What Does Third Party Insurance Cover in the UK?

At its most basic, third party insurance covers your liability if you injure someone else or damage their property. It’s the absolute minimum level of cover you need to drive legally in the UK but here’s the crucial part: it does not cover damage to your own car or your own injuries if you’re the one who caused the accident.

Your Guide to the UK's Legal Minimum Car Insurance

Think of third party insurance less as a policy for you and more as a financial safety net for everyone else on the road. If you're involved in a collision and found to be at fault this insurance steps in to handle the costs for the other person involved—the "third party".

This cover is the bedrock of UK driving law. It makes sure that innocent victims of an accident aren't left facing huge bills for car repairs or medical treatment. With over 23 million motor insurance policies active in the UK third party cover is a common choice, largely because it’s a legal must-have. You can discover more insights about UK car insurance trends to see the bigger picture.

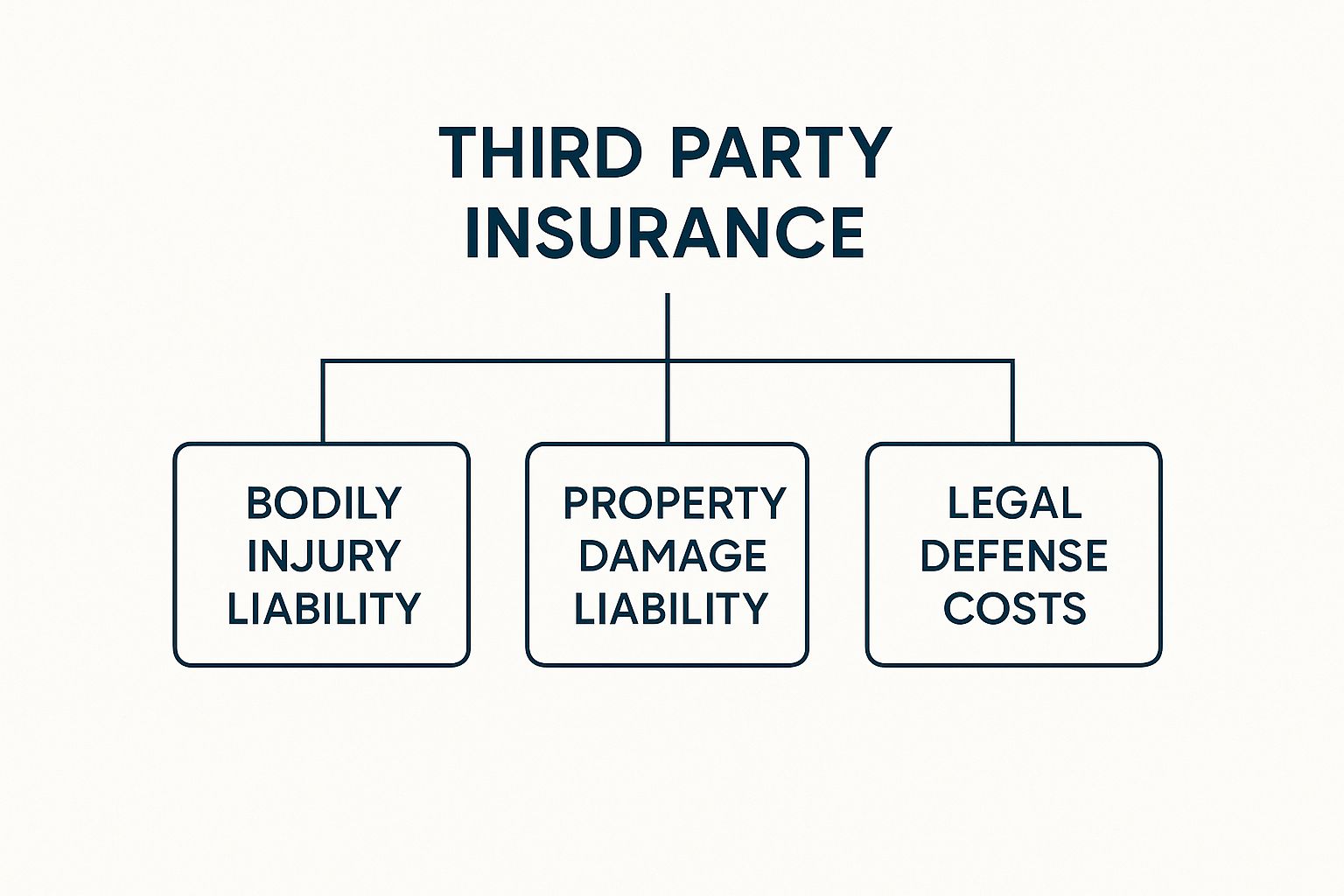

Let's break down what third party insurance really covers.

As you can see, the protection is entirely focused outward, on your liability to other people. This leaves you financially exposed for your own vehicle and wellbeing. It’s a structure that highlights just how important proof is when a claim is made. Without solid verifiable evidence figuring out who is at fault can quickly become a messy affair opening the door to disputes and even fraudulent claims that end up pushing up costs for all drivers.

