UK Commercial Automobile Liability Insurance Explained

Think of commercial automobile liability insurance as your business's bodyguard on the road. While your personal car insurance looks after your private journeys, this cover is built specifically for vehicles used for work. It’s designed to shield your company from the potentially crippling costs if one of your vehicles injures someone or damages their property.

Understanding Your Business Bodyguard on the Road

A standard personal car insurance policy just isn't fit for purpose when a vehicle is part of your business operations. Insurers see business use as a higher risk and for good reason. It often means more miles on the clock, driving in trickier conditions and sometimes several different people behind the wheel. If you try to rely on personal cover for commercial use you could find your policy is void just when you need it most.

This is where commercial automobile liability insurance steps in, acting as a vital shield for your business assets. A single accident can spark legal action and compensation demands that far exceed what most businesses could ever afford to pay out of pocket, threatening your entire financial stability.

The Core Components of Cover

At its heart, this insurance stands on two fundamental pillars of protection. Each one tackles a different type of third-party loss that your business could be held legally responsible for after an incident. Getting your head around these two is the first step to seeing the real value of the cover.

- Bodily Injury Liability: This is the part that handles costs when other people are injured. It can cover everything from their medical bills and lost wages to compensation for pain and suffering.

- Property Damage Liability: This component pays to repair or replace someone else's property that your vehicle has damaged. Most of the time this means the other driver's car but it could just as easily be a fence, a wall or even a building.

Together, these two elements are the foundation of your financial defence. Without them, your business is left completely exposed to the full, uncapped cost of legal fees and settlement awards, which can easily rocket into the tens or even hundreds of thousands of pounds from just one accident.

The Problem of Proof and Rising Fraud

One of the biggest headaches after any accident is simply figuring out what happened. Conflicting stories are common and proving the facts is essential for a fair outcome. For any business owner, this issue of provability is absolutely critical.

Unfortunately, this uncertainty also opens the door to dishonesty. Insurance fraud is a growing problem, from people exaggerating their injuries to criminals staging deliberate 'crash for cash' incidents. These are not victimless crimes; they play a huge part in driving up the cost of claims that insurers have to pay out.

Ultimately, insurers pass those increased costs on to all their customers through higher premiums. So, having solid commercial automobile liability insurance is not just about protecting your own company. It is about being part of a system that needs honesty and verifiable evidence to keep costs fair for everyone. This guide will explore how you can protect your business while helping to create a more transparent claims environment.

Why This Insurance Is a Business Necessity

Operating a company vehicle without the right insurance is not just a poor business decision—it’s a serious legal offence here in the UK. The law is crystal clear on this, making commercial automobile liability insurance the absolute baseline for any business with vehicles on the road. Overlooking this can bring immediate and severe consequences that could easily disrupt your operations and tarnish your reputation.

The penalties for non-compliance are hefty for a reason. If you’re caught, your business could face an unlimited fine, while your driver gets hit with six to eight penalty points on their licence. For more serious incidents or repeat offences, the police even have the power to seize and destroy the vehicle.

But as tough as these legal hurdles are, they're just the tip of the iceberg. The real need for this insurance becomes frighteningly apparent when you start to think about the financial exposure your business faces after an accident.

Understanding the Financial Exposure

A single road traffic incident can unleash a torrent of costs that would threaten the very survival of most uninsured businesses. The financial fallout from an at-fault accident is not a minor inconvenience; it's a potentially catastrophic event. Without the right liability cover, every single pound of compensation and every legal fee comes straight out of your business's pocket.

Let's imagine one of your delivery drivers misjudges a turn and causes a multi-vehicle pile-up. The aftermath could involve:

- Significant Vehicle Repairs: The cost of fixing multiple damaged vehicles, especially modern ones packed with complex electronics, can quickly spiral into tens of thousands of pounds.

- Compensation for Injuries: If other people are injured, the claims for medical treatment, rehabilitation and loss of earnings can become eye-wateringly expensive over time.

