A Guide to General Liability Insurance in the UK

Think of general liability insurance as your business's frontline defence. It's the essential financial safety net that catches you when the unexpected happens, protecting you from the potentially ruinous costs of accidents. At its heart, it shields your company from claims of bodily injury or property damage – the kind of incidents that can derail a business overnight.

Why General Liability Insurance Is Your First Line of Defence

It is easy to imagine. A customer slips on a freshly mopped floor in your café or perhaps one of your team accidentally damages a client's expensive equipment while on a job. Without the right cover, the legal fees and compensation from these everyday mishaps could be catastrophic. General liability insurance is designed to step in and handle these costs, giving you the peace of mind to run your business.

This cover is not just for high-risk industries. Far from it. Any business that deals with the public, has visitors on-site or works at client locations needs this foundational protection. It is a cornerstone of any solid business strategy, acting as the first shield against the bumps and scrapes of daily operations.

The Core Protections for Your Business

In the UK, general liability insurance is not just one single thing; it typically bundles several crucial protections together, each tackling a different kind of risk. Getting your head around these components is the first step to seeing its real value.

- Public Liability: This is the big one. It covers claims from the public for injury or property damage caused by your business activities. It is absolutely vital for shops, contractors and any business with a physical footprint.

- Employers' Liability: If you have staff, this is a legal must-have for most UK businesses. It protects you if an employee gets injured or falls ill because of the work they do for you.

- Product Liability: Do you make, fix or sell products? This covers claims for injury or damage caused by a faulty item you have supplied.

Together, these elements form a powerful shield but its strength depends entirely on one thing: proving the facts of a claim. This is exactly where things can get complicated, leading to disputes and frustrating delays.

The High Cost of Doubt and Fraud

For insurers, the real challenge lies in sifting the genuine claims from the fraudulent ones and this is no small problem. The UK's general insurance market is massive, worth around £89.3 billion . To put it in perspective, UK insurers pay out over £7.6 million every single day for liability claims alone.

When claims are padded out or completely fabricated, the cost does not just disappear. It gets passed on to every honest policyholder in the form of higher premiums. That is why establishing a clear, verifiable record of assets and the circumstances of an incident is not just good practice—it's essential for a fairer system for all of us.

This fundamental need for proof really sets the scene for why managing claims effectively is so important. Without it, the entire industry creaks under the weight of uncertainty and inflated costs, making a robust business risk management framework more critical than ever.

Deconstructing Your General Liability Insurance Policy

To really get to grips with your protection, you have to look under the bonnet of the policy itself. Think of a general liability insurance policy less like a single shield and more like a multi-layered suit of armour. Each piece is designed to defend against a specific kind of threat your UK business might face.

For most businesses, this armour is built from three core plates: public liability, employers' liability and product liability. Getting to know what each one does is the first step towards feeling confident in your cover.

Public Liability: Your Outward-Facing Shield

Public liability is probably the first thing people think of when it comes to business insurance. It is your main line of defence against claims made by members of the public – customers, visitors or even just a passer-by. This cover kicks in when your business activities are blamed for causing an injury or damaging someone’s property.

A classic example? A customer slips on a wet floor in your shop and gets hurt. Public liability cover is there to handle the legal fees and any compensation that might follow. It is a must-have for any business that interacts with the public.

Employers’ Liability: Protecting Your Team

If you have employees, employers' liability is not just a good idea; for most UK businesses, it is the law. This part of your policy protects you if an employee gets ill or is injured as a direct result of the work they do for you. The legal minimum cover required is typically £5 million .

Imagine a warehouse worker injures their back and claims it was due to poor manual handling training. Employers' liability insurance would step in to cover the legal costs and any compensation awarded if the business is found liable. It is absolutely vital for meeting your duties as an employer.

Product Liability: Cover for What You Sell

The third key piece is product liability . This is for any business that designs, manufactures or supplies a physical product. It protects you against claims of injury or property damage caused by a fault in something you sold.

For instance, if a kettle you sold overheats and starts a fire in a customer's kitchen, product liability cover would be needed to address the claim. This protection is critical for staying afloat when the things you sell do not work as they should.

