Winning Your LV Insurance Car Claims

Making an LV insurance car claim can feel like a mountain to climb, especially when you are still reeling from the stress of an accident. It all boils down to reporting the incident quickly, giving them clear, undeniable evidence and then working with the claims handlers to get a fair settlement for repairs or loss.

Once you understand the key stages, the whole journey from that first phone call to the final resolution becomes much less intimidating.

Your Guide to LV Insurance Car Claims

After a road incident, the best thing you can do is keep a clear head and take a methodical approach. I have seen it time and time again: the quality of the information you provide right at the start has a massive impact on how quickly and successfully your claim gets sorted. It is not just about telling them what happened but proving it with solid facts.

There is a good reason the process is so thorough: it protects all policyholders from fraud. Insurance fraud is not a victimless crime. From someone exaggerating the damage to their car to organised 'crash for cash' schemes, these fraudulent claims cost the industry a fortune. Those costs inevitably get passed on to honest customers like you and me through higher premiums.

The Standard Claims Journey

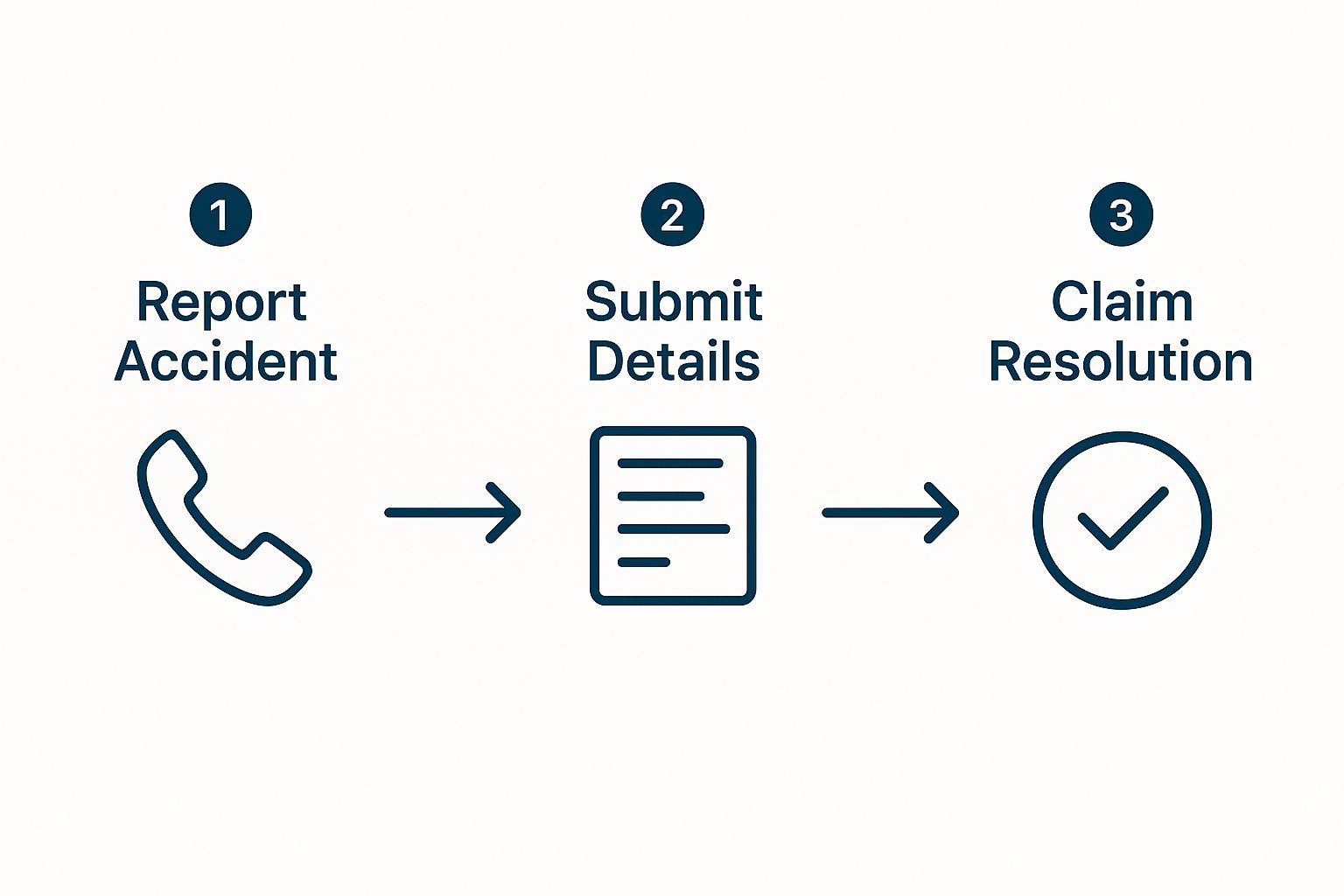

When you kick off a claim with LV, you are setting a well-defined process in motion. This infographic gives you a bird's-eye view of the typical flow, from reporting the accident right through to getting it resolved.

As you can see, a successful outcome really depends on a clear sequence of actions. It all starts with you reporting it immediately and submitting every last detail.

Every photo, every note and every witness statement you provide helps LV verify that your claim is legitimate. This ensures that any payout is fair and completely justified. This rigour is what keeps the whole system equitable and helps keep insurance affordable for everyone.

By providing clear, provable details, you not only build a much stronger case for yourself but also help the industry in its fight against costly insurance fraud. Your diligence helps ensure that premiums stay as fair as possible for all drivers.

To get a head start and make sense of the complex claims process, it can be helpful to explore some of the innovative support tools out there. For instance, you might get some quick answers from an AI-powered insurance guide , which can help clarify general questions and what is required. A little preparation goes a long way in making sure your claim is handled efficiently from the very beginning.

Building an Undeniable Case for Your Claim

When you need to make a claim with LV, the strength of your case boils down to one thing: the quality of the evidence you gather right after the incident. A detailed, provable record is your single best tool for a smooth process and a fair outcome. It is not just about proving what happened; it is about creating a factual account that shuts down disputes before they can even start.

