Renew House Insurance: A Quick Guide to Protecting Your Home

When you renew house insurance , it’s tempting to treat the letter from your insurer as just another bill. But that’s a mistake. Think of it as a critical annual check-up for the financial safety net protecting your most valuable asset. Simply letting your policy auto-renew is a gamble. You could end up overpaying for cover you don’t need, or worse, discovering you’re underinsured just when you have to make a claim.

Why Your Renewal Letter Deserves a Closer Look

That annual house insurance renewal letter has landed on your doormat. It’s easy to just file it away and let the direct debit sort itself out. But taking that passive approach could be a seriously costly mistake. The world of home insurance is changing, and just coasting along isn't good enough anymore.

Insurers are facing pressures we haven't seen before. In the UK, home insurance claims have hit staggering heights. According to the Association of British Insurers, their members paid out a record £4.6 billion in property claims in just the first nine months of a recent year. That's the highest figure ever recorded for that period. You can get the full picture by reading the report on rising insurance payouts from the Association of British Insurers. This kind of financial strain inevitably affects how policies are priced and how claims are handled.

The Problem of Proof

Think about what this means for you, personally. Let’s try a quick 'lounge exercise'. Right now, without looking, can you list every single item in your living room from memory? It sounds simple until you actually try it. Now, for your TV, sound system, and games console, can you add the make, model, and serial number? For almost everyone, it's an impossible task.

This is the exact challenge you'd face after a burglary or a fire. Your insurer is going to ask for proof of ownership and the value of everything you're claiming for. If you don't have it, your claim could be delayed, reduced, or even flat-out rejected.

Your insurance policy is a promise of financial protection, but that promise is conditional. It hinges on you being able to prove what you've lost. An out-of-date policy based on guesswork is a risk you simply can’t afford to take.

A Proactive Approach to Protection

Taking the time to renew house insurance thoughtfully is so much more than a box-ticking chore. It's your annual opportunity to ensure the policy truly reflects your current situation. Have you bought new furniture? Inherited some valuable jewellery? Started working from home with expensive office gear? All these things change the value of your contents, and your policy needs to know about them.

A proactive review, starting with a clear, verifiable record of what you actually own, ensures you have the right protection at a fair price. It will save you money now and a world of stress when it matters most.

What to Check Before Accepting Any Renewal Offer

Before you jump at comparing quotes or just accept the price your insurer has offered, take a moment. The single most important step when you renew house insurance is to understand exactly what you're paying for. A policy that was a perfect fit last year might have serious gaps today, leaving you exposed without you even realising it.

Your renewal letter isn't just a bill; it's a contract. You need to review the key details to make sure it still fits your life. Start with the most fundamental numbers on the page.

Are Your Sums Insured Still Accurate?

The sums insured are the maximum amounts your insurer will pay out for a claim. There are two critical figures to check here: one for your buildings and one for your contents.

- Buildings Cover: This is the cost to completely rebuild your home from the ground up, not what it might sell for. Have you built an extension, converted the loft, or installed a new kitchen in the past year? These improvements can significantly push up your home's rebuild cost, and your cover must be updated to match.

- Contents Cover: This covers everything you'd take with you if you moved house—from your sofa and TV to your clothes and jewellery. It's incredibly easy to underestimate the total value. Did you buy a new laptop, invest in a pricey piece of art, or inherit a family heirloom? If your contents sum insured is too low, you'll be underinsured and could receive only a fraction of your claim's value.

Understanding the Small Print

Beyond the headline figures, the policy wording is where the details that make a huge difference in a claim are hiding. Don't skip them.

First, check your excess . This is the amount you have to pay towards any claim before the insurer chips in. A higher excess usually means a lower premium, but make sure it's an amount you could comfortably find at a moment's notice.

Next, look for exclusions . These are specific situations or items your policy simply won't cover. Common exclusions include damage from wear and tear, frost, or pests. Many policies also have single-item limits, meaning any individual item over a certain value (often around £1,500 ) has to be listed separately to be fully covered.

A key detail to confirm is whether your cover is 'new for old' or 'indemnity' . New for old means the insurer will pay to replace a lost or damaged item with a brand-new equivalent. Indemnity cover, on the other hand, only pays out the item's value at the time of the loss, accounting for wear and tear—which is almost always less.

By scrutinising these points, you can make an informed decision about whether your current policy is still the right one for you. For a deeper dive into the claims journey itself, you can master the home insurance claims process with our guide . It'll help you understand exactly why getting these details right at renewal is so vital.

