AIG For Intermediaries: A UK Broker's Guide

Working with AIG gives UK brokers a powerful suite of products and digital tools, all designed to help them succeed. This partnership is not just about selling policies but about arming brokers with the resources they need to handle complex risks, prove claims and deliver real value in a tough market.

The Evolving Role of the Modern Insurance Broker

The world of the UK insurance broker is changing, and fast. The days of simply selling a policy are long gone. Today, clients expect a true consultative partner—an expert who can offer bespoke advice and help them navigate an increasingly complex risk landscape.

This shift from transaction to consultation means brokers have to prove their worth in tangible ways. It is no longer enough to find a competitive premium. Now, it is about providing sharp risk management insights and ensuring claims are handled with provable accuracy. This focus on solid evidence is a direct response to the rising tide of insurance fraud, which hits everyone’s pockets, from the policyholder to the insurer, and ultimately costs the industry billions.

From Salesperson to Strategic Partner

The modern broker's job description has expanded dramatically. It is now a role that demands a much deeper level of engagement and responsibility.

- Bespoke Risk Analysis: Clients need partners who can really get under the bonnet of their unique risk profiles and recommend tailored cover, not just an off-the-shelf product.

- Navigating Complexity: From cyber threats to thorny liability issues, brokers are on the front line, translating complex insurance jargon into practical, real-world strategies.

- Demonstrating Value: Success is now measured by the quality of advice given, the strength of the cover provided and how smoothly the claims process runs.

This evolution is exactly why the provability of claims has become so important. For example, understanding why insurance brokers need digital proof more than ever shows just how vital verifiable data is for building client trust and fighting fraud. It is a challenge the entire industry is facing, and it is shaping how major insurers think and act.

AIG’s intermediary-first approach is a direct answer to these industry shifts. It is built on a simple idea: by empowering brokers with better tools, specialised products and a solid commitment to claims integrity, the whole insurance ecosystem gets stronger.

As the role continues to evolve, bringing new tools into the fold is no longer a luxury—it is essential. Getting to grips with resources like guides on AI Chatbots for Insurance Agents can help smooth out client interactions and make day-to-day operations far more efficient. By embracing these advances, brokers can not only meet modern client demands but truly thrive, cementing their position as indispensable partners in risk management.

AIG's Deep-Rooted Commitment to UK Intermediaries

For AIG, the partnership with UK intermediaries is not just another sales channel; it is a foundational piece of their entire business strategy. Think of it as a genuine partnership where both sides are pulling in the same direction, especially when it comes to proving claims and tackling the persistent problem of insurance fraud.

Insurance fraud is not a victimless crime. It is a costly issue that pushes up premiums for everyone and chips away at the trust that holds the industry together. AIG gets this. That is why they arm their intermediary partners with the data, training and support needed to properly assess risk and write policies with confidence. This hands-on collaboration is vital for keeping the market on stable ground.

This relationship gives brokers access to a global support network and world-class products. In return, AIG gains something just as valuable: the on-the-ground expertise and deep client relationships that only local intermediaries can bring to the table.

A Partnership Proven by Performance

The success of this intermediary-first model is not just talk; you can see it clearly in AIG's impressive financial turnaround. This recovery story really shines a light on what happens when you combine AIG's global muscle with the specialised knowledge of UK brokers.

It was not always smooth sailing. Between 2008 and 2018, AIG was in a tough spot with its underwriting, racking up cumulative losses of over $30 billion . But a major strategic shift to lean into its intermediary network has turned things around dramatically. Since 2021, the company has consistently posted underwriting profits exceeding $2 billion each year—a powerful testament to how well this collaboration works.

Intermediaries in the UK have been absolutely critical, matching AIG’s specialised products—like cyber insurance for tech start-ups or complex liability cover for contractors—to the clients who need them most. This tailored approach has boosted customer satisfaction and retention, which in turn has strengthened financial stability, helping the full-year combined ratio drop below 90 by 2022. You can dig into the numbers yourself in AIG's 2023 annual report.

This strategic alignment shows that AIG for intermediaries is more than a slogan; it is a model built for shared success and the long-term health of the market.

Fostering Confidence Through Collaboration

A central pillar of this relationship is the shared fight against fraudulent claims, which ultimately hurt everyone by driving up costs. By equipping brokers with sophisticated tools and data-driven insights, AIG empowers them to act as the first line of defence.

