Travel Insurance Over 80 Medical Conditions Guide

Getting travel insurance when you're over 80 with medical conditions isn't just possible, it's absolutely vital for travelling with true peace of mind. It might feel like a daunting task, wading through questions about your health and age but there are specialist providers out there ready to help. They design policies specifically for your circumstances, making sure you can jet off knowing you’re properly protected if a medical emergency crops up abroad.

Understanding The Stakes of Honest Disclosure

Arranging travel insurance in your later years, especially with a few health issues in the mix, can certainly feel like a hurdle. Many travellers worry about sky-high premiums, endless forms and even the fear of being turned down flat. But please, don't let these worries stop you from getting the cover you need. The right policy isn’t just a piece of paper; it’s your financial safety net and a provable contract.

An insurance policy is a contract built on trust. You pay your premium and in return, the insurer promises to cover you for specific events. The entire agreement hinges on the provable information you give them. If that information is incomplete or inaccurate the contract becomes shaky and could easily fall apart right when you need it most.

Why Your Honesty Matters

This is the most critical part of the entire process: you must declare every single medical condition. It doesn’t matter how minor it seems or how well-controlled it is with medication. Full transparency is completely non-negotiable. It might be tempting to leave something out to get a cheaper quote but that's a false economy that could backfire spectacularly.

If you need to make a claim, insurers have the right to look at your medical records to verify the details. Should they find an undeclared condition that’s relevant to your claim, they are perfectly entitled to reject it. This could be viewed as insurance fraud and would leave you personally responsible for what could be staggering medical bills. It’s not about punishing you; it’s simply a case of the original agreement being invalid because it was based on false information.

A policy's strength is completely dependent on the honesty and provability of the information provided from the start. An insurer bases your premium on the risk you present; if that picture is inaccurate, their calculations—and your cover—are void.

The Wider Cost of Non-Disclosure

This isn’t just about the risk to one person. When claims are denied because of non-disclosure or when hidden conditions lead to massive, unexpected payouts, it puts a strain on the whole insurance system. This practice, if it becomes common, is a form of insurance fraud that has serious consequences for the entire industry.

The costs involved in investigating and dealing with these situations don’t just vanish. They get absorbed by the insurers and are eventually passed on to every single policyholder through higher premiums for everyone. So when you provide a complete and honest medical history, you're not just protecting yourself. You’re helping to keep the insurance market fair and sustainable for all travellers. Being upfront contributes to a system that we can all rely on.

Why Full Disclosure of Medical Conditions Is Crucial

Being completely open about every single medical condition isn't just a suggestion—it's the absolute bedrock of a valid travel insurance policy. This isn't about being polite; it's a contractual obligation. Skimping on the details is like building a house on shaky ground. It might look fine on the surface but it's guaranteed to crumble when you need it most.

When you apply for travel insurance over 80 with medical conditions , you're entering into an agreement based on what the industry calls 'utmost good faith'. You give the insurer a complete and honest picture of your health and in return, they calculate a premium based on that specific level of risk. Withholding information shatters that trust and can make your entire policy worthless.

The Importance of 'Material Facts'

Insurers weigh up your application based on 'material facts' . Simply put, a material fact is any piece of information that would influence an underwriter’s decision to offer you cover and at what price. That bout of bronchitis you had five years ago might seem trivial to you but to an insurer, it could signal a pattern of respiratory weakness they need to know about.

Think of it this way: if you were selling a used car, you would be legally required to mention if it had been in a major accident. Failing to do so is misrepresentation. It's the same principle here. Your medical history is the "service history" the insurer needs to see to make a fair assessment.

Failing to declare these facts can even be seen as insurance fraud. It might feel like a harmless omission to get a cheaper quote but the consequences can be incredibly severe. It’s not just about a claim being rejected; it could get you blacklisted, making it difficult to get any kind of insurance in the future.

The Insurer's Right to Verify Claims

When you make a claim, particularly for something serious, your insurer has the right to look at your medical records. They will meticulously compare the information you gave them on your application with the history held by your GP and any specialists. Any gaps or inconsistencies will be flagged immediately.

This isn't about trying to catch people out. It's a standard process to ensure the claim is legitimate and falls within the terms of the policy they sold you. If they discover an undeclared condition that contributed to your claim, they are well within their rights to void the policy from the day it started.

The core principle is simple: if you weren't honest about the risk, the insurer isn't obliged to cover the loss. This leaves you personally liable for potentially astronomical medical bills abroad.