To make this clearer, let's break down these core components in a table.

| Type of Cover | What It Protects Against | Example Claim Scenario |

|---|---|---|

| Public Liability | Injury to third parties or damage to their property caused by your business activities. | A decorator accidentally spills paint on a client’s expensive antique rug. |

| Employers’ Liability | Illness or injury sustained by an employee as a result of their work. | An office worker develops repetitive strain injury due to an unsuitable workstation. |

| Product Liability | Injury or damage caused by a faulty product you have sold or supplied. | A cosmetic product causes a severe allergic reaction in a customer. |

Understanding these pillars is just the starting point. The real detail lies in the small print, which sets out the limits of your cover and the excess you have to pay on a claim. Getting your head around these terms is essential for knowing exactly what your policy will – and will not – do for you when you need it most.

The Hidden Costs of Insurance Fraud

Insurance fraud often feels like a distant, corporate problem but it is far from a victimless crime. In reality, it acts as a hidden tax, levied on every honest business and individual who pays an insurance premium. The issue runs deeper than just outlandish, fake claims; it seeps into the everyday process through subtle exaggerations and opportunistic dishonesty. This escalating challenge is a huge cost to the insurance industry and ultimately to every policyholder.

This escalating challenge ranges from the relatively minor, like slightly overstating the value of a stolen laptop, to highly organised schemes designed to defraud insurers of huge sums. While sophisticated plots grab headlines, it is the cumulative weight of small-scale embellishment that steadily poisons the insurance pool for everyone.

The Psychology of Claim Embellishment

Picture this: a small business owner’s workshop has been burgled. When they are asked to list everything stolen, recalling the exact make, model and value of every tool is a real challenge. This is where the temptation to 'guess' creeps in, often leading to inflated figures that feel reasonable at the time but are not based on fact.

This behaviour directly contributes to rising premiums for all of us. When an insurer cannot definitively prove the value—or even the existence—of an item, they often have to pay out more than is fair. These accumulated losses do not just vanish; they are mathematically factored into the next year's pricing. In the end, every policyholder pays for the dishonesty of a few.

The core of the problem is provability . Insurers are duty-bound to meticulously verify every aspect of a general liability insurance claim to weed out fraud. This essential diligence, however, creates friction, causing delays and disputes even for completely legitimate claimants who are simply trying to get back on their feet.

The sheer volume of claims in key sectors highlights the scale of this challenge. Employers’ liability insurance, for instance, sees intense usage, with companies reporting over 2 million workplace injuries and illnesses annually. Alarmingly, 26% of SMEs stopped buying compulsory employers’ liability (EL) insurance in a recent year. On another front, professional indemnity claims now account for 26% of all annual business insurance claims , driving the PI market to £3.3 billion .

Why Verifiable Evidence Is Non-Negotiable

Without a solid foundation of proof, the entire insurance system becomes unstable. It creates a confrontational dynamic where the insurer has to act like a detective and the policyholder feels unjustly scrutinised. This adversarial relationship benefits no one, only serving to increase administrative costs and drag out settlement times.

The absence of upfront, verifiable evidence creates several critical problems:

- Increased Investigative Costs: Insurers are forced to spend more on loss adjusters and investigators to validate claims—costs that are ultimately passed on to customers.

- Delays for Genuine Claimants: Honest policyholders face longer waits for payouts as their claims get stuck in a queue behind suspicious ones needing a deep dive.

- Erosion of Trust: The constant need for verification can damage the relationship between insurer and insured, turning what should be a partnership into a battle of wills.

This environment highlights why a shift towards proactive evidence collection is so critical. By establishing clear, undeniable proof of what a business owns from the very beginning, we can start to tackle these deep-rooted issues. For a deeper dive, read our insights on how a claims database is a key part of insurance fraud prevention. This sets the stage for a more efficient and trustworthy system, where verifiable evidence is not an afterthought—it's the priority.

How Outdated Claims Processes Hurt Everyone

Traditional insurance underwriting and claims are slow, expensive and frankly, full of holes. It is like building a house on a foundation of sand; without solid ground to build on, the whole structure is unstable. This is the exact problem general liability insurance faces when it lacks verifiable evidence from day one.

This instability comes from an age-old challenge: proving what a business owned and what condition it was in before something went wrong. When a claim is filed, the process kicks into a reactive, investigative mode. Insurers have to send out loss adjusters to verify assets and piece together the facts after the event, a costly and time-consuming exercise. These operational costs do not just hit the insurer's balance sheet; they are a massive factor in the premiums every single business pays.