Using a Home Inventory to Secure Better Terms

Remember that mental exercise of listing everything in your lounge? The fact that it’s nearly impossible is the single best reason to create a home inventory. This isn't just about preparing for a worst-case scenario claim; it’s your most powerful tool when you renew house insurance , giving you the evidence you need to secure the right cover in the first place.

Having a detailed, up-to-date inventory moves your insurance from guesswork to fact. It proves to an insurer that you're an organised, lower-risk policyholder who actually understands what they own. This clarity can lead to more accurate quotes and a much smoother renewal process because there's no ambiguity about what needs protecting.

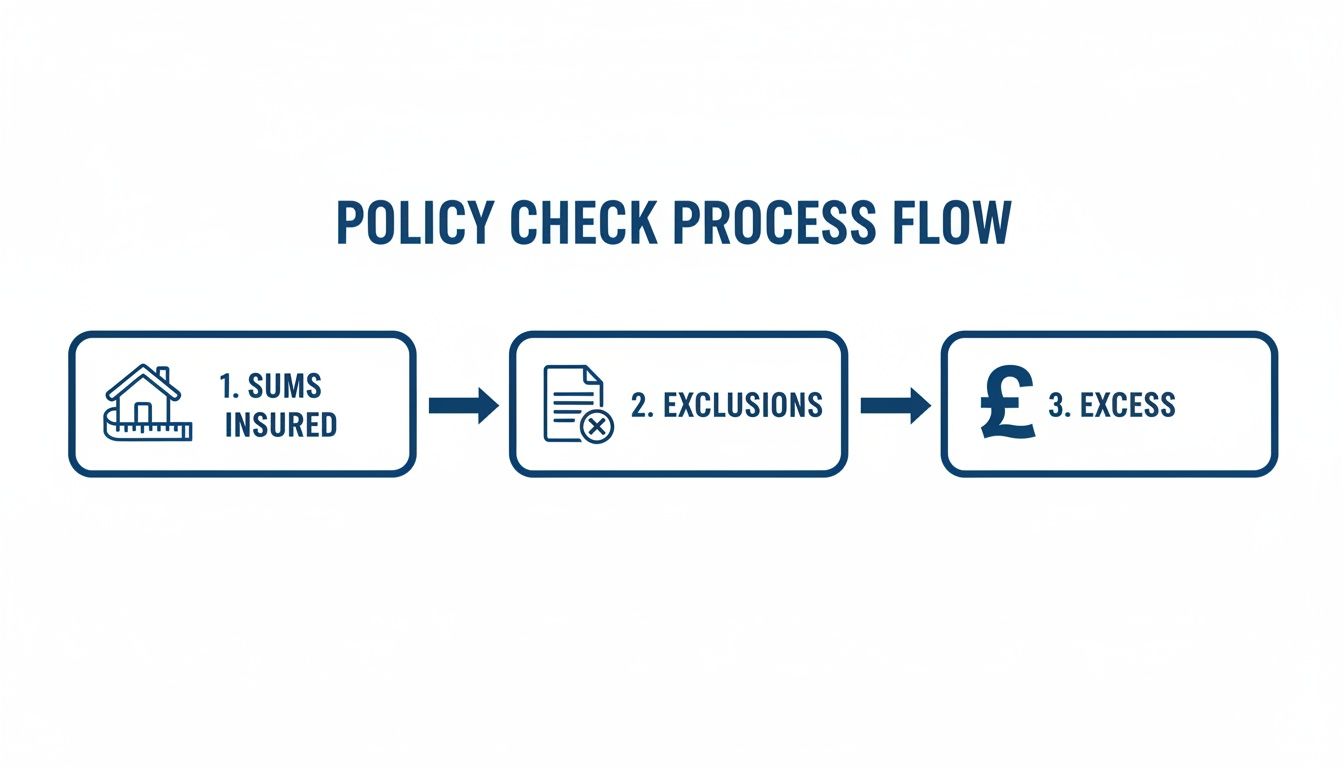

The process below breaks down how to review your policy's key details—a task made far simpler when you have an accurate inventory to hand.

As the visual guide shows, the core elements—sums insured, exclusions, and your excess—are directly informed by what’s in your home. A thorough inventory is the foundation for getting these right.

Creating an Inventory That Works for You

Building an effective inventory doesn’t have to be a monumental chore. The goal is to create a clear, simple record of your belongings that will stand up to scrutiny from an insurer.