Third Party Insurance at a Glance

To make it even clearer here’s a quick comparison of what a standard third party policy typically includes versus what it leaves out.

| Coverage Area | What's Covered (Protects Others) | What's Excluded (Your Own Losses) |

|---|---|---|

| Vehicle Damage | Repairs for the other person's car or property. | Any damage to your own vehicle. |

| Personal Injury | Medical costs for injuries to third parties (drivers, passengers, pedestrians). | Your own medical expenses or injury claims. |

| Legal Costs | Legal fees if the third party sues you for damages. | Your own legal costs to defend yourself or pursue a claim. |

| Theft & Fire | No cover. | No cover for theft of or fire damage to your vehicle. |

This table really drives home the point: third party insurance is purely about protecting others from the financial consequences of your actions on the road not protecting yourself.

What Third Party Insurance Actually Pays For

So what happens when someone makes a claim against you? Think of a third party policy as your financial shield but one that only protects others from your actions. It’s purely designed to cover the costs you're legally on the hook for after an accident.

Imagine you accidentally reverse into another car in a supermarket car park. Your third party insurance won’t pay a penny to fix the dent in your own bumper but it will cover the repair costs for the other person’s vehicle. This same principle applies whether it's a minor scrape or a much more serious collision.

And this cover extends beyond just other cars. If you were to lose control and knock down a garden wall or plough through a fence your insurance would step in to pay for the property damage you caused. Essentially it handles your liability for damaging someone else's physical property.

Personal Injury and Medical Costs

Where this insurance becomes absolutely critical though is when people get hurt. If an accident you cause results in injury to someone else your policy is there to cover the fallout.

This protection is extensive making sure that victims get the financial support they need to recover. The cover typically includes:

- Other Drivers and Passengers: It handles medical treatment, rehabilitation costs and even potential loss of earnings for people in the other vehicles involved.

- Your Own Passengers: If passengers in your car are injured your third party cover will also handle their injury claims against you.

- Pedestrians or Cyclists: The policy pays for injuries to any vulnerable road user you might accidentally harm.

In the most devastating cases where an accident leads to a fatality the policy also covers compensation claims made by the deceased’s family.

The core purpose of third party insurance is to ensure that victims of a road accident are not left with crippling financial burdens. It guarantees that compensation for injury and property damage can be paid regardless of the at-fault driver's personal financial situation.

Understanding exactly what your third party insurance covers is crucial as it defines where your financial responsibility ends. Of course the success of any claim always hinges on proving who was at fault—an area where disputes often crop up and the risk of fraudulent claims becomes a costly problem for everyone involved.

Understanding the Gaps in Your Cover

While third party insurance ticks the legal box it’s crucial to understand what it doesn’t do. It leaves you the driver personally exposed to some pretty significant financial risks. Many people only realise just how big these gaps are when it’s far too late.

At its core the policy is designed to protect other people from your actions on the road not to protect you or your own property.

So if you cause an accident any damage to your own vehicle is entirely your problem. The whole bill for getting your car fixed? That comes straight out of your pocket. This is the single most important distinction to grasp about this level of cover.

This lack of protection also extends to other common mishaps. If your car is stolen or damaged in a fire a third party policy won’t pay out a penny. You’d be left facing the daunting cost of replacing your vehicle all by yourself.

Personal Costs and Belongings

The financial exposure doesn’t stop with your car. Any personal injuries you suffer in an accident that was your fault are also not covered. You’ll have the NHS for medical care of course but there will be no compensation for lost income or long-term rehabilitation costs.

This gap really highlights the fundamental nature of this insurance. Although comprehensive policies make up over 60% of the market third party cover remains a vital yet very limited option. It’s built to exclude your vehicle your medical bills and your personal belongings.

And what about your stuff inside the car? If items like a laptop, phone, or tools are stolen from your vehicle or damaged in a crash a third party policy offers no way to claim for them. The responsibility for replacing everything rests squarely on your shoulders.

These exclusions can feel like a harsh reality check after an incident. It’s essential to be aware of them from the outset as they can sometimes lead to confusion and disputes about why your insurance company might refuse to pay a claim.

How Insurance Fraud Inflates Every Driver's Premium

Ever wondered why your insurance premium keeps creeping up even with a spotless driving record? A huge part of the answer is insurance fraud. It’s a pernicious problem that adds a little extra to every honest driver's bill and undermines the entire industry.

When fraudsters push through dishonest claims the entire system feels the ripple effect. These aren't just one-off incidents; it’s a widespread issue that costs insurers millions in investigations and payouts for claims that should never have existed. That money doesn’t just appear out of thin air. To cover these losses insurers have no choice but to increase the price of their policies for everyone. So a fraudulent claim in one part of the country really does contribute to the premium you pay making it a collective problem for us all.

