A Practical Guide to Contractors Insurance UK for Tradespeople

If you’re a contractor in the UK, you know insurance isn’t just a single, off-the-shelf product. It’s a vital package of different covers, designed to shield your business from the unique risks you face every day. It’s the one investment that ensures a single accident, theft, or honest mistake doesn’t bring your entire livelihood crashing down.

What Is Contractors Insurance and Why Does It Matter?

Think of contractors insurance less like a standard policy and more like a custom-built toolkit. Each tool—or type of cover—is there to solve a very specific problem you could run into on the job. Whether you’re a self-employed electrician or a growing construction firm, this insurance package is the financial safety net that catches you when things go wrong.

It’s there to protect you from the everyday hazards of your work, from a client tripping over your extension lead to the theft of your essential tools from the van overnight. Without it, you’re personally on the hook for legal fees, compensation payouts, and the cost of replacing expensive kit. For most tradespeople, just one significant claim could be financially crippling.

The Problem of Proof

Let’s try a quick thought experiment, our version of the "lounge exercise". If your van was broken into tonight, could you list every single tool you own from memory? Not just the big-ticket items, but every drill bit, every hand tool, every specialist piece of kit. Now, could you add the makes, models, and serial numbers for all of them? It’s an almost impossible task.

That’s the fundamental challenge every contractor faces when they need to make a claim. You can only claim for what you can prove you owned. Insurers need evidence, and without it, the claims process turns into a frustrating battle of your memory versus their requirements. This often leads to delayed payments or, worse, rejected claims for items you know you’ve lost.

The harsh truth of insurance is that the burden of proof is on you, the policyholder. An insurer doesn't pay out based on what you think you had; they pay out based on what you can document. This single point is where most claims fall apart.

More Than Just a Policy—It's a Business Necessity

Having the right contractors insurance uk package isn't just about ticking a box. It's a cornerstone of running a professional, resilient business. It gives you peace of mind, but it also shows clients you’re a credible and responsible professional they can trust. In fact, many clients, especially on larger commercial projects, won’t even let you on-site without seeing proof of adequate cover.

Ultimately, this insurance is an investment in your business's survival and its reputation. It ensures that an unexpected event doesn't derail all your hard work by providing the funds to:

- Compensate a member of the public for injury or property damage.

- Cover your legal defence costs if a claim is made against you.

- Replace stolen or damaged tools and equipment quickly so you can get back to earning.

- Protect your business if an employee gets injured on the job.

Without this protection, you're exposed to huge financial and legal risks every single day you're on the tools.

The Essential Covers Every UK Contractor Needs

Getting your head around the different bits of a contractors insurance policy can feel a bit much, but it really just boils down to protecting yourself from specific, real-world risks. Think of it like a toolkit. You've got different tools for different jobs, and you wouldn't use a spanner to knock in a nail. In the same way, you can't rely on just one type of insurance to fix every problem that might come your way.

So, let's break down the core covers that make up most contractors insurance UK packages. We'll use practical, everyday examples you'll definitely recognise.

Public Liability Insurance: The Foundation of Your Cover

This is the absolute bedrock of any contractor's insurance. Public Liability insurance has your back if your work accidentally injures a member of the public or causes damage to their property. And it's not just for the big disasters; it covers the small, everyday mishaps that can happen on any site.

Let’s say you're a joiner fitting a kitchen in a client's house. You accidentally drop a heavy hammer, and it smashes a large, expensive floor tile. The client is fuming and rightly demands you pay for a whole new floor to make sure it all matches. Without insurance, that's a big bill coming straight out of your pocket.

With Public Liability cover, your insurer steps in. They'll handle the cost of the claim, from repairing the damage to paying for legal fees if the client decides to sue. It’s the policy that saves you from the financial headache of those "oops" moments. Find out more in our complete guide to public liability insurance.

