Contents Insurance Aviva: Your Complete Guide to Protecting Valuables

Think of the contents insurance Aviva offers as a crucial safety net for everything you have worked hard to put inside your home. It is there to protect your personal stuff—from the sofa you relax on to the smartphone in your pocket—against the unexpected, like a break-in, a fire or a burst pipe. This kind of protection is a must-have for both homeowners and renters right across the UK.

Why Aviva Contents Insurance Is Essential

It is easy to underestimate just how much all your belongings are worth. Seriously, take a moment and think about it. If you had to replace everything at once after a disaster, the bill could be staggering. This is exactly where a good contents policy proves its worth, giving you the funds to get back on your feet without a crippling financial hit.

As one of the UK's biggest names in insurance, Aviva is a major player in the home insurance market. They currently hold an 8.7% market share , making them a go-to choice for millions. If you are curious, you can read more about the UK's biggest home insurance brands to see how the market stacks up. But this popularity also shines a light on a huge challenge the entire industry faces.

The Hidden Cost of Fraud

At its heart, the whole insurance system runs on trust. When you make a claim, insurers like Aviva need to be sure the loss actually happened and the value you are claiming is fair. This is where the idea of a provable claim becomes so important. A claim that is unverified or worse, deliberately exaggerated, is not just a headache for the insurer—it is a form of insurance fraud.

Insurance fraud is far from a victimless crime. It forces insurers to hike up premiums for every single honest policyholder to cover the losses from dishonest claims. This costs the industry billions each year and makes essential cover more expensive for everyone.

What This Means for You

In this guide, we will break down Aviva's contents insurance in simple terms but we will also dig into why making a provable claim matters so much. Understanding this connection helps explain why insurers investigate claims and how, by doing so, they protect the fairness of the system for all of us.

By the time you finish reading, you will not just know what your policy covers. You will also get your role in keeping insurance fair, honest and affordable for everyone.

Diving Into Your Aviva Policy Coverage

Think of your Aviva contents insurance as a financial safety net, custom-built to protect your personal belongings. At its heart, every policy has standard cover. This is the foundation, protecting everyday things like your sofa, wardrobe and laptop from major events like theft, fire or flood damage.

But not everything you own is an "everyday" item. Most standard policies have a single-item limit , which is the maximum they will pay out for any one thing. That beautiful engagement ring or your specialised camera gear? They could easily be worth more than this limit, meaning they would not be fully protected without a little extra attention.

Tailoring Your Protection to Your Life

This is where you get to shape your policy to fit your reality. Aviva lets you bolt on optional extras to your basic cover, turning a standard policy into something that truly reflects what you own and how you live. It is all about building a plan that works for you.

Here are a few of the most popular add-ons:

- Accidental Damage Cover: For those heart-stopping moments. Think spilling a glass of red wine on the new cream carpet or your toddler knocking over a pricey vase. Standard policies often do not cover these mishaps.

- Personal Possessions Cover: Your basic policy usually only protects items while they are safely inside your home. This add-on extends that protection to the things you take out and about with you, like your phone, watch or bicycle.

- Home Emergency Cover: This one is a real stress-saver. It provides immediate help for urgent problems like a burst pipe or a boiler that has given up, covering the cost of call-outs and repairs.