- Legal Defence Costs: Even if you're certain your driver was not at fault, you’ll still have to pay for legal representation to defend your business against claims—a long and costly process.

The crucial takeaway is that one mistake on the road can lead to a claim far exceeding the value of the vehicle itself. This is exactly why commercial automobile liability insurance is not an optional extra but a fundamental investment in your company’s financial stability.

The Ripple Effect of Insurance Fraud

The need for robust insurance is magnified by the persistent problem of insurance fraud. Deceptive schemes, from exaggerated 'whiplash' claims to organised 'crash for cash' rackets, put an enormous strain on the entire insurance system. These are far from victimless crimes; they create a huge financial burden that ends up affecting every honest policyholder.

When insurers are tricked into paying out on fraudulent claims, the losses are massive. The Association of British Insurers (ABI) previously reported that detected fraudulent claims were valued at over £1.1 billion in a single year. Inevitably, these costs are passed on to customers through higher premiums for everyone.

So, getting the right cover is also about shielding your business from the financial consequences of someone else's dishonesty. A proper policy gives you access to an insurer's resources and expertise to investigate and fight back against suspicious claims. Without it, your business is left defenceless, making you a much more attractive target for fraudsters looking for an easy payday.

The True Cost of Claims and Rising Insurance Fraud

When the renewal notice for your commercial auto liability insurance lands, it’s easy to file it away as just another business expense. But that figure is not arbitrary. The price you pay is a direct reflection of much wider economic forces squeezing the entire motor insurance industry. The simple truth is that claim costs are rocketing, driven by a perfect storm of soaring inflation and increasingly complex vehicle technology.

Today’s commercial vehicles are technological marvels, packed with sophisticated sensors, cameras and onboard computers. While these advancements undoubtedly make our roads safer, they also make repairs eye-wateringly expensive. A minor bump that once meant a simple panel replacement might now demand the recalibration of sensitive equipment, pushing both labour and parts costs to new heights.

This trend is starkly clear in the industry-wide figures. Recently, UK motor insurers paid out a record £11.7 billion in claims across both private and commercial policies. In the same period, they handled 2.4 million claims, with the average claim value jumping by 13% to £4,900 . Repair costs alone hit a staggering £7.7 billion . For any business running a fleet, this translates directly into higher premiums.

The Financial Drain of Fraudulent Claims

As if rising repair costs were not enough, there’s the persistent and growing problem of insurance fraud. This is not a victimless crime. It's a calculated drain on the system that ultimately forces every honest business owner to pay more for their cover. Fraudulent activity runs the gamut from opportunistic exaggeration to highly organised criminal rings.

These schemes are designed purely to exploit the system for financial gain, creating a huge financial burden for insurers. And that cost does not just vanish—it gets absorbed by the industry and passed straight on to all policyholders through increased premiums.

The following chart from RSM UK paints a clear picture of just how sharply motor claims costs have risen, a key driver behind your premium.

The data speaks for itself, highlighting the escalating value of paid claims and underscoring the financial pressures that shape the cost of your policy.

Unmasking Common Fraud Tactics

While some fraud is simple opportunism, a significant portion is meticulously planned. Getting to grips with these tactics is the first step in protecting your business and the wider industry from their impact.

- 'Crash for Cash' Schemes: These are deliberate, staged accidents where criminals cause a collision to make a fraudulent claim. They often target commercial vehicles, knowing the business will have robust insurance.

- Exaggerated Injury Claims: After a genuine but minor incident, a claimant might falsely allege severe injuries like whiplash to inflate their compensation payout. Proving or disproving the extent of these injuries can be incredibly difficult and expensive.

- Phantom Passenger Claims: In this scam, fraudsters add claims for injuries to people who were not even in the vehicle at the time of the accident. Without clear, objective evidence from the scene, these can be tough for insurers to dispute.

The real problem in all these situations is proving what actually happened. A lack of verifiable, objective evidence creates the perfect environment for dishonest claims to flourish, forcing insurers to pour significant resources into investigations.