This lack of upfront proof creates a glaring loophole for fraud. One of the most common scams is 'after-the-event' fraud . This is where someone damages their property, quickly buys an insurance policy and then files a claim a few weeks later, pretending the damage just happened. Without a time-stamped record of the asset's condition when the policy started, it is incredibly difficult for insurers to prove the deception.

The Ripple Effect of High Costs and Fraud

The financial hit from these inefficiencies and fraudulent claims is huge. Every pound paid out for a bogus claim or spent on a lengthy investigation is a cost the industry has to recover. It is not the insurance companies that absorb it alone; it is passed directly to honest policyholders through higher premiums. In short, honest businesses end up footing the bill for fraudsters and the cumbersome systems used to fight them. This is a cost we all bear.

The core issue is a fundamental lack of trust, born from a system that defaults to suspicion because it has no baseline of truth. When a claim is filed without pre-existing proof, the relationship between the policyholder and the insurer can quickly become adversarial. This slows down legitimate payouts and causes immense frustration for businesses just trying to get back on their feet after a genuine loss.

Wider market pressures only make this problem worse. Right now, the UK general liability market is a mixed bag. While some casualty lines are seeing prices drop due to high capacity, this is happening against a backdrop of soaring claims inflation in other areas. Property claims are particularly strained, with theft rates jumping by over 50% in the last five years and home premiums spiking due to severe weather and supply chain nightmares. You can get a deeper dive into these trends in the UK insurance market outlook from Aon.com. These external pressures make it even more critical to get a handle on the costs we can control, like fraud and inefficiency.

Why the Old Ways Just Do Not Cut It Anymore

The traditional way of handling claims leans heavily on paperwork that may or may not even exist after an incident. An insurer will ask for receipts, invoices or photos but for a busy company—especially after a fire or flood—these records are often incomplete or gone for good.

This leads to a cascade of negative outcomes:

- Delayed Settlements: Genuine claimants are left waiting weeks, sometimes months, for their payout while the insurer investigates. For a small business, this delay can be devastating to its cash flow.

- More Disputes: Disagreements over an item's value or even its existence become common, leading to stressful negotiations and, in some cases, legal battles.

- Unfair Payouts: Without concrete proof, settlements often end up as a compromise. This means the business may not get the full amount it is legitimately owed for its loss.

Ultimately, the entire system pays the price for this lack of a single, verifiable source of truth. Relying on post-event investigation is not just inefficient; it is fundamentally flawed. It penalises the honest, rewards the dishonest and inflates the cost of general liability insurance for every business in the country.

Using Technology To Build Trust And Proof

The historic tug-of-war between insurers and policyholders over a claim's validity boils down to one simple problem: a lack of verifiable proof. This information gap creates a reactive, investigative process that is slow, expensive and frankly, ripe for exploitation. A modern approach however is flipping this dynamic on its head, using technology to build a foundation of trust and proof from the very beginning.

Instead of a business owner scrambling for receipts and evidence after a loss, this new model creates an authenticated, time-stamped inventory of their assets when the policy starts. This digital record serves as undeniable proof of what a business owned and its condition, shutting down many common avenues for insurance fraud before a claim is even made. The provability of the claim becomes indisputable.

The process is refreshingly straightforward. A business owner can simply photograph their assets, log important details like serial numbers and upload everything to a secure platform. Each entry is geolocated and time-stamped, making it nearly impossible to invent items or commit 'after-the-event' fraud, where damage is claimed for an incident that happened before the policy was even active.

