A Plain English Guide to Rights of Subrogation in the UK

In simple terms, rights of subrogation are what allow your insurer to legally 'step into your shoes' after they have paid your claim. It’s a formal way of saying they can pursue the person or company who caused your loss to recover the money they paid out to you.

At its heart, it’s a core principle that makes sure the at-fault party is held accountable.

Understanding Your Insurer's Rights of Subrogation

Let’s use a classic example. Imagine a delivery driver carelessly reverses into your parked car, causing a fair bit of damage. You file a claim with your motor insurer, who sorts it out quickly and pays for the repairs to get you back on the road.

Without subrogation, that is where the story would end. The driver and their employer would face no real financial consequences for their mistake.

But subrogation changes the game completely. Once your insurer settles your claim, they effectively inherit your legal right to demand compensation from the person responsible. They can then take up the chase with the delivery company or their insurer to recover the repair costs. It is a process built on fairness.

To make things clearer, let's break down the key ideas.

Subrogation at a Glance: Key Concepts

This table offers a quick summary of the fundamental principles and parties involved in the subrogation process.

| Concept | Simple Explanation | Who It Involves |

|---|---|---|

| The Insurer | The company that pays your claim first. | Your insurance provider (e.g., motor, property insurer). |

| The Insured | You—the person who suffered the loss and received the payout. | The policyholder. |

| The Third Party | The person or company responsible for causing the loss. | The at-fault individual, business, or their insurer. |

| The 'Right' | The legal authority for the insurer to act on your behalf to recover costs. | This is the core of subrogation. |

Ultimately, it’s a straightforward transfer of rights from you to your insurer after they have made you whole.

The Core Principles of Subrogation

Subrogation isn’t just about insurers clawing their money back; it serves a few critical functions that keep the whole insurance system ticking.

Its main goals are to:

- Hold the At-Fault Party Responsible: It makes sure the person or business that actually caused the damage is the one who ultimately pays for it.

- Prevent Double Recovery: It stops you, the policyholder, from getting paid twice for the same loss—once from your insurer and then again from the person who caused it.

- Manage Industry Costs: By recovering funds from at-fault parties, insurers can offset what they pay out in claims. This helps keep premiums more affordable for everyone.

The entire concept hangs on a simple truth: the party that causes the damage should be the one to carry the financial weight. Subrogation is the legal tool that makes this happen.

Why Provability Is Everything

An insurer's ability to actually use its subrogation rights comes down to one thing: the strength of the evidence. You cannot have a successful recovery without clear, provable facts that pin the fault on a third party.

This is exactly why gathering solid evidence right from the start of a claim is not just a good idea—it is absolutely essential.

Weak or missing evidence can completely sink an otherwise solid subrogation case, leaving the insurer to swallow the cost. Those unrecovered losses contribute to the rising cost of claims, which eventually gets passed on to all of us through higher premiums. In the end, the provability of a claim is the bedrock of a fair and functioning insurance market.

The Legal Framework for Subrogation in the UK

Subrogation rights in the UK are not some new-fangled legal concept; they are deeply rooted in centuries of common law. This long-standing tradition is what allows an insurer to step into a policyholder's shoes and pursue a negligent third party after paying a claim. It’s the very foundation of how insurers manage and recover losses.

Of course, these days it’s not just left to tradition. This right is almost always spelled out in black and white within modern insurance policies. This contractual language makes the insurer’s position crystal clear, removing any doubt about their authority to act on their customer's behalf.

Ultimately, the wording in the policy is the final say. It can fine-tune or even expand on the common law rights, defining the exact scope of the insurer's power to chase a recovery.

The Landmark Ruling That Shaped Modern Subrogation

When it comes to complex claims, the legal landscape was clarified significantly by a crucial House of Lords decision. This case created a clear pecking order for how recovered money should be shared, which is especially important when multiple layers of insurance are involved.

The landmark ruling in Lord Napier and Ettrick v Hunter (1993) established what’s known as the “top-down” rule for allocating subrogation recoveries. This principle dictates how multiple insurers get their money back, giving priority to those providing the higher layers of cover. It means any recovered funds are applied first to the highest excess layers before trickling down to the lower ones—a system that remains vital in large, complicated claims today. You can discover more about this foundational legal case and its lasting impact.