Employers' Liability Insurance: A Legal Must-Have

Right, this one's non-negotiable. If you have anyone working for you—even a temp, a labourer for a one-off job, or an apprentice—you are legally required to have Employers’ Liability insurance in the UK. Get caught without it, and you're looking at hefty fines from the Health and Safety Executive (HSE).

This cover protects your business if an employee gets ill or is injured because of the work they do for you. Picture this: a roofer you've hired slips from a ladder and breaks their arm. They could make a claim against you for their injuries and loss of earnings. Employers’ Liability insurance would cover the compensation payment and any legal costs that come with it.

Workplace accidents are, unfortunately, a fact of life. Recent UK statistics show that over two million workplace injuries and illnesses led to 44,547 new claims, with settlements hitting 53,074 as older cases were also resolved. It just goes to show how critical this cover really is.

Professional Indemnity Insurance: For Your Advice and Expertise

While Public Liability covers your physical actions, Professional Indemnity (PI) insurance covers the financial fallout from your professional advice or designs. This is absolutely vital for any contractor who provides plans, specifications, or expert advice as part of their service.

Imagine an electrician who designs a new lighting system for a local shop. A few months down the line, it turns out the design was flawed, causing constant electrical faults that force the shop to close for a week for a complete rewire. The owner could sue you for their financial losses—the cost of the new wiring and the business they lost while shut. PI insurance is designed for exactly this kind of situation.

For trades that deal with critical safety paperwork, this cover is paramount. Things like Landlord CP12 Certificates are a serious professional responsibility, and PI insurance protects you if a mistake in that process ends up costing your client money.

Tools, Equipment and Plant Insurance

Finally, let’s talk about the gear you can’t work without. Your tools, equipment, and any hired-in plant are the lifeblood of your business. This part of your policy protects them against theft or damage.

This brings us right back to the original problem: proving what you actually owned. If your van gets nicked, you're faced with the nightmare of trying to remember every single spanner, drill, and saw that was inside. It's that "lounge exercise" all over again, but this time it's your livelihood on the line.

Without a detailed, up-to-date inventory, you’ll have a tough time making a successful claim. Insurers need proof, and a vague list pulled from memory just isn't going to cut it if you want to get the full value of your loss back.

How Market Volatility Affects Your Insurance

Let’s be honest, it’s a tough climate for contractors in the UK right now. You’re not just hunting for the next job; you’re wrestling with rising material costs, unpredictable supply chains, and a general feeling of uncertainty that hangs in the air. These pressures don’t just hit your bottom line—they have a real, direct impact on your insurance.

Insurers, after all, are businesses too. They keep a close eye on economic tremors, and when they see volatility rocking the construction sector, they naturally become more cautious. Every policy application gets scrutinised with a finer-toothed comb as they try to minimise their own exposure to risk.

This shift means that simply being in business is no longer enough to get the best cover. Insurers want to see cold, hard proof that you’re running a tight ship—a low-risk operation that’s built to withstand the current economic storm and less likely to make a claim.

Why Insurers Are More Cautious Than Ever

The construction industry has been on the front line of recent economic instability. Soaring material costs and wage inflation are squeezing profit margins wafer-thin, making it harder than ever for firms to stay afloat. This has led to a worrying spike in company failures, a trend that makes insurers understandably nervous.

The situation has become so serious that in a recent quarter, the construction sector accounted for a staggering 16.3% of all UK insolvencies , with specialist subcontractors hit the hardest. This wave of failures has forced insurers to tighten their underwriting criteria. They're now looking for more robust financial histories and evidence of solid risk management to avoid being left with unpaid premiums from businesses that have gone under. You can learn more about the current state of the construction insurance market on pib-insurance.com.

For contractors trying to get insured, this means the goalposts have well and truly moved. Insurers are now asking for more than a simple list of your services; they want proof of your stability and a clear picture of how you manage your assets.

In a volatile market, your risk profile becomes your most valuable asset. The better you can demonstrate that you actively manage your risks, the more favourably an insurer will view your business when it's time to quote for your policy.