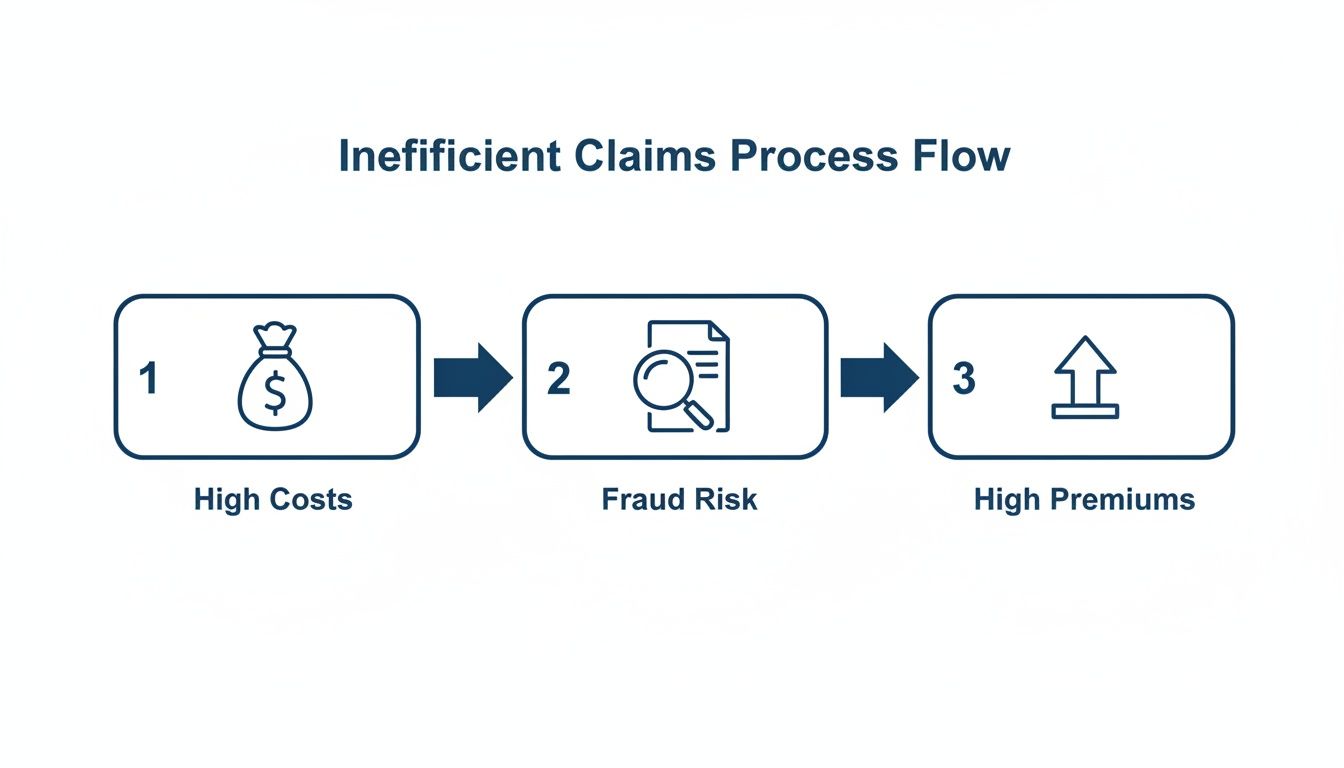

This proactive stance transforms the old, inefficient claims process — a cycle that often leads to high costs, increased fraud risk and ultimately, higher premiums for everyone.

As the infographic shows, it is a damaging cycle where operational inefficiencies and fraud directly inflate the cost of insurance for honest policyholders.

Accurate Underwriting Without The Overheads

For insurers, this technology provides a clear, verified picture of the risk they are taking on. Traditionally, assessing a new commercial policy might require a costly and time-consuming site visit from a surveyor to catalogue assets and evaluate their condition. This is especially true for businesses with significant physical assets, like a garage, workshop or a large office.

By using a digital verification platform, underwriters can remotely and accurately see exactly what they are covering. This does not just cut down on operational costs; it allows for much more precise risk pricing. An insurer armed with a verified asset list can offer more competitive premiums because a huge layer of uncertainty has been removed from the equation.

A verified digital inventory acts as a single source of truth for both the insurer and the policyholder. It replaces ambiguity with certainty, transforming the underwriting process from an estimation exercise into an evidence-based assessment.

This level of detail ensures that the general liability insurance policy accurately reflects the business's real-world assets and exposures from day one.

Streamlining Claims With Verifiable Evidence

The true power of this approach really shines when a claim is made. Instead of an adversarial process of questioning and investigation, the claims handler has instant access to a pre-verified inventory. They can compare the items being claimed against the digital record, confirming ownership, existence and pre-loss condition in minutes, not months.

This has several profound benefits:

- Speed: Legitimate claims can be validated and paid out incredibly quickly, helping businesses get back on their feet with minimal disruption.

- Efficiency: The need for expensive loss adjusters is dramatically reduced, lowering the administrative cost of handling a claim.

- Fairness: Disputes over the value or existence of an item are eliminated, ensuring the policyholder receives a fair settlement based on previously agreed evidence.

This efficiency is crucial in an environment where businesses are facing increased pressure. Modern solutions like Intelligent Document Processing (IDP) are already transforming how businesses handle vast amounts of information, improving data accuracy and processing speed. Applying a similar evidence-based mindset to asset verification is the logical next step.