The temptation to hold back is understandable, especially when you see the quotes. A recent study found that 73% of UK travellers with medical conditions see the USA as the most expensive place for a medical emergency, which can inflate premiums by over 1,000% . This pressure leads around 30% of travellers with pre-existing conditions to risk going without insurance or not declaring their full history.

How Non-Disclosure Affects Everyone

This problem doesn't just affect the individual. When insurers are forced to pay out for unexpected claims due to undeclared conditions or spend time and money investigating potential fraud, those costs get passed on. They are not just absorbed by the company; they get baked into future premiums for all customers.

Essentially, every act of non-disclosure contributes to higher costs for the entire industry. This means honest policyholders end up subsidising the risks taken by those who were not transparent. Being upfront isn't just about protecting yourself; it's about contributing to a fair and sustainable insurance market for everyone.

This transparency is vital for building a relationship of trust between you and your insurer. Understanding the psychology of why this openness builds policyholder trust offers great insight into this process. It ensures the system works as it should, providing a reliable safety net right when you need it. By being meticulous with your declaration, you can travel with the confidence that your policy is solid and ready to protect you.

How Insurers Calculate Risk For Travellers Over 80

When an insurer works out the premium for your travel insurance over 80 medical conditions , that number isn't just plucked out of thin air. It’s the final output of a careful, structured process called underwriting, which is all about figuring out the specific level of risk involved in covering your trip. The main tool for this job? The medical screening questionnaire.

It’s easy to see the questionnaire as just another hurdle but it’s actually a very logical way for the insurer to build a clear picture of your health. Every question is designed to gather what’s known as a 'material fact'—a piece of information that directly affects the chances of you needing medical help while you're away. Once you understand how these facts are weighed up, you start to see your premium not as an arbitrary cost but as a fair reflection of the cover you’re getting.

Key Factors in The Risk Calculation

Insurers look at several interconnected things to land on your final premium. Their goal is to get a complete picture of your health, its stability and your travel plans so the price accurately matches the potential cost if you need to make a claim.

Here are the main things they'll assess:

- The Stability of Your Conditions: A condition that's well-managed, with no recent tweaks to your medication or new symptoms, is a much lower risk than something unstable or recently diagnosed. Insurers pay close attention to pre-existing conditions and how stable they are; for instance, understanding the nuances of heart attack recovery timelines helps them accurately assess the risk for older travellers.

- Current Medications and Treatments: The type and dosage of your medication give a pretty clear sign of how severe your conditions are and how they're being managed.

- Recent Hospital Visits: Any recent admissions, outpatient appointments or ongoing investigations will suggest a higher immediate risk and that will be factored into the premium.