Every piece of solid evidence you collect does two jobs. First, it validates your claim. Second, it helps insurers like LV weed out the fraudulent ones. This diligence matters because fraudulent claims cost the UK insurance industry billions and that cost eventually gets passed down to every honest driver through higher premiums.

Capturing Crucial Photographic Evidence

Your smartphone is your most powerful tool at the scene. Do not just get a few blurry close-ups of a dent; you need to capture the entire context of what happened.

- Go Wide: Take photos of the positions of all vehicles from several different angles. Make sure you include nearby landmarks, road signs and any traffic lights in the frame.

- Check the Ground: Snap pictures of the road conditions. Was it wet? Were there potholes? Were the road markings faded or obscured? Anything that might have played a part is worth documenting.

- Get Specific: Now you can move in for the detailed shots. Photograph the damage to all vehicles involved, not just your own. And make sure you get a clear, readable photo of every number plate.

This collection of images tells a story that words alone simply cannot. Today’s technology can even add another layer of undeniable proof; you can read more about how geo-location data strengthens insurance claims and adds serious credibility to your report.

Documenting the Incident Beyond Photos

While photos are vital, they are only part of the story. A written record and other proof points are just as important for building a rock-solid case for your LV insurance car claim.

To make sure you do not miss anything in the heat of the moment, here is a quick-reference checklist of the essential information you need to gather at the scene.

Your Essential Claim Evidence Checklist

| Evidence Type | Why It's Essential | Expert Tip |

|---|---|---|

| Written Notes | Your memory fades fast. A detailed account written at the scene is a powerful reference for your claims handler. | Note the time, weather and traffic flow. Write down exactly what was said between you and the other driver. |

| Witness Details | An independent third-party account can be incredibly persuasive and helps settle liability disputes quickly. | Get the full name and a contact number for anyone who saw what happened. Do not just rely on them sticking around. |

| Dashcam Footage | This is often the single most decisive piece of evidence. It can end a "he said, she said" argument instantly. | Make sure you save the relevant clip immediately so it does not get overwritten. Download a copy as soon as you can. |

| Police Reference Number | If the police attend the scene, getting a reference number proves the incident was officially logged. | Ask the attending officer for the number before they leave. This is crucial if there are injuries or serious disputes. |

Having all this information organised and ready to go makes the entire process smoother and shows your claims handler that you are on top of things.

