Insurance Claims Process: A Clear, Practical UK Guide

When you file an insurance claim, you are putting your policy to the ultimate test. This is the moment of truth, the structured process you and your insurer follow to get you the compensation you are owed after a loss. For too many people, however, it becomes a frustrating battle of proof, delays and disputes.

The Hidden Struggle of Proving Your Insurance Claim

At its core, the insurance claims process hinges on a single, deceptively simple principle: you have to prove what you have lost. This one requirement is the source of immense friction for both policyholders and insurers, creating a system strained by foggy memories and the near-impossible task of accurate post-loss reporting.

Imagine your office burns down. Now, try to list every single item that was inside. Do not forget to add the purchase date, price and serial number for each one. And you have to do it all from memory. This is the monumental challenge facing individuals and businesses when disaster strikes. It is an almost impossible task that opens the door to honest mistakes and, unfortunately, opportunistic fraud.

The High Cost of Uncertainty and Insurance Fraud

This lack of verifiable proof creates a painful ripple effect. When a policyholder struggles to remember every lost asset, they might inadvertently inflate the claim by guessing at the details. This is often an honest mistake, but it can also be a form of opportunistic fraud. From an insurer's perspective, that uncertainty immediately raises red flags, triggering costly and time-consuming investigations. The financial impact of such fraud is significant and ultimately borne by all policyholders through increased premiums.

The fundamental problem is that a claim's validity is often determined after the event, not before. This reactive approach forces insurers to pour resources into verification, which drives up their operational costs and, ultimately, the premiums every customer has to pay.

This sets up an adversarial dynamic right from the start. Instead of a swift resolution, the process becomes a lengthy negotiation, often requiring expensive loss adjusters to sift through the wreckage and attempt to validate ownership and condition without any reliable pre-loss evidence.

A System Under Pressure

The financial scale of this challenge is enormous. In the UK, insurers pay out a staggering £22 million every single day in business insurance claims alone, highlighting the immense pressure on the system. This surge is made worse by economic pressures and environmental shifts, placing even greater strain on traditional verification methods. The cost of insurance fraud further burdens this system, making robust proof more critical than ever to protect the industry and its honest customers.

For claims managers, this translates directly into longer processing times and a heightened risk of fraudulent claims padded with embellished lists of lost items. If you want to dig deeper, you can learn more about the scale of business insurance claims and their impact on the industry.

This is the hidden struggle of the insurance claims process—a system fundamentally hampered by the difficulty of proving what you owned before it was gone and threatened by the pervasive cost of fraud.

Mapping Your Journey Through a Typical Claim

Navigating the insurance claims process can often feel like you have been handed a map to an unknown country. But once you understand the key landmarks, the whole journey becomes much clearer. At its core, the process is a structured conversation between you and your insurer, designed to verify your loss and agree on a fair payout. Knowing what is coming next turns a stressful situation into a manageable one.

It all kicks off the moment you notify your insurer about an incident. This is officially known as the First Notice of Loss (FNOL) and it is the starting gun for the entire claims lifecycle. From here, a series of well-defined steps are triggered. While the details might differ slightly between a home or business policy, the fundamental stages are remarkably consistent.

