Decoding Your Travel Insurance Cost

So, you're wondering what you should budget for travel insurance? It’s a common question and the honest answer is: it depends. The cost can swing quite a bit based on the kind of trip you're taking.

For a simple week away, a single trip policy will be your most wallet-friendly option but if you’re a frequent jet-setter, an annual multi-trip policy almost always works out cheaper in the long run. Then there are the more specialised plans, like backpacker insurance for long-term adventures, which naturally sit at a higher price point.

Understanding Average Travel Insurance Costs

Before we get into the nitty-gritty of what pushes your premium up or down, it helps to have a rough idea of the starting line. Think of these figures as a ballpark estimate; your final quote will be shaped by your own circumstances, where you're going and the level of cover you need.

Still, these averages give you a good snapshot of what the market looks like.

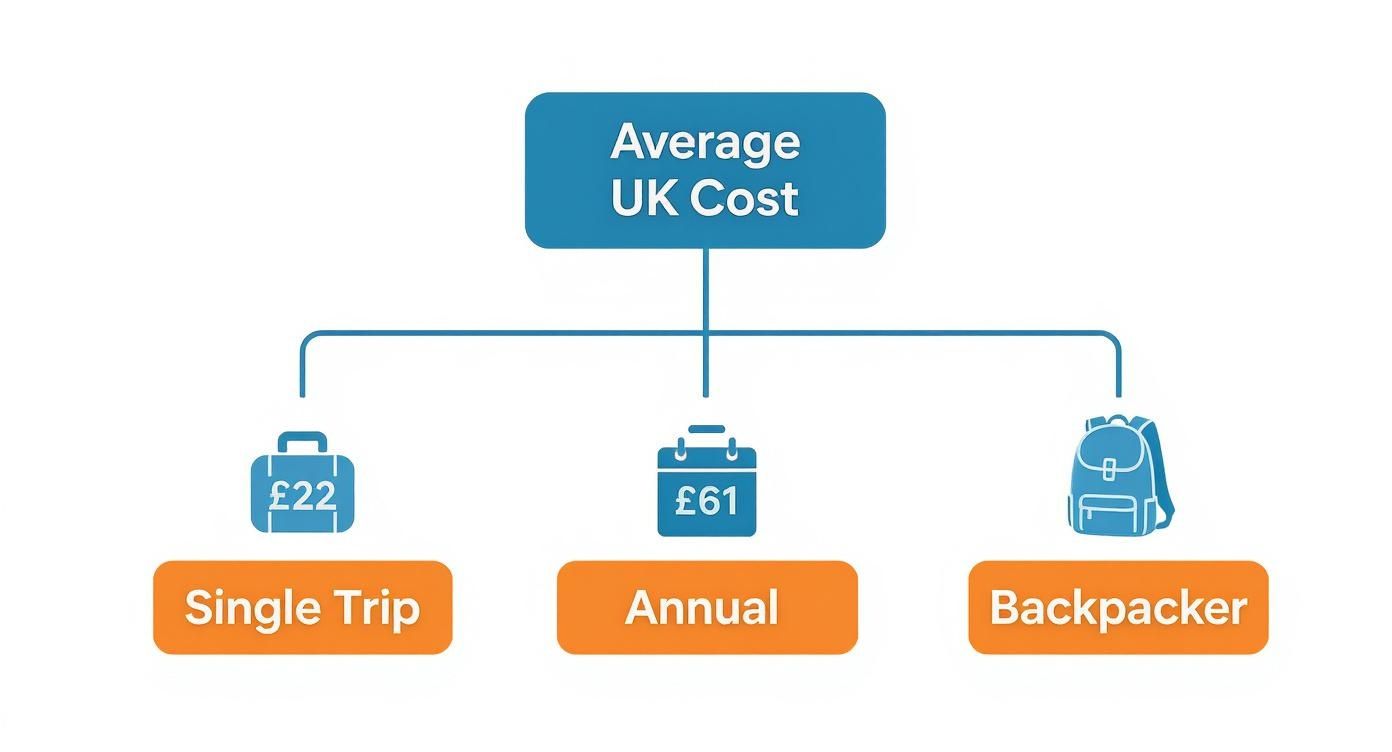

Recent data shows that a standard single trip policy in the UK will set you back around £22.59 . If you travel a few times a year, an annual multi-trip policy offers much better value at an average of £61.52 . For those epic, long-stay trips, backpacker insurance is a bigger investment, averaging £245.57 . You can dig deeper into these travel insurance statistics to see the full breakdown.