The goal is to create a more transparent and resilient insurance market where genuine claims are settled swiftly and fraudulent activity is identified and prevented. This builds trust not only between the insurer and the broker but also between the broker and their end client.

This collaborative spirit means intermediaries can place complex risks with total confidence, knowing they have the backing of a carrier that is serious about sound underwriting and robust claims handling. It is this support system that allows brokers to deliver exceptional value, turning client interactions into lasting partnerships built on trust and reliability. It is a powerful combination that benefits the entire insurance ecosystem.

Getting to Grips with AIG's Platforms and Core Solutions

For UK intermediaries, AIG has developed a set of digital tools aimed at taking the friction out of the entire policy lifecycle. Think of these platforms as a central hub, designed to pull brokers away from the old world of cumbersome paperwork and into a much more efficient, client-focused way of working. The main broker portal simplifies everything from quoting and binding right through to day-to-day policy management.

This digital toolkit is especially useful when placing specialised commercial lines, which is a major focus for AIG for intermediaries . Products like professional indemnity and cyber liability demand both precision and speed, and that is exactly what the platform is built to deliver. By bringing these solutions together, AIG helps lighten the administrative load that so often slows brokers down.

What this really means is you get more time back in your day. Instead of getting bogged down in processes, you can concentrate on the high-value advisory work that your clients truly appreciate, strengthening relationships and providing the kind of strategic risk advice that really makes you stand out. The efficiency boost also helps keep a lid on operational costs—a vital part of running any successful brokerage.

Core Solutions for Modern Risks

AIG's product suite is not just a random list of policies. It is a carefully selected set of solutions designed to tackle the complex risks that UK businesses are grappling with right now. The focus is squarely on areas where AIG’s deep underwriting expertise and global claims experience give both the broker and the end client a real edge.

Key product lines available through the intermediary channel include:

- Professional Indemnity: Robust protection for professionals facing claims of negligence or a breach of their duties.

- Cyber Liability: Comprehensive cover for the fallout from data breaches, system interruptions and the ever-present threat of cyber-crime.

- Specialised Commercial Lines: A wide range of cover for unique risks across diverse industries, from technology to manufacturing.