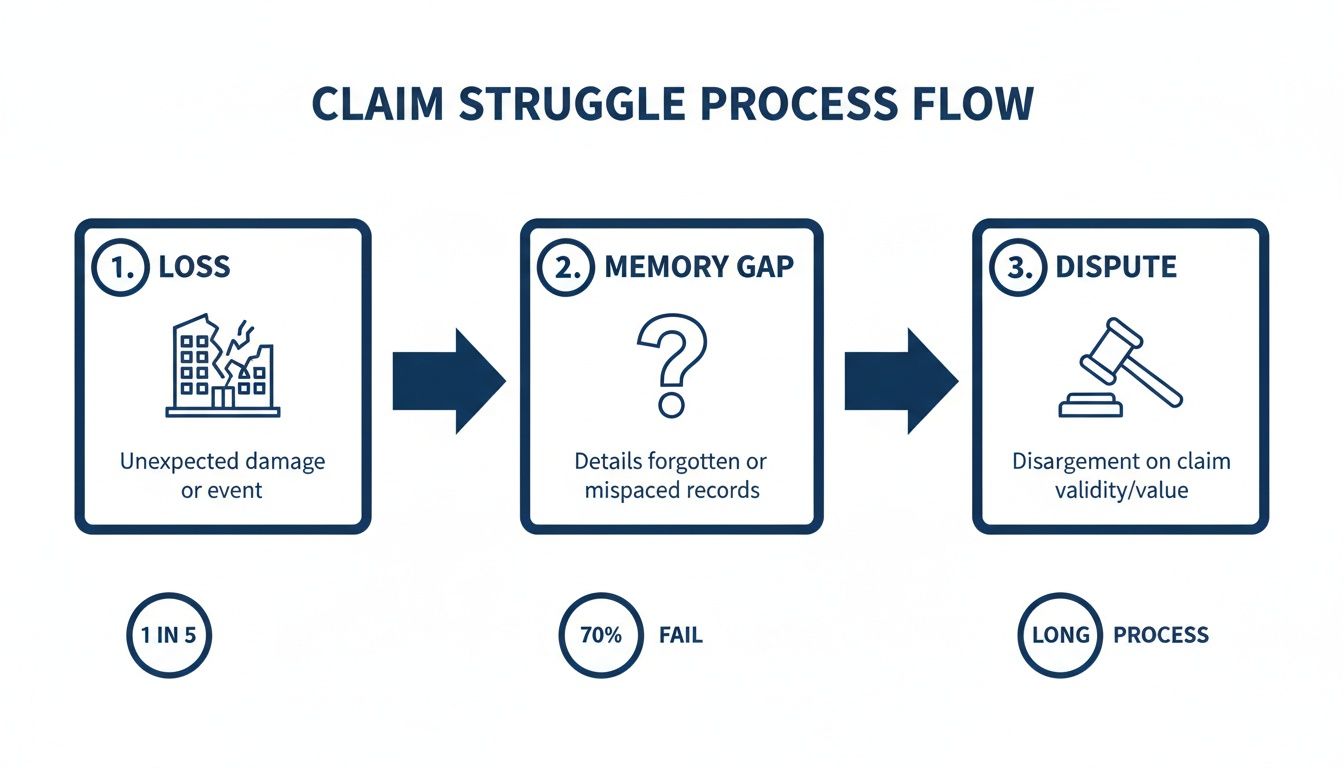

The infographic below shows just how quickly a claim can get complicated. It starts with the loss, gets tangled up in the struggle to remember details and can unfortunately end in a dispute.

This visual drives home a crucial point: the biggest headaches in the claims process pop up when you cannot easily prove what you owned before it was lost.

Stage 1: Notification and Validation

After you have submitted your FNOL, the insurer's first task is validation . This is not about doubting your word; it is a procedural checkpoint to confirm two basic things. First, was your policy active when the incident happened? Second, is the type of loss you are reporting actually covered by your policy?

Think of it as the gatekeeper checking your ticket at the entrance. Giving clear, accurate information at this point is vital. Vague or incomplete details are the number one reason for early delays, forcing the insurer to circle back for more information before they can move forward.

Stage 2: Investigation and Assessment

Once your claim is validated, things move into the investigation and assessment phase. This is where your insurer gets down to the nitty-gritty, digging into the specifics of your loss to figure out its full extent and value. How deep they dig depends entirely on the claim.

A straightforward claim for a stolen laptop might just need a police report and a receipt to get sorted. On the other hand, a major fire at a business premises will kick off a much more detailed investigation, almost always involving a loss adjuster.

A loss adjuster is an independent expert hired by the insurer to investigate the claim's circumstances. Their job is to assess the damage, figure out the cause and recommend a settlement amount based on the policy's terms.

It is at this stage that the "provability" problem really rears its head. Without records made beforehand, proving the existence and condition of every single lost item becomes a massive headache, often leading to drawn-out negotiations and arguments over value. You can find more detail in our comprehensive guide to master the home insurance claims process with our guide.

