How Much Contents Insurance Do I Need? A No-Nonsense Guide

Figuring out how much contents insurance you need sounds complicated, but the core idea is simple. You need enough cover to replace everything you own with brand-new equivalents if it were all lost today. That's the golden rule. We're not talking about what you paid for it five years ago, or what it might fetch on Facebook Marketplace. It’s about the full, current replacement cost.

The Hidden Risk of Underestimating Your Belongings

Go on, try it now. Without looking, try to list every single item in your living room. Right down to the last book, cushion, and charging cable. It’s harder than it sounds, isn’t it?

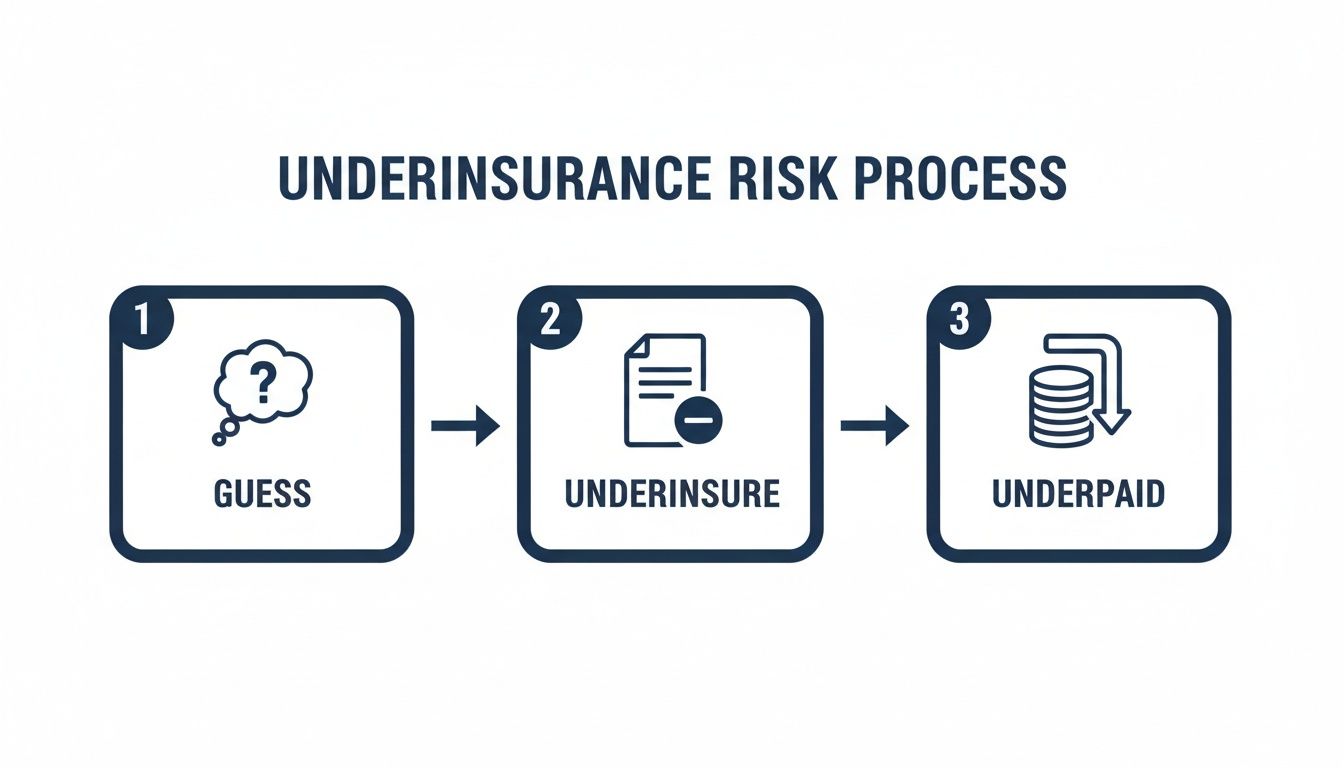

This little ‘lounge exercise’ highlights a massive problem. Most people guess when they buy contents insurance. But a rough estimate can lead to a dangerous gap known as underinsurance, leaving you with a huge financial headache when you need to make a claim.

Getting this figure wrong is no small matter; it can genuinely cost you thousands. The sum you insure is the absolute ceiling on what your insurer will pay out. If you pluck a figure of £30,000 out of the air, but a house fire reveals it would actually cost £50,000 to replace everything, you’re instantly looking at a £20,000 shortfall.

