Signs of House Subsidence: Indicators You Should Watch For

The first signs of house subsidence are often subtle but they have a habit of showing up in very specific ways. You might notice new, diagonal cracks suddenly appearing around your doors and windows. A key giveaway is that they are often wider at the top than the bottom. You could also find your doors and windows starting to stick for no apparent reason or wallpaper that begins to crinkle or tear out of the blue.

Understanding What House Subsidence Really Means

So let's cut through the jargon. Subsidence is what happens when the ground underneath your home starts to sink, taking the foundations down with it. Think of the soil as a giant sponge holding up your house; if that sponge dries out and shrinks, the support gives way.

The real problem is that this downward movement is rarely even. One part of your property might start sinking faster than another, putting immense stress on the building's structure. This is what causes those tell-tale cracks and distortions that are the classic signs of house subsidence. It is a fundamental failure of the very ground that is meant to support everything.

Beyond Cracks: The Financial Reality

But understanding this process is about more than just your home's structural integrity. Subsidence is a massive financial issue for homeowners and the entire insurance industry. The cost to put things right can be eye-watering, often running into tens of thousands of pounds for underpinning and repairs.

This financial strain hits from two sides:

- Immediate Repair Costs: For anyone uninsured, these costs can be crippling. For insurers, they represent a major liability.

- Long-Term Insurance Implications: A property with a history of subsidence can become incredibly difficult and expensive to insure down the line, which directly impacts its market value.

This is not just a personal headache; it is a collective problem. The rising costs of subsidence claims ultimately get passed on to all policyholders through higher premiums. As our climate patterns shift, insurers are seeing a significant increase in these claims, putting a real strain on the market.

Provability and the Problem of Fraud

For insurers, one of the biggest challenges is proving the exact cause and timing of the damage. Was that crack already there or is it a direct result of a recent event? This grey area unfortunately opens the door to insurance fraud, from people exaggerating the damage to blaming old issues on a new claim.

Insurance fraud in this area is not a victimless crime. Fabricated or embellished claims drive up operational costs for insurers, which inevitably leads to higher premiums for honest policyholders right across the board.

This is precisely why accurate, verifiable evidence is so crucial. Being able to distinguish between genuine signs of house subsidence and opportunistic claims is vital for keeping the insurance system fair and sustainable.

To really get to grips with your home's foundational integrity and how ground movement might affect it, it helps to dive into understanding structural engineering. This knowledge gives you context for how professionals assess these complex issues and our guide will walk you through spotting the real warning signs and navigating the tricky world of insurance with far more confidence.

Why Are UK Homes So Prone to Subsidence?

The chance of your home suffering from subsidence is not the same everywhere; some properties are just built on less stable ground. Here in the UK, a few distinct factors come together to create a perfect storm for foundation problems, making certain regions far more vulnerable than others. Getting to grips with these risks is the first step in protecting your home.

The ground beneath our feet is not one solid, uniform block. It changes dramatically from one area to another and this geological lottery plays a massive part in determining subsidence risk. In the UK, one of the biggest troublemakers is clay soil – a material that behaves a bit like a volatile sponge.

The Clay Soil Problem

Clay soil is incredibly sensitive to moisture. When it rains, it swells up as it absorbs water. But during long, dry spells, it shrinks dramatically as all that moisture evaporates. This constant cycle of swelling and shrinking can cause the ground to shift unpredictably, destabilising the very foundations that sit on top of it.

This is no small issue. Clay shrinkage is the single biggest cause of subsidence in the UK , with a heavy concentration in London and the South East. The geology in these areas is dominated by highly shrinkable clay, putting millions of homes at a higher risk every single time a heatwave hits.

The long-term financial fallout from this is staggering. In London alone, claim volumes are expected to shoot up by 57.3% by 2070 . As our climate continues to change, this problem is predicted to spread into areas that were previously unaffected, with an estimated financial impact of around £1.9 billion . You can dig into the numbers in this insightful report on subsidence trends.

Thirsty Trees and Hidden Dangers

It is not just the soil itself that poses a threat. What is happening in the immediate environment can ramp up the risk, especially the presence of large, thirsty trees and shrubs.