To make this a bit clearer, here’s a quick look at how those costs compare.

Average UK Travel Insurance Costs at a Glance

This table shows the typical cost for different travel insurance policy types in the UK, helping you quickly compare options.

| Policy Type | Average Cost |

|---|---|

| Single Trip | £22.59 |

| Annual Multi-Trip | £61.52 |

| Backpacker (Long-Stay) | £245.57 |

These figures really highlight the trade-off between upfront cost and long-term value, depending on your travel habits for the year.

Key Takeaways on Policy Costs

Getting your head around these averages helps you set realistic expectations. Here’s a quick summary:

- Single Trip Policies: Perfect for that one-off holiday and the cheapest option out of the gate.

- Annual Multi-Trip Policies: A no-brainer if you’re planning two or more trips within a year. The value is undeniable.

- Specialised Policies: Absolutely essential for long-term travel but they demand a bigger initial investment because the insurer is on the hook for a much longer period.

The logic here is pretty straightforward: the longer you’re away and the more trips you take, the higher the risk for the insurer. This has a direct knock-on effect on the cost but picking the right type of policy ensures you aren’t paying for cover you simply don’t need.

This basic cost structure is just the foundation. From here, your personal quote is built up by layering on factors like your age, destination and how much cover you want, which we'll explore next.

The Building Blocks of Your Insurance Premium

Ever wondered why your travel insurance quote is £20 while your friend’s is £200 for a similar trip? The difference isn't random; it's a calculated assessment of risk, much like pricing any other financial product. Each detail about you and your trip is a building block. The more complex or risky the blocks, the higher the final price will be.

Understanding these building blocks is key. Insurers aren’t just picking numbers out of thin air. They're meticulously piecing together a profile of your journey to figure out the likelihood of you making a claim and the premium you pay is a direct reflection of this risk.

This infographic gives you a quick breakdown of the average costs for common UK policy types, showing how your initial choice of cover sets the foundation for the price.

As you can see, specialised cover like backpacker insurance costs a lot more. That's because the insurer is taking on a much longer and more unpredictable period of risk. These base costs are then tailored using your personal circumstances.

Your Personal Risk Profile

The first and most significant building block is you. Your age and your health are the primary drivers of your premium. Statistically, older travellers are more likely to need medical assistance and insurers price this increased probability into the policy. Simple as that.

Likewise, you absolutely must declare any pre-existing medical conditions . While this will almost certainly increase your premium, hiding them can be a financial disaster. An insurer can rightfully deny any claim related to an undeclared condition, leaving you responsible for potentially astronomical medical bills. Honesty here isn't just a requirement; it's your financial safeguard.

The Destination and Duration Effect

Where you're going and for how long are the next crucial blocks. A two-week holiday in Spain carries a very different risk profile to a three-month trek through Southeast Asia. Insurers group destinations based on factors like the cost of local healthcare, political stability and even crime rates.

A trip to the USA , for example, will always come with a higher premium than a trip to Europe. This is purely down to the staggering cost of medical care in the States. If you need treatment there, the potential payout for the insurer is enormous and your premium reflects that high-stakes reality.

The core principle is simple: the higher the potential claim cost for the insurer, the higher the premium for the policyholder. Every factor, from your destination to your planned activities, is weighed to balance this equation.

The Broader Impact of Fraud

There’s also a hidden factor influencing every single policy: insurance fraud. It’s easy to think of it as a victimless crime but that couldn’t be further from the truth. When someone exaggerates a claim or completely invents an incident, the insurer pays out money for a loss that never really happened.

These fraudulent payouts aren't just absorbed by the insurance company. Instead, they get factored into the overall risk pool. To stay in business, insurers have to recoup these losses and they do it by adjusting premiums upwards for everyone. This means every dishonest claim, no matter how small, contributes to a higher travel insurance cost for all of us. The industry and its honest customers end up footing the bill.

How Age and Health Influence Your Final Cost

When it comes to travel insurance, two factors stand head and shoulders above the rest in determining your final premium: your age and your health. This isn't some arbitrary decision by insurers; it's a straightforward calculation of risk. The older we get, the higher the statistical chance we'll need medical help while abroad and that assistance can get very expensive, very quickly.

An insurer's job is to price that risk. A twenty-something traveller is a relatively low-risk bet when it comes to a major medical claim. An older traveller, however, is statistically more likely to need medical attention for issues that can crop up without warning, making their policy inherently riskier to underwrite.

This direct link between age and risk isn't just a minor detail—it's a fundamental part of how travel insurance is structured and it leads to a steep rise in what you'll pay.

