Proof of No Claims: A UK Driver's Guide

Think of your proof of no claims as a driving passport. It’s the official stamp of approval from a previous insurer that confirms your claim-free history, and it’s your golden ticket to getting a hefty discount on your next car insurance policy. Without it, a new insurer has no verified record of your careful driving, meaning you’ll pay a much higher premium.

Unlocking Your No Claims Discount

Ever found a brilliant car insurance quote online, only to see the price shoot up because you couldn't find a simple document? That's the power of your proof of no claims in action. It’s the formal confirmation—usually a letter or an email—that spells out exactly how many years you’ve been insured without making an at-fault claim.

For UK insurers, this document is non-negotiable. It’s how they verify you’re a lower-risk driver who has genuinely earned a discount, rather than just taking your word for it. The whole system is built to reward careful drivers, and the savings aren't small. In fact, your No Claims Discount (NCD) is often the single biggest factor that can slash your annual insurance costs.

Why It's More Than Just a Piece of Paper

At its core, your proof of no claims is a valuable financial asset. Every single year you drive without making a claim, your potential discount gets bigger. Insurers see a long, unbroken record as a strong signal that you’re less likely to cost them money, and they reward that confidence by lowering your premium.

The system works because it creates a trustworthy, standardised way for insurers to assess your personal risk based on actual history, not just on broad statistics for your age or postcode. This ultimately makes pricing fairer for everyone.

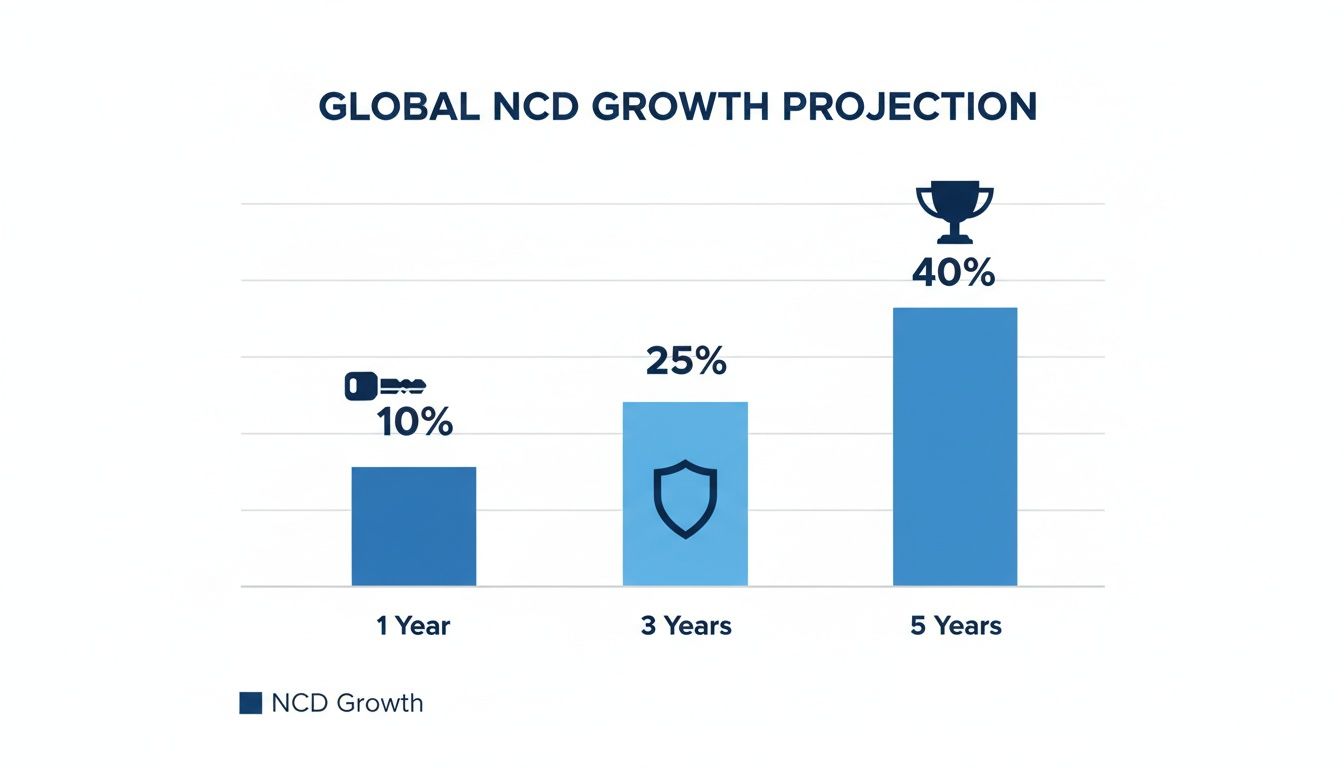

This chart shows just how quickly your No Claims Discount can build up, offering bigger savings with each claim-free year you accumulate.