This 'top-down' approach ensures a fair and logical distribution of any money clawed back from the responsible party. It neatly sidesteps potential squabbles between different insurers covering the same loss by setting out a clear order of repayment.

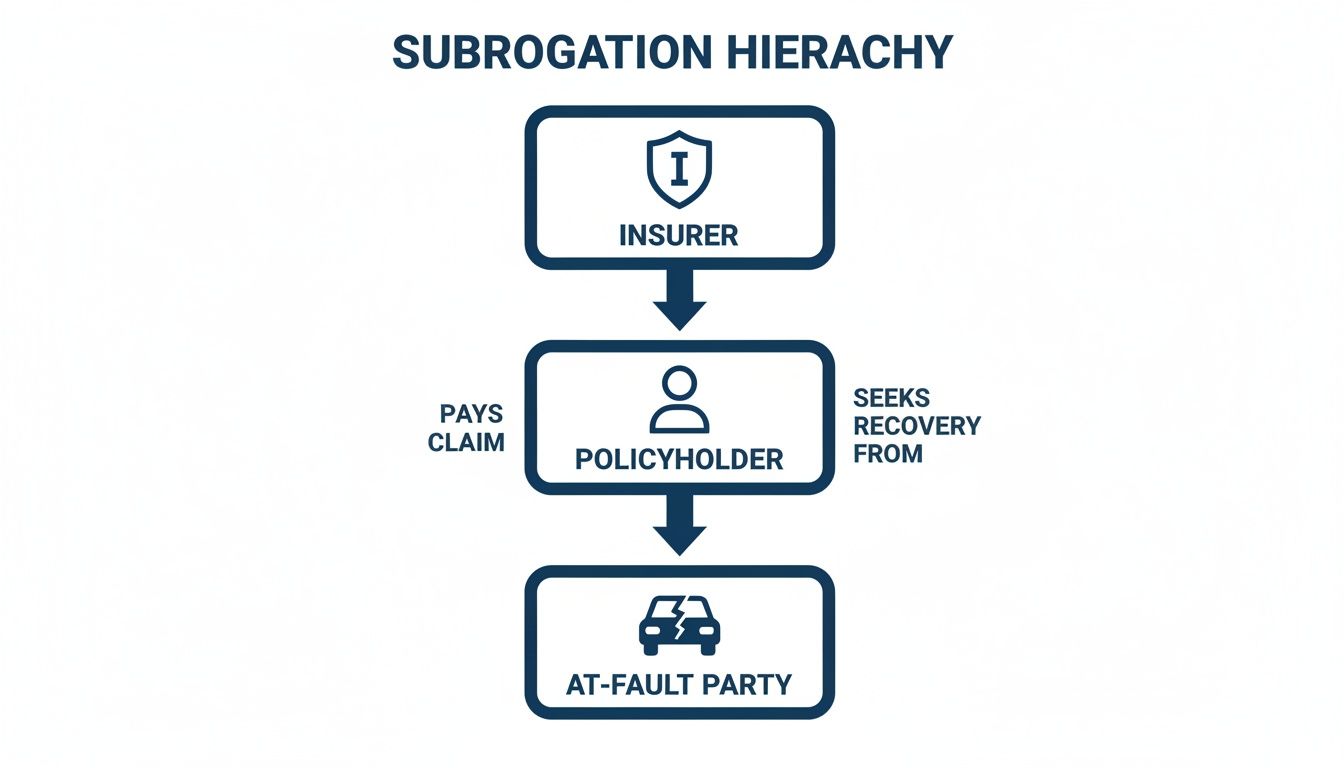

The diagram below shows the typical flow of a subrogation claim, from the insurer to the at-fault party.

As you can see, the process is straightforward: the insurer first pays the policyholder's claim and then takes over their right to seek financial recovery from the third party who caused the damage in the first place.

Provability and its Impact on the Industry

The entire legal framework for subrogation hinges on one critical thing: provability . Without solid, compelling evidence to prove a third party was negligent, an insurer’s rights are just theoretical. A weak or poorly substantiated claim simply will not fly and often is not worth the time or money to pursue.