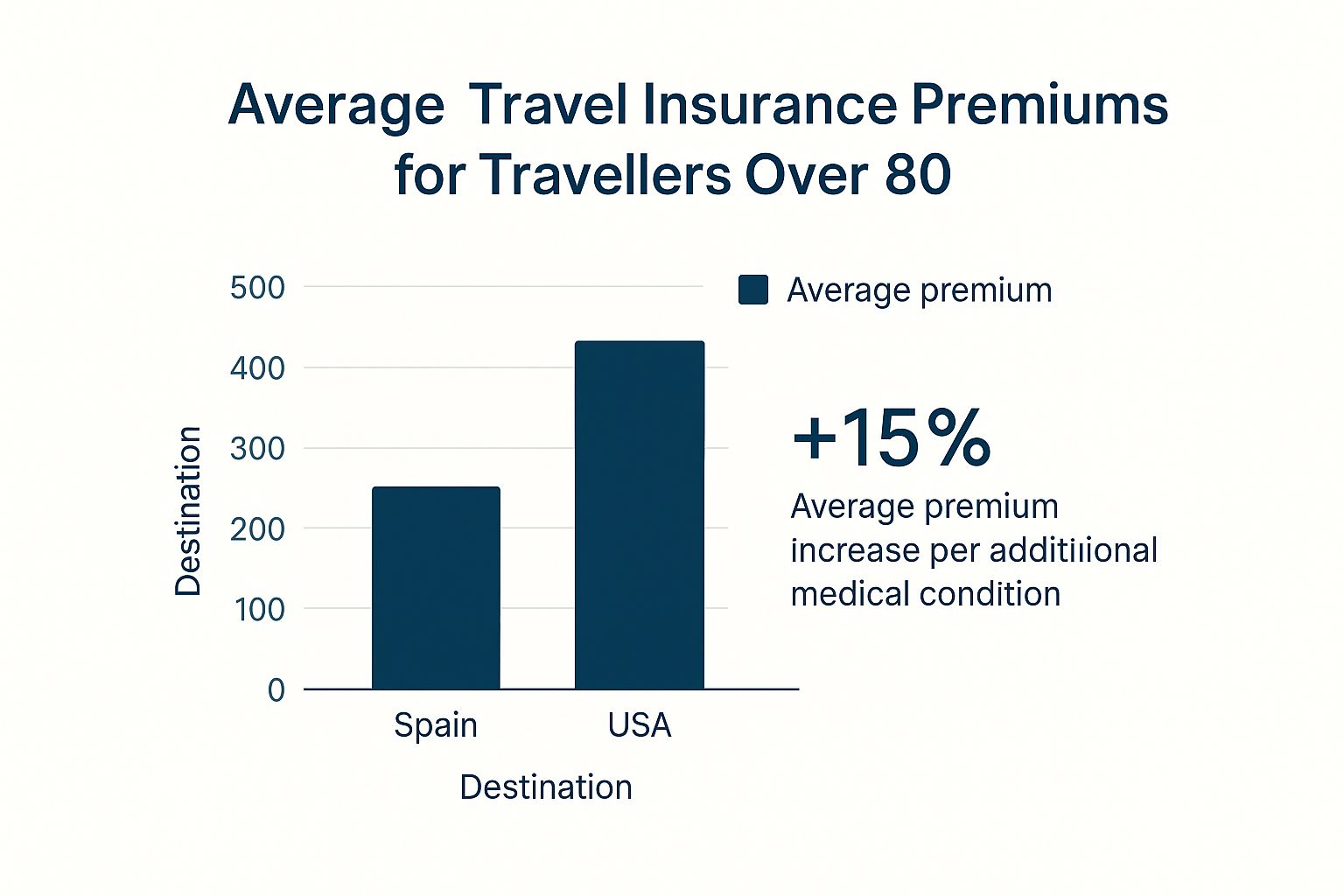

- Your Chosen Destination: This is a big one. Healthcare costs vary wildly across the globe. A trip to Spain will carry a much lower premium than a holiday in the USA, where medical treatment is notoriously expensive.

- The Duration of Your Trip: It makes sense—a longer holiday naturally creates a bigger window for a medical issue to pop up. This means a higher premium compared to a short weekend break.

This infographic gives a great visual breakdown of how your destination and the number of medical conditions can impact average premiums for travellers over 80.

As you can see, both where you're going and the complexity of your health play a massive part in the final cost.

The Financial Reality Behind the Premiums

It's so important to grasp the huge financial stakes involved for insurers. They are not just covering the cost of a quick doctor's visit; they're potentially on the hook for life-saving emergency surgery and medical repatriation, both of which can be mind-bogglingly expensive. A higher premium is the direct result of the insurer genuinely taking on that significant financial responsibility.

A higher premium isn’t a penalty. It’s an acknowledgement of your unique health circumstances and a guarantee that the policy is robust enough to come through for you if you need it. It signifies true acceptance of risk.

The scale of these potential costs is immense. Medical expenses consistently make up a huge slice of all UK travel insurance claims. According to the Association of British Insurers (ABI), their members pay out hundreds of millions on medical claims, with one policyholder's treatment in the USA and flight home costing over £1 million . It really brings home the real-world financial weight of covering pre-existing conditions and shows why being completely honest during your application is absolutely vital.

When you look at the screening process and the final premium through this lens, you can really appreciate its value. It’s a meticulous system built to give you a reliable financial safety net, making sure your policy will be there for you, no questions asked, when it matters most.

The True Cost of Underinsurance For Everyone

It’s easy to think of getting travel insurance as a simple, private transaction. You list your health conditions, get a quote and decide whether or not to buy. But the choice to leave something out—or downplay a condition—sends ripples far beyond your own policy, affecting every single traveller in the UK. This isn’t just about one person risking their cover; it’s about the collective cost we all end up paying.

Think of the insurance system as a huge community fund. We all pay into it through our premiums, which are carefully worked out based on the expected level of risk from everyone involved. When we’re all honest, insurers can keep this fund balanced. But when someone makes a dishonest claim by not declaring a condition they knew about, it puts a massive financial and administrative strain on the whole system and ultimately hurts us all.

How Non-Disclosure Drives Up Premiums For All

Those extra costs don’t just disappear into the insurance company’s balance sheet. Instead, they get passed on to every customer in the form of higher premiums next year. Each time an insurer has to investigate or pay out a claim based on incomplete information, it knocks the whole financial model off-kilter. This is the real cost of insurance fraud.