As you can see, the rewards for safe driving really stack up over time, which is why having the right proof is so vital to securing the best possible price.

Your No Claims Discount Journey

To see how this plays out in the real world, here’s a look at how an NCD can grow and its powerful effect on what you pay for car insurance.

| Years Claim-Free | Typical Discount (%) | Example Annual Premium |

|---|---|---|

| 1 Year | 30% | £700 |

| 2 Years | 40% | £600 |

| 3 Years | 50% | £500 |

| 4 Years | 60% | £400 |

| 5+ Years | 65% - 75% | £350 - £250 |

Note: Discounts and premiums are illustrative examples. Actual figures will vary between insurers and individual circumstances.

The table clearly shows that protecting your NCD is one of the most effective ways to manage your insurance costs year after year.

The Impact on Your Wallet

Losing this proof or failing to provide it means you effectively hit the reset button on your driving record in the eyes of a new insurer. You'll be quoted a premium as if you have zero years of no claims, which could easily cost you hundreds of pounds more.

Without verified proof, an insurer has to assume the highest risk. Your driving history becomes invisible, and you pay the price for that uncertainty, losing out on discounts that could be as high as 60-70% after five or more years.

It all comes down to evidence. Just as you’d need proof of ownership to claim for a stolen watch, you need proof of your driving record to claim your discount. That’s why understanding how your no claims bonus works in the UK is so critical for any driver wanting to keep their costs down. Protecting this record is one of the smartest financial moves you can make on the road.

Why Insurers Require Proof and What They Accept

In the world of insurance, a quote is all about managing risk. While trust is important, insurers simply can’t take your word for it when significant discounts are on the line. This is precisely why they ask for official proof of no claims —it's their primary defence against inaccurate pricing and outright fraud.

Think about it: without a verified document, anyone could claim a long, unblemished driving history to snag a cheaper quote. This would completely undermine the system designed to reward careful drivers. By demanding proof, insurers make sure the discounts go only to those who have genuinely earned them through years of claim-free driving. It’s a standard, non-negotiable step in the UK insurance market.

And the financial stakes are incredibly high. The value of a no claims bonus is substantial. A driver with zero years of NCB might face a baseline annual premium of around £1,174.98 . After just one year, a 30% discount brings that down to £944.80 . By the five-year mark, the discount is typically around 50% , reducing premiums to £594.43 . Drivers with 20 years of NCB could pay as little as £350.91 —a massive 70% reduction from the starting point. You can see more on how these car insurance statistics affect drivers across the country.

What Documents Count as Proof

Insurers are specific about the evidence they’ll accept. Just telling them your old policy number won't cut it; they need an official document from your previous insurer that lays out all the necessary details.

Fortunately, you probably already have what you need. The proof is usually included in the standard paperwork you get when your policy ends or is up for renewal.

The three most common forms of proof are:

- Your Renewal Invitation: The letter or email your old insurer sends before your policy expires will almost always state the number of no claims years you've built up.

- A Cancellation Letter: If you end your policy mid-term, the confirmation letter should include your NCD entitlement as of that date.

- A Dedicated ‘Proof of No Claims’ Document: If the info isn't on the other documents, you can simply ask your old insurer for a specific letter confirming your claim-free history.

Think of our "lounge exercise"—ask someone to list everything in their lounge without looking, and they'll struggle. Insurers face a similar problem. Your memory of your driving history isn't enough; they need a concrete, documented inventory of your claim-free years to give you the discount you've earned.

Key Details Insurers Check For

When you submit your proof, your new insurer isn't just giving it a quick glance. They are meticulously checking specific details to validate the document and make sure it lines up with the information you gave them for your quote. Any mismatch can cause delays or even lead to your policy being cancelled.

They will always look for:

- Your Full Name: The name on the proof must match the main policyholder for the new insurance.

- Your Previous Policy Number: This helps them verify the document's authenticity with your old insurer if they need to.

- The Policy Expiry Date: This is crucial. Your proof of no claims is generally only valid for two years after a policy ends. An outdated document is worthless.

- The Exact Number of No Claims Years: This is the most important bit. It must match the number you declared to get your quote.

