A Guide to Insurance for Window Cleaners

Working as a window cleaner without the right insurance is a bit like working on a high-rise without a safety harness; it is a massive gamble that puts your entire business on the line. Thinking of a comprehensive policy as just another expense is a mistake. In reality, it is one of the most critical assets you can have, protecting you from accidents whilst also proving your professionalism to clients.

Why Insurance Is Your Business's Strongest Asset

Let’s be straight about it—balancing on a ladder or handling a long water-fed pole system comes with genuine risks. The right insurance is not just about ticking a box; it is the bedrock of a professional, resilient window cleaning business. This is where theory gets left behind and the real world takes over, a world where one simple slip could have financially devastating consequences.

Real-World Risks and Their Costs

Picture this: you have left your water hose running across a client's pathway and someone trips over it, leading to an injury claim. Or perhaps a squeegee slips from your grasp from a few storeys up and smashes through a conservatory roof below. Without the right cover, you would be personally on the hook for every penny of compensation and repair costs, which can easily spiral into thousands of pounds.

These are not far-fetched horror stories. They are the everyday possibilities that can destroy a small business overnight. A solid policy is your financial shield, making sure a simple mistake does not bring your career to a sudden halt.

The dangers of the job are officially recognised, too. In the UK, window cleaning is classed as one of the more hazardous trades, with the Health and Safety Executive reporting around 30 serious injuries each year. You can find more insights on these risks and how to protect yourself over at Protectivity.

The Growing Challenge of Insurance Fraud

Beyond genuine accidents, there is the rising tide of insurance fraud to contend with. This is where having proof becomes absolutely essential. It is not unheard of for a dishonest client to blame you for pre-existing damage, like an old scratch on a windowpane, or to blow a minor incident completely out of proportion to file a large claim.

Disproving a false allegation without solid evidence is incredibly difficult and stressful. This is where your insurance becomes more than just financial protection; it provides the legal muscle to defend your reputation.

It is important to remember that every fraudulent payout does not just hit the insurer's bottom line. It creates a ripple effect, driving up the cost of premiums for every honest window cleaner in the trade. Protecting your own livelihood means understanding these threats and investing in cover that not only safeguards your future but also contributes to a more sustainable industry for everyone.

Understanding Your Core Insurance Options

Getting to grips with insurance can feel a bit like learning a new language, full of jargon and clauses that do not make much sense at first. But for a window cleaning business, it is not about ticking boxes; it is about building a solid defence against the real-world risks you face every single day. Without it, one small mistake could put you out of business.

Think of Public Liability Insurance as your business's main financial shield. It is the cover that kicks in if your work accidentally causes an injury to a member of the public or damages their property.

This is what saves the day if a client trips over your trailing hosepipe or your water-fed pole slips and shatters an expensive pane of glass. Without it, you are personally on the hook for legal fees and compensation costs, which can easily run into thousands. Whilst it is not always a legal requirement for a sole trader, good luck finding a commercial client or even a savvy homeowner who will hire you without seeing proof of cover.

Want a closer look at what this policy involves? You can learn more about Public Liability Insurance in our complete guide.

Protecting Your Team and Your Tools

The moment your business grows and you hire someone—even on a casual or temporary basis—a different type of insurance becomes a legal must-have. Employers’ Liability Insurance is a non-negotiable requirement in the UK for almost any business with staff.

This policy protects you if an employee gets injured or becomes ill as a direct result of working for you. The penalties for skipping this are severe, with potential fines of up to £2,500 for every single day you operate without the correct cover.

It is a common mistake to think subcontractors do not count as employees. But if you tell them how to work, provide their equipment and they cannot send someone else in their place, the law may well see them as an employee. That makes this insurance absolutely vital.

Finally, do not forget the value of your gear. A professional water-fed pole system, purification unit and your van are serious investments. This is where Tools and Equipment Insurance comes in, covering you against theft or accidental damage.

Losing your kit could bring your work to a screeching halt for weeks. With the right policy, you can get replacements sorted quickly, minimising downtime and protecting your income. Together, these three policies form the foundation of any solid insurance plan for a window cleaner.

To make it clearer, here is a quick breakdown of the essential cover types:

Essential Insurance Cover for Window Cleaners

This table summarises the main policies you will need to consider to keep your business, your team and your clients protected.

| Type of Insurance | What It Covers | Is It Legally Required? |

|---|---|---|

| Public Liability | Injury to the public or damage to their property caused by your work. | Not always, but most clients will insist on it. |

| Employers’ Liability | Claims from employees who get injured or fall ill due to their work. | Yes, if you have one or more employees. |

| Tools & Equipment | Theft of or accidental damage to your essential business gear. | No, but it is highly recommended to protect your investment. |

Whilst only one of these is a strict legal requirement for all employers, a combination of all three provides the comprehensive protection a professional window cleaning business needs to operate with confidence.