This means your honesty does more than just protect you. It helps keep travel insurance affordable and accessible for everyone—including yourself—for years to come. Being upfront is as much a social responsibility as it is a personal one. You’re not just buying peace of mind; you're helping maintain a fair and sustainable insurance market where the "community fund" is strong enough to protect everyone when they truly need it.

The Financial Chasm: A Personal Perspective

Let's bring this back from the collective impact to your own personal risk. The reality of a medical emergency abroad without valid insurance is nothing short of catastrophic. A comprehensive policy for an 80-year-old with medical conditions might look expensive at first glance but it's a drop in the ocean compared to the bills you could face if things go wrong.

It’s hard to wrap your head around just how high these bills can climb. Recent data shows that medical expenses make up more than half ( 51.1% ) of all travel insurance claims in the UK. It’s clear that needing emergency treatment is the most common reason people have to call their insurer. You can see the full picture by exploring the latest findings on travel insurance claims from Which.co.uk.

A rejected claim doesn't just mean your holiday is ruined; it can mean your life savings are wiped out. The premium for a valid policy is a small, predictable cost compared to an unpredictable, six-figure medical bill.

To put this into perspective, let's compare the cost of a policy against potential uninsured medical bills.

Cost of Insurance vs Potential Uninsured Medical Bills

| Scenario | Example Comprehensive Insurance Premium | Potential Uninsured Cost Abroad |

|---|---|---|

| Heart attack in the USA | £450 - £800 | £100,000+ for surgery & hospital stay |

| Broken hip in Spain | £350 - £600 | £20,000+ for surgery & repatriation |

| Medical evacuation flight | Included in comprehensive policies | £50,000+ from the USA to the UK |

| Respiratory infection in the Caribbean | £400 - £700 | £30,000+ for intensive care & treatment |

These are not exaggerated figures; they are real-world costs that uninsured travellers have been forced to pay. When you weigh a policy premium of a few hundred pounds against a bill that could wipe out your savings, the value of proper cover becomes undeniable.

It really is the difference between a manageable expense and total financial ruin. If an insurer turns down your claim because you didn't declare something, you're facing a tough and complicated battle. To understand your options, you can discover more about what to do if your insurance company refuses to pay a claim in our detailed guide. Securing the right travel insurance over 80 medical conditions isn’t just a good idea—it’s a crucial investment in your financial security.

A Practical Guide To Finding The Right Policy

Navigating the world of travel insurance over 80 with medical conditions can feel like a maze. But with a bit of preparation, it becomes a clear, step-by-step task. The trick is to get all your ducks in a row before you even start looking for quotes. A little time spent gathering information now makes the entire journey smoother and ensures you land the right cover for your trip.

Think of it like preparing a file for a meeting. Before you pick up the phone or go online, you need all the relevant facts at your fingertips. This simple step stops you from getting flustered and means you're giving every insurer the same, accurate story.

Prepare Your Medical Information

First things first, sit down and make a detailed list of your complete medical history. This isn't just helpful; it's the absolute foundation of your search. Don't try to do it from memory because the small details really do matter.

Here’s a quick checklist to get you started:

- A list of all conditions: Write down every single pre-existing medical condition you've been diagnosed with. Even things that seem minor or are perfectly managed need to be on there.

- Medication details: Make a note of all the medications you currently take, including the specific name and dosage.

- Recent medical events: Jot down any hospital stays, surgeries or specialist appointments you’ve had in the last couple of years.

- Dates are important: Where you can, add the dates of diagnoses, treatments or any significant changes to your health.

Having all this written down means you can answer those detailed medical screening questions accurately every time. It also shows insurers you’re organised and taking this seriously, which can only help build confidence.

Why Specialist Brokers Are Often Better

You might be tempted to head straight to a standard price comparison website and while they’re great for simple insurance, they often fall short when dealing with complex medical histories. These sites are built for speed and simplicity, which means they can sometimes offer policies with sweeping exclusions for pre-existing conditions that are not obvious at first glance.

A specialist insurance broker, on the other hand, offers a more personal, tailored service. They get the nuances of underwriting for older travellers and have established relationships with insurers who are actually willing to cover more complex risks. Their expertise can be priceless in finding a policy that genuinely fits you, rather than just the one with the cheapest headline price.

A specialist broker acts as your advocate. They don't just find a policy; they find the right policy, ensuring the cover matches your specific health profile and travel plans. Their role is to provide expertise, not just price options.

As you start looking at different options, you'll come across key terms like policy limits. It’s well worth getting your head around them and this helpful guide to understanding insurance policy limits explains the concept simply.