- Official Insurer Branding: The document needs to be on official letterhead or come from a recognised company email address.

Submitting the wrong document or one with missing information is a common mistake that can invalidate your new policy, potentially leaving you uninsured. Always double-check your paperwork to ensure every detail is correct before sending it off.

The True Cost of an At-Fault Claim

Making an at-fault claim is far more than a one-off inconvenience. The excess you pay is just the tip of the iceberg; the real financial pain kicks in when you see your next renewal quote. In the UK, insurers use a ‘step-back’ system, meaning a single incident can wipe out years of your carefully built no claims discount in an instant.

It’s a brutal drop. A driver with five years of clean driving, often enjoying a discount of 60% or more , could see that slashed back to just two years’ worth. In real terms, this can easily add hundreds of pounds to your premium. It’s like being forced back down a ladder you’ve spent years climbing.

The Double Penalty of a Claim

But the financial hit doesn't stop with losing your discount. Insurers also ‘load’ your premium. Because you’ve now made a claim, you’re statistically a higher risk, and they charge you for it. This loading is an extra charge added to your base premium before your now-reduced discount is even applied.

This creates a painful double whammy:

- Discount Step-Back: Your percentage saving is cut, so you pay more of the underlying premium.

- Premium Loading: The underlying premium itself has been hiked up because your risk profile has changed.

This combination is why a single at-fault claim feels so disproportionately expensive. You’re not just losing a benefit you earned; you’re being hit with an extra fee for the incident itself, with financial consequences that stick around for years.

A Real-World Example

Let’s put some numbers to this to see the real-world damage.

-

Driver A (Claim-Free): Has five years of no claims, giving them a 60% discount on a base premium of £1,000.

- Annual Premium: £400

-

Driver B (After At-Fault Claim): Also had five years, but an at-fault claim knocks their discount back to two years (around 40% ). The insurer also loads their base premium by 20% to reflect the new risk.

- New Base Premium: £1,200 (£1,000 + 20% loading)

- New Discount: 40%

- New Annual Premium: £720

In this scenario, just one claim leads to a staggering £320 premium increase for the next year. It perfectly illustrates why protecting your proof of no claims record is so vital to your finances.

The Long-Term Financial Impact

And this penalty isn't just a one-year problem. You then have to spend the next few years slowly rebuilding your discount, all while paying more than you would have. The financial fallout from losing your no claims bonus (NCB) can be devastating. For some UK drivers, it can mean paying an extra £2,700 or more over the five years it takes to get back to the maximum discount. You can discover more insights about the shocking cost of claims in the UK.

The step-back system ensures the financial consequences of a claim are felt long after the incident is a distant memory. It's a stark reminder that your claim-free record is a valuable asset—one that needs protecting just as much as the car it insures.

It's this long-term view that often gets lost in the moment. When faced with a minor bump or scrape, claiming might seem like the easy option. But once you understand the full financial fallout, the calculation changes completely. Sometimes, paying for a small repair out of your own pocket is by far the smarter move to protect the huge value locked in your no claims history.

How to Get Your Proof of No Claims

Knowing you need proof of no claims is one thing; actually getting your hands on it can feel like another chore on your to-do list. The good news is that it’s usually quite straightforward. Your previous insurer is legally obliged to provide it, and often, the proof is already sitting in documents you’ve received from them. This guide breaks down the most common situations UK drivers find themselves in.

The trick is to be proactive. Waiting until your new insurer starts chasing you for the document just adds unnecessary stress to the process. By knowing where to look and what to ask for, you can make the switch between policies seamless and lock in that discount you've worked so hard to earn.

Scenario 1: At Renewal Time

This is by far the easiest scenario. As your car insurance policy nears its end date, your current insurer will send you a renewal notice, either in the post or via email. This document will almost always include a clear statement confirming the number of no claims years you've built up with them.

That's it. Just save this document—a PDF is perfect—and it becomes your official proof for the next insurer. It has all the key details they need: your name, policy number, the policy expiry date, and your NCD entitlement.

Scenario 2: After You Have Cancelled Your Policy

If you’ve already switched providers or simply cancelled your old policy without keeping the renewal letter, you'll need to get in touch with your previous insurer directly. Don't worry, this is a very common request, and they are required to give you the information.

You can usually get it sorted in one of three ways:

- Phone: Give their customer service team a call and ask them to email or post your proof of no claims.

- Online Portal: Most insurers now have a self-service area on their website where you can log in and download policy documents, including your NCD proof.

- Email: A quick, polite email requesting the document is often all it takes.