Start by working through your home one room at a time. It’s a methodical approach that stops you from feeling overwhelmed and ensures nothing gets missed. For each item, focus on capturing the essential details:

- Photographs: Take clear pictures of your most valuable items from several angles. Make sure to capture any identifying marks, brand names, or unique features.

- Serial Numbers: For electronics, appliances, and tools, photograph or jot down the serial and model numbers. This is non-negotiable proof of ownership for high-value tech.

- Receipts and Valuations: If you have receipts, especially for recent purchases, or professional valuations for items like jewellery or art, scan them or take clear photos.

This is exactly where an app like Proova becomes invaluable. It guides you through this process, letting you catalogue everything on your phone and store the evidence securely in one place, ready for that renewal conversation.

Proving Your Contents Value Accurately

One of the biggest mistakes homeowners make is underestimating the total value of their contents. It’s so easy to forget the cumulative cost of everything from kitchen gadgets to the clothes in your wardrobe.

A detailed inventory provides an accurate total, ensuring your sum insured is correct. You can learn more about how to calculate this figure by exploring the UK average house contents value explained in our detailed guide.

An inventory isn't just a list; it's a demonstration of diligence. By presenting a verified record of your belongings, you are showing a potential insurer that you are a responsible homeowner who takes risk seriously. This can positively influence their assessment of your policy.

When compiling your inventory, remember to include features that actively mitigate common risks. Documenting the presence of high-quality smoke alarms, robust security systems, or even smart water leak detectors can show you've taken proactive steps to protect your property. This level of detail strengthens your position and helps justify the cover you need, turning a standard renewal into an opportunity to secure better, more accurate terms.

Finding the Best Value When You Renew House Insurance

Right, you’ve got your inventory sorted and a solid idea of the cover you actually need. Now you're in the perfect spot to find the best deal when you renew house insurance . But hold on—this isn't just about chasing the lowest possible price. The cheapest policy is rarely the best value if it’s packed with sneaky exclusions that leave you high and dry when you need it most.

This is the fork in the road: do you stick with your current provider, or is it time to switch? Loyalty rarely pays in the insurance market. Actively shopping around is almost always the surest way to get the right blend of cover and cost.

Comparing Your Options Effectively

Comparison websites are a brilliant starting point, but you need to use them wisely. They’re great for getting a quick snapshot of the market, but they can sometimes lure you in with policies that only look cheap on the surface.

To get the most out of them, here’s what to do:

- Enter Identical Information: Be meticulous. Every detail you input—from your sums insured to your claims history—must be identical across all sites. Only then can you get a true like-for-like comparison.

- Look Beyond the Price Tag: Don't just sort by the lowest price. Dig into the policy details. Pay close attention to the compulsory excess, check for any frustrating single-item limits, and read the key exclusions.

- Check the Defaqto Rating: This is an independent star rating from 1 to 5 . It assesses the quality and comprehensiveness of the policy features, giving you a quick, at-a-glance indicator of its overall value.

To Stick or to Switch

Now, while Financial Conduct Authority (FCA) rules stop insurers from charging existing customers more than new ones for the same policy—a practice known as 'price walking'—that doesn't automatically mean your renewal offer is the best deal out there. Far from it.

Once you have a few cheaper quotes from your research, don't be afraid to pick up the phone to your current insurer. Tell them you're considering leaving and that you've found a better price elsewhere for comparable cover. They might not be able to match it exactly, but you'd be surprised how often they're willing to negotiate to keep your business.

The UK home insurance market is feeling the pressure from a turbulent claims landscape. The Association of British Insurers reports on real paid prices, not just quotes, which reveals the true cost pressures on providers. To manage rising costs, many customers are now increasing their excess or shopping around more actively at renewal. You can find more insights on the current state of property claims from the ABI.

At the end of the day, the best value isn't just the cheapest premium. It’s the peace of mind that comes from knowing you have robust, reliable cover that will actually be there for you if you ever have to make a claim. That's what really counts.

Finalising Your Policy and Staying Protected All Year

So, you’ve navigated the quotes, compared the small print, and picked out the right policy. You’re on the home straight. Whether you’re clicking ‘buy’ online or talking it through with your broker, there are a couple of final checks worth doing to make sure the cover you chose is what you actually get.

When the official documents land in your inbox or postbox, take a few minutes to read through them properly. This is your last real chance to catch any mistakes before they become a massive headache.