Stage 3: Settlement

The final stage is settlement . With the investigation and assessment complete, your insurer will present a formal offer to settle your claim. This figure is based on their findings and what is covered in your policy.

You have every right to review this offer with a fine-tooth comb. If you feel it is fair, you accept it and the insurer arranges payment. If you disagree with their valuation, you can start negotiations, bringing your own evidence to the table to back up your position. If you still cannot reach an agreement, the next step is typically a formal complaint, which can be taken to the Financial Ombudsman Service if needed.

Why a Lack of Proof Derails Claims and Inflates Costs

An insurance claim is only ever as solid as the evidence backing it up. When that proof is shaky or missing altogether, the whole process starts to crumble. It creates a domino effect of delays, arguments and spiralling costs that, sooner or later, affect every single policyholder.

This is the ‘provability problem’ in action. It is the friction at the very heart of why so many claims become adversarial and deeply frustrating.

For the policyholder, the challenge is immediate and intensely personal. Imagine trying to create a perfect inventory of everything you owned after a fire or flood has turned your life upside down. It is a near-impossible task. Receipts are often destroyed in the very incident you are claiming for, digital records might be inaccessible and memory is always clouded by stress.

This uncertainty is a breeding ground for problems. Someone might honestly forget certain items or have to guess their value, which an insurer could easily misinterpret as an attempt to inflate the loss. That unintentional overestimation immediately complicates the claim, shifting the dynamic from one of cooperation to suspicion and placing a greater burden on the system that we all pay for.

The Insurer's Dilemma and the Cost of Doubt

From the insurer's side of the desk, this lack of verifiable evidence forces a costly and time-consuming response. Without a clear, pre-loss record of what was owned and its condition, they have little choice but to investigate every detail from scratch. And that is where the operational costs really start to mount up.

To bridge the evidence gap, insurers often have to:

- Hire loss adjusters to visit the site, sift through the damage and try to piece together an inventory of what is gone.

- Conduct extensive interviews with the policyholder, painstakingly cross-referencing details and looking for inconsistencies.

- Request supplementary evidence , like old bank statements or family photos, which can be difficult and stressful for the claimant to find.

Every one of these steps adds time and expense to the claims process. This friction is not some deliberate tactic to avoid paying out; it is a necessary defence against uncertainty and the very real threat of insurance fraud.

The core issue is that proof is being established reactively, under the worst possible circumstances. When a claim relies on memory and post-loss investigation, the process is inherently inefficient, expensive and prone to conflict for everyone involved.

This inefficiency gets magnified during widespread events. When severe weather hits a region, thousands of claims pour in at once, completely overwhelming traditional verification methods. The sheer volume makes it impossible for adjusters to get to every case quickly and the lack of pre-existing proof creates a system-wide bottleneck.

How Widespread Events Overwhelm Traditional Proof

The financial impact of these events is staggering. For instance, UK property insurers paid out £1.6 billion in claims during the second quarter of 2023 alone. A huge chunk of that— £322 million —was for damage caused by storms and floods, showing just how easily environmental perils can cripple the standard verification model. You can dig into the full breakdown of these property claim figures on abi.org.uk.

When thousands of homes are affected at once, the weakness of a reactive, memory-based system is laid bare. The cost of investigating all these claims, on top of payouts for fraudulent or inflated ones, does not just vanish. It gets absorbed by the insurance industry and is eventually passed on to every customer through higher premiums.

Ultimately, the struggle for proof is a burden we all share. The time and money spent verifying legitimate claims after the fact—and weeding out the fraudulent ones—directly contribute to the price everyone pays for cover. This makes it painfully clear that finding a better way to establish proof before a loss ever happens is vital for a faster, fairer and more affordable insurance system for all.

The difference between establishing ownership after a disaster versus having it ready beforehand is night and day. A proactive approach transforms the entire claims dynamic.