- Aggressive Root Systems: The roots of mature trees, particularly species like oak, poplar and willow, can draw enormous amounts of water from the soil. A single large oak tree can pull up to 50,000 litres of water from the ground in just one year.

- Localised Drying: When these trees are planted too close to a property, their roots can cause the clay soil in one specific spot to shrink much faster than the surrounding ground. This creates uneven support for the foundations, leading directly to structural stress and those classic diagonal cracks that are such a worrying sign of subsidence.

It is a common misconception that only huge, ancient trees are a problem. Even a row of fast-growing conifers planted too close to a wall can draw enough moisture from the ground to cause significant issues over time.

Beyond natural causes, there are also man-made dangers lurking out of sight. Leaking drains or damaged water mains are silent culprits. A slow, persistent leak can gradually wash away fine particles of soil from beneath your foundations – a process known as 'washout'. Over months or years, this creates empty pockets in the ground, leaving the foundations unsupported and vulnerable.

Finally, the UK's industrial past has left its own legacy. Properties built over or near old mining works are at risk from the ground shifting as old tunnels and shafts collapse. It all goes to show why, for homeowners and insurers alike, understanding the local geography and history is not just interesting—it is absolutely essential for assessing the real risk.

How to Read the Warning Signs in Your Home

Spotting the early signs of house subsidence is not about finding one dramatic crack. It is more like being a detective in your own home, learning to read a collection of subtle clues that, together, tell a much bigger story about the ground shifting beneath your feet.

Many homeowners brush off the first indicators as simple quirks of an older building. But knowing how to separate normal settlement from genuine subsidence is crucial. Getting this right can save you a world of stress and money down the line, empowering you to act decisively instead of worrying over every little hairline crack.

Distinguishing Subsidence Cracks from Settling Cracks

Let's be clear: not all cracks are created equal. It is completely normal for new homes to develop thin, harmless cracks as they settle under their own weight. The trick is to look for specific characteristics that signal a more serious, underlying problem.

A classic subsidence crack has a distinct personality. It is often:

- Diagonal: You will see it running diagonally down the wall, frequently starting from the corners of windows or doors where the structure is weakest.

- Wider at the Top: This tapering shape is a tell-tale sign that one side of the foundation is dropping away from the other.

- Sudden in Appearance: These cracks tend to show up quite abruptly, especially after a long, dry spell of weather shrinks the soil.

- Visible Inside and Out: A crack that mirrors itself on both the interior and exterior walls is a major red flag.

In contrast, normal settlement or thermal movement usually results in fine, vertical cracks that do not really change over time. These are typically found in plaster and are more of a cosmetic nuisance than a structural threat.

Beyond the Cracks: Other Telltale Signs

While cracks get all the attention, your home can communicate distress in other ways. When the ground moves, it can subtly distort the property's frame, leading to a cascade of related issues.

Keep an eye (and an ear) out for these additional clues:

- Sticking Doors and Windows: If a door that once swung freely suddenly starts jamming or a window becomes a battle to open, it can mean the frame is being warped by movement.

- Crinkling Wallpaper: Ripples or tears in your wallpaper, especially near ceiling corners or around door frames, can be caused by the wall behind it shifting.

- Gaps Appearing: You might notice new gaps opening up between the skirting boards and the floor or where an extension joins the main body of the house.