Turning Proof into an Advantage

So, how do you prove you're a low-risk business in what's seen as a high-risk market? This is where proactive documentation becomes your secret weapon. It’s one thing to say you have £20,000 worth of tools; it’s another thing entirely to present a verified, digital catalogue of every single item, complete with photos, serial numbers, and purchase dates.

This level of detail does more than just prepare you for a potential claim down the line. It sends a powerful, immediate message to an insurer:

- You are organised: It shows you run a professional outfit and take asset management seriously.

- You understand your value: You know exactly what your business owns and what it would cost to replace everything.

- You are transparent: Handing this data over upfront builds trust and instantly lowers the insurer's perceived risk.

Put yourself in their shoes for a moment. An application with a vague, thumb-in-the-air valuation of tools is a red flag. But an application backed by a detailed, verified inventory? That screams responsible business owner. In this climate, that distinction can make all the difference.

Having a digital record of your tools, equipment, and on-site materials gives you a tangible edge. It helps you sidestep being penalised by an insurer's generalised caution and can lead to better terms, more competitive premiums, and a much smoother negotiation. You’re shifting the conversation from uncertainty to evidence, putting you firmly in control.

Securing Better Rates in a Changing Market

Navigating the world of contractors insurance pricing can feel like trying to hit a moving target. One year, premiums are climbing relentlessly; the next, you hear whispers of a ‘buyer-friendly’ market. So, what’s the real story right now, and how can you make sure you’re getting the best possible deal?

The good news is that after a period of pretty tough conditions, the market has seen a real shift. Increased competition among insurers has led to a softening of rates across several key areas, creating a valuable opportunity for contractors who come prepared. It means underwriters are actively looking for good, low-risk businesses to add to their books.

A Window of Opportunity for the Well-Prepared

Recent market analysis shows a significant downturn in premiums for certain types of cover. In fact, UK insurance rates for contractors softened notably, with financial and professional lines plunging 10% in the first quarter of the year. In another quarter, property insurance rates dived between 11-20% , with some risk-managed firms securing reductions as high as 30% due to fierce competition. As you can read more about these UK insurance rate trends on marsh.com , this buyer-friendly shift rewards contractors who can provide top-tier risk data.

But this doesn't mean insurers are suddenly handing out discounts to everyone. While they are keen to grow, they’re still extremely cautious about two major factors:

- Claims Inflation: The cost to repair or replace property and equipment keeps rising thanks to higher material and labour costs. An insurer might pay out far more for a claim today than for the exact same incident just a couple of years ago.

- Economic Instability: High rates of insolvency in the construction sector mean insurers are still nervous about taking on clients who might go out of business, leaving premiums unpaid.

This creates a two-tier market. The best rates and the most comprehensive cover are reserved for contractors who can clearly and confidently prove they are a superior risk.

Proving You Are a Top-Tier Risk

In this environment, your ability to manage and document your business assets is more than just good practice—it's your most powerful negotiation tool. When you approach an insurer for a quote, you need to prove you are not just another name on a high-risk list. This is where meticulous documentation really sets you apart.

Imagine two contractors applying for the same policy. The first gives a rough, back-of-the-envelope estimate of their tools' value. The second provides a detailed digital inventory, complete with photos, serial numbers, and proof of ownership for every single asset. Which one do you think an underwriter will see as the safer bet?

An insurer's quote is a direct reflection of their perceived risk. By providing clear, verifiable evidence of your assets and risk management from day one, you remove the guesswork and position yourself as a professional, organised, and less risky client.

This proactive approach is at the heart of effective business protection. Building a solid framework for managing risk isn't just about insurance; it’s about creating a more resilient business. To learn more, check out our guide to your business risk management framework.

By using a system to catalogue your tools and equipment, you are not just preparing for a potential claim. You are actively demonstrating to insurers that you are a top-tier risk worthy of their best rates. It’s a simple step that can help you take full advantage of the current competitive conditions, securing meaningful reductions on your premiums and ensuring your business is protected by the best cover available.