Beyond the fraudulent payouts themselves, the administrative and investigative costs add up. For more on understanding the true cost of reactive investigations , it’s clear that every pound spent fighting fraud is another cost that feeds back into the premiums paid by law-abiding businesses. It highlights why we all have a collective need for vigilance and robust evidence to keep the system fair and affordable.

Navigating the Claims Process and Proving Your Case

When one of your company vehicles is involved in an incident, the moments that follow are critical. A calm, methodical response is your best defence against unfair blame and fraudulent claims. Handling the process well not only protects your business but also paves the way for a smoother, quicker resolution with your insurer.

The first priority is always safety. Once you've confirmed everyone is safe and emergency services have been called if needed, the focus must shift to meticulously gathering evidence. This is where you begin to build your case and shield your business from the costly fallout of ambiguity.

It’s absolutely vital that your drivers are trained to never admit fault at the scene. A simple apology can easily be twisted into an admission of liability which can be incredibly damaging down the line. Instead, their job is to focus solely on documenting the facts.

Gathering Verifiable Evidence at the Scene

The strength of any claim rests entirely on the quality of the evidence you provide. Without clear proof, things can quickly devolve into a costly “he said, she said” dispute—an environment where insurance fraud thrives. A structured approach to collecting evidence is not just a good idea; it's non-negotiable.

Your driver's immediate actions should include:

- Photographic and Video Evidence: Take extensive photos and videos of the entire scene from multiple angles. This should cover damage to all vehicles, their final positions, road markings, traffic signs and any relevant conditions like potholes or bad weather.

- Witness Information: Get the names and contact details of any independent witnesses. Their objective account can be invaluable in countering false narratives from the other parties involved.

- Third-Party Details: Collect the name, address, contact number and insurance information from all other drivers. It's also crucial to note the make, model and registration of every vehicle.

This initial documentation forms the bedrock of your claim. It’s your first line of defence against exaggerated or completely fabricated stories.

The Power of Technology in Proving Your Case

While on-the-scene evidence is crucial, modern technology adds an even more powerful, objective layer of proof. Telematics and dashcams are no longer just operational tools; they are essential instruments in the fight against fraud and a key part of robust commercial automobile liability insurance risk management.

Dashcam footage acts as an impartial, silent witness, capturing the undeniable truth of what happened. It can instantly disprove 'crash for cash' schemes where a fraudster slams on their brakes for no reason or gives a false account of the incident.

Likewise, telematics data provides an objective log of a vehicle's speed, location and braking patterns in the moments leading up to an incident. This digital evidence is incredibly difficult to dispute. It gives your insurer the hard facts needed to challenge suspicious claims, saving your business from unfair liability and protecting your claims history. Efficiently managing this data is key and businesses can learn more about how specialised software can help you streamline and combat fraud.

Reporting the Incident Promptly

Once the scene is secure and the initial evidence is gathered, the final step is to report the incident to your insurer as soon as you possibly can. Prompt reporting allows them to start their investigation while the details are still fresh and the evidence is readily available.

Give your insurer all the documentation you’ve collected, including photos, witness details and any dashcam or telematics data. A complete and organised submission shows professionalism and helps speed up the process, minimising business disruption and ensuring a fair, accurate outcome for your claim. This proactive approach strengthens your position and reinforces the value of your insurance partnership.

Key Factors That Influence Your Insurance Premium

Ever wondered how insurers arrive at the final figure for your commercial vehicle insurance? It’s not a number plucked from thin air. It’s a carefully calculated assessment of risk, blending specific details about your vehicles, your drivers and your business’s track record.

Getting to grips with these factors is not just an academic exercise—it gives you the power to manage and potentially lower your costs over time.

It Starts With Your Fleet

The starting point for any underwriter is your fleet. The type , age and number of vehicles you operate are fundamental to the calculation. It makes sense, right? A fleet of heavy goods vehicles (HGVs) carries a much higher potential for causing costly damage in an accident than a couple of small cars used by your sales team.