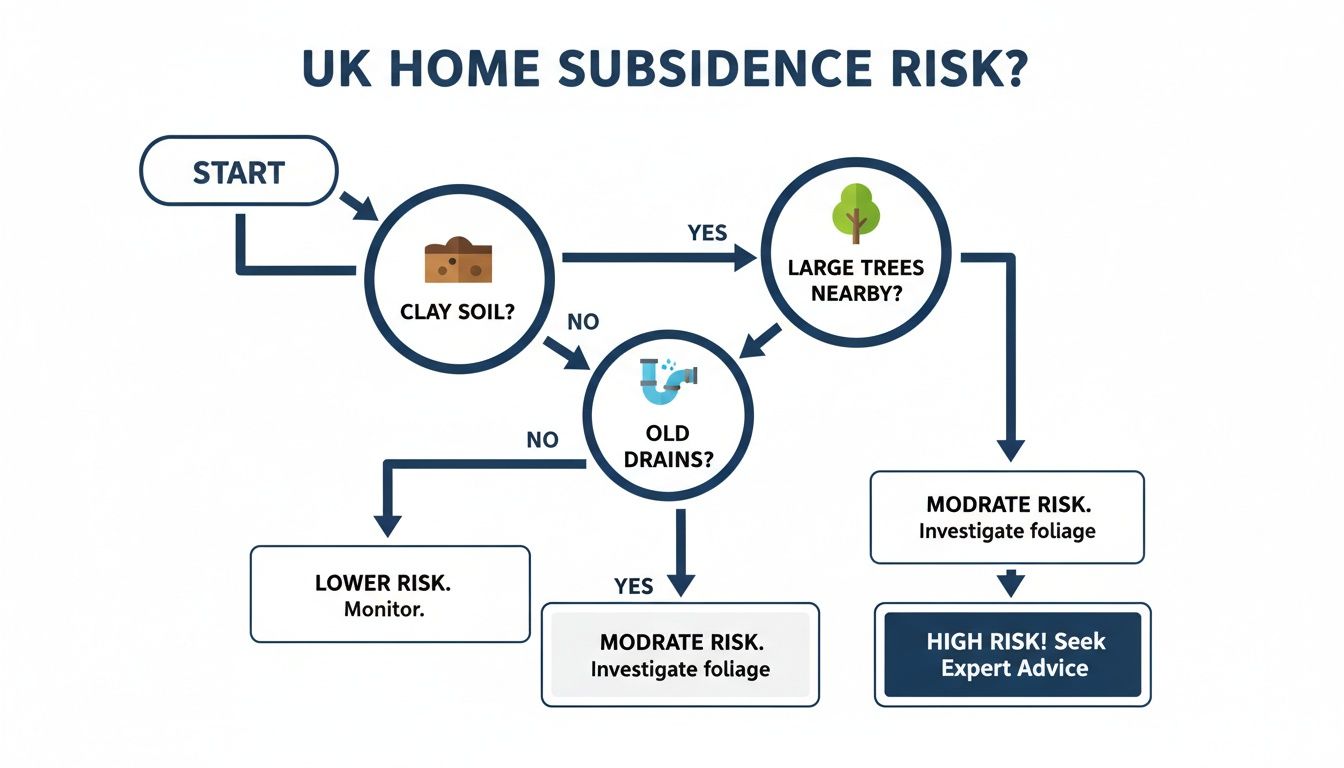

This decision tree is a handy tool for quickly assessing some of the main environmental risk factors for UK properties.

As the flowchart shows, things like clay soil, large thirsty trees near the house and old, leaky drains are a recipe for a higher-risk environment.

To help you tell the difference at a glance, here is a quick comparison of the signs you might see.

Subsidence or Just Settling? A Quick Comparison

| Symptom | Likely Sign of Subsidence | Likely a Minor Issue |

|---|---|---|

| Cracks | Diagonal, wider at the top, visible inside and out, appear suddenly. | Fine, vertical hairline cracks, usually in plaster, unchanging over time. |

| Doors & Windows | Suddenly start sticking or jamming for no obvious reason. | Sticking might be seasonal due to humidity causing wood to swell. |

| Gaps | New gaps appear around skirting boards or between extensions. | Minor gaps might be related to flooring settling or decorating changes. |

| Wallpaper | Rippling or tearing, particularly in corners or near frames. | Peeling or bubbling is often caused by damp, not structural movement. |

Remember, this table is a guide. If you are seeing several signs from the 'Subsidence' column, it is time to take it seriously.

The Problem of Provability in Insurance

Identifying these signs is the first step but proving their cause and timing to an insurer can be a real headache. Your insurer needs to be certain that the damage is new and directly linked to an insured event, not a pre-existing issue you have just noticed.

The challenge for both homeowners and insurers is establishing a clear timeline. Without definitive proof of when a crack appeared or a door started sticking, the claims process can become slow, contentious and frustrating for everyone involved.