By tackling the core issue of provability, technology builds a more transparent and efficient system. It shifts the focus from post-loss investigation to pre-loss verification, creating a win-win for everyone involved. For a real-world look at how this works in practice, you can learn more about how real-time evidence changes everything from theft to payout . This move towards verifiable proof is not just an improvement; it is a necessary evolution for the future of general liability insurance.

The Future of Fairer and Faster Insurance

As insurance fraud gets more sophisticated and operational costs keep climbing, an evidence-based approach is no longer a nice-to-have; it is a necessity. The traditional model is fundamentally reactive, often kicking off an investigation long after an incident has already happened. It is a system bogged down by verification headaches, delays and the constant threat of fraud.

Technology however is now driving a critical shift towards a proactive model, one built on a foundation of verifiable proof. By creating an undeniable record of assets before a loss ever occurs, we can change the entire dynamic of general liability insurance for the better. This move away from post-claim scrambling and towards pre-policy certainty is paving the way for a much more sustainable insurance ecosystem.

Benefits Across The Board

This evidence-first approach delivers real, tangible benefits for everyone involved in the insurance chain. It helps dismantle the often adversarial relationship that can crop up during a claim, replacing it with a partnership based on a shared, undisputed set of facts.

The advantages are clear and powerful:

- For Insurers: Fraud-related losses and the huge operational overheads of manual verification are slashed. Underwriting becomes sharper and risk can be priced with much greater confidence.

- For Claims Managers: Claims get processed with far greater speed and efficiency. Instead of launching lengthy investigations, they can simply compare the claim against a pre-verified inventory, letting them settle legitimate claims in record time.

- For Honest Policyholders: This is arguably the biggest win. Businesses get faster, fairer payouts right when they need them most and they contribute to a healthier system that encourages more stable premiums for everyone.

By embracing this technological evolution, the industry can build a more transparent and resilient system. It is a move from ambiguity to clarity, where trust is established through proof, not just assumed through paperwork.

This shift is not just an upgrade to existing processes; it is a complete reimagining of how general liability insurance can and should work. It is a future where fairness and speed are not competing ideals but the direct results of a smarter, evidence-based framework.

Frequently Asked Questions

Getting your head around general liability insurance can throw up a lot of questions, whether you are a business owner or an insurance pro. Here are some straightforward answers to the most common queries, with a focus on UK rules and how solid proof is changing the game.

Is General Liability Insurance a Legal Requirement in the UK?

While the full general liability package is not mandatory, one crucial part of it is. Employers’ liability cover is compulsory for almost every UK business that has staff and you need a minimum of £5 million in cover. It is a legal safeguard for your team.

Public liability, on the other hand, is not a legal must-have but in reality, you will find it is often a requirement in client contracts and is simply essential for any business that deals with the public. It is your shield against claims if someone gets hurt or their property is damaged.

How Does a Lack of Proof Complicate a Liability Claim?

A claim without proof is a recipe for delay and dispute. If there is no clear evidence showing you owned something, what condition it was in and its value before the incident, the whole process grinds to a halt. It immediately puts the insurer on the back foot, forcing them to investigate to rule out fraud.

Insurers will ask for receipts, bank statements or other proof of purchase—documents that are often the last thing a business can find after a major incident. This guesswork leads to arguments, lower payouts or even a genuine claim being rejected outright, which is incredibly frustrating for everyone.

A verified inventory, created before anything goes wrong, cuts through all that uncertainty. It establishes a baseline of truth from day one, paving the way for a fast, fair and undisputed settlement. It turns a potential conflict into a simple transaction.

Can Technology Help Reduce My Business Insurance Premiums?

Absolutely. The right technology can directly improve your risk profile and, in turn, lower your premiums. When an insurer has a transparent, verified and time-stamped record of your business assets from a platform, you are removing a massive chunk of their uncertainty. This cuts their potential costs tied to fraud investigations and disputes.

An insurer who can see exactly what they are covering is in a much stronger position to offer you competitive pricing. As this kind of technology helps reduce fraud across the board, the savings get passed on, leading to more stable and affordable premiums for all honest policyholders. It creates a fairer system where being prepared pays off.

By building a foundation of verifiable proof, Proova gives both businesses and insurers the tools to handle claims with speed and confidence. This evidence-first approach tackles fraud at its source, slashes admin costs and helps create a more transparent insurance ecosystem for everyone. Find out more at https://www.proova.com.