The "Average Clause" Can Make a Bad Situation Worse

But it actually gets worse. Buried in the small print of many policies is something called the 'average clause'. It's the insurer's defence against being knowingly under-insured.

Here’s how it works: if you’ve only insured your belongings for 60% of their true value, your insurer can legally slash your payout by 40% . This applies to any claim, not just a total loss. So, if a thief nabs your £2,000 television, you might only get £1,200 back. Why? Because your overall level of cover was inaccurate.

Key Takeaway: Underinsurance doesn't just limit your total payout. It can actively shrink the amount you get for any single claim, big or small. The responsibility for getting the valuation right sits squarely with you, the policyholder.

This isn’t a niche problem; it’s widespread. Research from the Association of British Insurers (ABI) shows the average UK home contains over £60,000 worth of contents—a figure that catches many by surprise. While home insurance claims payouts hit a staggering £1.6 billion in just one quarter of 2023, countless claims are paid out at a reduced value, purely because of guesswork and poor inventories.

Common Underestimation Traps and Their True Cost

It's shockingly easy to undervalue what you own, especially when you forget entire categories of items. People remember the sofa and the TV, but what about everything packed away in cupboards, drawers, and the attic? It all adds up, often to a much higher figure than anticipated.

| Area of the Home | Common Items Forgotten | Typical Estimated Value | Likely Replacement Cost |

|---|---|---|---|

| Kitchen | Cutlery, utensils, pots & pans, small appliances | £500 | £2,500+ |

| Wardrobe | Coats, shoes, suits, accessories, bags | £1,000 | £5,000+ |

| Attic/Shed | Stored furniture, tools, sports equipment, luggage | £300 | £3,000+ |

| Home Office | Books, stationery, monitor stands, cables, software | £200 | £1,500+ |

This table shows just how quickly the financial gap can widen. What feels like a minor oversight can easily create a shortfall of thousands of pounds per room.

Understanding this risk is the first step toward getting it right. You're not just ticking a box on a form; you're building a financial safety net. A guessed figure is full of holes, but an accurate, evidence-backed valuation ensures that net will actually hold when you need it most.

Creating a Simple Room-by-Room Home Inventory

The idea of listing every single thing you own is enough to make anyone put it off. It feels like a massive, overwhelming job. But the secret isn’t to try and tackle the entire house in one go; it’s to break it down into manageable chunks.

Forget trying to create one giant, daunting list. A room-by-room approach turns an impossible task into something you can actually get done. Start somewhere easy, like a spare bedroom or home office, not the kitchen with its hundreds of utensils and gadgets. The goal here is steady progress, not instant perfection.

Just open the notes app on your phone, or go old-school with a pen and paper, and start listing. Work your way methodically around the room, noting down every item. And don’t just write "bed" or "wardrobe"—you need to remember what's inside them, too.

Starting Your Catalogue

Think about it this way: what would it cost you money to replace if it were gone tomorrow? A quick checklist for a typical bedroom might look something like this:

- Large Furniture: Bed frame, mattress, wardrobe, chest of drawers, bedside tables.

- Electronics: Television, alarm clock, lamps, phone chargers.

- Furnishings: Curtains or blinds, rugs, any artwork on the walls, mirrors.

- Contents of Drawers: All your clothing (think about how much a good coat, suit, or a few dresses cost to replace!), shoes, accessories, and bedding.

As you go, use your smartphone. It’s your best tool for this job. Snap clear photos of individual items, especially electronics and furniture where you can capture the make and model. Even better, take a slow, continuous video of each room, opening cupboards and drawers as you go. This visual record is gold dust—it’s priceless proof for an insurer if you ever need to make a claim.

What starts as a dreaded task can quickly become an achievable weekend project. It’s this very process—moving from a vague guess to an accurate inventory—that is the key to getting a fair payout. So many people fall into the trap of just estimating their needs.

This simple flow shows exactly how a ballpark guess leads directly to being underinsured and, when the worst happens, being underpaid on your claim.

Making the Process Even Simpler

While a manual list is a fantastic start, digital inventory apps are designed to make this whole process quicker, easier, and far more secure. With an app like Proova, you can capture photos, add descriptions, and store receipts or serial numbers all in one organised place. Everything is neatly categorised and securely backed up, ready to share with your insurer at a moment's notice.

A detailed inventory removes all ambiguity. It transforms your insurance policy from a document based on guesswork into a concrete agreement based on proven facts. This is how you ensure a claim is settled quickly and fairly.