When you make contact, have your old policy number ready to speed things up. A simple request like, "I've recently cancelled my policy and my new insurer needs a formal letter confirming my no claims discount," is all you need to say.

Insurers are generally quick to send this over, but it’s best to request it as soon as you take out your new policy. For a deeper dive, our detailed guide to proving your no claims discount covers even more specific situations.

The Critical Two-Year Rule

Here’s something you absolutely need to remember: the NCD expiry date. In the UK, your proof of no claims is only valid for two years from the day your last policy ended. If you have a gap in your insurance cover for more than 24 months—maybe you were using a company car or living abroad—your entire discount will be wiped out. You’ll be starting from scratch.

This rule is strict and is applied by virtually every insurer in the UK. If you know you'll be taking a break from driving, it’s worth looking into being a named driver on someone else's policy. While it won't always protect your NCD, it can help maintain an active driving history.

Special Cases: Company Cars and Named Drivers

What happens if you haven't been the main policyholder?

- Company Car Drivers: If you've been driving a company car, you won't have a personal NCD to show. However, most insurers will accept a formal letter from your employer's fleet manager. This letter should confirm your claim-free driving record on their commercial policy, which can often secure you a significant introductory discount.

- Named Drivers: Traditionally, being a named driver on someone else’s policy meant you didn't build up your own NCD. Things are changing, though. Some insurers now offer a "named driver discount" to acknowledge that experience when you take out a policy in your own name for the first time. It's always worth asking about.

Solving Common Proof of No Claims Problems

Even with the best intentions, getting your proof of no claims can sometimes feel like an uphill battle. You've found a brilliant new insurance quote, but now you're stuck in a frustrating loop, chasing a simple document from your old provider. This section is your go-to guide for navigating the most common headaches UK drivers face, giving you practical steps to cut through the red tape.

The process should be simple. But delays, errors, and lost documents can turn it into a real source of stress. Knowing your rights and the right steps to take can make all the difference, ensuring you don't lose out on the discount you've rightfully earned.

Your Old Insurer Is Being Slow

You’ve called, you’ve emailed, but your previous insurer is dragging its feet. Meanwhile, your new provider is sending reminders, and the deadline to submit your proof is getting dangerously close. This is by far one of the most common and infuriating problems.

Under the Financial Conduct Authority (FCA) guidelines, insurers are expected to treat customers fairly and communicate clearly and promptly. While there isn't a strict legal deadline for sending the proof, a delay of more than a few days is just not on.

Here’s a clear action plan:

- Follow Up in Writing: Ditch the phone for a moment and send a formal email. Reference your previous calls, state your old policy number, the date you first requested the proof, and underline the urgency. This creates a paper trail.

- Mention the FCA: Politely state that you need the document to avoid financial loss (i.e., your premium going up) and that you expect them to handle your request promptly as per their regulatory obligations.

- Lodge a Formal Complaint: If you still get radio silence, use the insurer’s official complaints procedure. This escalates the issue internally and usually gets a much faster response.

The Document Contains an Error

You finally get the document, but it's wrong. Maybe they’ve listed four years of no claims instead of the five you've built up, or they've managed to misspell your name. An incorrect document is as bad as no document at all, because your new insurer will simply reject it.

Don't panic. Contact your previous insurer immediately and clearly point out the error. If you have any evidence to back it up, like your original policy schedule or last year's renewal letter showing the correct information, send it over. If the mistake is theirs, they are obliged to correct it and issue a new document right away.

Think of it like our "lounge exercise." If you were asked to list everything in your living room and you missed the television, the list would be inaccurate and incomplete. An incorrect NCD proof is the same—it doesn't reflect the full picture and must be corrected to be of any value.

You Have Lost the Proof Entirely

It happens. Letters get misplaced, and emails get accidentally deleted. If you can't find your renewal or cancellation letter anywhere, the solution is thankfully simple: just ask for another one. Your previous insurer keeps your policy history on file and can reissue the proof of no claims document on request.

Most insurers can send a digital copy by email, often within 24 hours. Just have your old policy number and personal details handy to verify your identity.

When you're navigating these kinds of snags, it's always useful to be prepared. For instance, knowing how to effectively deal with insurance adjusters and other company representatives can help you communicate your needs clearly and get a faster resolution.

Transferring an NCD from an Overseas Policy

Now, this is a trickier situation. If you’ve been driving abroad, you might find that many UK insurers are hesitant to accept a no claims discount from another country. The reason is simple: there’s no universal system for verifying international driving records.