Comparing Traditional vs Digital Proof of Ownership

| Aspect | Traditional Method (Post-Loss) | Digital Method (Pre-Loss e.g. Proova) |

|---|---|---|

| Timing | Evidence is gathered after the loss event, often under distress. | Ownership is verified and recorded before any incident occurs, when calm and organised. |

| Accuracy | Relies on memory, estimations and whatever documentation survives. Prone to errors and omissions. | Based on verifiable, time-stamped digital records. Highly accurate and complete. |

| Speed | Slow and manual. Requires lengthy investigation, interviews and site visits by adjusters. | Near-instant. The verified digital inventory can be accessed immediately, speeding up validation. |

| Conflict Potential | High. Disagreements over item existence, condition and value are common. | Low. The pre-agreed record acts as a single source of truth, minimising disputes. |

| Fraud Risk | Moderate to high. Gaps in evidence can be exploited to inflate or fabricate losses. | Very low. Immutable, verifiable records make it extremely difficult to submit a fraudulent claim. |

| Cost | Expensive. Incurs costs for loss adjusters, investigators and administrative overhead. | Low operational cost. A simple, automated process that saves significant backend expense. |

As the table shows, shifting from a reactive to a proactive model is not just an improvement; it is a fundamental change that tackles the root cause of delays, costs and conflict in the claims process. Using a tool like Proova to create a pre-loss digital inventory benefits everyone involved.

How Insurance Fraud Hits Every Honest Policyholder

It is tempting to think of insurance fraud as a victimless crime—a small fib told to a massive, faceless company. But that could not be further from the truth. The reality is that every bogus claim, from a slightly exaggerated loss to a sophisticated criminal plot, puts a strain on the entire system. That financial weight gets passed down to one group: honest policyholders, in the form of higher premiums for everyone.

The issue is not just about big, dramatic scams. It often starts small, blurring the lines of what is acceptable. When someone with a genuine claim decides to add a few extra items that were not really lost or inflates the value of a damaged TV, that is opportunistic fraud . It might feel like a minor tweak, but when thousands of people do it, the cumulative cost is staggering.

Then you have the more deliberate, organised schemes. These can be anything from staged car accidents to professional fraudsters who know exactly how to exploit loopholes. One of the trickiest for insurers to catch is ‘after-the-event’ fraud, where someone buys a new policy to cover something that has already been damaged , then waits a bit before filing the claim.

The Real-World Cost of Motor Insurance Fraud

The motor insurance sector gives us a crystal-clear—and alarming—picture of how these costs spiral out of control. The claims process is under enormous pressure. Recent data reveals that average motor insurance claim costs have shot up by a massive 37% , climbing from £2,410 in 2019 to £3,293 in 2023. This is not just random inflation; it is a perfect storm of soaring repair costs, complex vehicle technology and creaking supply chains. You can read the full analysis of motor insurance claims from the FCA to see just how intense these pressures are.

For insurers and loss adjusters, this climate is a minefield. Without solid proof of a vehicle's condition before an accident—like its mileage, any modifications or general wear and tear—verification becomes a nightmare. This gap is an open invitation for fraud, allowing for embellished damage reports or sneaky add-ons that are nearly impossible to disprove after the incident.

Every single unproven claim has to be investigated. The costs for adjusters, investigators and admin time do not just vanish. They get baked into next year's premiums for every customer.

What this means is that your premium is not just covering your own risk. It is also paying for the fraudulent claims slipped through by others. It creates a broken system where honest customers end up subsidising the dishonest ones. You can learn more about what insurance fraud really costs the industry in our detailed breakdown.

Red Flags That Trigger Deeper Investigations

To protect themselves and their honest customers, insurers have become skilled at spotting the warning signs of a suspicious claim. When these red flags pop up, the standard claims process grinds to a halt and a much more thorough investigation kicks off, creating serious delays for everyone involved.

Common triggers include:

- Vague or inconsistent details about what happened or what is being claimed.

- A history of frequent claims , especially if they are for similar types of losses.

- Pushing for a quick cash settlement without allowing for a proper assessment.

- Claims filed right after a policy starts or just before it is about to expire.

- A complete lack of supporting proof , like receipts, photos or original packaging.

These investigations are non-negotiable for keeping the insurance pool fair but they add friction and cost to the entire process. The single best way to avoid suspicion and get a claim settled quickly is to remove every shred of doubt right from the start.