This ambiguity is also where the risk of insurance fraud creeps in. A dishonest person might try to blame long-standing structural problems on a recent event or exaggerate the severity of new damage. These actions are not victimless; they drive up costs for insurers and that financial burden is eventually passed on to all of us through higher premiums.

It is also important to remember that not all property problems point to subsidence. Water damage, for example, can sometimes be mistaken for structural issues. You can get a better sense of what is what by exploring our guide on whether your house insurance will cover a leaking roof.

Once you are attuned to these subtle indicators, it is also helpful to understand how professionals approach broader structural issues. For a detailed guide on diagnosing and addressing common foundation problems like cracks, leaks, or uneven floors , you can explore resources like this. Building a well-rounded knowledge base prepares you to have more informed conversations with surveyors and insurers, making sure you can protect your property effectively.

The Hidden Costs of a Subsidence Claim

When you first spot the tell-tale signs of subsidence, your mind probably jumps straight to the repair bill. And yes, the cost of underpinning and structural work can be eye-watering but that is really just the tip of the iceberg. A subsidence claim sets off a chain reaction of hidden costs that ripple through your finances for years to come.

Understanding these long-term consequences is vital. A history of subsidence leaves a permanent mark on your property's file, making it a tougher sell for future buyers and a much bigger risk in the eyes of insurers. The true financial toll goes far beyond a builder's initial quote.

The Immediate and Lingering Financial Impact

The most obvious cost is, of course, the claim payout itself. We are not talking about small change here; complex subsidence repairs frequently run into tens of thousands of pounds. But the financial headache does not end when the builders pack up their tools. A property with a subsidence history is immediately flagged as a higher risk, which has a direct and lasting impact on your insurance premiums.

This is not a minor hike, either. Homeowners with a history of subsidence pay an average of £545 per year for their home insurance. Compare that to the £227 paid for unaffected properties and you are looking at an extra £318 every single year—a financial penalty that can stick with you for a very long time.

It is not just individual homeowners feeling the pinch. The entire industry is under pressure. Recent figures show that flood and subsidence-related claims across the UK have shot up by a staggering 58% , while general home insurance claims grew by only 20% . This massive jump, detailed in recent analysis, proves that environmental risks like subsidence are growing nearly three times faster than standard claims. You can read more about these rising claim trends to get a sense of the scale.

The Growing Burden on the Insurance Industry

This surge in expensive, complex claims is putting a huge strain on the insurance market. Subsidence is a difficult and costly problem to manage, requiring specialist surveyors, engineers and contractors. Those escalating operational costs do not just vanish—they get absorbed and then passed on to every single customer.

The hard truth is that the rising cost of subsidence claims is spread across all policyholders, not just those directly affected. Every fraudulent or inflated claim adds to the pot, pushing up premiums for everyone. This is why solid, reliable verification has never been more important.

Insurers are caught in a tough spot. They have to balance paying genuine claims fairly and quickly with protecting their business—and their honest customers—from the financial fallout of fraud. This is where the simple act of proving what happened, and when, becomes a major financial issue.

Fraud and the High Cost of Uncertainty

Subsidence-related insurance fraud can be subtle. It might be someone exaggerating the extent of new cracks or trying to blame long-standing structural problems on a recent dry summer. Each dishonest or unverified claim adds to the industry's losses, which just keeps the cycle of rising premiums going.

When there is no clear, provable record of a property's condition, insurers have to spend a lot more time and money investigating. These costs—for multiple site visits, expert reports and admin hours—all get tacked onto the overall expense of the claim. The longer a claim stays open because of uncertainty, the more it costs. This is a key reason why understanding the cost of delayed claims is so critical for the industry's financial health.

To fight back, insurers need better ways to verify the facts. Imagine having a definitive, time-stamped record of a property's condition right from the start of a policy. It creates a clear baseline. This kind of evidence-based approach means genuine claims can be processed quickly, while providing the solid proof needed to reject fraudulent ones. It is about protecting the integrity of the whole system and getting a handle on the hidden costs that ultimately affect us all.