However, it's not impossible. Your chances are much higher if:

- The policy was with a well-known international insurer.

- The document is written in English.

- You are returning from a country with similar driving standards, like Ireland, Australia, or Canada.

Your best bet is to ring insurers directly, especially specialist brokers, and explain your circumstances. Be ready to provide a formal letter from your overseas insurer that confirms your claim-free history. While it isn't guaranteed, some providers will honour it or at least offer a hefty introductory discount.

The Future of Digital Claims Verification

Let's be honest, the days of waiting for a letter to land on your doormat or frantically searching through old emails for your proof of no claims are numbered. The current system, built on paper and PDFs, feels clunky and slow in a world where almost everything else happens in an instant. The insurance industry is finally catching up, moving towards a future of immediate, digital verification that will change far more than just how you prove your driving record.

This shift gets to the heart of a universal problem: the struggle of proving something after the fact. It’s the same challenge whether you’re trying to show a claim-free driving history or prove you owned that specific television now missing after a burglary. The core issue is identical.

From Driving Records to Digital Inventories

Think back to the "lounge exercise" we mentioned. Trying to list every single item in your living room from memory—right down to the serial numbers—is a nightmare after the shock of a fire or theft. A digital solution that instantly verifies your driving history works on the exact same principle as an app that verifies your home contents before you ever need to claim.

Both systems solve the problem by creating a secure, verified record of the facts upfront. One catalogues your driving history; the other catalogues your prized possessions. This proactive approach strips the guesswork and stress out of the claims process, making it faster and fairer for everyone. Of course, the success of any future digital claims system hinges on robust methods of digital identity verification.

Why Insurers Are Embracing This Shift

Insurers aren’t just adopting new tech for the sake of it; they're driven by the cold, hard need for better efficiency and accuracy. The profitability of UK car insurance can swing wildly. One year the industry might report a deeply unprofitable net combined ratio (NCR) of 112.7% , only to see it bounce back to a healthier 97% the next. This volatility forces insurers to scrutinise claims with extreme care, making solid, verifiable proof more critical than ever.

Digital verification provides a clear solution by:

- Cutting Down Fraud: Instant, secure data exchange makes it far more difficult to submit a fake or inflated claim.

- Speeding Things Up: Automated checks mean your NCD can be confirmed in seconds, not days. Your policy gets set up correctly from the very start.

- Improving the Customer Experience: It removes a massive headache for customers, creating a smoother, less frustrating journey when buying or renewing insurance.

The ultimate goal is a system where your driving history becomes a secure, portable digital asset that you control—just like a digital inventory of your home contents. This puts you firmly in the driver's seat, ending the reliance on slow, outdated administrative hoops.

This is all a crucial part of the wider digital transformation in the UK insurance industry . The focus is on using technology to build a more transparent, efficient, and trustworthy ecosystem. For customers like you, that means less paperwork, faster service, and the simple peace of mind that comes from knowing your proof is always ready when you need it.

Got Questions? We’ve Got Answers

Here are quick, clear answers to the most common questions UK drivers have about their proof of no claims. This section tackles a few extra details not fully covered in the main article.

How Long Is My Proof of No Claims Valid For?

In the UK, most insurers will accept a no claims discount for up to two years after a policy has ended. If you go without car insurance for more than 24 months , that hard-earned discount will unfortunately expire. You’ll have to start building it all over again from scratch. It’s a firm rule applied by nearly every provider out there.

Can I Use My No Claims Discount on Two Cars?

This is a common one, but the short answer is no. Typically, you can’t apply the same No Claims Discount to two separate car policies at once. The discount is earned by one driver on one policy and is tied to that specific vehicle.

That said, some insurers might offer a 'mirrored' discount for a second car as a goodwill gesture, though it’s unlikely to be for the full amount. It’s always worth asking your chosen provider what their specific policy is on this.

What Happens If I Forget to Send My Proof of No Claims?

Failing to provide valid proof within your new insurer's timeframe – usually between 7 and 21 days – will have immediate consequences. Your premium will be recalculated as if you have zero no claims discount, which can cause a serious price hike.

In some cases, the insurer might even cancel your policy altogether for non-disclosure. The bottom line? Send that document over as soon as you get it to avoid any headaches.

Just as a clean driving record needs solid proof, so do your home contents. Try the "lounge exercise"—it shows how impossible it is to remember everything you own after a fire or theft. Proova lets you create a verified digital inventory of your possessions, so you have undeniable proof ready for any insurance claim. Secure your belongings and ensure a faster, fairer payout.