Comparing Policies Beyond The Price

Once you have a few quotes in hand, the real work begins. It’s so important to look beyond the total cost and the headline medical cover figure. A truly robust policy is a comprehensive safety net that covers you for much more than just emergency treatment.

Use this simple checklist to compare the heart of each policy:

- Medical Cover: What’s the total amount for emergency medical cover? We recommend a minimum of £5 million , especially if you’re travelling to countries with eye-watering healthcare costs like the USA.

- Cancellation and Curtailment: Is the cover high enough to reimburse the full cost of your holiday if you have to cancel or cut the trip short for an insured reason?

- Repatriation: This covers the cost of getting you back home to the UK if it's medically necessary. It's a critical component that can run into tens of thousands of pounds.

- Policy Excess: Check the amount you would have to pay towards any claim. A cheap premium can sometimes hide a painfully high excess.

- Exclusions: This is where the true value of a policy is revealed. Read the policy wording carefully for any specific exclusions related to your conditions or the activities you have planned.

Travel With Confidence And Complete Peace Of Mind

So, what’s the main takeaway from all of this? It’s simple, really: honest, careful diligence is your most powerful tool when looking for travel insurance over 80 with medical conditions .

This isn’t just about ticking a box. It’s about investing in a proper safety net, one that genuinely protects you from what could be a financial disaster. We’ve looked at the very real dangers of not declaring everything and how insurance fraud ends up costing all travellers more in the long run.

With the right approach, you can find a policy that truly has your back. Just remember that your ability to make a successful claim hinges entirely on how accurately you completed that initial declaration.

Think of comprehensive insurance as the key that unlocks your freedom to travel. It gives you the confidence to explore the world, knowing you are fully and honestly protected if the unexpected happens.

When you take the time to find the right policy and declare your health conditions properly, you’re not just buying a piece of paper. You’re buying peace of mind. You’re free to focus on the joy and excitement of your upcoming adventure.

Travel should be about making wonderful memories, not stressing about what might go wrong. A solid, honestly-secured insurance policy makes that possible, ensuring every trip is as relaxing and enjoyable as it should be.

Frequently Asked Questions

Working through the details of travel insurance for over 80s with medical conditions can naturally bring up a few final questions. Let’s clear up some of the most common ones so you can finalise your plans with total peace of mind.

What Happens If I Forget To Declare A Minor Condition?

This is a classic pitfall. Forgetting to mention what seems like a minor condition can be treated by an insurer as non-disclosure . It’s a serious issue. If you later need to make a claim, the insurance company has the right to comb through your entire medical history.

If they discover an undeclared condition—no matter how small you thought it was—they could argue that you misrepresented your health. That might be all they need to invalidate your entire policy, leaving you to foot every bill yourself. The golden rule? When in doubt, declare it. It’s always better to be overcautious.

Are Specialist Insurers Much More Expensive?

It’s true that specialist insurers can have higher premiums but there’s a good reason for it. They’re taking on a level of risk that standard insurers simply won’t touch. That price tag reflects a genuine, calculated acceptance of your specific medical history.

A cheaper, standard policy might look tempting but it will almost certainly have a blanket exclusion for any pre-existing conditions. In reality, it would be useless when you needed it most. Think of the higher premium not as an extra cost but as an investment in real, dependable cover that actually works. For a deeper dive, our guide to frequently asked questions about insurance offers more helpful context.

Can I Get An Annual Multi-Trip Policy Over 80?

Yes, in many cases, you absolutely can. Plenty of specialist insurers offer annual multi-trip policies designed for older travellers with pre-existing conditions. If you travel more than once a year, it can be a much more convenient and cost-effective way to get covered.

Just be aware that there will likely be some conditions attached. You might find there’s a maximum age limit or caps on how long any single trip can last. And, of course, a full and thorough medical screening will still be a non-negotiable part of the application process.

My Doctor Says I Am Fit To Travel. Does This Matter?

It definitely helps but it’s not the whole story. A ‘fit to travel’ letter from your GP can be a useful supporting document—and some insurers may even ask for one—but it does not get you out of declaring everything during your application.

An insurer’s risk assessment is a financial calculation, which is entirely separate from your doctor's medical opinion. You must answer every single question in the screening process honestly and fully, no matter what your doctor has said.

The insurer bases their decision and pricing on the specific details you provide in your declaration, not on a doctor's general thumbs-up. The cover they offer is tied directly to the information you give them.

At Proova , we believe clear, verifiable information is the bedrock of good insurance. Our platform creates a transparent record for both policyholders and insurers, helping to speed up claims and build trust when it really counts. See how we’re making insurance smarter and more secure at https://www.proova.com.