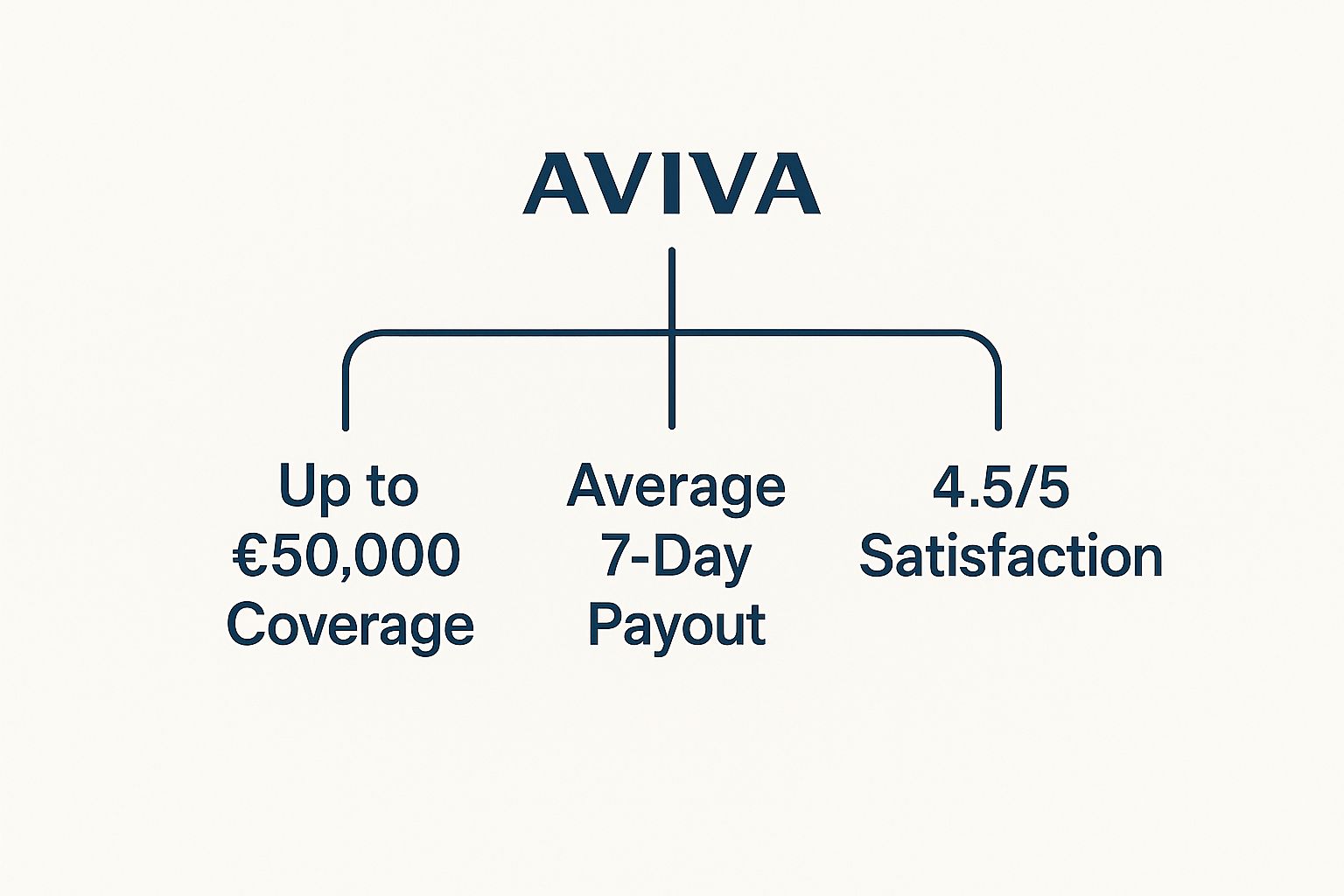

This infographic gives you a quick snapshot of what makes Aviva a popular choice.

The numbers speak for themselves, highlighting Aviva's ability to handle a huge number of claims, pay out quickly and keep customers happy. These are exactly the things you want to see when you are trusting a company to have your back.

How This All Works in the Real World

To help you get a better feel for how Aviva’s coverage options work together, here is a quick summary table.

Aviva Contents Insurance Coverage Options at a Glance

| Coverage Type | Description | Typically Included or Optional? |

|---|---|---|

| Standard Contents Cover | Protects belongings inside the home against fire, theft and flood. | Included |

| Accidental Damage Cover | Covers accidental mishaps, like spilling paint on a sofa or dropping a laptop. | Optional |

| Personal Possessions Cover | Extends protection to items you take outside your home, like jewellery, phones and bags. | Optional |

| High-Value Item Cover | Provides specific cover for individual items that exceed the standard single-item limit. | Optional |

| Home Emergency Cover | Provides 24/7 assistance and covers call-out fees for emergencies like boiler breakdowns or burst pipes. | Optional |

This table makes it easy to see how you can start with a solid foundation and add the specific layers of protection that make sense for you.

Imagine you are moving house. In the chaos, a professional mover drops a box, smashing a set of expensive glassware. A standard policy might not cover this but with the right contents insurance Aviva policy that includes accidental damage, you would be covered for the replacement cost. It is in these real-life moments that a well-chosen policy really proves its worth.

An insurer's job is to pay valid claims but they also have a duty to protect all their customers by making sure claims are genuine. This is why clear evidence and a good understanding of your policy are so important. To dive deeper, check out our guide on https://www.proova.com/why-your-insurance-company-might-refuse-to-pay-a-claim-and-what-you-can-do-about-it.

For another angle on understanding the intricacies of insurance costs and coverage , this guide on drone insurance is surprisingly useful. It breaks down similar principles of risk, value and getting the right level of protection.