When a claim cannot be proven, the loss stays with the insurer. This does not just hit one company; it contributes to wider industry costs, which eventually get passed on to every policyholder through higher premiums.

This is also where the battle against insurance fraud becomes so important. Fraudulent claims, by their very nature, are built on lies and lack genuine provability. They drain valuable resources that could be used to chase legitimate recoveries, driving up costs for honest customers.

A strong legal framework, backed by undeniable evidence, is essential for a few key reasons:

- Deters Negligence: It makes at-fault parties financially accountable for their actions.

- Reduces Costs: Successful recoveries help offset claim payouts, keeping premiums stable for everyone.

- Combats Fraud: A sharp focus on provability makes it much harder for fraudulent claims to succeed.

The strength of the UK’s legal framework for subrogation is, therefore, directly tied to an insurer's ability to gather clear, verifiable and indisputable evidence.

How Subrogation Affects Your Insurance Premiums

The idea of subrogation can feel a bit abstract but its impact hits you right where it counts: your wallet. When an insurer successfully uses their rights of subrogation to get money back from the party who caused the damage, it is not just a win for them. It’s a vital process that helps keep the entire insurance market stable.

Think of it like financial recycling. Every single pound an insurer recovers is a pound they do not have to write off as a loss. This money flows back into the central pot, helping to offset the enormous sums paid out in claims every year.

The Direct Link to Your Policy Costs

Without subrogation, the total cost of every claim caused by a third party would have to be spread across all policyholders. Insurers would have no option but to hike up premiums for everyone to cover these unrecovered losses. In short, you would pay more for your policy, regardless of your own claims history.

Successful recoveries boost an insurer's financial health by lowering their total claims spend. This stability is the bedrock of fair and sustainable insurance pricing, allowing them to offer competitive premiums while still having the funds to pay future claims without delay.

You really cannot overstate the importance of these recoveries. Major reinsurers have reported that strong subrogation efforts can significantly offset underwriting losses. In some cases, third-party recoveries have clawed back nearly the entire cost of the insured losses, directly improving the bottom line and reinforcing the insurer's financial strength. Discover more insights on how subrogation efforts pay off.

A Wider Economic Benefit

Beyond keeping your premiums in check, subrogation has a crucial role in promoting responsibility and discouraging negligence. It sends a powerful signal that carelessness comes with financial consequences.

By ensuring the party at fault ultimately pays, subrogation creates a powerful financial deterrent against negligent behaviour, contributing to a safer and more accountable society for everyone.

This process also acts as a filter against insurance fraud. If a claim is fraudulent, it usually lacks the solid evidence needed for an insurer to pursue subrogation. This naturally focuses attention on legitimate, evidence-backed claims and helps weed out attempts to cheat the system—a cost that ultimately hits every policyholder.

In essence, subrogation is a cornerstone of the insurance ecosystem. It directly impacts:

- Premium Affordability: Recoveries help keep your annual insurance costs lower than they would otherwise be.

- Industry Stability: It ensures insurers remain financially sound and capable of meeting their promises to policyholders.

- Societal Accountability: It holds negligent parties responsible for the consequences of their actions.

This makes it far more than just a dry legal procedure; it is a fundamental tool for managing risk, fighting fraud and maintaining fairness across the entire insurance industry.

Why Strong Evidence Is Crucial for Subrogation Claims

An insurer's rights of subrogation are only as strong as the evidence backing them up. The whole process really boils down to one simple, yet critical, factor: can you prove, without a shadow of a doubt, that another party was at fault? Without solid proof, the right to recover losses is just a theory, leaving the insurer to foot the bill.

This is why the provability of claims is so fundamental. For any subrogation effort to work, there needs to be a clear, unbroken chain of evidence that points the finger directly at a third party’s negligence. The link between quality evidence and a successful outcome cannot be overstated; it’s the bedrock of every single recovery action.

The Challenge of Gathering Quality Proof

Out in the real world, securing definitive proof is rarely a straightforward affair. Insurers face countless hurdles that can weaken or even completely derail a potential recovery claim before it even gets off the ground.

These challenges often include things like:

- Evidence Degradation: Physical evidence can be lost, damaged or simply disappear over time, especially if it is not documented on the spot.