A Contractor’s Guide to Mastering the Claims Process

Having the right insurance is one thing, but knowing how to use it when disaster strikes is what really matters. This is the moment your policy goes from being a piece of paper to a financial lifeline. But let's be honest, the claims process can feel overwhelming, especially when you’re already stressed out from an incident.

The key to a smooth, successful claim isn't luck; it's all in the preparation. Without it, you’re left scrambling in a chaotic situation, trying to prove what you’ve lost from memory alone.

The Nightmare of an Unprepared Claim

Imagine your van is broken into overnight. The police give you a crime reference number, and you call your insurer. Their first question is simple enough: "What was in the van?" Suddenly, you’re faced with the impossible task of listing every single tool you own.

You start with the big power tools, but what about all the hand tools? The specialist drill bits? The boxes of screws and fixings? Can you remember the exact make and model of everything? Do you have the serial numbers handy? It’s like a game show memory test, but this time, every forgotten item is money you won’t get back.

This is where most claims hit a wall. An incomplete or vague list creates delays while the insurer asks for more detail. Arguments over value pop up because you can't provide receipts or prove what you paid. The whole thing turns into a frustrating, drawn-out negotiation instead of a straightforward settlement.

A Step-by-Step Guide to a Successful Claim

A proactive approach turns this potential nightmare into a manageable task. By having your evidence ready before you need it, you completely change the dynamic and put yourself in control. Here’s what to do immediately after an incident to ensure a fast and fair payout.

- Safety First, Always: Before you do anything else, make sure everyone is safe and secure the site to prevent any more damage or loss.

- Notify the Authorities: For theft or significant damage, call the police right away and get a crime reference number . This is non-negotiable evidence for your insurer.

- Contact Your Insurer Promptly: Don't put it off. Report the incident to your insurance provider as soon as you can, giving them the basic facts of what happened.

- Provide Verifiable Proof: This is the game-changer. Instead of a list scribbled from memory, you submit a detailed, pre-prepared inventory of the lost or damaged items, complete with photos, serial numbers, and purchase dates.

- Document Everything: Keep a log of all communications with your insurer, including dates, times, and the names of the people you speak to.

