A Clear Guide to Insurance for Window Cleaning

Staring up at a multi-storey building, tools in hand, the risks of window cleaning are crystal clear. This is not just about getting panes to sparkle; it is about protecting yourself, your clients and the business you have worked so hard to build from the unexpected.

This guide will explain why the right insurance for window cleaning is not just a piece of paper—it is the very foundation of a professional, trustworthy operation.

Why Proper Insurance Is Non-Negotiable for Window Cleaners

Think of comprehensive cover as more than just a safety net. It is a powerful tool for building client trust and proving your professionalism from the moment you quote a job.

For businesses providing essential services like professional window cleaning operations , having robust insurance is not merely an option—it is a fundamental requirement. Without it, a single accident, like a dropped tool or a slip, could lead to devastating financial consequences, putting everything you have built at risk.

Unfortunately, the industry faces a growing challenge that hits every honest tradesperson right where it hurts. Insurance fraud, from exaggerated claims to outright deception, is a serious issue. When fraudulent claims are paid out, insurers are forced to raise premiums for everyone. This dishonest activity drives up the cost of essential cover for all of us and damages the industry's reputation.

This makes legitimate cover more expensive and wears away the trust between clients, cleaners and insurance providers. You can get a deeper understanding of the economic impact of insurance fraud and see how it harms responsible businesses like yours.

This ripple effect means that dishonest claims do not just affect one person; they drive up operational costs for the entire industry. This makes proving the legitimacy of any genuine claim you might have even more critical.

So, let's get you prepared. This guide will unpack:

- The essential policies every single window cleaner needs.

- The real-world dangers of being underinsured.

- How to use your insurance to win more business and stand out from less reputable outfits.

Right, let's get into the essentials. Navigating the world of insurance can feel like you are trying to learn a new language but for your window cleaning business, it really boils down to a few core protections.

It is best not to think of these policies as just another expense. See them as essential tools in your kit, the ones that shield your livelihood from the everyday and sometimes unexpected risks of the job. Each policy has a specific job to do, protecting you from different kinds of costly mishaps.

Your Fundamental Cover: Public Liability Insurance

The absolute cornerstone of your insurance setup is Public Liability Insurance . This is your first line of defence if an accident connected to your work affects a member of the public or their property.

Picture this: your squeegee slips from your hand and shatters a conservatory window pane below. Or maybe a passer-by trips over the hose from your water-fed pole system left on the pavement. Without this cover, you would be personally on the hook for the repair bills or compensation claims, which could easily spiral into thousands of pounds.

Protecting Your Team and Your Gear

If you employ anyone—even on a part-time or temporary basis— Employers’ Liability Insurance is not just a good idea; it is a legal must-have in the UK. The risks in window cleaning are real and this policy protects your business if an employee gets injured or becomes ill because of the work they do for you.

For any business with employees, UK law mandates you have at least £5 million of cover . While sole traders flying solo are not legally required to have it, most commercial clients will not even consider hiring you without proof of public liability insurance. To get the full picture, you can find out more about the right window cleaning insurance and its legal requirements.

Beyond these two mainstays, a couple of other policies offer vital protection depending on your setup.

- Personal Accident Insurance: This one is especially crucial for sole traders. If you get injured and cannot work, it provides a financial safety net to cover your lost income while you recover.

- Tools and Equipment Insurance: Let's face it, your gear is your business. This policy covers the cost of replacing your poles, squeegees and other equipment if they are stolen or damaged.

Think about it: your professional-grade water-fed pole system is a serious investment. A single theft from your van could put a massive dent in your operations and your bank account, leaving you unable to finish jobs. Tools insurance makes sure that does not happen.

Each of these policies works together to form a solid shield. Public liability has your back against third-party claims, while employers' liability handles your legal duty to your team. By adding personal accident and tools cover, you are making sure that both you and your essential kit are properly safeguarded. That is what turns a basic policy into a complete protective package.

The Hidden Costs of Cutting Corners on Your Cover

Choosing inadequate insurance for your window cleaning business is a bit like building a house on shaky ground. It might save you a few quid upfront and look perfectly fine from the street but it is guaranteed to crumble the moment any real pressure is applied. The true cost of that gamble only hits home when an accident happens and a claim lands on your doormat.