- Uncooperative Parties: Witnesses might forget key details or become unwilling to help, while at-fault parties may actively try to muddy the waters.

- Delayed Reporting: The longer the gap between an incident and the claim report, the harder it becomes to piece together an accurate picture of what really happened.

These hurdles make the first few moments after an incident absolutely critical. That first opportunity to capture the scene is often the best—and sometimes the only—one you will get.

The Role of Technology in Strengthening Claims

This is where modern technology really makes its mark. Capturing clear, verifiable and time-stamped evidence from the second a claim is reported can dramatically strengthen an insurer's position. It shifts the claim from a messy "he said, she said" scenario to one built on undeniable facts.

Think about it. A high-definition video of a faulty appliance taken moments after a fire carries far more weight than a verbal description given weeks later. Likewise, time-stamped photos of a contractor's shoddy work can dismantle any attempt to deny responsibility. This kind of real-time documentation is invaluable, particularly when tackling complex cases like theft, as it creates a clear and immediate record of events. You can learn more about how real-time evidence changes everything in our detailed article.

Capturing indisputable evidence at the outset is the most effective way to combat insurance fraud and ensure legitimate claims can be successfully subrogated. It protects the insurer, the policyholder and the integrity of the industry.

By making robust evidence gathering a priority, insurers can prove liability far more easily, shut down fraudulent activity and secure the financial recoveries that ultimately help keep premiums affordable for everyone.

Real-World Examples of Subrogation in Action

Theory is one thing but seeing how subrogation rights play out in the real world is where it all clicks. These everyday scenarios show how an insurer can step into their policyholder's shoes to make sure the person or company at fault is held financially accountable for the damage they caused.

The entire process hangs on one critical element: proof. Without solid, undeniable evidence that a third party was negligent, an insurer's subrogation rights are essentially powerless. Getting this right not only helps recover costs but also acts as a powerful deterrent against the kind of insurance fraud that ends up costing everyone more in premiums.

Let’s walk through a few common situations to see how it works, from the initial incident right through to the final recovery.

Common Subrogation Scenarios

Subrogation applies across many different types of insurance, from everyday car accidents to complex commercial losses. While the specifics change, the core principle remains the same: identify the liable party and recover the costs. The table below breaks down a few typical examples.

| Scenario | At-Fault Party | Typical Evidence Required | Potential Recovery |

|---|---|---|---|

| Leaky Apartment Above | The upstairs neighbour | Photos/videos of the leak, plumber's report, witness statements. | Costs for repairs to ceilings, walls, flooring and damaged contents. |

| Faulty Product Fire | The product manufacturer | Expert forensic report, the defective product itself, purchase receipts. | Repair/replacement of damaged property, business interruption losses. |

| Delivery Driver Damage | The delivery company | CCTV footage, photos of the damage, driver's admission of fault. | Repair costs for damaged gates, walls or other property. |

| Tree Falling From Next Door | The neighbour (if negligent) | Arborist's report showing the tree was diseased/unsafe, photos. | Costs to remove the tree and repair damage to the roof, fence or garden. |

As you can see, the success of any subrogation attempt comes down to the quality of the evidence. A clear, well-documented case makes it far easier to prove liability and secure a recovery.

Motor Claim: A Distracted Driver

Imagine you are stopped at a red light when another car slams into your rear bumper. The other driver was texting and did not see you stop. The damage is not catastrophic but your insurer still pays out £5,000 for repairs and a hire car to keep you mobile.

Once you are back on the road, the insurer’s recovery team gets to work. They use the evidence gathered—dashcam footage, witness statements and the police report—to build a watertight case against the distracted driver. They then pursue that driver's insurer to get back the full £5,000 they paid out on your behalf.

Home Insurance Claim: Faulty Workmanship

A homeowner has just had a brand-new kitchen fitted but the plumber made a crucial error when connecting the washing machine pipes. A few days later, what started as a slow drip becomes a major flood, ruining the new cabinets, flooring and freshly painted walls. The home insurer pays £15,000 to make everything right again.