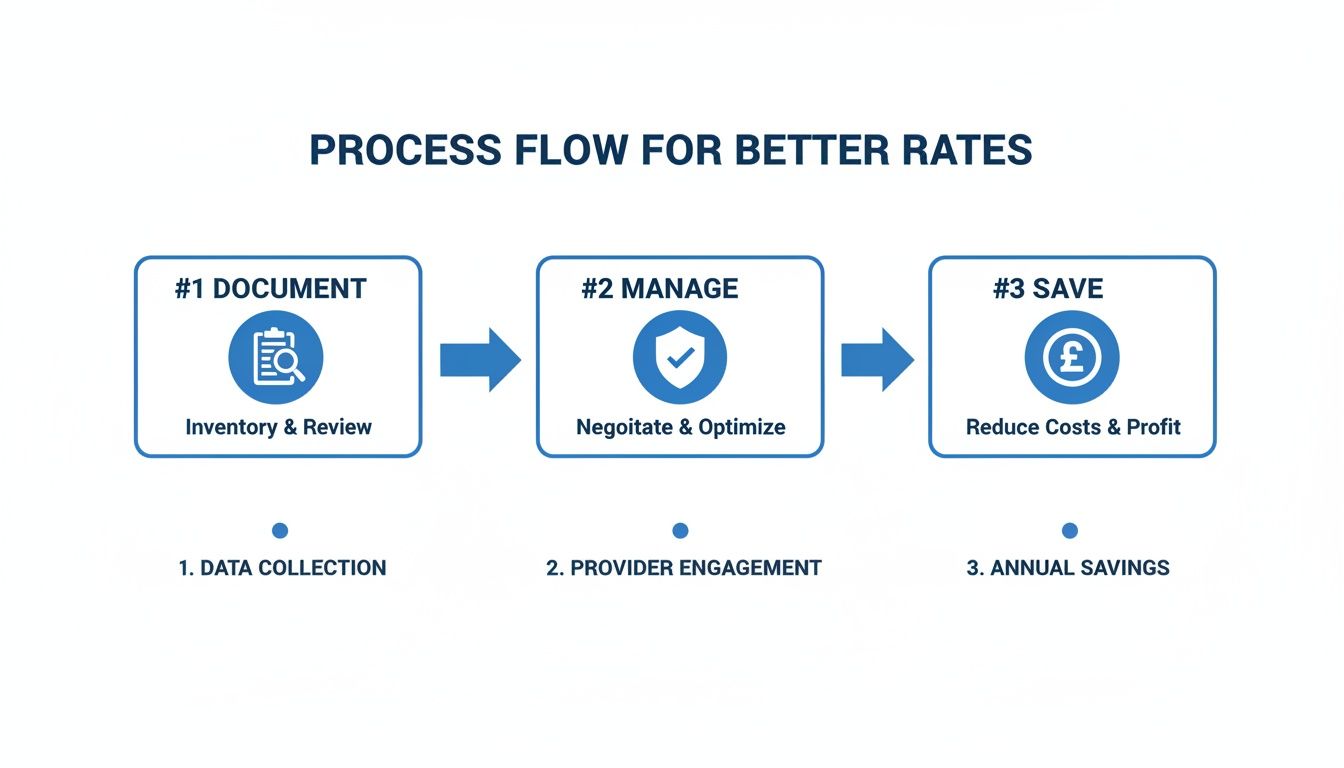

This structured process, shown in the flow below, highlights how documenting your assets beforehand is the foundation for managing risk and getting a much better financial outcome.

As you can see, a smooth claims process doesn't start after a loss; it begins with proactive, solid documentation.

Avoiding Common Claims Pitfalls

Many contractors unknowingly make simple mistakes that can put their entire claim at risk. To avoid this, it's vital to have a practical incident management procedure in place to document events thoroughly and make the whole process with your insurer much smoother.

The table below shows some classic mistakes and how to avoid them with a bit of forward-thinking.

Common Claims Pitfalls vs Best Practices

| Common Pitfall | Why It Fails | Best Practice Solution |

|---|---|---|

| Reporting a claim late. | Policies have strict reporting deadlines. A delay can give the insurer grounds to deny the claim. | Report the incident to your insurer within 24 hours , even if you don't have all the details yet. |

| Providing a vague list of stolen items from memory. | It's impossible to remember everything, leading to undervaluation, disputes, and a much lower payout. | Maintain a live, digital inventory of all tools and equipment with photos, serial numbers, and receipts. |

| Not knowing your policy's specific terms (e.g., security requirements). | If your van's locks didn't meet the policy standard, your claim for theft could be rejected outright. | Read your policy documents carefully, especially the 'warranties' and 'conditions' sections. Know your obligations. |

| Disposing of damaged items before the insurer sees them. | The insurer needs to inspect the damage to assess the loss. No evidence often means no payment. | Keep all damaged items safely aside until the loss adjuster has inspected them or given you the go-ahead. |

Ultimately, most problems boil down to a lack of detailed, verifiable proof. That's the single biggest point of friction.

By documenting everything you own before an incident occurs, you eliminate the guesswork and replace memory with undeniable fact. This makes it faster and simpler for the insurer to approve your claim and pay you exactly what you're owed.

A well-documented claim isn't just about getting paid; it's about getting back to work quickly with minimal disruption. For a deeper dive into the specifics, our practical UK guide on the insurance claims process offers more detailed steps.

Being prepared transforms a stressful, uncertain event into a straightforward business transaction, ensuring you get paid quickly and fully, every time.

Got Questions About Contractors Insurance? We’ve Got Answers.