Beyond the vehicles themselves, insurers want to know how you use them. A long-haul logistics firm clocking up thousands of miles every week has a far greater chance of being involved in an incident than a local baker whose van rarely leaves its home town. Your annual mileage and the nature of the vehicle's use are critical pieces of the puzzle.

Your Drivers and Claims History Matter Most

While the vehicles are important, it's the people behind the wheel that underwriters really focus on. A driver’s profile—their age , experience and driving history —directly shapes the perceived risk. A team of seasoned drivers with clean licences will always secure better terms than a group of young, inexperienced drivers with points for previous offences.

But perhaps the single most significant factor is your business's own claims history. A pattern of frequent or expensive claims sends a clear signal to an insurer: this business is a higher risk. On the flip side, a clean record demonstrates a solid commitment to safety and is almost always rewarded with more competitive pricing.

This is where commercial and private motor insurance share common ground but the details diverge. The competitive UK motor insurance market, led by giants like Admiral Group and Aviva, prices risk based on vehicle type, usage and driver history. Commercial policies, however, have to factor in unique risks like higher mileage, multiple drivers for one vehicle and cargo liability. The growing shift to electric vehicles (EVs) adds another layer, with higher average premiums for EVs due to complex repairs and battery risks—a factor now hitting commercial fleet operators hard.

The Power of Proactive Risk Management

It’s easy to feel like your premium is out of your hands but that’s not entirely true. Your approach to risk management is a powerful lever you can pull to influence your costs. Taking proactive steps to improve safety does not just reduce the likelihood of accidents; it shows insurers that you are a responsible partner they want to work with.

This is where investing in safety really pays off. Many businesses are now seeing first-hand the role of technology in reducing insurance claims costs. By actively managing your risk, you build a much stronger case for better premiums when renewal comes around.

A proactive safety culture is one of the most effective long-term strategies for controlling your commercial automobile liability insurance costs. It moves you from being a passive price-taker to an active participant in managing your risk profile.

Here are a few actionable steps that prove your commitment to safety:

- Advanced Driver Training: Putting your drivers through advanced or defensive driving courses gives them the skills to anticipate and avoid hazards on the road.

- Regular Vehicle Maintenance: A well-documented maintenance schedule is proof that your vehicles are kept in safe, roadworthy condition, reducing the risk of an accident caused by mechanical failure.

- Implementing Telematics Systems: These devices offer a goldmine of data on driving behaviour, flagging issues like speeding, harsh braking or rapid acceleration. This allows you to spot high-risk drivers and provide targeted coaching to help them improve.

Let's break down the key variables that insurers look at when setting your premium.

Key Factors That Determine Your Insurance Premium

This table summarises the main things insurers assess when calculating the cost of your commercial motor insurance and shows how they can affect what you pay.

| Factor | Why It Matters to Insurers | Potential Impact on Premium |

|---|---|---|

| Fleet Composition | The type, age and value of your vehicles determine the potential cost of repairs or replacement. HGVs pose a higher risk than small vans. | Higher value or higher risk vehicles (like lorries or tankers) lead to higher premiums. |

| Vehicle Usage | How far and where your vehicles travel. Long-haul transport has more exposure to risk than local delivery routes. | Increased mileage and travel in high-traffic urban areas typically increase the premium. |

| Driver Profiles | The age, experience and driving records of your employees. A history of accidents or violations signals higher risk. | Younger, less experienced drivers or those with points on their licence will raise your premium. |

| Claims History | Your business's track record of past claims. Frequent or severe claims suggest a higher likelihood of future incidents. | A history of claims, especially at-fault ones, will almost certainly lead to a higher premium. A clean record lowers it. |

| Industry & Cargo | The nature of your business and what you transport. Hauling hazardous materials is riskier than delivering office supplies. | Riskier industries (e.g., construction, hazardous waste) will face higher insurance costs. |

| Risk Management | Proactive safety measures you have in place, such as telematics, driver training and regular maintenance schedules. | Demonstrating strong risk management can lead to significant discounts and lower premiums. |

Ultimately, insurers are trying to predict the future based on the past. The more you can do to show them you are a safe, well-managed operation, the better your premium will be.