The insurer's investigation quickly points the finger at the plumber's shoddy work. Armed with an expert's report and clear photos of the faulty connection, the insurer exercises its rights of subrogation. They file a claim against the plumber's public liability insurance to recover the full £15,000 . Without this, the negligent tradesperson would face no financial consequence for their mistake. If you ever find yourself in a similar situation, it is helpful to understand the steps involved; our guide to master the home insurance claims process is a great place to start.

Commercial Claim: A Defective Component

A small manufacturing business invests in a new piece of machinery. A critical component inside it is defective and fails catastrophically, causing a small fire and forcing production to a halt for a week. The business’s insurer covers the £50,000 cost of the damaged machine and the lost income.

The insurer’s own forensic investigators trace the fault directly back to that specific component. From there, the insurer initiates a subrogation claim against the component's manufacturer to recover the £50,000 payout. These cases can get complicated and are often disputed, which really highlights the commercial importance of having strong subrogation rights.

In every single one of these scenarios, the goal is identical: to make sure the financial burden lands squarely on the party that caused the loss in the first place. This is not just about money; it upholds fairness, discourages negligence and helps control the costs that affect the entire insurance industry.

Common Questions About Subrogation

Even when you get your head around the basic idea, the practical side of subrogation can throw up a few questions. It’s a process that mostly happens behind the scenes, yet your cooperation is absolutely vital for it to work. Let's tackle some of the most common queries to clear up your role and what is expected of you.

At its heart, your insurance policy is a contract between you and your insurer. Buried in that contract are clauses that legally require you to help them with any recovery action. Without that teamwork, the whole system of holding negligent people accountable would fall apart and that would just drive up costs for everyone.

Do I Have to Help My Insurer with Their Subrogation Claim?

Yes, you do. Think of your insurance policy as a two-way agreement. It includes a cooperation clause , which means you are contractually obliged to assist your insurer. This is not usually a huge burden—it might just mean providing some documents, giving a witness statement or, in rare cases, attending court.

Choosing not to cooperate is a big deal. It could be seen as a breach of your policy terms and that can have serious consequences. The worst-case scenario? Your insurer could try to recover the claim payment from you. Your help is essential because, legally speaking, the action against the third party is pursued in your name.

What Happens If the Insurer Recovers More Than They Paid Me?

This is a great question and the answer is built around a principle of fairness. The golden rule is that you, the policyholder, must be made ‘whole’ first.

If the recovered amount is enough to cover your entire loss, the first thing your insurer will do is use it to refund any excess you paid. It will also cover any other uninsured losses you might have had from the same incident—things your policy did not cover but you had to pay for out of pocket.

Only after you have been fully compensated does the insurer keep the rest and even then, only up to the amount they paid out for your claim. The system is designed to put you back in the financial position you were in before the incident, not for anyone to turn a profit.

The goal is always restoration, not enrichment. Subrogation ensures you are fully compensated for your insured and uninsured losses before the insurer recoups its own costs. This principle of fairness is central to the entire process.

Can I Stop My Insurer from Pursuing Subrogation?

Generally, no. The right to subrogate is a fundamental part of your insurance agreement. When you accept a claim payment, you essentially transfer your legal right to sue the at-fault party over to your insurer.

The real danger here is accidentally getting in their way. For example, if you sign a waiver or accept a private cash settlement from the third party without your insurer's approval, you could completely destroy their ability to recover their costs. This is known as ‘prejudicing’ their rights and it is a serious breach of your policy. For more on claim disputes, check out our guide on what to do if your insurance company refuses to pay a claim.

How Long Does the Subrogation Process Take?

This is a classic "how long is a piece of string?" question. The timeline can vary wildly depending on how complex the case is. A straightforward road traffic accident where fault is crystal clear might be sorted out in a few months.

On the other hand, a complex commercial property dispute involving technical forensic evidence and multiple parties could drag on for several years, especially if it ends up in court. Things like the other party's willingness to cooperate, the quality of the evidence and backlogs in the legal system all play a part. The good news is that your insurer is the one managing this long and often expensive process for you.

At Proova , we understand that the foundation of any successful subrogation claim is solid, verifiable evidence captured right from the start. Our platform gives insurers and policyholders the tools to document every detail, strengthening the provability of claims and helping to shut down fraud. Discover how we are making insurance claims management smarter and more secure at https://www.proova.com.