The Rising Threat of Insurance Fraud

Whilst you are rightly focused on the physical risks of working at height, there is another, quieter threat that can hit your business just as hard: insurance fraud.

This is not just about elaborate criminal schemes you see on television. More often, it is an opportunistic claim from a dishonest client who sees a chance to get a pre-existing problem fixed at your expense. Without solid proof, these claims can be incredibly difficult to fight.

Every time a fraudulent claim gets paid out, it is not a victimless act. It contributes to a bigger pool of risk and that inevitably drives up the cost of insurance for every honest window cleaner out there. The provability of a claim is everything and without it, the cost to us all is substantial.

When It Becomes Your Word Against Theirs

Picture this: a client points to a deep scratch on a windowpane that you know, for a fact, was there before you even started. Or they blame you for a faint stress crack in a corner that has clearly been there for years.

Suddenly, you are on the back foot. It becomes a frustrating 'he said, she said' situation. In these cases, the burden of proof often lands squarely on you to prove you did not cause the damage. Insurers, facing a potentially long and expensive dispute, might even feel pressured to simply settle the claim.

This is where being prepared is not just a good idea—it is essential for protecting your livelihood. The ability to prove what happened, or what did not happen, is your greatest defence.

Building Your Defence Against False Claims

Your best line of defence is not just your insurance policy; it is the professional habits you build into every single job. Think of it as creating your own evidence locker. Diligent, proactive record-keeping is your most powerful tool for shutting down a false claim before it gathers steam.

A few simple steps can make all the difference, creating an undeniable record of your work and the state of the property.

- Take Before-and-After Photos: It takes seconds. Use your phone to snap a few date-stamped pictures of the windows before you start. This creates a clear visual baseline, showing any pre-existing scratches, chips or broken seals.

- Keep Detailed Job Records: A simple logbook or app entry for each job is invaluable. Note the date, time, services you provided and any observations about the property's condition. This professional approach can dismantle a claim built on a shaky timeline.

- Use Clear Client Agreements: Even a basic service agreement that outlines the scope of your work helps manage expectations. It gets everyone on the same page and can prevent misunderstandings from escalating into something more serious.

A fraudulent claim is not a victimless act. Every false payout contributes directly to higher premiums for every honest window cleaner, threatening the profitability and reputation of the entire industry.

The Ripple Effect on the Industry

The true cost of insurance fraud is staggering and it ripples out far beyond the two parties involved in a dodgy claim. When insurers have to pay out for illegitimate claims, they do not just absorb the loss. They recoup it by raising premiums across the board for everyone.

You can get a sense of the sheer scale when you look at what insurance fraud really costs the industry —a problem that runs into the billions globally.

This means your window cleaner insurance gets more expensive year after year, not because you have become a bigger risk, but because of the dishonest actions of a few. By taking meticulous steps to protect yourself, you are not just safeguarding your own business; you are doing your part to maintain the stability and integrity of the trade.

What Really Determines Your Insurance Premium?

Ever wondered why your insurance quote lands where it does? It is not a number pulled out of thin air. Insurers carefully weigh up a specific set of risks tied directly to your business, from the kind of jobs you do to the size of your team.

Getting your head around these factors is the key to securing the right cover at a fair price. It helps you see your business through an insurer's eyes and spot what is pushing your premium up or down. The aim is always the same: get solid protection without paying for extras you just do not need.

Your Level of Public Liability Cover

One of the biggest levers on your premium is the limit of indemnity you pick for your Public Liability Insurance. Whilst a £1 million limit might seem fine for small domestic jobs, it often will not cut it for commercial contracts. In fact, many local authorities, property managers and bigger companies will not even look at you without proof of a £5 million limit.

Yes, opting for a higher level of cover will nudge your premium up. But it also opens the door to much more lucrative work, signalling to clients that you are a serious professional ready to tackle larger, more complex projects.

Business Size and Equipment Value

The scale of your operation has a direct impact on your premium. If you have people working for you, you are legally required to have Employers’ Liability Insurance, which adds to the cost. The more staff you have, the higher the potential risk of a claim and your premium will reflect that.

It is the same story with your tools and equipment. A modern water-fed pole system, a top-notch purification unit and all your other gear add up to a serious investment. Insuring it all against theft or damage will increase your premium, but it is what protects your ability to actually get out there and earn a living.

Wider Economic Pressures on Premiums

It is not just about your business. Broader economic trends send ripples across the insurance market, pushing up costs for everyone. Take rising wages, for example. With government-mandated increases pushing the National Living Wage nearly 29% higher than in 2022 , the financial stakes in an employers’ liability claim have shot up.

This wage inflation means that potential compensation payouts for lost earnings are higher, increasing the insurer's potential liability and, in turn, your premium.