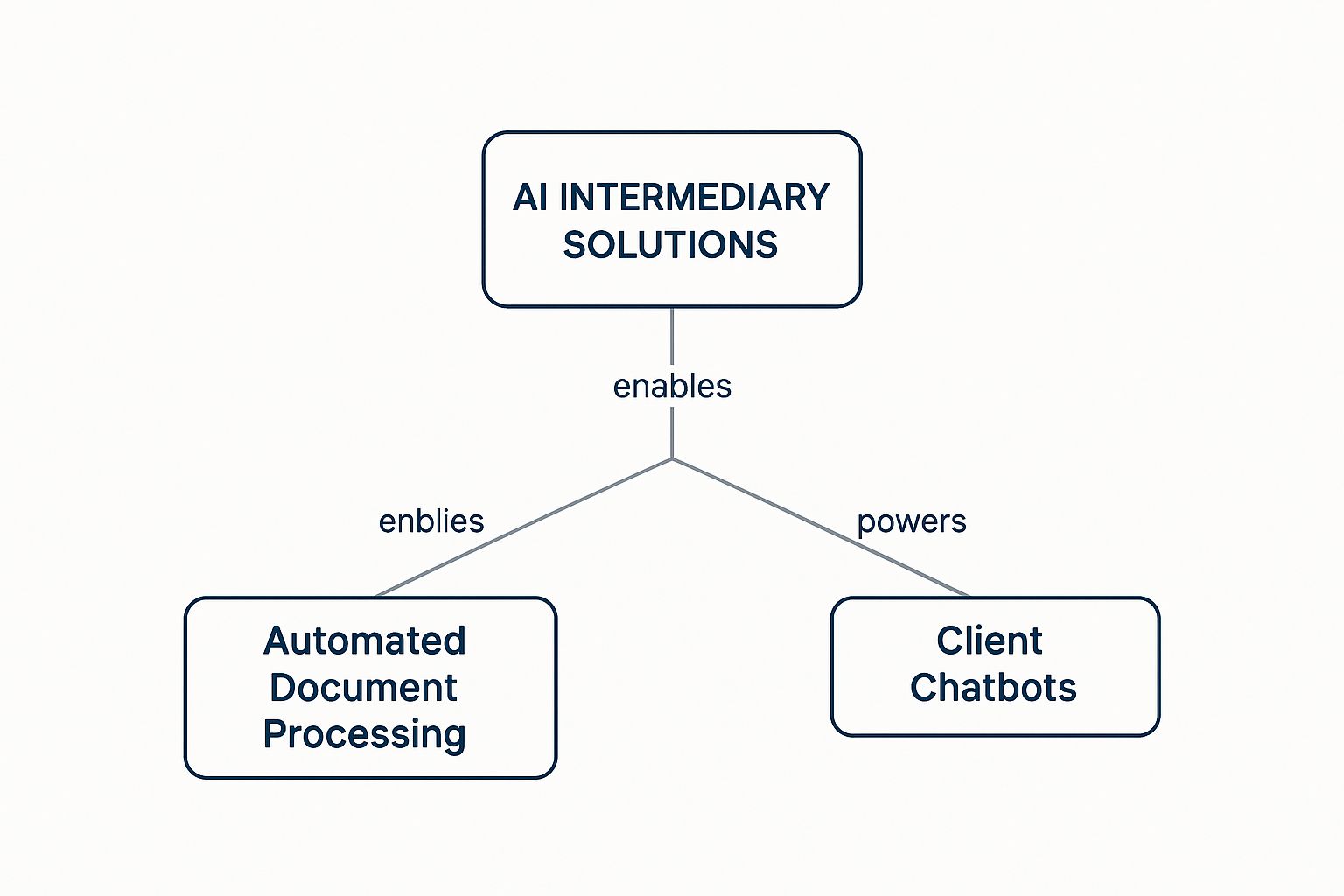

This concept map below illustrates how solutions like these are becoming fundamental to the modern intermediary's toolkit.

As the diagram shows, technology sits at the heart of the modern intermediary's functions, from processing documents and analysing risk to engaging more effectively with clients.

To give you a clearer picture, here is a breakdown of how the platform’s features translate into direct benefits for your brokerage.

AIG Intermediary Platform Feature Overview

| Platform Feature | Description | Benefit for Intermediary |

|---|---|---|

| Digital Quoting & Binding | Allows brokers to generate quotes and bind policies online in real-time for key commercial lines. | Speeds up the placement process, improving client response times and securing business faster. |

| Policy Management Dashboard | A centralised view of all client policies, renewal dates and key documents. | Simplifies portfolio management and reduces the administrative effort needed to track policies. |

| Claims Reporting Portal | A dedicated online tool for submitting and tracking the status of new claims. | Provides a more efficient and transparent claims process, keeping both broker and client informed. |

| Product Information Hub | An accessible library of policy wordings, marketing materials and underwriting guides. | Ensures brokers have the latest information at their fingertips to advise clients accurately. |

| Direct Underwriter Access | Integrated communication tools to connect with AIG underwriters on complex cases directly. | Facilitates quicker decision-making and better collaboration on specialised or high-value risks. |

These features work together to create a more connected and responsive experience, making it easier to do business and serve clients well.

Boosting Efficiency and Provability

One of the standout benefits of using AIG’s platform is how it strengthens claims provability. When you have accurate, digitally logged data from the very start of a policy, the claims process becomes far smoother and less likely to hit snags. This focus on clear, verifiable information is also a powerful weapon against insurance fraud, a persistent problem that drives up costs for everyone.

By simplifying the quoting and binding process, AIG’s platform ensures that all policy details are captured accurately and efficiently. This creates a solid foundation of proof that is invaluable when a claim occurs, protecting both the client and the insurer.

The integration of these digital tools has a direct and positive impact on your operational effectiveness. To dig deeper into this, you can learn more about the role of technology in reducing insurance claims costs in our related article. Ultimately, AIG’s solutions empower brokers to work smarter, not harder, letting you deliver superior service while upholding the integrity of the underwriting process.

Enhancing Profitability and Managing Client Risk

For any intermediary, long-term success is not just about closing deals. It is about the stability and reliability of the carriers you choose to work with. Partnering with a financially solid insurer like AIG has a direct, tangible impact on your brokerage's profitability and reputation.