Stepping into the world of contractors insurance can feel like navigating a maze. There are a lot of specific questions that pop up, and getting the right answers is crucial for protecting your business. We've gathered some of the most common queries we hear from tradespeople and laid out the answers in plain English.

Do I Need Insurance If I’m a Subcontractor?

Yes. Simple as that. It’s a massive misconception that the main contractor’s insurance has you covered. It doesn’t. Their policy is there to protect their business, not yours. You are always legally responsible for your own work and any accidents you might cause, whether it's an injury to a member of the public or damage to property.

In fact, almost every main contractor will refuse to let you on-site until you can show them proof of your own Public Liability insurance. Relying on their cover is a huge gamble that could leave you on the hook for thousands in compensation claims and legal fees. Think of it this way: it's your business, your work, and ultimately, your risk to manage.

How Much Public Liability Cover Do I Actually Need?

This is one of the most important questions, and the answer really depends on where you work and who you work for. There’s no single magic number, but there are some solid guidelines to go by.

- Working in Homes: If your bread and butter is domestic work, a cover limit of £1 million to £2 million is usually the sweet spot.

- Working on Commercial Sites: The game changes when you step onto larger commercial projects or do work for local authorities. Here, the requirements are far stricter. Contracts will often demand a minimum of £5 million in cover, and for riskier jobs, it’s not uncommon to see that figure jump to £10 million .

The golden rule is to always read the insurance clause in any contract before you even think about starting the job. Getting this wrong could put you in breach of contract and leave you dangerously underinsured if something goes wrong.

Never just assume your standard policy is enough for a commercial contract. Always check the specific requirements buried in the paperwork. A mismatch could not only lose you the job but expose your business to a financial catastrophe if a major claim comes in.

Are My Tools Covered if They’re Left in My Van Overnight?

This is a classic trap and a major reason why tool theft claims get rejected. Your standard tool insurance policy will almost certainly not cover theft from your van overnight. For that, you need a specific add-on, often called an 'overnight van cover' extension.

But even with that extra cover, insurers will have a list of strict security conditions you must follow to the letter. These aren't suggestions; they're 'policy warranties', and failing to meet them means you won't get a payout. Typically, they'll require things like:

- The van must be kept in a locked garage or a secure, gated yard overnight.

- If it’s on your driveway, all of the van’s original locks must be engaged, and any extra security you have (like slam locks) must also be active.

- Parking it on the street overnight is almost always a deal-breaker and will likely invalidate your cover.

Make sure you read the small print. Missing one of these conditions, even just once, gives the insurer the right to refuse your claim, leaving you to replace thousands of pounds worth of stolen gear out of your own pocket.

What’s the Difference Between Public Liability and Professional Indemnity?

It’s easy to mix these two up, but they cover completely different risks. The easiest way to remember it is to think actions vs. advice .

Public Liability (PL) is all about the financial fallout from your physical actions . It kicks in if your work causes an injury to someone or damages their property.

- Real-world example: You’re a plumber fitting a new bathroom. A pipe you installed springs a leak overnight, flooding the client’s brand-new kitchen downstairs and ruining the flooring. Your Public Liability policy would cover the cost of the repair and replacement.

Professional Indemnity (PI) is for the financial consequences of your professional advice, design, or expertise . It protects you if a client loses money because of a mistake you made in the specialist knowledge or service you provided.

- Real-world example: You’re a building contractor who advises a client on the best structural support for a wall removal. Your calculations are wrong, and the ceiling begins to sag, requiring urgent and expensive remedial work. Your Professional Indemnity policy would cover the client’s financial losses caused by your faulty advice.

When your tools are stolen, proving what you owned shouldn't rely on guesswork and old receipts. Proova gives you a simple way to build a digital, verified record of your assets, making sure you have indisputable evidence ready before a disaster happens.

Protect your business, speed up claims, and get the peace of mind that comes from being properly prepared. Visit https://www.proova.com to find out more.