Finally, your own track record is a huge indicator of risk. A long, claim-free history shows you are a careful operator and can lead to lower premiums over time. On the flip side, a history of claims will almost certainly mean a higher price. It is also worth looking at how different excess levels can affect your premium; you can get a clearer picture by understanding the difference between compulsory and voluntary excess. As technology evolves in property maintenance, it is also useful understanding how drone insurance costs are determined for those using newer methods to reduce risk.

How to Choose the Right Policy for Your Business

Picking the best insurance cover is not just about hunting down the cheapest price. It is a strategic move. You need a clear head to make sure the policy you land on genuinely covers the risks your window cleaning business faces day in, day out. The right policy is what lets you sleep at night – it is not just a certificate to file away.

Getting this right starts with a proper, honest look at your business's unique risks. Think about it: a sole trader cleaning ground-floor bungalows has a completely different risk profile than a limited company tackling high-rise commercial contracts. You need to weigh up the value of your jobs, the places you work and what an accident could realistically cost.

Comparing Quotes and Checking the Details

When the quotes start rolling in, it is all too easy to get fixated on the headline price. But the real value is always buried in the small print. Look past the annual premium and dig into the details that actually matter, like the policy excess. A temptingly low premium might be hiding a sky-high excess, making a small claim not even worth the bother.

You also need to pay close attention to the policy exclusions. A classic one for our trade is an exclusion for damage to the specific item being worked on. That means a simple scratched window might not be covered by a standard public liability policy. You absolutely must get clarity on these points to avoid any nasty surprises down the line.

Your business is unique, so your insurance policy should be too. A cheap, off-the-shelf policy might feel like a bargain, but it could leave you dangerously exposed if it does not cover the specific work you actually do.

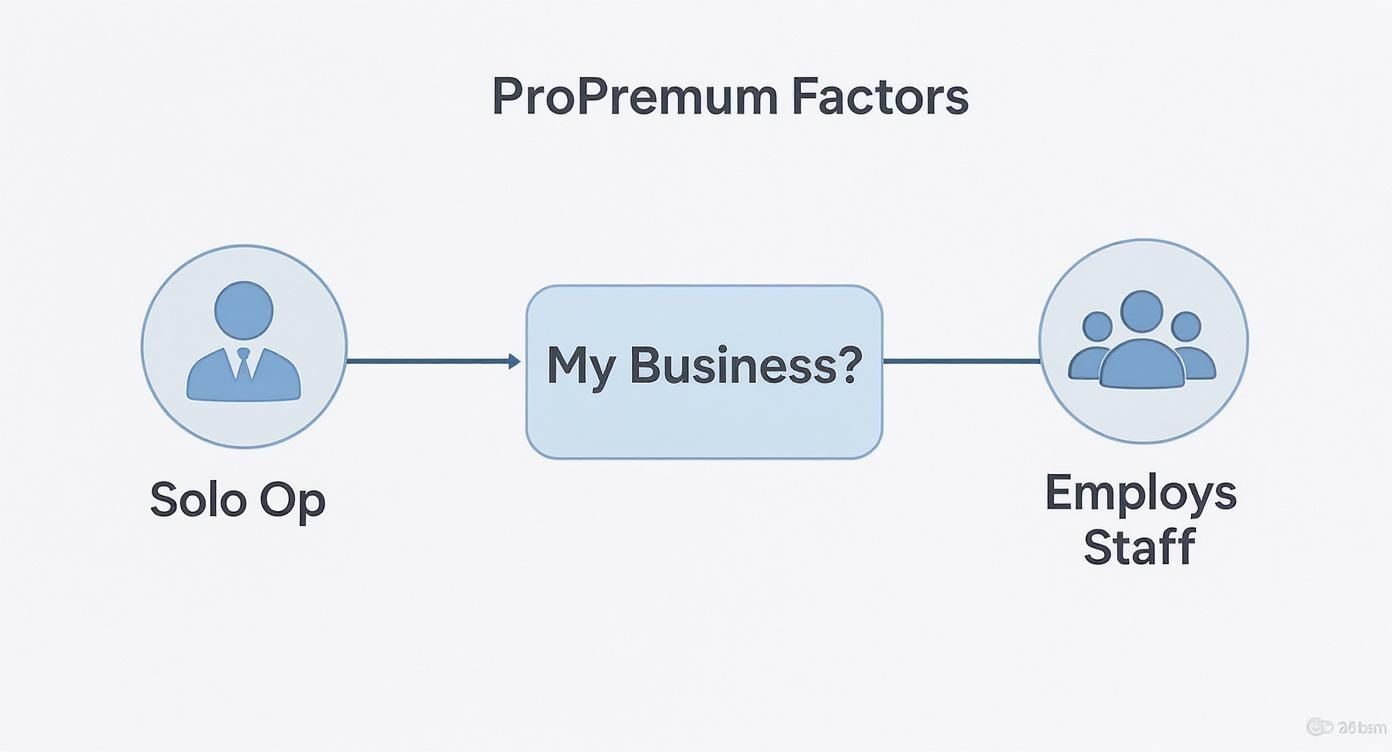

This decision tree gives you a clear visual of how your business structure is the first big factor in shaping your insurance needs.