The minute you are safe, write down everything you remember. Details disappear surprisingly quickly, so a real-time account of the time, weather and exactly what was said is invaluable. This objective record becomes a critical reference point for everyone involved.

Dashcam footage can be the ultimate tie-breaker, often stopping liability disputes dead in their tracks. If you have one, save the footage right away. And if there were any independent witnesses, grab their names and contact details. A statement from a neutral party carries a lot of weight.

Presenting all this information clearly to the claims handler is the final piece of the puzzle. For some pointers on this crucial step, you can find expert tips on dealing with insurance adjusters that will help you state your case with confidence.

How Insurance Fraud Impacts Every Driver

When you are making a genuine car insurance claim with LV, the level of detail they ask for can sometimes feel a bit much. But there is a very good reason for their thorough checks. Insurance fraud is not a victimless crime; it is a massive problem that ends up hitting every honest driver in the pocket through higher premiums. The rigour is not about LV distrusting you—it is about protecting everyone from the fallout of criminal activity.

This is not just about someone slightly exaggerating a scratch. We are talking about organised ‘crash for cash’ schemes where criminals intentionally cause accidents just to file bogus injury claims. It also covers people who dishonestly inflate the real extent of damage to their vehicle, hoping for a bigger payout. Every single false claim paid out adds to a huge pot of losses that insurers have to cover and that cost is passed directly on to all of us in our annual premiums.

The Real Cost of a Fake Claim

The scale of this issue is staggering. In 2022 alone, the UK car insurance industry had to deal with around 42,500 fraudulent claims. That number gives you a sense of the constant pressure insurers are under to weed out the fakes from the genuine incidents.

This ongoing battle is exactly why providing clear, solid evidence for your own claim is so critical. It helps LV quickly separate legitimate cases from the fraudulent ones, which is good news for everyone.

For those who get caught trying to pull a fast one, the consequences are serious. They are not just risking a slapped wrist; they could face:

- Their insurance policy being cancelled immediately.

- Being added to the Insurance Fraud Register, which makes getting cover in the future incredibly difficult and expensive.

- A criminal record and in some cases even a prison sentence.

Every single fabricated or exaggerated claim contributes to what is now a multi-billion-pound problem for the industry. Ultimately, that collective cost is passed on to honest policyholders, making robust checks essential to keep pricing fair for everyone.

This all comes down to provability. Insurers do not just want a story; they need cold, hard facts backed up by evidence. Think photos, witness statements and dashcam footage. Find out more about what insurance fraud really costs the industry and you will see why they take it so seriously. By putting together a solid case from the start, you not only help get your own claim approved faster but also play your part in the wider fight against fraud.

Why Are My Premiums Going Up If I Haven't Claimed?

It is a fair question and one a lot of drivers ask. You drive carefully, you have not had an accident in years, yet your renewal price still creeps up. It can feel frustrating but the reality is that your individual driving record is only one part of a much bigger picture.

Wider industry trends, completely outside of your control, have a huge impact on what everyone pays.

One of the biggest culprits right now is the sheer cost of vehicle repairs. Cars today are essentially computers on wheels, packed with sophisticated sensors, cameras and advanced driver-assistance systems. While this tech makes our roads safer, it means even a minor prang can lead to an eye-watering repair bill. Fixing or recalibrating these systems requires specialist skills and expensive, manufacturer-specific parts.

Add in ongoing global supply chain headaches and rising labour costs at garages and you can see why the average repair bill has shot through the roof. When insurers have to pay out more for every single claim, it inevitably trickles down and affects overall premium costs for all of us.

The Numbers Behind the Price Rise

The financial knock-on effect for the insurance market is significant. Recent data from the Financial Conduct Authority paints a very clear picture of just how expensive claims have become.

It is a classic case of quality over quantity but not in a good way. Between 2019 and 2023 in the UK, the actual number of claims fell by 7% . But during that same period, the average cost to settle a single claim rocketed by a massive 37% – jumping from £2,410 to £3,293. You can dig into the full details in this motor insurance claims analysis on FCA.org.uk.

In short, insurers are paying out far more for each individual incident, even though people are claiming less often. This escalating expense has to be reflected in the premiums every policyholder pays.