Let’s paint a picture. You are working on a residential job and your ladder slips. It crashes through a large, expensive window, taking a chunk out of the ornate stone frame on its way down. The homeowner, understandably, is furious and immediately kicks off the claims process. They will be taking photos of the damage from every conceivable angle and probably getting statements from neighbours who saw it happen.

The Financial Downward Spiral

For an uninsured or underinsured business, this is where the nightmare really begins. A legitimate claim, backed up with clear, provable evidence, can quickly escalate from a simple request for repair costs to a formal legal demand. Without an insurer to step in and manage the process, you are left to face the music all on your own.

Suddenly, that one slip could lead to:

- Compensation Payouts: The cost to replace a bespoke window and carry out specialist stonework repairs could easily spiral into thousands of pounds.

- Legal Fees: If the client gets solicitors involved, your legal defence costs will start racking up immediately, whether you are in the right or not.

- Reputational Damage: Bad news travels fast. An unresolved claim can poison the well, destroying the trust you have worked so hard to build with other clients in the area.

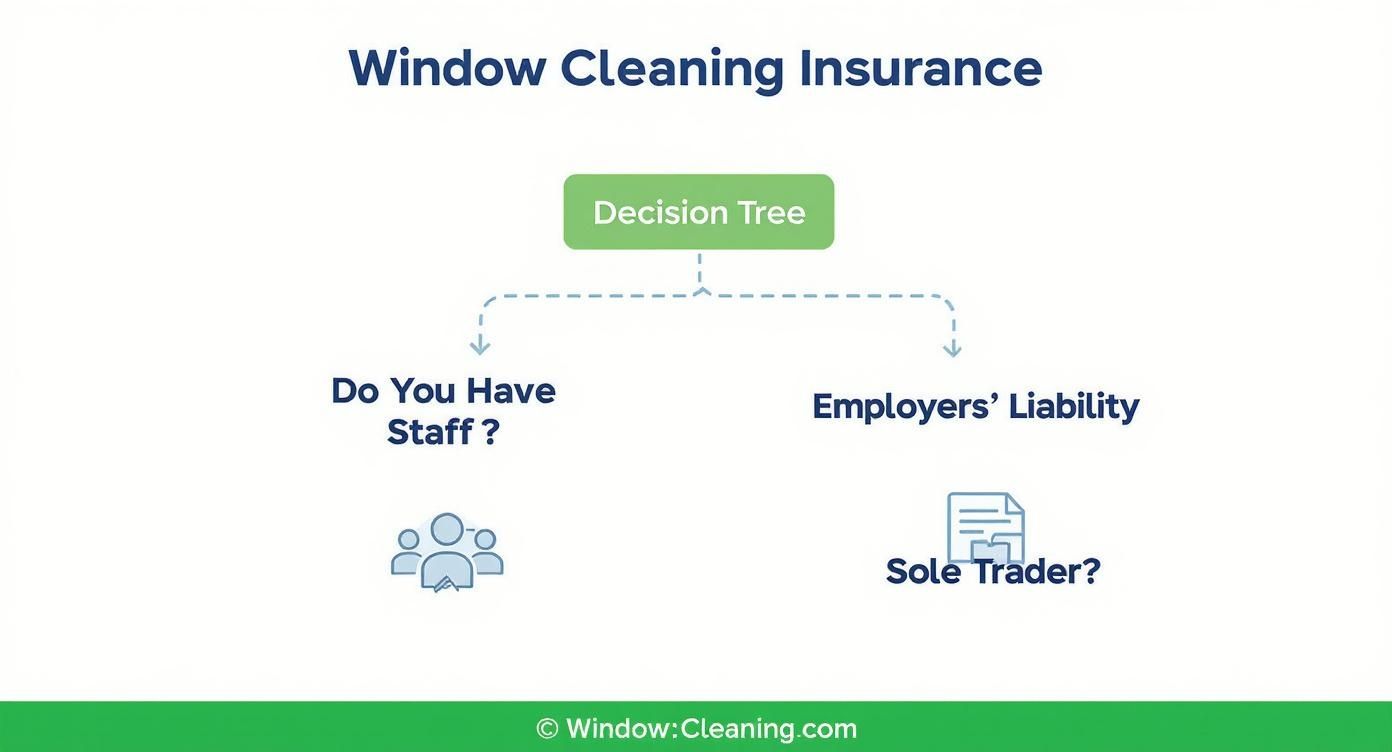

This infographic breaks down the decision-making process for figuring out what cover you absolutely need.

