without clear proof, claimants might unintentionally embellish details or guess values, which can inflate the claim. This lack of verifiable evidence creates a huge opportunity for opportunistic fraud and slows down the process for everyone. An insurer has to spend more time and resources investigating the claim, which drives up operational costs and ultimately impacts premiums for all customers.

This is where having a pre-verified inventory of assets, with photos and serial numbers recorded right at the policy's start, changes everything. It simplifies the entire claims process, eliminates ambiguity and shuts the door on "after-the-event" fraud where someone insures an item after it has been damaged. Best of all, it allows legitimate claims to be paid much faster, massively improving the customer experience.

At Proova , we believe in making the insurance claims process transparent, fast and secure. Our platform helps policyholders create a verified digital record of their assets, giving insurers the concrete proof they need to settle claims quickly and confidently. By tackling the core issue of provability, we help reduce fraudulent claims and their associated costs. Learn more about how we are changing the industry at https://www.proova.com.