It is simple, really. A strong partner helps you sidestep the massive risks that come with market volatility or, worse, unpaid claims. Those issues do not just cost money; they shatter client trust and can seriously damage your standing in the industry.

AIG's sharp underwriting and disciplined approach to risk management mean brokers can place complex risks with genuine confidence. This is not just about writing more business—it is about writing good , sustainable business. A stable carrier guarantees that when a client has a legitimate loss, the claim gets paid fairly and quickly. That simple act reinforces your value and builds relationships that last for years.

This commitment to stability is backed by a meticulous claims handling process and a tough stance against insurance fraud—a problem that drives up costs for everyone. By zeroing in on the provability of claims, AIG helps protect the entire insurance ecosystem.

The Impact of a Strong Claims Infrastructure

One of the most valuable things AIG brings to the table for intermediaries is its powerful claims infrastructure. With a global team of claims professionals, your clients get prompt, expert support right when they need it most. That level of service is absolutely critical for client retention, which is the bedrock of any profitable brokerage.

You can see this operational strength in the numbers. AIG’s General Insurance division hit a combined ratio of 91.8% , making it the third year in a row with a sub-92 combined ratio. This financial discipline is supported by a smart reinsurance strategy, crafted in close collaboration with UK intermediaries who know their clients' risk profiles inside and out. With more than 4,200 claims professionals worldwide, AIG provides the frontline support that proves your role as a trusted advisor.

For intermediaries working with property cover, getting the client's risk assessment right means having a firm grasp on property values. A core part of this is understanding the rebuild cost for insurance , which is essential to prevent underinsurance and keep policies stable.

Partnering with AIG means you are not just selling a policy; you are delivering a promise of financial security backed by one of the world's most respected insurers. In a competitive market where trust is the ultimate currency, that assurance is priceless.

The efficiency of the claims process cannot be overstated. When claims are managed well, it does not just keep the client happy—it frees up your time. Our article on https://www.proova.com/how-proova-helps-brokers-speed-up-claim-resolutions-by-70 dives deeper into this. This efficiency strengthens the entire value chain, letting you focus on growing your business, confident that your existing clients are in safe hands.

Of course. Here is the rewritten section, crafted to sound completely human-written and natural, following the style of the provided examples.

Carving Out a Niche in the UK Market with AIG

In the crowded UK insurance market, headline market share figures do not always give you the full picture. While a few giants might seem to dominate, AIG’s focused strategy in the intermediated space gives brokers a real edge. This is not about chasing volume; it is about giving intermediaries the tools and specialised products to serve clients who need something more than a one-size-fits-all policy.

Partnering with AIG means you are not just getting another product provider. You are tapping into a global powerhouse with serious expertise in complex and high-stakes risk. That financial muscle offers incredible peace of mind, both for you and your client. It is the quiet confidence that comes from knowing that when a legitimate claim comes in, the backing is there to make it right. That kind of reliability is the bedrock of any strong client-broker relationship.

Turning Global Strength into Local Impact

This is where you, the intermediary, come in. The real magic happens when you act as that crucial link between AIG's global capabilities and the specific, on-the-ground needs of UK businesses and individuals. You are the local expert who can translate a complex insurance solution into practical cover that solves a real-world problem. AIG provides the powerful products; you are the one who crafts them into the perfect fit.

This partnership model is at the heart of how AIG operates in the UK. As of the second quarter of 2025 , AIG holds a market share of around 2.74% in the UK insurance sector. On the surface, that might seem small next to the industry titans, but its influence where it matters—in the intermediated segment—is substantial. The strategy is all about empowering brokers and financial advisors with comprehensive solutions, so you can offer finely tuned products for niche client needs. It is an approach that secures AIG’s position by focusing on the part of the market that truly values expert advice. If you want to dig deeper into the numbers, you can explore more about AIG's competitive landscape .

For intermediaries, this means AIG is not just a provider but a genuine strategic ally. The goal is not mass-market saturation. It is about delivering high-quality, specialised cover through brokers who know their clients' worlds inside and out.