For a more detailed guide on documenting all your possessions, you can learn how to build your personal property inventory list. Having that thorough list is the single most important step in calculating how much contents insurance you really need and avoiding the painful trap of underinsurance. By documenting everything methodically, you replace uncertainty with certainty.

How to Value Your Belongings for Insurance

So you’ve got your room-by-room inventory. Fantastic. Now for the crucial next step: figuring out what it’s all actually worth.

This is where so many people make a costly mistake. They think about what they paid for an item years ago, or what they might get for it on Gumtree.

But your insurer isn't interested in what your five-year-old sofa is worth today. For almost every standard UK contents policy, they care about one thing and one thing only: the cost to replace it with a brand-new equivalent .

Grasping this concept is the single most important part of calculating how much contents insurance you need. Get this right, and you’ll have enough money to put your life back together without dipping into savings or settling for lower-quality replacements.

Replacement Cost vs Actual Cash Value

Understanding the difference between these two valuation methods is vital. It’s the difference between a successful claim that gets you back on your feet and a serious financial headache.

- Replacement Cost: This is the 'new-for-old' value. It's what it would cost to walk into a shop today and buy a similar item from new. If your television is stolen, this cover gives you the money to buy a brand-new one of an equivalent specification. Simple as that.

- Actual Cash Value (ACV): This is the replacement cost minus depreciation. It reflects the item's current, second-hand worth, accounting for age, wear, and tear. An ACV policy would only pay out what your five-year-old TV is worth today—which probably isn’t enough to buy a new one.

While ACV policies can have cheaper premiums, most UK homeowners should seek 'new-for-old' replacement cost cover . It provides the true financial safety net needed to recover from a major event like a fire or flood.

Finding the Right Replacement Value

Calculating the new-for-old value for everything on your list is much easier than it sounds. You don’t need to be a professional valuer; you just need to do a bit of online window shopping.

Fire up your browser and use major online retailers to get a current price for your items. Check sites like John Lewis, Currys, or Argos for electronics, furniture, and appliances. This gives you a realistic, evidence-based figure for what it would cost to replace each thing.

For clothing, look up your favourite brands and make a realistic estimate of what it would cost to replace your entire wardrobe. You'll probably be shocked at how quickly this adds up; our guide on the UK average house contents value often comes as a surprise to people.

If you have unique antiques or collectables, they're a special case. You'll likely need a specialist valuation, so it’s worth consulting a practical guide to determining their worth. By taking a little time now to find accurate replacement costs, you’re ensuring your final sum insured is a true reflection of what you'd need after a disaster.

Covering Your High-Value Items and Collections

Your overall contents value is a huge piece of the puzzle, but there’s another critical detail that often catches people out. Standard contents policies have what’s called a ‘single-item limit’ . This is the absolute maximum an insurer will pay out for any one item that hasn't been specifically listed on your policy.

That limit is often somewhere around £1,500 to £2,000 . If your engagement ring, high-end laptop, or specialised camera gear is worth more than this, it simply won't be fully covered under your general contents sum.

To protect these items for their full value, you have to declare them separately to your insurer. It might feel like a bit of extra admin now, but failing to do so means you could be left thousands of pounds out of pocket if that specific item is lost, stolen, or damaged.

Identifying Your Most Valuable Possessions

So, what should you be looking out for? It’s not just about the obviously expensive things; certain collections can also easily exceed the single-item limit when valued as a complete set.

Here are a few common categories that almost always need to be specified:

- Jewellery & Watches: Engagement rings, expensive watches, and inherited pieces are the usual suspects. Getting an expert valuation is key here, as we cover in our guide to unlocking certainty in diamond rings insurance.

- High-End Electronics: Think about your top-of-the-range MacBook, television, sound system, or that specialist photography equipment you’ve invested in.

- Art & Antiques: Paintings, sculptures, or antique furniture often require a professional valuation to be properly insured for their true worth.

- Collections: This could be anything from a prized collection of rare records and designer handbags to valuable sports memorabilia.

- Bicycles & Sports Gear: A high-spec road bike can easily cost several thousand pounds and absolutely needs to be listed individually.

The Importance of Detailed Proof

When you list a high-value item, your insurer will almost certainly ask for proof of ownership and its value. This is where your detailed inventory becomes undeniable. Don't just list "gold ring"; you need much more detail.