Navigating the Claims Process and Avoiding Fraud

Filing a subsidence claim is not usually straightforward. It is rarely as simple as spotting a crack and getting a quick payout from your insurer. They need to be absolutely sure the damage is recent, is a direct result of subsidence and was not there before your policy started. This is often where the real headache begins for everyone involved.

The burden of proof falls squarely on your shoulders. How do you prove exactly when that crack appeared? How do you show that a sticking door is a new problem, not just an old quirk of the house you have lived with for years? This vagueness can drag out genuine claims, leaving homeowners stuck in lengthy investigations.

Unfortunately, where there is ambiguity, there is also an opportunity for fraud. While the vast majority of people are honest, a small minority will always try to game the system. And that has a financial knock-on effect that ends up costing every single policyholder.

The High Cost of Unprovable Claims

Insurance fraud is not a victimless crime. It inflates the operational costs for insurers, who have to pour resources into investigating suspicious claims. In the end, those extra expenses get passed on to all of us in the form of higher premiums.

Fraud in this area can pop up in a few different ways:

- Exaggeration: Someone might overstate the severity of new cracks or other signs of house subsidence to try and secure a bigger payout than they are entitled to.

- Misattribution: Pre-existing damage, maybe from years ago, is dishonestly blamed on a recent event like a hot, dry summer to make a claim on a current policy.

- Opportunism: Minor, harmless settlement cracks get presented as evidence of a much more serious structural issue.

Without a crystal-clear, objective record of the property's condition, it is incredibly tough for an insurer to tell a legitimate claim from a fraudulent one. This does not just cost the industry money; it chips away at the trust the whole system is built on.

The Power of a Verifiable Baseline

This is where modern verification technology really comes into its own. Picture this: at the very start of your insurance policy, a verifiable, time-stamped record of your property’s condition is created. Every wall, ceiling and window frame is documented, establishing an undeniable baseline.

This single source of truth changes the entire game. It hands insurers a powerful tool to validate claims with both speed and accuracy.

When an insurer can compare a new claim against a previously verified record of the property's condition, the entire process becomes faster and more transparent. Genuine claims can be approved quickly, while embellished or fraudulent ones can be challenged with concrete evidence.

This approach protects everybody. Honest homeowners with genuine signs of house subsidence get their claims sorted faster, cutting down on the stress and disruption. At the same time, insurers are shielded from fraud, helping them control costs and keep premiums fair for everyone else. It replaces guesswork with certainty, which is a win-win.

Taking Control of the Process

For any homeowner, this can feel like a daunting world to navigate. The best way to feel more in control is to be proactive. Keep meticulous records and document any changes to your property with dated photographs—it could prove invaluable if you ever need to make a claim. For a deeper dive into the steps and what to expect, you might want to learn how to master the home insurance claims process with our guide.

Ultimately, the goal is to build a system where the facts are clear and indisputable. By establishing a definitive record of a property’s condition from day one, we can cut down on the friction, cost and potential for dishonesty in the claims process. This protects the integrity of the insurance system, making sure it stays fair and affordable for all.

Preparing for Weather-Driven Subsidence Surges

Subsidence claims do not just pop up out of the blue. They follow predictable cycles, closely tied to the weather and there is a clear connection between long, dry heatwaves and a sudden jump in calls from worried homeowners. Getting to grips with this pattern is crucial for both property owners and insurers.

When the weather stays hot and dry for weeks on end, moisture gets sucked out of the ground. This is especially true for the clay soils found across much of the UK. As the clay dries, it shrinks and compacts, pulling away from your foundations and leaving them without proper support. It is no surprise, then, that the months immediately following a heatwave often bring a dramatic spike in people spotting the first signs of subsidence.

These weather-driven surges create intense, high-volume periods that can seriously stretch an insurer's resources. Ignoring these cycles is a huge risk as it leads to slower response times and overwhelmed claims departments right when customers need them the most.

The Financial Impact of Weather Events

The scale of these surges is staggering. To give you an idea, the UK property insurance market recently saw subsidence claims shoot up to £153 million in just the first half of one year. That spike was linked directly to an unusually warm and sunny spring.