The True Cost of Insurance Fraud

It is easy to think of insurance fraud as a victimless crime. After all, what is a little exaggeration on a claim form to a massive company like Aviva? But that way of thinking is a dangerous myth. The truth is, every single fraudulent claim sends ripples across the industry and it is honest policyholders who end up paying the price.

Insurance fraud is not just about elaborate, made-up stories like staged break-ins. It is often far more subtle. Think of someone inflating the value of a stolen laptop or adding a few extra items to a claim that were never really lost. Each fib, no matter how small, chips away at the trust the entire insurance system is built on.

The Impact on Your Premiums

So, where does the money from a fraudulent payout actually come from? It has to be drawn from the collective pot of premiums paid by every customer. According to the Association of British Insurers (ABI), a staggering £1.1 billion in dishonest claims were detected in just one recent year. To absorb these massive losses, insurers have no choice but to raise premiums on contents insurance Aviva policies for everyone.

Every fraudulent claim paid out is a direct tax on honesty, pushing up the price of essential protection for families and individuals across the country. It is a significant factor in making insurance more expensive.

To protect their honest customers, insurers have to take the provability of claims very seriously, which is why the process can sometimes feel so meticulous. To manage these risks and combat the true cost of insurance fraud, providers use rigorous checks, including essential identity verification services , to make sure every claim is legitimate.

Aviva's Stance on Fraud Detection

Aviva does not take this lightly. They use a combination of advanced data analytics and experienced investigation teams to spot suspicious patterns and inconsistencies in claims. This robust process is not there to give genuine claimants a hard time; it is designed to weed out the dishonest ones.

By investing heavily in fraud detection, Aviva works to keep the system fair and affordable for the vast majority of its customers. This commitment helps keep premiums as low as they can possibly be. The scale of the problem is huge and you can learn more by reading about the £308 billion problem and what insurance fraud really costs the industry.

How to Make a Provable and Painless Claim

Dealing with a theft or damage at home is stressful enough. The last thing you want is a complicated insurance claim on top of it all. The secret to a smooth process with any contents insurance Aviva policy is having solid, provable evidence ready to go.

This does not just get you paid faster; it helps protect the entire insurance system. While an insurer's job is to pay valid claims, they also have a duty to all their customers to stamp out fraud. When you can clearly show what you owned and its condition, you make their validation process simple. It is a win-win: you avoid delays and premiums stay fair for everyone.

Build Your Evidence Before You Need It

The absolute best time to prepare for a claim is right now, long before anything happens. A few simple habits can turn a potential nightmare into a straightforward admin task. Think of it as creating a digital inventory of your life’s valuables.

It is easier than you think. Just create a folder on your computer or in the cloud for your important items.

Good evidence includes:

- Digital Receipts: Whenever you make a big purchase, save a digital copy of the receipt. This is undeniable proof of ownership and what you paid for it.

- Photographs: Get into the habit of taking photos of your rooms and close-ups of your valuables. These images prove you owned the items and show their condition.

- Serial Numbers: Jot down the serial numbers for electronics like your TV, laptop or games console. It is concrete proof that a specific item belonged to you.

Having this information organised means you can hand Aviva everything they need right after an incident. This simple, proactive step is the key to a painless claim and ensuring you get a fair and accurate payout. It really highlights how real-time evidence changes everything from theft to payout , making the whole verification process quick and indisputable.

The Claims Process Demystified

So, the worst has happened. What next? Once you have made sure everyone is safe and reported any crime to the police, your next call should be to Aviva. They will connect you with a claims handler who will walk you through everything.

Having your evidence ready to share from that very first call can speed things up dramatically. It shows you are on top of things and helps the insurer validate your claim quickly, moving you from distress to resolution much faster.

This preparation takes all the mystery out of the process. You will understand exactly what insurers need and why they need it. They are not trying to be difficult; they are just doing their due diligence to verify every claim. By providing clear, provable evidence, you become a partner in getting a quick and fair result.

Why an Insurer's Financial Strength Matters

When you buy a contents insurance policy, you are not just buying a piece of paper. You are buying a promise. It is a promise that if the worst should happen, the insurer will be there to help you put things right.

But a promise is only as strong as the company making it. That is why an insurer’s financial stability is not just a minor detail—it is the absolute foundation of your peace of mind.

A financially solid insurer has the resources to handle a huge volume of claims all at once. Think about a widespread event, like a major flood that devastates an entire region. Thousands of policyholders will need help at the same time and a stable company can meet that sudden, massive demand without faltering.