As the flowchart shows, the first critical question is whether you have staff. If the answer is yes, you are immediately pointed towards Employers' Liability cover – it is not a choice, it is the law.

At the end of the day, it all comes down to provability . A claim's strength is in the evidence behind it. If a client can prove your work caused the damage, that financial liability lands squarely on your shoulders. A single, well-documented claim has the power to bankrupt a small business overnight.

Ultimately, skimping on insurance is a false economy. The potential for financial ruin massively outweighs any short-term savings on your premiums. While insurers have systems to handle these situations, it is also smart to understand why your insurance company might refuse to pay a claim to make sure you are properly protected.

How Insurance Fraud Harms the Entire Industry

It is easy to think of insurance fraud as a victimless crime, something that only hits a massive, faceless company. The reality is quite different. It is a costly problem that quietly hikes up the price of doing business for every honest tradesperson in the window cleaning industry. When someone makes a fraudulent claim, it kicks off a ripple effect that ultimately hurts us all.

Insurers have to pay out on claims that are not legitimate and they do not just absorb that cost. They recoup their losses by pushing up premiums for everyone. This means your annual bill for essential insurance for window cleaning gets more expensive, hitting your bottom line directly.

What Does Fraud Look Like in Practice?

Fraud is not always some grand, complicated scheme pulled from a film. More often than not, it is a series of seemingly small dishonest acts that add up.

Here are a few common examples you might see:

- Exaggerating a Genuine Claim: A ladder slips and puts a minor scratch on a windowsill but the claim submitted is for a full, top-of-the-line window replacement.

- Lying to Get a Cheaper Premium: A cleaner says they only work on ground-floor bungalows to get a lower price when in fact they are regularly up ladders on multi-storey houses.

- Staging an 'Accident': Deliberately causing a bit of damage to a client’s property to then claim for an issue that was already there.

These actions might seem isolated but they poison the well for everyone. Insurers naturally become more sceptical of all claims, which can mean longer waits and a lot more hassle proving your case, even when it is completely legitimate. This is why technology is now crucial for fighting fraud before it happens with verified evidence , making solid, provable evidence more important than ever.

The real problem is that every false payout gets added to a big pot of losses that insurers have to cover. That financial burden is then spread across all policyholders as higher annual premiums.

Ultimately, this behaviour damages the reputation of our entire trade. It makes it tougher for hardworking, honest window cleaners to get affordable, comprehensive cover. More than that, it chips away at the trust that is absolutely essential for building a successful, respected business. Keeping things honest is a responsibility we all share.

Why Economic Pressures Make Insurance More Important Than Ever

When the economy gets tight, every business owner starts looking for ways to trim the fat. It is a natural survival instinct. With costs for everything on the rise, it is all too easy to eye up your insurance premium as a potential saving. But let me be blunt: that is a dangerous mistake.

In fact, when times are tough and your business has less of a financial cushion to fall back on, solid insurance becomes your most critical asset. It is the one thing standing between a minor hiccup and a full-blown catastrophe that could shut you down for good. Think of it less as an expense and more as a strategic investment in keeping your business alive and kicking.

Navigating Growth and Rising Costs

The window cleaning world is definitely growing. In the UK, the industry pulls in around £467 million in revenue and has been expanding at a rate of 2.1% each year for the last five years. You can get a deeper look into the UK window cleaning services industry and its economic landscape to see the full picture.

But here is the catch: this growth is happening against a backdrop of serious pressure from rising wages, especially with the National Living Wage climbing higher.