Insurers ended up supporting nearly 9,000 households in that six-month window alone, with the average payout hitting a hefty £17,264 . This is not a one-off; the pattern repeats itself after every major heatwave, showing a clear cause-and-effect relationship. You can discover more insights about these subsidence payouts and see the data for yourself.

Proactive Risk Management for Homeowners

While you cannot control the weather, you can take practical steps to manage the risks around your property. Being proactive is always better than reacting to a crack once it has already appeared.

- Tree Maintenance: Keep large trees in check, especially thirsty species like oak and willow growing close to your house. A good tree surgeon can advise on crown reduction to limit how much water the roots are pulling from the soil.

- Drainage and Guttering: Make sure your drains and gutters are clear and working properly. Leaks can oversaturate the ground, washing soil away or, in a dry spell, making shrinkage in other areas even worse.

- Monitor Your Property: Be extra vigilant after a long period of dry weather. Take a walk around your home and keep an eye out for those early warning signs we have discussed, like new diagonal cracks or doors that suddenly start to stick.

Anticipating Surges for Insurers

For insurers, the game is changing from being reactive to predictive. By using climate data to anticipate when these claim surges will hit, they can allocate resources far more intelligently and deliver better service when it really counts.

By tracking meteorological forecasts and soil moisture data in high-risk regions, insurers can prepare their claims teams for an influx of reports. This proactive stance means they can allocate adjusters and surveyors more efficiently, managing operational costs and maintaining service standards during peak times.

This kind of foresight also opens the door to proactive communication. Insurers can send out preventative advice to policyholders in vulnerable areas before a heatwave arrives, helping customers protect their properties and potentially reducing the number of claims down the line. Ultimately, understanding these trends is fundamental to managing risk, controlling costs and being there for customers when they need it most.

Still Got Questions About Subsidence?

We get it. Subsidence is a complex topic and it is natural to have a few more questions rattling around. Let's tackle some of the most common ones we hear from homeowners.

How Much Does Subsidence Devalue a Property?

This is the big one, is it not? The truth is, a history of subsidence does not just knock a bit off the asking price; it can make a property incredibly difficult to sell at all.

Mortgage lenders are famously cautious. They demand comprehensive subsidence cover and a previous claim instantly flags your home as a high-risk asset. This can stop a buyer's mortgage application in its tracks, causing sales to collapse and leaving you in a very tough spot.

Do I Have to Declare Past Subsidence When Insuring My Home?

Absolutely, yes . When you apply for home insurance, you will almost certainly be asked, ‘Has the property ever suffered from subsidence, landslip or heave?’

Do not be tempted to fudge the answer. Hiding this information is a surefire way to have your policy invalidated just when you need it most, leaving you to face a massive repair bill all on your own.

Are All Cracks a Sign of Subsidence?

Thankfully, no. Your home is always moving in tiny ways. Minor, hairline cracks are often just the house settling naturally or reacting to seasonal temperature changes (known as thermal movement).

Subsidence cracks look and feel different. They tend to be diagonal , often wider at the top than the bottom and they usually appear quite suddenly around weak points like doors and windows.

For an insurer, telling these two types of cracks apart is the heart of the problem. Without solid, verifiable proof of when a crack appeared and how it has changed, the whole claims process can grind to a halt. This back-and-forth is what makes claims so slow, stressful and ultimately, more expensive for everyone.

How Does Insurance Fraud Affect Me?

It might seem like a victimless crime but claiming for old damage or exaggerating the severity of new cracks hits everyone in the pocket.

Every fraudulent payout drives up the operational costs for insurance companies. They do not just absorb that loss—they pass it on to all of us through higher annual premiums. In the end, we all pay the price.

Navigating the evidence for a subsidence claim is often the most frustrating part of the entire experience. Proova gives you a simple, powerful way to create a verifiable, time-stamped record of your property. By establishing a clear baseline before a problem occurs, you can speed up genuine claims and provide the solid proof insurers need. It is about creating a fairer, faster system for everyone.

Find out more at https://www.proova.com.