The Stark Reality of Age-Based Pricing

The increase in cost isn't a gentle, gradual slope. It often feels more like a cliff edge, accelerating sharply once travellers reach their senior years. This is because both the frequency and potential severity of health issues climb, meaning the insurer has to account for a much higher potential payout.

Industry data paints a very clear picture of this. For an 80-year-old traveller, premiums can be around 10 times higher than for someone in their 30s. To put real numbers on it, a worldwide policy for an 80-year-old might come in at £338.80 , while a 20-year-old could get similar cover for just £31.09 . This gap has actually widened since the pandemic, as the industry has become even more sensitive to health risks. You can dig deeper into the data on how age affects insurance pricing on NimbleFins.co.uk.

It just goes to show that while the product might look the same on the surface, the risk being covered is vastly different, which explains the huge price variation.

Declaring Pre-Existing Conditions Is Non-Negotiable

Beyond your age, your personal health history plays a massive role. Any pre-existing medical condition has to be declared when you apply. We’re talking about everything from chronic conditions like diabetes or high blood pressure to previous illnesses or surgeries.

Trying to save a few quid by not disclosing a condition is a massive false economy. It might get you a lower premium upfront but it effectively invalidates your cover for any claim even remotely related to that undeclared issue.

An insurance policy is a contract built on good faith. Hiding a medical condition breaks that trust and gives the insurer every right to refuse a claim. This could leave you facing catastrophic medical bills that can easily run into tens or even hundreds of thousands of pounds.

Yes, declaring your conditions will almost certainly push your premium up. The insurer will assess the specific risk your condition poses and adjust the price accordingly but that higher price buys you something absolutely invaluable: genuine, reliable protection when you need it most.

Why Honesty Provides Provable Protection

Think of your declared medical history as the foundation of your policy. By being completely upfront, you're giving the insurer everything they need to offer you a policy that will actually cover you.

When you make a claim, the first thing the insurer will do is review your medical records. If they find an undeclared condition that's relevant to what happened, they are well within their rights to reject your claim. It's one of the most common reasons claims get denied and it can cause immense financial and emotional pain.

Here’s why full disclosure is the only way to go:

- It Ensures Validity: Your policy remains valid, meaning you’re properly covered for emergencies, including those related to your condition.

- It Prevents Financial Ruin: You sidestep the horrifying risk of being personally liable for enormous overseas medical bills.

- It Provides Peace of Mind: You can travel knowing you have a safety net that will actually work if you fall.

Ultimately, the higher travel insurance cost that comes with age and pre-existing conditions is a direct payment for covering a higher level of risk. Paying that premium ensures your policy is a dependable tool for protection, not just an expensive piece of paper.

The Hidden Cost of Insurance Fraud for Everyone

The price you pay for travel insurance isn’t just about your age, health or destination. There’s another, less obvious factor quietly pushing up costs for every single policyholder: insurance fraud . It’s easy to dismiss it as a victimless crime but its effects ripple across the entire industry, ultimately hitting honest customers in the pocket.

When a traveller makes a dishonest claim—whether it’s slightly exaggerating the value of a lost camera or fabricating an entire incident—it creates a financial hole for the insurer. These losses don't just disappear. To stay in business and continue offering cover, insurers have to balance their books by spreading these costs among all their customers.

How Fraud Inflates Everyone's Premiums

Think of the money from everyone's premiums as a collective pool used to pay out genuine claims. Every fraudulent payout is like a leak in that pool. To keep it full, the insurer has to ask everyone to contribute a little bit more next time.

This means your premium is partly determined by the dishonest actions of others. The cost of that fabricated theft or exaggerated loss is passed on to you and every other honest customer. It’s a collective problem where the actions of a few directly impact the wallets of the many.

This issue has become more complex with the rise of accessible online tools. The availability of resources that allow people to create things like generated hotel receipts can be misused. For instance, someone might create a fake receipt to claim for accommodation costs after a supposed trip cancellation, adding another layer of difficulty for insurers trying to verify claims.

The Insurer's Response and Investigation Process

Insurers aren’t just sitting back and letting this happen. They have dedicated teams and sophisticated systems in place to detect and investigate suspicious claims. A claim that seems inconsistent or lacks verifiable proof will immediately raise a red flag, triggering a much closer look.

Investigators are trained to spot several warning signs, including:

- Vague Details: A lack of specific information about when, where and how an incident occurred.

- Missing Documentation: An inability to provide essential proof like police reports for theft or official receipts for valuable items.

- Inconsistent Timelines: Stories that just don't add up or contradict other available information.