From Organised Scams to Small Exaggerations

Insurance fraud isn't a single type of crime. It runs the full spectrum from highly organised criminal rings to seemingly minor fibs by individuals. Both are equally damaging to the industry and ultimately your wallet.

Some of the most common types of motor insurance fraud include:

- 'Crash for Cash' Schemes: This is where criminals deliberately cause an accident with an innocent driver often by slamming on their brakes to cause a rear-end collision. They then make wildly exaggerated claims for personal injury and vehicle damage.

- Phantom Passengers: After a genuine accident a fraudster might add fictitious passengers to the claim all alleging they've suffered whiplash or other injuries.

- Damage Exaggeration: Sometimes someone in a real accident will inflate the extent of the damage to their car or try to claim for pre-existing scuffs and dents to get a bigger payout.

No matter the scale every fraudulent act undermines the provability of genuine claims. It forces insurers to be more sceptical which can slow down the process for honest people and creates a system where trust is eroded and costs are inflated for all.

Ultimately fighting fraud is a shared responsibility. The financial burden is a multi-billion-pound problem and you can learn more about what insurance fraud really costs the industry and how it affects everyone. Understanding this is key to appreciating why provability is so critical in any claim situation.

The Critical Role of Provability in a Claim

When an accident happens the outcome of any claim hangs on a single powerful word: provability . What you can prove plain and simple determines who is held responsible. In the world of third party insurance where you’re on the hook for damage to others solid evidence isn’t just helpful—it’s your only real defence.

Without clear undeniable proof you're left in a messy "he said she said" scenario. This kind of ambiguity is a perfect breeding ground for dodgy claims and unfair blame which ultimately pushes up insurance costs for everyone. Insurers need cold hard facts to make fair decisions and it's up to you to provide them. Good information allows your insurer to pin down liability correctly push back against fraudulent claims and get genuine ones sorted much faster. Remember robust evidence doesn't just protect the insurance company; it protects you from being wrongly blamed for something you didn't cause.

Gathering Your Evidence at the Scene

The first few moments after a collision are absolutely critical. What you do right then can make or break your claim later on. Your one and only goal should be to create an unshakeable record of what actually happened.

Here's what to focus on:

- Take Clear Photographs: Snap pictures of everything. Get the whole scene from multiple angles the positions of the cars the damage to all vehicles any road markings and relevant signs.

- Note Down Third Party Details: Get the other driver's name address phone number and their insurance details. Don't ever rely on your memory alone.

- Gather Witness Contacts: Independent witnesses are worth their weight in gold. Make sure you get their names and phone numbers as their account can be the deciding factor in a dispute.

By building a solid trail of evidence you’re not just strengthening your own position. You're helping maintain the integrity of the whole insurance system by keeping fraudulent activity in check.

The rising cost of claims really drives home why this is so important. In 2023 motor insurance claims costs shot up to £9.1 billion —a massive increase that directly hits every driver’s premium. A huge chunk of that goes towards personal injury and property damage which is exactly what third party insurance is for. This is precisely why fighting fraud before it happens with verified evidence has become so essential to keeping costs under control.

Got Questions About Third Party Cover?

It's natural to have questions when you're sorting out car insurance. Let's clear up some of the most common queries about third party cover to help you understand exactly where you stand.

A big point of confusion for many drivers is whether their policy lets them get behind the wheel of another car.

Can I Drive Someone Else's Car On My Policy?

This is a classic misconception. Your third party insurance policy is almost always tied only to the specific vehicle listed on your documents. It doesn't follow you from car to car.

The 'Driving Other Cars' (DOC) benefit you might have heard about is rarely included with third party policies; it's usually an extra reserved for more comprehensive plans. Before you even think about driving a friend's car you absolutely must check your policy wording. Getting it wrong could mean you're driving uninsured which is a serious offence with hefty penalties.

Is Third Party Always the Cheapest Option?

You'd think so wouldn't you? It offers the most basic level of protection so it should be the cheapest. But that's not always the case.

Insurers are all about analysing risk. Sometimes they see drivers looking for the bare minimum cover as being higher risk and the price reflects that. It’s always a good idea to get quotes for all levels of cover. You might be surprised to find that a third party fire and theft policy—or even a fully comprehensive one—comes in at a similar price or sometimes even less.

What Happens If an Uninsured Driver Hits Me?

This is where the limitations of a third party policy really show. If an uninsured driver hits you your insurance will not cover any of the repair costs for your own vehicle. You're left to sort it out yourself.

Your only option for compensation is to go through the Motor Insurers' Bureau (MIB). Be warned this is often a very long and complicated process and there's no guarantee you'll get back the full cost of your losses. This situation really highlights the financial risk you take on with a minimum-level insurance policy.

Understanding these details is key to making a smart decision about the right level of protection you need on the road.

At Proova we believe clear verifiable evidence makes the claims process fair and straightforward for everyone involved. Our platform helps you build a secure record of what you own protecting you from the uncertainty that can follow an accident or theft. Visit Proova to learn how we are building trust in insurance.