The Scale of Aviva's Operations

Choosing a market leader like Aviva for your contents insurance gives you a level of reassurance that smaller providers might struggle to match. Their ability to manage enormous financial commitments is a direct benefit to you as a policyholder.

Aviva's sheer scale is a testament to its reliability. As one of the UK’s largest financial service franchises, it serves over 21 million customers . In a recent year, it paid out a staggering £29.3 billion in claims and benefits. This immense capacity to honour its policies demonstrates a rock-solid financial footing. You can find out more about Aviva’s operations and financial commitments on their official site.

This financial strength is your guarantee. It means that whether your claim is for a single stolen laptop or for extensive damage after a house fire, the funds are there to provide the payout you are entitled to.

Ultimately, this reassurance is a core part of the value you get with your contents insurance Aviva policy. You are not just insuring your belongings; you are securing a reliable financial backstop from a company proven to withstand large-scale events and consistently meet its obligations to millions.

Overcoming Barriers to Getting Insured

It is surprising how many households in the UK, especially renters, still skip contents insurance. This often boils down to a few common myths that create mental roadblocks to getting protected. People either worry about the cost or figure their stuff just is not valuable enough to bother with a policy.

This line of thinking is a huge gamble.

It is easy to underestimate the combined value of everything you own. Imagine having to replace all your clothes, books, kitchen gadgets and electronics after a fire or burglary. The financial hit would be massive. The reality is, a good policy is often far more affordable than people think.

Despite a growing market, research shows that around a quarter of UK households still do not have contents insurance. This points to a major gap in protection but it also creates an opportunity for insurers to design cover that is more straightforward and accessible. You can discover more insights about the UK home insurance market and see where things are headed.

Debunking Common Insurance Myths

Let us tackle some of the most persistent myths that stop people from getting the cover they genuinely need. Once you have the facts, the decision to get insured becomes a lot clearer.

- Myth 1: "It is too expensive." This is the number one reason people give for not getting covered. But a contents insurance Aviva policy can be shaped to fit your budget. By adjusting your cover level and the excess you pay, it almost always works out to be a tiny fraction of what it would cost to replace everything you own from scratch.

- Myth 2: "My landlord's insurance covers me." This is a critical mistake for renters. Your landlord's insurance protects the building itself—the bricks and mortar. If there is a fire, their policy will sort out the walls and roof but it will not replace your laptop, furniture or clothes. That is all on you.

- Myth 3: "I do not own enough valuable things." Even if you do not own priceless art or family jewels, think about the total replacement cost of your everyday items. It adds up fast. A basic policy provides an essential financial safety net for just about everyone.

By offering flexible policies, Aviva makes it possible to build a plan that fits your specific lifestyle and budget. You can adjust coverage limits and choose optional extras, ensuring you only pay for the protection you actually need.

Ultimately, getting past these barriers is about shifting your perspective. Instead of seeing insurance as just another bill, it is better to view it as a small, manageable investment in your financial security and peace of mind.

Your Aviva Insurance Questions Answered

When you are looking at an insurance policy, it is natural to have a few questions. Let us clear up some of the most common queries about contents cover from Aviva, so you can feel confident you have got the right protection in place.

How Do I Figure Out the Value of My Contents for Aviva?

The best way to get this right is to do a proper inventory yourself. Walk through your home, room by room and make a list of everything you own—from the big stuff like your sofa and TV down to your clothes and kitchen gadgets. The key is to find out what it would cost to replace them today , not what you paid for them years ago.

You could use an online calculator for a ballpark figure but nothing beats a detailed list. If you can back it up with photos and receipts, you have created a solid, provable record. This simple step avoids any guesswork and makes a potential claim much smoother for everyone involved.

Does Aviva Cover Accidental Damage as Standard?

No, this is usually an optional extra you need to add on. A standard contents insurance Aviva policy is there to protect you from major events like a fire, theft or flood. For those everyday mishaps—like spilling red wine on the new carpet or knocking your TV off its stand—you will need to add specific accidental damage cover.

It is always a good idea to double-check your policy documents to see exactly what you are and are not covered for.

Are My Laptop and Phone Covered When I Leave the House?

Your standard contents insurance only covers your belongings while they are physically inside your home. If you want to protect items like your phone, laptop or even your bike when you are out and about, you will need to add 'Personal Possessions Cover' to your policy.

This add-on extends your protection beyond your front door, giving you real peace of mind wherever you go.

Get your claims sorted faster and protect yourself from fraud with Proova . Our platform helps you build a secure, verifiable inventory of your belongings, leading to a much quicker and fairer claims process. See how it works at https://www.proova.com.