An insurer can’t argue with a clear photo, a receipt, and a valuation certificate. This evidence moves a claim from a stressful negotiation to a simple administrative process, ensuring you get the full amount you’re owed without the back-and-forth.

For these key items, you need to make a special effort to document them thoroughly.

- Keep Receipts: Store digital or physical copies of receipts for all your major purchases. Cloud storage is great for this.

- Record Serial Numbers: For electronics and bicycles, the serial number is a unique identifier that proves ownership beyond doubt.

- Get Professional Valuations: For jewellery, art, and antiques, a formal valuation certificate from a reputable expert is essential. Remember to get these updated every few years, as values can change.

Documenting these items isn’t just for your own peace of mind—it's a critical step in building a robust insurance policy that actually works when you need it to.

Finalising Your Cover and Dodging Common Pitfalls

With an accurate inventory and a solid valuation in hand, you're finally in a position to choose the right contents insurance policy. This isn't just about finding the cheapest premium; it's about translating all that careful work into a financial safety net that will actually protect you when you need it most.

A smart first move is to add a small buffer to your final calculated figure. Think of it as a safety margin. Adding an extra 10% to your total sum insured can provide cover for inflation, new purchases you make throughout the year, and any small items you might have missed. It’s a simple trick to prevent yourself from becoming accidentally underinsured between renewals.

Looking Beyond the Basics

Once you've got your core number sorted, it’s time to think about what else your lifestyle requires. A standard policy covers the big events like fire and theft, but the add-ons are what truly tailor the cover to your specific needs.

- Accidental Damage: This covers those heart-stopping moments, like spilling paint on a brand-new carpet or your toddler deciding the television screen is a canvas. Without it, you’re on your own.

- Personal Possessions Cover: This extends your insurance to items you take outside the home. It protects things like your phone, laptop, jewellery, and bicycle when you're out and about, whether in the UK or abroad.

- Legal Expenses: This can be an absolute lifesaver, offering cover for legal costs related to disputes over employment, property, or personal injury claims.

These extras turn a basic policy into robust protection that reflects how you actually live. It’s also worth reading our guide on the complete contents insurance definition and what it covers to fully understand the scope of a standard policy before adding anything on top.

Common Traps UK Homeowners Fall Into

Even with the best intentions, it's surprisingly easy to make mistakes that can weaken your cover. Being aware of these common pitfalls is the final step in making sure your policy is watertight.

The most frequent error, by far, is forgetting entire areas of the home. Just like the 'lounge exercise' proves we can't remember everything in one room, it's even easier to forget what's stored away. Items in the shed, loft, or garage—like power tools, sports equipment, or old furniture—can add up to thousands of pounds and are often completely missed from the calculation.

Another classic mistake is failing to update your policy after a major purchase. Splashed out on a high-end sofa or a state-of-the-art television? Your total contents value has just gone up. A quick call to your insurer is all it takes to adjust your cover and stay properly protected.

Finally, the biggest pitfall of all is not reading the policy exclusions. Every single policy has them. Your insurance might not cover damage from pets, or business equipment used at home, unless you have a specific add-on. Knowing what isn't covered is just as important as knowing what is.

Common Questions Answered

When you're trying to figure out your contents insurance, a few common questions always seem to pop up. Let's clear up some of the most frequent sticking points.

What About Carpets and Curtains?

Yes, you should almost always include them.

A great rule of thumb is to think about what you'd pack up and take with you if you moved house. That means carpets (but not laminate or tiled flooring that's permanently fitted), curtains, blinds, and even those light fittings you'd unscrew and take with you.

It's always smart to double-check the specifics in your policy document, but it's much safer to include them in your total from the start.

What if I Get the Value Wrong and Underinsure?

This is a bigger deal than most people realise and can lead to a nasty surprise right when you need support the most. Insurers call it being underinsured, and they have a rule called the 'average clause' to deal with it.

Here’s how it works: if you've only insured your belongings for 70% of what they're actually worth, your insurer might only pay out 70% of any claim you make, regardless of the claim's size. That could leave you thousands of pounds out of pocket.

How Often Should I Re-evaluate My Cover?

Make it an annual habit. Review your total sum insured every year just before your policy is up for renewal.

It’s also crucial to give your insurer a heads-up straight after any major new purchase. Think new sofa, a top-of-the-range TV, or a special piece of jewellery. A quick update ensures you’re never left underinsured.

Figuring out your contents value doesn't need to be a guessing game. With Proova , you can build a simple, visual inventory of everything you own, making sure your valuation is spot-on and your claim is undeniable.