How Verifiable Evidence Stops Fraud in its Tracks

The ultimate defence against both opportunistic and organised fraud is clear, undeniable proof. When a policyholder can show a verifiable, time-stamped record of their assets and their condition from before anything went wrong, the whole dynamic of the claims process shifts.

There is simply no room left to exaggerate or fabricate. The insurer can validate the claim against a trusted, pre-agreed record, which means there is no need for a costly, time-consuming deep dive. This proactive approach does not just catch fraud; it deters people from even trying it in the first place.

By building the policy on a foundation of provable facts, the system becomes fairer and far more efficient. Legitimate claims get paid faster, fraudulent ones are stopped cold and the savings are eventually passed back to every honest customer through more stable and affordable premiums.

Using Technology to Digitise Trust and Speed Up Payouts

For too long, the insurance claims process has been bogged down by inefficiency and the constant risk of fraud. But what if we could flip the entire model on its head? Instead of starting from a place of suspicion, technology now allows us to build a foundation of trust right from the start, completely changing the experience for everyone involved.

The real shift happens when we move the burden of proof from a stressful, post-loss scramble to a simple, proactive task. Think about it: instead of trying to recall every single item you owned after a fire or theft, you could create an authenticated, time-stamped digital inventory of your assets the moment you take out a policy.

This one change has a massive ripple effect. For customers, it means faster, fairer settlements without the nightmare of digging up ancient receipts or filling out endless forms. For insurers, it is a game-changer, dramatically cutting down on fraud and the high costs of investigation.

A New Workflow Built on Trust

When proof is established before a loss ever occurs, the entire claims journey becomes smoother. The old, adversarial dynamic—where every detail is questioned—is replaced by a cooperative process built on a shared, verifiable record of fact.

With a claim backed by a pre-existing digital inventory, the workflow is beautifully straightforward:

- Instant Notification: The policyholder reports the loss and immediately attaches their verified digital record.

- Swift Validation: The insurer cross-references the claim against the time-stamped evidence, confirming ownership and condition in minutes, not weeks.

- Rapid Assessment: With no need for a lengthy investigation, the value of the lost items can be assessed quickly based on the agreed-upon record.

- Fast Settlement: The claim is approved and the payment is processed, often in a fraction of the time it would take using traditional methods.

This proactive approach is a world away from the tangled, confrontational process of the past. It removes the friction points where delays and disputes usually pop up, ensuring legitimate claims get paid quickly and without any unnecessary hassle.

The Financial Benefits of Digital Proof

The upside of a digitally-backed claims process goes well beyond speed and happy customers. It has a direct, significant impact on the financial health of the insurance industry, which ultimately benefits all policyholders.

A digitally verified inventory acts as a powerful deterrent to fraud. It closes the door on opportunistic exaggeration and makes it nearly impossible to claim for items that were never owned or to misrepresent their condition before the loss.

This drop in fraud leads to huge cost savings. Insurers can minimise their reliance on expensive loss adjusters and drawn-out investigations, which are often needed simply because a claim lacks clear evidence. For example, research shows AI-driven automation can slash operational costs by 30-40% . Those are savings that can be passed on to customers through more stable premiums. You can explore the key features of digital claims technology to see how platforms are enabling this shift.

On top of that, having a crystal-clear picture of the assets being insured allows for much sharper underwriting. Insurers can price risk more accurately, rewarding diligent customers who maintain a verified inventory with more competitive rates. This fosters a fairer system where premiums reflect actual risk, rather than being inflated to cover the industry-wide costs of fraud and inefficiency. By embracing technology, we can build a more transparent, efficient and trustworthy claims process for everyone.

The Future of Claims Is Proactive and Evidence-Based

The future of insurance claims hinges on a simple idea: preventing disputes before they even have a chance to start. For far too long, the industry has been stuck in a reactive cycle, scrambling to piece together the facts after a loss has already happened. This old way of doing things is slow, expensive and often puts insurers and their customers at odds.

But a fundamental shift is underway, moving us toward a model that is built on proactive, evidence-based principles.