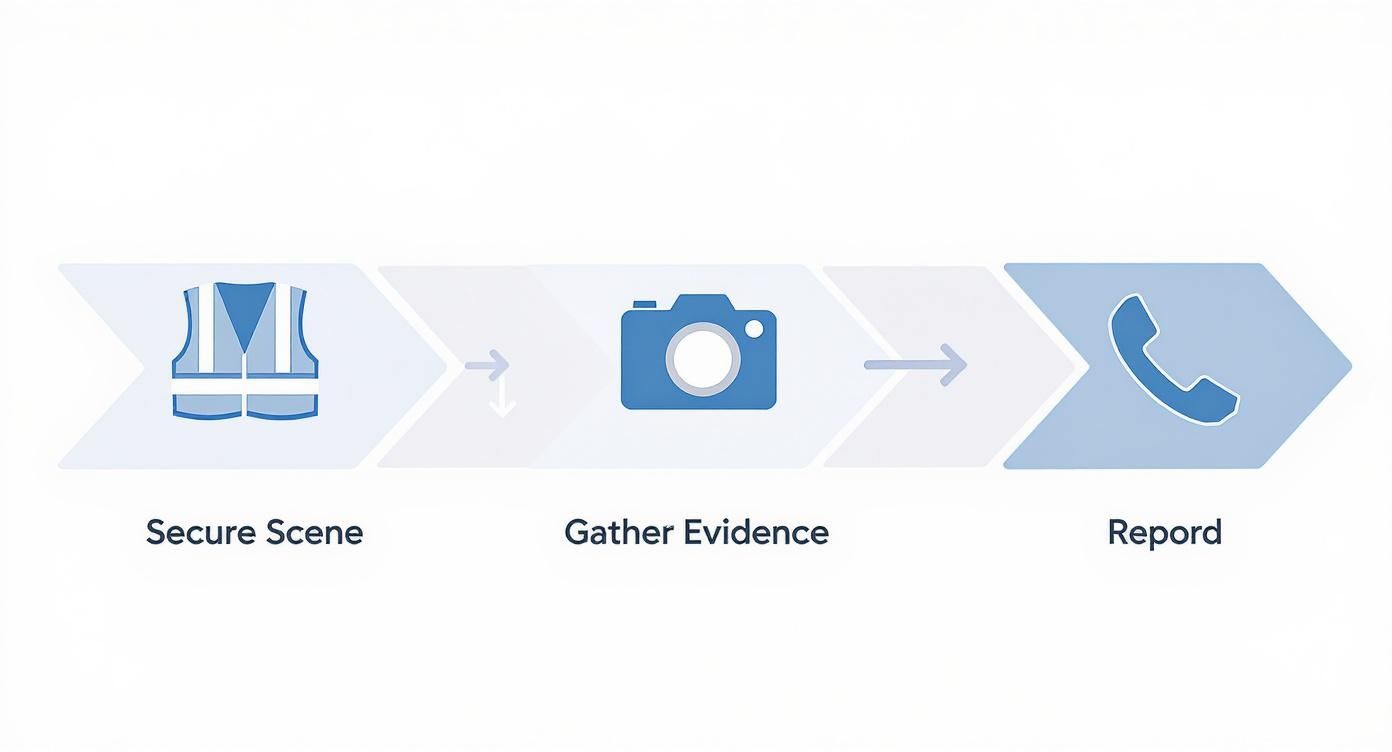

This infographic outlines the simple, crucial steps to take immediately following an incident to secure the scene and begin gathering evidence.

The UK Commercial Motor Insurance Market: What’s Really Happening?