This synergy allows you to carve out a strong position for yourself. You can offer sophisticated products like cyber liability or professional indemnity with the full confidence that comes from having a globally recognised carrier behind you. It is this blend of broker expertise and insurer strength that builds lasting value and helps UK businesses navigate an increasingly complex world with a lot more certainty.

Getting the Most from Your AIG Partnership

Forging a strong, profitable partnership with AIG is about more than just getting access to their platforms. It is built on a foundation of proactive communication, a real commitment to continuous learning and a shared goal of protecting the integrity of the insurance market. For brokers and agents ready to truly maximise this relationship, a few key practices can make all the difference.

It all starts with a successful onboarding. This means going beyond the basics and really immersing your team in AIG’s training modules and key resources. If you understand their underwriting appetite and risk philosophy from day one, you will avoid a lot of friction down the line and ensure you are bringing the right kind of business to the table. This alignment is absolutely vital for long-term success.

This foundational knowledge directly feeds into your ability to advocate for your clients. When you can clearly communicate their needs to AIG underwriters—backed by a solid grasp of AIG’s own perspective—you are far more likely to secure the best outcomes for everyone involved.

Strategic Alignment for Mutual Growth

A truly successful partnership is a two-way street. It is not just about placing business but about actively using the support systems AIG has put in place. Tapping into their marketing support, for instance, can help you articulate the value of specialised cover to your clients, cementing your position as an expert advisor.

Here are a few practical steps to make sure your AIG partnership thrives:

- Master the Tools: Dedicate proper time to learning the AIG intermediary portal inside and out. Every bit of efficiency you gain here frees you up for more valuable, client-facing activities.

- Build Underwriter Relationships: Do not wait for a problem to arise. Proactively communicate with AIG underwriters. A strong working relationship can be invaluable when you are trying to place a complex or unusual risk.

- Stay Informed: Regularly check in with AIG’s market insights and product updates. This keeps your advice sharp, relevant and ahead of the curve.

The core of a successful AIG for intermediaries partnership lies in a shared commitment to quality and transparency. By focusing on clear communication and continuous learning, you build a foundation of trust that benefits your clients, your brokerage and the wider industry by helping to reduce the impact of fraud.

Ultimately, putting these practices into action transforms the relationship from a simple transactional one into a genuine strategic alliance. This alignment ensures you are not just selling policies but are building a sustainable book of business backed by a world-class insurer, paving the way for mutual growth and lasting success.

Got Questions About Working With AIG?

Stepping into a partnership with a global insurer like AIG naturally brings up a few questions. We have put together some straightforward answers to the most common queries we hear from UK brokers and agents who are thinking about, or already, working with AIG.

Our aim here is to demystify the AIG for intermediaries experience. Getting these practical details clear from the outset is the best way to build a solid, successful partnership right from day one.

How Do I Become an Approved AIG Intermediary in the UK?

First things first, you will need to get in touch with AIG's UK broker relationship team. The process kicks off with an application, followed by a thorough due diligence check to make sure your firm ticks all the regulatory boxes and is a good fit for AIG's partnership standards. Once that is sorted, they will walk you through the rest of the onboarding steps.

What Training Does AIG Provide for New Brokers?

AIG sets you up for success with a really comprehensive onboarding programme. This includes training modules for their broker portal, deep dives into specific product lines and clear guidance on their underwriting appetite. You also get ongoing access to a wealth of resources and specialist teams to keep you sharp on market trends and risk management. It is this commitment to continuous learning that really makes a difference.

A huge part of the AIG partnership is about equipping intermediaries with the knowledge to uphold the provability of claims. This kind of collaboration is essential in the fight against insurance fraud, which costs the UK economy over £3 billion a year. Ultimately, it protects honest policyholders and the integrity of the industry.

Which Client Profiles Are Best Suited for AIG's Products?

AIG really shines when it comes to clients with complex or specialised risks. Think businesses in cutting-edge sectors like technology (cyber liability), professional services (professional indemnity) or large commercial operations that need bespoke multinational programmes. Their strength is not in competing on price; it is in delivering deep expertise and genuine value where it matters most.

At Proova , we know just how critical claims verification and fraud prevention are. Our platform gives intermediaries a simple, secure way to document assets and make the claims process smoother for everyone involved. See how Proova can help you strengthen client relationships and your partnership with insurers like AIG.