- Previous Claims History: A pattern of frequent or similar claims can sometimes indicate fraudulent behaviour.

When fraud is suspected, the investigation deepens. Insurers may use loss adjusters, check public records and even analyse digital footprints to verify a claim. It’s a detailed process designed to protect the integrity of the insurance system and, by extension, the premiums of honest customers.

The Serious Consequences of Getting Caught

The idea of getting a bit of extra money from an insurer might seem tempting but the consequences of being caught are severe and far-reaching. Insurance fraud is not a minor slip-up; it is a criminal offence.

The penalties can be life-altering and go well beyond just having a claim denied. Someone found guilty of fraud can face:

- Policy Cancellation: The insurer will void the policy, leaving the person without any cover for the rest of their trip.

- Repayment of Costs: They may be required to repay any money already paid out, plus the insurer's investigation costs.

- A Criminal Record: A conviction for fraud can have a lasting impact on future employment and travel opportunities.

- Difficulty Getting Future Insurance: Being blacklisted makes it extremely difficult and expensive to get any type of insurance in the future.

Ultimately, understanding what insurance fraud really costs the industry reveals why insurers take it so seriously. By tackling fraud, they protect the pool of funds for those who genuinely need it and help keep travel insurance manageable for everyone else.

How to Prove Your Claim the Right Way

A travel insurance policy is only as good as its ability to pay out when you actually need it. While insurance fraud unfortunately pushes up the travel insurance cost for everyone, even genuine claims can be rejected if they’re not backed up with solid proof.

To make sure your claim sails through smoothly, you need to provide clear, verifiable evidence that leaves no room for doubt.

Think like an insurer from the moment something goes wrong. They aren't trying to catch you out; they just need concrete documents to validate your loss, prevent fraud and release the funds. Without that proof, they’re working blind and a denial becomes far more likely.

The Foundation of a Successful Claim

At the heart of any successful claim is one simple thing: provability. You have to show, beyond any reasonable doubt, that the incident happened as you said it did and that the value you’re claiming is accurate. This isn’t the time for guesswork; it requires a methodical approach to gathering evidence.

Let's say your luggage gets stolen. Your very first move should be to report it to the local police. An official police report isn’t just a nice-to-have; it's a non-negotiable piece of evidence for any theft claim. It provides an official, third-party account of the incident, complete with a time and date, which is exactly what an insurer needs to see.

A claim without proof is merely a story. To an insurer, verifiable documents transform that story into a fact. This distinction is the difference between a claim being paid or denied, directly affecting your financial outcome.

The same logic applies if you need medical help. Always get official paperwork from the clinic or hospital. This must include a clear diagnosis, a list of treatments you received and a fully itemised bill. A few scribbled notes on a piece of paper just won't cut it.

Building Your Evidence File

To give your claim the best possible chance, you need to collect and organise all the relevant paperwork. This is where so many people stumble, leading to frustrating delays or even an outright denial. When compiling the necessary documentation to prove your claim, understanding methods for efficiently organizing your receipts can be extremely helpful.

Here are the essential documents you should always try to get your hands on:

- Proof of Ownership: For lost or stolen items, this could be original receipts, bank statements showing the purchase or even photos of you with the item. Anything that proves it was yours.

- Police Reports: For any crime-related incident like theft, this official report is your most powerful piece of evidence.

- Medical Records: If you were ill or injured, gather every official report, prescription and itemised invoice from the medical facility.

- Carrier Confirmation: If your flight is delayed or cancelled, get something in writing from the airline that explains the reason and the length of the disruption.

Technology is also changing the game here. For instance, understanding how real-time evidence changes everything in the journey from theft to payout highlights just how crucial digital proof is becoming for validating claims quickly.

By being meticulous and transparent with your documentation, you put yourself in the strongest possible position for a successful outcome.

Smart Ways to Lower Your Travel Insurance Cost

While some factors that shape your travel insurance cost —like your age or destination—are pretty much set in stone, you’re not completely powerless. There are several smart moves you can make to bring down your premium without sacrificing the essential cover you need for peace of mind.

It all comes down to making informed choices. When you understand where the savings are, you can put together a policy that fits your trip and your budget, ensuring you only pay for the protection that actually matters.

Choose the Right Policy Type

One of the easiest wins is matching your policy type to your travel habits. If you’re only planning one short holiday this year, a single-trip policy is almost always going to be your cheapest bet. Simple as that.