If you want to make smart decisions about your commercial motor insurance, you need to look beyond your own policy. The UK market is not just a static list of prices; it's a fast-moving, highly competitive space that literally keeps the country's economy on the road. It’s this constant jostling between insurers that pushes them to innovate, creating new types of cover and better ways to figure out risk.

But it’s also a market feeling the squeeze. Insurers are up against some powerful trends that are completely changing how they calculate premiums and pay out claims. Getting your head around these shifts gives you context, turning you from a passive buyer into someone who understands what's driving the numbers.

The Big Trends Redefining Risk and Premiums

The UK's motor insurance sector, commercial included, is a huge part of the economy. The whole market was recently valued at around £23 billion and is expected to grow by 4.3% each year. That growth is no surprise when you consider there are over 40.7 million vehicles on our roads as of 2023, with insurers all fighting for a piece of the action. You can get more insights into the UK motor insurance market on imarcgroup.com.

This intense competition is speeding up a few key changes:

-

Technology is No Longer Optional: Forget add-ons. Tech like telematics, dashcams and data analytics is now at the very heart of underwriting and claims. Insurers are using this data to paint a much clearer picture of who's a genuine risk, allowing them to reward safe fleets and penalise those with poor driving habits. For you, it means how you run your business now directly impacts your premium.

-

The Electric Fleet Revolution: The big switch to electric vehicles (EVs) is a mixed bag for insurers. On one hand, they promise lower running costs and greener credentials. On the other, they currently cost more to insure. Why? Because repairing them requires specialist skills, replacing a battery is incredibly expensive and they present a whole new set of risks. Insurers are working flat-out to build new models that can price EV fleet cover fairly.

-

The Ever-Changing Rulebook: Insurance is a heavily regulated world. Any changes from bodies like the Financial Conduct Authority (FCA) can ripple through the market, affecting how policies are designed and priced. These tweaks are usually meant to create a fairer deal for customers but they can also change how insurance is sold and what options are even available to your business.

Keeping an eye on these market forces is vital. They're not abstract concepts—they directly shape the availability, structure and cost of your commercial motor insurance. That's why it's so important to work with a broker or insurer who truly gets this evolving landscape and can guide you through it.

Frequently Asked Questions

Let's tackle some of the most common questions business owners have when navigating commercial vehicle insurance.

Does This Insurance Cover the Goods I’m Transporting?

This is a crucial point to understand: no, it does not. Commercial automobile liability insurance is designed purely to cover your legal responsibility if you cause injury to other people or damage their property.

It will not cover the actual cargo or goods inside your vehicle. For that, you’ll need a separate Goods in Transit policy.

What If My Employees Use Their Own Cars for Work?

If an employee uses their personal car for business—and we’re talking about more than just their daily commute—their standard car insurance is almost certainly invalid. The policy must specifically include ‘business use’ cover.

As the business owner, the responsibility falls on you to make sure this cover is in place. Without it, you could be facing a massive liability gap if an incident occurs.

Think about it: an employee making a single delivery in their own car without the right insurance could leave your business completely exposed to a major claim. Verifying your team's policies is not just paperwork; it's a critical risk management step.

What’s the Difference Between ‘Any Driver’ and ‘Named Driver’ Policies?

Getting this right is key to balancing cost against the operational needs of your business fleet.

An ‘any driver’ policy is the more flexible option. It allows any employee to drive, as long as they meet certain criteria, like being over 25 with a clean licence. This is great for convenience, especially with larger fleets but it usually costs more because the insurer is taking on a broader, unassessed risk.

A ‘named driver’ policy, on the other hand, only covers the specific individuals listed on the policy. This is a lower-risk proposition for insurers—they know exactly who is behind the wheel—which often makes it the cheaper option. The right choice really comes down to how your business operates day-to-day.

At Proova , we provide the tools to document and verify your assets, strengthening your position during the claims process and helping to combat fraud. Protect your business with clear, verifiable evidence. Find out more at https://www.proova.com.