This is exactly why having a smooth and efficient LV insurance car claims process is so important. When you do need their help, you want to know the support you receive truly reflects the modern and often high cost of getting your car safely back on the road.

Practical Tips for a Faster Claim Resolution

While some parts of the LV insurance claims process are out of your hands, you are not powerless. There are definitely things you can do to avoid frustrating delays and keep everything moving.

Taking these steps can really speed up the journey from that initial stressful report to the final settlement, putting you back in control.

Honestly, the single most effective thing you can do is report the incident to LV straight away. The sooner they know, the faster a claims handler can be assigned to your case and start looking into it. Leaving it for a few days can raise questions and just slows the whole machine down from the very beginning.

When it is time to send your evidence, think about making it as easy as possible for the handler to understand what happened. Organise your photos in the order things occurred, write a clear, concise statement and double-check that all your documents are easy to read. The easier you make their job, the quicker they can get your file processed.

Keeping the Momentum and Communication Flowing

It is a good idea to keep the lines of communication open with your LV claims handler. If they ask for more information, try to get it back to them as quickly as you can. You would be surprised how often a simple follow-up email can get your file moved to the top of their to-do list.

This kind of proactive approach is more important than ever right now. The UK motor insurance industry recently paid out a record-breaking £11.7 billion in claims, with vehicle repairs alone hitting £7.7 billion . These numbers give you a sense of the immense pressure insurers are under and why a well-managed, straightforward claim really stands out. You can read more about the state of motor insurance on rsmuk.com.

Choosing an LV-approved repairer can be a massive time-saver. These garages already have a working relationship and direct billing systems set up with LV, which cuts out a lot of the administrative back-and-forth that can cause maddening delays when using an independent garage.

Using verified, solid evidence is another key to avoiding hold-ups. Clear, undeniable proof helps brokers and insurers work faster because there is less need for them to launch lengthy investigations. It is interesting to see how Proova helps brokers speed up claim resolutions by focusing on this very principle.

And if you feel like your claim has stalled? Do not be afraid to politely ask your handler for a clear update on where things are and what the next steps look like.

Got Questions About Your LV Car Claim? Here Are Some Answers

Filing a car insurance claim with LV can feel a bit daunting, especially if you have never done it before. It is natural to have questions. We have pulled together answers to some of the most common queries we hear, focusing on what happens when things get complicated.

A bit of insight can go a long way in managing your expectations and navigating any bumps in the road.

What Should I Do If the Other Driver Disputes My Story?

This is exactly where your evidence becomes your best friend. If the other driver’s version of events does not match yours, the success of your claim will come down to the proof you gathered at the scene. It is as simple as that.

Your detailed notes, photos from multiple angles, dashcam footage and any independent witness details are what your LV claims handler will rely on. They will use this evidence to build a strong case on your behalf and challenge the other party’s story.

When a claim becomes a simple ‘he said, she said’ situation with nothing to back it up, things can grind to a halt. This often leads to a messy dispute and can even end in a ‘split liability’ settlement, where both drivers are found to be partially at fault.

How Do I Prove My Claim Is Genuine?

Honesty and consistency, backed up by solid documentation. That is all it takes. Insurers are very good at spotting claims that do not quite add up, whether it is a small exaggeration or a major inconsistency.

Just present a clear, factual account of what happened, making sure it aligns with all the evidence you have collected. Responding quickly to any requests from your LV claims handler and providing all the necessary paperwork shows you have nothing to hide. A straightforward, well-documented claim is always the fastest route to a smooth outcome.

Will Making a Claim Increase My Premium?

It is very likely, yes. Making a claim, especially if the incident was deemed your fault, will probably affect your premiums when it is time to renew. You can also expect to lose some or all of your No Claim Discount unless you have paid to protect it. From an insurer's perspective, a claim simply changes your risk profile.

But it is also important to remember this is not just about your individual claim. Wider industry trends, like the rising cost of car repairs and the huge financial impact of fraudulent claims, push up prices for everyone.

At Proova , we're focused on making the claims process more transparent and fair. Our platform helps you create a secure, undeniable record of your assets before anything happens, which can dramatically speed up settlements and prevent disputes when you need to make a claim.