Check your name and address are spot on, the sums insured match what you agreed, and any special high-value items you listed are present and accounted for. It’s a five-minute job that could save you a world of pain down the line.

Protection Doesn't Stop at Renewal

Getting the right policy sorted is a big tick off the list, but genuine peace of mind comes from making sure you stay protected all year round. Your insurance policy isn't a 'set and forget' document; it's a living agreement that needs to keep pace with your life.

This means you’ve got a responsibility to let your insurer know about any significant changes that could affect their risk. These are often called ‘material changes’ , and failing to declare them could actually invalidate your cover, leaving you high and dry if you need to claim.

Key events you absolutely must tell your insurer about include:

- Major renovations: Building an extension, converting the loft, or even just knocking down a few internal walls will all change the structure and rebuild cost of your home.

- Acquiring valuable items: If you inherit expensive jewellery, buy a piece of art, or invest in a new high-end camera, you need to make sure it's covered, often as a separately specified item.

- Changing how you use your home: Starting a business from your spare room or getting a lodger can definitely alter your insurer’s view of the risk.

Keeping Your Inventory Current

Just as you update your insurer, you should get into the habit of keeping your home inventory current. Just bought a new laptop or a fancy set of golf clubs? Take two minutes to add them to your Proova inventory. Snap a quick photo of the item and the receipt, and you’re done. This simple habit ensures your digital record of ownership is always accurate and ready if you need it.

An up-to-date inventory is also vital for risks you might not think about until it’s too late, like a sudden water leak. A detailed record helps prove the condition of your property before an incident, which can be invaluable.

Staying protected also means taking practical steps to reduce risks around the home. Simple actions, like those recommended when preparing your home before vacation , can prevent common claims and show your insurer you’re a responsible homeowner.

The UK is seeing a huge surge in weather-related claims, with insurers paying out hundreds of millions for storm and flood damage in a single quarter. It just shows how quickly things can change, making proactive protection absolutely essential. Taking this approach ensures you’re fully protected throughout the policy year, not just on the day you renew.

Common Questions About Renewing Home Insurance

Navigating the annual ritual to renew house insurance can throw up a lot of questions. It's a process filled with jargon and small print, so feeling a bit uncertain is completely natural. Here are clear, straightforward answers to some of the most common queries UK homeowners have when their renewal date looms.

Will My Home Insurance Premium Go Up Every Year?

Not always, but it's very common. Insurers adjust their prices based on a whole host of factors, many of which are completely out of your control. This includes things like inflation, the soaring cost of building materials and labour for repairs, and an increase in national claims due to events like severe storms or floods.

So, even if you’ve never made a claim, your premium can still creep up to reflect these wider market trends. This is precisely why it's so vital to actively shop around each year instead of just accepting the auto-renewal price your current provider sends you.

Can I Switch Insurers Mid-Policy if I Find a Better Deal?

Yes, you absolutely can, but you need to do the maths first. Most insurance providers will hit you with a cancellation or administration fee if you decide to end your policy before its official renewal date.

Before making the jump, you need to weigh the savings you'd get from the new, cheaper policy against the cancellation fee from your current one. In many cases, you might find it's more cost-effective to simply see out your current term and make the change on your renewal date to avoid any penalties.

What Happens if I Forget to Renew My House Insurance?

This is a scenario you really want to avoid. If you pay for your policy by direct debit, it will most likely auto-renew, which at least ensures you remain covered. The catch? This is often at a far less competitive price than you could find by shopping around.

If you don't have an auto-renewal in place and you forget, your cover will simply lapse. This leaves you completely uninsured. Any damage from a fire, flood, or a burglary would be entirely your financial responsibility. What’s more, a gap in your insurance history can make it more difficult and expensive to get cover in the future.

Do I Need to Declare Small Home Improvements?

You absolutely must declare any changes that could impact your property's value or its rebuilding cost. Minor cosmetic updates, like painting a room or putting up new shelves, don't need to be declared.

However, for significant projects, you have to let your insurer know. This includes things like:

- A brand-new kitchen or bathroom installation

- A loft conversion or an extension

- Building a conservatory or a new outbuilding

Failing to declare these kinds of substantial changes could give your insurer grounds to reduce or even reject a future claim, as your policy would be based on outdated information. Keeping them in the loop is essential.

Don't get caught out by guesswork when you need to make a claim. With the Proova app, you can create a simple, secure, and verified inventory of everything you own, giving you the proof you need for a faster, fairer claims process. Take control of your home insurance by downloading the app today. Find out more at Proova.com.