Digital verification tools are leading this charge. They are not just changing how claims are handled; they are rewriting the rules for how policies are underwritten in the first place. By creating a clear, verifiable picture of an asset from day one, insurers gain a level of clarity that was previously impossible.

This approach strengthens the very core of the insurance system. It builds a foundation of trust between the insurer and the policyholder, turning a potentially tense process into a straightforward validation of pre-agreed facts.

From Claims Tool to Underwriting Intelligence

The impact of pre-loss verification reaches far beyond the claims department. It creates a powerful new stream of data that makes the underwriting process smarter, fairer and far more efficient.

Historically, assessing the risk of insuring a high-value item or a complex business asset meant sending someone out for an expensive, time-consuming survey. Digital verification offers a much more practical and cost-effective alternative.

- Accurate Risk Pricing: When insurers can see exactly what they are covering and its condition, they can calculate risk with greater precision. The result is fairer premiums for everyone.

- Reduced Operational Costs: The need for physical, on-site surveys is drastically reduced, saving significant time and money.

- Competitive Premiums: Policyholders who take the time to properly document their assets can be rewarded with better rates, creating a powerful incentive for good practice.

This transition ensures the billions paid out in claims each year go to legitimate losses, protecting the entire system for honest customers. As we look ahead, developments like future voice technology promise to streamline things even further and enhance digital trust.

A Fairer System for Everyone

Ultimately, this shift towards transparent, evidence-based insurance benefits everybody involved. It moves the focus from post-loss investigation to pre-loss preparation, building a solid and trustworthy foundation for every single policy.

For policyholders, it means faster payouts and less stress. For insurers, it means lower fraud rates and more accurate underwriting. For the industry, it means a more resilient system that protects honest customers from the costs of fraud and inefficiency.

By embracing digital verification, we are not just speeding up claims. We are building a fairer, more transparent and more efficient insurance ecosystem where the focus remains where it should be: on recovery, not disputes over proof.

Frequently Asked Questions About the Claims Process

The world of insurance claims can feel a bit like a maze. Let us clear up a few of the most common questions we hear from UK policyholders to help you navigate it with confidence.

How Long Does an Insurance Claim Typically Take in the UK?

This is the big question and the honest answer is: it varies hugely. A straightforward, well-documented claim for a lost item might be wrapped up in a couple of weeks. But when things get complicated, it can stretch to months.

Claims involving major losses, disputes over who is at fault or suspicions of fraud are the ones that really face the longest delays. The single biggest hold-up is nearly always the time it takes to verify what was lost and what it was worth. This is where having your proof ready ahead of time makes a world of difference. Using a digital inventory tool at the start of your policy provides instant, verifiable proof of ownership and condition, slashing the time it takes to get things sorted.

What Is the Most Common Reason for a Claim Being Rejected?

Claims usually hit a wall for one of three reasons: policy exclusions, non-disclosure or not enough proof. An exclusion simply means the specific event or item is not covered by your policy. Non-disclosure is when crucial information was left out or was inaccurate when you first took out the policy.

But the real stumbling block for many is the ‘provability’ issue. If you cannot prove you owned something, or cannot show what condition it was in before it was damaged or stolen, an insurer might challenge its value or even reject that part of the claim entirely.

Without clear evidence, the insurer's hands are often tied. They have a duty to all their policyholders to ensure payouts are for legitimate, proven losses. This makes your evidence the most powerful tool you have.

Can I Dispute a Settlement Figure from My Insurer?

Yes, absolutely. If you believe the amount your insurer has offered is too low, you have every right to challenge it. The first step is always to negotiate directly with your insurer. You will need to back up your position with your own evidence—things like original receipts, independent valuations or clear pre-loss photographs are perfect.

If you cannot reach an agreement, you can make a formal complaint to the insurer. If their final response still is not satisfactory, your next move is to take your case to the Financial Ombudsman Service. They are an independent body that steps in to resolve disputes like these for consumers and their decision is binding on the insurer.

Taking a proactive approach to proving what you own is the secret to a faster, fairer claims experience. With Proova , you can create a verifiable digital record of your assets before a loss ever happens, eliminating doubt and speeding up your payout. Visit https://www.proova.com to secure your assets today.