As the infographic shows, the second you hire staff, your legal duties shift. Employers' Liability insurance suddenly becomes a mandatory requirement, which fundamentally changes the type of policy you need.

Using Specialist Brokers and Asking the Right Questions

Instead of going straight to one of the big-name insurers, it is often smarter to use a specialist insurance broker who really gets the trades. They know the market inside and out and can often sniff out more suitable and competitively priced policies than you would ever find on your own. To help cut through the jargon and make a smarter choice, an AI-powered business agent for policy choice can also offer some solid support.

Before you sign on the dotted line with anyone, have a checklist of questions at the ready. This ensures you are getting the robust cover you need without paying for things you do not.

Key Questions for Your Potential Insurer:

- What is the exact compulsory excess on this policy?

- Is damage to the property I am working on included as standard?

- Does this policy include cover for working at height?

- What is the process for making a claim and how long does it usually take to resolve?

Protecting Your Business and Our Industry

Let's be honest, proper insurance for window cleaners is much more than just another bill to pay. Think of it as a badge of honour. It is what separates the serious, professional outfits from the casual traders and it gives your clients the confidence they need to trust you with their property. Your policy is a direct investment in your business’s future and its long-term stability.

It all links back to the safety measures you take day in, day out and the diligence you apply to documenting your work. Every time you prevent an accident or have the evidence to shut down a bogus claim, you are not just saving your own skin. You are helping keep insurance affordable for every other window cleaner out there. The cost of not being able to prove your case is ultimately borne by everyone in the industry.

Securing the Future of the Trade

Every single fraudulent claim that gets paid out puts more pressure on insurers. That pressure inevitably gets passed straight back to honest, hard-working window cleaners in the form of higher premiums. When you start seeing your policy as a tool for empowerment, you are taking an active role in protecting the integrity of our entire industry.

A robust insurance policy does more than just protect you from financial loss. It empowers you to stand firm against the costly and damaging impact of fraudulent claims, securing both your reputation and the industry’s future.

Taking this proactive stance is what ensures insurance for window cleaners remains a sustainable safeguard, not an unaffordable burden that pushes good people out of the trade.

Frequently Asked Questions

Here are some quick, straightforward answers to the questions we hear most often from window cleaners about their insurance.

Do I Really Need Insurance for Ground-Floor Residential Jobs?

Yes, absolutely. Public liability insurance is a must-have, no matter the height you are working at or the type of property. It is easy to think low-risk jobs do not need cover, but a simple accident – like a client tripping over your hosepipe or you accidentally cracking a pane of glass – can lead to a surprisingly costly claim.

The reality is that the risk of injuring someone or damaging their property exists on every single job, which is what makes this cover so essential.

My Policy Excludes “Damage to Property Being Worked On.” What Is That?

This is a really critical exclusion to get your head around, as it catches a lot of people out. In simple terms, it means your standard public liability policy probably will not cover damage to the specific item you are actively working on. For a window cleaner, that means the window itself.

So, if you cause a deep scratch in the glass with a scraper, your standard policy will not pay out. To get covered for this, you often need an extension, sometimes called "damage to property being worked upon" . It is vital you clarify this specific point with your insurer to make sure you are protected against one of the most common risks in the trade.

A standard policy might protect you if your pole falls and damages a customer’s car, but it probably will not help if your squeegee scratches the very glass you are cleaning. Understanding this distinction is key to being properly insured.

How Can I Lower My Premium Without Sacrificing Cover?

Bringing your premium down without cutting corners on your cover is definitely possible. The best way is to demonstrate to insurers that you are a lower risk. Building up a long, claims-free history is one of the most effective ways to do this over time.

But there are also a few practical steps you can take right now:

- Hold relevant qualifications: Having health and safety certifications shows insurers you are serious about minimising risk.

- Pay annually: Insurers often add a charge for monthly payment plans, so paying for the year in one lump sum can save you a decent chunk of cash.

- Increase your voluntary excess: Agreeing to pay a bit more towards any claim can lower your overall premium. Just be sure it is an amount you can comfortably afford if you do need to make a claim.

Finally, using a specialist insurance broker who understands the window cleaning trade can make a huge difference. They know the market inside out and can often find you a more competitive rate.

Protecting your business from fraudulent claims starts with undeniable proof of what you own. With Proova , you can create a secure digital inventory of your tools and equipment, making any future claims process faster and simpler. Secure your assets and strengthen your business today by visiting Proova.