This economic squeeze makes every single financial decision count. While the industry as a whole is expanding, individual businesses are feeling the pinch, which makes them far more vulnerable if something goes wrong.

A single uninsured claim for property damage or personal injury could wipe out months of hard-earned profit, if not the entire business. When margins are tight, you simply cannot afford to self-insure against a major incident.

Cutting corners on your insurance might save you a few quid today but it exposes your entire operation to catastrophic risk tomorrow. Proper cover ensures that one slip-up does not undo all your hard work, especially when financial pressures are already mounting and every penny is vital for stability and future growth.

Choosing the Right Policy to Prove Your Professionalism

Getting the right insurance for your window cleaning business is so much more than a box-ticking exercise. Think of it as a clear statement about your standards and how seriously you take your work. When you are looking at policies, it is easy to get fixated on the price but that is a mistake. You need to dig a little deeper.

Look at the actual level of cover, figure out the excess you would have to pay on a claim and most importantly, check the insurer's reputation. Will they actually be there for you when it matters most?

And be completely honest when you are getting a quote. The work you do—whether it is residential, commercial or involves tasks like working at height—massively changes your risk profile and, in turn, your premium. Trying to save a few pounds by downplaying what you do could completely void your policy if you ever need to claim, leaving you to foot the entire bill yourself.

Turn Your Insurance into a Marketing Asset

Once you have got that solid cover in place, do not keep it a secret. Use it.

Advertising that you are ‘Fully Insured’ is not just empty jargon; it is a powerful signal of professionalism that instantly puts potential clients at ease. This simple move builds trust right from the start, helps you land bigger contracts and sets you leagues apart from the uninsured operators who cut corners and take massive risks.

Your insurance certificate is not just a piece of paper. It is a tangible business asset. It proves you take your responsibilities seriously, protecting both your clients and your own livelihood against the unexpected.

Showcasing your professionalism goes beyond just insurance; it is about embracing comprehensive risk management, which is a core part of many modernization strategies for SMBs. It shows your business is built to last.

In England alone, there are roughly 60,420 cleaning businesses out there. It is a crowded market where trust is everything. With 61% of people feeling reassured about safety when they see cleaning staff, broadcasting your insured status taps directly into that need for confidence. It is simple, effective and provable evidence that you are a professional.

Your Questions Answered

Let's clear up some of the most common questions window cleaners have about getting the right insurance.

Do I Still Need Insurance If I Only Clean Ground Floor Windows?

Yes, absolutely. Even if you are keeping your feet firmly on the ground, public liability insurance is a must-have. Accidents can happen anywhere, at any time.

You could accidentally scratch an ornate window frame, crack a paving slab with a dropped pole or someone could trip over your water hose. The risks might feel smaller but they are never zero and a claim for property damage or personal injury can still be incredibly costly.

What’s the Minimum Public Liability Cover I Should Get?

While a basic £1 million policy might seem enough to get started, it is often not sufficient for commercial work. Many businesses and almost all local authorities will insist on a minimum of £5 million of cover before you can even quote for a job.

Always think about the kind of work you want to attract. If you are aiming for commercial contracts, higher cover is not just a good idea—it is a requirement to even get in the door.

A common mistake is thinking a basic policy will cover all bases. If you do not meet a client's minimum insurance requirement, you will automatically lose the work to a competitor who has the right cover in place.

How Can I Lower My Insurance Premium?

There are a few practical ways to keep your insurance costs down. Over time, building up a claims-free record is one of the best ways to prove you are a low-risk professional, which insurers love to see.

Taking accredited health and safety courses also demonstrates your commitment to working safely. It is also vital to be completely honest and accurate about the type of work you do—do not pay for cover you simply do not need. Finally, always get quotes from specialist trade insurers who actually understand the window cleaning industry and its specific risks.

At Proova , we help you prepare for the unexpected. Our platform simplifies the process of documenting your valuable equipment and assets before anything happens. By creating a verifiable record of ownership and condition, we make any future claims faster and far more straightforward. Protect your business with clarity by visiting https://www.proova.com to learn more.