But what if you think you’ll take two or more trips within a 12-month period? That’s where an annual multi-trip policy often delivers far better value. It saves you the hassle of buying a new policy every time and frequently works out cheaper than buying two or more separate single-trip plans.

Adjust Your Policy Excess

The excess is the amount you agree to pay towards any claim before your insurer steps in to cover the rest. Most policies give you some flexibility here and your choice has a direct impact on your premium.

By volunteering to pay a higher excess, you are essentially sharing more of the potential risk with the insurer. In return for this, they will usually offer you a lower upfront premium. Be careful though; set it too high and it could make smaller claims impractical.

Compare Providers and Buy Early

Never, ever accept the first quote you see. The travel insurance market is incredibly competitive and premiums can vary wildly between providers for the exact same level of cover. Using a comparison site is a brilliant way to get a bird's-eye view of your options in minutes.

Also, a crucial tip: buy your insurance as soon as you’ve booked your trip. This doesn’t usually change the price but it means your cancellation cover kicks in immediately. If you have to call off your holiday for a covered reason, you’ll be protected from day one. Some insurers even offer a no-claims discount if you’ve had a policy before without claiming, much like car insurance. You can learn more in our guide to proving your no claims discount.

Fine-Tune Your Cover Level

Finally, take a moment to look at what’s actually included in the policy. Do you really need cover for expensive gadgets if you’re leaving your laptop at home? Are you paying for winter sports cover for a beach holiday in Spain?

Trimming unnecessary add-ons is a simple but effective way to lower your travel insurance cost . Make sure you have solid cover for the big things—like medical emergencies and cancellation—but don’t pay for extras you’ll never use.

Cost-Saving Tactics Comparison

To help you decide which strategies are right for you, here’s a quick breakdown of the most effective ways to reduce your premium.

| Strategy | How It Saves Money | Best For |

|---|---|---|

| Annual Multi-Trip Policy | Cheaper than buying multiple single-trip policies. | Travellers taking two or more trips a year. |

| Increase Your Excess | A higher excess leads to a lower premium. | People who are comfortable covering smaller claims themselves. |

| Shop Around | Premiums vary significantly between insurers for similar cover. | Everyone! Never skip this step. |

| Remove Add-Ons | Strips out costs for cover you don’t need. | Travellers with specific, straightforward trip plans. |

Each of these tactics puts a bit more control back in your hands. By combining a few of them, you can make a real difference to the final price without compromising on the cover that truly counts.

Frequently Asked Questions

Digging into the details of travel insurance costs can feel a bit like trying to solve a puzzle. But once you grasp a few core ideas, it all starts to make sense. Here are some of the most common questions we hear, with answers to help clarify how insurers arrive at that final figure.

Does My Destination Really Change the Cost That Much?

Yes, it makes a huge difference. Think of it this way: insurers group countries by risk and the single biggest risk factor is the cost of medical care. For places like the USA, Canada or parts of the Caribbean, healthcare is incredibly expensive. A trip to the hospital there could easily run into tens or even hundreds of thousands of pounds.

Because of this, your insurance premium for these regions will be much higher than for somewhere like Europe, where medical costs are generally lower. Your premium is a direct reflection of the insurer's potential payout, making your destination one of the most critical factors in the price you pay.

Is It Fraud If I Just Add a Little to the Value of a Lost Item?

Absolutely. Intentionally inflating the value of a lost or stolen item is considered insurance fraud, plain and simple. Insurers are very experienced at spotting these kinds of exaggerations and have methods to verify the true value of items. This sort of dishonesty is a major reason why travel insurance costs rise for everyone.

If you get caught, your entire claim could be rejected, your policy cancelled and you might even face legal action. More importantly, it adds to the pool of fraudulent losses that every honest policyholder ends up covering through higher premiums year after year.

It's far from a victimless act; it directly undermines the fairness of the entire insurance system.

Why Is My Annual Policy Renewal More Expensive This Year?

A few things could be at play here. One of the most common reasons is simply moving into a new age bracket. As we get older, our risk profile changes in the eyes of an insurer and the price is adjusted accordingly.

General inflation also has an impact, pushing up the costs of medical care and travel services worldwide. If you made a claim last year, that will likely increase your renewal price, too. Finally, wider events, like a global health crisis or a rise in industry-wide fraud, can lead insurers to adjust their pricing across the board to cover their own increased risks and potential payouts.

At Proova , we believe in making the insurance process clearer and more secure for everyone. Our platform helps validate item ownership before a claim is even made, reducing fraudulent activity and creating a fairer system for both policyholders and insurers. Learn how Proova can bring certainty to your insurance claims at https://www.proova.com.